After doing a read through of this thread, yes, I feel the news is influencing my collecting a bit. I will share that I’m a little leery about shipping any valuable coins at the moment. I think my coins will sit this out and not instigate any new buys for at least a few weeks till we see how this all plays out.

@Mgarmy said:

I fear for the elderly or those with copd etc.

Those same folks would also likely succumb to the flu, flu shot or not. I just got done with some sort of upper respiratory thing that well could have been corona.

@thebeav said:

100 thousand people die in the US every year just from the flu. I don't think that has ever affected coin prices.......

Check your decimal point. From the CDC... 12,000 is the average number of deaths in any given year. The largest number of deaths in the past decade was 2017-18 with 61,000 deaths from the flu in the US.

I'm gonna go out on a limb and make a prediction that this will not be as bad as most people fear. Seems like every few years there is a new virus, and it always fizzles out (thankfully).

The whole drop is somewhat irrational. The yield on 10 and 30 year bonds are negative in real terms. Yet the underlying economy has not changed from 2 weeks ago. A lot of hysteria driving all market sectors.

The underlying economy and company profits will see a big change if supply chains are interrupted. Anticipation of this is causing the sell off. Supply chain breakdowns are now moving from a threat to a reality.

I read that 80% of US pharmaceuticals are produced in the Wahun region, ground zero for the bug.

That is the fear and possibly hysteria since it is not clear that it will happen broadly. Latest estimate was decrease of 0.1% in global GDP.

All comments reflect the opinion of the author, even when irrefutably accurate.

@nags said:

In situations of turmoil I typically wait for a period a stability before buying the dip. I'd much rather miss some of the rebound then join the roller coaster a quarter of the way down the hill. I'm not nearly smart enough to call the tops or bottoms.

There definitely will be some buying opportunities presented from this situation. I don't know if that will be in a week or (6) months. If the weekend induces more panic, Monday may be a bloodbath.

I sold a lot going into the close ( stocks rebounding on Fed Chief Powell news). Didn’t want to hold too much going into the weekend. It seems more likely bad news will occur over the weekend then good news. Regardless I will hope for good news

@CoinJunkie said:

I still have some dry powder. Almost went all-in today, as I'm expecting a rebound early next week. The market was even selling off REITs hard this week, which is completely irrational given that interest rates are going to be cut further still.

The whole drop is somewhat irrational. The yield on 10 and 30 year bonds are negative in real terms. Yet the underlying economy has not changed from 2 weeks ago. A lot of hysteria driving all market sectors.

The perception of the extent and impact of Coronavirus has changed from a couple weeks ago. Also, the available information is not definitive, and markets hate uncertainty. But yeah, it's like people don't realize normalcy will return at some point. There are also some political dynamics in play, but I'm not going to go there, here.

Agree with every sentence.

Rough week for my trading account, brutal really, but my 401k was only off 4 or 5% due to being half in cash and short-term bonds. So, I can still afford to eat. LOL.

How can you be off 4-5% in your 401k if you own bonds and cash ??

Unless you own junk bonds.

Spreads are widening on some of those .

I manage money. I earn money. I save money . I give away money. I collect money. I don’t love money . I do love the Lord God.

I've had funds in money market for some time, missed a lot of the upside past couple years so hope to cash in like others...but, that can wait at least for now.

Best investment is your family, community, and you. I'd stock up on extra food, and medical supplies, spend quality time with family, and friends, have fun, don't worry. Make sure to have a laugh when this is in the rear view mirror, or, be confident you'll have the assurance to say "I'm so glad we prepared." Can't lose. Win win.

@nags said:

In situations of turmoil I typically wait for a period a stability before buying the dip. I'd much rather miss some of the rebound then join the roller coaster a quarter of the way down the hill. I'm not nearly smart enough to call the tops or bottoms.

There definitely will be some buying opportunities presented from this situation. I don't know if that will be in a week or (6) months. If the weekend induces more panic, Monday may be a bloodbath.

I sold a lot going into the close ( stocks rebounding on Fed Chief Powell news). Didn’t want to hold too much going into the weekend. It seems more likely bad news will occur over the weekend then good news. Regardless I will hope for good news

@CoinJunkie said:

I still have some dry powder. Almost went all-in today, as I'm expecting a rebound early next week. The market was even selling off REITs hard this week, which is completely irrational given that interest rates are going to be cut further still.

The whole drop is somewhat irrational. The yield on 10 and 30 year bonds are negative in real terms. Yet the underlying economy has not changed from 2 weeks ago. A lot of hysteria driving all market sectors.

The perception of the extent and impact of Coronavirus has changed from a couple weeks ago. Also, the available information is not definitive, and markets hate uncertainty. But yeah, it's like people don't realize normalcy will return at some point. There are also some political dynamics in play, but I'm not going to go there, here.

Agree with every sentence.

Rough week for my trading account, brutal really, but my 401k was only off 4 or 5% due to being half in cash and short-term bonds. So, I can still afford to eat. LOL.

How can you be off 4-5% in your 401k if you own bonds and cash ??

Unless you own junk bonds.

Spreads are widening on some of those .

I said I was HALF in cash and short-term bonds. The other half was stocks.

All comments reflect the opinion of the author, even when irrefutably accurate.

first reported death of COVID-19 in the US reported in Washington State.

schools now closed at some locations in/around King County(Seattle).

a Health Facility/Nursing Home in King County has two "confirmed" cases of COVID-19 and as many as 50 people suffering respiratory distress, closed to visitors.

I'm having a hard time even coming up with a scenario where the market doesn't plunge on Monday. We know that the numbers will only get worse, we know that hundreds were exposed because of the slow CDC response in testing a case that was then confirmed in Northern California. Trump puts Pence in charge and he immediately limits transparency by filtering what's said. Finally, shortages of prescription medicines, masks, test kits and various supplies needed for people to work their shifts will be affected.

Where's the good news that calms the markets?

If you do what you always did, you get what you always got.

@DollarAfterDollar said:

I'm having a hard time even coming up with a scenario where the market doesn't plunge on Monday. We know that the numbers will only get worse, we know that hundreds were exposed because of the slow CDC response in testing a case that was then confirmed in Northern California. Trump puts Pence in charge and he immediately limits transparency by filtering what's said. Finally, shortages of prescription medicines, masks, test kits and various supplies needed for people to work their shifts will be affected.

Where's the good news that calms the markets?

Biden win in SC today

I manage money. I earn money. I save money . I give away money. I collect money. I don’t love money . I do love the Lord God.

The market is going to continue to slide because there is no announced plan of action between the local, state and feds on how to stop the virus. Saying that the coronavirus is "low risk and do not panic" in not a plan. The battle has started on the West Coast and clearly we were not ready. There needs to be a plan of attack on how to slow down the virus until we get to summer. If the virus dies out in summer like other respiratory virus , it should provide enough time to get a vaccine ready by next winter.

@Dave99B said:

The 1st death has been reported in the U.S., in Kirkland. WA. Five miles from my home. Sort of crazy. 50ish male with existing health issues. Dang...

@Dave99B said:

The 1st death has been reported in the U.S., in Kirkland. WA. Five miles from my home. Sort of crazy. 50ish male with existing health issues. Dang...

Dave

Stay alert. Stay well

mark

Walker Proof Digital Album Fellas, leave the tight pants to the ladies. If I can count the coins in your pockets you better use them to call a tailor. Stay thirsty my friends......

@DollarAfterDollar said:

I'm having a hard time even coming up with a scenario where the market doesn't plunge on Monday. We know that the numbers will only get worse, we know that hundreds were exposed because of the slow CDC response in testing a case that was then confirmed in Northern California. Trump puts Pence in charge and he immediately limits transparency by filtering what's said. Finally, shortages of prescription medicines, masks, test kits and various supplies needed for people to work their shifts will be affected.

Where's the good news that calms the markets?

Chinese factories reopening.

All comments reflect the opinion of the author, even when irrefutably accurate.

@DollarAfterDollar said:

I'm having a hard time even coming up with a scenario where the market doesn't plunge on Monday. We know that the numbers will only get worse, we know that hundreds were exposed because of the slow CDC response in testing a case that was then confirmed in Northern California. Trump puts Pence in charge and he immediately limits transparency by filtering what's said. Finally, shortages of prescription medicines, masks, test kits and various supplies needed for people to work their shifts will be affected.

Where's the good news that calms the markets?

If you try a different news source, you might see a different response.

There have been travel restrictions in place for several weeks from China which have been expanded to include Iran, Italy, etc. The CDC has been working on this for weeks.

Creating a sense of panic and hysteria over a flu-like illness is not going to help anything or anyone. And certainly politicizing it will not help anything or anyone.

All comments reflect the opinion of the author, even when irrefutably accurate.

Here are some private emails that I have sent out to members of this blog:

This email was sent on Tuesday February 18, 2020, to a member of this blog:

“i sold a sizeable portion of my stocks this morning. I don’t think the market has enough risk built in. Moved it to cash and will probably keep it there waiting for either a dip or put it in short term treasuries.”

This email was sent on Thursday February 26, 2020, to another member of this blog:

“i sold some stocks a week ago on Tuesday. I bought back in on Monday afternoon and sold out again on Tuesday morning pre-market when Dow Futures were up +200. I’m currently underweight stocks. I think we have bubbles all around. I think Precious Metals, stocks and bonds are all in a bubble. Setting in cash is a good thing. Being in the ______ you only have so many moves to make and you cant make any Real Time trades. In this volitile market timing is everything. I told _____ you have to watch the 10 year. Forget about the stock market telling you anything because people are accustomed to buying the dips. I’m afraid that the 10 year Could get as low as 1.00%. IF that happens it will set the Fed up to cut rates again which should help the stock market. The only problem with the 10 year going down to 1.00% is that things would have to be REALLY weak for that to happen.

The bubble Im seeing in precious metals is that virtually all the money coming in is going to Gold vs. Silver. That tells me that Gold is leading and Silver is being drug along. When the Fed cuts, and then the stock market could pop upwards and suck all the money out of Gold”

This email was sent on Friday February 28, 2020, to another member of this blog:

“Gold/Silver showed today that there is NO safe haven. Look at yields on Treasurys: 30 year at 1.679%. 10 year closed at 1.15%, 2 year at 0.93%. 1 year at 1.02%. There is NO where to hide. You can’t make money in bond market unless rates go Lower. IF you’re in bond market just for the yield, you’re going to lose money to inflation. Silver sold off 6.25% today. Even with stocks taking a beating and P/Es so high, don’t see in Long Run you have any options but to be in stocks.”

@DollarAfterDollar said:

I'm having a hard time even coming up with a scenario where the market doesn't plunge on Monday. We know that the numbers will only get worse, we know that hundreds were exposed because of the slow CDC response in testing a case that was then confirmed in Northern California. Trump puts Pence in charge and he immediately limits transparency by filtering what's said. Finally, shortages of prescription medicines, masks, test kits and various supplies needed for people to work their shifts will be affected.

Where's the good news that calms the markets?

All this was KNOWN on Friday and PRICED in, IMO. The only new news is one death in USA.

@cagcrisp said:

Here are some private emails that I have sent out to members of this blog:

This email was sent on Tuesday February 18, 2020, to a member of this blog:

“i sold a sizeable portion of my stocks this morning. I don’t think the market has enough risk built in. Moved it to cash and will probably keep it there waiting for either a dip or put it in short term treasuries.”

This email was sent on Thursday February 26, 2020, to another member of this blog:

“i sold some stocks a week ago on Tuesday. I bought back in on Monday afternoon and sold out again on Tuesday morning pre-market when Dow Futures were up +200. I’m currently underweight stocks. I think we have bubbles all around. I think Precious Metals, stocks and bonds are all in a bubble. Setting in cash is a good thing. Being in the ______ you only have so many moves to make and you cant make any Real Time trades. In this volitile market timing is everything. I told _____ you have to watch the 10 year. Forget about the stock market telling you anything because people are accustomed to buying the dips. I’m afraid that the 10 year Could get as low as 1.00%. IF that happens it will set the Fed up to cut rates again which should help the stock market. The only problem with the 10 year going down to 1.00% is that things would have to be REALLY weak for that to happen.

The bubble Im seeing in precious metals is that virtually all the money coming in is going to Gold vs. Silver. That tells me that Gold is leading and Silver is being drug along. When the Fed cuts, and then the stock market could pop upwards and suck all the money out of Gold”

This email was sent on Friday February 28, 2020, to another member of this blog:

“Gold/Silver showed today that there is NO safe haven. Look at yields on Treasurys: 30 year at 1.679%. 10 year closed at 1.15%, 2 year at 0.93%. 1 year at 1.02%. There is NO where to hide. You can’t make money in bond market unless rates go Lower. IF you’re in bond market just for the yield, you’re going to lose money to inflation. Silver sold off 6.25% today. Even with stocks taking a beating and P/Es so high, don’t see in Long Run you have any options but to be in stocks.”

Here is where you could have told investors to "hide"

Index shorts made money i.e. using DIA, QQQ, or SPY

Individual stock shorts made money

Shorting the stock index futures made money i.e. using Dow or S&P E-mini

Buying puts made money

Writing calls made money

Buying SH ETF made money

Etc......

There is always money being made by someone in the market. They just don't put it in the news headlines because it would be boring to let viewers and readers know that some investors have been waiting for this to happen and are very happy. Doom and gloom sells. Taking your money out and parking it in a money market is a passive defensive strategy in a down market. The strategies above are proactive offensive strategies in a down market. Most investors just don't understand them and have brokers who don't promote them as well.

@cagcrisp said:

Here are some private emails that I have sent out to members of this blog:

This email was sent on Tuesday February 18, 2020, to a member of this blog:

“i sold a sizeable portion of my stocks this morning. I don’t think the market has enough risk built in. Moved it to cash and will probably keep it there waiting for either a dip or put it in short term treasuries.”

This email was sent on Thursday February 26, 2020, to another member of this blog:

“i sold some stocks a week ago on Tuesday. I bought back in on Monday afternoon and sold out again on Tuesday morning pre-market when Dow Futures were up +200. I’m currently underweight stocks. I think we have bubbles all around. I think Precious Metals, stocks and bonds are all in a bubble. Setting in cash is a good thing. Being in the ______ you only have so many moves to make and you cant make any Real Time trades. In this volitile market timing is everything. I told _____ you have to watch the 10 year. Forget about the stock market telling you anything because people are accustomed to buying the dips. I’m afraid that the 10 year Could get as low as 1.00%. IF that happens it will set the Fed up to cut rates again which should help the stock market. The only problem with the 10 year going down to 1.00% is that things would have to be REALLY weak for that to happen.

The bubble Im seeing in precious metals is that virtually all the money coming in is going to Gold vs. Silver. That tells me that Gold is leading and Silver is being drug along. When the Fed cuts, and then the stock market could pop upwards and suck all the money out of Gold”

This email was sent on Friday February 28, 2020, to another member of this blog:

“Gold/Silver showed today that there is NO safe haven. Look at yields on Treasurys: 30 year at 1.679%. 10 year closed at 1.15%, 2 year at 0.93%. 1 year at 1.02%. There is NO where to hide. You can’t make money in bond market unless rates go Lower. IF you’re in bond market just for the yield, you’re going to lose money to inflation. Silver sold off 6.25% today. Even with stocks taking a beating and P/Es so high, don’t see in Long Run you have any options but to be in stocks.”

Here is where you could have told investors to "hide"

Index shorts made money i.e. using DIA, QQQ, or SPY

Individual stock shorts made money

Shorting the stock index futures made money i.e. using Dow or S&P E-mini

Buying puts made money

Writing calls made money

Buying SH ETF made money

Etc......

There is always money being made by someone in the market. They just don't put it in the news headlines because it would be boring to let viewers and readers know that some investors have been waiting for this to happen and are very happy. Doom and gloom sells. Taking your money out and parking it in a money market is a passive defensive strategy in a down market. The strategies above are proactive offensive strategies in a down market. Most investors just don't understand them and have brokers who don't promote them as well.

I don’t think those types of positions constitute “hiding”.

Mark Feld* of Heritage Auctions*Unless otherwise noted, my posts here represent my personal opinions.

@cagcrisp said:

Here are some private emails that I have sent out to members of this blog:

This email was sent on Tuesday February 18, 2020, to a member of this blog:

“i sold a sizeable portion of my stocks this morning. I don’t think the market has enough risk built in. Moved it to cash and will probably keep it there waiting for either a dip or put it in short term treasuries.”

This email was sent on Thursday February 26, 2020, to another member of this blog:

“i sold some stocks a week ago on Tuesday. I bought back in on Monday afternoon and sold out again on Tuesday morning pre-market when Dow Futures were up +200. I’m currently underweight stocks. I think we have bubbles all around. I think Precious Metals, stocks and bonds are all in a bubble. Setting in cash is a good thing. Being in the ______ you only have so many moves to make and you cant make any Real Time trades. In this volitile market timing is everything. I told _____ you have to watch the 10 year. Forget about the stock market telling you anything because people are accustomed to buying the dips. I’m afraid that the 10 year Could get as low as 1.00%. IF that happens it will set the Fed up to cut rates again which should help the stock market. The only problem with the 10 year going down to 1.00% is that things would have to be REALLY weak for that to happen.

The bubble Im seeing in precious metals is that virtually all the money coming in is going to Gold vs. Silver. That tells me that Gold is leading and Silver is being drug along. When the Fed cuts, and then the stock market could pop upwards and suck all the money out of Gold”

This email was sent on Friday February 28, 2020, to another member of this blog:

“Gold/Silver showed today that there is NO safe haven. Look at yields on Treasurys: 30 year at 1.679%. 10 year closed at 1.15%, 2 year at 0.93%. 1 year at 1.02%. There is NO where to hide. You can’t make money in bond market unless rates go Lower. IF you’re in bond market just for the yield, you’re going to lose money to inflation. Silver sold off 6.25% today. Even with stocks taking a beating and P/Es so high, don’t see in Long Run you have any options but to be in stocks.”

Here is where you could have told investors to "hide"

Index shorts made money i.e. using DIA, QQQ, or SPY

Individual stock shorts made money

Shorting the stock index futures made money i.e. using Dow or S&P E-mini

Buying puts made money

Writing calls made money

Buying SH ETF made money

Etc......

There is always money being made by someone in the market. They just don't put it in the news headlines because it would be boring to let viewers and readers know that some investors have been waiting for this to happen and are very happy. Doom and gloom sells. Taking your money out and parking it in a money market is a passive defensive strategy in a down market. The strategies above are proactive offensive strategies in a down market. Most investors just don't understand them and have brokers who don't promote them as well.

I don’t think those types of positions constitute “hiding”.

I put it in quotes because it was tongue in cheek.

@cagcrisp said:

Here are some private emails that I have sent out to members of this blog:

This email was sent on Tuesday February 18, 2020, to a member of this blog:

“i sold a sizeable portion of my stocks this morning. I don’t think the market has enough risk built in. Moved it to cash and will probably keep it there waiting for either a dip or put it in short term treasuries.”

This email was sent on Thursday February 26, 2020, to another member of this blog:

“i sold some stocks a week ago on Tuesday. I bought back in on Monday afternoon and sold out again on Tuesday morning pre-market when Dow Futures were up +200. I’m currently underweight stocks. I think we have bubbles all around. I think Precious Metals, stocks and bonds are all in a bubble. Setting in cash is a good thing. Being in the ______ you only have so many moves to make and you cant make any Real Time trades. In this volitile market timing is everything. I told _____ you have to watch the 10 year. Forget about the stock market telling you anything because people are accustomed to buying the dips. I’m afraid that the 10 year Could get as low as 1.00%. IF that happens it will set the Fed up to cut rates again which should help the stock market. The only problem with the 10 year going down to 1.00% is that things would have to be REALLY weak for that to happen.

The bubble Im seeing in precious metals is that virtually all the money coming in is going to Gold vs. Silver. That tells me that Gold is leading and Silver is being drug along. When the Fed cuts, and then the stock market could pop upwards and suck all the money out of Gold”

This email was sent on Friday February 28, 2020, to another member of this blog:

“Gold/Silver showed today that there is NO safe haven. Look at yields on Treasurys: 30 year at 1.679%. 10 year closed at 1.15%, 2 year at 0.93%. 1 year at 1.02%. There is NO where to hide. You can’t make money in bond market unless rates go Lower. IF you’re in bond market just for the yield, you’re going to lose money to inflation. Silver sold off 6.25% today. Even with stocks taking a beating and P/Es so high, don’t see in Long Run you have any options but to be in stocks.”

Here is where you could have told investors to "hide"

Index shorts made money i.e. using DIA, QQQ, or SPY

Individual stock shorts made money

Shorting the stock index futures made money i.e. using Dow or S&P E-mini

Buying puts made money

Writing calls made money

Buying SH ETF made money

Etc......

There is always money being made by someone in the market. They just don't put it in the news headlines because it would be boring to let viewers and readers know that some investors have been waiting for this to happen and are very happy. Doom and gloom sells. Taking your money out and parking it in a money market is a passive defensive strategy in a down market. The strategies above are proactive offensive strategies in a down market. Most investors just don't understand them and have brokers who don't promote them as well.

I don’t think those types of positions constitute “hiding”.

I put it in quotes because it was tongue in cheek.

Sorry and whew!😉

Mark Feld* of Heritage Auctions*Unless otherwise noted, my posts here represent my personal opinions.

@cagcrisp said:

Here are some private emails that I have sent out to members of this blog:

This email was sent on Tuesday February 18, 2020, to a member of this blog:

“i sold a sizeable portion of my stocks this morning. I don’t think the market has enough risk built in. Moved it to cash and will probably keep it there waiting for either a dip or put it in short term treasuries.”

This email was sent on Thursday February 26, 2020, to another member of this blog:

“i sold some stocks a week ago on Tuesday. I bought back in on Monday afternoon and sold out again on Tuesday morning pre-market when Dow Futures were up +200. I’m currently underweight stocks. I think we have bubbles all around. I think Precious Metals, stocks and bonds are all in a bubble. Setting in cash is a good thing. Being in the ______ you only have so many moves to make and you cant make any Real Time trades. In this volitile market timing is everything. I told _____ you have to watch the 10 year. Forget about the stock market telling you anything because people are accustomed to buying the dips. I’m afraid that the 10 year Could get as low as 1.00%. IF that happens it will set the Fed up to cut rates again which should help the stock market. The only problem with the 10 year going down to 1.00% is that things would have to be REALLY weak for that to happen.

The bubble Im seeing in precious metals is that virtually all the money coming in is going to Gold vs. Silver. That tells me that Gold is leading and Silver is being drug along. When the Fed cuts, and then the stock market could pop upwards and suck all the money out of Gold”

This email was sent on Friday February 28, 2020, to another member of this blog:

“Gold/Silver showed today that there is NO safe haven. Look at yields on Treasurys: 30 year at 1.679%. 10 year closed at 1.15%, 2 year at 0.93%. 1 year at 1.02%. There is NO where to hide. You can’t make money in bond market unless rates go Lower. IF you’re in bond market just for the yield, you’re going to lose money to inflation. Silver sold off 6.25% today. Even with stocks taking a beating and P/Es so high, don’t see in Long Run you have any options but to be in stocks.”

Here is where you could have told investors to "hide"

Index shorts made money i.e. using DIA, QQQ, or SPY

Individual stock shorts made money

Shorting the stock index futures made money i.e. using Dow or S&P E-mini

Buying puts made money

Writing calls made money

Buying SH ETF made money

Etc......

There is always money being made by someone in the market. They just don't put it in the news headlines because it would be boring to let viewers and readers know that some investors have been waiting for this to happen and are very happy. Doom and gloom sells. Taking your money out and parking it in a money market is a passive defensive strategy in a down market. The strategies above are proactive offensive strategies in a down market. Most investors just don't understand them and have brokers who don't promote them as well.

I don’t think those types of positions constitute “hiding”.

And if the market rebounds...?

It is best to not change strategies based on temporary disruptions.

All comments reflect the opinion of the author, even when irrefutably accurate.

@cagcrisp said:

Here are some private emails that I have sent out to members of this blog:

This email was sent on Tuesday February 18, 2020, to a member of this blog:

“i sold a sizeable portion of my stocks this morning. I don’t think the market has enough risk built in. Moved it to cash and will probably keep it there waiting for either a dip or put it in short term treasuries.”

This email was sent on Thursday February 26, 2020, to another member of this blog:

“i sold some stocks a week ago on Tuesday. I bought back in on Monday afternoon and sold out again on Tuesday morning pre-market when Dow Futures were up +200. I’m currently underweight stocks. I think we have bubbles all around. I think Precious Metals, stocks and bonds are all in a bubble. Setting in cash is a good thing. Being in the ______ you only have so many moves to make and you cant make any Real Time trades. In this volitile market timing is everything. I told _____ you have to watch the 10 year. Forget about the stock market telling you anything because people are accustomed to buying the dips. I’m afraid that the 10 year Could get as low as 1.00%. IF that happens it will set the Fed up to cut rates again which should help the stock market. The only problem with the 10 year going down to 1.00% is that things would have to be REALLY weak for that to happen.

The bubble Im seeing in precious metals is that virtually all the money coming in is going to Gold vs. Silver. That tells me that Gold is leading and Silver is being drug along. When the Fed cuts, and then the stock market could pop upwards and suck all the money out of Gold”

This email was sent on Friday February 28, 2020, to another member of this blog:

“Gold/Silver showed today that there is NO safe haven. Look at yields on Treasurys: 30 year at 1.679%. 10 year closed at 1.15%, 2 year at 0.93%. 1 year at 1.02%. There is NO where to hide. You can’t make money in bond market unless rates go Lower. IF you’re in bond market just for the yield, you’re going to lose money to inflation. Silver sold off 6.25% today. Even with stocks taking a beating and P/Es so high, don’t see in Long Run you have any options but to be in stocks.”

Here is where you could have told investors to "hide"

Index shorts made money i.e. using DIA, QQQ, or SPY

Individual stock shorts made money

Shorting the stock index futures made money i.e. using Dow or S&P E-mini

Buying puts made money

Writing calls made money

Buying SH ETF made money

Etc......

There is always money being made by someone in the market. They just don't put it in the news headlines because it would be boring to let viewers and readers know that some investors have been waiting for this to happen and are very happy. Doom and gloom sells. Taking your money out and parking it in a money market is a passive defensive strategy in a down market. The strategies above are proactive offensive strategies in a down market. Most investors just don't understand them and have brokers who don't promote them as well.

I don’t think those types of positions constitute “hiding”.

And if the market rebounds...?

It is best to not change strategies based on temporary disruptions.

I agree buy and hold is a great long term strategy. My comment was aimed at the inference that the sky is falling and there is no where to make money. This simply is not true. My other point is you don't have to just "hide" when the market is in a severe correction. Depends a lot on your tolerance for risk, age, and your understanding of alternative investment strategies.

It is best to not change strategies based on temporary disruptions.

Disagree, I went from 100% cash to 100% Stock Index fund all last week one third at a time.

Just because you did it doesn't make it "best". If the market drops 20% more, was it still best?

I'm not saying that moving money into the market is wrong. But trying to time something like this is, as they say, like trying to catch a falling knife.

All comments reflect the opinion of the author, even when irrefutably accurate.

It is best to not change strategies based on temporary disruptions.

Disagree, I went from 100% cash to 100% Stock Index fund all last week one third at a time.

Just because you did it doesn't make it "best". If the market drops 20% more, was it still best?

I'm not saying that moving money into the market is wrong. But trying to time something like this is, as they say, like trying to catch a falling knife.

I have no idea what the market will do on Monday.

I had been in cash for quite a while now as I thought the market was overbought.

The VIX tells me the market is oversold now so I went all in.

I had been Waiting for a place to get back in and last week presented itself to me.

If the market crashes from here then this turns into a longterm hold.

If it spikes, we go to all cash again at 27,997 on the dow

two questions I would ask that I haven't seen reported in the news:

1. how long is the incubation period, how long between initial infection and noticeable signs??

2. can the virus live outside of its host, i.e. on the surface of a counter, and for how long??

@keets said:

a new case has been reported in Rhode Island.

two questions I would ask that I haven't seen reported in the news:

1. how long is the incubation period, how long between initial infection and noticeable signs??

2. can the virus live outside of its host, i.e. on the surface of a counter, and for how long??

@keets said:

a new case has been reported in Rhode Island.

two questions I would ask that I haven't seen reported in the news:

1. how long is the incubation period, how long between initial infection and noticeable signs??

2. can the virus live outside of its host, i.e. on the surface of a counter, and for how long??

The coronavirus will typically show up in about 5 days, but the incubation period can be up to 14 days. Some experts have reported up to 24 days for a incubation period. The virus can survive on a surface, but I an going to to give a time period because I have read different information. The virus does not like heat and light. One other thing that has happened with this virus in China and Japan there have been cases where the person was cured and tested negative, but the virus reappeared. They are not sure if the testing was faulty or the virus went dormant in the body and reappeared.

@keets said:

a new case has been reported in Rhode Island.

two questions I would ask that I haven't seen reported in the news:

1. how long is the incubation period, how long between initial infection and noticeable signs??

2. can the virus live outside of its host, i.e. on the surface of a counter, and for how long??

Reporting I heard is ....

1) 2 to 14 days

2) yes. not sure.

2) yes and a time number I've heard/seen is for about 24 hours.

If one shops do it in the middle of the night when it is way less crowded. Wear disposable plastic food gloves for handling merchandise. Pick your items from the back of the shelf and not the front.

@keets said:

a new case has been reported in Rhode Island.

two questions I would ask that I haven't seen reported in the news:

1. how long is the incubation period, how long between initial infection and noticeable signs??

2. can the virus live outside of its host, i.e. on the surface of a counter, and for how long??

Up to 9 or 10 days depending on conditions.

But it's a potent flu-like disease, no more and no less. Let's not panic.

All comments reflect the opinion of the author, even when irrefutably accurate.

@keets said:

a new case has been reported in Rhode Island.

two questions I would ask that I haven't seen reported in the news:

1. how long is the incubation period, how long between initial infection and noticeable signs??

2. can the virus live outside of its host, i.e. on the surface of a counter, and for how long??

Up to 9 or 10 days depending on conditions.

But it's a potent flu-like disease, no more and no less. Let's not panic.

How long can the virus survive on coins - that's what I want to know!

Thus far, the news media have failed to cover the numismatic implications of this disease...

@keets said:

a new case has been reported in Rhode Island.

two questions I would ask that I haven't seen reported in the news:

1. how long is the incubation period, how long between initial infection and noticeable signs??

2. can the virus live outside of its host, i.e. on the surface of a counter, and for how long??

Up to 9 or 10 days depending on conditions.

But it's a potent flu-like disease, no more and no less. Let's not panic.> @keets said:

But it's a potent flu-like disease, no more and no less. Let's not panic.

my questions are directed to transmission and how it seems to spread distances without a "contact" source and have nothing to do with panic.

There's no evidence for it traveling distances without contact. We simply don't know who the contact was. Remember, many people have few symptoms or no symptoms. It is flu-like during flu season. Given millions of flu cases this year, im sure some of them are coronavirus cases.

That's why the mortality rate will fall as the number of infections are undercounted.

All comments reflect the opinion of the author, even when irrefutably accurate.

Another case just popped up in Washington State this time a Postsl Worker just tested positive. Will they be delivering mail tomorrow from that division? Hope your not waiting for a DC Registered Mail cause then you have to enter the infected workers building to sign for the coins.

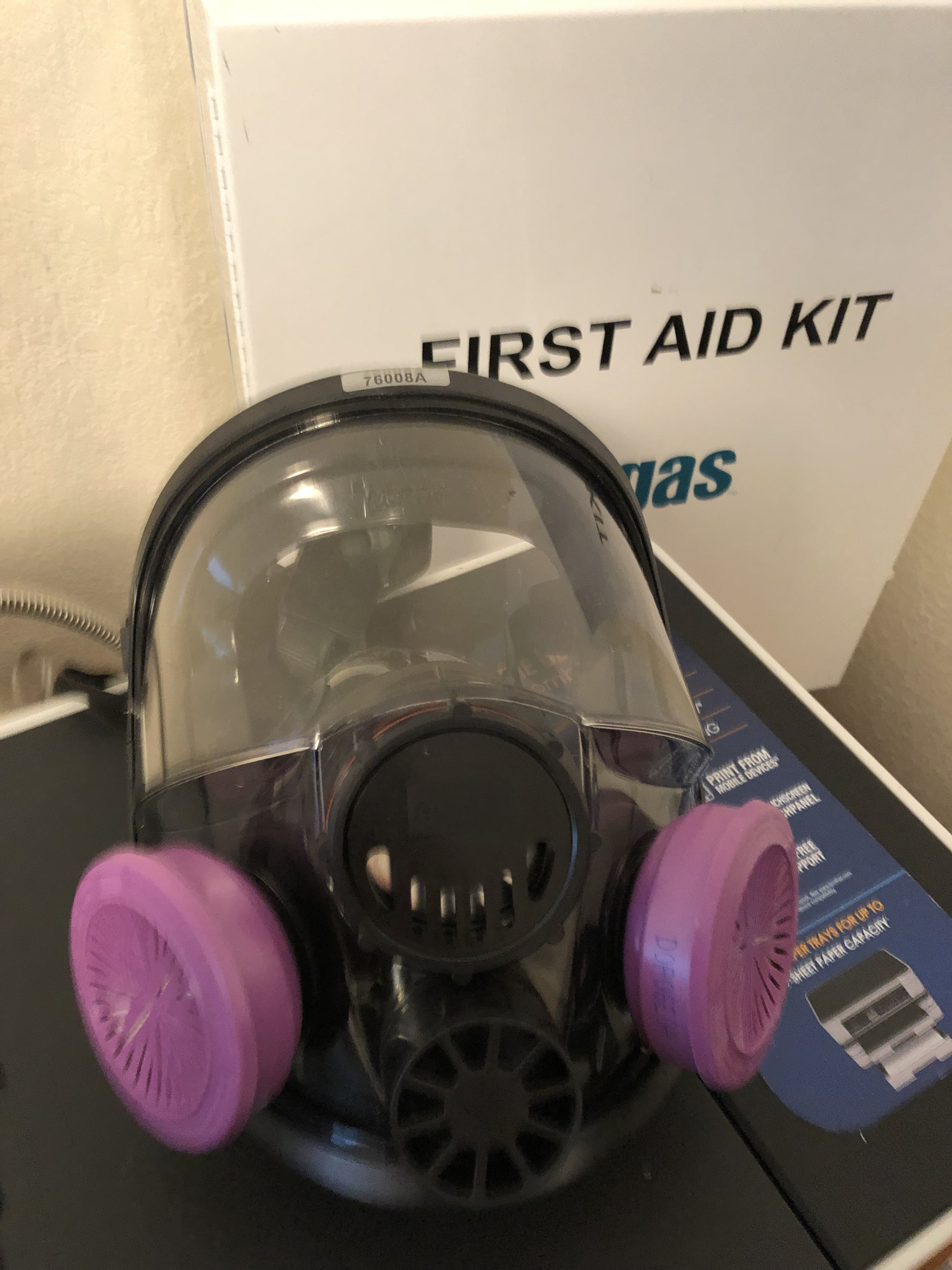

I am going to don my full face mask when I go the office in the morning.

Oh! It's gonna spread. Just read about an infected person in S. Korea who went to church twice in one day and exposed 4,300 people during each service. Not good. Peace Roy

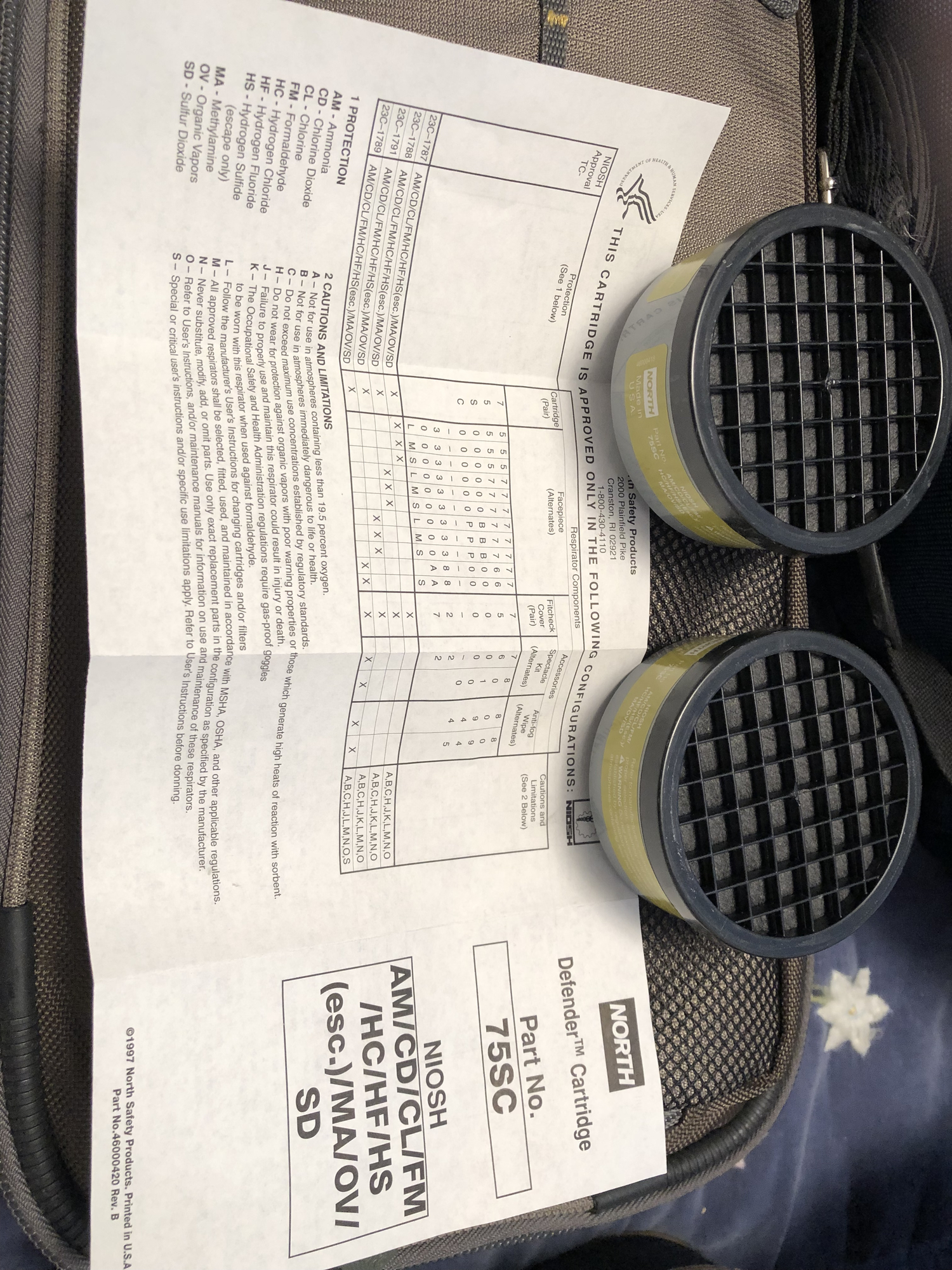

I just packed my North 7600 Full Face mask with my P-100 Cartridges for work tomorrow. If I need to Don the better filtering Defender Cartridge which will go up to Organic Vapors so be it, but the P-100 should be sufficient while in my office.

I have never been a big player in the stock market. Just low interest pass book and cd’s. Would buy more gold all along if the wife wouldn’t give me such a hard time with each purchase. With that said she has been on my case for years to put some in ERJ. So two weeks ago I finally gave her the ok. The agent could tell I really wasn’t on board. Last week minus $1600. Called the agent on Friday and told him that I wasn’t real happy. Said if we weren’t in the conservative part we’re down $7000. I’m waiting to buy my next gold and tell my wife at least we have it in hand. $1600 would have bought me one $20 gold

You can tell people are acting irrationally when they buy bottled water. The virus doesn’t affect the water supply and your city / town is not going to shut off the water to your house.

Comments

After doing a read through of this thread, yes, I feel the news is influencing my collecting a bit. I will share that I’m a little leery about shipping any valuable coins at the moment. I think my coins will sit this out and not instigate any new buys for at least a few weeks till we see how this all plays out.

Those same folks would also likely succumb to the flu, flu shot or not. I just got done with some sort of upper respiratory thing that well could have been corona.

Check your decimal point. From the CDC... 12,000 is the average number of deaths in any given year. The largest number of deaths in the past decade was 2017-18 with 61,000 deaths from the flu in the US.

I'm gonna go out on a limb and make a prediction that this will not be as bad as most people fear. Seems like every few years there is a new virus, and it always fizzles out (thankfully).

That is the fear and possibly hysteria since it is not clear that it will happen broadly. Latest estimate was decrease of 0.1% in global GDP.

All comments reflect the opinion of the author, even when irrefutably accurate.

Sold ?

How can you be off 4-5% in your 401k if you own bonds and cash ??

Unless you own junk bonds.

Spreads are widening on some of those .

I give away money. I collect money.

I don’t love money . I do love the Lord God.

I've had funds in money market for some time, missed a lot of the upside past couple years so hope to cash in like others...but, that can wait at least for now.

Best investment is your family, community, and you. I'd stock up on extra food, and medical supplies, spend quality time with family, and friends, have fun, don't worry. Make sure to have a laugh when this is in the rear view mirror, or, be confident you'll have the assurance to say "I'm so glad we prepared." Can't lose. Win win.

Godspeed.

I said I was HALF in cash and short-term bonds. The other half was stocks.

All comments reflect the opinion of the author, even when irrefutably accurate.

I'm having a hard time even coming up with a scenario where the market doesn't plunge on Monday. We know that the numbers will only get worse, we know that hundreds were exposed because of the slow CDC response in testing a case that was then confirmed in Northern California. Trump puts Pence in charge and he immediately limits transparency by filtering what's said. Finally, shortages of prescription medicines, masks, test kits and various supplies needed for people to work their shifts will be affected.

Where's the good news that calms the markets?

Biden win in SC today

I give away money. I collect money.

I don’t love money . I do love the Lord God.

The market is going to continue to slide because there is no announced plan of action between the local, state and feds on how to stop the virus. Saying that the coronavirus is "low risk and do not panic" in not a plan. The battle has started on the West Coast and clearly we were not ready. There needs to be a plan of attack on how to slow down the virus until we get to summer. If the virus dies out in summer like other respiratory virus , it should provide enough time to get a vaccine ready by next winter.

The 1st death has been reported in the U.S., in Kirkland. WA. Five miles from my home. Sort of crazy. 50ish male with existing health issues. Dang...

Dave

Scary. Stay safe.

Stay alert. Stay well

mark

Fellas, leave the tight pants to the ladies. If I can count the coins in your pockets you better use them to call a tailor. Stay thirsty my friends......

Chinese factories reopening.

All comments reflect the opinion of the author, even when irrefutably accurate.

If you try a different news source, you might see a different response.

There have been travel restrictions in place for several weeks from China which have been expanded to include Iran, Italy, etc. The CDC has been working on this for weeks.

Creating a sense of panic and hysteria over a flu-like illness is not going to help anything or anyone. And certainly politicizing it will not help anything or anyone.

All comments reflect the opinion of the author, even when irrefutably accurate.

At this point it’s pretty clear the virus will spread around the US. Protect yourself by using good hygiene.

A few encouraging points:

I invest in index funds mostly - so my strategy is the same as I had in 2000 or 2008 - ignore the market and check back in a few years.

Here are some private emails that I have sent out to members of this blog:

This email was sent on Tuesday February 18, 2020, to a member of this blog:

“i sold a sizeable portion of my stocks this morning. I don’t think the market has enough risk built in. Moved it to cash and will probably keep it there waiting for either a dip or put it in short term treasuries.”

This email was sent on Thursday February 26, 2020, to another member of this blog:

“i sold some stocks a week ago on Tuesday. I bought back in on Monday afternoon and sold out again on Tuesday morning pre-market when Dow Futures were up +200. I’m currently underweight stocks. I think we have bubbles all around. I think Precious Metals, stocks and bonds are all in a bubble. Setting in cash is a good thing. Being in the ______ you only have so many moves to make and you cant make any Real Time trades. In this volitile market timing is everything. I told _____ you have to watch the 10 year. Forget about the stock market telling you anything because people are accustomed to buying the dips. I’m afraid that the 10 year Could get as low as 1.00%. IF that happens it will set the Fed up to cut rates again which should help the stock market. The only problem with the 10 year going down to 1.00% is that things would have to be REALLY weak for that to happen.

The bubble Im seeing in precious metals is that virtually all the money coming in is going to Gold vs. Silver. That tells me that Gold is leading and Silver is being drug along. When the Fed cuts, and then the stock market could pop upwards and suck all the money out of Gold”

This email was sent on Friday February 28, 2020, to another member of this blog:

“Gold/Silver showed today that there is NO safe haven. Look at yields on Treasurys: 30 year at 1.679%. 10 year closed at 1.15%, 2 year at 0.93%. 1 year at 1.02%. There is NO where to hide. You can’t make money in bond market unless rates go Lower. IF you’re in bond market just for the yield, you’re going to lose money to inflation. Silver sold off 6.25% today. Even with stocks taking a beating and P/Es so high, don’t see in Long Run you have any options but to be in stocks.”

All this was KNOWN on Friday and PRICED in, IMO. The only new news is one death in USA.

Here is where you could have told investors to "hide"

Index shorts made money i.e. using DIA, QQQ, or SPY

Individual stock shorts made money

Shorting the stock index futures made money i.e. using Dow or S&P E-mini

Buying puts made money

Writing calls made money

Buying SH ETF made money

Etc......

There is always money being made by someone in the market. They just don't put it in the news headlines because it would be boring to let viewers and readers know that some investors have been waiting for this to happen and are very happy. Doom and gloom sells. Taking your money out and parking it in a money market is a passive defensive strategy in a down market. The strategies above are proactive offensive strategies in a down market. Most investors just don't understand them and have brokers who don't promote them as well.

I don’t think those types of positions constitute “hiding”.

Mark Feld* of Heritage Auctions*Unless otherwise noted, my posts here represent my personal opinions.

I put it in quotes because it was tongue in cheek.

Sorry and whew!😉

Mark Feld* of Heritage Auctions*Unless otherwise noted, my posts here represent my personal opinions.

Air pollution vanished across China due to virus. Air quality improved. Lots of factories closed

And if the market rebounds...?

It is best to not change strategies based on temporary disruptions.

All comments reflect the opinion of the author, even when irrefutably accurate.

I agree buy and hold is a great long term strategy. My comment was aimed at the inference that the sky is falling and there is no where to make money. This simply is not true. My other point is you don't have to just "hide" when the market is in a severe correction. Depends a lot on your tolerance for risk, age, and your understanding of alternative investment strategies.

Disagree, I went from 100% cash to 100% Stock Index fund all last week one third at a time.

Just because you did it doesn't make it "best". If the market drops 20% more, was it still best?

I'm not saying that moving money into the market is wrong. But trying to time something like this is, as they say, like trying to catch a falling knife.

All comments reflect the opinion of the author, even when irrefutably accurate.

I have no idea what the market will do on Monday.

I had been in cash for quite a while now as I thought the market was overbought.

The VIX tells me the market is oversold now so I went all in.

I had been Waiting for a place to get back in and last week presented itself to me.

If the market crashes from here then this turns into a longterm hold.

If it spikes, we go to all cash again at 27,997 on the dow

a new case has been reported in Rhode Island.

two questions I would ask that I haven't seen reported in the news:

1. how long is the incubation period, how long between initial infection and noticeable signs??

2. can the virus live outside of its host, i.e. on the surface of a counter, and for how long??

Reporting I heard is ....

1) 2 to 14 days

2) yes. not sure.

The coronavirus will typically show up in about 5 days, but the incubation period can be up to 14 days. Some experts have reported up to 24 days for a incubation period. The virus can survive on a surface, but I an going to to give a time period because I have read different information. The virus does not like heat and light. One other thing that has happened with this virus in China and Japan there have been cases where the person was cured and tested negative, but the virus reappeared. They are not sure if the testing was faulty or the virus went dormant in the body and reappeared.

2) yes and a time number I've heard/seen is for about 24 hours.

If one shops do it in the middle of the night when it is way less crowded. Wear disposable plastic food gloves for handling merchandise. Pick your items from the back of the shelf and not the front.

But it's a potent flu-like disease, no more and no less. Let's not panic.

All comments reflect the opinion of the author, even when irrefutably accurate.

How long can the virus survive on coins - that's what I want to know!

Thus far, the news media have failed to cover the numismatic implications of this disease...

This is a good article comparing flu to the Coronavirus -

https://www.nytimes.com/2020/02/29/health/coronavirus-flu.html

But it's a potent flu-like disease, no more and no less. Let's not panic.

my questions are directed to transmission and how it seems to spread distances without a "contact" source and have nothing to do with panic.

Nothing will help if you keep forgetting to not touch your face.

But it's a potent flu-like disease, no more and no less. Let's not panic.> @keets said:

There's no evidence for it traveling distances without contact. We simply don't know who the contact was. Remember, many people have few symptoms or no symptoms. It is flu-like during flu season. Given millions of flu cases this year, im sure some of them are coronavirus cases.

That's why the mortality rate will fall as the number of infections are undercounted.

All comments reflect the opinion of the author, even when irrefutably accurate.

World leaders seem to be panicking a lot more than usual calling this a pandemic. Maybe they know something we don't?

On the China cases: https://www.cnbc.com/2020/02/24/coronavirus-chinas-air-pollution-levels-smog-show-hit-to-the-economy.html

Another case just popped up in Washington State this time a Postsl Worker just tested positive. Will they be delivering mail tomorrow from that division? Hope your not waiting for a DC Registered Mail cause then you have to enter the infected workers building to sign for the coins.

I am going to don my full face mask when I go the office in the morning.

https://www.yahoo.com/gma/global-death-toll-coronavirus-reaches-nearly-3-000-145800588--abc-news-topstories.html?soc_src=yahooapp

Pandemic simply means that it has spread. Influenza is a pandemic every year.

All comments reflect the opinion of the author, even when irrefutably accurate.

Oh! It's gonna spread. Just read about an infected person in S. Korea who went to church twice in one day and exposed 4,300 people during each service. Not good. Peace Roy

BST: endeavor1967, synchr, kliao, Outhaul, Donttellthewife, U1Chicago, ajaan, mCarney1173, SurfinHi, MWallace, Sandman70gt, mustanggt, Pittstate03, Lazybones, Walkerguy21D, coinandcurrency242 , thebigeng, Collectorcoins, JimTyler, USMarine6, Elkevvo, Coll3ctor, Yorkshireman, CUKevin, ranshdow, CoinHunter4, bennybravo, Centsearcher, braddick, Windycity, ZoidMeister, mirabela, JJM, RichURich, Bullsitter, jmski52, LukeMarshall, coinsarefun, MichaelDixon, NickPatton, ProfLiz, Twobitcollector,Jesbroken oih82w8, DCW

Some perspective. In the last 6 weeks there have been:

It's no consolation to those affected, but mass panic isn't justified....... just yet.

I just packed my North 7600 Full Face mask with my P-100 Cartridges for work tomorrow. If I need to Don the better filtering Defender Cartridge which will go up to Organic Vapors so be it, but the P-100 should be sufficient while in my office.

My motto “ BE PREPARED “

I have never been a big player in the stock market. Just low interest pass book and cd’s. Would buy more gold all along if the wife wouldn’t give me such a hard time with each purchase. With that said she has been on my case for years to put some in ERJ. So two weeks ago I finally gave her the ok. The agent could tell I really wasn’t on board. Last week minus $1600. Called the agent on Friday and told him that I wasn’t real happy. Said if we weren’t in the conservative part we’re down $7000. I’m waiting to buy my next gold and tell my wife at least we have it in hand. $1600 would have bought me one $20 gold

Lafayette Grading Set

You can tell people are acting irrationally when they buy bottled water. The virus doesn’t affect the water supply and your city / town is not going to shut off the water to your house.

@Gluggo

Edit: No offense intended. I was assuming you were being facetious about wearing the mask to work, but if not, all the best to you