Also, given that China is already close to us on a nominal basis (and above us on a PPP basis), and has at least four times as many people, it's not exactly a bold prediction. I hope the Chinese continue to grow and prosper and ultimately find leadership who will adopt more free and open norms. Usually, however, things end badly for countries led by megalomaniacal dictators.

PS: @derryb -- I'm glad to see you posting material from the NY Times. I suspect that you don't see eye to eye with their editorial page, but it's good to see that you are accessing a range of views.

@Higashiyama said:

Also, given that China is already close to us on a nominal basis (and above us on a PPP basis), and has at least four times as many people, it's not exactly a bold prediction. I hope the Chinese continue to grow and prosper and ultimately find leadership who will adopt more free and open norms. Usually, however, things end badly for countries led by megalomaniacal dictators.

PS: @derryb -- I'm glad to see you posting material from the NY Times. I suspect that you don't see eye to eye with their editorial page, but it's good to see that you are accessing a range of views.

I have always accessed a range of views. It's how one forms an informed opinion. Reading only what one is spoon fed molds opinion in the shape of a spoon.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

@Higashiyama said:

Also, given that China is already close to us on a nominal basis (and above us on a PPP basis), and has at least four times as many people, it's not exactly a bold prediction. I hope the Chinese continue to grow and prosper and ultimately find leadership who will adopt more free and open norms. Usually, however, things end badly for countries led by megalomaniacal dictators.

PS: @derryb -- I'm glad to see you posting material from the NY Times. I suspect that you don't see eye to eye with their editorial page, but it's good to see that you are accessing a range of views.

I have always accessed a range of views. It's how one forms an informed opinion. Reading only what one is spoon fed molds opinion in the shape of a spoon.

The dollar is facing a change in sentiment globally, but there isn't currently a challenger strong enough to dethrone it. BRICS+ has a ways to go to establish itself. Meanwhile the west (Europe in particular) is moving towards (ie. actively developing) an interconnected CBDC system. It remains to be seen if it is ever fully realized (and accepted by the people).

@dcarr said:

Yes, due to your incessant boasting we all know how great you do all the time, with everything

But I think reality is somewhat different.

How is that any different from the Gold Bugs incessant cheerleading and predictions whereby 99% of them fall flat on their face ?

Get a second mortgage on your house and put all the money in the stock market.

That wouldn't have been a bad strategy unless you did it in early-2020, 2007 or 2008, 2000, or August 1987.

Me thinks he just gets bitter because he is stuck in the gutter while the rest of us know that the key to success is diversification. RGDS!.

I like silver and collecting unusual silver items. These types of things usually have a higher premium above "melt" than "generic" modern silver. But I only buy a few things here and there when I think the price is right and I like the item. The price level doesn't really matter to me, so long as it is in line with the current market price for a similar item.

What I don't waste my time on is obsessing over something I hate.

Some people were "born with a silver spoon in their mouth", which is a reference to wealth and/or health.

Apparently, some other people have a silver fork up the a$$

(which is a reference to having their shorts handed to them in the silver market).

@dcarr said:

Yes, due to your incessant boasting we all know how great you do all the time, with everything

But I think reality is somewhat different.

How is that any different from the Gold Bugs incessant cheerleading and predictions whereby 99% of them fall flat on their face ?

Get a second mortgage on your house and put all the money in the stock market.

That wouldn't have been a bad strategy unless you did it in early-2020, 2007 or 2008, 2000, or August 1987.

Me thinks he just gets bitter because he is stuck in the gutter while the rest of us know that the key to success is diversification. RGDS!.

I like silver and collecting unusual silver items. These types of things usually have a higher premium above "melt" than "generic" modern silver. But I only buy a few things here and there when I think the price is right and I like the item. The price level doesn't really matter to me, so long as it is in line with the current market price for a similar item.

What I don't waste my time on is obsessing over something I hate.

Some people were "born with a silver spoon in their mouth", which is a reference to wealth and/or health.

Apparently, some other people have a silver fork up the a$$

(which is a reference to having their shorts handed to them in the silver market).

I come here for PRECIOUS metals, AKA the metal of kings. Gutter metal is far from precious, they don't even deliberately mine for the crap. You seem to be hell bent on spending your time obsessing over me (and the gutter metal). Get over it man. Good day!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

@dcarr said:

Yes, due to your incessant boasting we all know how great you do all the time, with everything

But I think reality is somewhat different.

How is that any different from the Gold Bugs incessant cheerleading and predictions whereby 99% of them fall flat on their face ?

Get a second mortgage on your house and put all the money in the stock market.

That wouldn't have been a bad strategy unless you did it in early-2020, 2007 or 2008, 2000, or August 1987.

Me thinks he just gets bitter because he is stuck in the gutter while the rest of us know that the key to success is diversification. RGDS!.

I like silver and collecting unusual silver items. These types of things usually have a higher premium above "melt" than "generic" modern silver. But I only buy a few things here and there when I think the price is right and I like the item. The price level doesn't really matter to me, so long as it is in line with the current market price for a similar item.

What I don't waste my time on is obsessing over something I hate.

Some people were "born with a silver spoon in their mouth", which is a reference to wealth and/or health.

Apparently, some other people have a silver fork up the a$$

(which is a reference to having their shorts handed to them in the silver market).

I come here for PRECIOUS metals, AKA the metal of kings. Gutter metal is far from precious, they don't even deliberately mine for the crap. You seem to be hell bent on spending your time obsessing over me (and the gutter metal). Get over it man. Good day!

.

The economical primary silver mines are mostly mined out, and that is why silver is only produced as a byproduct of other mining. And maybe that bodes well for the future price of silver ?

Fine, you don't like silver. You don't need to be disrespectful to others here by always referring to something that they like as "gutter". But you chose to be that way anyway. Have you ever even typed the proper word "silver" ?

Is it beyond you to make your points intelligently and respectfully without being condescending ?

@dcarr said:

Yes, due to your incessant boasting we all know how great you do all the time, with everything

But I think reality is somewhat different.

How is that any different from the Gold Bugs incessant cheerleading and predictions whereby 99% of them fall flat on their face ?

Get a second mortgage on your house and put all the money in the stock market.

That wouldn't have been a bad strategy unless you did it in early-2020, 2007 or 2008, 2000, or August 1987.

Me thinks he just gets bitter because he is stuck in the gutter while the rest of us know that the key to success is diversification. RGDS!.

I like silver and collecting unusual silver items. These types of things usually have a higher premium above "melt" than "generic" modern silver. But I only buy a few things here and there when I think the price is right and I like the item. The price level doesn't really matter to me, so long as it is in line with the current market price for a similar item.

What I don't waste my time on is obsessing over something I hate.

Some people were "born with a silver spoon in their mouth", which is a reference to wealth and/or health.

Apparently, some other people have a silver fork up the a$$

(which is a reference to having their shorts handed to them in the silver market).

I come here for PRECIOUS metals, AKA the metal of kings. Gutter metal is far from precious, they don't even deliberately mine for the crap.

FYI,

Off the actual topic of BRICS, but to respond, yes there really are silver mines.

I went underground on a company trip to Fresnillo, in Mexico for a couple days and it was one of the most modern and efficiently run UG mines I have seen. Fresnillo PLC is the world's largest silver producer; and yes, they also produce gold at some other sites. A very well-run company that has been mining silver there originally under the Penoles name since 1887.

@dcarr said:

Yes, due to your incessant boasting we all know how great you do all the time, with everything

But I think reality is somewhat different.

How is that any different from the Gold Bugs incessant cheerleading and predictions whereby 99% of them fall flat on their face ?

Get a second mortgage on your house and put all the money in the stock market.

That wouldn't have been a bad strategy unless you did it in early-2020, 2007 or 2008, 2000, or August 1987.

Me thinks he just gets bitter because he is stuck in the gutter while the rest of us know that the key to success is diversification. RGDS!.

I like silver and collecting unusual silver items. These types of things usually have a higher premium above "melt" than "generic" modern silver. But I only buy a few things here and there when I think the price is right and I like the item. The price level doesn't really matter to me, so long as it is in line with the current market price for a similar item.

What I don't waste my time on is obsessing over something I hate.

Some people were "born with a silver spoon in their mouth", which is a reference to wealth and/or health.

Apparently, some other people have a silver fork up the a$$

(which is a reference to having their shorts handed to them in the silver market).

I come here for PRECIOUS metals, AKA the metal of kings. Gutter metal is far from precious, they don't even deliberately mine for the crap.

FYI,

Off the actual topic of BRICS, but to respond, yes there really are silver mines.

I went underground on a company trip to Fresnillo, in Mexico for a couple days and it was one of the most modern and efficiently run UG mines I have seen. Fresnillo PLC is the world's largest silver producer; and yes, they also produce gold at some other sites. A very well-run company that has been mining silver there originally under the Penoles name since 1887.

Interesting, I always thought Fresnillo primarily mined copper. At least there's a metal that has some use. Would love to someday see it in person. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

@Higashiyama said:

Also, given that China is already close to us on a nominal basis (and above us on a PPP basis), and has at least four times as many people, it's not exactly a bold prediction. I hope the Chinese continue to grow and prosper and ultimately find leadership who will adopt more free and open norms. Usually, however, things end badly for countries led by megalomaniacal dictators.

GDP growth is a simple function of increased labor supply and productivity growth.

China has hit the Minsky Wall and is now LOSING population and labor supply. They lost 7 million workers last year. Their working-age population will hit 750 MM by 2050, a 25% drop in 25 years. That is unprecedented.

It's now doubtful they eclipse the U.S. in total GDP. Their growth going forward will be 2-4% tops, the days of 6-8% GDP growth are long gone.

PPP GDP calculations are questionable. I'm not sure if the Yuan should be higher or lower, you have a capital-controlled economy controlled by an authoritarian regime.

@jmski52 said:

What you’ve just illustrated is that financial assets have been inflated by more than a hundred times relative to gold, since 1980.

.

While many think that the USD was the world reserve currency right since the 70es, it's interesting that it was only in 1990 that gold was replaced by the USD as the main global international reserve currency

@Peter89 said:

While many think that the USD was the world reserve currency right since the 70es, it's interesting that it was only in 1990 that gold was replaced by the USD as the main global international reserve currency

Jan posted a follow up on that issue (huge wall of text that explains what happened):

@Peter89 said:

While many think that the USD was the world reserve currency right since the 70es, it's interesting that it was only in 1990 that gold was replaced by the USD as the main global international reserve currency

Jan posted a follow up on that issue (huge wall of text that explains what happened):

@Peter89 said: @pmbug said: @Peter89 said:

While many think that the USD was the world reserve currency right since the 70es, it's interesting that it was >only >in 1990 that gold was replaced by the USD as the main global international reserve currency

Not true, gold had fallen since 1980 relative to the dollar and U.S. and global fixed income instruments. In 1980 we had flexible exchange rates only for 7 years.

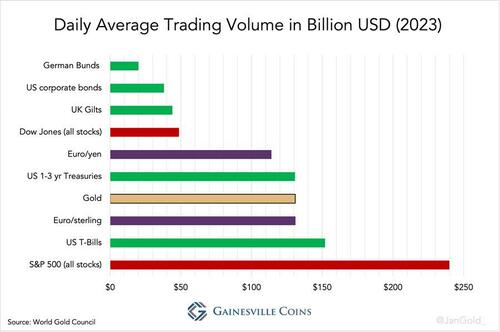

That chart above from Gainesville Coin is somewhat incomplete and deceptive. In addition to overstating the daily (U.S.) gold volume (~$60 billion last I checked), the total Treasury and MBS bond markets have daily trading volumes of $550 and $350 billion, respectively. They are the largest liquid bond markets on the face of the Earth and they are the reason why the U.S. dollar is the global reserve financial currency in the past....today...and years from now.

The Gainesville article makes the following dubious claims:

After Bretton Woods fell apart, it was clear that we were going to flexible exchange rates. There really wasn't a belief that an alternative gold standard was going to to be implemented. Export-oriented Europe wasn't going to put their exports and gold reserves both at risk.

There was no "deal" for Saudi Arabia to reinvest their oil revenues in U.S. Treasuries. They did it voluntarily and in their best interests.

A global reserve currency country must -- by definition !! -- be willing to run trade deficits and capital account surpluses. This mandates a LOSS of gold reserves. Who else but the U.S. would be willing to do that in 1944 ? 1960 ? 1970 ? Nobody.....

No mention of the 1951 Treasury-Fed Accord and the impact on the Gold Standard.

1960's Gold Pool: _** "...France accepted to join on the condition the US would restore its balance of payments deficit" **_ BUT OF COURSE !!! HOW NICE OF THEM !!!!

The deal with Saudi Arabia is just working out specifics of how a foreign government can purchase U.S. debt...also, the "secrecy" was because Islamic law prohibited the payment or receipt of interest. There is no "quid pro quo" here -- it's Investing 101.

The obsession with gold and its "holding its value" is something that maybe made sense in the 1970's but not today.

The Dutch are part of the Euro -- they aren't preparing for any New Gold Standard. First ECB President was a Dutch central banker !

"The primary argument against the dollar is that the Neocons have turned it into a political weapon by sanctioning Russia and removing it from SWIFT. That woke up many countries, who then realized that the dollar had become a weapon and no longer an impartial currency in world commerce."

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

"The primary argument against the dollar is that the Neocons have turned it into a political weapon by sanctioning Russia and removing it from SWIFT. That woke up many countries, who then realized that the dollar had become a weapon and no longer an impartial currency in world commerce."

He writes,.. "All Western currencies are now subject to political intervention...

So let's bring in the BRICS, as those currencies surely are not subject to political intervention. Lol. What a friggin hypocritical world we live in. Epitome of weakness.

One could easily argue that a collective of Brics currencies would be weaker than the individual currencies themselves as the differences in moral, social, monetary, fiscal, religious, political, economic and natural resources are so diverse.

Current BRICS members: Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Iran, and the United Arab Emirates.

It's a shame to watch a country destroy its own currency. And the list grows as more countries seek to get away from relying on a weaponized/politicized dollar. Don't worry, coho will take your dollars when no one else will.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Current BRICS members: Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Iran, and the United Arab Emirates.

It's a shame to watch a country destroy its own currency. And the list grows as more countries seek to get away from relying on a weaponized/politicized dollar. Don't worry, coho will take your dollars when no one else will.

I suspect EVERYONE will still be taking dollars LONG AFTER we are ALL gone.

Your continued delusional fantasy about the destruction of America is certainly clouding your reality. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Current BRICS members: Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Iran, and the United Arab Emirates.

It's a shame to watch a country destroy its own currency. And the list grows as more countries seek to get away from relying on a weaponized/politicized dollar. Don't worry, coho will take your dollars when no one else will.

I suspect EVERYONE will still be taking dollars LONG AFTER we are ALL gone.

Your continued delusional fantasy about the destruction of America is certainly clouding your reality. RGDS!

I have never commented on the destruction of America only it's infatuation with destroying it's currency. But while we're on the subject, destruction of the currency will lead to much further destruction, as demonstrated for centuries by others. LOL

Love of one's country is measured by one's criticism of it's weaknesses and failures. Those like you who feel everything is rainbows know not what true love of country is, but keep pretending you do.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

@derryb said:

Current BRICS members: Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Iran, and the United Arab Emirates.

It's a shame to watch a country destroy its own currency. And the list grows as more countries seek to get away from relying on a weaponized/politicized dollar. Don't worry, coho will take your dollars when no one else will.

Are the countries you listed destroying their currencies? You'd better answer yes. Egypt just did a devaluation for crying out loud. And India and China are frequently flexing military muscle against each other. The ignorance surrounding this group is unfathomable.

This whole Brics story is just fear-mongering right wing politics designed to promote contempt and loathing. "They" know we are weak and can be easily controlled and manipulated. Seems "they" are succeeding with some of us.

Current BRICS members: Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Iran, and the United Arab Emirates.

It's a shame to watch a country destroy its own currency. And the list grows as more countries seek to get away from relying on a weaponized/politicized dollar. Don't worry, coho will take your dollars when no one else will.

I suspect EVERYONE will still be taking dollars LONG AFTER we are ALL gone.

Your continued delusional fantasy about the destruction of America is certainly clouding your reality. RGDS!

I have never commented on the destruction of America only it's infatuation with destroying it's currency. But while we're on the subject, destruction of the currency will lead to much further destruction, as demonstrated for centuries by others. LOL

Love of one's country is measured by one's criticism of it's weaknesses and failures. Those like you who feel everything is rainbows know not what true love of country is, but keep pretending you do.

You see weakness and failure. I see the land of opportunity. Gold bless America! SEMPER!! RGDS!!!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Current BRICS members: Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Iran, and the United Arab Emirates.

It's a shame to watch a country destroy its own currency. And the list grows as more countries seek to get away from relying on a weaponized/politicized dollar. Don't worry, coho will take your dollars when no one else will.

I suspect EVERYONE will still be taking dollars LONG AFTER we are ALL gone.

Your continued delusional fantasy about the destruction of America is certainly clouding your reality. RGDS!

I have never commented on the destruction of America only it's infatuation with destroying it's currency. But while we're on the subject, destruction of the currency will lead to much further destruction, as demonstrated for centuries by others. LOL

Love of one's country is measured by one's criticism of it's weaknesses and failures. Those like you who feel everything is rainbows know not what true love of country is, but keep pretending you do.

You see weakness and failure. I see the land of opportunity. Gold bless America! SEMPER!! RGDS!!!

Yes, I recognize weakness and failure. Everything is not the rainbows and unicorns you have been sold.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Life is what you make it brother. You can continue to dwell in the bunker or you can come out and experience the real world....Because the real world.....It be absolutely BOOMIN. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Are the countries you listed destroying their currencies? You'd better answer yes. Egypt just did a devaluation for crying out loud. And India and China are frequently flexing military muscle against each other. The ignorance surrounding this group is unfathomable.

all currencies are being slowly destroyed by their printers. The world's reserve currency US dollar gained an added advancement toward destruction when its issuer decided to weaponize it and steal them from their largest adversary. Evidence shows that other countries are ditching the dollar after witnessing how easily they can be stolen. Would you want your central bank to be holding dollars if and when you fell into the crosshairs?

The ignorance surrounding the diehards in this group is unfathomable.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

@derryb said:

"The primary argument against the dollar is that the Neocons have turned it into a political weapon by sanctioning >Russia and removing it from SWIFT. That woke up many countries, who then realized that the dollar had become a >weapon and no longer an impartial currency in world commerce."

Right, if you are an authoritarian country considering genocide, better not have money in the U.S. financial markets >or SWIFT.

You guys should send your $$$ to Sberbank, which is owned by Putin's thugs. Go for it !

@cohodk said:

Are the countries you listed destroying their currencies? You'd better answer yes. Egypt just did a devaluation >for crying out loud. And India and China are frequently flexing military muscle against each other. The ignorance >surrounding this group is unfathomable.

all currencies are being slowly destroyed by their printers. The world's reserve currency US dollar gained an added >advancement toward destruction when its issuer decided to weaponize it and steal them from their largest >adversary. Evidence shows that other countries are ditching the dollar after witnessing how easily they can be >stolen. Would you want your central bank to be holding dollars if and when you fell into the crosshairs?

The ignorance surrounding the diehards in this group is unfathomable.

The dollar is UP since we froze Russia's assets. That's what a higher number means. We didn't "steal" them. It is going to go to the Russian people, not Putin and his murdering thugs.

The dollar is ATTRACTING assets from folks who value the rule of law and the attractiveness of U.S. financial assets.

More journalistic ignorance. BRICs wasn't a country creation, it was a MONIKER created by Goldman Sachs PM Jim O'Neill in the early-2000's to describe commodity-dependent countries.

How can anybody trust the analysis on a complex financial system from this source when they can't even get the creation and date right concerning BRICs ?? The article is a joke and the analysis even worse. It's garbge in, garbage out.

BTW, I invented the term "NASA" in the 1960's as a 6-year old. Hey, what the hell.....as long as we're going to push bull**** !!

I have never commented on the destruction of America only it's infatuation with destroying it's currency. But while we're on the subject, destruction of the currency will lead to much further destruction, as demonstrated for centuries by others. LOL

Love of one's country is measured by one's criticism of it's weaknesses a @derryb said:

Current BRICS members: Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Iran, and the United Arab Emirates.

It's a shame to watch a country destroy its own currency. And the list grows as more countries seek to get away from relying on a weaponized/politicized dollar. Don't worry, coho will take your dollars when no one else will.

I suspect EVERYONE will still be taking dollars LONG AFTER we are ALL gone.

Your continued delusional fantasy about the destruction of America is certainly clouding your reality. RGDS!

I have never commented on the destruction of America only it's infatuation with destroying it's currency. But while we're on the subject, destruction of the currency will lead to much further destruction, as demonstrated for centuries by others. LOL

Love of one's country is measured by one's criticism of it's weaknesses and failures. Those like you who feel everything is rainbows know not what true love of country is, but keep pretending you do.

You see weakness and failure. I see the land of opportunity. Gold bless America! SEMPER!! RGDS!!!

Yes, I recognize weakness and failure. Everything is not the rainbows and unicorns you have been sold.

So why is it that you see no failure and weakness in Brics and only the rainbows and unicorns that you've been sold?

The dollar is UP since we froze Russia's assets. That's what a higher number means. We didn't "steal" them. It is going to go to the Russian people, not Putin and his murdering thugs.

The dollar index is up. Simply a ranking of all the pitiful currencies. The dollar's purchasing power continues to decline. Is Publix charging you what the index says or what inflation says. LOL

Russia's dollars were stolen from those who owned them. What we did with them is irrelevant. Other countries do not want their dollars stolen, thus the search for alternatives. Not want to hold dollars also involves not wanting to buy US debt. The reason they buy US debt is because they need dollars for international trade. BRICS is reducing that need. So yes, the dollar's days as a world reserve currency are numbered.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

So why is it that you see no failure and weakness in Brics and only the rainbows and unicorns that you've been sold?

Never claimed no weakness and failure with BRICS. I have only discussed how its search for alternative payment systems is a threat to the dollar's reserve currency status. This is a valid concern to the dollar's future on the world stage. Weaken it on the world stage and you weaken it on the home front.

You should start a "woke" economics club.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

The dollar is UP since we froze Russia's assets. That's what a higher number means. We didn't "steal" them. It is going to go to the Russian people, not Putin and his murdering thugs.

The dollar index is up. Simply a ranking of all the pitiful currencies. The dollar's purchasing power continues to decline. Is Publix charging you what the index says or what inflation says. LOL

Russia's dollars were stolen from those who owned them. What we did with them is irrelevant. Other countries do not want their dollars stolen, thus the search for alternatives. Not want to hold dollars also involves not wanting to buy US debt.

A Russia apologist. Can you understand why some question the flag you wave?

And great. Don't buy US debt...more for the rest of us!!!

So why is it that you see no failure and weakness in Brics and only the rainbows and unicorns that you've been sold?

Never claimed no weakness and failure with BRICS. I have only discussed how its search for alternative payment systems is a threat to the dollar's reserve currency status. This is a valid concern to the dollar's future on the world stage. Weaken it on the world stage and you weaken it on the home front.

You should start a "woke" economics club.

It's not a threat. You're scared because you don't understand and that's OK. Pat pat on top of head.

Funny how you always go "woke". You say folk need to wake up then complain if they "woke". More hypocritical blah blah blah.

The dollar is UP since we froze Russia's assets. That's what a higher number means. We didn't "steal" them. It is going to go to the Russian people, not Putin and his murdering thugs.

The dollar index is up. Simply a ranking of all the pitiful currencies. The dollar's purchasing power continues to decline. Is Publix charging you what the index says or what inflation says. LOL

Russia's dollars were stolen from those who owned them. What we did with them is irrelevant. Other countries do not want their dollars stolen, thus the search for alternatives. Not want to hold dollars also involves not wanting to buy US debt.

A Russia apologist. Can you understand why some question the flag you wave?

I carried a weapon in armed conflict to defend this country. And you? To kill unarmed rabbits? LOL

So you deny Russian sanctions resulted in the theft of hundreds of billions of US dollar assets? I have never argued here it was wrong , only that it got the attention of other nations holding dollars and that it will have an affect on their desire to hold dollars (and it has, as evidenced by BRICs and the declining use of dollars in international trade).

One thing that you and blitzboy need to learn is that criticism does not equal hate. I never woulda thunk "woke" or an attempt to censor would find its way to this forum, but apparently you guys are embedded everywhere.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Weaponize. Everything is weaponized. The Govt, the dollar, the media...all weaponized., right. Such a strong word, it instills fear among the weak hearted and weak minded.

Stop being so weak people. Don't allow them to control and manipulate you.

@derryb said:

One thing that you and blitzboy need to learn is that criticism does not equal hate. I never woulda thunk "woke" or an attempt to censor would find its way to this forum, but apparently you guys are embedded everywhere.

So you dont criticize Russia and China who devalue their currency and weaponize their economies to a much greater extent than the US because you hate them? And you wonder why some question your motives.

What the hell is this "woke" thing anyway?

Embedded...another scary word. Illicit and hidden. Sounds like something "they" would do. Is that what "woke" means? Help me out here.

The Brics have tremendous headwinds against them. They are not a threat.

Weaponize. Everything is weaponized. The Govt, the dollar, the media...all weaponized., right. Such a strong word, it instills fear among the weak hearted and weak minded.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

@derryb said:

One thing that you and blitzboy need to learn is that criticism does not equal hate. I never woulda thunk "woke" or an attempt to censor would find its way to this forum, but apparently you guys are embedded everywhere.

So you dont criticize Russia and China who devalue their currency and weaponize their economies to a much greater extent than the US because you hate them? And you wonder why some question your motives.

I don't care what happens to the Russian/Chinese economies and currencies. My motives? To highlight threats to our economy and our currency in hopes to educate unicorns such as yourself.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

There’s a common thread between those who benefit from investing in wars, and those who benefit by financing those wars.

Janet Yellen wants to take the Russian assets for whatever purpose - and pointing this out doesn’t make anyone a Russian apologist. In fact, implying such a thing is nothing more than an ad hominum attack on a forum member with no substance.

Nobody here is saying that a BRICS currency will replace the dollar. What confiscation of Russian assets means is that it is going to be much harder for the US to continue to buy influence in less-developed nations with dollars.

It also means that a large swath of countries are now looking to lighten up on their holdings of US Treasuries and to replace them with something else (gold). It also means that the Fed’s old playbook of creating “money” from thin air (at the expense of US citizens and foreign bond holders) won’t work as well as in the past - because the inflation that’s coming will be obvious and harder to ignore or paper-over.

The Fed is a privately-owned institution that has no legitimate purpose in controlling US interest rates and money supply. The central banks’ move to implement CBCDs is nothing more than another illegitimate grab for total control over every aspect of our lives via a debt-based scheme. $34+ trillion in debt is a sick joke. End the Fed.

Weaponization? If you don’t think that this is happening across-the-board, it hasn’t affected you, yet. But it will.

Q: Are You Printing Money? Bernanke: Not Literally

Comments

Also, given that China is already close to us on a nominal basis (and above us on a PPP basis), and has at least four times as many people, it's not exactly a bold prediction. I hope the Chinese continue to grow and prosper and ultimately find leadership who will adopt more free and open norms. Usually, however, things end badly for countries led by megalomaniacal dictators.

PS: @derryb -- I'm glad to see you posting material from the NY Times. I suspect that you don't see eye to eye with their editorial page, but it's good to see that you are accessing a range of views.

I have always accessed a range of views. It's how one forms an informed opinion. Reading only what one is spoon fed molds opinion in the shape of a spoon.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

LoL

https://www.buzzfeednews.com/article/craigsilverman/drudge-report-links-site-plagiarizes-stories

Some have opinions in the form of a shovel. Lol

Knowledge is the enemy of fear

The dollar is facing a change in sentiment globally, but there isn't currently a challenger strong enough to dethrone it. BRICS+ has a ways to go to establish itself. Meanwhile the west (Europe in particular) is moving towards (ie. actively developing) an interconnected CBDC system. It remains to be seen if it is ever fully realized (and accepted by the people).

Yelling at clouds on pmbug.com

I like silver and collecting unusual silver items. These types of things usually have a higher premium above "melt" than "generic" modern silver. But I only buy a few things here and there when I think the price is right and I like the item. The price level doesn't really matter to me, so long as it is in line with the current market price for a similar item.

What I don't waste my time on is obsessing over something I hate.

Some people were "born with a silver spoon in their mouth", which is a reference to wealth and/or health.

Apparently, some other people have a silver fork up the a$$

(which is a reference to having their shorts handed to them in the silver market).

I come here for PRECIOUS metals, AKA the metal of kings. Gutter metal is far from precious, they don't even deliberately mine for the crap. You seem to be hell bent on spending your time obsessing over me (and the gutter metal). Get over it man. Good day!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

.

The economical primary silver mines are mostly mined out, and that is why silver is only produced as a byproduct of other mining. And maybe that bodes well for the future price of silver ?

Fine, you don't like silver. You don't need to be disrespectful to others here by always referring to something that they like as "gutter". But you chose to be that way anyway. Have you ever even typed the proper word "silver" ?

Is it beyond you to make your points intelligently and respectfully without being condescending ?

.

FYI,

Off the actual topic of BRICS, but to respond, yes there really are silver mines.

I went underground on a company trip to Fresnillo, in Mexico for a couple days and it was one of the most modern and efficiently run UG mines I have seen. Fresnillo PLC is the world's largest silver producer; and yes, they also produce gold at some other sites. A very well-run company that has been mining silver there originally under the Penoles name since 1887.

My US Mint Commemorative Medal Set

Interesting, I always thought Fresnillo primarily mined copper. At least there's a metal that has some use. Would love to someday see it in person. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

GDP growth is a simple function of increased labor supply and productivity growth.

China has hit the Minsky Wall and is now LOSING population and labor supply. They lost 7 million workers last year. Their working-age population will hit 750 MM by 2050, a 25% drop in 25 years. That is unprecedented.

It's now doubtful they eclipse the U.S. in total GDP. Their growth going forward will be 2-4% tops, the days of 6-8% GDP growth are long gone.

PPP GDP calculations are questionable. I'm not sure if the Yuan should be higher or lower, you have a capital-controlled economy controlled by an authoritarian regime.

.

While many think that the USD was the world reserve currency right since the 70es, it's interesting that it was only in 1990 that gold was replaced by the USD as the main global international reserve currency

.

https://en.wikipedia.org/wiki/List_of_countries_by_GDP_(PPP)

Jan posted a follow up on that issue (huge wall of text that explains what happened):

https://www.gainesvillecoins.com/blog/gold-wars-us-vs-europe-during-demise-bretton-woods

Yelling at clouds on pmbug.com

.

The article was picked up today by Zerohedge - and rightly so.

Very long... yes... but also very informative!

.

.

.

.

https://www.zerohedge.com/geopolitical/gold-wars-us-versus-europe-during-demise-bretton-woods

Debate: The Fate Of The US Dollar

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Long article and most won't read but presented as a true study rather than hyperbolic drivel.

https://carnegieendowment.org/2023/12/05/difficult-realities-of-brics-dedollarization-efforts-and-renminbi-s-role-pub-91173

Knowledge is the enemy of fear

I wouldn't trust the data from the Communist Party of China.

Good article, but it fails to mention:

When billionaires or SWFs start investing in a BRICs alliance or currency, give me a call.

The orange orangutan? RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Not true, gold had fallen since 1980 relative to the dollar and U.S. and global fixed income instruments. In 1980 we had flexible exchange rates only for 7 years.

That chart above from Gainesville Coin is somewhat incomplete and deceptive. In addition to overstating the daily (U.S.) gold volume (~$60 billion last I checked), the total Treasury and MBS bond markets have daily trading volumes of $550 and $350 billion, respectively. They are the largest liquid bond markets on the face of the Earth and they are the reason why the U.S. dollar is the global reserve financial currency in the past....today...and years from now.

The Gainesville article makes the following dubious claims:

The obsession with gold and its "holding its value" is something that maybe made sense in the 1970's but not today.

The Dutch are part of the Euro -- they aren't preparing for any New Gold Standard. First ECB President was a Dutch central banker !

.

Far East and South East leading

In actual BRICS news, Russia is now promoting the idea of a BRICS block CBDC:

https://tass.com/economy/1752465

https://news.bitcoin.com/russia-hints-at-development-of-cbdc-based-brics-bridge-payments-system/

Yelling at clouds on pmbug.com

Martin Armstrong:

"The primary argument against the dollar is that the Neocons have turned it into a political weapon by sanctioning Russia and removing it from SWIFT. That woke up many countries, who then realized that the dollar had become a weapon and no longer an impartial currency in world commerce."

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

He writes,.. "All Western currencies are now subject to political intervention...

So let's bring in the BRICS, as those currencies surely are not subject to political intervention. Lol. What a friggin hypocritical world we live in. Epitome of weakness.

One could easily argue that a collective of Brics currencies would be weaker than the individual currencies themselves as the differences in moral, social, monetary, fiscal, religious, political, economic and natural resources are so diverse.

Knowledge is the enemy of fear

yet BRICS has doubled in size recently. They will be a force to reckon with. Denial does not change that.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

From 1 to 2? Let us know when it's 50.

And why are folk so worried, concerned, anxious, fearful about BRICs anyway?

The only force the US needs to reckon with is our own weakness.

Knowledge is the enemy of fear

I assumed that @derryb was talking about expansion to include Egypt, Ethiopia, Iran, and the UAE.

Current BRICS members: Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Iran, and the United Arab Emirates.

It's a shame to watch a country destroy its own currency. And the list grows as more countries seek to get away from relying on a weaponized/politicized dollar. Don't worry, coho will take your dollars when no one else will.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

z> @derryb said:

I suspect EVERYONE will still be taking dollars LONG AFTER we are ALL gone.

Your continued delusional fantasy about the destruction of America is certainly clouding your reality. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

I have never commented on the destruction of America only it's infatuation with destroying it's currency. But while we're on the subject, destruction of the currency will lead to much further destruction, as demonstrated for centuries by others. LOL

Love of one's country is measured by one's criticism of it's weaknesses and failures. Those like you who feel everything is rainbows know not what true love of country is, but keep pretending you do.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Are the countries you listed destroying their currencies? You'd better answer yes. Egypt just did a devaluation for crying out loud. And India and China are frequently flexing military muscle against each other. The ignorance surrounding this group is unfathomable.

This whole Brics story is just fear-mongering right wing politics designed to promote contempt and loathing. "They" know we are weak and can be easily controlled and manipulated. Seems "they" are succeeding with some of us.

We are weak!!

Knowledge is the enemy of fear

You see weakness and failure. I see the land of opportunity. Gold bless America! SEMPER!! RGDS!!!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Yes, I recognize weakness and failure. Everything is not the rainbows and unicorns you have been sold.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Life is what you make it brother. You can continue to dwell in the bunker or you can come out and experience the real world....Because the real world.....It be absolutely BOOMIN. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Saudi Arabia joined the BRICS last month after making nice with Iran at China's behest.

https://www.bbc.com/news/world-66525474

Yelling at clouds on pmbug.com

all currencies are being slowly destroyed by their printers. The world's reserve currency US dollar gained an added advancement toward destruction when its issuer decided to weaponize it and steal them from their largest adversary. Evidence shows that other countries are ditching the dollar after witnessing how easily they can be stolen. Would you want your central bank to be holding dollars if and when you fell into the crosshairs?

The ignorance surrounding the diehards in this group is unfathomable.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

You guys should send your $$$ to Sberbank, which is owned by Putin's thugs. Go for it !

It's not the diehards who are ignorant, Derry:

https://finance.yahoo.com/quote/DX=F?.tsrc=fin-srch

The dollar is UP since we froze Russia's assets. That's what a higher number means. We didn't "steal" them. It is going to go to the Russian people, not Putin and his murdering thugs.

We didn't "steal" them. It is going to go to the Russian people, not Putin and his murdering thugs.

The dollar is ATTRACTING assets from folks who value the rule of law and the attractiveness of U.S. financial assets.

More journalistic ignorance. BRICs wasn't a country creation, it was a MONIKER created by Goldman Sachs PM Jim O'Neill in the early-2000's to describe commodity-dependent countries.

How can anybody trust the analysis on a complex financial system from this source when they can't even get the creation and date right concerning BRICs ?? The article is a joke and the analysis even worse. It's garbge in, garbage out.

BTW, I invented the term "NASA" in the 1960's as a 6-year old. Hey, what the hell.....as long as we're going to push bull**** !!

So why is it that you see no failure and weakness in Brics and only the rainbows and unicorns that you've been sold?

Knowledge is the enemy of fear

The dollar index is up. Simply a ranking of all the pitiful currencies. The dollar's purchasing power continues to decline. Is Publix charging you what the index says or what inflation says. LOL

Russia's dollars were stolen from those who owned them. What we did with them is irrelevant. Other countries do not want their dollars stolen, thus the search for alternatives. Not want to hold dollars also involves not wanting to buy US debt. The reason they buy US debt is because they need dollars for international trade. BRICS is reducing that need. So yes, the dollar's days as a world reserve currency are numbered.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Never claimed no weakness and failure with BRICS. I have only discussed how its search for alternative payment systems is a threat to the dollar's reserve currency status. This is a valid concern to the dollar's future on the world stage. Weaken it on the world stage and you weaken it on the home front.

You should start a "woke" economics club.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

A Russia apologist. Can you understand why some question the flag you wave?

And great. Don't buy US debt...more for the rest of us!!!

Knowledge is the enemy of fear

It's not a threat. You're scared because you don't understand and that's OK. Pat pat on top of head.

Funny how you always go "woke". You say folk need to wake up then complain if they "woke". More hypocritical blah blah blah.

Cracks me up!!

Knowledge is the enemy of fear

I carried a weapon in armed conflict to defend this country. And you? To kill unarmed rabbits? LOL

So you deny Russian sanctions resulted in the theft of hundreds of billions of US dollar assets? I have never argued here it was wrong , only that it got the attention of other nations holding dollars and that it will have an affect on their desire to hold dollars (and it has, as evidenced by BRICs and the declining use of dollars in international trade).

One thing that you and blitzboy need to learn is that criticism does not equal hate. I never woulda thunk "woke" or an attempt to censor would find its way to this forum, but apparently you guys are embedded everywhere.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Weaponize. Everything is weaponized. The Govt, the dollar, the media...all weaponized., right. Such a strong word, it instills fear among the weak hearted and weak minded.

Stop being so weak people. Don't allow them to control and manipulate you.

Knowledge is the enemy of fear

So you dont criticize Russia and China who devalue their currency and weaponize their economies to a much greater extent than the US because you hate them? And you wonder why some question your motives.

What the hell is this "woke" thing anyway?

Embedded...another scary word. Illicit and hidden. Sounds like something "they" would do. Is that what "woke" means? Help me out here.

The Brics have tremendous headwinds against them. They are not a threat.

Knowledge is the enemy of fear

.> @cohodk said:

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

I don't care what happens to the Russian/Chinese economies and currencies. My motives? To highlight threats to our economy and our currency in hopes to educate unicorns such as yourself.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

There’s a common thread between those who benefit from investing in wars, and those who benefit by financing those wars.

Janet Yellen wants to take the Russian assets for whatever purpose - and pointing this out doesn’t make anyone a Russian apologist. In fact, implying such a thing is nothing more than an ad hominum attack on a forum member with no substance.

Nobody here is saying that a BRICS currency will replace the dollar. What confiscation of Russian assets means is that it is going to be much harder for the US to continue to buy influence in less-developed nations with dollars.

It also means that a large swath of countries are now looking to lighten up on their holdings of US Treasuries and to replace them with something else (gold). It also means that the Fed’s old playbook of creating “money” from thin air (at the expense of US citizens and foreign bond holders) won’t work as well as in the past - because the inflation that’s coming will be obvious and harder to ignore or paper-over.

The Fed is a privately-owned institution that has no legitimate purpose in controlling US interest rates and money supply. The central banks’ move to implement CBCDs is nothing more than another illegitimate grab for total control over every aspect of our lives via a debt-based scheme. $34+ trillion in debt is a sick joke. End the Fed.

Weaponization? If you don’t think that this is happening across-the-board, it hasn’t affected you, yet. But it will.

I knew it would happen.