With so many of us preaching the importance of grading and quality…

…shouldn’t we at least have a few preaching “value”? And maybe even “numismatic importance”? Well, where are they?

Andy Lustig

Doggedly collecting coins of the Central American Republic.

Visit the Society of US Pattern Collectors at USPatterns.com.

Doggedly collecting coins of the Central American Republic.

Visit the Society of US Pattern Collectors at USPatterns.com.

4

Comments

Where do you see Value now in numismatics?

We have had a week long discussion of value in the moderns thread.

All comments reflect the opinion of the author, even when irrefutably accurate.

That’s what the World & Ancient coin forum is for. Where is the “value” in US?

That’s another thread for another day.

Doggedly collecting coins of the Central American Republic.

Visit the Society of US Pattern Collectors at USPatterns.com.

Well, grading, quality, value, and numismatic importance are all intertwined. If you can't grade, you'll never really understand quality or value.

Oh, wise one, please help me find it.

I’d love your help building a set.

The problem with any discussion of value is it always ends up focused on price appreciation rather than the actual value of the artifact.

All comments reflect the opinion of the author, even when irrefutably accurate.

Check out the price changes in $5 Liberty. Tons of increases now showing up as collectors realize the rarity of properly graded and unprocessed scarce dates in an important numismatic series.

There is still value there down the road...

Grading is mostly about getting what you paid for. Value has more to do with what an accurately graded coin should be worth, relative to all other coins. Which is often a very different thing than the price.

Doggedly collecting coins of the Central American Republic.

Visit the Society of US Pattern Collectors at USPatterns.com.

Value is in the eyes of the beholder and strongly connected to how deep the buyer's pockets are.

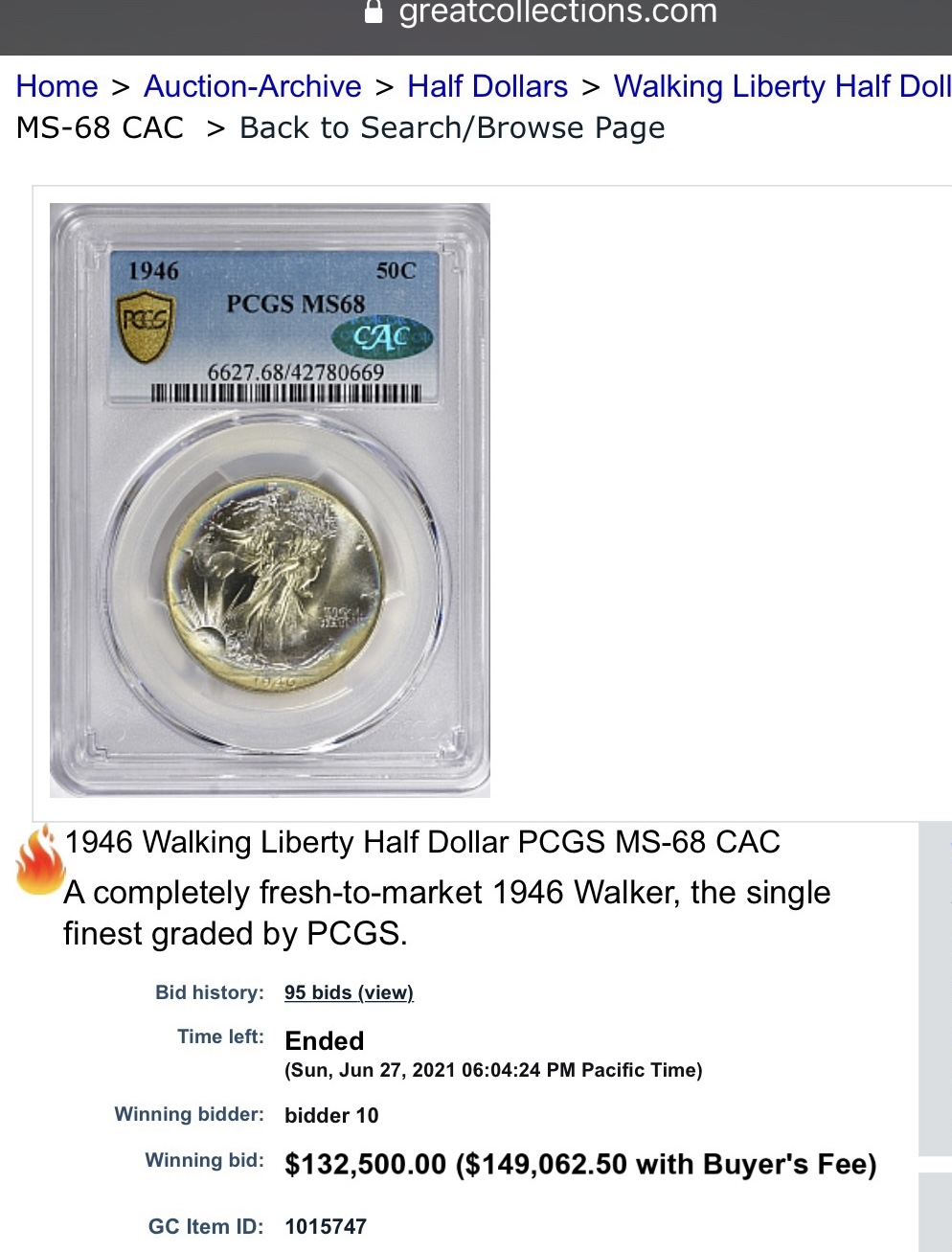

The grading standards for coins in the 67 - 70 range minor flaws separate these coins. A spot or two in one location rather than another drops the grade a point which can translate into a huge premium loss based on relatively minor imperfections. An otherwise beautiful coin with a weak strike places a part in the higher grades. An imperfect the size of the dot at the end of this sentence in a prime focal area could men a loss of hundreds or thousands of dollars if it knock a coin down from 69 to 68.

I think if you buy coins up in this stratosphere you need to understand the technical distinctions in these grades and the sliver of difference that makes one coin a $10K coin and another a $200K coin.

@MrEureka I'm not sure I'm following you. I don't think it's that simple.

Nobody really gets to decide what a coin " should be worth." Warren Buffet says "Price is what you pay, value is what you get." But, even the mighty oracle of Omaha doesn't really know how a particular investment will perform in the future.

In simple economic terms, the market decides the price, more-or-less following the supply and demand curve. In a perfect market (the collectible coin market doesn't even come close) there are always an adequate number of well informed, willing buyers and well-informed, willing sellers. The current market price in this situation represents the collective knowledge and emotions of the participants. In perfect markets, the price and the value should be the same.

An individual might think something sold at X price has Y value, but that's because their knowledge and emotions are different than the market. For example, when it comes to toned ASEs, I think they should be worth less than they currently sell for, so I don't play. For me, those coins are over-valued (I perceive too much risk in buying/holding them). I might be wrong. They might become the next tulip bulb craze. Nobody knows.

Two years ago, I might have assumed the price of 1921 Peace dollars would skyrocket in 2021 and that they were therefore under-valued. Back then, the collective market didn't agree with me, but the actual coin market is easily distracted, whimsical, subject to fads, and impossible to predict. Turns out, my assumption of value would have been correct. Are they over-valued right now? Nobody knows, but I'm darn certain I can't get a nice one right now without paying more than a couple years ago.

When I'm contemplating a purchase, the seller determines an asking price. He does this based on his own set of assumptions which includes his perceived grade. As the buyer, I evaluate the coin, see if I agree with the proposed grade (his, or that of a TPG), and if my set of assumptions match up I'll buy it. You, as a third party, might think the sale price was under-valued or over-valued. Who is right? Nobody gets to decide, but no part of this potential transaction happens in the absence of grading.

Of course, all of this ignores the value of the pure joy of collecting, the history of the coin, and appreciation of the art and symbolism depicted. Therein lies the actual value for most of us (that don't make our living this way). That value is certainly important for me when I consider the financial opportunity cost of owning expensive coins when compared to other asset classes. How often does the coin market keep up with the 10-11% long-term average of the S&P 500? Wait, actually it even has to do better than the stock market, because capital gains tax on collectibles is higher than securities....... I digress.

As for numismatic importance, again, nobody gets to decide. The collecting base has determined that 1804 dollars, 3-legged buffaloes, and 1913 nickels are really, really important. None of those coins do much for me, but my lack of interest in them affects the market not at all. People can promote certain coins, sometimes with tremendous success.

edited to correct the reference to 1913 nickels

Well my 2 cents is everything on great collections is through the roof!!

Good question Andy. Let me respond perhaps somewhat in the direction you might have been thinking....

I think there are a number of quite important numismatic treasures that are very rare and historic and not things of superb technical grades. This description often applies to items like early very rare US mint patterns before 1840. Often unique or nearly so or the only collectible examples outside of museums. Another example might be my modest collection of Comitia Americana cliches with none to a few know of each observe or reverse. Struck to honor brave heroes of the Revolutionary War. Ben Franklin was involved. Thomas Jefferson had a set of cliches sent home from Paris. So cool, so historic, but often a bit rough in condition. George Washington was a recipient. So not often technically superb, but very much so historic and cool.

I'm not knocking high grade coins or pcgs registry sets, I collect in that realm as well. Recently though I've enjoyed doing a Franklin cent (fugio copper) set with many modest grade coins and the clear legacy as the first federal coinage series, even predating the 1792 half dismes. Often confused with colonial coinage.

Combining early American history told through the medium of coins makes for loads of epic fun IMHO.

Good topic, that started off on the wrong foot, but has since gotten on track with some really thoughtful posts.

With many things being relative, I've usually aimed for value, where I see it.

30 years ago, when registry set collecting was in its infancy and people were paying top dollar for late date Walkers in 65 and up grades, I steered clear, and put my money in the early dates in XF/AU/low MS. Going to shows, it was easy to see STACKS of raw late date MS walkers from original rolls. All it would take was more submissions, or a slight relaxation in TPG grading standards, and the pops in > 64 were going much higher. On the other hand, where were the early dates? Most were tough to find above VF, had always been scarce, and would always be scarce. There were no rolls or hoards of these, waiting to be dumped on the market. I'd gobble these up, raw or slabbed, wherever I could find them, and had no problem putting away a few duplicates if/when I could find them. Over time, the pops of the late dates in gem exploded and prices collapsed. At that point, I upgraded some of my 64's to 65/66.

I've long since moved the primary value hunt to large cents, specifically pre 1844. Walk the typical bourse looking for these in VF and up, and you see very little, apart from the holdings of a few major specialists. And the earlier you go, the slimmer the pickings - apart from the Randall hoard examples - and even these have gotten scarcer. And pre-1816, you better be willing to live with lower grades, and/or minor issues, unless you have deep pockets. And for some on the forums who nitpick and preach problem free - some of whom I suspect most of their holdings are probably generic and mundane - saying send it back, wait for a better one, for anything posted that's not pristine - let's see your wreath, chain, 1799, 1804, classic head cents....Rant over LOL, please collect what you like!

This is what got me thinking about the subject. More later.

Doggedly collecting coins of the Central American Republic.

Visit the Society of US Pattern Collectors at USPatterns.com.

Aren't there lots people out talking about value in terms of history/numismatic significance? The tend to publish research articles, maintain inventories of more esoteric things (colonials, medals, tokens, trial strikes/spalshers/cliches, documents, etc), and focus less on Registry points.

Chasing condition rarities has never been my thing, though I don't fault people for trying to put collections together that include the best of the best. My take is that certification populations change, grading is subjective, and I don't value single grade points as highly as some other people. That's not to say I don't like attractive decimal coins. If it's nice for the grade and not 100x the price of a coin one point lower, awesome.

I prefer medals, particularly those that have been awarded, and tokens. The stories and variety of designs are appealing. But anything artistically or historically interesting, rare in the absolute sense (some of those Liberty Head fives and tens!), or something that has a neat association (numismatic or otherwise) will do.

Dealing in Canadian and American coins and historical medals.

There are entire areas of numismatics that are ignored if people focus only on quality. That sentiment is partly driving me to start to learn about and collect some coins from the middle ages.

I don't think you can discuss value without also clarifying what your values are. An XF Franklin set is certanly better value than an UNC Franklin set, you get the same set for a lower price! If you're a set builder, that may very well be a true statement. If you have different values and goals, the opposite may be true. If your goal is to show coins as they were made/intended, then a gem set may be a better value because the XF set doesn't accomplish that at all. If you want to show coins in their best form in the best possible light, then a proof set is probably closer to ideal, and value becomes based on that. If value is only determined by the future selling price of a coin, then that seems like something slightly different from collecting and numismatics.

I always like to remind people that if you buy coins based on what you can sell them for, then you are collecting based on other people's tastes. Their tastes will dictate the prices they will pay. Everyone should strive to collect based on their own taste. If your tastes diverge from others, then consider yourself lucky. You will likely get more for your money.

Topics like this make me wonder: Does a discussion on price ever help the numismatic discourse?

IG: DeCourcyCoinsEbay: neilrobertson

"Numismatic categorizations, if left unconstrained, will increase spontaneously over time." -me

For those that remember the book, "A Mercenary's Guide to the Coin Market" (mostly famous and remembered for the cover picture with the 3 people holding firearms and surrounded by coins), the main recommendation was to buy and hold only the highest graded certified coins, MS64 and higher, ideally much higher.

Essentially, if you can't afford gem bust dimes, buy gem seated dimes. If you can't afford gem seated, buy Barber, or Mercury, or Roosevelts. Sell everything under MS64.

Then came the registery, and here we are.

Personally, I find a bust dime in VG a lot more interesting, and a far better value, than a late date Mercury in 68. I think of it as an example in the middle of a small pile of survivors, rather than one near the tippy top of an enormous mountain of remaining coins.

And frankly, I'm glad the larger coin market continues the other direction, or else I'd never be able to afford my humble and honest worn coins, as there are not nearly enough to go around.

Liberty: Parent of Science & Industry

Yikes!

Unfortunately when I get the urge to contemplate such matters I usually wait until the urge subsides as it is less stressful than participating in and following a herd mentality.

Experience the World through Numismatics...it's more than you can imagine.

Define value. It would have to inherently incorporate opportunity cost in some manner - but that’s dependent upon the buyer’s financial circumstances. To some, one more Ferrari for the collection is the same as one more Starbucks coffee to others. I’d imagine they perceive more value in the MS68 WLH than the Ferrari.

I agree with so many of the members who have posted thus far. I look at it this way. If one is purchasing coins of any perceived value as an investment, the prices are going to go up and down based on so many factors, just like any other commodity. Stocks, Bonds, real estate, and practically everything else vary in price due to supply and demand, fads and fashions, emotions, desires, etc.

Coins and other "collectibles" vary by an additional factor, that of "tiers" of buyers. Most avid collectors purchase coins based on their own disposable income. Some of us can only afford to spend X amount per year on coins, others can easily afford X times 100 or 1000 or more, and every level in between. As @Walkerguy21D posted, Large Cents are a prime example. When I was heavily into LCs, I could afford AU to MS late dates, VF to XF middle dates, and primarily G to F early dates. I knew other LC collectors (EAC guys mostly) who had the ability to buy everything in MS if they wanted. As some collectors' disposable income increased (like me) they could, and many times did, upgrade some of the lower grade coins.

But what is value? Again, it is based mostly on two things, investing vs. collecting. To the investor or dealer, it comes down to the question, "For how much do I think I can resell this coin at a later date"? To the collector, value is different based on whether the said collector is pleased with owning the coin in his or her collection. Personally, I look for eye appeal (my eye, not anyone elses') regardless of grade. To others, it might be just filling a hole. And there are many other factors that come into play.

I don't know if my thoughts have come across as meaningful and lucid or not. But that's my two cents, and my humble opinion. Thanks for your time.

My OmniCoin Collection

My BankNoteBank Collection

Tom, formerly in Albuquerque, NM.

Value is, of course, subjective. To me, I think of value as the extent to which a coin will advance the importance of my collection. Not market value, but importance. Then again, the two measures should converge in the long run, and an uncirculated Pine Tree Shilling may ultimately sell for more than an MS 68 1946 Walker.

Doggedly collecting coins of the Central American Republic.

Visit the Society of US Pattern Collectors at USPatterns.com.

But there's only one MS68 1946 Walker. Unc Pine Tree shillings are common.

Dealing in Canadian and American coins and historical medals.

For too many “collectors,” making money trumps every other aspect of the hobby. The whole idea of buying nothing but key dates is a reflection of this. Whatever happened to, “I would like to fill every hole in this album?” What happened to, “What’s the history or an interesting story about this item that I have or might buy?”

You can work hard on convention presentation about Charlotte or Dahlonega Mints, and few people will come. If you give it the title, “How to make money with coins,” you will fill the room. The fact is those experts probably won’t give you any answers.

It’s the same reason why all the get rich quick schemes work. People want maximum reward for the least effort. The reality is, in most cases, the speaker charging people to listen to their advice is the only one getting rich.

Personally, I’d love to watch a good presentation on southern gold. Especially if there are actual examples to look at and see instead of just photographs. It’s funny, as much as I enjoy coin photography I’m starting to migrate more to requiring to see a coin in hand before I buy.

Especially if there are actual examples to look at and see instead of just photographs. It’s funny, as much as I enjoy coin photography I’m starting to migrate more to requiring to see a coin in hand before I buy.

From BillJones:

For too many “collectors,” making money trumps every other aspect of the hobby. The whole idea of buying nothing but key dates is a reflection of this. Whatever happened to, “I would like to fill every hole in this album?” What happened to, “What’s the history or an interesting story about this item that I have or might buy?”

Reminds me of the Melbourne coin show. Month after month this part time dealer came, with a beautiful display of Civil War tokens. R5, R6, etc lots of die breaks, original mint red mint red around the devices, little note cards with some info, provenance, etc. Never sold a one of em. Meanwhile 1921 peace dollars and CC Morgans were flying out the door from other dealers’ tables.

Myself, I enjoy owning scarce items where I hope/believe that there will be future demand. Not necessarily to make a profit, but hopefully not lose much, since I’m putting a fair amount of money into them. There are many esoteric things that are interesting and genuinely rare, but finding “the next buyer “ could be problematic.

There is usually some explainable reason for both current and historical relative prices, even evaluating within US coinage.

An earlier post used Liberty $5 as an example and it can be equally applied to the QE and eagle. A noticeable proportion are legitimately scarce and a few rare due to the mintages.

Presumably most buyers are type collectors or for the eagle, buying the common dates as bullion substitutes.

I would love to speak at the FUN shows, but the guy who runs the education program won't let me.

The one year I did speak at FUN, I had a Power Point presentation on a 1795 date set of U.S. coins. I had to beg the guy to get a slot. I had examples of all the coins from the half cent to the $10 gold piece. I had about 25 people show up. They were very interested in my topic, asked questions and looked at my coins. After it was over, his response was, "See I told you so."

I had article published in the latest FUN Topics about year 238 when there were six Roman Emperors. I am sure that won't cut any ice with him.

Some people are just too tied up looking at numbers. They want something impressive to show off. It’s a shame because it trends everything to the banal.

Sure, there are reasons for everything. But here's an example of what I'm talking about. If you have an R-7 variety of a Capped Bust Half Dollar in XF, it might bring something like 50X what a common variety of the same date would bring. If we're talking Bust Dollars, more like 2X. And if we're talking 1795-1834 gold, people will like at you like you have two heads if you quote them any premium at all. That's because the half dollars are so much heavily collected. (Which is mostly because the common coins are so affordable.) But to someone inclined to collect early coins by die variety, and who doesn't mind that every coin will cost at least 4 figures, the dollars and gold are incredibly good relative value. Maybe not a better investment, but a better value.

Doggedly collecting coins of the Central American Republic.

Visit the Society of US Pattern Collectors at USPatterns.com.

Part of that is because you are starting off with that something that has a 5-figure price from the get-go. I have more resources than most collectors. For me it was a huge strain just to get the 12 major type coins that are required to complete the type set. There are two 6-figure coins in that set. Going any further with the collection is simply out of the question. Forget the rare die varieties. I have the book, but even collecting the dates is not financially feasible.

If you have the resources like Harry Bass did, sure, you can do it. But for us mortals, it’s out of the question.

I agree with you.

By this line of reasoning, the Spanish colonial series I collect is "dirt cheap". As a collectible, I rate it comparable to flowing, hair and draped bust coinage of equivalent denomination and it's scarcity fits the pattern of the equivalent liberty seated denominations but is usually almost certainly scarcer or much scarcer.

Financially, I don't believe it will do much of anything (somewhat better than average) and if it does exceed my expectations, I won't be able to complete it, assuming the coins exist that I actually want to buy.

Simple:

Price is an issue in the absence of value .

I give away money. I collect money.

I don’t love money . I do love the Lord God.

Was it centered around the importance of grading and quality?

Keeper of the VAM Catalog • Professional Coin Imaging • Prime Number Set • World Coins in Early America • British Trade Dollars • Variety Attribution

Followed this thread yesterday and today. Interesting thoughts and viewpoints.

For many, the hobby is only about money and price, not necessarily preservation and value.

For some, it is about competition to obtain the finest examples, or the most complete collections, or maybe both.

For others still, there as many other things as we can pinpoint for why we collect.

All of these ways have some value, to one extent or another. Whether the value matches the price, or has staying power, is another matter entirely.

And what we each perceive as value varies relative to our thoughts and knowledge and intuitions. We may be one of many, or stand alone, whistling in the wind.

.

I find value in a combination of quality and rarity, supply and historically long-term demand, artistic merit and interesting attributes and stories ... maybe provenance or another matter giving a piece character slightly unlike it's brethren ... especially attractive originality that has not succumb to the pull of greed to improve the appearance or deceive the unknowing.

“We are only their care-takers,” he posed, “if we take good care of them, then centuries from now they may still be here … ”

Todd - BHNC #242

Agreed, and your comments are consistent with what I said. Fewer collectors means lower prices, which makes the coins better value for the money.

Try looking at it this way. If you didn't seriously collect early US coins, and if you weren't concerned about resale value, which would you rather have: An R-7 1831 Half Dollar or an 1800 Heraldic Eagle $5 of similar rarity and quality? Not even close, as far as I'm concerned.

Doggedly collecting coins of the Central American Republic.

Visit the Society of US Pattern Collectors at USPatterns.com.

yes.

All comments reflect the opinion of the author, even when irrefutably accurate.

The comments here are still focusing more on "price" rather than the more esoteric idea of "value". The most inexpensive coin could easily be the most valuable.

All comments reflect the opinion of the author, even when irrefutably accurate.

There are more billionaires collecting now. Will we see record breaking results like the Pinnacle Collection?

Type collecting replaced date collecting for many. That's been going on for a long time.

A lot of the exonumia posted here falls in to this camp as much history is not as well known as for coins.

Maybe you just need sunglasses and a high powered rifle?

There have been quite a few posts about the value of aa MS69 vs the quality of a MS70, or the inflection point where prices start to increase a lot in lower grades for classics.

@Zoins, unless you are LeLand Rogers, a type collector from long ago who filled the spaces with key dates or varieties (e.g. the finest known 1806 Small 6, Stems half cent), buying only key dates is not type collecting. I agree with you that type collecting has supplanted date and mint collecting for many, including me, for the most part. From what I have seen from most of these guys who buy nothing but key dates, type collecting has nothing to do with their objectives.

I agree. I was was commenting specifically on the following:

But I agree with you as well, key date collecting isn't like date collecting or type collecting. I will say what one collects isn't necessarily the same as what one's interested in researching.

I have also heard of collectors hoarding key dates. I don't know how often it happens but don't see much of a collecting motive behind that.

I think a lot of this depends on how one defines value.

Yes, if it persists. I don't think it has much relevance to the coins I collect though; not a high enough collector preference. More like the examples you gave, gold and crown sized coins.

I'll pass on the sun glasses and high powered rifle.

Seems that the yardsticks that folks use to measure value, numismatic significance and even rarity could stand to be updated... The numismatic world is not as small as it once was.

Experience the World through Numismatics...it's more than you can imagine.

all coming from ASIA buyers

I give away money. I collect money.

I don’t love money . I do love the Lord God.

It's a good thing they are interested in coins!

With more billionaires collecting coins, it's good to know where they are.

Check this out:

https://en.wikipedia.org/wiki/List_of_cities_by_number_of_billionaires