an interesting market report

We have a lot of discussions on the state of the rare coin market. If it was easy to determine, then there would not be all these discussions (i.e. for instance it is easy to look at the S & P 500 and say it is down or up). One of the best statements on the coin market in my opinion was from Brian Kendrella, President of Stacks. He said:

When I speak with customers, perhaps the question I get asked most is how is the numismatic market? Like most markets, ours is a little too complex to be covered by a single question or a simple answer. Coins or bank notes? US or foreign? China or Great Britain? And so on. There are too many variables in that five word question to give a fair and accurate answer.

Generally speaking, and I will quote Tad Smith, CEO of Soethebys who spoke recently on the state of the art market: "The [numismatic] market is very strong. Not frothy. It's a smart market."

We have noticed an ongoing increased interest in quality, and as a result, objects that offer tremendous rarity, that are the finest known, are of great quality and originality, or have superior provenance continually trade at higher prices. Generally, demand and prices for these objects is growing.

On the contrary, common pieces of mediocre quality are less and less sought after a yesterday's prices, resulting in the prices of objects in the middle and low end market showing a downward trajectory.

The above assestment is from Brian's Rare Coin market report dated December 21, 2018.

I take a couple things from this assessment. 1) it is a mistake to continuously talk about the numismatic market as a whole. Clearly there are many segments and some are breaking records and others continue to see prices drop and 2) how your collection is currently doing may be an indication on what you are collecting. If you see prices on your coins 30%, 40% or 50% lower---maybe it is because your coins are common or of mediocre quality (for some this is not a concern--they like to collect what they collect and more power to them). If your coins seem to be holding up well or increasing in price, maybe it is because you have collected truly rare coins or coins that are of superior quality or originality.

Comments

We need a market report based on length of time coins remain on eBay with no change in price and obviously no sale.

The conclusions above are the same we have arrived at on the forum. FSF has nailed it.

This sounds like a 2018 observation of bifurcation which @RYK and others have been talking about since 2006! Sounds like those that took heed would have done well.

RYK even called it the "Great Bifurcation" in 2007 here:

Street dealers don't speak poorly of street goods. Doh.

I agree this has been going on for awhile. What RYK said in his thread in 2007 about the bifurcation of the rare gold market is still true. Too many people pass on an original rare gold coin that is solid for the grade but is priced aggressively but bite on the gold coin that is overgraded and is dipped out at a "bargain" price. A coin that is original, solid for the grade, and is rare (meaning I can't find 10 online just like it) will I believe continue to have an upward trend. Those bargain coins in my opinion will continue to be more "expensive" in the end.

it will take influx of new investors improve market. While online retail steady still slow turnover. Shows have attended essentially doa due to impact of online and abundance of wholesalers. There basically is oversupply vs demand.

Champagne taste, beer budget - that's my problem. I don't see the market ever correcting this.

The "quality" coins these market comments are about make up a fraction of 1% of the available coins. "Ordinary" coins still have a market but it is a market that continues to slip lower. If you are a collector who can only afford "ordinary" coins (and that is the great majority of collectors) it is time to get both selective and smart in your buying. Stop being generous in your offers and buy with a lower future price in mind. There are plenty of "ordinary" coins available. If the seller won't budge on price just move on. Buy with the attitude that you don't have to own anything right now.

I think the metal markets has a lot to do with it. Get gold and silver up 40% and a lot of dreck starts moving.

Those were fun times, the halcyon days of coin collecting. It was soooo much simpler, too, when the market was only bifurcated. Since then, we have had trifurcation (think, in general terms NGC, PCGS, PCGS/CAC), quadrification, and even pentafication! The world is a much more dangerous and complicated place.

I know a couple of folks who have made millions in the junkyard business. That doesn't mean I want to fill my backyard with junk. I'd piss off the neighbors and the City would make my life miserable. Best left to the professionals

Coin collecting, as a hobby, has given me thousands of hours of pleasure since I was a kid. I've never tried, or pretended, to be a dealer. When I have bought collections or coins in bulk, it's almost always been with hobby money, and I bought it at a price that I knew I could resell it without taking a haircut.

The high end of numismatics is out of my financial reach. I love to read about it and experience it here, and on the fringes at occasional shows... But nothing - bifurcated market, sinking values, 3rd party grading controversies - can, or ever will, take away my basic love for coins.

Check out my current listings: https://ebay.com/sch/khunt/m.html?_ipg=200&_sop=12&_rdc=1

There are quality and truly rare gold coins that can be bought on a budget and I believe will hold their value or increase. You do not need to be in the top 1 or 2 % of collectors. I would urge anyone to check out the video article on coinweek where Doug Winter was interviewed about this very subject. It is called "Doug Winter and Coinweek bring you: Collecting Gold coins---tips for the rest of us." You can also find this link on Doug's website.

Here's a link to Doug's interview.

https://raregoldcoins.com/blog/2018/11/7/doug-winter-and-coinweek-bring-you-collecting-gold-coins-tips-for-the-rest-of-us

I wonder if the "bifurcation" is a result of the overall (& growing) wealth gap in the rest of the economy.

It can't help but have some effect, IMHO, ESPECIALLY at the very high-end. Simple economics.

Check out my current listings: https://ebay.com/sch/khunt/m.html?_ipg=200&_sop=12&_rdc=1

I think if this were to happen you would see an unusually high amount of this type of material consigned to the melt bucket.

As I posted about a month ago, during a conversation with an antique car dealer, he said the same thing. High grade, high end antique cars are selling. The lower end stuff is sitting. He had a 1937 Cord convertible on the floor, which was really nice. I was able to note on the Internet that it is still available however.

quality never goes out of style

m

Fellas, leave the tight pants to the ladies. If I can count the coins in your pockets you better use them to call a tailor. Stay thirsty my friends......

Or dreck starts being melted.

I’m actually hopeful that that my budget will increase and the market will decrease, so they will meet somewhere around house wine.

LIBERTY SEATED DIMES WITH MAJOR VARIETIES CIRCULATION STRIKES (1837-1891) digital album

Absolutely. If you’re not in a position to collect the top 1% coins now, it’s going to be very difficult to ever catch up unless the macro picture changes. That’s part of why I’m slowly switching to ancients though the learning curve is steep.

LIBERTY SEATED DIMES WITH MAJOR VARIETIES CIRCULATION STRIKES (1837-1891) digital album

Just how many US coins are considered the top 1%? The best to fight over by rich people? A few thousand coins? The top 5% of US coins?

Just curious. Because if it is less then I think it is... naturally you have to be rich to consider buying them.

Look at pop reports for the last ten years on all post 1850 coins which are not hard to find in Unc. That's all you need to know.

"Seu cabra da peste,

"Sou Mangueira......."

Top 10 coins or Hansen level stuff & will go up a lot in price.

Top 100 coins or serious collector stuff & will inch upward

Top 1000 coins are popular & will likely hold value

Below 1000 are widgets and likely to go down.

I think the number of important coins is much lower than what people think.

The good news is that people of average means can now buy a top 100 coin, you just might not be able to have a whole bunch of them.

I think this is why the "box of 20" idea" is getting more popular.

Your set may skew the numbers slightly one way or the other.

For me it's like 8/80/800 & below.

My Saint Set

So much of this discussion is around market prices. Sure, the cost of coins is relevant to collectors... The market is much more relevant to dealers and those looking for profit. Collectors just want nice coins in their collection...and many have little concern about selling or 'investment', since they buy coins with disposable hobby funds. Certainly no one wants to be ripped off, and most think that if they were forced to liquidate, they would get approximately what they have spent to acquire those coins. Maybe, maybe not. The main bifurcation on this forum is between business and hobbyists. Good luck to all... in the meantime, I will enjoy my coins - and maybe add a few. Cheers, RickO

I think the bold text above (emphasis mine) is the case for inexpensive coins, but not necessarily for more expensive coins, say in the 4, and definitely 5-8 figures.

There is a market segment for the expensive coins vs those most can afford or material trading close to BV.

Neither one will do well without buyer interest. One constant like gravity is the bigger the MV of the coin the bigger the hit can be. I was amazed in the tremendous MV difference just between AU 55 vs AU53 for the 1845-D $2.50 Wuarter Eagle in another thread analyzing both CPG and CU values on this issue along with auction history.

Inventory mgt and investment decisions need to be considered carefully.

It is interesting to note how buying and asking prices work. I have an AU-50 graded 1808 Quarter Eagle in an old green label holder that I bought at the top of the market. I an buried, but when see what dealers want problem coins from the same issue, I shake my head. Coins with big marks in the field or planchette issue still have 6-figure asking prices. You see cheaper auction results, how many of those coins actually sold? Truly rare type coins, like the 1808 Quarter Eagle will always be expensive. The question is how expensive?

I’ve really only been collecting since 2014 but I’m having a blast. I probably invested several thousand into getting started but I’ve been able to keep churning and keep making money and adding sets. In 2018 alone I added an entire peace dollar set - all AU-low ms, greatly expanded my Franklins and added an entire walking liberty set that’s ms from 1929 up. All this was from funds earned from buying/selling/trading and all of it is raw. If the market goes down I’m not out much - it was all self-generating anyways.

Sure, some of you would turn noses up at my lowly AU 1934-S peace etc but owning something like that is an accomplishment for me - particularly since it was basically free. I’m more interested in date runs than box of 20. Both for my enjoyment and investment. At any time I could liquidate my entire collection in a week - I only have one (or a couple) of each coin so I’m the epitome of diversification.

Market being down means I can score some of those thousand dollar high AU or low MS rare dates as they dip down into the hundreds.

From my experience, this has always been the case.

From my experience, this is the new dynamic. Since 99.9% off all collectors fit the the "common pieces of mediocre quality" category, the market is going down.

I am not sure I agree that 99.9% of all collectors fit the common mediocre category. However, my point in an earlier comment in this thread is that there are affordable coins---rare, gold, attractive---that are available that do not fit into the "common and mediocre" category (see the article I mentioned by Doug Winter that Zoins so graciously linked above). 99.9% collectors are not doomed to buy common mediocre coins that are on a downward trajectory. With a little work there are coins that Doug points out (and coins not mentioned by Doug) that I believe can be bought on a small budget and will hold their value or go up because they are truly rare and attractive.

I totally understand that position, and as a result, I have adjusted my collection to focus on coins that virtually no matter what happens in the coin market, good or bad, it will not have a significant impact on my financial status (positive or negative). This was not always case.

If I am buried in a coin, my peeps might as well bury it with me. It won't matter.

Here's my take:

Although I believe the prices have likely dropped for common coins, such as common Mint State Morgans and Peace dollars in higher-grade, XF barbers, Etc.

I do believe you can still do well by buying better quality, scarcer issues that aren't million dollar coins.

For example, if you're like me and bought a nice Mint State early Walker, I think you would do okay and you don't have to buy an 1804 dollar or 1913 Liberty nickel to do well. There are other series, besides walkers, that have potential, too, and don't cost million dollars. I only used walkers as an example, because that's what I'm familiar with.

Just ask @BillJones. I believe that MOST of the material that he purchases fits my example for better quality and has good potential. Bill has a wider understanding, than most people on these boards, about different series as a whole and their Rarity.

Also, let me reiterate what I have said many times before---know your series and research prices, so you can be a knowledgeable buyer!

Sometimes, it’s better to be LUCKY than good. 🍀 🍺👍

My Full Walker Registry Set (1916-1947):

https://www.ngccoin.com/registry/competitive-sets/16292/

I think you hit the proverbial "nail" on the head.

I will continually move forward with my way of collecting, and my own perceptions of that is "rare" and of "quality" to me.

Pete

Well mine was a bit of an exaggeration, but you should know something. When when someone like the CEO of Sotheby's is commenting on coins and they use the words "Common" or "mediocrity" that can still be a coin of absolute beauty, of fantastic eye appeal or even a scarce semi-key or key date coin that is all of the above. However none of these conditions make a coin "rare", not even most of your "key" date coins. If it is not top grade, then it is not rare by these standards.

You have to realize that comments such as these, when referring to common or mediocre are most coins that are not this: "objects that offer tremendous rarity, that are the finest known, are of great quality and originality, or have superior provenance continually trade at higher prices. "

These are the coins that very few of us here collect, could afford to collect or even want to collect.

Very roughly speaking I would estimate the top 5 specimens of every date /mintmark. So that’s about 10,000 coins. The logic is that the folks with vast financial resources will compete to be in the Top 5 All Time Registry Sets; those people probably aren’t interested in being number 27th for example.

We are dealing with a spectrum really. The top 1 coin may do very well and the 10th nicest may do OK. Or not.

Of course none of this matters at all unless you need to sell in the future. Till then, my suggestion is to collect what you enjoy and don’t sweat it if finances allow.

LIBERTY SEATED DIMES WITH MAJOR VARIETIES CIRCULATION STRIKES (1837-1891) digital album

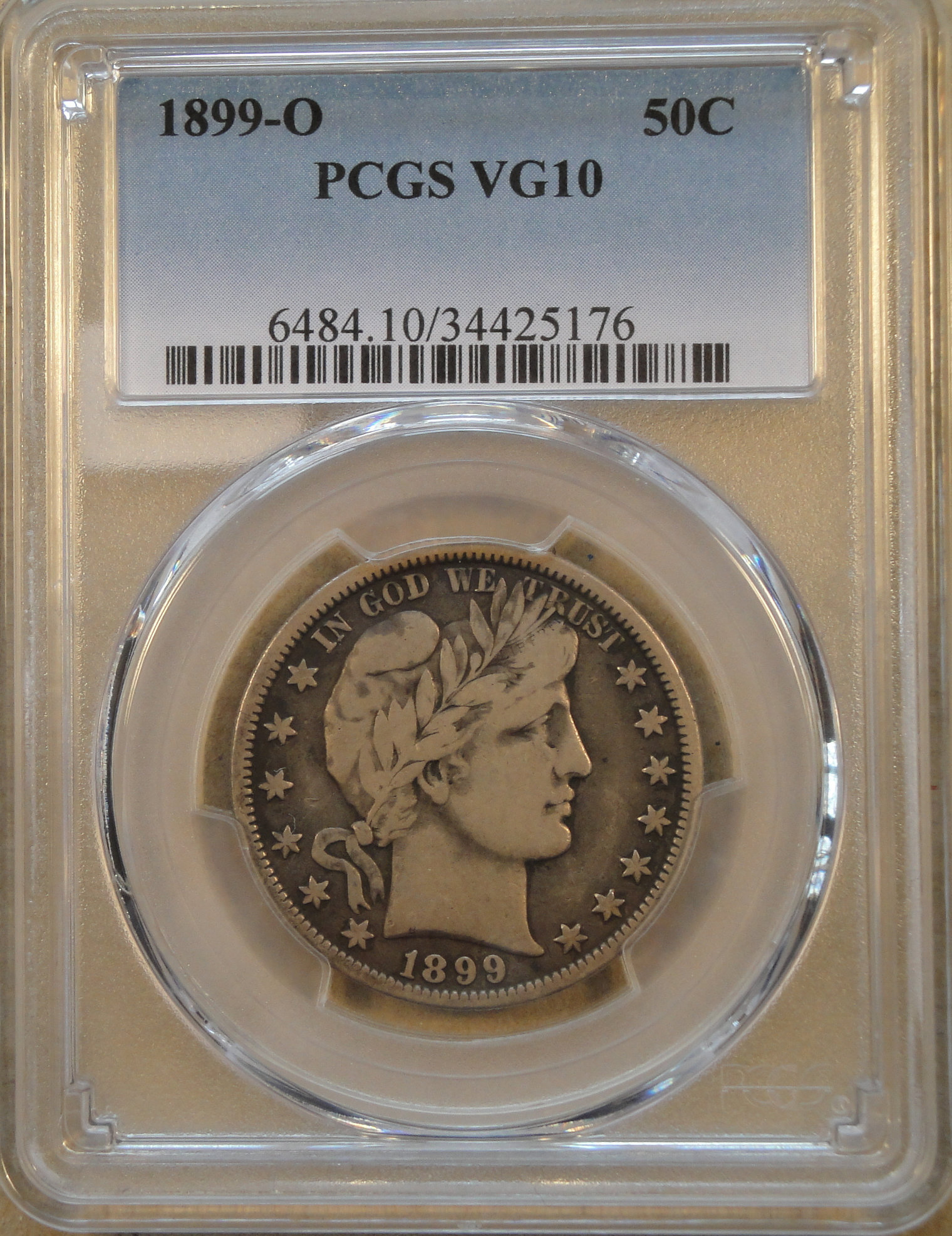

Here's my take on the Barber Market. Yes...overall prices have dropped and I blame that on our hosts. Basically nice original midgrade Barbers are tough to find. The 1st few years beginning around 2011 when the demand was high pretty much of all the F and Better nice original coins were submitted over the next few years. I probably had around 1000 pieces graded myself. Then submissions dried up because there wasn't much nice material readily available. Due to the prices the Barbers were bringing dealers started taking shots on marginal coins that more times than not would not straight grade. Guess what...they started getting a pass. Now the market is flooded with them. Then the noose was tightened again. My last submission over a year ago was undergraded straight through by an average of 10 points. I had probably a dozen coins with all but full and a couple of full Liberty coins come back in VG holders! The Full ones graded 10 and the others 8! I sold a couple on ebay as examples at the price point they should have graded and took the hammer to the rest and most have since sold at their proper grade sans plastic.

Now the market is flooded with them. Then the noose was tightened again. My last submission over a year ago was undergraded straight through by an average of 10 points. I had probably a dozen coins with all but full and a couple of full Liberty coins come back in VG holders! The Full ones graded 10 and the others 8! I sold a couple on ebay as examples at the price point they should have graded and took the hammer to the rest and most have since sold at their proper grade sans plastic.

Now the majority of what you see at pre 2011 prices are these very coins that got a pass. I still cringe at the 2 96-O Half's PCGS graded 58. While 1 was pretty... I would never buy it as a 58. The other 4 96-O's that grade 58 all sold in the 5 figures. The last two for less than 1/2. I wonder why?

This boy right here is sitting on a very nice holding of nice original Half's. No way, No how will I sell them for what the market is dictating due to all the crap out there. I might have to hold them for awhile...who knows maybe my heirs will have to be the ones to sell them.

Ducking and hope I don't see a boot coming at me!

When it comes to collecting drek… I'm the king.

I've been collecting gold double eagles since 2012. Most of the buys have been from 2014-2018. On balance, the prices have gone nowhere to down.

I understand my game. I'm collecting gold. Let gold fall 30% and the price of my coins will fall by 30% . I'm not collecting numismatics.

The market report focused on the wealthy who want to own unique items that are clearly the best of their category. It doesn't matter if it's coins, stamps, cars, art or comic books. They are not collectors of a type but interested in the 1 coin no one else can obtain. The wealthy have the surplus capital to dabble in anything they desire to obtain. The last 10 years have been another boom for these unique items. They play to excessive incomes that become "funny money". Won't these items always outperform? They have for quite a while (especially so since the US got off the gold standard). In the early 70's the Dow traded at 500-800. Today 22.000 down from 26,000. Thus should a unique coin have appreciated at least 40 fold? The only small problem.... what if the fall in the markets are signaling the beginning of a new period where difficult economic times are of lasting duration. A period similar to 2008 but of a more lasting timeframe. Then the prices of collectibles will deflate. In serious downturns all the wealthy are not immune. In very tough times the items trade but at lower... sometimes much lower levels. In very, very tough times cash is king. Hopefully, the decline in stocks was a much needed correction and not signaling something more severe. If not, they we will be stunned by what can happen to liquidity and price in the very high end markets.

I see your point and one thing that I've learned, while selling, is to never, ever allow a dealer to offer you generic, wholesale prices for coins that are exceptional for the grade. Coins such as those are much better suited for an auction setting.

Sometimes, it’s better to be LUCKY than good. 🍀 🍺👍

My Full Walker Registry Set (1916-1947):

https://www.ngccoin.com/registry/competitive-sets/16292/

Notice there hasn't been too much nice circulated Barber material in the auction scene lately.

Randy Holder and his Mid-grade Barbers are what got me back into the hobby in 2000. In those days, Ebay was new and the TPGs completely irrelevant to circulated Barbers. Finding a Barber half of any date in original VF or better was quite the accomplishment. Randy H. sold me an XF40 1904-S for the then full retail price of $750.00. My later VF35 04-S example was purchased on Ebay for $450 and I bought two AU 1893-S Barbers both under $500.00. Of course, those are now long gone pipe dreams.

IMO Barbers had a mad rush in price and popularity around 2004-2011. I remember putting coins on Ebay at true auction and just watching the feeding frenzy. 70% of my auctions just killed it (doubled prices, tripled in a few cases), 20% made some money or broke even and maybe 10% lost or just broke even - and these were my duplicates or coins that I didn't love.

My Barber VF-XF half set cost about 12K to acquire (probably another 2k for PCGS grading) and I sold the whole set for 30K.

Then, the prices just kept going up like the earlier run-up, but the quality went down. With the TPG's you now had coins that were problematic and overgraded, but the plastic grade dictated the pricing, not the coin itself. Then (2011-2015), Auctions were about breaking even. Now, it is about how much will I lose, absolutely, positively, guaranteed to lose if I buy this coin?

I don't know all the reasons for these changes and I don't really try to place blame anywhere, I just know that the fun is gone for me.

Superior eye appealing coins continue to bring large premiums to the ho hum and unattractive pieces of the same date/trype/grade.

within 20 years or so all the ultra rich will be swinging from lamp posts or their heads will be in baskets under the guillotine and those closely held top end rarities will come flooding back onto the market

Unfortunately us poor wretched widget collectors still won't be able to afford them we will be struggling to fill whitman folders with zincolns .

Yeah... I wish I had kept all the nice Barbers I bought and sold before 2011. I bought @barberfantics wonderful raw set around 2008-9? I paid way over trends...outbid Julian Leedman at a show for it. I didn't get rich on it...but even today if I had that set back I could've doubled my money on it...of course most of them would have probably ended up in my sets!

I also bought quite a few coins from you when you were selling on ebay. I am still bullish on nice original Barber Half's and my heels are dug in!

Thought I would post this up to make my point!

I will pay well over F money for any coins you can offer me like this!

PS I listed this on ebay with 2 PCGS F12's take your pick between the 3 coins for more than I ask for a F12 and it sold quickly!