When we went to clad in 1965...

...the Mint released 40% halves until 1970, so why not quarters and/or dimes at 40%?

Anyone know the answer to this?

Later, Paul.

0

...the Mint released 40% halves until 1970, so why not quarters and/or dimes at 40%?

Anyone know the answer to this?

Comments

I wrote a paper on this while I was in undergraduate school. The debate in Congress was not whether or not if the dime and quarter would be 40% silver. The 40% silver half dollar was a bone that Congress threw to the silver lobby to get more support. If many people had had their way, there would have been no silver in the half dollar.

Well this 1965 piece from GC stayed at 90% silver.

Really?

I figured that since there was nothing but silver in circulation already, they would've at least put 40% in the 3 denoms. that had it already...for a year of 2. Thanks for the answer @BillJones I appreciate it.

Later, Paul.

$$$$$$$$

Also, a company I worked for and retired from, was one of the early suppliers for the "sandwich" clad. It was not incredibly hard to make, but it was not a walk in the park. The basic metallurgy, bonding 2 different metals together, was a basic component of thermostats. As heat is applied, they metals expand at different rates, and due to different coefficients of expansion, the metallic strip "bends" thus moving the "needle" and typically causing a switch to turn on and off.

The mint was a little different, bonding .750 copper and 250 nickel over a solid copper core. I do not know why.

But, for example, the dime, to lay down a silver core AND bond over the copper and zinc, the $$$$ savings would be virtually nil, and, as evidenced by the short life of the half dollar, even any amount of silver caused them to quickly phase out of general circulation.

The Canadian fiasco with .500 fine dimes and quarters from mid-1967 to mid-1968 is a good indication that .400 fine dimes and quarters would not have worked for more than a few years, and then you would have had to completely replace the workhorse dime and quarter supply all over again.

It was sad to see silver coins go away. I grew up with silver in change... dimes, quarters and the big half dollar...There were plenty of Walkers around too.... though Franklins were the most common. I think the 40% silver halves were just a panacea for both the silver people and the public, to ease the way out. JMO. Cheers, RickO

The 40% silver Kennedy Half Dollar was probably one of the last nails that went into the half dollar coffin as a useful denomination. Within a few years, the coin melted for more than 50 cents which was the perfect reason for taking all of them out of circulation, not that very many of them made it there anyway.

Non collectors were totally confused. They had heard that half dollars were made of silver and were worth more than their face value. That prompted them to hoard ALL half dollars, included the cupro-clad pieces. Most any dealer who seen a family hoard has seen many of these coins mixed in the silver pieces. When you tell the owners “to spend them in good health,” because they are only worth their face value, many are genuinely surprised.

Before 1964, I got half dollars in change now and then. Most all of them were circulated, which showed that the coin was used although much less than the dimes and quarters. Today “junk silver” lots of half dollars contain circulated coins with the Franklins often grading VF and the Walkers something less. The half dollar did have a place in the economy, but that came to an end with the Kennedy Half Dollar.

There is a good discussion of this in the draft article on Inco private pattern pieces. (Hope to have it finished soon - just one more part to complete.)

Also, from Congressional Hearings on the Coinage Act of 1965.

“The new half dollar was designed with the strong desire in mind of many Americans to retain some silver in our everyday coinage. We believe that by eliminating silver from use in the dime and the quarter, we will have enough silver to carry out market operations in protection of our existing silver coinage — and to make a half dollar of 40 percent silver content. It is clear and unmistakable that we would not have enough silver to extend this to the dime and quarter: they are heavily used, indispensable coins that we must have at all times in large quantity. We are convinced that we can include a 40-percent silver half dollar in the new coinage, but we cannot safely go beyond that. As a precaution, we intend to concentrate at first on getting out large quantities of the new quarter and dime before we embark upon quantity production of the new half dollar.

the joint commission on the coinage.”

Would it be safe to say that if we got totally off the 'silver standard' people would have thought our government 'demonetized' our coinage?

"Keep your malarkey filter in good operating order" -Walter Breen

It is sad but I heard it was necessary because collectors were hoarding the silver and not allowing the coins to circulate. Too much of a good thing?

Of course, it’s interesting that we now have silver in our shirts and socks (for odor control).

...in the 1960's, ALL cash registers had a .50 coin slot for change. By the 70's that slot held nothing but paper clips & rubber bands.

"Keep your malarkey filter in good operating order" -Walter Breen

My understanding is that the adopted clad composition coins would be accepted by vending machines without the necessity for major overhauls.

That was the government's propaganda at the time, but "collectors" were nothing more than a convenient scapegoat. The general public was pulling silver coins out of circulation because inflation (caused by the government) had driven the price of silver to its full face value in silver dollars, and nearly so for dimes, quarters and halves. Many people knew that the silver price was likely to go higher, and acted accordingly. In 1964, war nickels were already worth 7.4 cents each and were being withdrawn and melted in quantity. The government's vast stockpile of silver was shrinking rapidly as it attempted to "defend" the price of silver at around $1.29. Demonizing coin collectors was an attempt to shift the blame for this fiasco. Proposals were floated to stop putting dates on coins, and even to outlaw coin collecting. Fortunately cooler heads prevailed, and the chief legacy from this dark period was a three-year ban on mint marks and proof sets.

My Adolph A. Weinman signature

Well, it's comforting to know that ALL our money is now monetized with nothing.

Oh wait. Bad mortgages. That's something.

Not true at all, it is backed by the full faith and credit of the US Federal Government - the latter of which has demonstrated very clearly the last couple of decades that it is completely out of touch with reality.

I always thought it was funny that the mint/government demonized collectors for perceived shortages.... I am sure some people hoarded a bit of silver, but just cannot believe it was enough to have an impact on overall coin availability. Cheers, RickO

circa 1969, silver was still quasi plentiful. I lived in the New York City area. I would go to various banks, buy as much rolled coins as I could (dimes, quarters, halves), slide out the silvers, replace with clad, mark the roll, and "sell" the clad rolls to grocery stores, etc. and go to the next bank.

My dad rode the train into Grand Central, and there was a coin shop in the terminal that advertised in the newspaper how much they paid (2.4x, 5.2x face, whatever it was, week by week). My dad dropped off the silver, gave me the money, and that was fuel for more buying.

Never thought to look for 40%, and IIRC, there was not a marker for them anyway.

By 1971, the silver was effectively gone, not worth looking, and the weather had changed. It was very windy, or shall I say DRAFTY coming out of SE Asia.

There are two factors that give money its value.

It has legal tender status. That is the legal system says that debts are paid if a debtor offers legal tender to a creditor.

The supply of money in circulation is at a reasonable level relative to the size of the economy.

Time and time again governments have gotten into trouble when they issued too much money. Government officials have too often taken the easy route by flooding their economies with cash instead of addressing the fundamental issues of the problems they face.

All the gold standard or the silver standard or any other standard provides is a limit on the money supply. That can be a good or bad thing. If the economy is growing, and there is not enough money to keep it flowing, too little money can choke off economic growth. If there is too much of the commodity, even gold, available it can cause inflation. During the California gold rush there was too much gold in available. Hence there was inflation.

In 1896 and for years before that, there was too much silver. The “free silver” advocates were really only advocating inflation, which would have allowed debtors to pay off their loans with cheap money. It was a quick fix that would have caused a lot of damage in the long run.

The disappearance of silver coinage from the economy in the mid to late 1960s didn’t change anything with respect to the health of the short or long term economy. At the time of the switch to clad coinage, silver coins accounted for less than 1% of the money supply. Paper money and bank accounts, which made up the other 99%, was backed by the same thing that backs it today. The legal system.

By defining the monetary unit in terms of a given amount of a valued good, a gold or silver standard regulates the money supply in both directions. Gold coins can be minted or melted as needed, without impacting the supply of gold or its underlying value. The overall level of prices can be temporarily affected by an unexpected increase in the supply of gold (or any other commodity serving as backing for a nation's money). But as a store of value, unit of account and means of exchange, a currency denominated in a specific amount of gold is superior to one under the control of a government and well-connected financial institutions.

My Adolph A. Weinman signature

It's amazing how far we've come or put another way, how far we've fallen.

Prior to 1964, change in our hand was pure silver. Something of value. To think of making a transaction in aluminum or any other non precious metal like the 'Italians' were doing (in the 60's) would send a shudder through our systems.

Heck, even back 200 years when paper money was first introduced (a 'bank note' whereby the bank would promise to exchange a silver dollar to you upon returning their $1 bank note) even back then, THIS was looked upon with suspicion from the general population and took awhile to catch on.

Nowadays, we have bitcoins, credit cards and Paypal running through our daily lives and it ticks off this gold bug.

I see people swiping their debit cards at the drive thru paying for their $1 coffee and donut and I'm thinking 'don't you even have a dollar change in your pocket?'

Oh well, as Archie Bunker used to say "here's to the good old days"

"“Those who sacrifice liberty for security/safety deserve neither.“(Benjamin Franklin)

"I only golf on days that end in 'Y'" (DE59)

The argument that coins were "something of value" compared to today because they were composed mostly of silver, is not completely accurate. Silver was worth way less at the time. Over the last 100 years, silver was at its lowest price around 1932 at 28 cents. At that price, the silver value in a quarter is about 5 cents. Which is pretty close to the 4+ cents of base metal value in quarters today. Yes, this is a cherry picked example, but shows the narrative is not quite accurate. Just roughly gauging, it looks like the base silver value from 1915-1950 averaged about 10-12 cents. So sure, that is more than double the base metal value than today, but not really something of value compared to the 25 cent face value.

And I'm not seeing the complaint towards using electronic currency or electronic transfers of USD as a gold bug. Unless by gold bug you just mean physical slips of paper.

Data from macrotrends.net/1470/historical-silver-prices-100-year-chart and coinflation

I guess where I'm going with this is I'm thinking what chance does the importance of owning gold and silver have with today's credit card society?

Not much I think.

I wish it was different (re Archie Bunker (lol)).

"“Those who sacrifice liberty for security/safety deserve neither.“(Benjamin Franklin)

"I only golf on days that end in 'Y'" (DE59)

Small change, cents and nickels, were not being made of silver. A nickel was real money and could buy a candy bar or a soda. Due to deficit spending and money creation a quarter won't buy much of anything. Coins today are small change except pennies which actually have a negative value because it is toxic and costs more to count than it's worth. The same people who brought us inflation keep the penny to assure more inflation.

You can't blame the money when we all keep voting for the same government and the same thinking that got us where we are. Voters and consumers do not demand quality or results. We waste and vote for tax and spend in all of its guises.

The terrible quality of clad will remind people forever of what's wrong with this age and the penny will show the waste that lies at the heart of our problems and opportunities.

RE: “The general public was pulling silver coins out of circulation because inflation (caused by the government) had driven the price of silver to its full face value in silver dollars, and nearly so for dimes, quarters and halves.”

The above comment is false. The market price of silver increased as demand in industry increased, and production remained stable. Most silver was a byproduct of mining for other metals, and not a primary product. Thus, supply of new silver depended on commercial demand for lead, tin, antimony and other metals. The US Treasury attempted to maintain a stable silver value, but free market forces made that impossible.

The Mint attempted to blame coin collectors and dealers for hoarding of coins by rolls – not specifically silver coins. This coincided with the late 1950s fad of “roll collecting.” By 1964 the general public sensed silver would soon be removed from coinage and began more active hoarding - but, it was not an initial driver, nor a late-time sudden event. Most of the public did little hoarding, and evidence abounds for that in thousands of boxes and jars of a few dozen or a few hundred silver coins, and the fact that large amounts of 90% coins remained in circulation for a decade.

RE: “But as a store of value, unit of account and means of exchange, a currency denominated in a specific amount of gold is superior to one under the control of a government and well-connected financial institutions.”

This is misleading. It implies that “a currency denominated in a specific amount of gold is superior,” is somehow independent of government control. In truth, governments fixed the currency value of gold and actively supported that value. National ‘gold standards’ failed in part during/after WW-I because economic costs of gold extraction far exceeded any fixed value in dollars, pounds, francs or quatloos. Miners throughout the world could not sell their new gold at government mandated prices which did not cover the cost of production.

When President Roosevelt suspended gold exchange standard in the U.S. and Congress passed the Gold Act of 1934 fixing the value of an ounce of gold at $35.00, gold mining and extraction took a tremendous leap upward - mine owners could now cover their expenses and still sell at the government's controlled price. An identical thing happened more recently as gold pieces increased, low-yield ores and even 19th century tailings became profitable to mine. The TV shows tout production of a few hundred ounces as a really big deal, but the quantity of gold is very small and would not have been economically viable during the various "gold rush" eras.

When "money" had an intrinsic value, the currency exchanges didn't exist.

That wasn't entirely a bad thing.

A gold coin was a gold coin.

Anywhere in the world.

RE: “The general public was pulling silver coins out of circulation because inflation (caused by the government) had driven the price of silver to its full face value in silver dollars, and nearly so for dimes, quarters and halves.”

The above comment is true. Adjusted for inflation, the price of silver was actually 29% lower in 1964 than in 1913, the year that the Federal Reserve came into existence. Supply and demand are certainly factors, but excessive money creation led to the gradual rise in the nominal price of silver and the resulting substitution of clad coinage in 1965.

RE: “But as a store of value, unit of account and means of exchange, a currency denominated in a specific amount of gold is superior to one under the control of a government and well-connected financial institutions.”

This is totally on point. Even though gold is no longer used as money, gold has maintained its value since we went off the gold standard, while the U.S. dollar has lost 95% of its purchasing power during that time, according to the government’s own estimate.

My Adolph A. Weinman signature

Sorry. Both the above comments are bologna. They ignore contemporary conditions and facts. The first bold comment is completely false, and the second is highly misleading and biased. Neither are objective.

Of course, none of this matters at the present, and really did not matter in practical application in 1965.

I'm surprised you say this. I remember the mint announced as early as 1962 that it was running out of silver. Despite the skyrocketing mintages coins couldn't be kept in circulation. Certainly the FED and mint blamed the general public and coin collectors.

Also, remember that the Kennedy Halves were being saved because of the assassination. Halves were really not circulating coins. The cent, nickel, dime and quarter were what you saw every day - still have memories of pawing through Dad's pocket change and Mom's change purse looking for "real" quarters.

Net-net, agreeing to keep some silver in the half didn't change the status of circulating coins. It would have for the others.

It wasn't long after the change over when the mint decided all those evil coin collectors were the cause of the shortage and so they started taking, um, steps.

ANA 50+ year/Life Member (now "Emeritus")

Author: 3rd Edition of the SampleSlabs book, https://sampleslabs.info/

In 25 years of working in coin shops, I handled a lot of junk silver, including halves. Most of them were circulated. Halves did circulate before the Kennedy came out.

Let's go back to the "wooden" standard. Bring back the wooden nickels. And create all the rest of the change in wood too. Some coins can be pure Oak, some clad with Birch. Then we can talk about junk wood. Seriously though, can you see a time of a "bitcoin" standard? The age of computers and plastic...yechhhhhhh

Before we stopped putting silver in some US coins, many men had long since abandoned the silver standard.

When I had a paper route, before 1965, I quickly figured out not to collect early in the day, but late in the day. The price of the paper was 60 cents a week. The majority of times, if the woman answered the door, she got out that little coin purse or opened the little coin pocket in the wallet, and counted out 60 cents, often in dimes or smaller.

Tip = 0.

But if I collected later in the day, when the men were home (I know, sexist generalization, sue me) MOST men did not carry change. They opened their WALLETs and pulled out a $1 or even a $5 sometime. Especially when it was cold (New York), and I gave them the quarter, as the 5 cent and dimes were in another pocket of the coat, the men would tell me to keep the change.

Tip = 15 cents, and sometimes, even a quarter and EVEN KEEP THE CHANGE ! !

The other thing was the men normally would invite me in to make change, standing in the foyer, living room or whatever, and I got a minute or 2 of warmth. Virtually never with the women.

So, my limited story, coins, were already dying at that point.

As to effect of composition, even in 1964 (or earlier if you want) 25 pennies or 5 5 centers would buy the same as 1 silver quarter, so copper and nickel combined = the same value in silver.

Copper Nickel and Silver were "chump change" in 1964. Good for a couple gallons of gas, a few loaves of bread, and a fast food meal, but, really, every thing significant was cash, checks or even Diner's Club or American Express, bank transfers, etc.

The final nail in the coffin was in 1968, when you could no longer exchange silver certificates for the face amount on the note in silver coins. I remember a newspaper article that showed people in a line around the block at one of the branches of the Federal Reserve on the last day such exchanges were legally allowed.

"Seu cabra da peste,

"Sou Mangueira......."

20 trillion dollars in debt and 210 trillion in unfunded liabilities.

We aren't the Wiemar Republic yet...but those who forget the past are condemned to repeat it.

I would love to see a picture of that. Thanks for sharing, I had no idea.

Later, Paul.

LIFE Magazine, August 2, 1968. Article on page 53 - "The Last Run on Uncle Sam's Silver" (<--click the link to a Google Books copy of the issue.)

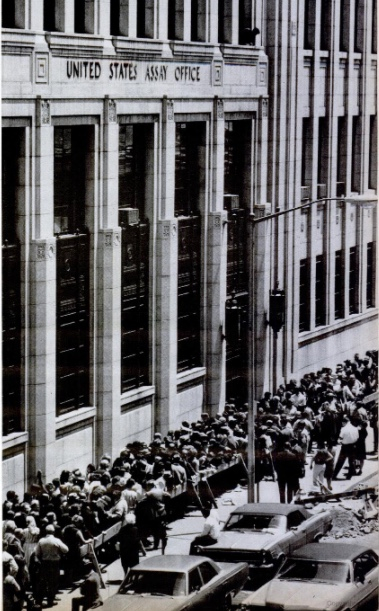

Picture from article linked above, depicting the line at the New York branch of the US Assay Office the day before the deadline to redeem silver certificates for silver bullion:

You are probably remembering the LIFE article I linked above. I remembered it was in LIFE and Googled it.

The cover of the issue says, "Wallace - coming on fast: The Spoiler from the South." Guess that didn't work out .

.

@mvs7 That is insane. Again thanks for sharing. Ironically, I was born in 1968.

Later, Paul.

I was born in 1969, so I missed all the fun, too. Just remembered someone showing me that article sometime in the 1980s.

I remember 1965. Word was out and everyone was hoarding silver. Banks and amour truck companies were even switching to clear plastic dime and quarter wrappers to "see" the silver they missed. I still have those silver dimes and quarters.

100% Positive BST transactions

Circulated $1, $5 and $10 silver certificates are available in quantity today at less than double face. Evidently a large number of them were never redeemed for silver coins or bullion.

My Adolph A. Weinman signature

Did you see that line? I bet some people at the end were like, "screw this. Where can I get a burger?"

Yes, I saw that one, but the LA Times also ran an article to that effect as well.

"Seu cabra da peste,

"Sou Mangueira......."