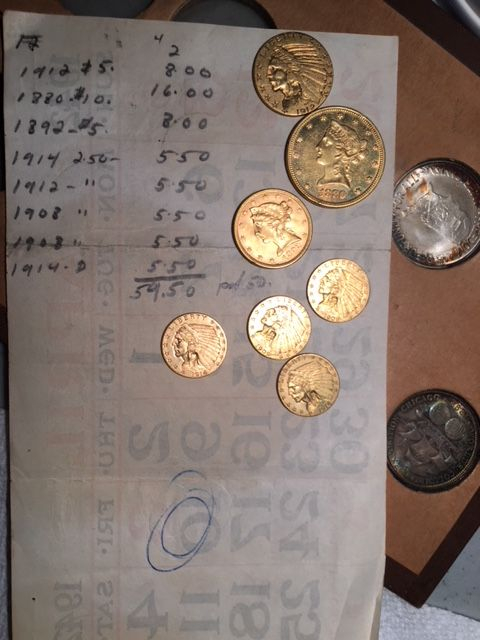

What would $50 buy you in 1942 for US Gold Coins? See for Yourself!

I recently purchased a collection of coins from an estate here in CT. The collector apparently started collecting in the 1940's and collected until his death in 1989. The collection sat in an heir's basement until I purchased it a few days ago.

There were 7 US gold coins in the estate. No "life changing" coins, but it had the type of gold coins typically found in these types of collections.

I when I started going through the collection in detail, I found this handwritten note (or receipt?) placed in an album of Canadian cents. It is written on the back of a calendar for the April of 1942.

It actually lists the list price paid of 8 gold coins (I think she said one gold coin was given to her on a chain many years ago; perhaps that is where the "missing" coin went). Based on the prices paid, they likely were bought in the 1940's. Remember, this is only 10 years or less since the government confiscated gold.

I thought the chat room would get a kick out of what these coins could be purchased for back then.

Comments

That’s great!!

Quarter eagles seem disproportionately exspencive

11.5$ Southern Dollars, The little “Big Easy” set

Cool! Looks like that worked out better than keeping one of these:

I'd love to see better pictures of the $10 coin. Color looks interesting... and I do love interesting color.

Sadly, it has been polished. Not very special, unfortunately.

Purchase of $32.50 face value in gold for $50. How times have changed.

An authorized PCGS dealer, and a contributor to the Red Book.

I'd like to see those commemorative halves!

Couldn't tell if it was that or toned darkly. Boo.

That's about right for the market value of those coins. Ordinary pieces brought approximately bullion value in the US, Canada and Mexico. European prices were about $42 for a US double eagle.

Door-to-door gold coin buyers paid $28 to $31 for double eagles or equivalent. Quarter eagles were more popular and sold for proportionately higher prices because of their jewelry use.

Also, there was no confiscation of gold. Those who turned it in to banks got full face value for it - just as if they had taken it to a store to buy groceries.

Gold coins were at least partially confiscated. People were forced to turn them in for paper dollars that had recently been devalued by nearly half.

A double eagle contains 0.9675 troy oz. of gold. At $35 per ounce, that is $33.86.

If someone took a double eagle to a bank, that person was given $20.

As I see it, that person had a loss of $13.86, or nearly 41% of the $33.86.

An authorized PCGS dealer, and a contributor to the Red Book.

Those look like pretty sweet commems behind the gold...

Let's see some more of the estate coins, love to see stuff put away for that long. Did you find any keys? How big a collection?

eBay ID-bruceshort978

Successful BST:here and ATS, bumanchu, wdrob, hashtag, KeeNoooo, mikej61, Yonico, Meltdown, BAJJERFAN, Excaliber, lordmarcovan, cucamongacoin, robkool, bradyc, tonedcointrader, mumu, Windycity, astrotrain, tizofthe, overdate, rwyarmch, mkman123, Timbuk3,GBurger717, airplanenut, coinkid855 ,illini420, michaeldixon, Weiss, Morpheus, Deepcoin, Collectorcoins, AUandAG, D.Schwager.

I'm interested as to what those commemorative halves look like in the background!

If you took them to the bank you were admitting they have no numismatic value ( which was one of the primary exceptions that allowed you to own them). And they would have been melted...

ANA 50+ year/Life Member (now "Emeritus")

Author: 3rd Edition of the SampleSlabs book, https://sampleslabs.info/

Wow! Cool find!

Nice. I can remember buying $5 Libs. for $ 17 in 1967.

FYI........$50 in 1942 equals $778.81 in 2017.

I was too young to buy gold coins back then... .... but what fun to go through an old collection. Rarely is anything of significant value found... however, in this case, the gold coins and the receipt are really interesting. Cheers, RickO

.... but what fun to go through an old collection. Rarely is anything of significant value found... however, in this case, the gold coins and the receipt are really interesting. Cheers, RickO

The receipt makes the coins "one of a kind", in my opinion

Successful transactions with : MICHAELDIXON, Manorcourtman, Bochiman, bolivarshagnasty, AUandAG, onlyroosies, chumley, Weiss, jdimmick, BAJJERFAN, gene1978, TJM965, Smittys, GRANDAM, JTHawaii, mainejoe, softparade, derryb, Ricko

Bad transactions with : nobody to date

RichieURich's comments are true, but only in an ex post facto approach.

In 1933 a double eagle had a statutory value of $20. Even though the open market price of gold fluctuated above and below $20.67 per ounce during the previous decade, Actions of the United States government in maintaining $20.67 created an undervalued commodity until FDR's executive orders suspended that support. During April 1933 the open market price of gold was about $29 per ounce. But that did not change the statutory value of a double eagle - it was till worth $20 - unless someone could get the coins out of the country and into the hands of foreign speculators. This was prohibited by temporary gold export restrictions. Those organizations holding hoards of gold in any form were required to exchange it at the statutory value. If they attempted to export it, they were subject to a fine in addition to the gold value. (There are actions against several Swiss nationals in this regard.)

According to files of Treasury chief counsel, gold coins continued in domestic circulation at least through August 1933. (Gold coin circulation had long been very limited, so what there was in mid-1933 didn't amount to a large sum of money.) Anecdotal reports indicate domestic circulation at face value as late as 1935, but these are naturally less reliable.

Treasury regulations defining collectible/antique coins of special value also placed small quantities (under about $25,000) of gold coins into a protected category. Treasury's refusal to issue specific guidance to field agents served to further protect nearly any group of coins.

Within the US, the legal value of gold coins remained at their face value. The government, as it had for decades, bought gold from any source at $20.67. Mines sold at this price, or stockpiled their bars in anticipation of being able to later sell at the open market rate. Door-to-door gold buyers paid above face value, although less than open market, for gold coins then hoped to send them to Mexico or Canada for conversion. (This was illegal but some must have gotten through. There are a bunch of Customs Dept actions relating to smuggling.)

The situation remained fluid until passage of the Gold Act of 1934. This demonetized all US gold coins as circulating media and resulted in nearly all coins in Treasury hands being melted. No business or bank was obligated to accept a gold coin as legal tender. Banks accepted gold coins as agents for the Treasury and paid the depositors based on the statutory value of gold in effect when the coins were issued - $20.67. Newly mined gold was bought by the government at $35 per Troy ounce, and imported gold followed that higher price.

For ordinary people during 1933, gold coins were worth their face value; itinerant buyers paid more. Later, licensed gold dealers purchased coins and other gold items at somewhat better prices, but faced restrictions on valuation based on the gold's source.

It's easy to make an isolated calculation and claim that people "lost money." But in the day-to-day world, that approach fails because there was no ready convertibility mechanism. Individuals who spent gold coins, received their full face value; those selling to gold buyers received more dollars; those holding collections saw no change.

I hope this little tome adds perspective to a situation that is often over simplified.

Incorrect. Only hoards were covered by the various orders, and the "gold" value of those was largely in paper certificates and bullion, not coins. The larger part of hoards were of foreign ownership, also.

Everyone in my family who was here in ‘42 is gone. I wouldn’t know how much gold could be bought for fifty bucks but apparently copper was the new gold in them days.

``https://ebay.us/m/KxolR5

The reason there were no ready convertibility mechanisms is because the government didn't allow them. To the best of its ability, the government prevented anyone other than itself from profiting from the forced surrender of gold. People were required to, and did, turn in massive quantities of gold coins at a huge discount to their newly established value. My grandmother was one of them.

This was confiscation, pure and simple. In a free market, people would have been allowed to keep their gold or sell it on the open market at greater than face value. It's true that people who spent gold coins received their full face value, but that was in "dollars" that had just been devalued by 43%. If you were forced to turn in your modern gold eagles for their $50 face value, would you not consider that confiscation?

RE: "People were required to, and did, turn in massive quantities of gold coins at a huge discount to their newly established value."

The actual quantity of gold coins turned in was small. These amounts are listed in the Director's annual reports. Most coins were already in Treasury vaults and had been for a long time.

There was no general confiscation. That is a simple, documented fact. The only ones required to deposit their bullion and certificates were hoarders - not ordinary people, such as your grandmother probably was.

People returned their cash, withdrawn and hoarded during the Hoover administration, to banks following the Bank Holiday as a sign of confidence in actions taken. Nearly all of this was in paper currency.

A very limited venue such as a message board is not a useful format for debate. Readers can, at least for the present time, freely and openly express and hold their opinions, regardless of their factual or false basis.

Awesome pickup.

The receipt definitely adds to the story of these coins.

Thanks for sharing.

Donato

Donato's Complete US Type Set ---- Donato's Dansco 7070 Modified Type Set ---- Donato's Basic U.S. Coin Design Set

Successful transactions: Shrub68 (Jim), MWallace (Mike)

The hobby might benefit from historical perspective if more purchasers of old family collections would post the kinds of detail Dave W did. Too many of use forget that collector behavior has not changed much in a century or more.

If you look at the Gold Surrender Order (see Wikipedia), you will see that the text of the order, particularly in bold at the top of the order, "all persons are required to deliver, ON OR BEFORE MAY 1, 1933, all GOLD COIN, GOLD BULLION, AND GOLD CERTIFICATES, now owned by them, to a Federal Reserve Bank, . . . " and in bold at the bottom of the order, "CRIMINAL PENALTIES FOR VIOLATION OF EXECUTIVE ORDER $10,000 fine or 10 years imprisonment, or both, . . ."

This was clearly written to scare people into giving up their gold. In discussing this with relatives who were adults in 1933, many people were scared and surrendered their gold. This is reasonable considering the penalties set forth in the Executive Order.

"The actual quantity of gold coins turned in was small. These amounts are listed in the Director's annual reports." Perhaps each person who surrendered their gold didn't have much of it, or perhaps the real quantity surrendered was larger than reported. If the government knew that the quantity of gold coins in circulation was small, why bother issuing the Executive Order?

An authorized PCGS dealer, and a contributor to the Red Book.