@dcarr said:

That is my point.

Outsiders like Bear Stearns and Lehman Brothers do not get the same benefits as major member/owner banks of >the Federal Reserve.

They ARE part of the same club.

Citibank got diluted 90%. Their stock price was basically wiped out.

The first bull market in gold ran from August 1971 to January 1980.

The dollar price of gold rallied from $35 per ounce to $800 per ounce. That’s a 2,200% gain in 9.4 years.

The second bull market in gold ran from August 1999 to August 2011.

The dollar price of gold rallied from $250 per ounce to $1,900 per ounce. That’s a 670% gain in 12 years.

.

The Third Bull Market

The third bull market in gold began on Dec. 16, 2015, with gold hitting a bottom of $1,050 per ounce at the end of the prior bear market.

Since then, gold has rallied to about $2,000 per ounce as of today, a 90% gain.

.

If we take a simple average of the price gains and durations of the two prior bull markets in gold, we arrive at a 1,435% gain over a period of 10.7 years.

Applying that gain and duration to a baseline of $1,050 per ounce beginning in December 2015 leads to a gains projection for this bull market of $15,070 per ounce by August 2026.

@dcarr said:

That is my point.

Outsiders like Bear Stearns and Lehman Brothers do not get the same benefits as major member/owner banks of >the Federal Reserve.

They ARE part of the same club.

Citibank got diluted 90%. Their stock price was basically wiped out.

Citibank made a lot of money during the home refinance craze leading up to 2008. And then the crash came. But the FED would never let them fail. Stockholders in Citibank did take a hit for sure. They had it coming. So did stockholders in most companies across the board in 2008-2009, especially in financial companies.

I thought it would be interesting to see a chart of Citibank stock on a silver price chart.

Citibank stock price (left scale) | Silver price (right scale) :

@dcarr said:

Citibank made a lot of money during the home refinance craze leading up to 2008. And then the crash came. But >the FED would never let them fail. Stockholders in Citibank did take a hit for sure. They had it coming. So did >stockholders in most companies across the board in 2008-2009, especially in financial companies.

The bank's owners -- the shareholders -- lost 90% of their money. That's practically the same thing as "failing." Just because Citibank didn't technically go out of business don't make it seem like the Fed "rescued" them. They did no such thing.

Your limited knowledge of financial markets comes through with your schadenfreude that "they had it coming."

I thought it would be interesting to see a chart of Citibank stock on a silver price chart.

How about JP Morgan Chase ? How about APPL ? GOOG ? What does that chart prove ?

Peter, I think the 2 earlier time periods are examples of cherry-picking from ultra-depressed prices and starting points.

I do think gold has lots of upside, but I'm not sure about another 700% in our lifetime. If it happens -- I doubt it -- it could signify global problems like a war or an asteroid hit.

Such a gold price -- and a comensurate rise in silver -- could render collecting coins with PM content impossible for many of us. I'd be lucky to buy 1 Saint-Gauden a decade !!!!

@dcarr said:

Citibank made a lot of money during the home refinance craze leading up to 2008. And then the crash came. But >the FED would never let them fail. Stockholders in Citibank did take a hit for sure. They had it coming. So did >stockholders in most companies across the board in 2008-2009, especially in financial companies.

The bank's owners -- the shareholders -- lost 90% of their money. That's practically the same thing as "failing." Just because Citibank didn't technically go out of business don't make it seem like the Fed "rescued" them. They did no such thing.

Your limited knowledge of financial markets comes through with your schadenfreude that "they had it coming."

I thought it would be interesting to see a chart of Citibank stock on a silver price chart.

How about JP Morgan Chase ? How about APPL ? GOOG ? What does that chart prove ?

Absolutely nothing.

They absolutely had it coming, When I saw ads on TV for 125% equity home loans, I knew that failure was inevitable. The banks made a lot of money on these questionable activities leading up to the collapse. They should have known better. Citibank got in too deep.

The chart shows that silver is not the only thing to have a large price spike and decline. And it also reflects how much money Citibank made until it all crashed.

@jmski52 said:

What was all the talk about “liar loans” if citi didn’t have it coming?

Those crap mortgages were put out by outfits like Novastar, Countrywide, and IndyMac. They all went out of business or got acquired on the cheap.

Incidentally, the Fed helped engineer some "bailouts" by banks of other financial institutions (BAC-CountryWide, JPM- Bear Stearns, JPM-WaMu). These deals really didn't help the banks and in some cases, they lost billions trying to help out the government (JP Morgan inherited lawsuits filed AFTER the deal).

So if you think a "banking cartel" helped them, think again. Even the TARP preferred stock issues for JPM and GS diluted their EPS about 10%. Basically, the shareholders of Wall Street banks SUBSIDIZED the American taxpayer and BAILED OUT the UAW and AFL-CIO, plus some local banks that were terribly managed and/or corrupt.

@jmski52 said:

What was all the talk about “liar loans” if citi didn’t have it coming?

Don't get me wrong: Citibank was TERRIBLY mismanaged. But that was because the CEO was picked by the NYS AG, Elliot Spitzer. Ditto for AIG. Both nearly imploded, which doesn't say much for Spitzer's ability to choose competent financial executives.

Bad loans were a problem but LEVERAGE was the bigger issue for Wall Street and other banks.

@GoldFinger1969 said:

JP Morgan's Commodities Strategist Natasha Kaneva, in BARRON'S a few issues back, is looking for $2,300 for gold in 2024 and $30 silver.

While $2,300 Au is certainly in the cards $30 gutter metal is nothing but a pipedream. It's by far the most overhyped "commodity" on planet earth. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

@blitzdude said:

While $2,300 Au is certainly in the cards $30 gutter metal is nothing but a pipedream. It's by far the most overhyped "commodity" on planet earth. RGDS!

.

Well, you are certainly obsessed with it like no other.

If you like gold, take a good look at gold mining stocks.

Barrick down more than 9% today! Newmont down 13% YTD.

Could be a good buying opportunity for the true believers.

Slightly counterintuitively, bad inflation news drove gold down today. (Presumably due to expectations of level or higher interest rates rather than a decline in 2024)

Coming from a geopolitical perspective, for those with a WSJ subscription, here’s a piece that would tend to support the $5000 per ounce thesis;

@Higashiyama said:

Slightly counterintuitively, bad inflation news drove gold down today. (Presumably due to expectations of level or higher interest rates rather than a decline in 2024)

The argument of a steady and predictable income stream vs "insurance"?

@Goldminers said:

If you like gold, take a good look at gold mining stocks.

Barrick down more than 9% today! Newmont down 13% YTD.

Could be a good buying opportunity for the true believers.

Why did a modest drop in gold -- and then a nice rebound -- not lead to a recovery in the gold stocks ?

@Higashiyama said:

Slightly counterintuitively, bad inflation news drove gold down today. (Presumably due to expectations of level or >higher interest rates rather than a decline in 2024)

Actually, not really. The bad inflation news from the CPI and PPI was a signal that more Fed hawkishness was on tap, and depressing the gold price.

@Goldminers said:

If you like gold, take a good look at gold mining stocks.

Barrick down more than 9% today! Newmont down 13% YTD.

Could be a good buying opportunity for the true believers.

Why did a modest drop in gold -- and then a nice rebound -- not lead to a recovery in the gold stocks ?

Gold stocks like NEM and Barrick (GOLD) have indicated they are struggling to increase or even replace reserves, they have higher costs, and declining production forecasts. In addition, more concerns about "resource nationalism". NEM is basically at a 5-year low, Barrick is only a point or two away from the same situation. Gold money going into bitcoin not helping either. Your "peak gold" production may end up happening sooner than first thought. A tough business currently. PGM miners announcing even more layoffs and are really in even more trouble.

@Goldminers said:

Gold stocks like NEM and Barrick (GOLD) have indicated they are struggling to increase or even replace reserves, they have higher costs, and declining production forecasts. In addition, more concerns about "resource nationalism". NEM is basically at a 5-year low, Barrick is only a point or two away from the same situation. Gold money going into bitcoin not helping either. Your "peak gold" production may end up happening sooner than first thought. A tough business currently. PGM miners announcing even more layoffs and are really in even more trouble.

They can't win. The same things that drive the price of gold UP also raise costs and are associated with re-writing of property rights.

They have really not produced shareholder value in decades, even with gold up 4-5 fold. Maybe they need to start mining for gold and Rare Earth Minierals.

@derryb said:

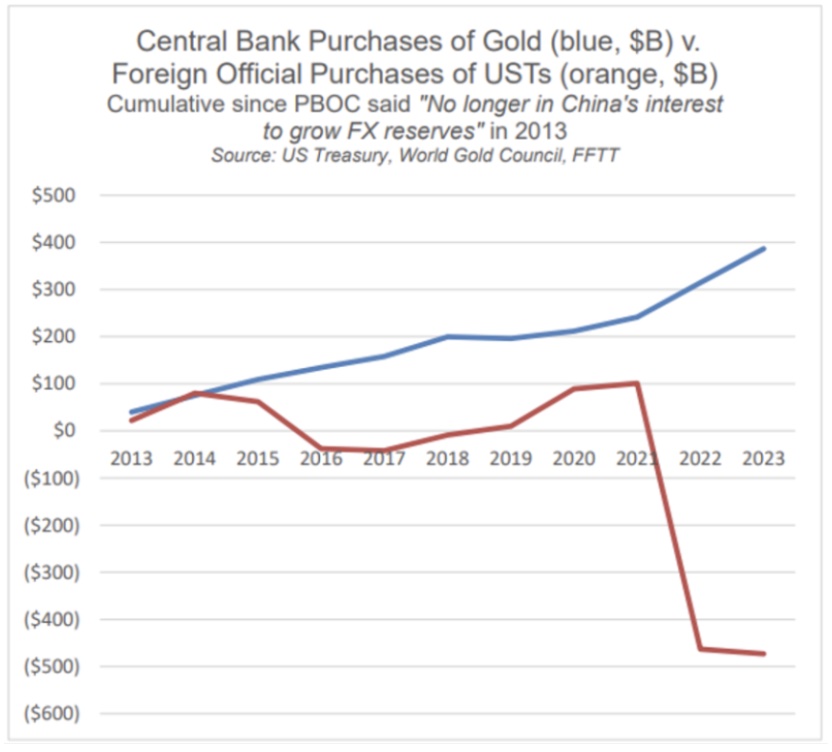

And some here want to believe there is not a reduction in foreign purchases of US debt. LOL

.

.

Beside Central Banks demand, the other main factor leading to a decrease in $ demand is de-dollarization i.e. the fact that countries stop using the $ as settlement currency in their bilateral trade.

Unfortunately I can't find a chart showing the decreasing share of the $ as international trade settlement currency.

@Peter89 said:

Unfortunately I can't find a chart showing the decreasing share of the $ as international trade settlement currency.

Isn't it funny that some can't find actual facts to support their theories. Lol

It's become a common theme, especially over the last few years. So very easy to create misinformation because we are now a land of idiots where we question truth and believe lies. It's quite fascinating in how easily we have allowed ourselves to be controlled and manipulated.

I've read comments on red websites where folk still believe the sun revolves around the earth and don't know the difference between a planet and a star. And they vote!!!

If folk don't know basic first grade science, how will they ever understand intermarket relationships or global monetary policy?

@Peter89 said:

Unfortunately I can't find a chart showing the decreasing share of the $ as international trade settlement currency.

Isn't it funny that some can't find actual facts to support their theories. Lol

It's become a common theme, especially over the last few years. So very easy to create misinformation because we are now a land of idiots where we question truth and believe lies. It's quite fascinating in how easily we have allowed ourselves to be controlled and manipulated.

I've read comments on red websites where folk still believe the sun revolves around the earth and don't know the difference between a planet and a star. And they vote!!!

If folk don't know basic first grade science, how will they ever understand intermarket relationships or global monetary policy?

.

You are easily manipulated.

Did it even occur to you that "flat Earth" posts on a conservative website might actually be agent provocateurs attempting to make conservatism look bad ?

@Peter89 said:

Unfortunately I can't find a chart showing the decreasing share of the $ as international trade settlement currency.

Isn't it funny that some can't find actual facts to support their theories. Lol

It's become a common theme, especially over the last few years. So very easy to create misinformation because we are now a land of idiots where we question truth and believe lies. It's quite fascinating in how easily we have allowed ourselves to be controlled and manipulated.

I've read comments on red websites where folk still believe the sun revolves around the earth and don't know the difference between a planet and a star. And they vote!!!

If folk don't know basic first grade science, how will they ever understand intermarket relationships or global monetary policy?

.

You are easily manipulated.

Did it even occur to you that "flat Earth" posts on a conservative website might actually be agent provocateurs attempting to make conservatism look bad ?

.

Those nutz need no "provocateurs" to make themselves look bad. We are evolving, get with the program or get left behind. "Merica IS great! THKS!!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

@Peter89 said:

Unfortunately I can't find a chart showing the decreasing share of the $ as international trade settlement currency.

Isn't it funny that some can't find actual facts to support their theories. Lol

It's become a common theme, especially over the last few years. So very easy to create misinformation because we are now a land of idiots where we question truth and believe lies. It's quite fascinating in how easily we have allowed ourselves to be controlled and manipulated.

I've read comments on red websites where folk still believe the sun revolves around the earth and don't know the difference between a planet and a star. And they vote!!!

If folk don't know basic first grade science, how will they ever understand intermarket relationships or global monetary policy?

.

You are easily manipulated.

Did it even occur to you that "flat Earth" posts on a conservative website might actually be agent provocateurs attempting to make conservatism look bad ?

.

Everything is a conspiracy, right?

Lol

Dude I'm a conservative. And I'll tell ya right now, a lot of my so called like minded group are proving the failings of our education system.

These folk didn't talk anything about flat earth. They are just plain stupid and ignorant. It's a disgrace.

1 out of 4 people have an IQ below 90. Dang, that's a lot of folk.

@TwoSides2aCoin said:

2000 years to get to $2000. You sure you wanna stay with that $5000 prediction ? I know inflation does a number >but .....

Why not ? It's not a super-aggresive forecast, though I admit we could fall short. Remember, I said 10-12 years...so you are talking about maybe 6-8% CAGR to get in the neighborhood of $5,000 gold.

I believe more people would buy gold and pre-1933 gold coins IF they knew about them. I myself didn't know about pre-1933 gold opportunities until about 15 years ago.

You get a sustained move in gold....you get some social media "influencers" talking about it....other famous people...we can see a $500 move in gold in a week.

Comments

They ARE part of the same club.

Citibank got diluted 90%. Their stock price was basically wiped out.

The Case For $15,000 Gold

.

Lessons From Two Prior Bull Markets

The first bull market in gold ran from August 1971 to January 1980.

The dollar price of gold rallied from $35 per ounce to $800 per ounce. That’s a 2,200% gain in 9.4 years.

The second bull market in gold ran from August 1999 to August 2011.

The dollar price of gold rallied from $250 per ounce to $1,900 per ounce. That’s a 670% gain in 12 years.

.

The Third Bull Market

The third bull market in gold began on Dec. 16, 2015, with gold hitting a bottom of $1,050 per ounce at the end of the prior bear market.

Since then, gold has rallied to about $2,000 per ounce as of today, a 90% gain.

.

If we take a simple average of the price gains and durations of the two prior bull markets in gold, we arrive at a 1,435% gain over a period of 10.7 years.

Applying that gain and duration to a baseline of $1,050 per ounce beginning in December 2015 leads to a gains projection for this bull market of $15,070 per ounce by August 2026.

https://dailyreckoning.com/15000-gold/

Citibank made a lot of money during the home refinance craze leading up to 2008. And then the crash came. But the FED would never let them fail. Stockholders in Citibank did take a hit for sure. They had it coming. So did stockholders in most companies across the board in 2008-2009, especially in financial companies.

I thought it would be interesting to see a chart of Citibank stock on a silver price chart.

Citibank stock price (left scale) | Silver price (right scale) :

The bank's owners -- the shareholders -- lost 90% of their money. That's practically the same thing as "failing." Just because Citibank didn't technically go out of business don't make it seem like the Fed "rescued" them. They did no such thing.

Your limited knowledge of financial markets comes through with your schadenfreude that "they had it coming."

How about JP Morgan Chase ? How about APPL ? GOOG ? What does that chart prove ?

Absolutely nothing.

Peter, I think the 2 earlier time periods are examples of cherry-picking from ultra-depressed prices and starting points.

I do think gold has lots of upside, but I'm not sure about another 700% in our lifetime. If it happens -- I doubt it -- it could signify global problems like a war or an asteroid hit.

Such a gold price -- and a comensurate rise in silver -- could render collecting coins with PM content impossible for many of us. I'd be lucky to buy 1 Saint-Gauden a decade !!!!

They absolutely had it coming, When I saw ads on TV for 125% equity home loans, I knew that failure was inevitable. The banks made a lot of money on these questionable activities leading up to the collapse. They should have known better. Citibank got in too deep.

The chart shows that silver is not the only thing to have a large price spike and decline. And it also reflects how much money Citibank made until it all crashed.

Citibank never offered 125% loans.

They did not.

But their over-extended loan portfolio faltered badly when the housing market took a hit and the MBS market crashed in 2008-2009.

I'm enjoying the back & forth read and I'm glad you two are keeping it civil.

Click on this link to see my ebay listings.

What was all the talk about “liar loans” if citi didn’t have it coming?

I knew it would happen.

Those crap mortgages were put out by outfits like Novastar, Countrywide, and IndyMac. They all went out of business or got acquired on the cheap.

Incidentally, the Fed helped engineer some "bailouts" by banks of other financial institutions (BAC-CountryWide, JPM- Bear Stearns, JPM-WaMu). These deals really didn't help the banks and in some cases, they lost billions trying to help out the government (JP Morgan inherited lawsuits filed AFTER the deal).

So if you think a "banking cartel" helped them, think again. Even the TARP preferred stock issues for JPM and GS diluted their EPS about 10%. Basically, the shareholders of Wall Street banks SUBSIDIZED the American taxpayer and BAILED OUT the UAW and AFL-CIO, plus some local banks that were terribly managed and/or corrupt.

Don't get me wrong: Citibank was TERRIBLY mismanaged. But that was because the CEO was picked by the NYS AG, Elliot Spitzer. Ditto for AIG. Both nearly imploded, which doesn't say much for Spitzer's ability to choose competent financial executives.

Bad loans were a problem but LEVERAGE was the bigger issue for Wall Street and other banks.

The Case For $5,000 Gold?

For those who are not US, let's make it international.

How about the case for WCU5000 Gold?

.

JP Morgan's Commodities Strategist Natasha Kaneva, in BARRON'S a few issues back, is looking for $2,300 for gold in 2024 and $30 silver.

While $2,300 Au is certainly in the cards $30 gutter metal is nothing but a pipedream. It's by far the most overhyped "commodity" on planet earth. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Silver is a lot less hyped than the stock market, or Bitcoin for that matter.

I knew it would happen.

Well then get that hype train a rollin'. We aint gettin' no younger!!!

Since we aint gonna convert it to dollars anyway, we may as well be able to say, "told ya so".

Knowledge is the enemy of fear

c> @cohodk said:

You all know my position - silver is currently a sleeper.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

.

Well, you are certainly obsessed with it like no other.

.

.

Derivative silver, yes, a sleeper.

Physical silver, has been awake and moving for a year now

.

.

Can we call it a textbook stair steps pattern?

Time for it to move up from the sleeper car to coach, maybe even dining.

We getting hungry!!!

Knowledge is the enemy of fear

If you like gold, take a good look at gold mining stocks.

Barrick down more than 9% today! Newmont down 13% YTD.

Could be a good buying opportunity for the true believers.

My US Mint Commemorative Medal Set

All precious metals and most PM companies getting crushed the past few days. Blood in the streets, soon.

My US Mint Commemorative Medal Set

This is another good case for $5.000 gold

.

And some here want to believe there is not a reduction in foreign purchases of US debt. LOL

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

https://www.reuters.com/markets/us/foreign-holdings-us-treasuries-august-hit-highest-since-december-2021-data-2023-10-18/

https://fred.stlouisfed.org/series/FDHBFIN

Lol

Knowledge is the enemy of fear

lol. $5000 gold.

Dreamers.

``https://ebay.us/m/KxolR5

Slightly counterintuitively, bad inflation news drove gold down today. (Presumably due to expectations of level or higher interest rates rather than a decline in 2024)

Coming from a geopolitical perspective, for those with a WSJ subscription, here’s a piece that would tend to support the $5000 per ounce thesis;

https://www.wsj.com/world/china/chinas-shipyards-are-ready-for-a-protracted-war-americas-arent-d6f004dd

The argument of a steady and predictable income stream vs "insurance"?

Knowledge is the enemy of fear

Inflation protection (insurance) does not provide an "income stream." It provides safe haven and piece of mind.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Exactly....the income stream will always win. Always.

Piece of mind comes from knowledge and confidence, not inanimate objects.

Knowledge is the enemy of fear

Why did a modest drop in gold -- and then a nice rebound -- not lead to a recovery in the gold stocks ?

Dumb money ? They bought at 0-2%....and they SOLD at 4-5%. Buying has been absorbed by other purchasers.

They bought at 0-2%....and they SOLD at 4-5%. Buying has been absorbed by other purchasers.

By 2030 ? 2035 at the latest ?

Actually, not really. The bad inflation news from the CPI and PPI was a signal that more Fed hawkishness was on tap, and depressing the gold price.

Markets don't make sense at times.

Gold stocks like NEM and Barrick (GOLD) have indicated they are struggling to increase or even replace reserves, they have higher costs, and declining production forecasts. In addition, more concerns about "resource nationalism". NEM is basically at a 5-year low, Barrick is only a point or two away from the same situation. Gold money going into bitcoin not helping either. Your "peak gold" production may end up happening sooner than first thought. A tough business currently. PGM miners announcing even more layoffs and are really in even more trouble.

My US Mint Commemorative Medal Set

They can't win. The same things that drive the price of gold UP also raise costs and are associated with re-writing of property rights.

They have really not produced shareholder value in decades, even with gold up 4-5 fold. Maybe they need to start mining for gold and Rare Earth Minierals.

.

.

Beside Central Banks demand, the other main factor leading to a decrease in $ demand is de-dollarization i.e. the fact that countries stop using the $ as settlement currency in their bilateral trade.

Unfortunately I can't find a chart showing the decreasing share of the $ as international trade settlement currency.

That's because it's UNCHANGED at about 90% going back decades.

https://www.atlanticcouncil.org/programs/geoeconomics-center/dollar-dominance-monitor/#:~:text=So for instance the dollar,2022 Triennial Central Bank Survey.

Isn't it funny that some can't find actual facts to support their theories. Lol

It's become a common theme, especially over the last few years. So very easy to create misinformation because we are now a land of idiots where we question truth and believe lies. It's quite fascinating in how easily we have allowed ourselves to be controlled and manipulated.

I've read comments on red websites where folk still believe the sun revolves around the earth and don't know the difference between a planet and a star. And they vote!!!

If folk don't know basic first grade science, how will they ever understand intermarket relationships or global monetary policy?

Knowledge is the enemy of fear

.

You are easily manipulated.

Did it even occur to you that "flat Earth" posts on a conservative website might actually be agent provocateurs attempting to make conservatism look bad ?

.

Those nutz need no "provocateurs" to make themselves look bad. We are evolving, get with the program or get left behind. "Merica IS great! THKS!!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Everything is a conspiracy, right?

Lol

Dude I'm a conservative. And I'll tell ya right now, a lot of my so called like minded group are proving the failings of our education system.

These folk didn't talk anything about flat earth. They are just plain stupid and ignorant. It's a disgrace.

1 out of 4 people have an IQ below 90. Dang, that's a lot of folk.

Knowledge is the enemy of fear

2000 years to get to $2000. You sure you wanna stay with that $5000 prediction ? I know inflation does a number but .....

``https://ebay.us/m/KxolR5

Why not ? It's not a super-aggresive forecast, though I admit we could fall short. Remember, I said 10-12 years...so you are talking about maybe 6-8% CAGR to get in the neighborhood of $5,000 gold.

I believe more people would buy gold and pre-1933 gold coins IF they knew about them. I myself didn't know about pre-1933 gold opportunities until about 15 years ago.

You get a sustained move in gold....you get some social media "influencers" talking about it....other famous people...we can see a $500 move in gold in a week.

.

The USD hasn't been existing for 2000 years

so I'd rather say 200 years to get to $2000

But the fed has been existing only for 100 years.

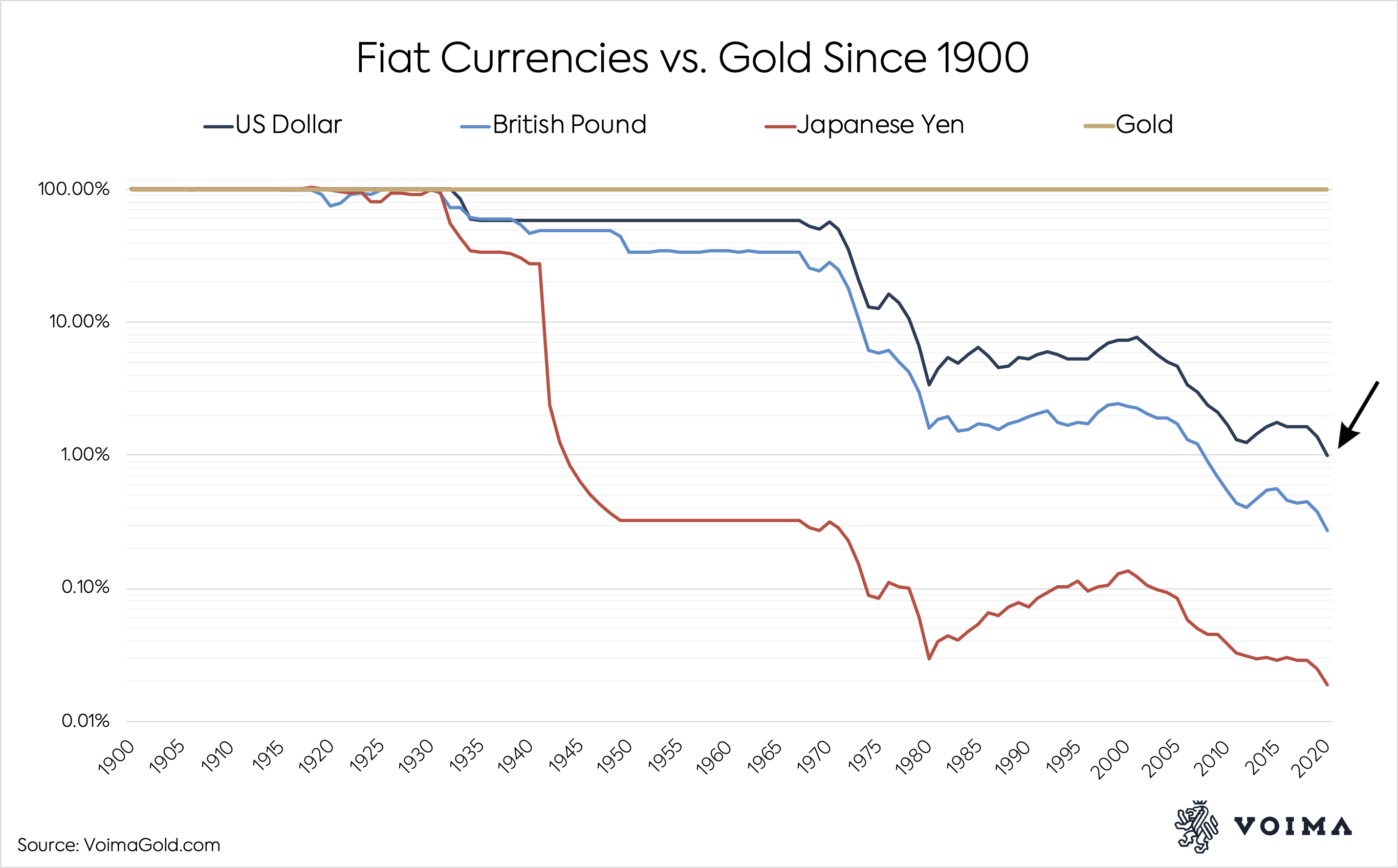

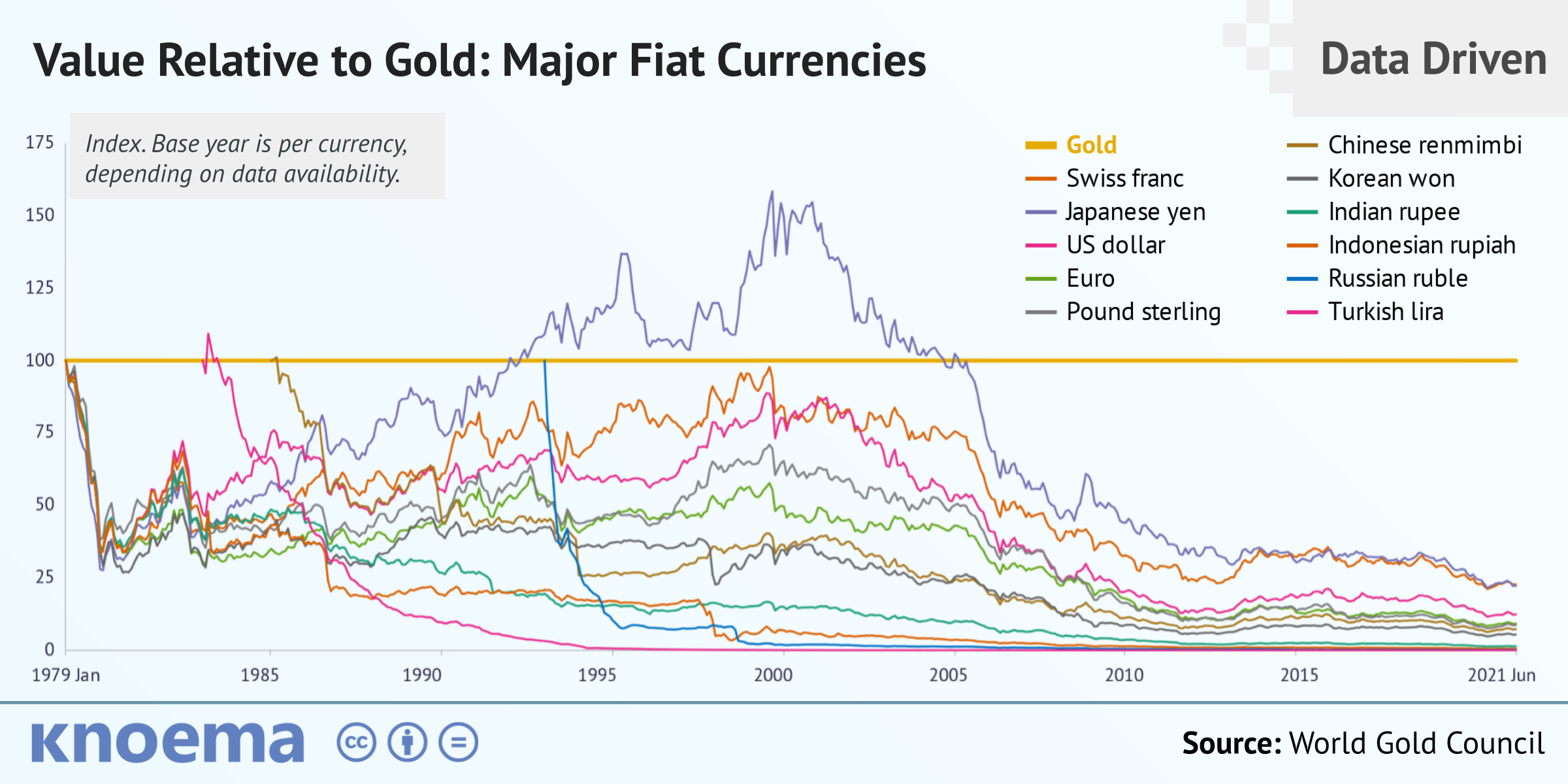

I think he said $5000 because he was thinking to something like this

.

.

or considering only the last 50 years, to something like this

.

1 out of 4 people have an IQ below 90. Dang, that's a lot of folk.

And most of them aren't conservative.

I knew it would happen.

Wrong answer. LOL RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Thats what THEY say!!! HAHA

Heres another case for $5000 gold.

Knowledge is the enemy of fear

Bank troubles are brewing.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong