$5K gold is not far off and will be but a temporary high that will continue to be taken out as long as the money printers are in charge. Gold and silver are where the smart money is going.

If two brothers can squeeze silver to $50, imagine what a world of stackers is about to do.

Those are interesting charts but they don't explain gold's action TODAY.....the Jefferies Report goes into the many factors affecting gold demand like this:

@derryb said:

$5K gold is not far off and will be but a temporary high that will continue to be taken out as long as the money printers are in charge. Gold and silver are where the smart money is going.

.

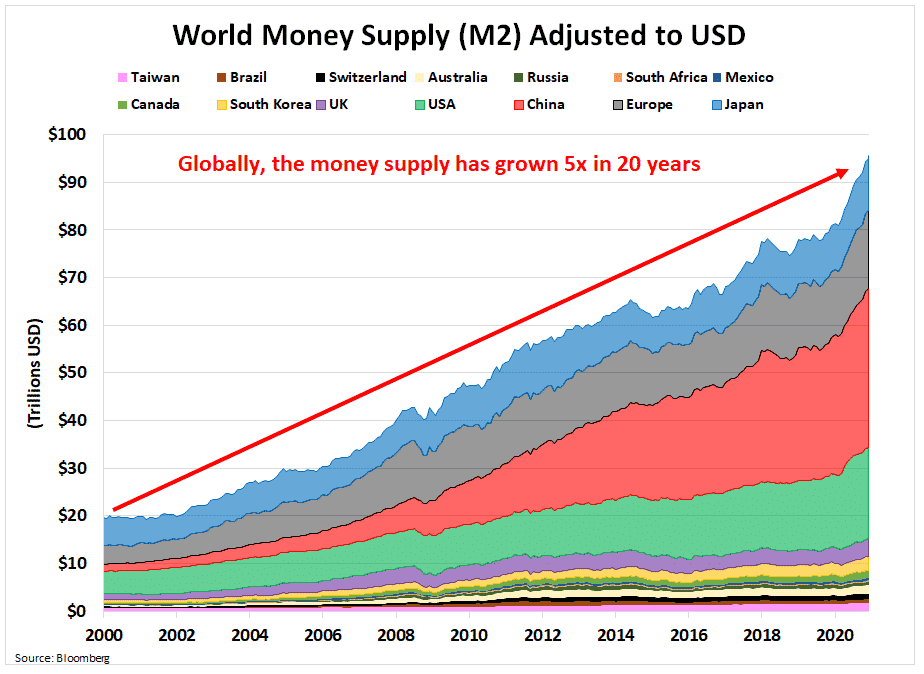

As long as the gold price depends on global demand, probably we should consider not only US money supply but global money supply.

Any attempt to forecast gold to domestic or international monetary aggregates, M2, M3, M5 Multitronic Enterprise computer, etc....are futile. There are DOZENS of ratios and relationships involving gold, most of which can be brought up on a Bloomberg within seconds. At any given time, a few track gold and accurately forecast the price moves for a few months -- until they don't.

Gold will ultimately move based on supply and demand.

Means NOTHING if people don't see rampant inflation or debasment of the currency. Which we haven't seen for many currencies.

That's a matter of opinion. There's alot of skepticism about inflation reporting, and that leads to interest in buying gold.

Clearly, the central banks know very well the effects of their debasement on monetary aggregates and that is why they have been loading up on gold. They aren't doing it for their health.

Q: Are You Printing Money? Bernanke: Not Literally

@jmski52 said:

Clearly, the central banks know very well the effects of their debasement on monetary aggregates and that is why >they have been loading up on gold. They aren't doing it for their health.

A central banker's performance won't matter if he has "X" in gold or "X + 50%" in gold. At the margins, just like there was selling in the 1990's, there is buying today.

It's a positive for the gold price, that is for sure.

@jmski52 said:

Clearly, the central banks know very well the effects of their debasement on monetary aggregates and that is why >they have been loading up on gold. They aren't doing it for their health.

At the margins, just like there was selling in the 1990's, there is buying today.

I was a buyer in the 90's and I'm still a buyer in the 20's. RGDS!

.

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

I haven't bought any gold in around 3 years. Happy when it goes up, but no big deal... So few central banks are actually accumulating. Basically, just China, Poland and Singapore.

@RobM said:

I haven't bought any gold in around 3 years. Happy when it goes up, but no big deal... So few central banks are actually accumulating. Basically, just China, Poland and Singapore.

But new central banks -- Africa -- will be accumulating even small amounts. Look at the rise in Indian buying over the decades that I have posted before.

It all adds up if there is no boost in supply from gold mines or CB selling.

Any attempt to forecast gold to domestic or international monetary aggregates, M2, M3, M5 Multitronic Enterprise computer, etc....are futile. There are DOZENS of ratios and relationships involving gold, most of which can be brought up on a Bloomberg within seconds. At any given time, a few track gold and accurately forecast the price moves for a few months -- until they don't.

Gold will ultimately move based on supply and demand.

And that supply and demand will move based on faith in the native currency.

If two brothers can squeeze silver to $50, imagine what a world of stackers is about to do.

@RobM said:

I haven't bought any gold in around 3 years. Happy when it goes up, but no big deal... So few central banks are actually accumulating. Basically, just China, Poland and Singapore.

FWIW:

Gopaul noted that all six of the central banks which increased their gold reserves by one tonne or more in January have been regular buyers.

_ But new central banks -- Africa -- will be accumulating even small amounts. Look at the rise in Indian buying over the decades that I have posted before._

It all adds up if there is no boost in supply from gold mines or CB selling.

But, but…………haven’t you been telling us that CB buying of x +50% in gold is inconsequential and hasn’t coho been saying that other countries are still loading up on US debt because the dollar is “strong” in spite of being unloaded by many of the BRICs?

How does THAT work?

Q: Are You Printing Money? Bernanke: Not Literally

@RobM said:

I haven't bought any gold in around 3 years. Happy when it goes up, but no big deal... So few central banks are actually accumulating. Basically, just China, Poland and Singapore.

FWIW:

Gopaul noted that all six of the central banks which increased their gold reserves by one tonne or more in January have been regular buyers.

True. But the demand from Indian and Chinese private citizens is a huge portion of overall gold demand. If I own more gold than all but the wealthier Indian or Chinese citizen, I probably have enough gold. I'm not sure if it helps to accumulate beyond some reasonable level. Same for crypto. At least for most people.

@jmski52 said:

But new central banks -- Africa -- will be accumulating even small amounts. Look at the rise in Indian buying over >the decades that I have posted before._

It all adds up if there is no boost in supply from gold mines or CB selling._

But, but…………haven’t you been telling us that CB buying of x +50% in gold is inconsequential and hasn’t coho been >saying that other countries are still loading up on US debt because the dollar is “strong” in spite of being unloaded >by many of the BRICs?

How does THAT work?

It works this way: OECD CB buying has been largely minimal, relative to past years. So net-net, it's not a big factor. The BIG change was 22 years ago when the OECD CB's went from net SELLERS to net BUYERS. Now, you add more buying (small) from established CBs....emerging market CBs....frontier market CB's....it adds up.

Probably another 500-1,000 tons per year by 2026.

This move in gold has not been led by ETF retail or institutional demand.

@jmski52 said:

_ But new central banks -- Africa -- will be accumulating even small amounts. Look at the rise in Indian buying over the decades that I have posted before._

It all adds up if there is no boost in supply from gold mines or CB selling.

But, but…………haven’t you been telling us that CB buying of x +50% in gold is inconsequential and hasn’t coho been saying that other countries are still loading up on US debt because the dollar is “strong” in spite of being unloaded by many of the BRICs?

How does THAT work?

How it works is that you actually look at facts rather than made up political talking points designed to control and manipulate via fear, loathing and contempt.

The BRICs are having 200 organizational meetings prior to their next big conference in October. Unfortunately for us, the complete mismanagement of our finances leaves us completely vulnerable for anything that comes out of the BRICs.

I don’t see alot of buying of Treasuries from BRICs countries in this report. I do see a drop in the total that is being partly offset by buying from the Fed’s Cayman Islands account. (You know - that huge economy in Cayman that supports $318 billion in Treasuries holdings, pfffft - gimme a break.)

We know that the Treasury and Fed have already gone opaque about spending and “The Budget”, so why would this report have any credibility?

Being an apologist for this chicanery isn’t a good look.

Q: Are You Printing Money? Bernanke: Not Literally

@derryb said:

LOL, government supplied data. "Liars figure and figures lie."

And my food cost me 2.2% more over the last year according to the U.S. Labor Department's Bureau of Labor >Statistics (BLS). LOL, LOL

If you disagree with their hedontical measurements, tell us why they are wrong.

Yes, you might experience different inflation. But their numbers are what they say they are.

The BRICs are having 200 organizational meetings prior to their next big conference in October. Unfortunately for us, the complete mismanagement of our finances leaves us completely vulnerable for anything that comes out of the BRICs.

I don’t see alot of buying of Treasuries from BRICs countries in this report. I do see a drop in the total that is being partly offset by buying from the Fed’s Cayman Islands account. (You know - that huge economy in Cayman that supports $318 billion in Treasuries holdings, pfffft - gimme a break.)

We know that the Treasury and Fed have already gone opaque about spending and “The Budget”, so why would this report have any credibility?

Being an apologist for this chicanery isn’t a good look.

You stated the Brics have "unloaded". I provided facts that show Brazil, India, and Saudi Arabia had increased hildings over the last year.

Kinda sad if you think folk apologize for stating facts. What a terrible state of American psyche "they" have created.

@derryb said:

LOL, government supplied data. "Liars figure and figures lie."

And my food cost me 2.2% more over the last year according to the U.S. Labor Department's Bureau of Labor >Statistics (BLS). LOL, LOL

If you disagree with their hedontical measurements, tell us why they are wrong.

Yes, you might experience different inflation. But their numbers are what they say they are.

You stated the Brics have "unloaded". I provided facts that show Brazil, India, and Saudi Arabia had increased hildings over the last year.

We are talking about the BRICs, correct? If you ignore both China and Russia, you are misrepresenting the whole data set. Is this how you advise your clients?

China + India + Brazil + Saudi:

Now: $1.355 trillion

Year Ago: $1,448 trillion

Net Treasuries Sold, Past Year, BRICs: $93 Billion (not counting Russia, for some reason). However, I think we can safely assume that Russia hasn’t bought any Treasuries this past year.

Based on YOUR “facts”.

6.4% decrease in holdings in the past year, and the BRICs haven’t even coalesced yet.

If you want to debate, at least take a look at the data that you yourself have provided.

My psyche is just fine. And yours?

Q: Are You Printing Money? Bernanke: Not Literally

@derryb said:

LOL, government supplied data. "Liars figure and figures lie."

And my food cost me 2.2% more over the last year according to the U.S. Labor Department's Bureau of Labor >Statistics (BLS). LOL, LOL

If you disagree with their hedontical measurements, tell us why they are wrong.

Yes, you might experience different inflation. But their numbers are what they say they are.

then why do they periodically change their formula (liars figure)? Always gives better numbers (figures lie), that's why. LOL

Those in the real world knows it takes more dollars than DOL tells us it does.

If two brothers can squeeze silver to $50, imagine what a world of stackers is about to do.

@jmski52 said: You stated the Brics have "unloaded". I provided facts that show Brazil, India, and Saudi Arabia had increased hildings over the last year.

We are talking about the BRICs, correct? If you ignore both China and Russia, you are misrepresenting the whole data set. Is this how you advise your clients?

China + India + Brazil + Saudi:

Now: $1.355 trillion

Year Ago: $1,448 trillion

Net Treasuries Sold, Past Year, BRICs: $93 Billion (not counting Russia, for some reason). However, I think we can safely assume that Russia hasn’t bought any Treasuries this past year.

Based on YOUR “facts”.

6.4% decrease in holdings in the past year, and the BRICs haven’t even coalesced yet.

If you want to debate, at least take a look at the data that you yourself have provided.

My psyche is just fine. And yours?

Then say China is selling....as certainly the Brics are not. And why has China sold some holdings?...cuz their economy is failing and they need the dough. Also their trade surplus with the USA is down $100 billion over the last year, so haven't bought more treasuries because they have less to invest.

India increased Treasury holdings by 1.7%.

Brazil increased holdings by 5.8%

Saudi increased by 14.9%.

What would be totally awesome is if China would sell all their holdings. US investors would gobble them up in a heartbeat, then all of your ilk wouldn't be able to spread mal-opinion that "China owns us".

Do you make investment decisions based on whether or not the Brics will ever be anything?

BARRON'S had Louise Yamada, a technical analyst since the 1970's who focuses on gold and PMs, with some bullish quotes. Looks for $2,500-$2,600 this year.

@tincup said:

Perhaps an increase to $3000 near the end of the year... but for now, certainly in the doldrums.

Doldrums? Wake up this is Au not the worthless gutter metal. It just painted ALL TIME highs. The Au be boomin!, not sure what conspiracy you be livin in.

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Nobody mentioned a conspiracy, But ok, gold be boomin! (if you say so, must be true)

Silly me.... thought things were in a temporary holding pattern / minor correction. The old summer doldrums like was common in the past but in recent years not so much.

Dude.... why ya so compelled - obsessed to provoke and belittle others? And I didn't even rate a RGRDS! at the end of your statement! Oh well. Guess I need to subscribe to your newsletter and become enlightened.

With annual gold production of roughly 3000 metric tons, central banks have acquired 1/3 of world gold production since 2022.

World Gold Production

Strong Central Bank Gold Demand To Continue

In a recently released survey by the WGC covering 69 Global Central Banks, 81% said they expected central bank gold holdings to increase over the next twelve months. This is up from 71% in 2023, and is the highest reading in the six years the survey has been taken.

@tincup said:

Nobody mentioned a conspiracy, But ok, gold be boomin! (if you say so, must be true)

Silly me.... thought things were in a temporary holding pattern / minor correction. The old summer doldrums like was common in the past but in recent years not so much.

Dude.... why ya so compelled - obsessed to provoke and belittle others? And I didn't even rate a RGRDS! at the end of your statement! Oh well. Guess I need to subscribe to your newsletter and become enlightened.

Just stay out of the gutter and you should do just fine. THKS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

@Goldminers said:

With annual gold production of roughly 3000 metric tons, central banks have acquired 1/3 of world gold production > since 2022.

GM, do you see gold production gradually going higher in a slow-rise environment (i.e., the price doesn't rocket to $3,500 in 12-18 months or something like that) ? Or is Peak Supply something more appropriate to gold than oil ?

Interesting that with all the political volatility -- India, France, the UK, the U.S. -- gold is down less than 2% from the ATH but Bitcoin is down almost 30%.

At this point, it is a bit hard to know production levels out the next 5-10 years, but most mines are mostly trying to maintain production levels. I have not heard of major expansions to fleets or to process plants that are incrementally add-ons, but more sustaining levels. So it seems that production is mostly in a stable range and the peak, may be more like a plateau for quite a while.

Demand from central banks in countries with currency issues remains fairly strong YTD in 2024.

Haven't read this forum in a long time. Read the first few posts but that's all I need to read.

I agree that gold (and silver) look to be "breaking out", but the reason doesn't make any difference.

The only actual reason anyone “invests” in anything is to realize a return. They expect to realize a monetary profit, or else they wouldn’t buy it. Whatever reasoning they believe or claim implicitly or explicitly to justify their decision is irrelevant.

Supposed “investors” (actually speculators) act on beliefs which actually determines prices, whether it is true or not or whether the outcome is “better” or “worse” than expected. When enough “investors” act on their beliefs, prices change regardless of “fundamentals”. That’s why “fundamentals” have no consistent predictability on anything. As future events confirm or contradict expectations, “investors” act on this feedback loop too but the event or outcome isn’t the actual reason for the price (change) either.

FED is trying to claim that it can taper a Ponzi scheme, and the gold market is calling the Fed’s bluff. This is why gold ended it's inverse relationship with real rates in 2022 and shot to record highs.

If two brothers can squeeze silver to $50, imagine what a world of stackers is about to do.

@derryb said:

FED is trying to claim that it can taper a Ponzi scheme, and the gold market is calling the Fed’s bluff. This is why gold ended it's inverse relationship with real rates in 2022 and shot to record highs.

There's no "Ponzi scheme" though I question the AI tech stocks' valuations.

@WCC said:

Haven't read this forum in a long time. Read the first few posts but that's all I need to read.

I agree that gold (and silver) look to be "breaking out", but the reason doesn't make any difference.

The only actual reason anyone “invests” in anything is to realize a return. They expect to realize a monetary profit, or else they wouldn’t buy it. Whatever reasoning they believe or claim implicitly or explicitly to justify their decision is irrelevant.

Supposed “investors” (actually speculators) act on beliefs which actually determines prices, whether it is true or not or whether the outcome is “better” or “worse” than expected. When enough “investors” act on their beliefs, prices change regardless of “fundamentals”. That’s why “fundamentals” have no consistent predictability on anything. As future events confirm or contradict expectations, “investors” act on this feedback loop too but the event or outcome isn’t the actual reason for the price (change) either.

In the long run fundamentals do play a factor in pricing. The issue is getting an accurate accounting of the fundamentals when there are entities that deliberately lie about or skew the fundamentals. When you have a situation where paper gold or silver bears no direct relationship to the actual amount of real gold and silver the value of those assets can be greatly manipulated by those holding and/or creating the paper.

The longer I live the more convincing proofs I see of this truth, that God governs in the affairs of men. And if a sparrow cannot fall to the ground without His notice is it possible for an empire to rise without His aid? Benjamin Franklin

@derryb said:

Printing money to pay debt is a ponzi

Not if it isn't inflationary. Learn about the Debt/GDP Denominator Effect and nominal GDP growth.

While it can NOT continue "forever" it is NOT a ponzi scheme if used in moderation and built-in to the term structure of interest rates.

I've managed and bought/sold billions in bonds. I know how a market works and how a Ponzi Scheme works. This isn't one.

The FED is running a Ponzi operation by using new cash commitments (and newly created dollars that have no backing) from new bond investors to pay out "earnings" to existing ones. This is the true definition of Ponzi.

Glad you're not managing my billions.

If two brothers can squeeze silver to $50, imagine what a world of stackers is about to do.

Comments

Re: @ $5,000 Au, almost half way there. RGDS!

RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

$5K gold is not far off and will be but a temporary high that will continue to be taken out as long as the money printers are in charge. Gold and silver are where the smart money is going.

If two brothers can squeeze silver to $50, imagine what a world of stackers is about to do.

Those are interesting charts but they don't explain gold's action TODAY.....the Jefferies Report goes into the many factors affecting gold demand like this:

.

As long as the gold price depends on global demand, probably we should consider not only US money supply but global money supply.

.

You guys try to make it all so complicated. Just follow the yen down the yellow brick road.

Knowledge is the enemy of fear

.

A case for $25k gold

Any attempt to forecast gold to domestic or international monetary aggregates, M2, M3, M5 Multitronic Enterprise computer, etc....are futile. There are DOZENS of ratios and relationships involving gold, most of which can be brought up on a Bloomberg within seconds. At any given time, a few track gold and accurately forecast the price moves for a few months -- until they don't.

Gold will ultimately move based on supply and demand.

Gold will ultimately move based on supply and demand.

And the global currency debasement initiative by central banks.

I knew it would happen.

Means NOTHING if people don't see rampant inflation or debasment of the currency. Which we haven't seen for many currencies.

Means NOTHING if people don't see rampant inflation or debasment of the currency. Which we haven't seen for many currencies.

That's a matter of opinion. There's alot of skepticism about inflation reporting, and that leads to interest in buying gold.

Clearly, the central banks know very well the effects of their debasement on monetary aggregates and that is why they have been loading up on gold. They aren't doing it for their health.

I knew it would happen.

A central banker's performance won't matter if he has "X" in gold or "X + 50%" in gold. At the margins, just like there was selling in the 1990's, there is buying today.

It's a positive for the gold price, that is for sure.

I was a buyer in the 90's and I'm still a buyer in the 20's. RGDS!

.

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

I haven't bought any gold in around 3 years. Happy when it goes up, but no big deal... So few central banks are actually accumulating. Basically, just China, Poland and Singapore.

But new central banks -- Africa -- will be accumulating even small amounts. Look at the rise in Indian buying over the decades that I have posted before.

It all adds up if there is no boost in supply from gold mines or CB selling.

.> @GoldFinger1969 said:

And that supply and demand will move based on faith in the native currency.

If two brothers can squeeze silver to $50, imagine what a world of stackers is about to do.

FWIW:

https://www.kitco.com/news/article/2024-03-06/central-banks-go-gold-january-pointing-third-straight-year-strong-demand

Yelling at clouds on pmbug.com

_ But new central banks -- Africa -- will be accumulating even small amounts. Look at the rise in Indian buying over the decades that I have posted before._

It all adds up if there is no boost in supply from gold mines or CB selling.

But, but…………haven’t you been telling us that CB buying of x +50% in gold is inconsequential and hasn’t coho been saying that other countries are still loading up on US debt because the dollar is “strong” in spite of being unloaded by many of the BRICs?

How does THAT work?

I knew it would happen.

L

True. But the demand from Indian and Chinese private citizens is a huge portion of overall gold demand. If I own more gold than all but the wealthier Indian or Chinese citizen, I probably have enough gold. I'm not sure if it helps to accumulate beyond some reasonable level. Same for crypto. At least for most people.

It works this way: OECD CB buying has been largely minimal, relative to past years. So net-net, it's not a big factor. The BIG change was 22 years ago when the OECD CB's went from net SELLERS to net BUYERS. Now, you add more buying (small) from established CBs....emerging market CBs....frontier market CB's....it adds up.

Probably another 500-1,000 tons per year by 2026.

This move in gold has not been led by ETF retail or institutional demand.

How it works is that you actually look at facts rather than made up political talking points designed to control and manipulate via fear, loathing and contempt.

Knowledge is the enemy of fear

LOL, government supplied data. "Liars figure and figures lie."

And my food cost me 2.2% more over the last year according to the U.S. Labor Department's Bureau of Labor Statistics (BLS). LOL, LOL

If two brothers can squeeze silver to $50, imagine what a world of stackers is about to do.

The BRICs are having 200 organizational meetings prior to their next big conference in October. Unfortunately for us, the complete mismanagement of our finances leaves us completely vulnerable for anything that comes out of the BRICs.

I don’t see alot of buying of Treasuries from BRICs countries in this report. I do see a drop in the total that is being partly offset by buying from the Fed’s Cayman Islands account. (You know - that huge economy in Cayman that supports $318 billion in Treasuries holdings, pfffft - gimme a break.)

We know that the Treasury and Fed have already gone opaque about spending and “The Budget”, so why would this report have any credibility?

Being an apologist for this chicanery isn’t a good look.

I knew it would happen.

If you disagree with their hedontical measurements, tell us why they are wrong.

Yes, you might experience different inflation. But their numbers are what they say they are.

Prune juice and Metamucil up that much?

Knowledge is the enemy of fear

.> @jmski52 said:

You stated the Brics have "unloaded". I provided facts that show Brazil, India, and Saudi Arabia had increased hildings over the last year.

Kinda sad if you think folk apologize for stating facts. What a terrible state of American psyche "they" have created.

Knowledge is the enemy of fear

If it ain't from Russia, it ain't the truth!!!

Lol

Knowledge is the enemy of fear

You stated the Brics have "unloaded". I provided facts that show Brazil, India, and Saudi Arabia had increased hildings over the last year.

We are talking about the BRICs, correct? If you ignore both China and Russia, you are misrepresenting the whole data set. Is this how you advise your clients?

China + India + Brazil + Saudi:

Now: $1.355 trillion

Year Ago: $1,448 trillion

Net Treasuries Sold, Past Year, BRICs: $93 Billion (not counting Russia, for some reason). However, I think we can safely assume that Russia hasn’t bought any Treasuries this past year.

Based on YOUR “facts”.

6.4% decrease in holdings in the past year, and the BRICs haven’t even coalesced yet.

If you want to debate, at least take a look at the data that you yourself have provided.

My psyche is just fine. And yours?

I knew it would happen.

then why do they periodically change their formula (liars figure)? Always gives better numbers (figures lie), that's why. LOL

Those in the real world knows it takes more dollars than DOL tells us it does.

If two brothers can squeeze silver to $50, imagine what a world of stackers is about to do.

Lot of people likely own the same ounce of synthetic gold. There's only one owner for real gold.

If two brothers can squeeze silver to $50, imagine what a world of stackers is about to do.

Then say China is selling....as certainly the Brics are not. And why has China sold some holdings?...cuz their economy is failing and they need the dough. Also their trade surplus with the USA is down $100 billion over the last year, so haven't bought more treasuries because they have less to invest.

India increased Treasury holdings by 1.7%.

Brazil increased holdings by 5.8%

Saudi increased by 14.9%.

What would be totally awesome is if China would sell all their holdings. US investors would gobble them up in a heartbeat, then all of your ilk wouldn't be able to spread mal-opinion that "China owns us".

Do you make investment decisions based on whether or not the Brics will ever be anything?

My psyche is better than yours, but why you ask?

Knowledge is the enemy of fear

Nice try at obfuscation, but no cigar!

I knew it would happen.

Dang facts got in the way for your narrative again. Sheesh!!

Heres some.more facts...

https://apnews.com/article/iran-currency-rial-record-low-economy-2c59af5dfa9bbbb9e5286352e2899cf5

Knowledge is the enemy of fear

$2,362...up another $13. High of $2,384.

BARRON'S had Louise Yamada, a technical analyst since the 1970's who focuses on gold and PMs, with some bullish quotes. Looks for $2,500-$2,600 this year.

CNBC will have a BOA analyst talking about $3,000 gold during this hour.

Gold: dollar barometer

If two brothers can squeeze silver to $50, imagine what a world of stackers is about to do.

Perhaps an increase to $3000 near the end of the year... but for now, certainly in the doldrums.

Doldrums? Wake up this is Au not the worthless gutter metal. It just painted ALL TIME highs. The Au be boomin!, not sure what conspiracy you be livin in.

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Nobody mentioned a conspiracy, But ok, gold be boomin! (if you say so, must be true)

Silly me.... thought things were in a temporary holding pattern / minor correction. The old summer doldrums like was common in the past but in recent years not so much.

Dude.... why ya so compelled - obsessed to provoke and belittle others? And I didn't even rate a RGRDS! at the end of your statement! Oh well. Guess I need to subscribe to your newsletter and become enlightened.

With annual gold production of roughly 3000 metric tons, central banks have acquired 1/3 of world gold production since 2022.

World Gold Production

Strong Central Bank Gold Demand To Continue

In a recently released survey by the WGC covering 69 Global Central Banks, 81% said they expected central bank gold holdings to increase over the next twelve months. This is up from 71% in 2023, and is the highest reading in the six years the survey has been taken.

My US Mint Commemorative Medal Set

Just stay out of the gutter and you should do just fine. THKS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

GM, do you see gold production gradually going higher in a slow-rise environment (i.e., the price doesn't rocket to $3,500 in 12-18 months or something like that) ? Or is Peak Supply something more appropriate to gold than oil ?

Interesting that with all the political volatility -- India, France, the UK, the U.S. -- gold is down less than 2% from the ATH but Bitcoin is down almost 30%.

At this point, it is a bit hard to know production levels out the next 5-10 years, but most mines are mostly trying to maintain production levels. I have not heard of major expansions to fleets or to process plants that are incrementally add-ons, but more sustaining levels. So it seems that production is mostly in a stable range and the peak, may be more like a plateau for quite a while.

Demand from central banks in countries with currency issues remains fairly strong YTD in 2024.

My US Mint Commemorative Medal Set

The French elections brought back to me the history of French gold hoarding over the last 150 years.

It's a little-known fact that gets overlooked when talkin about China, India, etc.

Haven't read this forum in a long time. Read the first few posts but that's all I need to read.

I agree that gold (and silver) look to be "breaking out", but the reason doesn't make any difference.

The only actual reason anyone “invests” in anything is to realize a return. They expect to realize a monetary profit, or else they wouldn’t buy it. Whatever reasoning they believe or claim implicitly or explicitly to justify their decision is irrelevant.

Supposed “investors” (actually speculators) act on beliefs which actually determines prices, whether it is true or not or whether the outcome is “better” or “worse” than expected. When enough “investors” act on their beliefs, prices change regardless of “fundamentals”. That’s why “fundamentals” have no consistent predictability on anything. As future events confirm or contradict expectations, “investors” act on this feedback loop too but the event or outcome isn’t the actual reason for the price (change) either.

The Great Monetary Pivot of 2024

FED is trying to claim that it can taper a Ponzi scheme, and the gold market is calling the Fed’s bluff. This is why gold ended it's inverse relationship with real rates in 2022 and shot to record highs.

If two brothers can squeeze silver to $50, imagine what a world of stackers is about to do.

There's no "Ponzi scheme" though I question the AI tech stocks' valuations.

Printing money to pay debt is a ponzi

If two brothers can squeeze silver to $50, imagine what a world of stackers is about to do.

In the long run fundamentals do play a factor in pricing. The issue is getting an accurate accounting of the fundamentals when there are entities that deliberately lie about or skew the fundamentals. When you have a situation where paper gold or silver bears no direct relationship to the actual amount of real gold and silver the value of those assets can be greatly manipulated by those holding and/or creating the paper.

Not if it isn't inflationary. Learn about the Debt/GDP Denominator Effect and nominal GDP growth.

While it can NOT continue "forever" it is NOT a ponzi scheme if used in moderation and built-in to the term structure of interest rates.

I've managed and bought/sold billions in bonds. I know how a market works and how a Ponzi Scheme works. This isn't one.

The FED is running a Ponzi operation by using new cash commitments (and newly created dollars that have no backing) from new bond investors to pay out "earnings" to existing ones. This is the true definition of Ponzi.

Glad you're not managing my billions.

If two brothers can squeeze silver to $50, imagine what a world of stackers is about to do.