@lermish said:

Though it doesnt make sense to us, I wasnt sure if these foreign adversaries prefer their gold in bar form, or >perhaps gold eagles or buffalos. It doesnt seem out of the realm of possibility for refiners to start melting down >junky pre33 if theres no longer a numismatic premium, but i have little knowledge of the inner workings of the >international gold market.

Not as critical today, but Pre-1933, citizens of other countries wanted our gold coins, especially Double Eagles.

Here's a NY Times article from 1931 talking about how the usual preference for gold bars was augmented with a request for coins/Double Eagles.

This opinion is an informed guess but I don't have any data to back me up and could be totally wrong. That being >said... I don't think any country wants to deal with bags of coins even a little bit. I believe the vast majority is in ingot >form and is shuffled between different storage areas in the same vaults. I also believe on the global scale, the vast >majority of gold movement is on paper.

Bars took off after WWI when we were still on a Gold Exchange Standard. Before that, coins were a good chunk or the majority of the gold settlement trade, more when you went back further in time.

@BillJones said:

what was wrong with K-Rands? I could find only one dealer at the Winter FUN show who would buy them.

I think the fact it it only 0.9167 gold and not a domestic coin probably is why the premium that other coins have has long since faded for the K-Rand. My LCS says he sells only a fraction of the K-Rands that he sold 20 or 30 years ago...and usually Proofs to collectors.

Once upon a time, the Kruggerand was the only modern gold coin regularly produced in volume that was widely available. So many choices today.

@davewesen said:

What percentage of the 90% silver coinage got melted during the Hunt brothers spike?

Actually, not that much though there was damage to collectibles.

A NY Times story I have posted on a thread here noted that the spike to $50 was so sharp and so quick that it didn't last long enough to melt many of the coins, including MSDs and other numismatics. Lots of coins were yanked back from refiners and wholsalers. We're talking about a 80% drop in silver in a few weeks, 50% in a few days.

@BillJones said:

what was wrong with K-Rands? I could find only one dealer at the Winter FUN show who would buy them.

I think the fact it it only 0.9167 gold and not a domestic coin probably is why the premium that other coins have has long since faded for the K-Rand. My LCS says he sells only a fraction of the K-Rands that he sold 20 or 30 years ago...and usually Proofs to collectors.

Once upon a time, the Kruggerand was the only modern gold coin regularly produced in volume that was widely available. So many choices today.

My inference is that the 1984 sanctions (if I have the year correct) changed the perception.

@WCC said:

My inference is that the 1984 sanctions (if I have the year correct) changed the perception.

That didn't help, for sure.

I also think that after a hot decade in the 1970's you had 2 decades following with not much interest in gold or gold coins. Financial assets took off.

@blitzdude said: I was offered 98% Spot/Melt (one in the same by the way)

Here is a screenshot of melt for a St Gaudens

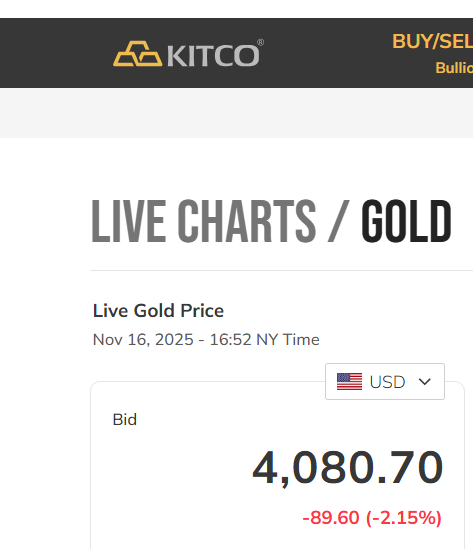

Here is a screenshot of gold spot at this moment

How are these "one and the same" when the melt value is $120 less than the gold spot value.

They are one and the same because they aren't one ounce of gold. Spot price is $/ ounce not $s. Expressed in units of $/ounce, as it should be, it is the same number.

If I say that I'm paying "spot for pre-33 gold", I'm not saying that I'm paying $4080 for every coin - all the coins? I'm paying $4080 per ounce for every coin.

That would be fun.

"I've got 13 AGEs to sell, what are you paying? "

"I'll pay double spot"

"I'll take it!"

"Here's your $8160!"

All comments reflect the opinion of the author, even when irrefutably accurate.

@jmlanzaf said:

They are one and the same because they aren't one ounce of gold. Spot price is $/ ounce not $s. Expressed in units of $/ounce, as it should be, it is the same number.

I understand that spot is biased on an ounce of gold. Math still doesn't work.

@jmlanzaf said:

They are one and the same because they aren't one ounce of gold. Spot price is $/ ounce not $s. Expressed in units of $/ounce, as it should be, it is the same number.

I understand that spot is biased on an ounce of gold. Math still doesn't work.

All comments reflect the opinion of the author, even when irrefutably accurate.

And here is what you get from the site you linked. What was posted above is that spot and melt are the same, they are not as the site you linked shows just as what I posted showed. Melt is a percentage of spot they are not equal.

And here is what you get from the site you linked. What was posted above is that spot and melt are the same, they are not as the site you linked shows just as what I posted showed. Melt is a percentage of spot they are not equal.

They are exactly the same number in $ per ounce. Again, you are looking at the $ value, not the $ per ounce value.

If I pay spot for a $5 AGE, how much is that? $408 or $4080?

By your logic, no one ever pays "spot" for anything but 1 oz bars. Comex trades 100 ounce bars not 1 ounce bars, yet "spot" is quoted in $ per ounce.

You're taking a minor semantic difference and sowing confusion.

All comments reflect the opinion of the author, even when irrefutably accurate.

And the only thing that I see stopping the melting of otherwise common gold coins including DEs -- and maybe turning them into semi-rarities in 10 or 15 years -- is that many of the graded & ceritified coins have built-in protection as the actual grade of the coin plus the ability to protect it and handle it from the holder should insure their survival.

For a dealer, I guess knowing that you can always melt a semi-numsimatic coin and not have to "eat" too much of a premium is somewhat comforting if you get caught with too much inventory and need to raise cash.

I wonder if now dealers will hold more MS-64's and MS-65's if gold holds $4,000 going forward, just as they used to hold a decent supply of MS-63 commons and AU raw coins as bullion substitutes.

@GoldFinger1969 said: The answer to the OP is a most definite YES.

And the only thing that I see stopping the melting of otherwise common gold coins including DEs -- and maybe turning them into semi-rarities in 10 or 15 years -- is that many of the graded & ceritified coins have built-in protection as the actual grade of the coin plus the ability to protect it and handle it from the holder should insure their survival.

For a dealer, I guess knowing that you can always melt a semi-numsimatic coin and not have to "eat" too much of a premium is somewhat comforting if you get caught with too much inventory and need to raise cash.

I wonder if now dealers will hold more MS-64's and MS-65's if gold holds $4,000 going forward, just as they used to hold a decent supply of MS-63 commons and AU raw coins as bullion substitutes.

I don't think I'd ever hold pre-33 as a bullion substitute at these levels. If 0.999 is the same price as 0.917, there's no point in holding the 0.917 other than the hope that a premium returns. But it's just as likely that the 0.999 ends up with a higher price than the 0.917 because it doesn't need to be refined.

At some number, the premium on 64s and 65s will also evaporate. It's already pretty much meaningless. If I've got a $4000 coin, is $4200 really significant? It's only meaningful at long as I can flip it instantly. Holding inventory for a 5% gain is too risky. The move in gold can be higher than the premium you are trying to reap.

All comments reflect the opinion of the author, even when irrefutably accurate.

@jmlanzaf said:

I don't think I'd ever hold pre-33 as a bullion substitute at these levels. If 0.999 is the same price as 0.917, there's >no point in holding the 0.917 other than the hope that a premium returns. But it's just as likely that the 0.999 ends >up with a higher price than the 0.917 because it doesn't need to be refined.

Is the pre-1933 (Saint, Liberty, Eagle, or small denomination gold coin) slabbed or not ? Most MODERN bullion coins that aren't proofs or high-grades are NOT slabbed. While I agree that if it's bullion the grade doesn't matter, some people like being able to handle the coin in a holder and also protecting it and storing it is easier.

So that's a reason that pre-1933 gold might be attractive to someone and we've had people on this and other forums ask: a Saint-Gaudens in low-60's grade or a modern AGE or Buffalo ? Obviously, the gold fineness is higher but most of the time the moderns aren't graded/slabbed whereas the Saint usually is.

At some number, the premium on 64s and 65s will also evaporate. It's already pretty much meaningless. If I've got >a $4000 coin, is $4200 really significant? It's only meaningful at long as I can flip it instantly. Holding inventory for a >5% gain is too risky. The move in gold can be higher than the premium you are trying to reap.

I agree.

But holding 65's now with $200 at risk on a $4,000 investment is alot better than holding 65's 3 years ago with $400 at risk on a $2,000 investment !

@GoldFinger1969 said: The answer to the OP is a most definite YES.

And the only thing that I see stopping the melting of otherwise common gold coins including DEs -- and maybe turning them into semi-rarities in 10 or 15 years --

Which specific coins do you have in mind?

For Saints, many of the counts are so high, it would take a lot of melting to turn "common" into "semi-rarities". And when I say a lot, like really a lot. I'm not referring to dates with 6-figure counts, but those a lot lower too.

@Coins3675 said:

If it were up to me I would never melt any 90% silver coins or pre-1933 gold coins.

But "you" also don't want to pay a premium to own them. Everyone loves to post how they picked up the coin for melt. Why is anyone going to hold a coin waiting for you to pay what the refinery is paying immediately?

If collectors start paying a premium, no coins will be melted. If they don't, they are essentially voting (with their wallets) in favor of melting.

All comments reflect the opinion of the author, even when irrefutably accurate.

@jmlanzaf said:

I don't think I'd ever hold pre-33 as a bullion substitute at these levels. If 0.999 is the same price as 0.917, there's >no point in holding the 0.917 other than the hope that a premium returns. But it's just as likely that the 0.999 ends >up with a higher price than the 0.917 because it doesn't need to be refined.

Is the pre-1933 (Saint, Liberty, Eagle, or small denomination gold coin) slabbed or not ? Most MODERN bullion coins that aren't proofs or high-grades are NOT slabbed. While I agree that if it's bullion the grade doesn't matter, some people like being able to handle the coin in a holder and also protecting it and storing it is easier.

So that's a reason that pre-1933 gold might be attractive to someone and we've had people on this and other forums ask: a Saint-Gaudens in low-60's grade or a modern AGE or Buffalo ? Obviously, the gold fineness is higher but most of the time the moderns aren't graded/slabbed whereas the Saint usually is.

At some number, the premium on 64s and 65s will also evaporate. It's already pretty much meaningless. If I've got >a $4000 coin, is $4200 really significant? It's only meaningful at long as I can flip it instantly. Holding inventory for a >5% gain is too risky. The move in gold can be higher than the premium you are trying to reap.

I agree.

But holding 65's now with $200 at risk on a $4,000 investment is alot better than holding 65's 3 years ago with $400 at risk on a $2,000 investment !

There's probably more slabbed Eagles than pre-33.

I also don't think many bullion buyers care. And they will care even less as fake slabs continue to proliferate. All the dealers i know sell more raw eagles and make leafs than slabbed pre-33 by a LARGE margin.

All comments reflect the opinion of the author, even when irrefutably accurate.

@Coins3675 said:

If it were up to me I would never melt any 90% silver coins or pre-1933 gold coins.

But "you" also don't want to pay a premium to own them. Everyone loves to post how they picked up the coin for melt. Why is anyone going to hold a coin waiting for you to pay what the refinery is paying immediately?

If collectors start paying a premium, no coins will be melted. If they don't, they are essentially voting (with their wallets) in favor of melting.

Your point is the primary one I have been making. Especially at these prices, there are too many coins for the marginal buyer. It's one thing to buy or hang onto "junk silver" or the huge number of post-1933 US circulation silver denomination gems, but another for gold coinage.

The proportion of the collector base who both buy coins at these prices (depending upon the denomination) is a minority to very low, as in really low.

I infer this thread is mostly about generic LH DE and Saints which now cost $4,000+. I question whether more than a few % of the collector base buys coins of this value for their collection, and all of them aren't buying gold coinage. It's just too expensive.

Non-collector stackers/speculators and collectors buying it for financial reasons don't have enough of an incentive to pay virtually any premium, if any at all, at current prices for common or the most common coins.

@Coins3675 said:

If it were up to me I would never melt any 90% silver coins or pre-1933 gold coins.

But "you" also don't want to pay a premium to own them. Everyone loves to post how they picked up the coin for melt. Why is anyone going to hold a coin waiting for you to pay what the refinery is paying immediately?

If collectors start paying a premium, no coins will be melted. If they don't, they are essentially voting (with their wallets) in favor of melting.

Your point is the primary one I have been making. Especially at these prices, there are too many coins for the marginal buyer. It's one thing to buy or hang onto "junk silver" or the huge number of post-1933 US circulation silver denomination gems, but another for gold coinage.

The proportion of the collector base who both buy coins at these prices (depending upon the denomination) is a minority to very low, as in really low.

I infer this thread is mostly about generic LH DE and Saints which now cost $4,000+. I question whether more than a few % of the collector base buys coins of this value for their collection, and all of them aren't buying gold coinage. It's just too expensive.

Non-collector stackers/speculators and collectors buying it for financial reasons don't have enough of an incentive to pay virtually any premium, if any at all, at current prices for common or the most common coins.

Definitely true of gold. Most collections out there aren't worth $4000 total much less contain a single $4000 coin.

But it's also become true of low-grade, common date silver. An AG Barber Half has few buyers at $17 much less $8+ for a G/VG 1950s Washington quarter.

All comments reflect the opinion of the author, even when irrefutably accurate.

@WCC said:

For Saints, many of the counts are so high, it would take a lot of melting to turn "common" into "semi-rarities". And >when I say a lot, like really a lot. I'm not referring to dates with 6-figure counts, but those a lot lower too.

I guess I was thinking the more commons (1924, 1927, 1908 NM, etc.).

You're PROBABLY right but I keep going back to that NY Times article (I think I posted it here) from 1985 which noted that lots of silver coins got destroyed in 1979-80 as silver spiked up. Had it held anywhere near $50/oz reached during the height of the Hunt Brothers Fiasco, who knows how many coins would have been destroyed.

I don't think you'd ever see a coin go from being a bullion substitute to one that traded at multiples of the underlying metal value....but you could easily see a common coin go to scarce or semi-scarce and trade at a premium.

Probably not on any coin with 6-figures in survivors or near that....but any coin with over 25,000 tends to trade as bullion. You could see someone arbitrage and then melt several hundred or even more coins and suddenly it swings back to a numismatic from investment coin.

@Cougar1978 said:

Well at second glance - Most likely culls, common low grade issues.

Thankfully so many coins have been graded/certified/holdered that I think that affords some degree of protection as they have some added value from the grade, protective holder, etc.

@coastaljerseyguy said:

The $20 St Gaudens might be 90% gold but its weight is > troy oz. So in reality, it is 96.75% troy oz of .999 gold.

It's 0.9675 troy ounces of 0.900 gold. 90% gold...10% copper (could be trace amounts of silver in some years).

Gold was $20.67 an ounce during DE years (1850-1933)......0.9675 ounces gives you the $20 value for a DE.

No, it weighs 33.436 ozs (more then a troy oz) & 90% gold so how could it be .9775 of 90%?

That's one very heavy coin. The actual gold content of a $20 double eagle is 0.9675 Troy ounces. The actual coin weighs more than this since it has copper added to harden the gold and to make it .900 fine.

Worry is the interest you pay on a debt you may not owe.

"Paper money eventually returns to its intrinsic value---zero."----Voltaire

"Everything you say should be true, but not everything true should be said."----Voltaire

@coastaljerseyguy said:

No, it weighs 33.436 ozs (more then a troy oz) & 90% gold so how could it be .9775 of 90%?

I'm confused....I'm just saying it's 90% gold, 10% copper....it's 0.9675 ounces of gold ($20 face value @ $20.67 official price of gold)....and like you said, it weighs more than a troy ounce to account for the 90/10 composition, with the 0.9675 troy ounce weight offsetting that a bit.

@WCC said:

For Saints, many of the counts are so high, it would take a lot of melting to turn "common" into "semi-rarities". And >when I say a lot, like really a lot. I'm not referring to dates with 6-figure counts, but those a lot lower too.

I guess I was thinking the more commons (1924, 1927, 1908 NM, etc.).

You're PROBABLY right but I keep going back to that NY Times article (I think I posted it here) from 1985 which noted that lots of silver coins got destroyed in 1979-80 as silver spiked up. Had it held anywhere near $50/oz reached during the height of the Hunt Brothers Fiasco, who knows how many coins would have been destroyed.

I don't think you'd ever see a coin go from being a bullion substitute to one that traded at multiples of the underlying metal value....but you could easily see a common coin go to scarce or semi-scarce and trade at a premium.

Probably not on any coin with 6-figures in survivors or near that....but any coin with over 25,000 tends to trade as bullion. You could see someone arbitrage and then melt several hundred or even more coins and suddenly it swings back to a numismatic from investment coin.

Except that the coins you're almost certainly thinking of as "semi-scarce" now are actually common. The comparison you're making to potential US silver coin melting in 1980 never would have made any of those coins even close to "semi-scarce" even if the 98% number you previously provided actually happened.

I checked a few Saints dates in the PCGS pops after reading your last post. Don't remember which now but anyone can replicate what I saw in about 5 minutes. Dates I presume fitting your description have less than 10,000 graded (total) and less than 1,000 in MS-64 which seem to be worth roughly a 50% premium.

My conclusion is an inference only, not "fact" obviously, but the only reason I can see why these PCGS 4-figure count Saints sell for current prices is that all prices are set by the marginal buyer. I question whether most of these are owned by a collector for a collection as a collectible either.

@WCC said:

I checked a few Saints dates in the PCGS pops after reading your last post. Don't remember which now but anyone >can replicate what I saw in about 5 minutes. Dates I presume fitting your description have less than 10,000 graded >(total) and less than 1,000 in MS-64 which seem to be worth roughly a 50% premium. My conclusion is an inference >only, not "fact" obviously, but the only reason I can see why these PCGS 4-figure >count Saints sell for current prices >is that all prices are set by the marginal buyer. I question whether most of these >are owned by a collector for a >collection as a collectible either.

When the total supply of coins exceeds the numismatic demand (Full-Time Registry Players + Part-Time Type Collectors) then the lower-gradeds in Mint State (or lower, if the grading cureve shifts downward) need to sell at their bullion value to attract the Investment Collectors.

While there's no exact figure, the experts with decades of experience seem to indicate you hit that inflection point at around 25,000 numismatic collectors. Maybe it's 50,000.....I'm just guestimating.

@Cougar1978 said:

I can’t see anything but culls and really low grade material being melted.

Does cull gold exist? I would hope 1700 gold or Colonials are not being melted.

Those have numismatic premium.

If any pre-33 gold is being melted, it isn't just culls. When retail customers are paying the same as the refiners, and the gold market is volatile,; you don't put the coins in inventory and risk gold moving against you. A $100 drop in the price of gold wipes out all profit on a $20 DE. So you lock in your price when the 50 AU common dates come in to the store.

All comments reflect the opinion of the author, even when irrefutably accurate.

@Cougar1978 said:

I can’t see anything but culls and really low grade material being melted.

Does cull gold exist? I would hope 1700 gold or Colonials are not being melted.

Those have numismatic premium.

If any pre-33 gold is being melted, it isn't just culls. When retail customers are paying the same as the refiners, and the gold market is volatile,; you don't put the coins in inventory and risk gold moving against you. A $100 drop in the price of gold wipes out all profit on a $20 DE. So you lock in your price when the 50 AU common dates come in to the store.

@logger7 said:

Certification holder is a very desirable guarantee of authenticity. Coin gold is in the ideal form for buying/selling, why would anyone want to spend all the money required to turning them into bars?

Because the BIGS want big gold bars, not sacks full of gold coins. RGDS!

I was just saying what's currently happening. Me personally, I would never melt history into a gold bar. I love gold coins and I'm doing my best to preserve a few here and there. RGDS!

At the same time the plaster models for these coins still do exist and we could also make more affordable modern versions of these coins like we do with modern Morgan and Peace dollars

Everything happens as events and the one that destroys most gold coins is when the holder has too much unsaleable coins and desires to sell them all at once. This is usually dealers and jobbers but it usually applies universally even when it's a single cull coin. People selling such junk are naturally going to include some low end stuff that isn't truly junk or he merely believes is junk. He might even fear prices are at a short term high so even a few nicer coins might best be included. The coins in refiner's inventory are hardly all junk. When you have huge numbers of anything some will better. Refiners might well skim off nice XF better date gold but they have to buy it and have limited time to move acquisitions to the furnace and limited ability to look at everything.

Who knows all the stuff being destroyed but at these levels it probably is not insignificant. One refiner might have demand for lots of cheap gold and another not. But coins are always degrading or encountering events that cause them to be culls.

Most people couldn't buy a single DE from a refiner even if it were worth twice as much. How much can people buy when the average is only 6 or 8% over melt? The market is efficient enough you can get culls or good low value gold coin on eBay for less than 6% over. Why would the refiner have lines of buyers?

Reality doesn't pick off the hindmost. it picks off what no longer works.

@WCC said:

I checked a few Saints dates in the PCGS pops after reading your last post. Don't remember which now but anyone >can replicate what I saw in about 5 minutes. Dates I presume fitting your description have less than 10,000 graded >(total) and less than 1,000 in MS-64 which seem to be worth roughly a 50% premium. My conclusion is an inference >only, not "fact" obviously, but the only reason I can see why these PCGS 4-figure >count Saints sell for current prices >is that all prices are set by the marginal buyer. I question whether most of these >are owned by a collector for a >collection as a collectible either.

When the total supply of coins exceeds the numismatic demand (Full-Time Registry Players + Part-Time Type Collectors) then the lower-gradeds in Mint State (or lower, if the grading cureve shifts downward) need to sell at their bullion value to attract the Investment Collectors.

While there's no exact figure, the experts with decades of experience seem to indicate you hit that inflection point at around 25,000 numismatic collectors. Maybe it's 50,000.....I'm just guestimating.

You're making my point. PCGS has graded about 1,200,000 Saints. NGC has graded about 1,100,000. That's slightly more than 25,000 or 50,000, and there isn't any reason to believe there are anywhere near these numbers of set collectors either. There likely aren't anywhere near 25,000 looking to buy each date in the series as collectible, maybe collectors buying the more or most common dates at low premiums as a bullion substitute, but still likely not near recent prices because most of them presumably bought what they have years ago at far lower prices.

Who does this leave to buy most of the supply later?

Stackers and "investors", even if my numbers are far off, and only a very low proportion are candidates to buy the more/most expensive coins or increase the premiums.

I'm not telling you it's impossible for the premiums to return. I expect it will at some point because prices are set at the margin and in the bigger picture, the amount of money to make it happen is peanuts compared to the scale in asset markets. Still, this doesn't mean that more than a very low fraction of these buyers does or will care about hardly any of the coins as collectibles.

We both know that if Saints had been struck as silver dollars instead of Morgan dollars with everything else unchanged, the gold widgets would be worth 5% or less of current value.

@WCC said:

You're making my point. PCGS has graded about 1,200,000 Saints. NGC has graded about 1,100,000. That's >slightly more than 25,000 or 50,000, and there isn't any reason to believe there are anywhere near these numbers >of set collectors either. There likely aren't anywhere near 25,000 looking to buy each date in the series

I agree, but the bulk of those graded Saints are in a few of the super-commons like the 1924 and 1908 No Motto. More than half of those graded are in the 1924, 1908 NM, and 1927.

The fact that in a low-enough grade lots of other coins are available for spot gold or a nominal premium -- meaning that numismatic demand has been satiated -- shows that for SOME coins, if they get culled now, it could backfire down the line if demand for them were to pick up.

In fact, the 1915-S has just over 16,000 graded by PCGS and I bought a nice MS-63 OGH back at FUN 2020 for basically spot gold (~3% premium adjusting for the lower gold content). If you can buy lots of coins not among the most common.....at bullion plus a nominal premium...and in grades from AU-58 to the low-60's....that's not bad.

Shows you even if there are tens of thousands of Type or PT collectors...they run the gamut from folks happy with 1 or 2 coins to semi-Registry players...and thus there are lots of coins trading for bullion (in 58-63 grades) when there are 5,000 coins and up available to collectors and certainly when 10,000 - 15,000 exist.

Comments

Not as critical today, but Pre-1933, citizens of other countries wanted our gold coins, especially Double Eagles.

Here's a NY Times article from 1931 talking about how the usual preference for gold bars was augmented with a request for coins/Double Eagles.

Bars took off after WWI when we were still on a Gold Exchange Standard. Before that, coins were a good chunk or the majority of the gold settlement trade, more when you went back further in time.

I think the fact it it only 0.9167 gold and not a domestic coin probably is why the premium that other coins have has long since faded for the K-Rand. My LCS says he sells only a fraction of the K-Rands that he sold 20 or 30 years ago...and usually Proofs to collectors.

Once upon a time, the Kruggerand was the only modern gold coin regularly produced in volume that was widely available. So many choices today.

Actually, not that much though there was damage to collectibles.

A NY Times story I have posted on a thread here noted that the spike to $50 was so sharp and so quick that it didn't last long enough to melt many of the coins, including MSDs and other numismatics. Lots of coins were yanked back from refiners and wholsalers. We're talking about a 80% drop in silver in a few weeks, 50% in a few days.

My inference is that the 1984 sanctions (if I have the year correct) changed the perception.

That didn't help, for sure.

I also think that after a hot decade in the 1970's you had 2 decades following with not much interest in gold or gold coins. Financial assets took off.

Here is a screenshot of melt for a St Gaudens

Here is a screenshot of gold spot at this moment

How are these "one and the same" when the melt value is $120 less than the gold spot value.

My Collection of Old Holders

Never a slave to one plastic brand will I ever be.

They are one and the same because they aren't one ounce of gold. Spot price is $/ ounce not $s. Expressed in units of $/ounce, as it should be, it is the same number.

If I say that I'm paying "spot for pre-33 gold", I'm not saying that I'm paying $4080 for every coin - all the coins? I'm paying $4080 per ounce for every coin.

That would be fun.

"I've got 13 AGEs to sell, what are you paying? "

"I'll pay double spot"

"I'll take it!"

"Here's your $8160!"

All comments reflect the opinion of the author, even when irrefutably accurate.

I understand that spot is biased on an ounce of gold. Math still doesn't work.

My Collection of Old Holders

Never a slave to one plastic brand will I ever be.

All comments reflect the opinion of the author, even when irrefutably accurate.

Pre33 is 90% not 97%

My Collection of Old Holders

Never a slave to one plastic brand will I ever be.

Here

https://stacksbowers.com/melt-value-calculator/gold/

Mike

My Indians

Dansco Set

$20 pre 33 gold has .9675 of gold

Mike

My Indians

Dansco Set

That's the gold weight not the fineness

All comments reflect the opinion of the author, even when irrefutably accurate.

St. G. melt @ $3962.57 = gold spot @ $4097.

And here is what you get from the site you linked. What was posted above is that spot and melt are the same, they are not as the site you linked shows just as what I posted showed. Melt is a percentage of spot they are not equal.

My Collection of Old Holders

Never a slave to one plastic brand will I ever be.

We're adjusting for the fact that a Double Eagle is 0.9675 troy ounces, right ?

They are exactly the same number in $ per ounce. Again, you are looking at the $ value, not the $ per ounce value.

If I pay spot for a $5 AGE, how much is that? $408 or $4080?

By your logic, no one ever pays "spot" for anything but 1 oz bars. Comex trades 100 ounce bars not 1 ounce bars, yet "spot" is quoted in $ per ounce.

You're taking a minor semantic difference and sowing confusion.

All comments reflect the opinion of the author, even when irrefutably accurate.

The answer to the OP is a most definite YES.

And the only thing that I see stopping the melting of otherwise common gold coins including DEs -- and maybe turning them into semi-rarities in 10 or 15 years -- is that many of the graded & ceritified coins have built-in protection as the actual grade of the coin plus the ability to protect it and handle it from the holder should insure their survival.

For a dealer, I guess knowing that you can always melt a semi-numsimatic coin and not have to "eat" too much of a premium is somewhat comforting if you get caught with too much inventory and need to raise cash.

I wonder if now dealers will hold more MS-64's and MS-65's if gold holds $4,000 going forward, just as they used to hold a decent supply of MS-63 commons and AU raw coins as bullion substitutes.

I don't think I'd ever hold pre-33 as a bullion substitute at these levels. If 0.999 is the same price as 0.917, there's no point in holding the 0.917 other than the hope that a premium returns. But it's just as likely that the 0.999 ends up with a higher price than the 0.917 because it doesn't need to be refined.

At some number, the premium on 64s and 65s will also evaporate. It's already pretty much meaningless. If I've got a $4000 coin, is $4200 really significant? It's only meaningful at long as I can flip it instantly. Holding inventory for a 5% gain is too risky. The move in gold can be higher than the premium you are trying to reap.

All comments reflect the opinion of the author, even when irrefutably accurate.

The $20 St Gaudens might be 90% gold but its weight is > troy oz. So in reality, it is 96.75% troy oz of .999 gold.

Is the pre-1933 (Saint, Liberty, Eagle, or small denomination gold coin) slabbed or not ? Most MODERN bullion coins that aren't proofs or high-grades are NOT slabbed. While I agree that if it's bullion the grade doesn't matter, some people like being able to handle the coin in a holder and also protecting it and storing it is easier.

So that's a reason that pre-1933 gold might be attractive to someone and we've had people on this and other forums ask: a Saint-Gaudens in low-60's grade or a modern AGE or Buffalo ? Obviously, the gold fineness is higher but most of the time the moderns aren't graded/slabbed whereas the Saint usually is.

I agree.

But holding 65's now with $200 at risk on a $4,000 investment is alot better than holding 65's 3 years ago with $400 at risk on a $2,000 investment !

If it were up to me I would never melt any 90% silver coins or pre-1933 gold coins.

Which specific coins do you have in mind?

For Saints, many of the counts are so high, it would take a lot of melting to turn "common" into "semi-rarities". And when I say a lot, like really a lot. I'm not referring to dates with 6-figure counts, but those a lot lower too.

But "you" also don't want to pay a premium to own them. Everyone loves to post how they picked up the coin for melt. Why is anyone going to hold a coin waiting for you to pay what the refinery is paying immediately?

If collectors start paying a premium, no coins will be melted. If they don't, they are essentially voting (with their wallets) in favor of melting.

All comments reflect the opinion of the author, even when irrefutably accurate.

There's probably more slabbed Eagles than pre-33.

I also don't think many bullion buyers care. And they will care even less as fake slabs continue to proliferate. All the dealers i know sell more raw eagles and make leafs than slabbed pre-33 by a LARGE margin.

All comments reflect the opinion of the author, even when irrefutably accurate.

Your point is the primary one I have been making. Especially at these prices, there are too many coins for the marginal buyer. It's one thing to buy or hang onto "junk silver" or the huge number of post-1933 US circulation silver denomination gems, but another for gold coinage.

The proportion of the collector base who both buy coins at these prices (depending upon the denomination) is a minority to very low, as in really low.

I infer this thread is mostly about generic LH DE and Saints which now cost $4,000+. I question whether more than a few % of the collector base buys coins of this value for their collection, and all of them aren't buying gold coinage. It's just too expensive.

Non-collector stackers/speculators and collectors buying it for financial reasons don't have enough of an incentive to pay virtually any premium, if any at all, at current prices for common or the most common coins.

Definitely true of gold. Most collections out there aren't worth $4000 total much less contain a single $4000 coin.

But it's also become true of low-grade, common date silver. An AG Barber Half has few buyers at $17 much less $8+ for a G/VG 1950s Washington quarter.

All comments reflect the opinion of the author, even when irrefutably accurate.

Not in the least bit.

Really?

All comments reflect the opinion of the author, even when irrefutably accurate.

Well at second glance - Most likely culls, common low grade issues.

But nice slabbed collectible coins I believe a different situation. Cutoff at AU?

It's 0.9675 troy ounces of 0.900 gold. 90% gold...10% copper (could be trace amounts of silver in some years).

Gold was $20.67 an ounce during DE years (1850-1933)......0.9675 ounces gives you the $20 value for a DE.

I guess I was thinking the more commons (1924, 1927, 1908 NM, etc.).

You're PROBABLY right but I keep going back to that NY Times article (I think I posted it here) from 1985 which noted that lots of silver coins got destroyed in 1979-80 as silver spiked up. Had it held anywhere near $50/oz reached during the height of the Hunt Brothers Fiasco, who knows how many coins would have been destroyed.

I don't think you'd ever see a coin go from being a bullion substitute to one that traded at multiples of the underlying metal value....but you could easily see a common coin go to scarce or semi-scarce and trade at a premium.

Probably not on any coin with 6-figures in survivors or near that....but any coin with over 25,000 tends to trade as bullion. You could see someone arbitrage and then melt several hundred or even more coins and suddenly it swings back to a numismatic from investment coin.

No, it weighs 33.436 ozs (more then a troy oz) & 90% gold so how could it be .9775 of 90%?

Thankfully so many coins have been graded/certified/holdered that I think that affords some degree of protection as they have some added value from the grade, protective holder, etc.

That's one very heavy coin. The actual gold content of a $20 double eagle is 0.9675 Troy ounces. The actual coin weighs more than this since it has copper added to harden the gold and to make it .900 fine.

Worry is the interest you pay on a debt you may not owe.

"Paper money eventually returns to its intrinsic value---zero."----Voltaire

"Everything you say should be true, but not everything true should be said."----Voltaire

Wow, that's surprising to me. Maybe they deal with real collectors confident in their grading skills and not susceptible to buying a counterfeit.

I'm confused....I'm just saying it's 90% gold, 10% copper....it's 0.9675 ounces of gold ($20 face value @ $20.67 official price of gold)....and like you said, it weighs more than a troy ounce to account for the 90/10 composition, with the 0.9675 troy ounce weight offsetting that a bit.

No, it's because that's what bullion buyers buy.

All comments reflect the opinion of the author, even when irrefutably accurate.

Except that the coins you're almost certainly thinking of as "semi-scarce" now are actually common. The comparison you're making to potential US silver coin melting in 1980 never would have made any of those coins even close to "semi-scarce" even if the 98% number you previously provided actually happened.

I checked a few Saints dates in the PCGS pops after reading your last post. Don't remember which now but anyone can replicate what I saw in about 5 minutes. Dates I presume fitting your description have less than 10,000 graded (total) and less than 1,000 in MS-64 which seem to be worth roughly a 50% premium.

My conclusion is an inference only, not "fact" obviously, but the only reason I can see why these PCGS 4-figure count Saints sell for current prices is that all prices are set by the marginal buyer. I question whether most of these are owned by a collector for a collection as a collectible either.

When the total supply of coins exceeds the numismatic demand (Full-Time Registry Players + Part-Time Type Collectors) then the lower-gradeds in Mint State (or lower, if the grading cureve shifts downward) need to sell at their bullion value to attract the Investment Collectors.

While there's no exact figure, the experts with decades of experience seem to indicate you hit that inflection point at around 25,000 numismatic collectors. Maybe it's 50,000.....I'm just guestimating.

I can’t see anything but culls and really low grade material being melted.

Does cull gold exist? I would hope 1700 gold or Colonials are not being melted.

Those have numismatic premium.

If any pre-33 gold is being melted, it isn't just culls. When retail customers are paying the same as the refiners, and the gold market is volatile,; you don't put the coins in inventory and risk gold moving against you. A $100 drop in the price of gold wipes out all profit on a $20 DE. So you lock in your price when the 50 AU common dates come in to the store.

All comments reflect the opinion of the author, even when irrefutably accurate.

That is what I thought.

Mine's not.

At the same time the plaster models for these coins still do exist and we could also make more affordable modern versions of these coins like we do with modern Morgan and Peace dollars

Like modern Morgans & Peace $'s not even close to the same, Yes they are nice but can't compare the brilliance of the original.

Everything happens as events and the one that destroys most gold coins is when the holder has too much unsaleable coins and desires to sell them all at once. This is usually dealers and jobbers but it usually applies universally even when it's a single cull coin. People selling such junk are naturally going to include some low end stuff that isn't truly junk or he merely believes is junk. He might even fear prices are at a short term high so even a few nicer coins might best be included. The coins in refiner's inventory are hardly all junk. When you have huge numbers of anything some will better. Refiners might well skim off nice XF better date gold but they have to buy it and have limited time to move acquisitions to the furnace and limited ability to look at everything.

Who knows all the stuff being destroyed but at these levels it probably is not insignificant. One refiner might have demand for lots of cheap gold and another not. But coins are always degrading or encountering events that cause them to be culls.

Most people couldn't buy a single DE from a refiner even if it were worth twice as much. How much can people buy when the average is only 6 or 8% over melt? The market is efficient enough you can get culls or good low value gold coin on eBay for less than 6% over. Why would the refiner have lines of buyers?

Reality doesn't pick off the hindmost. it picks off what no longer works.

You're making my point. PCGS has graded about 1,200,000 Saints. NGC has graded about 1,100,000. That's slightly more than 25,000 or 50,000, and there isn't any reason to believe there are anywhere near these numbers of set collectors either. There likely aren't anywhere near 25,000 looking to buy each date in the series as collectible, maybe collectors buying the more or most common dates at low premiums as a bullion substitute, but still likely not near recent prices because most of them presumably bought what they have years ago at far lower prices.

Who does this leave to buy most of the supply later?

Stackers and "investors", even if my numbers are far off, and only a very low proportion are candidates to buy the more/most expensive coins or increase the premiums.

I'm not telling you it's impossible for the premiums to return. I expect it will at some point because prices are set at the margin and in the bigger picture, the amount of money to make it happen is peanuts compared to the scale in asset markets. Still, this doesn't mean that more than a very low fraction of these buyers does or will care about hardly any of the coins as collectibles.

We both know that if Saints had been struck as silver dollars instead of Morgan dollars with everything else unchanged, the gold widgets would be worth 5% or less of current value.

I agree, but the bulk of those graded Saints are in a few of the super-commons like the 1924 and 1908 No Motto. More than half of those graded are in the 1924, 1908 NM, and 1927.

The fact that in a low-enough grade lots of other coins are available for spot gold or a nominal premium -- meaning that numismatic demand has been satiated -- shows that for SOME coins, if they get culled now, it could backfire down the line if demand for them were to pick up.

In fact, the 1915-S has just over 16,000 graded by PCGS and I bought a nice MS-63 OGH back at FUN 2020 for basically spot gold (~3% premium adjusting for the lower gold content). If you can buy lots of coins not among the most common.....at bullion plus a nominal premium...and in grades from AU-58 to the low-60's....that's not bad.

Shows you even if there are tens of thousands of Type or PT collectors...they run the gamut from folks happy with 1 or 2 coins to semi-Registry players...and thus there are lots of coins trading for bullion (in 58-63 grades) when there are 5,000 coins and up available to collectors and certainly when 10,000 - 15,000 exist.