BST references: jdimmick;Gerard;wondercoin;claychaser;agentjim007;CCC2010;guitarwes;TAMU15;Zubie;mariner67;segoja;Smittys;kaz;CARDSANDCOINS;FadeToBlack; jrt103;tizofthe;bronze6827;mkman;Scootersdad;AllCoinsRule;coindeuce;dmarks;piecesofme; and many more

BST references: jdimmick;Gerard;wondercoin;claychaser;agentjim007;CCC2010;guitarwes;TAMU15;Zubie;mariner67;segoja;Smittys;kaz;CARDSANDCOINS;FadeToBlack; jrt103;tizofthe;bronze6827;mkman;Scootersdad;AllCoinsRule;coindeuce;dmarks;piecesofme; and many more

I received another Sunflower Lib this morning.

It was one of the 2000 or so that were restocked recently. I bought it the other day when the HHL was lifted and ats was around 500 left.

There are Zero signs on the packaging & COA to indicate a prior handling.

There are Zero signs on the Coin Capsule to indicate a prior handling.

The Coin itself is in perfect, pristine condition. Not a single flaw or post-Mint damage to the Coin whatsoever.

To those that claim that these are Dealer Rejects or non 70's. - You are Sorely Mistaken and Clueless imo.

Do yourself a favor and move on to the next Boogieman. It's getting old.

PS: My new coin looks equal or better than the one that I sent in a few weeks ago.

This one ⇊

@Rc5280 said:

To those that claim that these are Dealer Rejects or non 70's. - You are Sorely Mistaken and Clueless imo.

The coin you got was a dealer reject, it appears they had ordered it and rejected taking delivery. I would expect it to be untouched as you claim since the dealer canceled all 2000 coins after not being able to cobble together enough outside dealer interest to take delivery. They bit off more than the market could handle.

When it was first posted that a dealer had 2000 coins, it was assumed they were delivered. The mint is the one who allowed a 2000 coin order to happen on retail, This is why it took over five weeks to sell this out.

Had they originally put up the coin with an inventory of 12k coins and a HHL of 2, it would have sold out completely within two to three days. Instead they played games with inventory and the HHL that dragged it out for five weeks.

I'm well aware of how this release was handled from start to finish. Yes, it could've been handled better, right along with several other releases as of late. There is a Rookie Director at the Helm imo.

The Dealer didn't reject the 2000 coins lol. Go ahead, play the semantics game with my statement regarding rejects - it's not a good look for you.

He reneged on the deal for a number of possibilities that you're not even remotely privy to. And suggesting that they were not delivered without any statement or documentation is pure speculation on your part.

@goldbuffalo said:

Yep, Broncos too good to be true are probably hacked, many months ago. I purchased one. It was a hacked account. I got my money back no harm done, but like I said if it’s too good to be true it probably is.

By the way, my most recent liberty from the mint, the second batch has shipped

mine has been saying processing since sunday. I hope it doesn't get cancelled.

@Rc5280 said:

I received another Sunflower Lib this morning.

It was one of the 2000 or so that were restocked recently. I bought it the other day when the HHL was lifted and ats was around 500 left.

There are Zero signs on the packaging & COA to indicate a prior handling.

There are Zero signs on the Coin Capsule to indicate a prior handling.

The Coin itself is in perfect, pristine condition. Not a single flaw or post-Mint damage to the Coin whatsoever.

To those that claim that these are Dealer Rejects or non 70's. - You are Sorely Mistaken and Clueless imo.

Do yourself a favor and move on to the next Boogieman. It's getting old.

PS: My new coin looks equal or better than the one that I sent in a few weeks ago.

This one ⇊

Oh no! Looks like when they took it out of the OGP capsule at PCGS the bee flew away!

@Rc5280 said:

To those that claim that these are Dealer Rejects or non 70's. - You are Sorely Mistaken and Clueless imo.

The coin you got was a dealer reject, it appears they had ordered it and rejected taking delivery. I would expect it to be untouched as you claim since the dealer canceled all 2000 coins after not being able to cobble together enough outside dealer interest to take delivery. They bit off more than the market could handle.

When it was first posted that a dealer had 2000 coins, it was assumed they were delivered. The mint is the one who allowed a 2000 coin order to happen on retail, This is why it took over five weeks to sell this out.

Had they originally put up the coin with an inventory of 12k coins and a HHL of 2, it would have sold out completely within two to three days. Instead they played games with inventory and the HHL that dragged it out for five weeks.

BST references: jdimmick;Gerard;wondercoin;claychaser;agentjim007;CCC2010;guitarwes;TAMU15;Zubie;mariner67;segoja;Smittys;kaz;CARDSANDCOINS;FadeToBlack; jrt103;tizofthe;bronze6827;mkman;Scootersdad;AllCoinsRule;coindeuce;dmarks;piecesofme; and many more

YIKES - just 20 sold in 5 hours!

Well, maybe not too surprising.

This time of year most sunflowers have been accounted for by squirrels caching their acquisitions.

The secondary market for these doesn't exist. > @RAWcoin said:

YIKES - just 20 sold in 5 hours!

Well, maybe not too surprising.

This time of year most sunflowers have been accounted for by squirrels caching their acquisitions.

Not that surprising. There's no secondary market for these which is why the orders were canceled in the first place.

All comments reflect the opinion of the author, even when irrefutably accurate.

There is secondary market, for end customers only but not for short term flipping.

These coins don't qualify for First Strike, the profit margin for flipping them after grading fees + eBay fees is not worth the hassle and money tied up opportunity cost. That's probably why the dealer cancelled the 2000 coin order in the first place.

@triplelake said:

There is secondary market, for end customers only but not for short term flipping.

These coins don't qualify for First Strike, the profit margin for flipping them after grading fees + eBay fees is not worth the hassle and money tied up opportunity cost. That's probably why the dealer cancelled the 2000 coin order in the first place.

That's a primary market not a secondary market. Or maybe we could call it an unprofitable secondary market.

All comments reflect the opinion of the author, even when irrefutably accurate.

The coins were profitable after fees when they originally came up, but now due to the rise in gold prices it has squeezed the margins by half at current issue price. This is the future for mint gold releases going forward, and they will have to strike half of what they thought they could sell earlier in the year.

I doubt the mint does that, it will have to be forced on them by consumers, and this is what has already been happening with other products. They have canceled the S proof silver eagle as a result of lower sales.

ats 987 shows many are not buying this this time around as they were earlier.

If gold hits $5k an ounce, the mint can shut down collector 1 ounce gold sales, as $6k a coin is a hard pill to swallow for buyers.

@HalfDime said:

The coins were profitable after fees when they originally came up, but now due to the rise in gold prices it has squeezed the margins by half at current issue price. This is the future for mint gold releases going forward, and they will have to strike half of what they thought they could sell earlier in the year.

I doubt the mint does that, it will have to be forced on them by consumers, and this is what has already been happening with other products. They have canceled the S proof silver eagle as a result of lower sales.

ats 987 shows many are not buying this this time around as they were earlier.

If gold hits $5k an ounce, the mint can shut down collector 1 ounce gold sales, as $6k a coin is a hard pill to swallow for buyers.

That's not uncommon for most mint issues. Initial speculation creates artificial rarity. Once they are in final consumer hands, the prices drop. I now fully expect these to be bullion coins in a year or two.

All comments reflect the opinion of the author, even when irrefutably accurate.

@HalfDime said:

The coins were profitable after fees when they originally came up, but now due to the rise in gold prices it has squeezed the margins by half at current issue price. This is the future for mint gold releases going forward, and they will have to strike half of what they thought they could sell earlier in the year.

I doubt the mint does that, it will have to be forced on them by consumers, and this is what has already been happening with other products. They have canceled the S proof silver eagle as a result of lower sales.

ats 987 shows many are not buying this this time around as they were earlier.

If gold hits $5k an ounce, the mint can shut down collector 1 ounce gold sales, as $6k a coin is a hard pill to swallow for buyers.

That's not uncommon for most mint issues. Initial speculation creates artificial rarity. Once they are in final consumer hands, the prices drop. I now fully expect these to be bullion coins in a year or two.

@HalfDime said:

The coins were profitable after fees when they originally came up, but now due to the rise in gold prices it has squeezed the margins by half at current issue price. This is the future for mint gold releases going forward, and they will have to strike half of what they thought they could sell earlier in the year.

I doubt the mint does that, it will have to be forced on them by consumers, and this is what has already been happening with other products. They have canceled the S proof silver eagle as a result of lower sales.

ats 987 shows many are not buying this this time around as they were earlier.

If gold hits $5k an ounce, the mint can shut down collector 1 ounce gold sales, as $6k a coin is a hard pill to swallow for buyers.

That's not uncommon for most mint issues. Initial speculation creates artificial rarity. Once they are in final consumer hands, the prices drop. I now fully expect these to be bullion coins in a year or two.

Have 2019, 2021 and 2023 become bullion coins?

An 1834 $5 hasn't either. What's your point? Was the price of the 2019, 2021 and 2023 this low on the secondary market a month after release. The answer is a resounding "no".

When the secondary market collapses this quickly, it is not usually a good sign for future value. This coin is acting more like 2017 than 2019. I know you WANT it to be like 2019, but it has not behaved that way.

All comments reflect the opinion of the author, even when irrefutably accurate.

ATS 955 - these would sell faster if they notified people they were in stock.

jmlanzaf, did spot price increase $500 while the 17 and 19 were in stock? we're in unprecedented times. these will end up like 21 or 23. lowest mintage year so far!

I wasn't collecting in 2017 and 2019 so i'm unaware of what was happening, but this certainly does seem unusual to me. maybe i'm just a noob and i buy shiny things thinking it will go up in value like the last few. my friend only buys bullion and maybe that's the way to go.

@HalfDime said:

The coins were profitable after fees when they originally came up, but now due to the rise in gold prices it has squeezed the margins by half at current issue price. This is the future for mint gold releases going forward, and they will have to strike half of what they thought they could sell earlier in the year.

I doubt the mint does that, it will have to be forced on them by consumers, and this is what has already been happening with other products. They have canceled the S proof silver eagle as a result of lower sales.

ats 987 shows many are not buying this this time around as they were earlier.

If gold hits $5k an ounce, the mint can shut down collector 1 ounce gold sales, as $6k a coin is a hard pill to swallow for buyers.

That's not uncommon for most mint issues. Initial speculation creates artificial rarity. Once they are in final consumer hands, the prices drop. I now fully expect these to be bullion coins in a year or two.

@HalfDime said:

The coins were profitable after fees when they originally came up, but now due to the rise in gold prices it has squeezed the margins by half at current issue price. This is the future for mint gold releases going forward, and they will have to strike half of what they thought they could sell earlier in the year.

I doubt the mint does that, it will have to be forced on them by consumers, and this is what has already been happening with other products. They have canceled the S proof silver eagle as a result of lower sales.

ats 987 shows many are not buying this this time around as they were earlier.

If gold hits $5k an ounce, the mint can shut down collector 1 ounce gold sales, as $6k a coin is a hard pill to swallow for buyers.

That's not uncommon for most mint issues. Initial speculation creates artificial rarity. Once they are in final consumer hands, the prices drop. I now fully expect these to be bullion coins in a year or two.

@HalfDime said:

The coins were profitable after fees when they originally came up, but now due to the rise in gold prices it has squeezed the margins by half at current issue price. This is the future for mint gold releases going forward, and they will have to strike half of what they thought they could sell earlier in the year.

I doubt the mint does that, it will have to be forced on them by consumers, and this is what has already been happening with other products. They have canceled the S proof silver eagle as a result of lower sales.

ats 987 shows many are not buying this this time around as they were earlier.

If gold hits $5k an ounce, the mint can shut down collector 1 ounce gold sales, as $6k a coin is a hard pill to swallow for buyers.

That's not uncommon for most mint issues. Initial speculation creates artificial rarity. Once they are in final consumer hands, the prices drop. I now fully expect these to be bullion coins in a year or two.

Have 2019, 2021 and 2023 become bullion coins?

An 1834 $5 hasn't either. What's your point? Was the price of the 2019, 2021 and 2023 this low on the secondary market a month after release. The answer is a resounding "no".

When the secondary market collapses this quickly, it is not usually a good sign for future value. This coin is acting more like 2017 than 2019. I know you WANT it to be like 2019, but it has not behaved that way.

There's always market "chaos" immediately after a mint release as everyone tries to figure out and gauge how popular these are. This is a winning design, there is no reason why this one won't be as popular as the other popular modern Gold Libs. I suspect that high gold prices are a big factor which means people don't want to buy them now, but when they get used to $4-5k/oz spot gold the demand for these will surface.

@HalfDime said:

The coins were profitable after fees when they originally came up, but now due to the rise in gold prices it has squeezed the margins by half at current issue price. This is the future for mint gold releases going forward, and they will have to strike half of what they thought they could sell earlier in the year.

I doubt the mint does that, it will have to be forced on them by consumers, and this is what has already been happening with other products. They have canceled the S proof silver eagle as a result of lower sales.

ats 987 shows many are not buying this this time around as they were earlier.

If gold hits $5k an ounce, the mint can shut down collector 1 ounce gold sales, as $6k a coin is a hard pill to swallow for buyers.

That's not uncommon for most mint issues. Initial speculation creates artificial rarity. Once they are in final consumer hands, the prices drop. I now fully expect these to be bullion coins in a year or two.

Have 2019, 2021 and 2023 become bullion coins?

An 1834 $5 hasn't either. What's your point? Was the price of the 2019, 2021 and 2023 this low on the secondary market a month after release. The answer is a resounding "no".

When the secondary market collapses this quickly, it is not usually a good sign for future value. This coin is acting more like 2017 than 2019. I know you WANT it to be like 2019, but it has not behaved that way.

There's always market "chaos" immediately after a mint release as everyone tries to figure out and gauge how popular these are. This is a winning design, there is no reason why this one won't be as popular as the other popular modern Gold Libs. I suspect that high gold prices are a big factor which means people don't want to buy them now, but when they get used to $4-5k/oz spot gold the demand for these will surface.

Obviously, I disagree. The higher gold is, the less likely anyone wants to tack a premium on top of it.

All comments reflect the opinion of the author, even when irrefutably accurate.

@zeesh said:

ATS 955 - these would sell faster if they notified people they were in stock.

jmlanzaf, did spot price increase $500 while the 17 and 19 were in stock? we're in unprecedented times. these will end up like 21 or 23. lowest mintage year so far!

No. Bullion was much cheaper. And as you might have noticed with pre-33, people's willingness to pay premiums decreases as gold goes up. There is no need to argue about. Come back in 2 years and compare notes.

The behavior of this coin is not unusual. Even the price run up is NOT unprecedented. It happened with the palladium coins a few years back.

I'd also add that while bullion went up $300 in the last month, the bid (and ask) on the secondary market went DOWN.

All comments reflect the opinion of the author, even when irrefutably accurate.

@HalfDime said:

The coins were profitable after fees when they originally came up, but now due to the rise in gold prices it has squeezed the margins by half at current issue price. This is the future for mint gold releases going forward, and they will have to strike half of what they thought they could sell earlier in the year.

I doubt the mint does that, it will have to be forced on them by consumers, and this is what has already been happening with other products. They have canceled the S proof silver eagle as a result of lower sales.

ats 987 shows many are not buying this this time around as they were earlier.

If gold hits $5k an ounce, the mint can shut down collector 1 ounce gold sales, as $6k a coin is a hard pill to swallow for buyers.

That's not uncommon for most mint issues. Initial speculation creates artificial rarity. Once they are in final consumer hands, the prices drop. I now fully expect these to be bullion coins in a year or two.

Have 2019, 2021 and 2023 become bullion coins?

An 1834 $5 hasn't either. What's your point? Was the price of the 2019, 2021 and 2023 this low on the secondary market a month after release. The answer is a resounding "no".

When the secondary market collapses this quickly, it is not usually a good sign for future value. This coin is acting more like 2017 than 2019. I know you WANT it to be like 2019, but it has not behaved that way.

There's always market "chaos" immediately after a mint release as everyone tries to figure out and gauge how popular these are. This is a winning design, there is no reason why this one won't be as popular as the other popular modern Gold Libs. I suspect that high gold prices are a big factor which means people don't want to buy them now, but when they get used to $4-5k/oz spot gold the demand for these will surface.

Obviously, I disagree. The higher gold is, the less likely anyone wants to tack a premium on top of it.

I agree, but eventually the market will get used to it.

There was lot of product dropped into the market in a short amount of time.

I believe the Dealers and the market will digest the inventory at the mint in a short amount of time and the 25da will prove to be winners.

You can call me out if I'm wrong on this one, but I am going to say this will win the coin of the year in 2025.

To me, there has been a dramatic improvement in the quality of product the mint has put out since 2021. Look at the 2021, 2023, 2025 libs and the 2024 flowing hair. Those 4 have great eye appeal and hopefully represent what the mint will put out going forward

Comments

28 available this morning

$4,665.00/each

jdimmick;Gerard;wondercoin;claychaser;agentjim007;CCC2010;guitarwes;TAMU15;Zubie;mariner67;segoja;Smittys;kaz;CARDSANDCOINS;FadeToBlack;

jrt103;tizofthe;bronze6827;mkman;Scootersdad;AllCoinsRule;coindeuce;dmarks;piecesofme; and many more

9 minutes gone

jdimmick;Gerard;wondercoin;claychaser;agentjim007;CCC2010;guitarwes;TAMU15;Zubie;mariner67;segoja;Smittys;kaz;CARDSANDCOINS;FadeToBlack;

jrt103;tizofthe;bronze6827;mkman;Scootersdad;AllCoinsRule;coindeuce;dmarks;piecesofme; and many more

I received another Sunflower Lib this morning.

It was one of the 2000 or so that were restocked recently. I bought it the other day when the HHL was lifted and ats was around 500 left.

There are Zero signs on the packaging & COA to indicate a prior handling.

There are Zero signs on the Coin Capsule to indicate a prior handling.

The Coin itself is in perfect, pristine condition. Not a single flaw or post-Mint damage to the Coin whatsoever.

To those that claim that these are Dealer Rejects or non 70's. - You are Sorely Mistaken and Clueless imo.

Do yourself a favor and move on to the next Boogieman. It's getting old.

PS: My new coin looks equal or better than the one that I sent in a few weeks ago.

This one ⇊

The coin you got was a dealer reject, it appears they had ordered it and rejected taking delivery. I would expect it to be untouched as you claim since the dealer canceled all 2000 coins after not being able to cobble together enough outside dealer interest to take delivery. They bit off more than the market could handle.

When it was first posted that a dealer had 2000 coins, it was assumed they were delivered. The mint is the one who allowed a 2000 coin order to happen on retail, This is why it took over five weeks to sell this out.

Had they originally put up the coin with an inventory of 12k coins and a HHL of 2, it would have sold out completely within two to three days. Instead they played games with inventory and the HHL that dragged it out for five weeks.

I'm well aware of how this release was handled from start to finish. Yes, it could've been handled better, right along with several other releases as of late. There is a Rookie Director at the Helm imo.

The Dealer didn't reject the 2000 coins lol. Go ahead, play the semantics game with my statement regarding rejects - it's not a good look for you.

He reneged on the deal for a number of possibilities that you're not even remotely privy to. And suggesting that they were not delivered without any statement or documentation is pure speculation on your part.

mine has been saying processing since sunday. I hope it doesn't get cancelled.

I sent mine registered to CACG and it’s been stuck in Norfolk since September 20th 😭

Registered is slow and the tracking can be spotty. But it is the most secure shipping method.

All comments reflect the opinion of the author, even when irrefutably accurate.

Oh no! Looks like when they took it out of the OGP capsule at PCGS the bee flew away!

Coinlearner, Ahrensdad, Nolawyer, RG, coinlieutenant, Yorkshireman, lordmarcovan, Soldi, masscrew, JimTyler, Relaxn, jclovescoins, justindan, doubleeagle07

Now listen boy, I'm tryin' to teach you sumthin' . . . . that ain't no optical illusion, it only looks like an optical illusion.

My mind reader refuses to charge me. . . . . . .

briefly to not hijack thread - someone got ebay to nuke it

maybe better said they were not grading rejects.

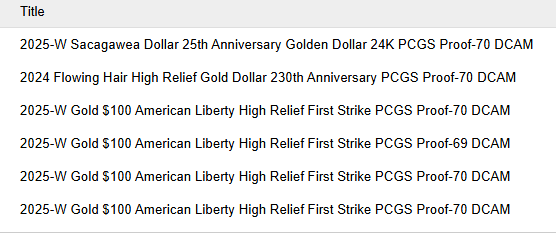

Grades came in last night.......not bad.....

.

1030 available for 4715/each

jdimmick;Gerard;wondercoin;claychaser;agentjim007;CCC2010;guitarwes;TAMU15;Zubie;mariner67;segoja;Smittys;kaz;CARDSANDCOINS;FadeToBlack;

jrt103;tizofthe;bronze6827;mkman;Scootersdad;AllCoinsRule;coindeuce;dmarks;piecesofme; and many more

seems like there is a lot of funny business going on with this release! how can there be over 1,000 available again??? LOL

Maybe they REALLY are minting more than 12,000.

Maybe the tooth fairy brought us these extra 1028 coins.

Ask @NJCoin, I'm sure he has some speculation that he will pass off as fact.

http://ProofCollection.Net

here's a theory

Production figures show, Precious Metal Products 25DA 2025 AM LIBERTY 24K GOLD 1 OZ 11,063 9/28/2025

that included the 2000 that came back on line.

so there were 1000 left that were just added.

Makes sense. Total will be 12,063

YIKES - just 20 sold in 5 hours!

Well, maybe not too surprising.

This time of year most sunflowers have been accounted for by squirrels caching their acquisitions.

i'm shocked it's available again, and at a higher cost. it's playing with my emotions

Somewhere there must have been a 1k coin order that was shopped on a dealer network with not enough takers and............... never mind.

I don't want to hurt my reputation again.

The secondary market for these doesn't exist. > @RAWcoin said:

Not that surprising. There's no secondary market for these which is why the orders were canceled in the first place.

All comments reflect the opinion of the author, even when irrefutably accurate.

why do you say there's no secondary market for them?

There is secondary market, for end customers only but not for short term flipping.

These coins don't qualify for First Strike, the profit margin for flipping them after grading fees + eBay fees is not worth the hassle and money tied up opportunity cost. That's probably why the dealer cancelled the 2000 coin order in the first place.

I'll agree with NJCoin that this whole thing could have been avoided, by just putting all up for sale on day 1 and release HH limit on day two.

Superman still hasn't shipped, but they had no issue putting all those up

Because there is no open bid above the purchase price and the retail price is in the low 5's which is barely profitable.

If there were a secondary market, so you think they would have gotten 3000 returns?

Here's the bid/ask on Pure:

All comments reflect the opinion of the author, even when irrefutably accurate.

That's a primary market not a secondary market. Or maybe we could call it an unprofitable secondary market.

All comments reflect the opinion of the author, even when irrefutably accurate.

The coins were profitable after fees when they originally came up, but now due to the rise in gold prices it has squeezed the margins by half at current issue price. This is the future for mint gold releases going forward, and they will have to strike half of what they thought they could sell earlier in the year.

I doubt the mint does that, it will have to be forced on them by consumers, and this is what has already been happening with other products. They have canceled the S proof silver eagle as a result of lower sales.

ats 987 shows many are not buying this this time around as they were earlier.

If gold hits $5k an ounce, the mint can shut down collector 1 ounce gold sales, as $6k a coin is a hard pill to swallow for buyers.

That's not uncommon for most mint issues. Initial speculation creates artificial rarity. Once they are in final consumer hands, the prices drop. I now fully expect these to be bullion coins in a year or two.

All comments reflect the opinion of the author, even when irrefutably accurate.

I no longer have FOMO, I have FOBO…fear of buying one….LOL 😂

Have 2019, 2021 and 2023 become bullion coins?

An 1834 $5 hasn't either. What's your point? Was the price of the 2019, 2021 and 2023 this low on the secondary market a month after release. The answer is a resounding "no".

When the secondary market collapses this quickly, it is not usually a good sign for future value. This coin is acting more like 2017 than 2019. I know you WANT it to be like 2019, but it has not behaved that way.

All comments reflect the opinion of the author, even when irrefutably accurate.

American Liberty 2025 High Relief Gold Coin is still available at 4:56PM ET.

Just like 2019.

All comments reflect the opinion of the author, even when irrefutably accurate.

ATS 955 - these would sell faster if they notified people they were in stock.

jmlanzaf, did spot price increase $500 while the 17 and 19 were in stock? we're in unprecedented times. these will end up like 21 or 23. lowest mintage year so far!

I wasn't collecting in 2017 and 2019 so i'm unaware of what was happening, but this certainly does seem unusual to me. maybe i'm just a noob and i buy shiny things thinking it will go up in value like the last few. my friend only buys bullion and maybe that's the way to go.

Those are a lot nicer designs, in my opinion. I still am not a fan of this design

The 2025 is definitely nicer design than the 2019. The 2019 is not even a proof coin.

Make lemonade folks ! Don't worry, be happy !

"Sunflowers symbolize positivity, joy, loyalty, and longevity.

Sunflowers in Chinese culture symbolize good fortune and longevity, reflecting the flower’s ability to turn towards the sun.

Symbolically, sunflowers for Native Americans represent the sun deity in some cultures, embodying energy, fertility, and the cycle of life.

The sunflower is recognized as the official third wedding anniversary flower.

Sunflowers are the official zodiac flower for the Leo star sign."

There's always market "chaos" immediately after a mint release as everyone tries to figure out and gauge how popular these are. This is a winning design, there is no reason why this one won't be as popular as the other popular modern Gold Libs. I suspect that high gold prices are a big factor which means people don't want to buy them now, but when they get used to $4-5k/oz spot gold the demand for these will surface.

http://ProofCollection.Net

Obviously, I disagree. The higher gold is, the less likely anyone wants to tack a premium on top of it.

All comments reflect the opinion of the author, even when irrefutably accurate.

No. Bullion was much cheaper. And as you might have noticed with pre-33, people's willingness to pay premiums decreases as gold goes up. There is no need to argue about. Come back in 2 years and compare notes.

The behavior of this coin is not unusual. Even the price run up is NOT unprecedented. It happened with the palladium coins a few years back.

I'd also add that while bullion went up $300 in the last month, the bid (and ask) on the secondary market went DOWN.

All comments reflect the opinion of the author, even when irrefutably accurate.

I agree, but eventually the market will get used to it.

http://ProofCollection.Net

Finally shot one of these yesterday:

https://www.greatcollections.com/Coin/1951176

Phil Arnold

Director of Photography, GreatCollections

greatcollections.com

899 left, maybe a week it sells out.

Wow! Currently bid up to $6,598 with the buyer's premium.

Coinlearner, Ahrensdad, Nolawyer, RG, coinlieutenant, Yorkshireman, lordmarcovan, Soldi, masscrew, JimTyler, Relaxn, jclovescoins, justindan, doubleeagle07

Now listen boy, I'm tryin' to teach you sumthin' . . . . that ain't no optical illusion, it only looks like an optical illusion.

My mind reader refuses to charge me. . . . . . .

There was lot of product dropped into the market in a short amount of time.

I believe the Dealers and the market will digest the inventory at the mint in a short amount of time and the 25da will prove to be winners.

You can call me out if I'm wrong on this one, but I am going to say this will win the coin of the year in 2025.

To me, there has been a dramatic improvement in the quality of product the mint has put out since 2021. Look at the 2021, 2023, 2025 libs and the 2024 flowing hair. Those 4 have great eye appeal and hopefully represent what the mint will put out going forward