@CoolCoins said:

What does this bring the total mintage to if 2800 coins were released?

Right now the mintage is about 10,800.

But over 5000 have been taken by the big buys,

and we now know why the mint raised the price $150 this week.

The Mint raised their price because gold went up. It's a fixed formula. They did NOT raise the price for any other reason. They adjust ALL such coin prices every Wednesday.

That is correct !! Precious metals Technical analysis of gold prices pointed to a very possible spike upwards before the release of the Sunflower and such immediate time afterwards. It was smart Mint business policy, in my opinion, to hang tight and get more for their profits by releasing more inventory later when the price of Gold spot was higher. Arbitrage. Good for the US mint bottom line.

Again, you are making things up. The Mint does not stare at charts. They also may not make any more money because they hedge their gold holdings with options.

When you change the reason, you are clearly just fishing for something to make your observation seem true rather than just admitting that you made an error.

All comments reflect the opinion of the author, even when irrefutably accurate.

@CoolCoins said:

What does this bring the total mintage to if 2800 coins were released?

Right now the mintage is about 10,800.

But over 5000 have been taken by the big buys,

and we now know why the mint raised the price $150 this week.

The Mint raised their price because gold went up. It's a fixed formula. They did NOT raise the price for any other reason. They adjust ALL such coin prices every Wednesday.

That is correct !! Precious metals Technical analysis of gold prices pointed to a very possible spike upwards before the release of the Sunflower and such immediate time afterwards. It was smart Mint business policy, in my opinion, to hang tight and get more for their profits by releasing more inventory later when the price of Gold spot was higher. Arbitrage. Good for the US mint bottom line.

Again, you are making things up. The Mint does not stare at charts. They also may not make any more money because they hedge their gold holdings with options.

When you change the reason, you are clearly just fishing for something to make your observation seem true rather than just admitting that you made an error.

Agreed. It is more likely that the mint uses futures to offset all PM inventory to maintain a neutral risk position.

If you are buying from the Mint, I believe the silver sunflowers are or were a good bargain.

I got a couple after the sell out by just dumping one in my cart and then grabbing it the next day.

Lucky I was.

And apparently the 70s are going up on eBay.

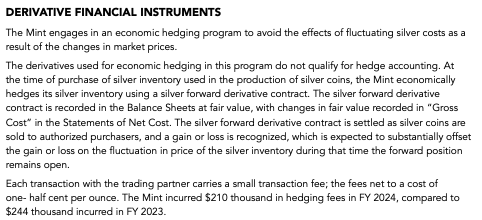

1) hedges its silver inventory with a forward contract.

See "Link", page #50.

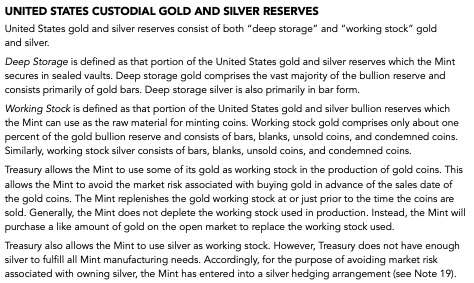

2) uses "working stock" from the Treasury for gold, and some silver.

See "Link", page #47.

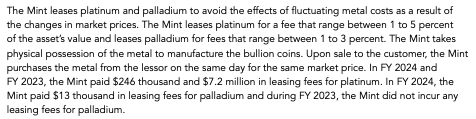

3) leases Pt and Pd.

See "Link", page #53.

Makes sense. They hedge silver because they sell it at a fixed price. They don't do that with precious metals they sell according to a pricing grid. They manage that risk by not taking delivery until they need it.

No surprises here. All this harping about whether the final minted number of gold should be or could be 8,000 or 12,000 coins. The Mint posted a 12,000 mintage limit from the get go and now it appears that’s what it’s going to be.

I signed up for back in store reminder on the Mint's website but never received any notification after the 1st day of release. How is everyone able to buy up 4000 coins so quickly?

@FreeThinker said:

No surprises here. All this harping about whether the final minted number of gold should be or could be 8,000 or 12,000 coins. The Mint posted a 12,000 mintage limit from the get go and now it appears that’s what it’s going to be.

Time to move on.

Well, A surprise is that 2800 showed up on the web, while an additional 4K were sold.

@FreeThinker said:

No surprises here. All this harping about whether the final minted number of gold should be or could be 8,000 or 12,000 coins. The Mint posted a 12,000 mintage limit from the get go and now it appears that’s what it’s going to be.

Time to move on.

Well, A surprise is that 2800 showed up on the web, while an additional 4K were sold.

@CoolCoins said:

What does this bring the total mintage to if 2800 coins were released?

Right now the mintage is about 10,800.

But over 5000 have been taken by the big buys,

and we now know why the mint raised the price $150 this week.

The Mint raised their price because gold went up. It's a fixed formula. They did NOT raise the price for any other reason. They adjust ALL such coin prices every Wednesday.

That is correct !! Precious metals Technical analysis of gold prices pointed to a very possible spike upwards before the release of the Sunflower and such immediate time afterwards. It was smart Mint business policy, in my opinion, to hang tight and get more for their profits by releasing more inventory later when the price of Gold spot was higher. Arbitrage. Good for the US mint bottom line.

Again, you are making things up. The Mint does not stare at charts. They also may not make any more money because they hedge their gold holdings with options.

When you change the reason, you are clearly just fishing for something to make your observation seem true rather than just admitting that you made an error.

I stated my opinion qualified as an " opinion".. You are making statements as unequivocally factual. So, show your credible references for each point you make! Thanks.

@CoolCoins said:

What does this bring the total mintage to if 2800 coins were released?

Right now the mintage is about 10,800.

But over 5000 have been taken by the big buys,

and we now know why the mint raised the price $150 this week.

The Mint raised their price because gold went up. It's a fixed formula. They did NOT raise the price for any other reason. They adjust ALL such coin prices every Wednesday.

That is correct !! Precious metals Technical analysis of gold prices pointed to a very possible spike upwards before the release of the Sunflower and such immediate time afterwards. It was smart Mint business policy, in my opinion, to hang tight and get more for their profits by releasing more inventory later when the price of Gold spot was higher. Arbitrage. Good for the US mint bottom line.

Again, you are making things up. The Mint does not stare at charts. They also may not make any more money because they hedge their gold holdings with options.

When you change the reason, you are clearly just fishing for something to make your observation seem true rather than just admitting that you made an error.

I stated my opinion qualified as an " opinion".. You are making statements as unequivocally factual. So, show your credible references for each point you make! Thanks.

It is posted above from the website. For those of us who have been dealing with the Mint for decades, there policies and procedures are known, as well as posted in their annual reports and on their website.

You did NOT claim it was an opinion. You made affirmative statements (accusations?) Your only stated "opinion" was that your false statement was "smart".

We should not have to pull the research to counter your inaccuracies when you could have done the research before making the statement.

Your initial accusation was that they raised the price $150 because they were going to release more. This is demonstrably untrue since all bullion pricing is based on a pricing grid tied to the current price of gold and published at the beginning of the year.

When that was pointed out, you then stated that the Mint held back the coins because the gold chart was pointing up. There is zero evidence for this and, as pointed out in the links above to Mint FAQs, doesn't really benefit them because of the way they handle bullion in their inventory.

The fact that you don't know the inner working of the Mint is understandable. What is less understandable is why you would stubbornly make such speculation (accusations) that require someone else to clean up.

All comments reflect the opinion of the author, even when irrefutably accurate.

@jmlanzaf said:

You did NOT claim it was an opinion. You made affirmative statements (accusations?) Your only stated "opinion" was that your false statement was "smart".

We should not have to pull the research to counter your inaccuracies when you could have done the research before making the statement.

Your initial accusation was that they raised the price $150 because they were going to release more. This is demonstrably untrue since all bullion pricing is based on a pricing grid tied to the current price of gold and published at the beginning of the year.

When that was pointed out, you then stated that the Mint held back the coins because the gold chart was pointing up. There is zero evidence for this and, as pointed out in the links above to Mint FAQs, doesn't really benefit them because of the way they handle bullion in their inventory.

The fact that you don't know the inner working of the Mint is understandable. What is less understandable is why you would stubbornly make such speculation (accusations) that require someone else to clean up.

Superman has been on preorder forever now, yet they couldn't take the extra orders for these at initial ordering knowing that they were making all 12k coins?

Since you have decades with the mint you might have remembered they have done that many times in the years of yore.

@MsMorrisine said:

if i don't see a name then i don't want to click on buy or sell

Not sure what you're getting at. At Pure you're not dealing with the seller. You're buying from Pure who acts as a middleman.

Exactly. I thought that folks would be interested in a multimillion dollar sale of these coins rather than the rather tiresome back and forth on this thread about mintage limits.😉

@MsMorrisine said:

if i don't see a name then i don't want to click on buy or sell

Not sure what you're getting at. At Pure you're not dealing with the seller. You're buying from Pure who acts as a middleman.

Exactly. I thought that folks would be interested in a multimillion dollar sale of these coins rather than the rather tiresome back and forth on this thread about mintage limits.😉

LOL, and I never thought limits were be so difficult to comprehend.

@MsMorrisine said:

if i don't see a name then i don't want to click on buy or sell

Not sure what you're getting at. At Pure you're not dealing with the seller. You're buying from Pure who acts as a middleman.

Exactly. I thought that folks would be interested in a multimillion dollar sale of these coins rather than the rather tiresome back and forth on this thread about mintage limits.😉

LOL, and I never thought limits were be so difficult to comprehend.

Yeah, well, when they apply to some but not others, without a clear stated policy, they can indeed be "so difficult to comprehend. "

In this case, 4K out of 12K were held back for later sale, without a HHL and without a public announcement. Difficult to comprehend, unless you accept that the deck is stacked in favor of some buyers and against others.

I understand that, although I am not happy about it. Others don't. So it's difficult to comprehend.

@jmlanzaf said:

You did NOT claim it was an opinion. You made affirmative statements (accusations?) Your only stated "opinion" was that your false statement was "smart".

We should not have to pull the research to counter your inaccuracies when you could have done the research before making the statement.

Your initial accusation was that they raised the price $150 because they were going to release more. This is demonstrably untrue since all bullion pricing is based on a pricing grid tied to the current price of gold and published at the beginning of the year.

When that was pointed out, you then stated that the Mint held back the coins because the gold chart was pointing up. There is zero evidence for this and, as pointed out in the links above to Mint FAQs, doesn't really benefit them because of the way they handle bullion in their inventory.

The fact that you don't know the inner working of the Mint is understandable. What is less understandable is why you would stubbornly make such speculation (accusations) that require someone else to clean up.

Superman has been on preorder forever now, yet they couldn't take the extra orders for these at initial ordering knowing that they were making all 12k coins?

Since you have decades with the mint you might have remembered they have done that many times in the years of yore.

They could have. They alseso don't always do that, especially as you get later in the year. Regardless of why the Mint did what they did, it is absolutely NOT for the two reasons that he manufactured. It is disappointing that you would even tacitly suggest that there is even a remote possibility that either of those reasons were true

And, in fact, the did EXACTLY the same thing with the Superman coins that they did here. They have NOT made the full mintage available. The only difference is there was no need for them to make the other Superman coins because they didn't sell out.

All comments reflect the opinion of the author, even when irrefutably accurate.

I’m new to the coin forum and not at all familiar with how the US Mint releases any of the stated mintage limit, whether in whole or in part.

This is what bothers me about this particular coin:

It appears the big boys bought almost 1/3 of the initial 8000 that were released in August.

Then they probably got at least 90% of the next 4000 released last Friday.

Meaning less than 1/2 of the 12,000 limit was available to the general public.

Am I wrong about this, and if not, is this a common practice?

@RAWcoin said:

I’m new to the coin forum and not at all familiar with how the US Mint releases any of the stated mintage limit, whether in whole or in part.

This is what bothers me about this particular coin:

It appears the big boys bought almost 1/3 of the initial 8000 that were released in August.

Then they probably got at least 90% of the next 4000 released last Friday.

Meaning less than 1/2 of the 12,000 limit was available to the general public.

Am I wrong about this, and if not, is this a common practice?

They can only pre-buy 10%. (And they pay MORE than you for those and have to go pick them up themselves) We don't know who bought the 4000. They're are a lot of people who watch the daily drop.

The rest of just conspiracy theories. The little people had 24 hours to buy. So you are not right. How wrong is impossible to know because we dont know who bought the second group. But they were publicly available. If they wanted them to go to the big boys, they wouldn't have made them ATS.

The rest of this is all FOMO and hand-wringing

All comments reflect the opinion of the author, even when irrefutably accurate.

@jmlanzaf said:

You did NOT claim it was an opinion. You made affirmative statements (accusations?) Your only stated "opinion" was that your false statement was "smart".

We should not have to pull the research to counter your inaccuracies when you could have done the research before making the statement.

Your initial accusation was that they raised the price $150 because they were going to release more. This is demonstrably untrue since all bullion pricing is based on a pricing grid tied to the current price of gold and published at the beginning of the year.

When that was pointed out, you then stated that the Mint held back the coins because the gold chart was pointing up. There is zero evidence for this and, as pointed out in the links above to Mint FAQs, doesn't really benefit them because of the way they handle bullion in their inventory.

The fact that you don't know the inner working of the Mint is understandable. What is less understandable is why you would stubbornly make such speculation (accusations) that require someone else to clean up.

Superman has been on preorder forever now, yet they couldn't take the extra orders for these at initial ordering knowing that they were making all 12k coins?

Since you have decades with the mint you might have remembered they have done that many times in the years of yore.

They could have. They alseso don't always do that, especially as you get later in the year. Regardless of why the Mint did what they did, it is absolutely NOT for the two reasons that he manufactured. It is disappointing that you would even tacitly suggest that there is even a remote possibility that either of those reasons were true

And, in fact, the did EXACTLY the same thing with the Superman coins that they did here. They have NOT made the full mintage available. The only difference is there was no need for them to make the other Superman coins because they didn't sell out.

Don't be so sure about this. The full 10K were indeed made available on the first day. First 5K, then, less than an hour later, the other 5K.

I'm pretty sure the difference between what they have sold to date, what is showing ATS, and 10K is sitting on a back shelf, ready to go when and if needed. The alternative is DC taking a pass on royalties they are contractually entitled to.

As I have now learned, anything is possible, but I wouldn't bet on DC taking a haircut to support secondary market value for collectors. The Mint habitually leaves money on the table. Because it isn't their money. People running private enterprises aren't so casual with money.

@jmlanzaf said:

You did NOT claim it was an opinion. You made affirmative statements (accusations?) Your only stated "opinion" was that your false statement was "smart".

We should not have to pull the research to counter your inaccuracies when you could have done the research before making the statement.

Your initial accusation was that they raised the price $150 because they were going to release more. This is demonstrably untrue since all bullion pricing is based on a pricing grid tied to the current price of gold and published at the beginning of the year.

When that was pointed out, you then stated that the Mint held back the coins because the gold chart was pointing up. There is zero evidence for this and, as pointed out in the links above to Mint FAQs, doesn't really benefit them because of the way they handle bullion in their inventory.

The fact that you don't know the inner working of the Mint is understandable. What is less understandable is why you would stubbornly make such speculation (accusations) that require someone else to clean up.

Superman has been on preorder forever now, yet they couldn't take the extra orders for these at initial ordering knowing that they were making all 12k coins?

Since you have decades with the mint you might have remembered they have done that many times in the years of yore.

They could have. They alseso don't always do that, especially as you get later in the year. Regardless of why the Mint did what they did, it is absolutely NOT for the two reasons that he manufactured. It is disappointing that you would even tacitly suggest that there is even a remote possibility that either of those reasons were true

And, in fact, the did EXACTLY the same thing with the Superman coins that they did here. They have NOT made the full mintage available. The only difference is there was no need for them to make the other Superman coins because they didn't sell out.

Don't be so sure about this. The full 10K were indeed made available on the first day. First 5K, then, less than an hour later, the other 5K.

I'm pretty sure the difference between what they have sold to date, what is showing ATS, and 10K is sitting on a back shelf, ready to go when and if needed. The alternative is DC taking a pass on royalties they are contractually entitled to.

As I have now learned, anything is possible, but I wouldn't bet on DC taking a haircut to support secondary market value for collectors. The Mint habitually leaves money on the table. Because it isn't their money. People running private enterprises aren't so casual with money.

And the 30,000 silver...?

Again, the point is not that we know exactly what the Mint is doing. What they did NOT do is raise the price $150 due to popularity nor wait for gold to go up to release them! 100%

All comments reflect the opinion of the author, even when irrefutably accurate.

@jmlanzaf said:

You did NOT claim it was an opinion. You made affirmative statements (accusations?) Your only stated "opinion" was that your false statement was "smart".

We should not have to pull the research to counter your inaccuracies when you could have done the research before making the statement.

Your initial accusation was that they raised the price $150 because they were going to release more. This is demonstrably untrue since all bullion pricing is based on a pricing grid tied to the current price of gold and published at the beginning of the year.

When that was pointed out, you then stated that the Mint held back the coins because the gold chart was pointing up. There is zero evidence for this and, as pointed out in the links above to Mint FAQs, doesn't really benefit them because of the way they handle bullion in their inventory.

The fact that you don't know the inner working of the Mint is understandable. What is less understandable is why you would stubbornly make such speculation (accusations) that require someone else to clean up.

Superman has been on preorder forever now, yet they couldn't take the extra orders for these at initial ordering knowing that they were making all 12k coins?

Since you have decades with the mint you might have remembered they have done that many times in the years of yore.

They could have. They alseso don't always do that, especially as you get later in the year. Regardless of why the Mint did what they did, it is absolutely NOT for the two reasons that he manufactured. It is disappointing that you would even tacitly suggest that there is even a remote possibility that either of those reasons were true

And, in fact, the did EXACTLY the same thing with the Superman coins that they did here. They have NOT made the full mintage available. The only difference is there was no need for them to make the other Superman coins because they didn't sell out.

Don't be so sure about this. The full 10K were indeed made available on the first day. First 5K, then, less than an hour later, the other 5K.

I'm pretty sure the difference between what they have sold to date, what is showing ATS, and 10K is sitting on a back shelf, ready to go when and if needed. The alternative is DC taking a pass on royalties they are contractually entitled to.

As I have now learned, anything is possible, but I wouldn't bet on DC taking a haircut to support secondary market value for collectors. The Mint habitually leaves money on the table. Because it isn't their money. People running private enterprises aren't so casual with money.

And the 30,000 silver...?

Again, the point is not that we know exactly what the Mint is doing. What they did NOT do is raise the price $150 due to popularity nor wait for gold to go up to release them! 100%

What 30K silver? The 2.5 oz had a mintage of 25K, and they were all put on sale. The 1 oz is unlimited, and I'm sure they'll make them to demand. As long as the program lasts.

And, yes. Of course! The screwing around had nothing to do with the price of gold, and everything to do with holding back quantity for later sale with no HHL.

@jmlanzaf said:

And, in fact, the did EXACTLY the same thing with the Superman coins that they did here. They have NOT made the full mintage available. The only difference is there was no need for them to make the other Superman coins because they didn't sell out.

They didn't do the exact same thing because it is unlikely any more superman gold coins get made, but it appears they had already struck all the sunflower golds. apples and oranges.

When the initial gold sunflower sold out they could have immediately added the final inventory, but they didn't do that. They waited days to do it just like they waited days to lift the HHL limits on the silver eagle proof privy coins.

Many people who missed out on the gold sunflower did not get a chance to buy from the later release due to how the mint handled it. It went up and few people knew it.

@RAWcoin said:

I’m new to the coin forum and not at all familiar with how the US Mint releases any of the stated mintage limit, whether in whole or in part.

This is what bothers me about this particular coin:

It appears the big boys bought almost 1/3 of the initial 8000 that were released in August.

Then they probably got at least 90% of the next 4000 released last Friday.

Meaning less than 1/2 of the 12,000 limit was available to the general public.

Am I wrong about this, and if not, is this a common practice?

No, chances are this is how it played out. 30% of the initial amount (which is actually based on the total mintage), plus the bulk of the late amount.

@jmlanzaf said:

The little people had 24 hours to buy. So you are not right.

the sunflower sold out in under 3 hours IIRC. 5,285 ATS on release date. we can assume the big boys got the bulk of the rest. they could have mirrored the army release to ensure the regular collector would have a chance to pick one up and keep the HHL. they didn't and it's not a great look but it was their choice to make.

@jmlanzaf said:

You did NOT claim it was an opinion. You made affirmative statements (accusations?) Your only stated "opinion" was that your false statement was "smart".

We should not have to pull the research to counter your inaccuracies when you could have done the research before making the statement.

Your initial accusation was that they raised the price $150 because they were going to release more. This is demonstrably untrue since all bullion pricing is based on a pricing grid tied to the current price of gold and published at the beginning of the year.

When that was pointed out, you then stated that the Mint held back the coins because the gold chart was pointing up. There is zero evidence for this and, as pointed out in the links above to Mint FAQs, doesn't really benefit them because of the way they handle bullion in their inventory.

The fact that you don't know the inner working of the Mint is understandable. What is less understandable is why you would stubbornly make such speculation (accusations) that require someone else to clean up.

Superman has been on preorder forever now, yet they couldn't take the extra orders for these at initial ordering knowing that they were making all 12k coins?

Since you have decades with the mint you might have remembered they have done that many times in the years of yore.

They could have. They alseso don't always do that, especially as you get later in the year. Regardless of why the Mint did what they did, it is absolutely NOT for the two reasons that he manufactured. It is disappointing that you would even tacitly suggest that there is even a remote possibility that either of those reasons were true

And, in fact, the did EXACTLY the same thing with the Superman coins that they did here. They have NOT made the full mintage available. The only difference is there was no need for them to make the other Superman coins because they didn't sell out.

Don't be so sure about this. The full 10K were indeed made available on the first day. First 5K, then, less than an hour later, the other 5K.

I'm pretty sure the difference between what they have sold to date, what is showing ATS, and 10K is sitting on a back shelf, ready to go when and if needed. The alternative is DC taking a pass on royalties they are contractually entitled to.

As I have now learned, anything is possible, but I wouldn't bet on DC taking a haircut to support secondary market value for collectors. The Mint habitually leaves money on the table. Because it isn't their money. People running private enterprises aren't so casual with money.

And the 30,000 silver...?

Again, the point is not that we know exactly what the Mint is doing. What they did NOT do is raise the price $150 due to popularity nor wait for gold to go up to release them! 100%

30,000 high relief silver

All comments reflect the opinion of the author, even when irrefutably accurate.

@jmlanzaf said:

And, in fact, the did EXACTLY the same thing with the Superman coins that they did here. They have NOT made the full mintage available. The only difference is there was no need for them to make the other Superman coins because they didn't sell out.

They didn't do the exact same thing because it is unlikely any more superman gold coins get made, but it appears they had already struck all the sunflower golds. apples and oranges.

When the initial gold sunflower sold out they could have immediately added the final inventory, but they didn't do that. They waited days to do it just like they waited days to lift the HHL limits on the silver eagle proof privy coins.

Many people who missed out on the gold sunflower did not get a chance to buy from the later release due to how the mint handled it. It went up and few people knew it.

No. You ASSUME they had struck them. It is quite possible, even likely, that demand was higher than they thought so they struck more. It's also possible they needed planchets before they could strike more.

Not everything is a conspiracy, especially when you're taking about these small amounts of money. The Mint probably makes more money striking quarters for circulation than all of their numismatic offerings combined.

All comments reflect the opinion of the author, even when irrefutably accurate.

@jmlanzaf said:

No. You ASSUME they had struck them. It is quite possible, even likely, that demand was higher than they thought so they struck more. It's also possible they needed planchets before they could strike more.

It doesn't really matter if they did or didn't, but they could have taken orders for all the coins at once. Otherwise they should have put out a notice through the coin websites that more were going to be offered later.

In the olden days that was sometimes done by Michael White at the US Mint.

Does anyone remember the fiasco over the first allotment of bullion 5 ounce silver quarters going to the dealers? This is not a first rodeo.

@jmlanzaf said:

You did NOT claim it was an opinion. You made affirmative statements (accusations?) Your only stated "opinion" was that your false statement was "smart".

We should not have to pull the research to counter your inaccuracies when you could have done the research before making the statement.

Your initial accusation was that they raised the price $150 because they were going to release more. This is demonstrably untrue since all bullion pricing is based on a pricing grid tied to the current price of gold and published at the beginning of the year.

When that was pointed out, you then stated that the Mint held back the coins because the gold chart was pointing up. There is zero evidence for this and, as pointed out in the links above to Mint FAQs, doesn't really benefit them because of the way they handle bullion in their inventory.

The fact that you don't know the inner working of the Mint is understandable. What is less understandable is why you would stubbornly make such speculation (accusations) that require someone else to clean up.

Superman has been on preorder forever now, yet they couldn't take the extra orders for these at initial ordering knowing that they were making all 12k coins?

Since you have decades with the mint you might have remembered they have done that many times in the years of yore.

They could have. They alseso don't always do that, especially as you get later in the year. Regardless of why the Mint did what they did, it is absolutely NOT for the two reasons that he manufactured. It is disappointing that you would even tacitly suggest that there is even a remote possibility that either of those reasons were true

And, in fact, the did EXACTLY the same thing with the Superman coins that they did here. They have NOT made the full mintage available. The only difference is there was no need for them to make the other Superman coins because they didn't sell out.

Don't be so sure about this. The full 10K were indeed made available on the first day. First 5K, then, less than an hour later, the other 5K.

I'm pretty sure the difference between what they have sold to date, what is showing ATS, and 10K is sitting on a back shelf, ready to go when and if needed. The alternative is DC taking a pass on royalties they are contractually entitled to.

As I have now learned, anything is possible, but I wouldn't bet on DC taking a haircut to support secondary market value for collectors. The Mint habitually leaves money on the table. Because it isn't their money. People running private enterprises aren't so casual with money.

And the 30,000 silver...?

Again, the point is not that we know exactly what the Mint is doing. What they did NOT do is raise the price $150 due to popularity nor wait for gold to go up to release them! 100%

30,000 high relief silver

Oh! If the pattern holds and the Big Boys want them, they'll make more. Otherwise, they won't.

By the way, they are not high relief. They are regular relief American Liberty. High relief was exclusively the gold.

All we know for sure is that they won't make them just because there is retail demand for them, and because they have not yet hit the maximum mintage. Another 30K might very well destroy secondary market value, and it will hardly be worth it for the Mint to go back and make less, so the Big Boys might be happy with where things presently are.

Just please, everyone, stop saying short strikes are due to planchet or packaging issues. The recent situation with the high relief gold hopefully puts the lie to that. They do what they want, with no consistency, and likely in coordination with what their best customers want.

@jmlanzaf said:

The little people had 24 hours to buy. So you are not right.

the sunflower sold out in under 3 hours IIRC. 5,285 ATS on release date. we can assume the big boys got the bulk of the rest. they could have mirrored the army release to ensure the regular collector would have a chance to pick one up and keep the HHL. they didn't and it's not a great look but it was their choice to make.

The regular collector had at least 3 hours to comfortably and easily order one. How big does the window need to be for you to consider it that the "regular collector" would have a chance?

All we know for sure is that they won't make them just because there is retail demand for them, and because they have not yet hit the maximum mintage. Another 30K might very well destroy secondary market value, and it will hardly be worth it for the Mint to go back and make less, so the Big Boys might be happy with where things presently are.

The mint doesn't give a crap about secondary value. All they care about is if they can sell them all in a timely fashion.

>

Just please, everyone, stop saying short strikes are due to planchet or packaging issues. The recent situation with the high relief gold hopefully puts the lie to that. They do what they want, with no consistency, and likely in coordination with what their best customers want.

Right, because gold planchets and silver planchets couldn't possibly have different supply chain logistics.

@jmlanzaf said:

The little people had 24 hours to buy. So you are not right.

the sunflower sold out in under 3 hours IIRC. 5,285 ATS on release date. we can assume the big boys got the bulk of the rest. they could have mirrored the army release to ensure the regular collector would have a chance to pick one up and keep the HHL. they didn't and it's not a great look but it was their choice to make.

The regular collector had at least 3 hours to comfortably and easily order one. How big does the window need to be for you to consider it that the "regular collector" would have a chance?

All we know for sure is that they won't make them just because there is retail demand for them, and because they have not yet hit the maximum mintage. Another 30K might very well destroy secondary market value, and it will hardly be worth it for the Mint to go back and make less, so the Big Boys might be happy with where things presently are.

The mint doesn't give a crap about secondary value. All they care about is if they can sell them all in a timely fashion.

>

Just please, everyone, stop saying short strikes are due to planchet or packaging issues. The recent situation with the high relief gold hopefully puts the lie to that. They do what they want, with no consistency, and likely in coordination with what their best customers want.

Right, because gold planchets and silver planchets couldn't possibly have different supply chain logistics.

24 hours. The 24 hours they promise.

If something sells out in the first 3, or the first 23 hours, and if they know, or even think that they might make more available for sale, they should keep the HHL on, or reinstate it for another 24 hours when they place the item back on sale, after the same public announcement they make when they first place anything on sale.

If 24 hours come and go with no sellout, then, as far as I'm concerned, all bets are off. Not 3, or 6, or 23. 24.

And, yes. Whatever is going on with gold, they use the same silver planchets for everything. They have a gazillion of them, and a shortage is not why they made a single medal less than the 60K maximum.

You might think the Mint "doesn't give a crap about secondary value," but something certainly drives their decision not to simply make everything to demand, and to let Big Boys and everyone else sort out "secondary value."

"The mintage is set at 12,000 units, with orders limited to one coin per household for the first 24 hours of sales."

The mintage might have been "set" at 12K, but 12K were not made available to the public while orders were limited to "one coin per household for the first 24 hours of sales." They were, however, made available later, to those who were probably given a heads-up, with no HHL.

Justify whatever you want. It's the opposite of transparent.

@smuglr said:

They don't/haven't for quite some time promised 24 hours

try all you want. the bickering will continue

Yup. Especially when what you are "trying" is to state fiction as fact.

I said nothing about mintage or production limits, I actually ageee with some of your points there to some degree. My post refers only to hhl, is in no way fiction, it has been the mint's stated policy for sometime that hhl were at their discretion. The fiction is that there is 'a promised 24 hours'. Under their stated policy they could impose/remove hhl at anytime noon, 2pm, 6pm, if they so chose.

@smuglr said:

They don't/haven't for quite some time promised 24 hours

try all you want. the bickering will continue

Yup. Especially when what you are "trying" is to state fiction as fact.

I said nothing about mintage or production limits, I actually ageee with some of your points there to some degree. My post refers only to hhl, is in no way fiction, it has been the mint's stated policy for sometime that hhl were at their discretion. The fiction is that there is 'a promised 24 hours'. Under their stated policy they could impose/remove hhl at anytime noon, 2pm, 6pm, if they so chose.

Understood. You literally said "They don't/haven't for quite some time promised 24 hours."

The Mint put out a press release, available on its website, in connection with this release, a week before the release, explicitly promising 24 hours. You literally stated fiction as fact.

Yes, under their so-called stated policy, they could change anything at any time, which, taken literally, would render anything they say at all to be meaningless. Except, in this case, they said there would be a HHL for 24 hours, and there was.

What was misleading here is that they said they'd make up to 12K. Which they did. But they did not offer them all for sale during the 24 HHL window.

Which, again, makes the HHL kind of meaningless. Even though they did literally promise a 24 hour HHL specifically in connection with this release. Contrary to your statement that "They don't/haven't for quite some time promised 24 hours."

Saying they can do anything they want, so don't believe anything they say is fine, if that's really what you mean to say. In which case, the Mint should stop putting out press releases, and just do whatever they want.

We'll get what we get, with no broken promises, no expectations, and no disappointment. I don't think they would want to go there. So people like you should stop saying they can do what they want, so we should just get over being continually misled.

@smuglr said:

They don't/haven't for quite some time promised 24 hours

try all you want. the bickering will continue

Yup. Especially when what you are "trying" is to state fiction as fact.

I said nothing about mintage or production limits, I actually ageee with some of your points there to some degree. My post refers only to hhl, is in no way fiction, it has been the mint's stated policy for sometime that hhl were at their discretion. The fiction is that there is 'a promised 24 hours'. Under their stated policy they could impose/remove hhl at anytime noon, 2pm, 6pm, if they so chose.

Understood. You literally said "They don't/haven't for quite some time promised 24 hours."

The Mint put out a press release, available on its website, in connection with this release, a week before the release, explicitly promising 24 hours. You literally stated fiction as fact.

Yes, under their so-called stated policy, they could change anything at any time, which, taken literally, would render anything they say at all to be meaningless. Except, in this case, they said there would be a HHL for 24 hours, and there was.

What was misleading here is that they said they'd make up to 12K. Which they did. But they did not offer them all for sale during the 24 HHL window.

Which, again, makes the HHL kind of meaningless. Even though they did literally promise a 24 hour HHL specifically in connection with this release. Contrary to your statement that "They don't/haven't for quite some time promised 24 hours."

Saying they can do anything they want, so don't believe anything they say is fine, if that's really what you mean to say. In which case, the Mint should stop putting out press releases, and just do whatever they want.

We'll get what we get, with no broken promises, no expectations, and no disappointment. I don't think they would want to go there. So people like you should stop saying they can do what they want, so we should just get over being continually misled.

And did they not honor the 24 hours?

All comments reflect the opinion of the author, even when irrefutably accurate.

@smuglr said:

They don't/haven't for quite some time promised 24 hours

try all you want. the bickering will continue

Yup. Especially when what you are "trying" is to state fiction as fact.

I said nothing about mintage or production limits, I actually ageee with some of your points there to some degree. My post refers only to hhl, is in no way fiction, it has been the mint's stated policy for sometime that hhl were at their discretion. The fiction is that there is 'a promised 24 hours'. Under their stated policy they could impose/remove hhl at anytime noon, 2pm, 6pm, if they so chose.

Understood. You literally said "They don't/haven't for quite some time promised 24 hours."

The Mint put out a press release, available on its website, in connection with this release, a week before the release, explicitly promising 24 hours. You literally stated fiction as fact.

Yes, under their so-called stated policy, they could change anything at any time, which, taken literally, would render anything they say at all to be meaningless. Except, in this case, they said there would be a HHL for 24 hours, and there was.

What was misleading here is that they said they'd make up to 12K. Which they did. But they did not offer them all for sale during the 24 HHL window.

Which, again, makes the HHL kind of meaningless. Even though they did literally promise a 24 hour HHL specifically in connection with this release. Contrary to your statement that "They don't/haven't for quite some time promised 24 hours."

Saying they can do anything they want, so don't believe anything they say is fine, if that's really what you mean to say. In which case, the Mint should stop putting out press releases, and just do whatever they want.

We'll get what we get, with no broken promises, no expectations, and no disappointment. I don't think they would want to go there. So people like you should stop saying they can do what they want, so we should just get over being continually misled.

And did they not honor the 24 hours?

They did. They did not honor "The mintage is set at 12,000 units, with orders limited to one coin per household for the first 24 hours of sales."

They cut off orders at 6K, 8K if you want to include ABPP, without taking back orders, or keeping the HHL in place while orders were suspended, but there was no sell out. They accepted orders with a HHL of 1 for 3 hours, ran the clock out, lifted the HHL, and then placed another 4K on sale. 2800 through the web, and 1200 through the back door.

It is what it is. No one should rely on anything they say, and should just pay attention to what they do.

@CoolCoins said:

What does this bring the total mintage to if 2800 coins were released?

Right now the mintage is about 10,800.

But over 5000 have been taken by the big buys,

and we now know why the mint raised the price $150 this week.

The Mint raised their price because gold went up. It's a fixed formula. They did NOT raise the price for any other reason. They adjust ALL such coin prices every Wednesday.

That is correct !! Precious metals Technical analysis of gold prices pointed to a very possible spike upwards before the release of the Sunflower and such immediate time afterwards. It was smart Mint business policy, in my opinion, to hang tight and get more for their profits by releasing more inventory later when the price of Gold spot was higher. Arbitrage. Good for the US mint bottom line.

Again, you are making things up. The Mint does not stare at charts. They also may not make any more money because they hedge their gold holdings with options.

When you change the reason, you are clearly just fishing for something to make your observation seem true rather than just admitting that you made an error.

I stated my opinion qualified as an " opinion".. You are making statements as unequivocally factual. So, show your credible references for each point you make! Thanks.

It is posted above from the website. For those of us who have been dealing with the Mint for decades, there policies and procedures are known, as well as posted in their annual reports and on their website.

You did NOT claim it was an opinion. You made affirmative statements (accusations?) Your only stated "opinion" was that your false statement was "smart".

We should not have to pull the research to counter your inaccuracies when you could have done the research before making the statement.

Your initial accusation was that they raised the price $150 because they were going to release more. This is demonstrably untrue since all bullion pricing is based on a pricing grid tied to the current price of gold and published at the beginning of the year.

When that was pointed out, you then stated that the Mint held back the coins because the gold chart was pointing up. There is zero evidence for this and, as pointed out in the links above to Mint FAQs, doesn't really benefit them because of the way they handle bullion in their inventory.

The fact that you don't know the inner working of the Mint is understandable. What is less understandable is why you would stubbornly make such speculation (accusations) that require someone else to clean up.

Ok,circular reasoning. Too big to fail top dog syndrome.

I have no personal problem with that, because it simply illustrates your own capable fallacies.

Comments

Again, you are making things up. The Mint does not stare at charts. They also may not make any more money because they hedge their gold holdings with options.

When you change the reason, you are clearly just fishing for something to make your observation seem true rather than just admitting that you made an error.

All comments reflect the opinion of the author, even when irrefutably accurate.

Agreed. It is more likely that the mint uses futures to offset all PM inventory to maintain a neutral risk position.

If you are buying from the Mint, I believe the silver sunflowers are or were a good bargain.

I got a couple after the sell out by just dumping one in my cart and then grabbing it the next day.

Lucky I was.

And apparently the 70s are going up on eBay.

FWIW, I just SKIMMED the 2024 Annual Report.

Link: https://www.usmint.gov/content/dam/usmint/reports/2024-annual-report.pdf

Appears that the Mint currently:

1) hedges its silver inventory with a forward contract.

See "Link", page #50.

2) uses "working stock" from the Treasury for gold, and some silver.

See "Link", page #47.

3) leases Pt and Pd.

See "Link", page #53.

Makes sense. They hedge silver because they sell it at a fixed price. They don't do that with precious metals they sell according to a pricing grid. They manage that risk by not taking delivery until they need it.

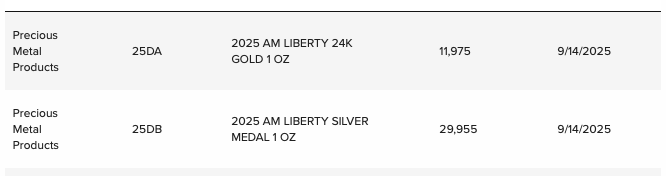

Last Sales Report (9/7/25): 7,954 Au / 29,966 Ag

Forum Link: https://forums.collectors.com/discussion/comment/13968708/#Comment_13968708

Current Sales Report (9/14/25):

Source: https://www.usmint.gov/about/production-sales-figures/cumulative-sales

Change: +4,021 Au / -11 Ag

I like the 9/7 #s better...

No surprises here. All this harping about whether the final minted number of gold should be or could be 8,000 or 12,000 coins. The Mint posted a 12,000 mintage limit from the get go and now it appears that’s what it’s going to be.

Time to move on.

Richard

Life Member #7070

I signed up for back in store reminder on the Mint's website but never received any notification after the 1st day of release. How is everyone able to buy up 4000 coins so quickly?

Well, A surprise is that 2800 showed up on the web, while an additional 4K were sold.

Well, something happened under the table.

I stated my opinion qualified as an " opinion".. You are making statements as unequivocally factual. So, show your credible references for each point you make! Thanks.

A big dump of 460 coins on PURE. Someone sold them below current US mint offer price

if i don't see a name then i don't want to click on buy or sell

It is posted above from the website. For those of us who have been dealing with the Mint for decades, there policies and procedures are known, as well as posted in their annual reports and on their website.

You did NOT claim it was an opinion. You made affirmative statements (accusations?) Your only stated "opinion" was that your false statement was "smart".

We should not have to pull the research to counter your inaccuracies when you could have done the research before making the statement.

Your initial accusation was that they raised the price $150 because they were going to release more. This is demonstrably untrue since all bullion pricing is based on a pricing grid tied to the current price of gold and published at the beginning of the year.

When that was pointed out, you then stated that the Mint held back the coins because the gold chart was pointing up. There is zero evidence for this and, as pointed out in the links above to Mint FAQs, doesn't really benefit them because of the way they handle bullion in their inventory.

The fact that you don't know the inner working of the Mint is understandable. What is less understandable is why you would stubbornly make such speculation (accusations) that require someone else to clean up.

All comments reflect the opinion of the author, even when irrefutably accurate.

Superman has been on preorder forever now, yet they couldn't take the extra orders for these at initial ordering knowing that they were making all 12k coins?

Since you have decades with the mint you might have remembered they have done that many times in the years of yore.

Not sure what you're getting at. At Pure you're not dealing with the seller. You're buying from Pure who acts as a middleman.

Exactly. I thought that folks would be interested in a multimillion dollar sale of these coins rather than the rather tiresome back and forth on this thread about mintage limits.😉

LOL, and I never thought limits were be so difficult to comprehend.

Yeah, well, when they apply to some but not others, without a clear stated policy, they can indeed be "so difficult to comprehend. "

"

In this case, 4K out of 12K were held back for later sale, without a HHL and without a public announcement. Difficult to comprehend, unless you accept that the deck is stacked in favor of some buyers and against others.

I understand that, although I am not happy about it. Others don't. So it's difficult to comprehend.

They could have. They alseso don't always do that, especially as you get later in the year. Regardless of why the Mint did what they did, it is absolutely NOT for the two reasons that he manufactured. It is disappointing that you would even tacitly suggest that there is even a remote possibility that either of those reasons were true

And, in fact, the did EXACTLY the same thing with the Superman coins that they did here. They have NOT made the full mintage available. The only difference is there was no need for them to make the other Superman coins because they didn't sell out.

All comments reflect the opinion of the author, even when irrefutably accurate.

I noticed last night that several listings on evilbay crossed the $6k threshold

Throw a coin enough times, and suppose one day it lands on its edge.

I’m new to the coin forum and not at all familiar with how the US Mint releases any of the stated mintage limit, whether in whole or in part.

This is what bothers me about this particular coin:

It appears the big boys bought almost 1/3 of the initial 8000 that were released in August.

Then they probably got at least 90% of the next 4000 released last Friday.

Meaning less than 1/2 of the 12,000 limit was available to the general public.

Am I wrong about this, and if not, is this a common practice?

They can only pre-buy 10%. (And they pay MORE than you for those and have to go pick them up themselves) We don't know who bought the 4000. They're are a lot of people who watch the daily drop.

The rest of just conspiracy theories. The little people had 24 hours to buy. So you are not right. How wrong is impossible to know because we dont know who bought the second group. But they were publicly available. If they wanted them to go to the big boys, they wouldn't have made them ATS.

The rest of this is all FOMO and hand-wringing

All comments reflect the opinion of the author, even when irrefutably accurate.

Don't be so sure about this. The full 10K were indeed made available on the first day. First 5K, then, less than an hour later, the other 5K.

I'm pretty sure the difference between what they have sold to date, what is showing ATS, and 10K is sitting on a back shelf, ready to go when and if needed. The alternative is DC taking a pass on royalties they are contractually entitled to.

As I have now learned, anything is possible, but I wouldn't bet on DC taking a haircut to support secondary market value for collectors. The Mint habitually leaves money on the table. Because it isn't their money. People running private enterprises aren't so casual with money.

And the 30,000 silver...?

Again, the point is not that we know exactly what the Mint is doing. What they did NOT do is raise the price $150 due to popularity nor wait for gold to go up to release them! 100%

All comments reflect the opinion of the author, even when irrefutably accurate.

What 30K silver? The 2.5 oz had a mintage of 25K, and they were all put on sale. The 1 oz is unlimited, and I'm sure they'll make them to demand. As long as the program lasts.

And, yes. Of course! The screwing around had nothing to do with the price of gold, and everything to do with holding back quantity for later sale with no HHL.

They didn't do the exact same thing because it is unlikely any more superman gold coins get made, but it appears they had already struck all the sunflower golds. apples and oranges.

When the initial gold sunflower sold out they could have immediately added the final inventory, but they didn't do that. They waited days to do it just like they waited days to lift the HHL limits on the silver eagle proof privy coins.

Many people who missed out on the gold sunflower did not get a chance to buy from the later release due to how the mint handled it. It went up and few people knew it.

No, chances are this is how it played out. 30% of the initial amount (which is actually based on the total mintage), plus the bulk of the late amount.

the sunflower sold out in under 3 hours IIRC. 5,285 ATS on release date. we can assume the big boys got the bulk of the rest. they could have mirrored the army release to ensure the regular collector would have a chance to pick one up and keep the HHL. they didn't and it's not a great look but it was their choice to make.

30,000 high relief silver

All comments reflect the opinion of the author, even when irrefutably accurate.

No. You ASSUME they had struck them. It is quite possible, even likely, that demand was higher than they thought so they struck more. It's also possible they needed planchets before they could strike more.

Not everything is a conspiracy, especially when you're taking about these small amounts of money. The Mint probably makes more money striking quarters for circulation than all of their numismatic offerings combined.

All comments reflect the opinion of the author, even when irrefutably accurate.

It doesn't really matter if they did or didn't, but they could have taken orders for all the coins at once. Otherwise they should have put out a notice through the coin websites that more were going to be offered later.

In the olden days that was sometimes done by Michael White at the US Mint.

Does anyone remember the fiasco over the first allotment of bullion 5 ounce silver quarters going to the dealers? This is not a first rodeo.

Oh! If the pattern holds and the Big Boys want them, they'll make more. Otherwise, they won't.

By the way, they are not high relief. They are regular relief American Liberty. High relief was exclusively the gold.

All we know for sure is that they won't make them just because there is retail demand for them, and because they have not yet hit the maximum mintage. Another 30K might very well destroy secondary market value, and it will hardly be worth it for the Mint to go back and make less, so the Big Boys might be happy with where things presently are.

Just please, everyone, stop saying short strikes are due to planchet or packaging issues. The recent situation with the high relief gold hopefully puts the lie to that. They do what they want, with no consistency, and likely in coordination with what their best customers want.

The regular collector had at least 3 hours to comfortably and easily order one. How big does the window need to be for you to consider it that the "regular collector" would have a chance?

The mint doesn't give a crap about secondary value. All they care about is if they can sell them all in a timely fashion.

>

Right, because gold planchets and silver planchets couldn't possibly have different supply chain logistics.

24 hours. The 24 hours they promise.

If something sells out in the first 3, or the first 23 hours, and if they know, or even think that they might make more available for sale, they should keep the HHL on, or reinstate it for another 24 hours when they place the item back on sale, after the same public announcement they make when they first place anything on sale.

If 24 hours come and go with no sellout, then, as far as I'm concerned, all bets are off. Not 3, or 6, or 23. 24.

And, yes. Whatever is going on with gold, they use the same silver planchets for everything. They have a gazillion of them, and a shortage is not why they made a single medal less than the 60K maximum.

You might think the Mint "doesn't give a crap about secondary value," but something certainly drives their decision not to simply make everything to demand, and to let Big Boys and everyone else sort out "secondary value."

>

They don't/haven't for quite some time promised 24 hours

They do for some. Not for others. For the High Relief Gold, they did.

https://www.usmint.gov/news/press-releases/2025-american-liberty-high-relief-gold-coin-and-2025-american-liberty-silver-medal-available-on-august-21

"The mintage is set at 12,000 units, with orders limited to one coin per household for the first 24 hours of sales."

The mintage might have been "set" at 12K, but 12K were not made available to the public while orders were limited to "one coin per household for the first 24 hours of sales." They were, however, made available later, to those who were probably given a heads-up, with no HHL.

Justify whatever you want. It's the opposite of transparent.

try all you want. the bickering will continue

Yup. Especially when what you are "trying" is to state fiction as fact.

I said nothing about mintage or production limits, I actually ageee with some of your points there to some degree. My post refers only to hhl, is in no way fiction, it has been the mint's stated policy for sometime that hhl were at their discretion. The fiction is that there is 'a promised 24 hours'. Under their stated policy they could impose/remove hhl at anytime noon, 2pm, 6pm, if they so chose.

Understood. You literally said "They don't/haven't for quite some time promised 24 hours."

The Mint put out a press release, available on its website, in connection with this release, a week before the release, explicitly promising 24 hours. You literally stated fiction as fact.

Yes, under their so-called stated policy, they could change anything at any time, which, taken literally, would render anything they say at all to be meaningless. Except, in this case, they said there would be a HHL for 24 hours, and there was.

What was misleading here is that they said they'd make up to 12K. Which they did. But they did not offer them all for sale during the 24 HHL window.

Which, again, makes the HHL kind of meaningless. Even though they did literally promise a 24 hour HHL specifically in connection with this release. Contrary to your statement that "They don't/haven't for quite some time promised 24 hours."

Saying they can do anything they want, so don't believe anything they say is fine, if that's really what you mean to say. In which case, the Mint should stop putting out press releases, and just do whatever they want.

We'll get what we get, with no broken promises, no expectations, and no disappointment. I don't think they would want to go there. So people like you should stop saying they can do what they want, so we should just get over being continually misled.

Coinlearner, Ahrensdad, Nolawyer, RG, coinlieutenant, Yorkshireman, lordmarcovan, Soldi, masscrew, JimTyler, Relaxn, jclovescoins, justindan, doubleeagle07

Now listen boy, I'm tryin' to teach you sumthin' . . . . that ain't no optical illusion, it only looks like an optical illusion.

My mind reader refuses to charge me. . . . . . .

And did they not honor the 24 hours?

All comments reflect the opinion of the author, even when irrefutably accurate.

They did. They did not honor "The mintage is set at 12,000 units, with orders limited to one coin per household for the first 24 hours of sales."

They cut off orders at 6K, 8K if you want to include ABPP, without taking back orders, or keeping the HHL in place while orders were suspended, but there was no sell out. They accepted orders with a HHL of 1 for 3 hours, ran the clock out, lifted the HHL, and then placed another 4K on sale. 2800 through the web, and 1200 through the back door.

It is what it is. No one should rely on anything they say, and should just pay attention to what they do.

Ok,circular reasoning. Too big to fail top dog syndrome.

I have no personal problem with that, because it simply illustrates your own capable fallacies.

Stay thirsty my friend!

$4615

How about when when you state speculation and assumptions as fact?

Just got mine back from PCGS, got a 70DCAM. Beautiful TV.

if you missed the chance to buy from the US Mint, you can a buy a sunflower w/Box & COA from APMEX for $6,295!

https://www.apmex.com/product/318944/2025-w-high-relief-american-liberty-gold-proof-box-coa