@FadeToBlack said:

By the way, DJIA is an outdated metric. Too compact. You wanna understand the markets, follow SP500 or one of its derivatives.

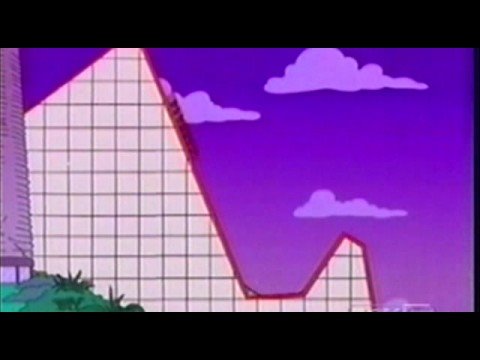

Triple top after that first pullback off ATH's... and then the breakdown. And down, and down...

10y-2y treasury spread is damn close to inverting too. Treasury spread inversions are classic leading indicators of a recession.

Meanwhile, choo choo, all aboard the gain train;

... Right now it's the bears turn.

Triple-levered ETFs are absolutely horrible investments for any reasonable length of time. They are for speculation only as volatility drag will kill your returns over time.

@FadeToBlack said:

By the way, DJIA is an outdated metric. Too compact. You wanna understand the markets, follow SP500 or one of its derivatives.

Triple top after that first pullback off ATH's... and then the breakdown. And down, and down...

10y-2y treasury spread is damn close to inverting too. Treasury spread inversions are classic leading indicators of a recession.

Meanwhile, choo choo, all aboard the gain train;

... Right now it's the bears turn.

Triple-levered ETFs are absolutely horrible investments for any reasonable length of time. They are for speculation only as volatility drag will kill your returns over time.

I'll sell once the market calms down lol. The market should cascade down to 230ish, dead cat bounce, and go lower.

Bold Prediction; SPY 180ish summer of 2019.

Alright, a testable hypothesis! Let’s check back on this at the end of June. If you are more than even 15% confident in that prediction I urge you to buy a 200-190 put spread on the S&P. It will cost you $1.32 and you would make up to $10.

Aesthetically the chart looks overdone on the downside and could have a potential bounce soon. I need to talk to wife to see if she wants to get back in for the SHORT TERM bounce. Once that happens, I would get out again.

The VIX is close to a signal, IMO. I need to see a huge spike up from here.

Everyone is talking about how chitty the market is. Getting close to a Buy signal for the short term, IMO.

@ErrorsOnCoins said:

Aesthetically the chart looks overdone on the downside and could have a potential bounce soon. I need to talk to wife to see if she wants to get back in for the SHORT TERM bounce. Once that happens, I would get out again.

The VIX is close to a signal, IMO. I need to see a huge spike up from here.

Everyone is talking about how chitty the market is. Getting close to a Buy signal for the short term, IMO.

With how volatile this break of support has been, if there is a bounce, I'd expect it to be VERY short lived.

I agree that is Probably why I will do nothing. I mean if it goes to 18000 super quick then I may buy, short-term.

The thing is, while I do see a bounce (after a larger spike down), news reports seem to have the special counsel releasing the report in mid-February. That may be being (quietly) priced in now by the professionals, but not the general public, IMO.

Thinking this is a good time to start my boys on a Roth IRA, figure I'd get them in a total stock market or S&P fund by Vanguard. Once started they can figure the rest out on their own.

Currently looking at Vanguards VTSMX or VOO, or maybe Schwabbs SWTSX since my account is there. Any ideas on others to study?

Figure its a better Xmas present than any other junk they would normally get.

Numismatist. 54 year member ANA. Former ANA Senior Authenticator. Winner of four ANA Heath Literary Awards; three Wayte and Olga Raymond Literary Awards; Numismatist of the Year Award 2009, and ANA Lifetime Achievement Award 2020. Author of "The Enigmatic Lincoln Cents of 1922," Available now from Whitman or Amazon.

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Retiring at 55, what day is today?

Honestly, with the subsequent bailouts, QE, and zero interest rates following the 2008 recession, this current market fit should be expected, and needed to get back to normal. Right?

What throws a wrench into any adjustment to normal is not just a global slowdown outside the U.S., but political turmoil around the globe including within the U.S. It's strange how so many countries at once experience such turmoil...

Oh well, I put my holdings into money market about 5 month's ago, and glad I did.

Honestly, with the subsequent bailouts, QE, and zero interest rates following the 2008 recession, this current market fit should be expected, and needed to get back to normal. Right?

What throws a wrench into any adjustment to normal is not just a global slowdown outside the U.S., but political turmoil around the globe including within the U.S. It's strange how so many countries at once experience such turmoil...

Oh well, I put my holdings into money market about 5 month's ago, and glad I did.

Only drawback to putting one’s holdings into a money market fund the Federal Goverment offers no insurance against loss, in regards to holding a Fidelity account.

I’m not willing to lose it all.

The Dow closed 1,086 points higher, or 4.98 percent. Wednesday’s gain also marked the biggest upside move on a percentage basis since March 23, 2009, when it rose 5.8 percentage points.

I saw the stock pros on CNBC today bemoaning the volatility caused by the high frequency trading algorithms and what must be done to address the instability. https://www.youtube.com/watch?v=T3imSKAvgmY

Comments

FTB I know that.

The two charts do correlate very well always have and always will.

The General Population watches the dow.

I watch the general population

We're several quarters away from a recession and I don't mean 25 cent pieces.

1Q2020 is likely to be negative GDP for the first time since 2009. Eleven years of growth.

Triple-levered ETFs are absolutely horrible investments for any reasonable length of time. They are for speculation only as volatility drag will kill your returns over time.

Alright, a testable hypothesis! Let’s check back on this at the end of June. If you are more than even 15% confident in that prediction I urge you to buy a 200-190 put spread on the S&P. It will cost you $1.32 and you would make up to $10.

Aesthetically the chart looks overdone on the downside and could have a potential bounce soon. I need to talk to wife to see if she wants to get back in for the SHORT TERM bounce. Once that happens, I would get out again.

The VIX is close to a signal, IMO. I need to see a huge spike up from here.

Everyone is talking about how chitty the market is. Getting close to a Buy signal for the short term, IMO.

I agree that is Probably why I will do nothing. I mean if it goes to 18000 super quick then I may buy, short-term.

The thing is, while I do see a bounce (after a larger spike down), news reports seem to have the special counsel releasing the report in mid-February. That may be being (quietly) priced in now by the professionals, but not the general public, IMO.

I started to P in my pants

....wait a minute ..... what pants? I started to P in my P

I started to P in my P

Panic is not what you want to do, do exactly the opposite.

Study the VIX over time and compare to the DJIA and SPX and you can CLEARLY see buy signals

Give it another day or two

Thinking this is a good time to start my boys on a Roth IRA, figure I'd get them in a total stock market or S&P fund by Vanguard. Once started they can figure the rest out on their own.

Currently looking at Vanguards VTSMX or VOO, or maybe Schwabbs SWTSX since my account is there. Any ideas on others to study?

Figure its a better Xmas present than any other junk they would normally get.

The only chart I care about.

I've had NO use for stocks since REITS went under 6% on well run and well capitalized ones.

They can stick Wall St. in Vegas for all I care.

“SPLUNGE!!!”

Even Berkshire Hathaway is down almost 16% since early October.

The VIX isn't where it needs to be yet. There's an implied premium.

Well so much for charts, buy high sell low. lol

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Retiring at 55, what day is today?

When this guy goes nuts, you know we have problems...should be good indicator to keep in mind. This is from Aug. 2007.

Honestly, with the subsequent bailouts, QE, and zero interest rates following the 2008 recession, this current market fit should be expected, and needed to get back to normal. Right?

What throws a wrench into any adjustment to normal is not just a global slowdown outside the U.S., but political turmoil around the globe including within the U.S. It's strange how so many countries at once experience such turmoil...

Oh well, I put my holdings into money market about 5 month's ago, and glad I did.

Only drawback to putting one’s holdings into a money market fund the Federal Goverment offers no insurance against loss, in regards to holding a Fidelity account.

I’m not willing to lose it all.

Ebay sucks. So does CLCT.... on that note , don't ask me why I'm a shareholder.

``https://ebay.us/m/KxolR5

Absolutely. I am still thinking 18,000 for DJIA is in going to happen.

The Dow closed 1,086 points higher, or 4.98 percent. Wednesday’s gain also marked the biggest upside move on a percentage basis since March 23, 2009, when it rose 5.8 percentage points.

https://www.cnbc.com/2018/12/26/us-futures-following-christmas-eve-plunge.html

Indian Head $10 Gold Date Set Album

CLCT closed just a hair down today, despite the big turn in the indexes.

Best, SH

whooooooooooooooooaaaaaaaaa

I saw the stock pros on CNBC today bemoaning the volatility caused by the high frequency trading algorithms and what must be done to address the instability. https://www.youtube.com/watch?v=T3imSKAvgmY

https://www.youtube.com/watch?v=T3imSKAvgmY

https://www.zerohedge.com/news/2018-12-26/why-stocks-are-soaring-massive-64-billion-buy-order

Update: 1/23/19

100% Out today into a capital preservation fund. Preserved the market growth of the last 10 years.

Took the remaining 1/3 that was in the market to completely out.

Looking for 18,000 to get back in

Can I play too?

http://www.silverstocker.com

Anyone can PM me Any Time about Any thing.