Commems: Everything Old is New Again

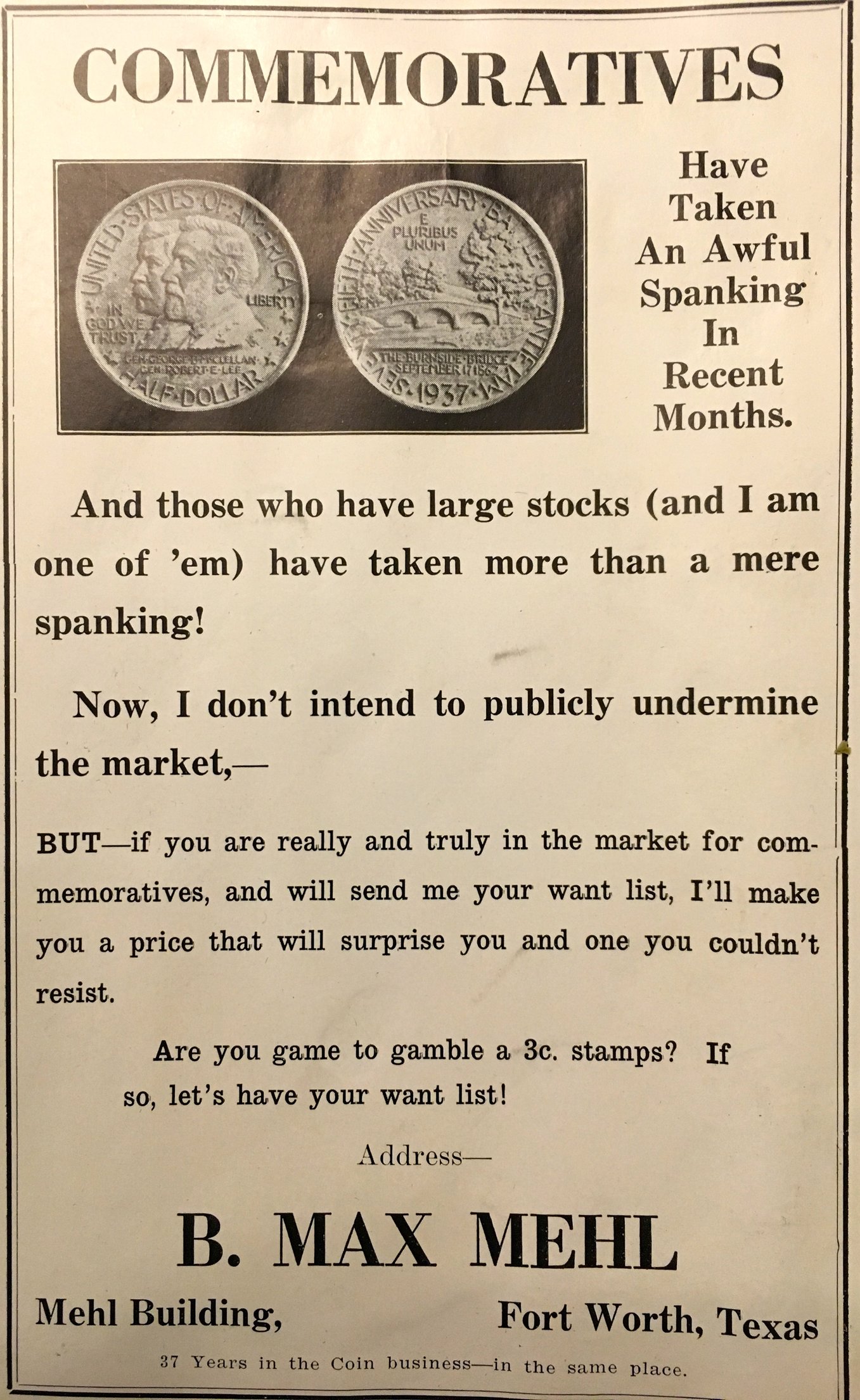

For many years, commems reflected the general movement of the coin market, but lately they seem stuck in a slide that has no bottom....this Mehl ad is from circa 1939, from a scrapbook I discovered of old advertisements of commems for sale.

Dr Mikey

Commems and Early Type

Commems and Early Type

3

Comments

Commemorative's definitely have their ups and downs.... seems every time I have an interest in some, it is during the up swing - usually at the top - Right now would be a good time to seek some, and I am not.....

- Right now would be a good time to seek some, and I am not.....  Cheers, RickO

Cheers, RickO

I recall back in 1993 or so I was telling folks that I thought the classic commemorative market had bottomed out and that it might be a good time to buy gem examples. Well, unless one had the discipline to only buy gem, superbly toned examples, my advice was way off-base. If it makes anyone feel better, I took my own advice and bought quite a few at that time myself.

In honor of the memory of Cpl. Michael E. Thompson

The commemorative coin market has been marked by a series of dealer promotions that have been prone to bubbles and crashes. We have been in a prolonged crash that has now lasted for about a decade.

The troubles are a number of dealers have promoted them with false information and expectations. These coins offer inviting opportunities for dealer promoters because maintaining an inventory of them is not that hard. The coins are always out there.

Dealers like to compare the "old" (series 1892 to 1954) commemorative mintages with regular issue coins, which is a totally bogus comparison. Regular issue coins are used and worn out with a survival in many cases that ranges from 1 to 5 percent of the mintages. Commemoratives were mostly bought and collected with survival rates of 90% or even more.

Dealers tout commemorative coins as pieces of history. The truth is all too many of them commemorate anniversaries that are of minor importance, or, as was the case with the Cincinnati commemorative half dollar, nothing of any importance except GREED.

If you want to get a laugh, check out the back "investment projection section" in The Encyclopedia of United States Silver and Gold Commemorative Coins 1792 to 1954 by Anthony Swiatek and Walter Breen. The book was published in 1981, and it is a good reference for topic. It won the book of the year award in 1981. The "investment advice" is worthy of a stand-up routine for coin collectors. For example the 1985 to 1990 here are some of the projections for commemorative coins in MS-65.

Layfayette Dollar $75,000

Lewis and Clark gold dollar $50,000 +

Providence Rhode Island half dollar type $3,300 +

Panama - Pacific $50 gold round $140,000 + (Well at least they go close on something)

At any reate it's hype like this that turns off collectors and speculators after they get burned.

That's a neat piece, @CommemDude .

--Severian the Lame

I've chosen to limit my exposure to these, as no one knows what they will be worth in a few years. Neat article. Thanks for posting it.

I have my select few in Classic Commemoratives, and even fewer of the moderns which I would care to purchase.

BST transactions: dbldie55, jayPem, 78saen, UltraHighRelief, nibanny, liefgold, FallGuy, lkeigwin, mbogoman, Sandman70gt, keets, joeykoins, ianrussell (@GC), EagleEye, ThePennyLady, GRANDAM, Ilikecolor, Gluggo, okiedude, Voyageur, LJenkins11, fastfreddie, ms70, pursuitofliberty, ZoidMeister,Coin Finder, GotTheBug, edwardjulio, Coinnmore, Nickpatton, Namvet69,...

If we consider Classic Commems as a bi-furcated market, is the top end sliding? Or only the bottom end?

I was offered a very nice Hawaiian half dollar in PCGS MS-66 for $10k. Ten years ago that coin would have been $20k.

The top end has been whacked too. The exception is the toner market, which is totally different matter.

With all that's been said, and I agree with all of it, many if not most of the classic commems have nice relief and are very artistic. Its a shame they've been struggling so long with no uptick in sight.

The upside of a sliding market is that it should be reasonable to build a nice collection.

It is largely reasonable, but the liquidity has generally been fairly poor since the extant populations of gem coins are so high. Kind of like an endless loop of the worst of both worlds.

In honor of the memory of Cpl. Michael E. Thompson

>

My War Nickels https://www.pcgs.com/setregistry/nickels/jefferson-nickels-specialty-sets/jefferson-nickels-fs-basic-war-set-circulation-strikes-1942-1945/publishedset/94452

If you buy at the grade / condition you like so you don't upgrade and keep for a long time, it seems like you could get reasonable enjoyment out of the collection. Of course, selling is an issue when it does come up.

Just ran across the following PCGS MS-68 1936-S Oregon for $11k. How much would this have been 10 years ago?

I am not into the P-D-S sets, but there are a few singles I'd love to buy at today's CDN bid -15%. i.e..Grant, Antietam, Gettysburg, Missouri, Cal, Conn, Alabama, Pan Pac.

Yes, I still have classic silver commems that I purchased 20 yrs ago...

The same can be said of modern craps from the mint.

Ah, the terrible toner market is always a trump card. Ya sure can't go by that now can ya.

I only have three, Antietam, California and San Diego.

The only one I'd consider adding would be an Oregon Trail. I've always liked those.

On the other hand there have been few really nicely toned commems at auction this year. Just lots of generic or ugly coins.

The coins that pull solid money in the series tend to stay in collectors hands.

The Antietam commemorative ...

Burnside's Bridge. The half dollar shows a mirror image of it. The tree in front of the left side of the bridge is "the oldest living veteran" of the battle. It was there when the shots were fired.

And here is General Burnside on a Civil War token.

Hey Bill,

How cool is that!! Thanks for showing this. It's makes me wanna go there.