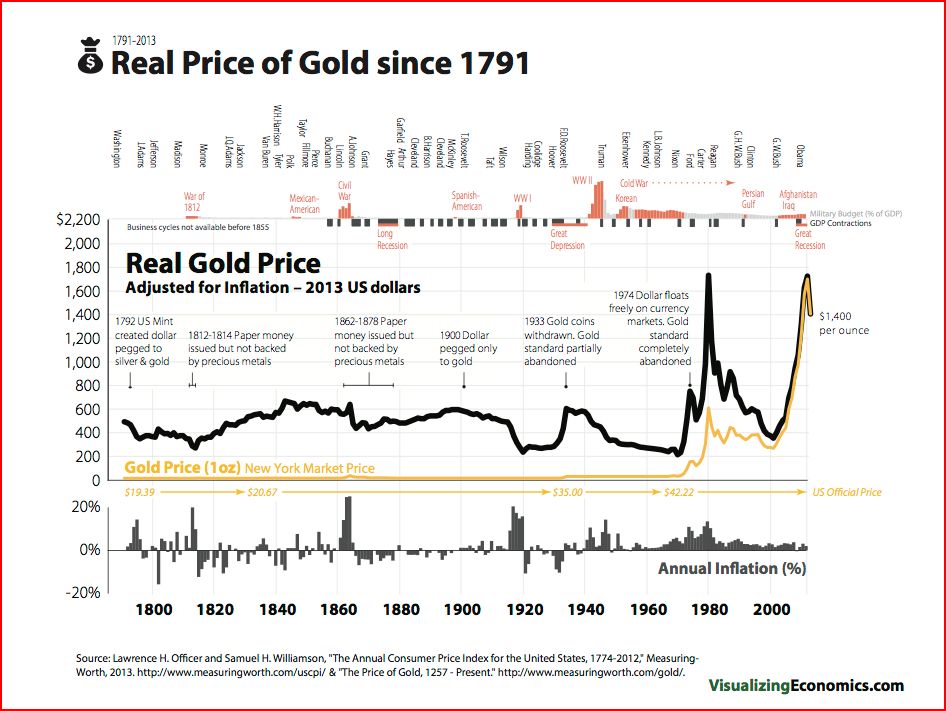

The price of gold (interesting chart of gold over last 225 years)

RedneckHB

Posts: 19,687 ✭✭✭✭✭

RedneckHB

Posts: 19,687 ✭✭✭✭✭

Interesting chart presented by Visualizingeconomics.

http://visualizingeconomics.com/blog/2014/3/25/real-price-of-gold-since-1791-updated-to-2013

An observation..

Lets look at the time period before 1933. I believe it shows marked periods of inflation and deflation. I like especially how there was a natural "checks and balances'. Strong inflation in the early 1800s countered by deflation during the 1820-1835 period. Then alternating from 1840 to 1860. The Civil War brought forth strong inflation (supply/demand constraints which took 35 years (until 1900) to correct. Strong inflation after WW1 (supply/demand constraints) was countered by deflation until 1940 (WWII). This inflationary period has lasted for 75 years. History has shown that inflation has always been met with deflation. Do we have an extended period of deflation ahead of us? Is this why investors are happy with getting 3% on long term debt? What does this mean for all assets, including gold? Maybe we never again have deflation?

which took 35 years (until 1900) to correct. Strong inflation after WW1 (supply/demand constraints) was countered by deflation until 1940 (WWII). This inflationary period has lasted for 75 years. History has shown that inflation has always been met with deflation. Do we have an extended period of deflation ahead of us? Is this why investors are happy with getting 3% on long term debt? What does this mean for all assets, including gold? Maybe we never again have deflation?

To add...look at the top of the chart. Notice how many recessions we had prior to going off the gold standard and how many after, and the size of the military budget.

http://visualizingeconomics.com/blog/2014/3/25/real-price-of-gold-since-1791-updated-to-2013

An observation..

Lets look at the time period before 1933. I believe it shows marked periods of inflation and deflation. I like especially how there was a natural "checks and balances'. Strong inflation in the early 1800s countered by deflation during the 1820-1835 period. Then alternating from 1840 to 1860. The Civil War brought forth strong inflation (supply/demand constraints

To add...look at the top of the chart. Notice how many recessions we had prior to going off the gold standard and how many after, and the size of the military budget.

Excuses are tools of the ignorant

Knowledge is the enemy of fear

0

Comments

Liberty: Parent of Science & Industry

What matters to the consumer is what he can buy today with his dollar.

What matters to the stacker is how much gold is his dollar worth today.

What we do learn from the chart is that as the value of dollars goes down the dollar value of gold goes up and vice versus. Tells me one can preserve purchasing power by holding gold in lieu of dollars.

No Way Out: Stimulus and Money Printing Are the Only Path Left

Chart makes me whant to sell all my gold while I can still get $1300/oz

Baley, is that because you think the dollar can't be devalued, or because you think that gold is artificially high?

There are reasons that gold might not be the best store of wealth, but a nominal price of $1,300/oz. isn't one of them.

I knew it would happen.

<< <i>This chart seems to indicate that the dollar is being devalued. See the other thread that so carefully explains how the dollar can never be devalued. Someone is wrong, and someone is correct. Which is it? >>

Dollar cannot be "officially" devalued by government decree as it could when it was tied to gold. It can and is slowly being devalued (watered down) via inflation and money creation. Leaders prefer this method because their indirect involvement in inflation is not as obvious as their direct involvement with decree.

No Way Out: Stimulus and Money Printing Are the Only Path Left

<< <i>Chart makes me whant to sell all my gold while I can still get $1300/oz >>

Just make sure you buy it all back at $1125.

No Way Out: Stimulus and Money Printing Are the Only Path Left

Nothing to see here, carry on

BST Transactions (as the seller): Collectall, GRANDAM, epcjimi1, wondercoin, jmski52, wheathoarder, jay1187, jdsueu, grote15, airplanenut, bigole

The initial run up in gold during the 70's may simply have been the availability of gold to be used as an alternative asset class. Prior to 1974 there really was no interest to buy gold as it could never really appreciate in value. The influx of money into this "newfound" investment class created the massive bubble that collapsed in 1980.

I think it is interesting to note also that the Baby Boomer demographic influence on the economy occurred at the same time the gold standard was abandoned. And during most of this time the military budget has been an integral part of the economy. What a perfect storm for the inflation that the last 3 generations have come to expect. Will the winds continue to blow?

Knowledge is the enemy of fear

I knew it would happen.

<< <i>Our levels of debt make Weimar look like a bunch of pikers. Of course there'll be a deflation, but not until inflation runs its course. The big question is "who defaults on whom?" Since they're in the habit of socializing debt and privatizing their own profits, it looks to me like a bad recipe' for social upheaval. >>

Not so sure where you got your info from...Our level of dept to GDP is close to 100%....The Weimar Republic stood at 250%

<< <i>

<< <i>Our levels of debt make Weimar look like a bunch of pikers. Of course there'll be a deflation, but not until inflation runs its course. The big question is "who defaults on whom?" Since they're in the habit of socializing debt and privatizing their own profits, it looks to me like a bad recipe' for social upheaval. >>

Not so sure where you got your info from...Our level of dept to GDP is close to 100%....The Weimar Republic stood at 250% >>

Our GDP includes foreign sales, a much bigger percentage than in past history. Wonder what our debt level to Gross Domestic Product would be if GDP was actually based on domestic consumption. Then again, GDP is just another Washington calculation. "Liars figure, and figures lie."

No Way Out: Stimulus and Money Printing Are the Only Path Left

Unfunded liabilities count.

I knew it would happen.

<< <i>Not so sure where you got your info from...Our level of dept to GDP is close to 100%....The Weimar Republic stood at 250%

Unfunded liabilities count. >>

Actually, no they dont. But specifically, the Weimar Republic had no infrastructure. They had no ability to work their way out of debt even if they wanted to. No one would lend Germany money especially after poisoned and destroyed Europe. The USA will continue to attract money.

Im afraid you will be long since deceased before we see a Weimar or Argentina type of situation.

Knowledge is the enemy of fear

I wonder what gold would be worth if it was grey?

Knowledge is the enemy of fear

<< <i>Chart's real price of gold is based on government reported inflation.

>>

Exactly. Were the fudging "govt issued & approved" stats prior to 1980 the way they do it these days? Did they even have govt stats in the 1800's?

Since 1971 I see more recessions than the chart does: 1973, 1974-1975, 1978, 1981-1982, 1987-1988, 1990-1993, 1995-1996, 2000-2003, 2008-2010. And I'm being "kind" with my list of recessions. There are probably more.

Back dating gold prices based on today's dollar doesn't seem to make sense. Why don't they base it on inflation since 1800? Where's the gold spike in 1869 that took gold to $162/oz in 1869 dollars? What would that be

today? The term "gold standard" for the 1800's is almost an abuse of the term. We were probably off the gold standard as much as we were on it. The only real true gold standard of the 1800's was probably from 1878-

1907. Most everything before that was some sort of hybrid. During times of stress and wars the govt came off the gold standard...hence panics, inflations, and depressions. The banks themselves cheated on the gold standard

often enough to question if there really ever was one prior to 1878. The gold standard was effectively shelved for the entire 20th century at the start of WW1. The gold standard was ignored from 1914-1918 and then a shell

of that standard was left to bear the blame from 1920-1933. When any argument is based on govt supplied statistics.....it starts off with one foot in the grave. Everything on that chart is bogus after 1982 since it's based on

CPI which has been altered significantly half a dozen times since. It is ironic to see our economists go back and define what a recession was 100-200 years ago when they can't even do that in real time today. The gold price

in 1869 was probably the highest level by far in the 19th century. Since the chart doesn't show that I have to question the data that was used. There was no universal gold standard from 1813-1823 as the southern banks

were off of it following the war of 1812. That's not on the chart nor is the weak livered gold "standard" of the post-1919 period that had no clearing via real bills. Technically, 1900-1913 was the true gold standard.

Im afraid you will be long since deceased before we see a Weimar or Argentina type of situation.

Unfunded liabilities are an order of magnitude larger than the current debt, and it won't be something that can be ignored. Weimar didn't have the advantage of having the world's reserve currency, and you can be sure that our biggest adversaries will work against this advantage until it is neutralized.

When you state that unfunded liabilities don't matter, you have already concluded that the USA can continue to do something that no other civilization has ever successfully done - to create money out of nothing to pay increasingly larger debts, both military and domestic.

When you extend more and more debt out to 30 years and beyond, it's not going to be pretty when rates are forced up.

I knew it would happen.

you can be sure that our biggest adversaries will work against this advantage until it is neutralized.

Bite the hand that feeds you? Those "adversaries" had better hope they are prepared for having a reserve currency--it isnt all its cracked up to be. And so what if the US dollar is not the reserve currency? The German mark, British pound, even Japanese yen are not reserve currencies and it seems to me the citizens of those countries live quite comfortably.

it's not going to be pretty when rates are forced up.

Japan has shown it is possible to keep rates low for decades. The USA is in much better position than Japan was 20 years ago. Rates will be "forced up" because the economy deems so due to increased economic activity. Last I checked growth was a good thing.

When you state that unfunded liabilities don't matter, you have already concluded that the USA can continue to do something that no other civilization has ever successfully done

Well no, im not saying that, but I see no reason why the USA would not be able to deal with this problem. It has, afterall, faced down every other problem it has encountered over the last 300 years.

Knowledge is the enemy of fear

If this true, we are in really deep trouble. Can anyone shed some light on what the U.S. is really worth. I am not including the private sector, just what the U.S. Government alone is worth?

Box of 20

The USA owns over 600 million acres of land directly on US soil with another 3x that offshore. It is estimated that just the value of our coal reserves is $22 trillion. Oil and gas estimated at another $120 trillion.

If the US were a company the value of its intellectual properties (patents) would also be included. How much is our knowledge worth?

Knowledge is the enemy of fear

<< <i>Chart's real price of gold is based on government reported inflation. >>

Enough said.

<< <i>

<< <i>Chart's real price of gold is based on government reported inflation. >>

Enough said. >>

exactly, enough said.

The fed should base it's calculations on MGLICKER's weekly purchase at Trader Joes, not on the thousands of data points from all over the country that it apparently "averages" in order to mislead us.

Liberty: Parent of Science & Industry

<< <i>The fed should base it's calculations on MGLICKER's weekly purchase at Trader Joes, not on the thousands of data points from all over the country that it apparently "averages" in order to mislead us. >>

I prefer the BBI (Baley's Barber Index). It shows zero inflation for 34 years!

If the US were a company the value of its intellectual properties (patents) would also be included. How much is our knowledge worth?

Thanks for the answer. I thought the U.S. might be worth in the 100s of trillions, just couldn't find the real answers.

Box of 20

<< <i>I always thought that the total assets of the U.S Government was in the 100's of trillions of dollars. I am including all the property owned by the Fed Gov't (national parks, mineral rights etc.). What I am reading online it is only around $1.5 trillion. I am not including the yearly $2.5 trillion in tax revenues collected, because that can't be used to pay down the debt, only to service that debt.

If this true, we are in really deep trouble. Can anyone shed some light on what the U.S. is really worth. I am not including the private sector, just what the U.S. Government alone is worth? >>

Hard to value in dollars as the measuring stick is readjusted daily. About an oz of gold per citizen if memory serves and some beautiful Canyons in Arizona and Utah. All military assets like ships and planes are paid for as well.

Problem is the liabilities. I think of the endless SSI "contributions" since my first real job in 1972. That money is gone, kaput. Multiply it by everyone who has earned a paycheck in this nation in the last week, year, decade or half century. Gone, virtually every dime.

Double the number when you consider the unfunded Medicare that is "owed" to those 65 and above. The numbers are staggering and obviously non sustainable.

Ponzi and Madoff looked like geniuses, until they no longer could maintain the charade.

<< <i>The USA owns over 600 million acres of land directly on US soil with another 3x that offshore. It is estimated that just the value of our coal reserves is $22 trillion. Oil and gas estimated at another $120 trillion.

If the US were a company the value of its intellectual properties (patents) would also be included. How much is our knowledge worth? >>

The US banks have "bet" an equivalent amount (or more) on their otc derivatives. At least there's something of real value backing those bets. How much "intellectual knowledge" created these things?

Knowledge is the enemy of fear

<< <i>I think if aliens wanted to buy the USA they would have to bid at least $1000 trillion. >>

Or just hop the fence and drop anchor babies as they have for the last generation.

<< <i>Or just hop the fence and drop anchor babies as they have for the last generation. >>

You're starting to sound like Drunk Uncle Just in time for Easter

Liberty: Parent of Science & Industry

<< <i>You're starting to sound like Drunk Uncle Just in time for Easter >>

Ahhh give Cohodk a break. He is good guy even if our thoughts don't always align.

Most of the other prices held from a couple of weeks ago, though strawberries were $4.49 a pound and tomatoes jumped half a buck to $3.99 a pound. All Organic. Some here would call that a luxury, but I consider the absence of Monsanto Round Up in my groceries a necessity.

Checking out of here for a bit to handle a business deal, but I enjoy the banter and will return in the not too distant future.

This is an issue that is sooooo very important yet I wonder how many people here and in the rest of this country do not know what you are referring to. The big commercial farming operations have been doing this for years and years....poisoning folks to keep their production costs down. I wonder about those that eat a lot of tofu and soy products....IIRC "Round Up Ready" soybeans were one of the first GMOs developed. They no longer have to weed the soy crop because the seeds/plants are now immune to the pesticide....they plant, spray and then forget about it. I wonder how much Round Up ends up in the soy/tofu people eat.

<< <i>"but I consider the absence of Monsanto Round Up in my groceries a necessity"

This is an issue that is sooooo very important yet I wonder how many people here and in the rest of this country do not know what you are referring to. The big commercial farming operations have been doing this for years and years....poisoning folks to keep their production costs down. I wonder about those that eat a lot of tofu and soy products....IIRC "Round Up Ready" soybeans were one of the first GMOs developed. They no longer have to weed the soy crop because the seeds/plants are now immune to the pesticide....they plant, spray and then forget about it. I wonder how much Round Up ends up in the soy/tofu people eat. >>

Roundup is only a problem if you are looking to reproduce at some point.

Knowledge is the enemy of fear

<< <i>The fed should base it's calculations on MGLICKER's weekly purchase at Trader Joes, not on the thousands of data points from all over the country that it apparently "averages" in order to mislead us. "

I wish we had a Trader Joe's.

We had a couple of Hometown Buffets (I do not partake.) What do they charge...$15? Apparently the Hawaiian's would come in and eat for hours. So they were closed down. No joke.

<< <i>Plants develop resistance to Roundup. Humans will as well. And probably evolve into a stronger species. This is probably on purpose so that we can better fight the coming Alien invasion. >>

The Sky Brothers are our friends. Most of them anyway, the ones who helped us along the way.

Most civilizations have called these visitors "gods" but they were apparently simply more advanced cultures who visited this planet from stars not our own.

There is a reason our money has birds and stars on it, and it's why In God We Trust

Liberty: Parent of Science & Industry

Liberty: Parent of Science & Industry