Recent advice from an advanced collector: “Don’t ever be an underbidder.” Ouch!

renomedphys

Posts: 3,917 ✭✭✭✭✭

renomedphys

Posts: 3,917 ✭✭✭✭✭

Over drinks at the EAC convention, one of the more senior members (I won’t say his name) told me this after I mentioned I was the underbidder on a coin that another member mentioned he won. My immediate thought was “yeah, right!” and “unless it’s you I’m bidding against, right?” But here’s the thing: he may be right. And it’s been haunting me.

Does anybody else here follow that advice? Going back 15-20 years, I was building my Lincoln set and did this on several occasions. While it felt like a sting to pay more than anyone ever had on say a 1915-s or a 55 DDO in a particular grade, the price guide always followed suit, and I was always rewarded handsomely when it came time to sell. Then I became a vest pocket dealer and my attitude shifted. I became opportunistic in my bidding and that sentiment hasn’t really changed. And while opportunism has its rewards, they aren’t as consistent or handsome as when going after and winning trophy coins. You just don’t WIN trophy coins that often being opportunistic. And sometimes you make mistakes on coins that just don’t sell.

Is there a moral to this story? Anyone?

Comments

I learned a long time ago that if you see something you like and can afford it (even if you THINK you’re over paying for it), GET IT…because the opportunity may not be there again for a long time, if ever. There are three or four coins I have had my eyes on recently…and luckily a few of each are available, so when the money comes together I will purchase them. Tired of beating myself up for missed opportunities that I thought would show up again…and never have. 😉

Nothing wrong with being an underbidder, but don’t miss a coin you might never get a chance at again just because you’re looking for a bargain against guide prices. Buying for the personal collection vs. resale is very different.

Nothing is as expensive as free money.

This is exactly right.

chopmarkedtradedollars.com

I don’t think there is a one size fits all answer.

I think it depends on whether you have seen the coin in hand first. Also, how does the coin measure up to other known examples? And perhaps another reasonable questions are how often the coin is offered and is the coin under consideration quality for the grade?

In the final analysis, the real question you have answer is this… Is this coin as good as it gets for me?

Experience the World through Numismatics...it's more than you can imagine.

MOST of my collection, especially, my Early Walkers are coins that I was going to buy regardless of price, b/c I HAD to have them. SOME I was extremely fortunate and got fair if not tremendous deals on and others I paid dearly. Never regretted it, either way. Coin collecting and purchasing is a game of AVERAGES but the nice thing is that most everything appreciates, so that helps to level the playing field, in the end. I can only think of one or two coins, in the last 20 YEARS, that I was glad to be the underbidder...Mostly, because the price was foolish and I had better opportunities, for the same issue, elsewhere....Sometimes, even in a higher grade. BUT, your friend is correct, as that is certainly the exception rather than the rule.

Sometimes, it’s better to be LUCKY than good. 🍀 🍺👍

My Full Walker Registry Set (1916-1947):

https://www.ngccoin.com/registry/competitive-sets/16292/

I use opportunistic buying for resale, but when it comes to my core collection I almost always have to pay a record price. Maybe one or two out of 25 coins was the result of opportunism, only once in a blue moon do the stars align and the two overlap, but I don't know of any truly "great" collections being the result of a passive buying strategy.

Edit: for further clarity, there is absolutely nothing wrong with being the underbidder, and sometimes the underbidder should be grateful they didn’t win, but it’s a case by case basis. I’m a box of 20 collector of rare issues , but I wouldn’t drop bombs on every target coin of if I was collecting another series where opportunities are plentiful. Listen to Kenny Rogers 😉.

Founder- Peak Rarities

Website

Instagram

Facebook

Had to post this....this movie made me laugh so many times (Talladega Nights: The Ballad of Ricky Bobby):

I prefer collecting coins in lower circulated condition G04 to F12

In all seriousness sometimes you can't win them all unless you have ''unlimited funds''.

I prefer collecting coins in lower circulated condition G04 to F12

“Don’t ever be an underbidder.”

For the large majority of bidders, that’s terrible advice. Because there are so many instances in which coins sell for prices that most of us can’t even contemplate.

And when someone uses the word “always” or “never” (among other things) with respect to coin grading and prices, their chances of being correct are extremely slim.

Mark Feld* of Heritage Auctions*Unless otherwise noted, my posts here represent my personal opinions.

Ouch indeed. I have also heard that the underbidder is the consignor’s best friend.

For me; the last four auction outings:

The 1859 dollar from the Chelsea collection: Underbidder. Coin sold for two more increments.

Great looking 1877-CC half dollar in P58+CAC: Direct underbidder. Unattended (coin went off on league night) ‘nuclear bid’ that was a dud.

1853-O NA P6CAC: Underbidder. A true damn it in terms of underbidder. A positive sale result would have been interesting, as my Seated Dollar collection would have hit the market at near the same time as the recent Chelsea collection.

1873-CC Arrows half dollar P58CAC. Winner. Radically overpaid. Learned from previous dud nuclear bid. Put in super nuclear bid and was online/‘present’ at the auction. Very happy with this excellent coin in the collection.

I do feel the ouch for the three losses. No doubt. Totally agree with your advanced collector.

Sometimes the underbidder is the winner since he avoided being buried in the coin.

Worry is the interest you pay on a debt you may not owe.

"Paper money eventually returns to its intrinsic value---zero."----Voltaire

"Everything you say should be true, but not everything true should be said."----Voltaire

Not with coins but with artworks from one particular artist I follow, I am frequently the underbidder, and I know that the auctioneers appreciate it.

I usually am looking to get a decent deal, not break auction records. For me, that's the best way to build a collection that will hold or increase its value.

This is my opinion too, because most coins aren't actually that difficult to buy with numerous roughly comparables available. The vast majority of coins are mass produced objects with survival rates high enough to enable those with the money to buy another similar one.

In a niche series like mine, (consistently) running up the final price also potentially increases the cost of future purchases.

If someone is going to adopt the sentiments of the OP, they better make sure they actually like the coin enough to potentially lose a noticeable proportion of their purchase price at resale.

It's one thing to be "buried" in coins that are or approach irreplaceability when the buyer likes it enough after they bought it even if it loses (noticeable) value later.

It's another thing entirely with the availability of coins the vast majority of collectors overwhelmingly buy which actually aren't irreplaceable and usually not difficult to buy at all.

I believe he’s speaking of a particular coin kinda like an old girlfriend that shouldn’t have got away lol.

Otherwise, I have nothing to say here. I don’t buy graded coins…yet.

I look at it slightly different. Unless the other bidder is completely irrational or has infinite cash, I rest assured knowing that someone was willing to pay one increment less and that theoretically, one increment is the most I'm overpaying by and is the most I can theoretically lose, assuming the market at least holds for that coin and not taking into account selling expenses.

http://ProofCollection.Net

Can you put that in layman‘s terms, dude?

For most coins, I value a coin and put a max price going into the auction. If I am the underbidder then so be it. However, if its a special coin (rare, high in eye appeal and I need it) then I will go higher. Just my 2 cents.

If two wealthy collectors get into a bidding war for a coin, there's always the risk that the underbidder won't still be around when it comes time to sell that coin so paying top dollar for a coin comes with certain risks.

Worry is the interest you pay on a debt you may not owe.

"Paper money eventually returns to its intrinsic value---zero."----Voltaire

"Everything you say should be true, but not everything true should be said."----Voltaire

One part of my collection is extremely niche, and very few pieces come up for sale, let alone ones that I don’t already have. To a certain degree, my MO is to win any item I’m after. Around a year ago, one such piece came up for auction in a higher grade than I needed, but it was a nice one. Bidding got to around 3x what I had expected (into 4 figures, so in real dollars it was a lot for me, to the point where I’d really feel it) and I had to bow out. Would you know another one in a slightly lower grade came up a few weeks later and I got it for a quarter what the first one had sold for. I don’t think it usually works that way, but I got lucky there and am glad I lost the first time. Years into this collection and those are the only two examples I’ve seen for sale.

‘’ Sometimes the opportunity to buy a rare coin is rarer than the coin itself’’

—-Lester Merkin, old-time coin dealer from New York (passed away many years ago)

OK to be the underbidder if you ask yourself the right questions when figuring your bid. Most importantly, how much would this coin have to bring for me to never regret letting it go? And remember that if the answer seems like it’s way too high, it’s probably too low.

Doggedly collecting coins of the Central American Republic.

Visit the Society of US Pattern Collectors at USPatterns.com.

Except if there are only two people willing to pay, e.g., $2500 for the coin and everyone else is at $1750 or less. Then a second auction will end at $1750 because you aren't bidding anymore.

All comments reflect the opinion of the author, even when irrefutably accurate.

Even if the underbidder is still around, you need a second bidder to push him.

True story. About 30 years ago a proof gold Una came to auction. It had been quite a few years since one came out. Andy Hale had wanted one for decades. The auction happens and Andy wins at $24000. Then, by coincidence, the next year another, higher grade example hit the market (might have been Pittman IIRC). It only sold for $20k because Andy wasn't bidding.

All comments reflect the opinion of the author, even when irrefutably accurate.

I suppose there is some wisdom to that, but it applies only to those collectors who are disciplined enough to only bid on coins that have the ultimate combination of positive attributes- be it grade, surfaces, toning, or whatever- that truly elevate their collections through their acquisition.

Realistically, for most of us, we make compromises when we buy coins. It's necessary, not just because we don't have unlimited money, but because the coins that really hit those points are just not often available and attract the most competition at auction.

Same here, within "reason", but the buyer has to be willing to treat the purchase at least partially as a hobby expense sunk cost and not an "investment", which is what many buyers (not just coin collectors) do to rationalize paying a price they otherwise would not pay.

I have the money to buy coins I don't normally buy, but no, I can't actually afford everything I have the money to buy.

I'm sure the underbidder on that MS67+ 1958 Franklin toner from Legend auctions would disagree.

As would the underbidders and “winners” of very large quantities of coins whose populations were once extremely low, but later increased dramatically.

Mark Feld* of Heritage Auctions*Unless otherwise noted, my posts here represent my personal opinions.

This exact scenario was discussed on Antiques Roadshow some years ago.

The values of Civil War swords had dropped substantially because one of the two wealthy sword collectors who would battle it out at auctions had passed away.

I can see how a rare coin might be (or seem) like a once in a lifetime shot. I have a few coins I have been hunting but have failed to find or win that are going into the more than 10 year pile.

Having said that. I always set MY price, which is sometimes half the going rate and at other times twice or more than retail bid. It is a coin by coin case. I still live by the motto that "It is great to win but there will always be another coin and or another auction. James

It depends.

Being the underbidder on an expensive coin that is on the market periodically and not paying a crazy price is probably good.

Being the underbidder on a coin that sells once every blue moon might be bad and could have been your only realistic chance of acquiring the coin.

Some of the Chelsea collection coins (Seated Liberty Dollars all P/C 45) sold for seemingly crazy prices but it might be another ten to twenty years before some of the tough dates hit the market again.

Okay here’s my own true story: one Winter FUN auction I pushed a mint state classic cent to 24k hammer and was outbid. 18 months later the winner put his whole set up for sale and I was able to buy the same coin for 18k hammer. In that case it really WAS good to be the underbidder.

Empty Nest Collection

True enough, but there seemed to be some special insanity going on during the COVID days. Maybe just my perception...

The OP was quoting something he heard from an “advanced collector” - “Don’t ever be an underbidder.” And the fatal flaw in that advice is the inclusion of the word “never”. That one word makes the advice both poor and dangerous.

Mark Feld* of Heritage Auctions*Unless otherwise noted, my posts here represent my personal opinions.

It’s more simple than that. Real antiquity evaluation consists of more parts than retail value, one most also consider

1- retail value for avg comparables

2- auction/wholesale value

3- price floor

4- liquidity (buyer/collector pool & market at the price point)

5- alignment of targeted interest (niche or mainstream)

And last but most importantly

6- opportunity presented

Never be the underbidder on an exceptional opportunity. Most other scenarios where everything isn’t lined up it is a blessing. If you can’t make real time calculations on the true opportunity presented then you’re a fish, not a shark and made the right call by being the underbidder.

11.5$ Southern Dollars, The little “Big Easy” set

Lots of variables here to consider and for each person, their bid strategy will be different:

I have an expensive coin that I do like, but I paid too much due to auction fever. It is of good quality, but it wasn't scarce or rare, and if I had more patience, I certainly could have found another and been satisfied. It serves as a good reminder. Generally speaking, my orientation is that if I truly like a coin, I am an aggressive bidder. 90% of my auction wins are coins that I feel good about.

Edit to add: Quality doesn't come cheap!

"She comes out of the sun in a silk dress,

running like a water color in the rain...."

I would agree that the vast majority of coins are not rare but you have to take into account the population for the desired grade. For instance, I'm working on a complete DMPL Morgan set, and for some dates like 1886-O, only the first 3 grades are in the realm of my affordability. With less than 9 "affordable" examples (and of those, 2 or 3 are likely undesirable), the auction history shows one comes up about every 3 years. If one of these 9 comes available, it's either win it or wait 3 more years and hope prices don't go up further in that time. If one was available today, the best bidding strategy I would recommend is to bid on it with a price of what you'd expect to pay 3 years from now. Because if you lose today's auction, you'll likely be paying 2028's prices. Now of course we don't know what prices will do between now and then, but I assume prices are headed higher, especially for coins with this condition rarity and total PCGS population of 15, not counting NGC or CACG examples. Luckily I already have my 86-O but there are several other slots this applies to.

http://ProofCollection.Net

Not even “historically monster coins” are immune from much of this. Even fantastic coins are subject to declines in value, especially if purchased for too strong of a price (or even at the right price, but at the wrong time).

Mark Feld* of Heritage Auctions*Unless otherwise noted, my posts here represent my personal opinions.

I haven’t collected coins for a long time, though I did, off and on for roughly thirty years.

Mark Feld* of Heritage Auctions*Unless otherwise noted, my posts here represent my personal opinions.

Mark, do you possibly see yourself putting together a small collection ever again? Perhaps when retirement comes along, and you may not be hands on with coins like you are now?

Or is it difficult to get excited about a coin now, considering that you have, for all intents and purposes, “seen it all”?

Founder- Peak Rarities

Website

Instagram

Facebook

I completely disagree with the concept of “ don’t ever be an underbidder “ based on being in numismatics for 68 years.

There are extremely wealthy and / or “ must have under any circumstances ” collectors who will maniacally bid non-stop. I recall Brent Pogue , most often in attendance but bidding thru agents

on the auction floor, who was willing to pay astronomical prices. He died prematurely in his early 50’s and quite a number of his top notch coins realized significantly lower prices, by multi hundreds of thousands of dollars, only a few years after he acquired them. Pogue’s underbidders either had died off or had lower enthusiasm or redirected interests.

Collector Age is an important factor in the decision on what level to bid. If you are, say, below 60 and in good health with marital or family stability, the “ must have “ high level you can bid can be much stronger than if you are in your late 60’s or have “ shaky “ marital or family relations.

If it’s an ex rare variety, hold off at deciding to pay astronomical prices. Very , very few die varieties retain their rarity over the years AND the market for such varieties tends to be quite thin at relative higher prices. Just wait for another to appear for sale.

The US rare coin market ( I can’t speak for the foreign coin market ) is rapidly aging and more important collections are appearing at auction more frequently. So if you miss a certain coin, it is very likely another even better piece will surface at auction in the near future

When prices just get too intolerable in your numismatic specialty, why not re-direct your collecting efforts to a “ niche “ field that is far more affordable , which is still challenging, and where ridiculous market value differences are not governed by a + or a single grade number or a green or gold sticker.

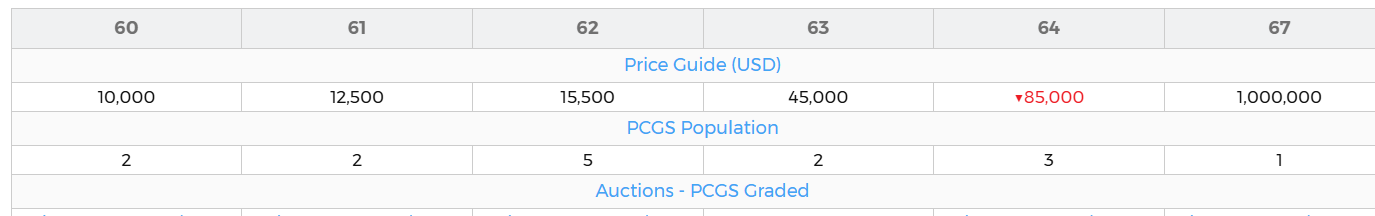

Are you collecting coins or plastic holders ? How many people can consistently determine the difference between a 66 or 67 or 67+ ? And yet price differences can be many thousands or tens of thousands of dollars.

I did this transfer of interest well over a decade ago and am very pleased with the result. And I still regard myself as a numismatist

A mentor of mine (an all time B&M guy) always said he could never collect because at best he would lose his best material out of retail and at worst he would unfairly compete with his customers. That said he did do little side sets of stuff he didn’t market like continental currency. That lesson always stuck with me

11.5$ Southern Dollars, The little “Big Easy” set

Don't ever be the underbidder? Yea, right. That's the way to end up owning a bunch of deep burials that will ruin the hobby for you. I have more regrets over the coins I've sold than the pieces I didn't buy in an auction. And I have very few of those regrets.

I was updating the value of my collection over the weekend. I've paid some stupid prices for some things. It's mostly been my gold holdings that have bailed me out. I used the PCGS Coin Facts numbers for bidding in auctions for a number of type coins I'm holding, and they have not performed well. Some of the worst buys were during the 2012 era.

There are bidders out there who are determined to buy something and will almost never stop bidding. When it becomes obvious that you up against one of those people, let them have it.

Here's a great coin I own, an 1808 quarter eagle. I love the piece, but it's financial loser. its highest value was over ten years ago. Since then, it has not done much, except drop and then recover a little. It's graded AU-50 in an old Green Label holder.

There almost no coins, tokens or medals in my collection which would fall into that category.

I've never understood the notion of "unfairly competing with customers." As a collector I know I'm competing with the entire marketplace including other dealers when I participate in auctions. I don't see how it matters if the dealers are competing to add inventory or their personal sets. If a dealer has my want list and I have a coin on it that the dealer also wants, and it walks into his shop and dealer buys it and doesn't offer it to me, I still don't see that he had or has any obligation to me, or that I had a shot at the coin to begin with. What am I missing here?

http://ProofCollection.Net

I've got a good number of coins in my primary non-US collecting interesting that presumably fall into the category covered by the theme of this thread. I've bought a disproportionate percentage of the better coins I'm aware of for 15 years. Yes, there is less competition, but only a tiny fraction of US coinage is harder to buy than these. When I look at Coin Facts, I hardly ever see the Condition Census with so few examples that a determined buyer with the money can't buy one fitting the sentiments of this thread in a "reasonable" timeframe.

I've owned some of these over 20 years and still waiting over 20 years for a few I wish I had bought to show up again. The three "name collection" sales of this segment since I've been a collector occurred in 1988, 1991, and 1996. Some might be in the TPG data now, some I might actually already own, but mostly, I either haven't or don't believe I have seen any of it. I presume to the extent it sold it probably traded privately.

I've never been a big budget collector, but this was behind my decision when I resumed collecting in 1998. My budget was lower than now, but prices might have increased even more for anything I really want(ed) to buy.

In my previous collecting iterations, I almost exclusively collected US coinage but have not since 1998 and never looked back.

I also did it by switching from one non-US segment to my current one in 2010. That market became too inflated with too many financially motivated buyers.

Sure, and then it depends on how you treat your collection. Apart from possibly upgrading later, my intention is to never sell this part of my collection, so the only reason cost comes into play is that if another example comes along at a way better price, I’ll lose out having bought the more expensive one. Otherwise, everything is money I’ll never see again, and that’s okay—I’ve already planned it that way.

There's a been a couple times where I wish I was the under bidder.

No need to thank me - I enjoy participating here (at least most of the time😉).

And I don’t think in terms of “little guys” or other such classifications. But rather, considerations such as good, helpful contributors, interesting, fun participants, etc.

Mark Feld* of Heritage Auctions*Unless otherwise noted, my posts here represent my personal opinions.