The 1989 Bubble

I’ve heard stories about the prices in 1989. I was collecting coins at that time, but was just a kid and not all that in to it at that time.

I’d love to hear stories about that period from anyone who was a dealer or collector then.

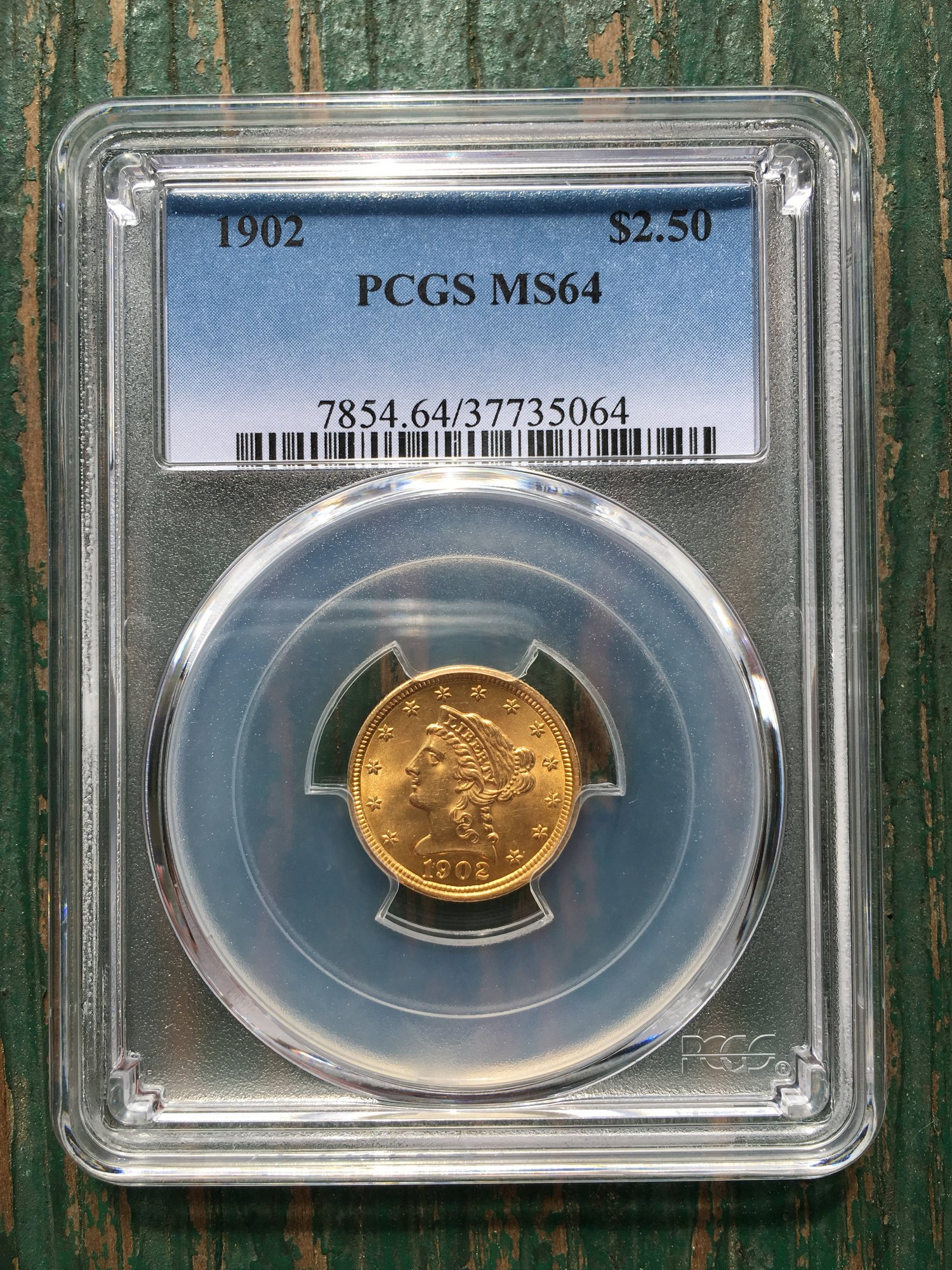

I picked up this beauty on Saturday for $460:

I’m astonished at how cheap this kind of material has become lately.

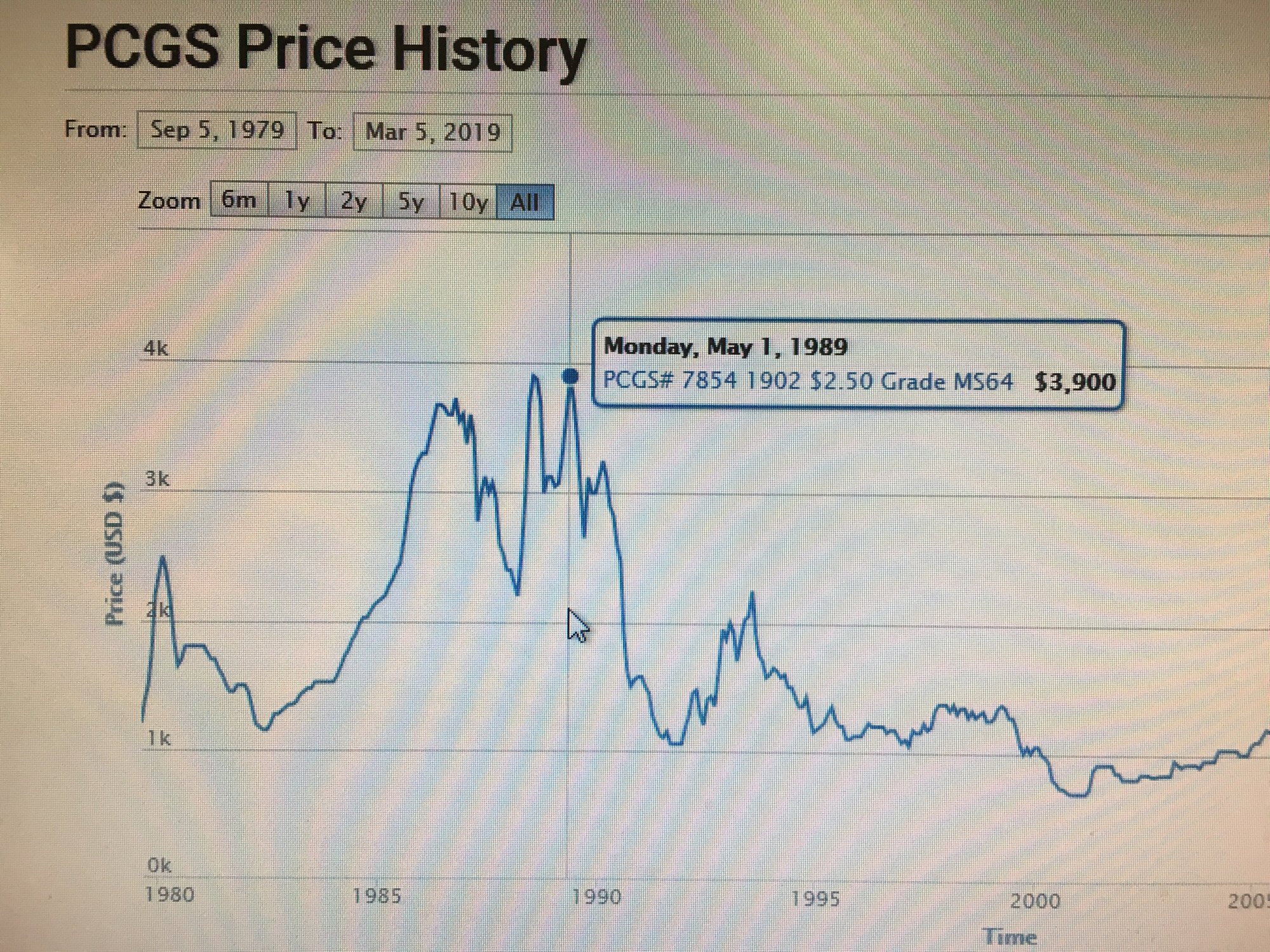

Just for my curiosity I checked the historic pricing to see this particular coin peaked in 1989. I mean this price is nuts!

Did they really fetch that kind of money then???

15

Comments

That's a very nice coin!

My recollection of that era (1989-1992) was that most of the frothy, visible speculation was in silver dollars (and to a lesser extent, classic Commems). And yes, there was a pretty hard crash that followed. I had a very nice 1902 2 and 1/2 $ Liberty in that era, but our Hosts did not happen to see it as genuine.

@BillDugan1959 Thank you!

Unfortunately I was really just a novice, still in middle school at that time, so I wasn't really up on the market.

I've heard about the certified Morgan dollars also being high around that time...

My YouTube Channel

I was not terribly active then, but I think a lot of money started flowing in as certified slabs got popular. Sort of like the Internet boom (and bust) c. 2000-2001. I was collecting raw, circulated "collector" coins so really didn't care.

But you have to keep in mind that a 64 then would probably be a gem today...

Very nice pickup @asheland and always interesting to see the price history of a coin. There were significant economic issues in the late 80’s: drought; big rise in the federal deficit; complete overhaul of the tax code; serious trade deficit; and a stock market crash to name a few.

One of my memories of that 'end of the market'

period is seeing Matte Proof $20's from the Garrett

Sale, I believe in March of '89 that were auctioned &

brought $80K-$90K each were almost unsalable a month

later, at the CSNS show where the market 'collapsed'

during PNG Day, and a few of them were offered at the

show for $45K, as I recall.

Lots of 'high market' / 'dead market' stories out there.

One of the seemingly fastest down markets ever seen in

coins.

It was crazy anything you bought you made money on. i remember buying ms65 franklins for $100 and walking them across the bourse floor selling them for $140 by the box easy money and as long as they were slabbed no one cared what they looked like

the crash was hard you couldn't buy stuff cheap enough

some of these coins still have not recovered i recall selling a nice delaware in ms65 for $1100 then are worth about 1/5 that now or less

Ike Specialist

Finest Toned Ike I've Ever Seen, been looking since 1986

A number of people advertised quite a bit, marketing coins as 'investments.' Morgans, Commems and Gold were the worst offenders.

"Seu cabra da peste,

"Sou Mangueira......."

Great thread! Keep it going.

I like that purchase @asheland. Should be good example as to why coins should not be bought as an investment? Factor in the purchasing power of a dollar in 1989, compared to today, and that should underscore point perhaps.

What event triggered the collapse of 1989? I was involved with paper money during that run-up/collapse period and didn't pay much attention to the coin market itself.

Fred, you are confusing the 1981 collapse at Central States in Iowa, caused by NERCG dumping coins they had just bought at Garrett to pay their tax bill, with the 1989 collapse at the ANA in Pittsburgh.

The 1981 collapse lasted for years, and then the market took off in the late 80's as slabs became accepted and there was talk of a mutual fund or something that was going to be buying tens of millions of dollars worth of coins but they had to be slabbed. Slabbed coins skyrocketed to stupid levels, and on the second day of the show word broke that the fund was not going to launch. Everything, slabbed or raw, fell to pre-bubble levels.

And now a story for the OP. I had married a lady from Chicago in 1986. During the Hunt Brothers silver bubble her father had sold a bunch of junk silver for good money, but then invested the money in classic commem halves that of course went down when that bubble collapsed. In 1989, as prices were skyrocketing, I told my father-in-law that now would be a good time to get out. I got the coins in fresh holders, prepared a list and had the coins and copies of the list in my briefcase on the flight from Chicago to Pittsburgh.

It so happened that I sat next to another dealer from Chicago that I knew. He asked if I had anything to sell and I said yes. I pulled the coins out and gave him a copy of the list. He pulled out a loupe and a Greysheet and started looking at the coins. He named a number that was very close to what I had in mind so I said yes, shook his hand and gave him the coins. THe next day on the floor he paid me for them. The next day the market died.

About a year later I found a copy of the list and did some figuring and figured that I could buy back the list for about one-fourth of what I had gotten for my father-in-law. He always thought that I was all right for his only daughter.

@CaptHenway you got out just in time!

Great stories everybody! Very interesting to read...

My YouTube Channel

I bought raw coins from reputable dealers in 1980-1981 but by 1983-1984, I sold my coins back to the same dealers for 30% loss. The coins were problem free, extremely attractive but I figured dealers need to make profit to continue to be in business. But I was not happy, was convinced that coin is a hobby, and I shouldn’t expect to break even in a short time and thus I left coin collecting after 1984. The last coin I bought in 1985 was $10 unc gold Olympic w mint mark in US Mint holder for $550 which I ketp until 2007. By 1999, I bought the same type 1984 Olympic gold in proof P-D-S mint marks for $210 each. Shortly after, I sent all 4 to PCGS for grading and the group came back as MS68 and PR68. In 2007, I sold all 4 coins for breakeven ($300 each).

I left the coin market before the introdution of third party slabs (anacs, ngc, pcgs). By 1990-1991, I came back to coin buying/selling for fun and I was able to buy very nice graded coins in PCGS & NGC holders and sold them a few years later for a little profit or breakeven. Since 1991 onwards, I felt more confident in my ability to pick nice quality coins in TPG holders. By 2005, I had acquired numerous better dates $20 Lib & Saints in MS64 which I believe is equivalent to MS65 today. One time in 1994, I paid $450 for a smooth surface virtually no bag mark PCGS 1915-S $20 in MS60. Could not understand why a coin that nice was given an MS60 grade.

I also paid $2450 for a beautiful 1907 $10 Indian no motto from Legend because I could not bring myself to paying $3500 for the same coin at Santa Clara coin show. But I regretted for not spending the extra $1000 because the Indian gold I encountered at the show was as good as any MS65. It was also in pcgs holder.

Looking back I’m glad that I left the market during its euphoria pre TPG but I do miss the time I could get any common date gold $20 Saints in premium condition (ms64) for less than $900.

I sold some coins for crazy money in 1989 but also I got stuck with some that turned out to be bought at the market's peak.

Churn and dump doesn't work when the sky is falling. :'(

Asheland: That was a good time to be a novice. The usual accompaning lack of funds at this stage may have saved you thousands!-Like paying $460.00 instead of $3900.00 for that gemmy quarter eagle!

I think the start of slabs PCGS had a lot to do with it. I worked in a shop when PCGS started and ran 100's of coins up to the only submitter in Seattle ( can't think of his name right now but he was a very popular guy back then). Took 3 months to get coins back. I watch people buy anything in the shop that was in a PCGS holder cost seemed secondary. It just kept snow balling up to $800 common MS65 Morgans.

The boom-bust was driven by two factors: initiation of independent authentication & grading, and opening of rare coin investment mutual funds.

The former were assumed to eliminate counterfeit and altered rare coins, while accurately and consistently grading them to established standards (ANA Guide). This was going to supply quantities of identical (i.e., "stock-like") rare coins that would then fuel sale of mutual fund shares in rare coins.

Marketing type people with no knowledge of coins, authentication, grading or collector appeal seemed to be pushing this nonsense program. Early operation drove up prices so that common Morgan dollars in "MS-65") were trading at high prices.

The whole enterprise failed due to limited supply, inconsistent grading, competition of mutual funds with coin collectors, and the inability of fund managers to turn shareholder profits. (There weren't enough MS-65 Morgans or other coins to supply a week's trading.) Mutual funds closed, prices collapsed and traders went back to stocks bonds and other financial instruments. An outgrowth was the gradual rise of hedge funds.

In 1989 I was working in Florida, but about to make a major career move to Seattle...which I did. It was a brief hiatus from coins, about a year - filled with moving, housing, new job/company/state/city....Probably fortuitous since I did not buy any over priced material and therefore suffered no major loss when it crashed.... Cheers, RickO

Cheers, RickO

Correction: ANACS started authenticating coins in the early 1970's. It started grading coins in March of 1979.

I believe you are referring to the initiation of slabbing, in 1986. This wonder drug would free investors from the need to actually look at the coins they were buying, since every MS-65 Morgan dollar would be exactly like every other MS-65 Morgan dollar.

Yes. I should have been more specific. Grading and encapsulation was supposed to make all "MS-65" coins the same "value" and equal, just like shares of common stock.

I seem to remember a time that Coinworld and other magazines were talking about how undervalued Morgan dollars were since the crash.

I just missed the peak and was apparently looking at the bottom.

Recently passed on a Buffalo nickel this weekend and was dealing with remorse. Checked old issues of greysheet from 2006 and 2011 and found out nothing had changed. Same price within $40+/- !

BST: KindaNewish (3/21/21), WQuarterFreddie (3/30/21), Meltdown (4/6/21), DBSTrader2 (5/5/21) AKA- unclemonkey on Blow Out

Mornin' All -

Tom, I -am- talking about the April 1980 Central States Show

held in Lincoln Nebraska. (not 1981 in Iowa).

That's my memory of the show - although the market was

a bit shaky in the weeks before, it literally 'stopped on a dime'

the very first day - PNG Day. Died. Dead. Shook everyone.

The market was quite Hot during 78-79, and large monthly

price increases were normal, due to the money flowing into

the market by various sources.

The market was still down and lackluster a year later, of course.

I was collecting circulated type and some early copper around 1989. The "bubble" was mostly limited to slabbed MS coins. Those who collected circulated early copper, bust halves, and other collector coins had fairly stable prices in that period. It would have been a great time to buy and hold circulated early dollars and early gold.

1989 was a great time to lose money investing in rare coins. The Athena find did get established, but with ancients. It's failure a year or two later prompted Merrill Lynch, I think them, to refund all monies invested.

It was a great time to buy large cents, and early circulated dollars BUST coins etc. 10 piece Carson City type set coins all of which I made money on. Most high grade common rare coins Morgan's Mercury dimes, etc. Sold for multiples of their true value.. I was at NGC when JA owned it. I saw a cart , a flatbed push cart with at least 1000 MS 65 Morgans I was young it was a real eye opener.

Rare Coins are rare coins, not all rare coins are Rare

nice score asheland, I like. I wish I could g back in time and get many ounces of gold at $400 an oz. oh well just as well and time marches on

@Soldi +1000 Best comment of 2019 to date!

Bought a lot in 86-89 with invent of slabbing, started taking tables at shows in 1990. Took some hits but bought stuff back much cheaper. Many players driven into bankruptcy, divorce, or both. Others who paid high prices on many coins, felt burned, never returned to numismatics. Many of these went to stock market.

After the crash amazed how cheap stuff was but a lot of it even cheaper today.

In retrospect 1990 after crash would have loaded up more on world gold close to melt, AGE, ASE, US large size currency.

The market was still down in 1982. I recall going to the Fall Michigan State Numismatic Society show that year with the intention of selling or trading some coins. I came back with everything. I couldn't sell or trade. The market was just plain dead.

In the case of US coins, very, very few coins are rare. If you have the money, you have the coins.

There was also a quite bad recession in 1982/3 which did not help matters any.

There wasn't a lot of cash floating around.

I remember buying a lot of stuff in those years that seemed very "cheap" but I was still using 1979/80 levels as the basis for my valuations.

The 1982 recession, while largely forgotten today, was quite severe. I remember it as the time when business lunch drinking began to fall out of favor. Many of the employees and reps who were well known for being useless after lunch due to too much drinking were let go. After that, business lunch drinking declined very noticeably, at least in the area where I worked.

I was at the 1980 CSNS show in Lincoln. I did not know that the market had collapsed. I had been trying for a couple of years to buy , from a major paper money dealer, a very nice and rare $50 1882 BB . The price had been too high. The dealer had been lowering the price each time that I had seen him. I asked the price this time. He asked what was the lowest price that he had quoted me. I said $2400. He then quoted me $2200. I said that I would flip a coin for $2000 or $2200. He agreed. He flipped a coin and I called heads. Heads it was. I paid him $2000. I still have the note. It is worth many times what I paid.

PNG Day 1980. A day of triumph for me; the first of my Mercury Dime articles published in the GreySheet. That day was chilly. I had no idea what was going on, but everyone seemed to be in the same space. I got on the next plane to NY, sold the whole group (about $150K) for $110K to a guy in Spring Valley. and could have bought in six months to years later for _bupkis. Maybe $50K.There is no truth to the story that @MrEureka and I flipped a quarter there and by the time it came down it was a dime.

In 1982, the market switched on. I believe, on the second day of ANA. The stock market reversed and some people were very aggressive. I remember selling an 1880-O $1 to Greg Roberts (then with Hannes Tulving) for $1,000 that I had paid $110 for in an auction.two days previously.

in !989 I had sold my entire inventory to Martin Paul at 3% over bid at the Atlanta (?) show. I was brilliant enough to re-invest by paying big premiums for very rare gold. Very brilliant :'( Fred and I still value the many pleasant hours spent trying to sell the (Kruthoffer?) 1911-D $10 MS63, which Martin Paul finally dipped to a semi-white 64). Which, by that time, was worth 63 money.

And I thought losing $500 on a coin was a real catastrophe!

I remember it as the time when business lunch drinking began to fall out of favor. Many of the employees and reps who were well known for being useless after lunch due to too much drinking were let go. After that, business lunch drinking declined very noticeably, at least in the area where I worked.

This is the true tragedy!

One of the interesting things about the crashes of 80 and 89 is that everything didn't crash all at once. I remember how in 1980 early type had a nice little run up for a number of months even as virtually all not-especially-rare "investment coins", e.g. proof type, were collapsing. I wasn't a market insider at the time, but it seemed like some of the money that hadn't been lost was in search of a safe haven somewhere in the market. As for 1989, again, it was the not-especially-rare "investment coins" that collapsed, but many seemingly solid value rarities, e.g. 1794 Dollars and pioneer gold and patterns, held their value well into 1990. But by late 1990, there was no place left to hide. The lesson, I suppose, is that you can't outrun a bear market. Best to just get completely out of its way.

Doggedly collecting coins of the Central American Republic.

Visit the Society of US Pattern Collectors at USPatterns.com.

One of my great regrets in this business is that I missed the 1980 Central States show. It would have been fascinating to witness the market turning on a dime. Probably won't happen again in my lifetime.

Doggedly collecting coins of the Central American Republic.

Visit the Society of US Pattern Collectors at USPatterns.com.

Interesting stuff to read... I also see prices were pretty high at least for gold type in 2006. Does anyone know what the deal with that was?

My YouTube Channel

Like a few others here, for me, the market crash in 1989 didn't happen all at once either.

I think it had to depend on what part of the market you were playing in.

I had my feet in between collecting and vest-pocket dealing, mostly in MS65 Morgans and classic commemoratives.

A few snippets: I found a OBW roll of 1880-O dollars that we opened. Bought that in 1983 but sold it in 1989 for 4x since half that roll would have graded MS65. My partner was very pleased since the check was a significant part of his down payment for his first house.

For me, a bellwether indicator of the commemorative bubble was the 1988 auction at Superior of the Peter Shaffer collection. He had a complete 144 set of commems that were either the highest grade or amongst the highest grades. For example, lot 1055 was an Isabella quarter in NGC MS66 that hammered for $13450 (including the 15% buyers premium). Back then, this was the highest grade and since I didn't keep the population reports from that time, I'd have to guess that the total population of MS66 (PCGS and NGC) was probably less than 10.

Lot 1066 was an 35-S Arkansas in MS65 that went for $1980, total MS65 population less than 10. And so on. This had to be some of the highest prices realized for classic commems. While many of the coins in this auction were top grades, they weren't always the best in eye appeal. Within two years, there was a flood of newly certified commems and then the commem market was never the same.

I escaped the crash, but just barely. In 1989, I thought I was the smartest guy out there and bought a few coins at a spring Long Beach to bring to the ANA up in Seattle. For instance, I found a raw 1936 red proof Lincoln cent that I made at PR65 and a few MS65 DMPLs Morgans. I had a few other coins in my collection but my inventory was pretty low.

When I got to the ANA in Seattle, you could almost smell the panic in the air. Instead of being able to off-load the Lincoln at blue sheet, I barely got away with only a 10% gain. The DMPLs were also sold but just barely at 10% above my cost. Instead of paying for my honeymoon, I was grateful just to offload those coins! If I had held onto those coins, it would have taken me 3 years to unload those coins and I might have got 25% of my cost!

Very interesting stories. Thanks for sharing and for starting this thread. It sounds like the coin market was a lot more exciting back then.

LIBERTY SEATED DIMES WITH MAJOR VARIETIES CIRCULATION STRIKES (1837-1891) digital album

If there's no TOS violation against resurrecting a 4-year old thread , let me add my 2 cents:

, let me add my 2 cents:

(1) The big difference between the 1980 and 1989 Bubbles IMO was the underlying price of gold and silver. In 1980, the metals were also in bubbles having risen 20-fold in less than a decade. Any coins with gold or silver were naturally dragged upward. This dragged up pure numismatic coins without bullion, too. But as this was before the TPGs, premiums to underlying metal content, while rich, were not in Nutso Land for many gold coins. Maybe 150-200% or so.

(2) In 1989 you had the promise of the TPGs underlying a belief that prices would go up and up. Premiums as the OP showed were tremendous, 700-900% for Saints and Morgans (which always traded at big premiums to the silver content) had tripled or more in price after the Stock Market Crash of 1987 by late-1988/early-1989.

(3) There was a belief that TPG certification would lead to "sight unseen" bids and increased liquidity. But dealer capital was never deep enough to make bids for dozens or hundreds of coins 24/7. When sellers appeared, what should have been a correction turned into a bloodbath.

(4) Wall Street $$$ (I actually sat through a marketing presentation by one of the funds) did enter in a small amount but the promised larger $$$ did not materialize. But that belief it would in 1988 and early-1989 clearly led to panic buying of what collectors/dealers thought would be the most targeted coins (generic commons and those with great liquidity or perceived liquidity).

(5) Lots of "weak hands" had entered the market, believing that prices for coins would keep going up...scared of stocks by the 1987 Crash....believing that another decade of rising prices and economic troubles (like the 1970's) was headed our way. They chased prices upward for almost 2 years and then were left holding the bag.

Next year will be the 35th Annivesary of the Coin Bubble popping.

I assume the super tight grading we've seen with NGC and PCGS and to a much lesser degree Anacs originated in the early era of TPGs. Many of those coins ended up much higher holders or with gold stickers. It would be curious to hear JA's, David Hall or Mark Salzburg's stories of that era.

I haven't seen too many articles or columns on that era. Maybe some of the coin magazines or The Numismatist had pieces but what I saw was stuff copied from newsletters (which were extremely popular at the time) like Burton Blumert's famous piece.

Many people here were active collectors or dealers. I guess there's not much to say, they survived the Crash or else they would have left the business/hobby long long ago. I suspect that the worst catastrophe's were people who loaded up near the highs, esp. on borrowed $$$.

Late 1980's a dealer in a chandelier lit office offered a raw 1893 Colombian Expo for $8000.

Not a collector but found the reverse to be fascinating. Respectfully passed on his generous offer.

Reallized a decade later that they are essentially bullion in lower grades.