Best Of

Re: Where is the unopened market heading, Up 20% or Down 20%?

@1982FBWaxMemories said:

I was once in art related hobby where the prices on vintage items increased so much that most exited. It has become a hobby that now everything is protection priced and most of the action is a few individuals trading amongst themselves.As West22 said there no tax benefits of unopened/ In the long term if you are beating the S&P 500 by 20% (accounting for inflation and all auction house cuts are factored in) then I'd agree with calling it a solid investment but only if that is the case.

Agree there. When I was younger I had more money in cards than in stocks. It sounds crazy but I was saving everything I could and had a lot tied up in real estate and starting a business, so I dabbled in cards for fun with the little I had and didn't start investing in the stock market until I had paid down my mortgages and business debt. Now the vast majority of spare funds I have go into retirement accounts and experiences with my kids, and then lastly cards as a hobby. I have daughters who would rather play with American Girl dolls so the cards really do take a backseat these days.

Cards can't come close to comparing to real estate or stocks when it comes to tax advantages, unless you do it as a business and that's a whole other ballgame that I'd rather not delve into. So as FBWaxMemories said, there's at least a 20% hurdle for cards to outperform. If I sell a $200 box on eBay there is so much slippage it's insane, especially since USPS raised rates again this year. I know some high volume sellers get preferential fees on eBay but as a lower volume Top Rated Seller I pay 12% on the hammer price plus 12% of the sales tax for whatever state the buyer is from. So that 12% is often 14% (or more if you're not a Top Rated Seller). So conservatively knock $28 off the hammer price and another $12-$15 for shipping, and that's around 21% off your net. And that's all before you get a 1099 at the end of the year from eBay.

My uneducated opinion is that 80% of the price appreciation in vintage cards and boxes is due to the growth in wealth level of the boomers, who are the largest demographic among card collectors. The other 20% was due to a variety of factors, among them: a pandemic hobby boom, smaller collecting demographics such as Gen-X and millennials getting to higher income levels, and finally, the investing public broadly seeking out alternative investments such as fine art, collectibles and crypto. I observe high correlations between these markets as they all compete for excess capital that is separate from retirement and brokerage stock accounts.

As long as these broader wealth effects trends continue then I believe cards will continue to appreciate despite some collectors leaving or dying off. If you want to play demographic trends rather than investing in the tried and true blue chips such as Mantles, vintage graded, vintage unopened, MJ, Gretzky, then clearly Pokemon and modern seem to be fast growing options among youths, as well as MTG. I've observed strong price appreciation and growing levels of participation in these areas but you would need a wide breadth of knowledge regarding these markets as (my opinion) they are the most volatile. As a millennial and non-participant I may not be the greatest expert on this one so someone please correct me if I'm wrong.

West22

West22

Re: How did you feel when you found coins you were looking for every day for years and years (or more)?

Unable to participate in this discussion from a world coin perspective…..but certainly can from various US endeavors.

My first serious collecting pursuit was a PCGS Everyman Barber Quarter registry. I was committed to putting the entire set together in AU grades, minus the Big 3 which I simply couldn’t afford to acquire at that grade level. However I did force myself to include the 1909-0, which is an absolute bear at the XF/AU level. That fact is a bit more widely known now than it was when I was putting my set together.

About 2-2.5 years into putting my set together, I was presented with an opportunity to purchase an AU50. Frankly not an attractive example, but I was so deep into the hunt and so fixated on filling that hole in my set that I was blinded to the simple fact that the coin was not appealing. I absolutely knew to “buy the coin, not the holder” at that stage in my collecting journey, but I broke that cardinal rule because there were 8 PCGS graded AU examples extant at the time (something like 5 at NGC…..all washed out fwiw) and I didn’t know if/when I’d ever have the chance to buy another one.

So I stretched myself very thin to buy it.

In all honesty, I never really enjoyed that coin. I’m a person who likes to get my coins out and play with them a lot, and I’m not afraid to study the same coin under magnification 1000 separate times. I have a strong preference for original surfaces and that coin had clearly been dipped. The detail was more like XF49 but it had been squeezed into a PCGS AU holder and in hindsight that was what had me so excited and willing to (over) pay up. I was buying rare plastic to fill a self created “need”.

Breaking up my set and auctioning that coin off (at a loss) was a pretty big lesson for me. It was beyond “buy the coin, not the holder” tbh. The end result is I have probably pursued my last date/mm set of any coin series. I’d much rather have a stash of appealing coins that I love individually than feel beholden to adding coins to my collection that I don’t really love.

Most importantly, it taught me to stay a lot more patient, and I learned that conditional rarity isn’t nearly as important to me as overall appeal. The thrill of the hunt should probably should not supersede the thrill of ownership……for me, anyway.

MEJ7070

MEJ7070

Re: Where is the unopened market heading, Up 20% or Down 20%?

I was once in art related hobby where the prices on vintage items increased so much that most exited. It has become a hobby that now everything is protection priced and most of the action is a few individuals trading amongst themselves.

As West22 said there no tax benefits of unopened/ In the long term if you are beating the S&P 500 by 20% (accounting for inflation and all auction house cuts are factored in) then I'd agree with calling it a solid investment but only if that is the case.

Re: Has anybody bought any nice raw coins lately

I bought this one raw about a month ago...

PCGS just graded it VF25 and I received it back last week.

Meltdown

Meltdown

Re: 1914 El Salvador Peso Press Release

@Boosibri Ive been lurking on these boards since you were doing dirty old US gold.

I’ve always found your pursuits to be very interesting……and your willingness and ability to research very inspiring. I know there are many others who agree with me.

Always appreciate you sharing your coins and insight!

MEJ7070

MEJ7070

Re: Chop marked Mexican 8 Reales and Peso newps……let’s see some CHOPPED world coinage!

@genosse said:

Very interesting - the top coin in the photo is a contemporary counterfeit.

Does it have a copper core with silver plating?

I haven't had a composition test done, but it does appear to be a base metal core with a silver wash; the nonsense date is also neat.

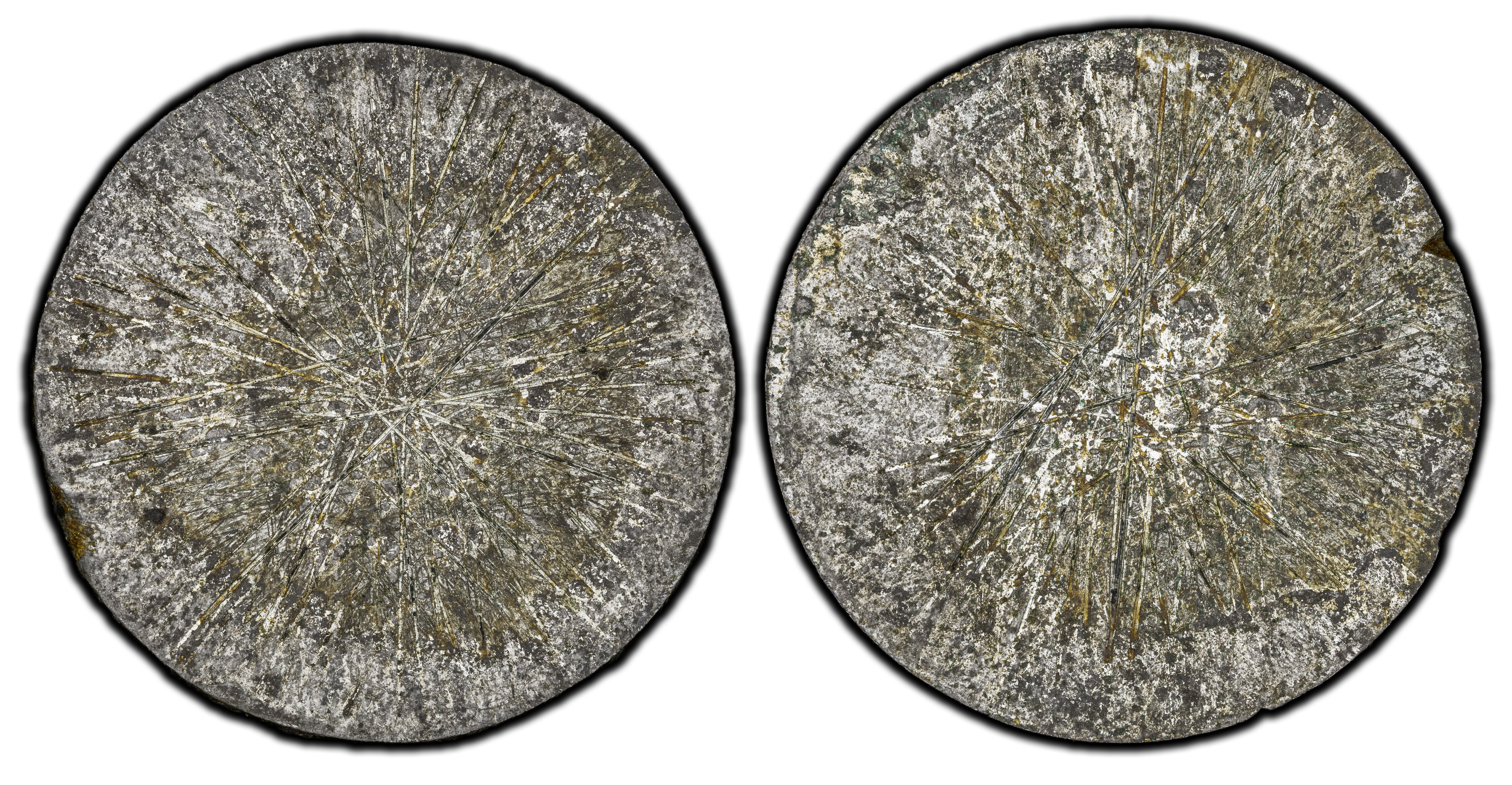

Chopmarked contemporary counterfeits are their own collecting niche, there are many different types and they share a theme with authentic coins, given that chopmarks were a way to combat counterfeits. Some of them are domestic Chinese imitations in good silver, which could circulate alongside the genuine article, but most were intended to deceive, such as these lead-core counterfeits made from hollowing out genuine Eight Reales; the first images are the exterior and interior of the shell (each made from authentic coins), and the third is the lead core.

Re: Three Day GTG - Coin 12 Ends 9-3 - REVEALED MS64

@JBN said:

Toning is even over the whole shield, so the trouble could be as minted.

I go w/UNC Details. Shame, but a common date.

This is a straight grade CAC coin (as are all coins for this experiment), feel free to guess again.

FlyingAl

FlyingAl

Re: 1837 LM-5 Capped Bust half dime in PCGS 63 Prooflike makes a tenfold gain

So much for due diligence

Maybe someone will be looking for a refund

Re: 1837 LM-5 Capped Bust half dime in PCGS 63 Prooflike makes a tenfold gain

@Bikergeek said:

This coin sold in February 2020 for $2,160. Now it's sold for $21,600.Can someone help me understand why?

I think the most likely explanation, by far, is that at least two bidders thought the coin was a Proof. And if so, that they didn’t see it before the previous sale.

MFeld

MFeld