Family member just offloaded a bunch of .999. They were given 15% back of spot. Doubt they would have even considered .925/.900 etc. but who knows.....None the less it was a good time to re-educate him on the absolute beauty of the SLV. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

@blitzdude said:

Family member just offloaded a bunch of .999. They were given 15% back of spot. Doubt they would have even considered .925/.900 etc. but who knows.....None the less it was a good time to re-educate him on the absolute beauty of the SLV.

Family don't let family sell .999 for $49.30 when spot is $58.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

@blitzdude said:

Family member just offloaded a bunch of .999. They were given 15% back of spot. Doubt they would have even considered .925/.900 etc. but who knows.....None the less it was a good time to re-educate him on the absolute beauty of the SLV.

Family don't let family sell .999 for $49.30 when spot is $58.

I don't know what spot was at the exact moment, but they got $50 flat. Generic rounds, fantasy tokens etc. Nothing that would interest me. I gave my opinion, and they did what they did. I can tell you one thing, I wish all my physical .999 was paper SLV in this current environment. Much easier to manage. I know you've done well. Good luck and hope it continues. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

@blitzdude said:

Family member just offloaded a bunch of .999. They were given 15% back of spot. Doubt they would have even considered .925/.900 etc. but who knows.....None the less it was a good time to re-educate him on the absolute beauty of the SLV.

Family don't let family sell .999 for $49.30 when spot is $58.

I don't know what spot was at the exact moment, but they got $50 flat. Generic rounds, fantasy tokens etc. Nothing that would interest me. I gave my opinion, and they did what they did. I can tell you one thing, I wish all my physical .999 was paper SLV in this current environment. Much easier to manage. I know you've done well. Good luck and hope it continues. RGDS!

Your family got screwed. God Bless America. And don't tell us that's all they could get. 15% back of spot for .999 LOL THEY GOT SCREWED

@blitzdude said:

Family member just offloaded a bunch of .999. They were given 15% back of spot. Doubt they would have even considered .925/.900 etc. but who knows.....None the less it was a good time to re-educate him on the absolute beauty of the SLV.

Family don't let family sell .999 for $49.30 when spot is $58.

I don't know what spot was at the exact moment, but they got $50 flat. Generic rounds, fantasy tokens etc. Nothing that would interest me. I gave my opinion, and they did what they did. I can tell you one thing, I wish all my physical .999 was paper SLV in this current environment. Much easier to manage. I know you've done well. Good luck and hope it continues. RGDS!

Your family got screwed. God Bless America. And don't tell us that's all they could get. 15% back of spot for .999 LOL THEY GOT SCREWED

That's why they call it life in the gutter. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

I’d be happy to pay 15% below the market price, and just as happy to pay the banker 10% on the note to do it. Capitalism and usery at its finest. It’s not a crime.

Elemetal has been back to buying for weeks. I started a thread https://forums.collectors.com/discussion/1118265/a-major-refiner-wholesaler-is-back-to-purchasing-alloyed-silver-925-900-and-400#latest

but it got no tread or traction. In spite of that, some like paper, some prefer plastic. Me ? metal is my preference. Silver at $50 or $60 or $100. Gold at $900, $2000, or 5k….. copper and nickel, not so much. But even that ( as a commodity) is money, too. How hard does a guy want to work ? Blitz plays hard with and for his. Some of us are workin’ stiffs.

My local refiner told me they weren't buying silver until after 12/1/2025. Too jammed up. Today I checked in and they are not buying anything until after 2/1/2026.

No problem - just sold the equivalent amount in SLV and keeping the physical silver as a long term investment.

@DisneyFan said:

My local refiner told me they weren't buying silver until after 12/1/2025. Too jammed up. Today I checked in and they are not buying anything until after 2/1/2026.

@DisneyFan said:

My local refiner told me they weren't buying silver until after 12/1/2025. Too jammed up. Today I checked in and they are not buying anything until after 2/1/2026.

No problem - just sold the equivalent amount in SLV and keeping the physical silver as a long term investment.

Hedging it like the BIGS. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

@DisneyFan said:

My local refiner told me they weren't buying silver until after 12/1/2025. Too jammed up. Today I checked in and they are not buying anything until after 2/1/2026.

@DisneyFan said:

My local refiner told me they weren't buying silver until after 12/1/2025. Too jammed up. Today I checked in and they are not buying anything until after 2/1/2026.

Here in Germany I went to two dealers to ask for their prices. They accept any alloy:

1st dealer: 98% for 999+ fine silver bullion, 80% for any other silver alloys, 97% for 999+ gold bullion and 96% for scrap gold (they pay extra for the silver content of the gold alloy).

They pick through the stuff to set aside better coins and jewellery for them selves.

2nd dealer: 93% for silver (any kind) and 99% for gold (any kind).

All metal will go to the refinery unsearched. Bullion, high end jewellery, numismatic coins - it does not matter, it all will go to the smelter.

Today I stopped at our local dealer, one of Coin World's Top 100 influential, to get a feel for coin shop bids for 90% silver.

If I had $1,000.00 face value to offer, their offer was $38 per $1. Otherwise, $30 per $1.

.

That is not good at 30x. Current melt is theoretically 44x. That would be about 32% under melt for $999 (or less) face value.

Ask them what they sell it for.

Perhaps this is more of a numismatic dealer than a bullion dealer ?

Recent sales of small lots of 90% silver on eBay are about 40x to 42x. Minus the eBay fees that is still a net of about 35x to 37x.

One major dealer on the internet currently has a buy offer of about 39x for large lots.

Refiners and LCS are afraid to get caught in a “Hunt Brothers” type correction while they are holding large quantities of Silver. Once the bottleneck eases and the price stabilizes they will normalize their buy prices. In January I was estimating my 90% at 22X-24X and now the offers I’m seeing are at 35x-38x. I’m not a seller but it’s been a great year for all PM’s.

JMHO,

Mike

Selling at 38.5 is the equivalent of silver at $54. Thats a 12% discount to spot. Is that acceptable to you?

A 12% discount to spot isn't the whole story.

It makes no difference that the equivalent of silver is at $54 on the sell side when the equivalent of silver is $57.87 on the buy side (which is a nice discount to spot). Since I've been buying at that level and below, I'm willing to accept a 7.1% buy/sell spread.

Suggesting that a 12% discount is in play on the sell side without mentioning the 5% discount on the buy side is a misrepresentation of reality.

In recent days, silver has shown price increases of 3% and even 5% in one day. A 7% buy/sell spread is easy to overcome at those rates.

Now is a reasonably good time to buy 90% silver.

Q: Are You Printing Money? Bernanke: Not Literally

That is not good at 30x. Current melt is theoretically 44x. That would be about 32% under melt for $999 (or less) face

Recent sales of small lots of 90% silver on eBay are about 40x to 42x. Minus the eBay fees that is still a net of about 35x to 37x.

.

Hmmm...kinda puts that ETF annual fee into perspective doesn't it?

Theoretical value of 44 and net of 36, for an 18% discount. Thats like, what, the equivalent of 30 years worth of 0.50% annual fee?

.

It is very, very simple:

If people are selling at 36x, then buy at 36x, not 44x.

That shouldn't be so hard to figure out, but I guess it is for some "folk".

And if you buy at 36x, eventually premiums could normalize on 90% coin and and net you a better gain than SLV (which only has a declining premium).

Selling at 38.5 is the equivalent of silver at $54. Thats a 12% discount to spot. Is that acceptable to you?

Well, to paraphrase an old proverb '...The best time to buy is when blood is running in the streets...' When people need to sell - buy at the lowest price they are willing to sell for.

But in defense of the shops, they don't have retail demand to absorb all the alloy being offered, so they have to ship it to a refiner. The refining process takes time, so the refiner is not willing to lock in a buy price until the silver is refined and they aren't sending the shop money until the silver is sold. I can't blame them - silver has a nasty habit of falling off cliffs...

That is not good at 30x. Current melt is theoretically 44x. That would be about 32% under melt for $999 (or less) face

Recent sales of small lots of 90% silver on eBay are about 40x to 42x. Minus the eBay fees that is still a net of about 35x to 37x.

.

Hmmm...kinda puts that ETF annual fee into perspective doesn't it?

Theoretical value of 44 and net of 36, for an 18% discount. Thats like, what, the equivalent of 30 years worth of 0.50% annual fee?

.

It is very, very simple:

If people are selling at 36x, then buy at 36x, not 44x.

That shouldn't be so hard to figure out, but I guess it is for some "folk".

And if you buy at 36x, eventually premiums could normalize on 90% coin and and net you a better gain than SLV (which only has a declining premium).

.

Last I looked, MONEX is selling $1,000 bags at $43.3 X face.

Wnat would normal premiums be on 90% coin?

Keep in mind SLV is just a trading vehicle, not a long term holding.

Popular LCS in my general region is buying CULL 90% dollars at $40 and selling at $43

Dimes, Quarters, and halve 90% they are buying at SPOT -$7 and selling for SPOT -$5

That is todays pricing. THis is who I use to gauge the 90 market as he has a long history does a public update almost every business day.

That is not good at 30x. Current melt is theoretically 44x. That would be about 32% under melt for $999 (or less) face

Recent sales of small lots of 90% silver on eBay are about 40x to 42x. Minus the eBay fees that is still a net of about 35x to 37x.

.

Hmmm...kinda puts that ETF annual fee into perspective doesn't it?

Theoretical value of 44 and net of 36, for an 18% discount. Thats like, what, the equivalent of 30 years worth of 0.50% annual fee?

.

It is very, very simple:

If people are selling at 36x, then buy at 36x, not 44x.

That shouldn't be so hard to figure out, but I guess it is for some "folk".

And if you buy at 36x, eventually premiums could normalize on 90% coin and and net you a better gain than SLV (which only has a declining premium).

.

Last I looked, MONEX is selling $1,000 bags at $43.3 X face.

Wnat would normal premiums be on 90% coin?

Keep in mind SLV is just a trading vehicle, not a long term holding.

.

Cut out the middleman. Buy from people that are selling, not from dealers with wide spreads.

Yes, SLV is a very poor choice for a long-term holding because half a percent of your holding would evaporate every year.

I would say that a "normal" premium for 90% silver coin is about 2%. But 90% coin is currently selling for 36x when "melt" is 44x. At some point, it will sell for closer to the melt value. A share of SLV ALWAYS declines relative to the "Spot" price.

Also,

if tomorrow the spot price of silver dropped to $40, the full amount of that loss ($20) would be experienced by SLV holders.

But it would be pretty likely that people would stop selling 90% coin at $40 spot as much as they have been at $60 spot, And that would cause the premium on 90% coin to increase. This would insulate the holders of 90% coin against some of the losses.

If spot declined from $60 to $40:

SLV holders would lose the full 33%.

90% coin might go from the current 36x (discounted to $60 spot) to 29x (at par with $40 spot).

Holders of 90% coin would lose 20%.

"Refiners have been inundated with material, partly due to Americans liquidating silver assets in response to high prices. However, the true breaking point has been a massive surge in silver lease rates—the interest rate paid to borrow physical silver. In normal times, refiners borrow silver or cash at low rates to finance the metal while it is being processed."

Like Taxmad said earlier, best time to buy (if you believe the silver run will continue) is when blood is on the street. Less than .999 is having a fire sale.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

if tomorrow the spot price of silver dropped to $40, the full amount of that loss ($20) would be experienced by SLV holders.

But it would be pretty likely that people would stop selling 90% coin at $40 spot as much as they have been at $60 spot, And that would cause the premium on 90% coin to increase. This would insulate the holders of 90% coin against some of the losses.

If spot declined from $60 to $40:

SLV holders would lose the full 33%.

90% coin might go from the current 36x (discounted to $60 spot) to 29x (at par with $40 spot).

Holders of 90% coin would lose 20%.

The key to remember it's good to have both in a diversified investment portfolio. If spot declines, neither are forced to sell. At least at this point in time SLV holders could get full value for their short term holdings - the spread between the bid and ask is one cent. And remember it was bought at a discount from spot. The cost of holding SLV is 1/2% annually or .0042% monthly.

Thanks for the info that the "normal" premium for 90% silver coin is about 2%. I trust that is what dealers will pay for it.

the true breaking point has been a massive surge in silver lease rates—the interest rate paid to borrow physical silver. In normal times, refiners borrow silver or cash at low rates to finance the metal while it is being processed."_

>

Why do refiners borrow silver to finance the metal while it is being processed?

the true breaking point has been a massive surge in silver lease rates—the interest rate paid to borrow physical silver. In normal times, refiners borrow silver or cash at low rates to finance the metal while it is being processed."_

>

Why do refiners borrow silver to finance the metal while it is being processed?

They hedge their production, similar to miners. If I just bough 100,000 ounces of 90% at $50, I can sell a percentage of that at $60 by borrowing that amount from a bullion vault. Once processed, I can return the metal, sell any I didn't hedge, pay my expenses (including the fee to the bullion vault) and have a profit - even if melt is down to $55.

Last I looked, MONEX is selling $1,000 bags at $43.3 X face.

I can buy a $1,000 bag locally at $41.38 x face. Monex is overpriced.

Wnat would normal premiums be on 90% coin?

The premiums have ranged from -5% (now) to as high as 12% (a couple years ago). The premiums fluctuate. A more relevant basis for price shopping is the buy/sell spread, which reflects the dealer's own position and willingness to transact.

Keep in mind SLV is just a trading vehicle, not a long term holding.

SLV is for tourists who are only along for the short ride and really don't follow the fundamentals. That's my opinion.

Q: Are You Printing Money? Bernanke: Not Literally

SLV is for tourists who are only along for the short ride and really don't follow the fundamentals. That's my opinion.

All PM ETFs are great tools for someone who does follow the fundamentals and who wants a quick, cheap and easy way to get in and out of the market with the least amount of hassle. Most PM ETFs have leaveraged (short) and inverse (multiples) trading "partners" that can allow a successful PM fortune teller to make money in both market directions.

A smart PM stacker will also use ETFs (such SLV) to either hedge their stack or take advantage of short term speculation.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

That is not good at 30x. Current melt is theoretically 44x. That would be about 32% under melt for $999 (or less) face

Recent sales of small lots of 90% silver on eBay are about 40x to 42x. Minus the eBay fees that is still a net of about 35x to 37x.

.

Hmmm...kinda puts that ETF annual fee into perspective doesn't it?

Theoretical value of 44 and net of 36, for an 18% discount. Thats like, what, the equivalent of 30 years worth of 0.50% annual fee?

It is very, very simple:

If people are selling at 36x, then buy at 36x, not 44x.

That shouldn't be so hard to figure out, but I guess it is for some "folk".

And if you buy at 36x, eventually premiums could normalize on 90% coin and and net you a better gain than SLV (which only has a declining premium).

.

Lol. "If", "could", "eventually". Haha. For years you folk said buy at spot or even pay premium. Now we folk are supposed to accept 85% of spot? Well, crack me a corncob pipe. Lol

And y'all made fun of blitz for buying at spot and selling at spot. Bizarro world indeed.

Folk are having to call all around the country to find an acceptable counter-party. I am loving all this unfold, as expected.

I cant wait till it hits 225 and y'all are wondering why you cant get more than 150 for it.

@jmski52 said: Last I looked, MONEX is selling $1,000 bags at $43.3 X face.

I can buy a $1,000 bag locally at $41.38 x face. Monex is overpriced.

But only sell it for 36x. Solid strategy. Lol

Wnat would normal premiums be on 90% coin?

The premiums have ranged from -5% (now) to as high as 12% (a couple years ago). The premiums fluctuate. A more relevant basis for price shopping is the buy/sell spread, which reflects the dealer's own position and willingness to transact.

Don't pay premiums. Period.

Keep in mind SLV is just a trading vehicle, not a long term holding.

Actual returns would prove you wrong.

SLV is for tourists who are only along for the short ride and really don't follow the fundamentals. That's my opinion.

Lots of different kinds of tourists out there. Thats my opinion.

SLV is for tourists who are only along for the short ride and really don't follow the fundamentals. That's my opinion.

All PM ETFs are great tools for someone who does follow the fundamentals and who wants a quick, cheap and easy way to get in and out of the market with the least amount of hassle. Most PM ETFs have leaveraged (short) and inverse (multiples) trading "partners" that can allow a successful PM fortune teller to make money in both market directions.

A smart PM stacker will also use ETFs (such SLV) to either hedge their stack or take advantage of short term speculation.

Some even use it to create an income stream, which you cant do with physical.

That is not good at 30x. Current melt is theoretically 44x. That would be about 32% under melt for $999 (or less) face

Recent sales of small lots of 90% silver on eBay are about 40x to 42x. Minus the eBay fees that is still a net of about 35x to 37x.

.

Hmmm...kinda puts that ETF annual fee into perspective doesn't it?

Theoretical value of 44 and net of 36, for an 18% discount. Thats like, what, the equivalent of 30 years worth of 0.50% annual fee?

It is very, very simple:

If people are selling at 36x, then buy at 36x, not 44x.

That shouldn't be so hard to figure out, but I guess it is for some "folk".

And if you buy at 36x, eventually premiums could normalize on 90% coin and and net you a better gain than SLV (which only has a declining premium).

.

Lol. "If", "could", "eventually". Haha. For years you folk said buy at spot or even pay premium. Now we folk are supposed to accept 85% of spot? Well, crack me a corncob pipe. Lol

And y'all made fun of blitz for buying at spot and selling at spot. Bizarro world indeed.

Folk are having to call all around the country to find an acceptable counter-party. I am loving all this unfold, as expected.

I cant wait till it hits 225 and y'all are wondering why you cant get more than 150 for it.

.

Yes, all of us "poor" precious metals speculators, we have all done so poorly over the last few years. We should have listened to your advice and stuck with commissioned financial planners (such as yourself) who would have sold us life insurance policies and annuities. Not.

Sub-999 silver is on sale right now. The best time to buy something is when it is on sale. 90% coin has sort of a built-in insurance mechanism with it.

You fail to realize (again) that the market price of physical silver is always less volatile than the "paper" price. When the "spot" price spikes up, physical silver lags behind (for a time). When the "spot" price drops, premiums on physical silver items increases (thus insulating the holder somewhat from the losses).

If you want to speculate (gamble) on the volatile swings of "paper" silver, then go ahead, be a click addict.

Silver Eagle premiums are, what, a $1 per coin right now (I'm guessing) ?

If the "spot" price of silver were to drop to $40 or even $30, a lot of people would probably decide not to sell them. This could drive the premiums back up to $5 or even $10 like they have been previously.

Consider another scenario:

Suppose the "spot" price of silver stays roughly stagnant from here, for the next couple years.

Holders of SLV would earn nothing. In fact, they would lose half a percent per year even if the silver price was completely unchanged.

The premiums on 90% coin would likely normalize over time. Buyers of 90% coin who paid the current 36x to 40x price, could earn a profit when sub-999 silver is not discounted like it is now. So buy now at 40x and sell in the future for 44x, even if the price of silver remains unchanged.

SLV is for tourists who are only along for the short ride and really don't follow the fundamentals. That's my opinion.

All PM ETFs are great tools for someone who does follow the fundamentals and who wants a quick, cheap and easy way to get in and out of the market with the least amount of hassle. Most PM ETFs have leaveraged (short) and inverse (multiples) trading "partners" that can allow a successful PM fortune teller to make money in both market directions.

A smart PM stacker will also use ETFs (such SLV) to either hedge their stack or take advantage of short term speculation.

Some even use it to create an income stream, which you cant do with physical.

You've come a long way derryb. Thumbs up emoji!!

.

this "income stream" business, again.

Prove (or at least show) how this is done by a small entity, without risk.

Big players can lease silver and earn the lease rate. But that is not without risk because the lessee can default.

@derryb said: A smart PM stacker will also use ETFs (such SLV) to either hedge their stack or take advantage of short term speculation.

Why buy silver or gold if you are going to bet against your own position? That's essentially what a hedge is. Sure enough, there might be a moment when you might want to shield your position from a sudden downdraft, but you'd better be right when you do it or you might compound your loss.

When you understand the market, it's much easier to ride the fundamentals than to try and outmaneuver the traders but my hat's off to you if you can do it successfully.

Q: Are You Printing Money? Bernanke: Not Literally

@jmski52 said: @derryb said: A smart PM stacker will also use ETFs (such SLV) to either hedge their stack or take advantage of short term speculation.

Why buy silver or gold if you are going to bet against your own position? That's essentially what a hedge is. Sure enough, there might be a moment when you might want to shield your position from a sudden downdraft, but you'd better be right when you do it or you might compound your loss.

When you understand the market, it's much easier to ride the fundamentals than to try and outmaneuver the traders but my hat's off to you if you can do it successfully.

There are those that like to hedge, I'm not one of them. Stackers should not fail to realize the benefits of also buying and selling short term ETFs. They are not contrarian moves, they work in tandem.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

At a recent small coin show, I sold two hockey pucks of melted coin. One was about 900 fine (mostly melted Peace Dollars) and the other was about 700 fine (mixed melted foreign coin).

The buyer is starting up the Golden Analytical refinery again. This small to medium sized refinery over the years produced many vintage silver ingots with their "G/A" logo.

I think there will likely be some new refining capacity coming on line in the near future. I doubt that GA is the only such example.

Prove (or at least show) how this is done by a small entity, without risk.

Big players can lease silver and earn the lease rate. But that is not without risk because the lessee can default.

.

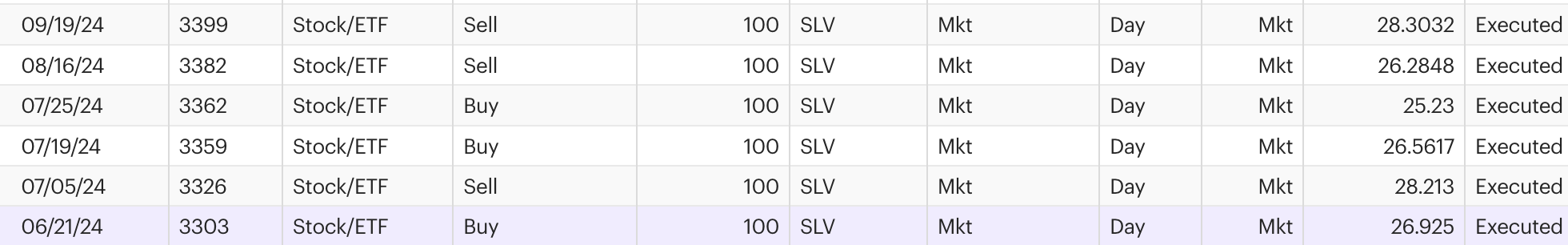

OK. Consider one has a core holding of SLV which one believes is a good investment for the time being. One can then use 100 share trades to pick up some "mad money." This is all done in a no commission Roth IRA brokerage account so there are no tax consequences. Here is an example from this summer - the result - $408 TAX FREE.

Of course one would only do this if one thought silver would be a good investment.

.

Comments

jack hunt takes 90% and 40% but not sterling

it seems they also sell same

i'm thinking for them they are really playing coin dealer

Family member just offloaded a bunch of .999. They were given 15% back of spot. Doubt they would have even considered .925/.900 etc. but who knows.....None the less it was a good time to re-educate him on the absolute beauty of the SLV. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Family don't let family sell .999 for $49.30 when spot is $58.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

I don't know what spot was at the exact moment, but they got $50 flat. Generic rounds, fantasy tokens etc. Nothing that would interest me. I gave my opinion, and they did what they did. I can tell you one thing, I wish all my physical .999 was paper SLV in this current environment. Much easier to manage. I know you've done well. Good luck and hope it continues. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Your family got screwed. God Bless America. And don't tell us that's all they could get. 15% back of spot for .999 LOL THEY GOT SCREWED

COPPER is gutter !

That's why they call it life in the gutter. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

I’d be happy to pay 15% below the market price, and just as happy to pay the banker 10% on the note to do it. Capitalism and usery at its finest. It’s not a crime.

``https://ebay.us/m/KxolR5

Elemetal has been back to buying for weeks. I started a thread https://forums.collectors.com/discussion/1118265/a-major-refiner-wholesaler-is-back-to-purchasing-alloyed-silver-925-900-and-400#latest

but it got no tread or traction. In spite of that, some like paper, some prefer plastic. Me ? metal is my preference. Silver at $50 or $60 or $100. Gold at $900, $2000, or 5k….. copper and nickel, not so much. But even that ( as a commodity) is money, too. How hard does a guy want to work ? Blitz plays hard with and for his. Some of us are workin’ stiffs.

``https://ebay.us/m/KxolR5

My local refiner told me they weren't buying silver until after 12/1/2025. Too jammed up. Today I checked in and they are not buying anything until after 2/1/2026.

No problem - just sold the equivalent amount in SLV and keeping the physical silver as a long term investment.

999 as well or just alloy?

Hedging it like the BIGS. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

999 still need to be converted to bigger bars.

COMEX

COPPER is gutter !

Today I stopped at our local dealer, one of Coin World's Top 100 influential, to get a feel for coin shop bids for 90% silver.

If I had $1,000.00 face value to offer, their offer was $38 per $1. Otherwise, $30 per $1.

Here in Germany I went to two dealers to ask for their prices. They accept any alloy:

1st dealer: 98% for 999+ fine silver bullion, 80% for any other silver alloys, 97% for 999+ gold bullion and 96% for scrap gold (they pay extra for the silver content of the gold alloy).

They pick through the stuff to set aside better coins and jewellery for them selves.

2nd dealer: 93% for silver (any kind) and 99% for gold (any kind).

All metal will go to the refinery unsearched. Bullion, high end jewellery, numismatic coins - it does not matter, it all will go to the smelter.

.

That is not good at 30x. Current melt is theoretically 44x. That would be about 32% under melt for $999 (or less) face value.

Ask them what they sell it for.

Perhaps this is more of a numismatic dealer than a bullion dealer ?

Recent sales of small lots of 90% silver on eBay are about 40x to 42x. Minus the eBay fees that is still a net of about 35x to 37x.

One major dealer on the internet currently has a buy offer of about 39x for large lots.

.

Hmmm...kinda puts that ETF annual fee into perspective doesn't it?

Theoretical value of 44 and net of 36, for an 18% discount. Thats like, what, the equivalent of 30 years worth of 0.50% annual fee?

Knowledge is the enemy of fear

I can sell 90% locally for 38.5X, and the buy/sell spread for 90% is just over 7%.

The spread on ASEs is also just over 7%. Changes in the buy/sell spreads reflects volatility in the market.

I knew it would happen.

Refiners and LCS are afraid to get caught in a “Hunt Brothers” type correction while they are holding large quantities of Silver. Once the bottleneck eases and the price stabilizes they will normalize their buy prices. In January I was estimating my 90% at 22X-24X and now the offers I’m seeing are at 35x-38x. I’m not a seller but it’s been a great year for all PM’s.

JMHO,

Mike

MIKE B.

Selling at 38.5 is the equivalent of silver at $54. Thats a 12% discount to spot. Is that acceptable to you?

Knowledge is the enemy of fear

Selling at 38.5 is the equivalent of silver at $54. Thats a 12% discount to spot. Is that acceptable to you?

A 12% discount to spot isn't the whole story.

It makes no difference that the equivalent of silver is at $54 on the sell side when the equivalent of silver is $57.87 on the buy side (which is a nice discount to spot). Since I've been buying at that level and below, I'm willing to accept a 7.1% buy/sell spread.

Suggesting that a 12% discount is in play on the sell side without mentioning the 5% discount on the buy side is a misrepresentation of reality.

In recent days, silver has shown price increases of 3% and even 5% in one day. A 7% buy/sell spread is easy to overcome at those rates.

Now is a reasonably good time to buy 90% silver.

I knew it would happen.

.

It is very, very simple:

If people are selling at 36x, then buy at 36x, not 44x.

That shouldn't be so hard to figure out, but I guess it is for some "folk".

And if you buy at 36x, eventually premiums could normalize on 90% coin and and net you a better gain than SLV (which only has a declining premium).

.

Well, to paraphrase an old proverb '...The best time to buy is when blood is running in the streets...' When people need to sell - buy at the lowest price they are willing to sell for.

But in defense of the shops, they don't have retail demand to absorb all the alloy being offered, so they have to ship it to a refiner. The refining process takes time, so the refiner is not willing to lock in a buy price until the silver is refined and they aren't sending the shop money until the silver is sold. I can't blame them - silver has a nasty habit of falling off cliffs...

Last I looked, MONEX is selling $1,000 bags at $43.3 X face.

Wnat would normal premiums be on 90% coin?

Keep in mind SLV is just a trading vehicle, not a long term holding.

Popular LCS in my general region is buying CULL 90% dollars at $40 and selling at $43

Dimes, Quarters, and halve 90% they are buying at SPOT -$7 and selling for SPOT -$5

That is todays pricing. THis is who I use to gauge the 90 market as he has a long history does a public update almost every business day.

COPPER is gutter !

.

Cut out the middleman. Buy from people that are selling, not from dealers with wide spreads.

Yes, SLV is a very poor choice for a long-term holding because half a percent of your holding would evaporate every year.

I would say that a "normal" premium for 90% silver coin is about 2%. But 90% coin is currently selling for 36x when "melt" is 44x. At some point, it will sell for closer to the melt value. A share of SLV ALWAYS declines relative to the "Spot" price.

Also,

if tomorrow the spot price of silver dropped to $40, the full amount of that loss ($20) would be experienced by SLV holders.

But it would be pretty likely that people would stop selling 90% coin at $40 spot as much as they have been at $60 spot, And that would cause the premium on 90% coin to increase. This would insulate the holders of 90% coin against some of the losses.

If spot declined from $60 to $40:

SLV holders would lose the full 33%.

90% coin might go from the current 36x (discounted to $60 spot) to 29x (at par with $40 spot).

Holders of 90% coin would lose 20%.

.

Disconnect between junk prices and spot prices expained.

The Silver Freeze: Refining Backlogs Create a Liquidity Crisis for Junk Silver

"Refiners have been inundated with material, partly due to Americans liquidating silver assets in response to high prices. However, the true breaking point has been a massive surge in silver lease rates—the interest rate paid to borrow physical silver. In normal times, refiners borrow silver or cash at low rates to finance the metal while it is being processed."

Like Taxmad said earlier, best time to buy (if you believe the silver run will continue) is when blood is on the street. Less than .999 is having a fire sale.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

The key to remember it's good to have both in a diversified investment portfolio. If spot declines, neither are forced to sell. At least at this point in time SLV holders could get full value for their short term holdings - the spread between the bid and ask is one cent. And remember it was bought at a discount from spot. The cost of holding SLV is 1/2% annually or .0042% monthly.

Thanks for the info that the "normal" premium for 90% silver coin is about 2%. I trust that is what dealers will pay for it.

the true breaking point has been a massive surge in silver lease rates—the interest rate paid to borrow physical silver. In normal times, refiners borrow silver or cash at low rates to finance the metal while it is being processed."_

>

Why do refiners borrow silver to finance the metal while it is being processed?

They hedge their production, similar to miners. If I just bough 100,000 ounces of 90% at $50, I can sell a percentage of that at $60 by borrowing that amount from a bullion vault. Once processed, I can return the metal, sell any I didn't hedge, pay my expenses (including the fee to the bullion vault) and have a profit - even if melt is down to $55.

Last I looked, MONEX is selling $1,000 bags at $43.3 X face.

I can buy a $1,000 bag locally at $41.38 x face. Monex is overpriced.

Wnat would normal premiums be on 90% coin?

The premiums have ranged from -5% (now) to as high as 12% (a couple years ago). The premiums fluctuate. A more relevant basis for price shopping is the buy/sell spread, which reflects the dealer's own position and willingness to transact.

Keep in mind SLV is just a trading vehicle, not a long term holding.

SLV is for tourists who are only along for the short ride and really don't follow the fundamentals. That's my opinion.

I knew it would happen.

All PM ETFs are great tools for someone who does follow the fundamentals and who wants a quick, cheap and easy way to get in and out of the market with the least amount of hassle. Most PM ETFs have leaveraged (short) and inverse (multiples) trading "partners" that can allow a successful PM fortune teller to make money in both market directions.

A smart PM stacker will also use ETFs (such SLV) to either hedge their stack or take advantage of short term speculation.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Lol. "If", "could", "eventually". Haha. For years you folk said buy at spot or even pay premium. Now we folk are supposed to accept 85% of spot? Well, crack me a corncob pipe. Lol

And y'all made fun of blitz for buying at spot and selling at spot. Bizarro world indeed.

Folk are having to call all around the country to find an acceptable counter-party. I am loving all this unfold, as expected.

I cant wait till it hits 225 and y'all are wondering why you cant get more than 150 for it.

Knowledge is the enemy of fear

But only sell it for 36x. Solid strategy. Lol

Don't pay premiums. Period.

Actual returns would prove you wrong.

Lots of different kinds of tourists out there. Thats my opinion.

Knowledge is the enemy of fear

Some even use it to create an income stream, which you cant do with physical.

You've come a long way derryb. Thumbs up emoji!!

Knowledge is the enemy of fear

Vermillion Enterprises in the Tampa area was buying 90% today at 39x

Selling at 40x

There are FAIR dealers out there.

COPPER is gutter !

.

Yes, all of us "poor" precious metals speculators, we have all done so poorly over the last few years. We should have listened to your advice and stuck with commissioned financial planners (such as yourself) who would have sold us life insurance policies and annuities. Not.

Sub-999 silver is on sale right now. The best time to buy something is when it is on sale. 90% coin has sort of a built-in insurance mechanism with it.

You fail to realize (again) that the market price of physical silver is always less volatile than the "paper" price. When the "spot" price spikes up, physical silver lags behind (for a time). When the "spot" price drops, premiums on physical silver items increases (thus insulating the holder somewhat from the losses).

If you want to speculate (gamble) on the volatile swings of "paper" silver, then go ahead, be a click addict.

Silver Eagle premiums are, what, a $1 per coin right now (I'm guessing) ?

If the "spot" price of silver were to drop to $40 or even $30, a lot of people would probably decide not to sell them. This could drive the premiums back up to $5 or even $10 like they have been previously.

Consider another scenario:

Suppose the "spot" price of silver stays roughly stagnant from here, for the next couple years.

Holders of SLV would earn nothing. In fact, they would lose half a percent per year even if the silver price was completely unchanged.

The premiums on 90% coin would likely normalize over time. Buyers of 90% coin who paid the current 36x to 40x price, could earn a profit when sub-999 silver is not discounted like it is now. So buy now at 40x and sell in the future for 44x, even if the price of silver remains unchanged.

.

bickering is back

this were livable up until very recently

.

Prove (or at least show) how this is done by a small entity, without risk.

Big players can lease silver and earn the lease rate. But that is not without risk because the lessee can default.

.

@derryb said: A smart PM stacker will also use ETFs (such SLV) to either hedge their stack or take advantage of short term speculation.

Why buy silver or gold if you are going to bet against your own position? That's essentially what a hedge is. Sure enough, there might be a moment when you might want to shield your position from a sudden downdraft, but you'd better be right when you do it or you might compound your loss.

When you understand the market, it's much easier to ride the fundamentals than to try and outmaneuver the traders but my hat's off to you if you can do it successfully.

I knew it would happen.

coho, stop mis-quoting me and stop misrepresenting what I've said.

I knew it would happen.

.

There are those that like to hedge, I'm not one of them. Stackers should not fail to realize the benefits of also buying and selling short term ETFs. They are not contrarian moves, they work in tandem.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

You can sell covered calls and earn income with SLV

At a recent small coin show, I sold two hockey pucks of melted coin. One was about 900 fine (mostly melted Peace Dollars) and the other was about 700 fine (mixed melted foreign coin).

The buyer is starting up the Golden Analytical refinery again. This small to medium sized refinery over the years produced many vintage silver ingots with their "G/A" logo.

I think there will likely be some new refining capacity coming on line in the near future. I doubt that GA is the only such example.

Thanks for always trying to keep the peace. THKS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

how unsucessful am i when the same people continue to bicker over the sames things on a daily basis?

but i am trying

So goes life in the gutter™. Keep trying, God knows we need it. RGDS!

Keep trying, God knows we need it. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Silver = $62.56 at Spot!

I knew it would happen.

OK. Consider one has a core holding of SLV which one believes is a good investment for the time being. One can then use 100 share trades to pick up some "mad money." This is all done in a no commission Roth IRA brokerage account so there are no tax consequences. Here is an example from this summer - the result - $408 TAX FREE.

Of course one would only do this if one thought silver would be a good investment.

.

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

What we don't need is useless posts like that.

This isn't the "gutter", even though you try very hard to make it so.

.