Fed opens new Repo facility of $490 billion to bail out mid-sized banks.

Fast forward to 25 minutes----------

Andy Schectman, John Rubino and Rafi Farber are reporting that the Fed is getting ready to bail out mid-sized banks that have ongoing losses in commercial, retail real estate and auto loans, etc.

Nobody is paying their rent, poor quality collateral is now being used for loan paybacks.

Q: Are You Printing Money? Bernanke: Not Literally

I knew it would happen.

I knew it would happen.

0

Comments

The banks have been getting away with poor banking practices for decades knowing they always get a bailout on the taxpayers' back. Let them go into the tank the same as any other business and/or individual who engages in the same practices. If up to me, they would not get so much as the steam off of my dog's last landmine!

Three of the five banks I have accounts with have been sold off in the last three years. All mid size and local to the area. All have been around for 50+ years or more under their original and former name. They were purchased from banks I’m not familiar with and appears to be local to WI., our neighboring state.

I do wonder what if they were purchased because they were starting to fail? One was family owned.

irresponsible lending. 08 all over again. Regulators, the FED and congress chose to kick the can down the road instead of swallowing the medicine. Cul-de-sac approaching

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Contagion.

youtube? really?

oh. that's the place where i get all my get rich quick coin information from. oh, ok then

youtube? really?

Yes, really.

Let me know if you ever hear about the new $490 billion Repo facility on CNBC, Bloomberg or Fox Business.

I knew it would happen.

the repo facility is a very short-term liquidity aid

bailout are the fed and fdic getting together to find long-term cash or a buyer.

https://www.reuters.com/business/finance/investor-behind-zions-western-alliance-bad-loans-is-tied-270-million-troubled-2025-10-20

warning of cockroaches and seeing cockroaches all over dying banks are two very different things

All this means is that the previous repo facility ran out of money and now the Fed will have to keyboard more money into existence when called upon.

The ongoing problems I mention in my original post have never gone away and the result will be more inflation.

I knew it would happen.

repo facilities are rotating and the the fed takes securities with an agreement they will be repurchased and paid interest for the priviledge

the fed res balance sheet is 6.6trillion and shrinking with no talk of qe again. no fear of the fed running out of money. and the repo is essentially a loan where the fed gets interest and the repo part is the debtor buying them back

Banks are mandated to hold a certain % of capital per loans. That capital is cash and primarily US Treasury securities. When banks need instant cash to fund daily operations, could be large customer withdrawals, they repo with the Fed to make sure they have the cash. Costs them interest but better then telling customers I can't wire your money.

the fed res balance sheet is 6.6trillion and shrinking with no talk of qe again. no fear of the fed running out of money. and the repo is essentially a loan where the fed gets interest and the repo part is the debtor buying them back

The sources I follow are concerned with the $5 trillion of debt that needs to be rolled over, a resumption of QE, and a rekindling of more inflation. DOGE was a complete failure and they are scrounging around for funds to pay the military during the shutdown, so there will be pressure for more money creation, soon.

The previous REPO had something like $2.9 trillion, but that's all been used up. If REPO is only a short term overnight loan, where did the $2.9 trillion disappear to? We don't get to know the details. The gov.com books have been dark now for several years. We don't get to know what's going on in government finance and it's useless to pretend that we do.

The Fed is being pressured to restart QE and the composition of its board will be changed to effect whatever the current administration wants, which includes lower rates and QE.

I knew it would happen.

ZIRP anyone?

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Now I just read the FED is looking to revise the bank's capital requirements lower to create more loans. BASEL wanted 19%, Biden Admin was ok with 9%, but now the FED is looking at 3 - 7% requirement under Trump's hand picked leader for Supervision. Got to love DEBT to keep the air in the balloon floating high.

How about this news.

(Reuters) -U.S. banks' loans to private credit providers have surged to nearly $300 billion, Moody's said in a report on Tuesday, and the ratings agency warned that smaller lenders could face heightened risks if underwriting standards weaken.

Loans to non-depository financial institutions (NDFIs) are now 10.4% of total bank loans, nearly three times the 3.6% exposure a decade ago, the report said. The aggressive growth outpaced all other lending activities since 2016, it added.

Besides exposure to private credit providers, there was a further $285 billion in loans to private equity funds as of June, and $340 billion in unutilized commitments available to these borrowers, Moody's said.

Guess all those corporate take-overs and AI spending has to come form somewhere.

I have just read reports that my bank here in Colorado has been acquired by the conglomerate PNC Bank.

FirstBank is the largest regional bank in Colorado and Arizona, and from what I can tell, it was a well-run operation.

FirstBank was fine on its own and did not need any sort of infusion.

Perhaps PNC Bank was the one that needed an infusion of capital (by acquiring FirstBank's assets) ?

i don't believe repo are necessarily overnight, but a limit could simply mean that's a fed limit to the total outstanding

He has NO idea what he is talking about. He's relying on a guy from Israel as his "repo expert" ? Come on.....

There are seasonal pressures in the money markets at this time of the year and have been going back 10-15 years.

Everything they are saying about bad loans is NOT backed up by the reported numbers. JPM just opened their $3 billion headquarters yesterday or today.....SanFran is making a comeback with real estate. It's not a boom, but the apocalpyse forecasted when WeWork went under during Covid is long past.

The banking sector is in the best shape it has been in capital-wise in 50 years. But this guy knows more than people who watch them 24/7 for decades, right ? He didn't even get the Target2 -- not "Tier 2" -- description right concerning national central bank accounting with the ECB.

He didn't even get the Target2 -- not "Tier 2" -- description right concerning national central bank accounting with the ECB.

These guys spout the same stuff for years and years. Even if they are (partially) right down the line, their overall performance lags any 60/40 balanced portfolio.

A repo line just replenishes liquidity in the system during times of stress or high-cash periods (i.e., Christmas holidays and year-end tax payments). There's no $490 billion "bailout" or repo that the Fed has announced. As far as I can see, they just made it up.

A bank with $27 billion in assets is going to "bail out" a bank with $575 billion in assets ?? Come on.....

FirstBank had flirted with selling itself on-and-off since 2022....the bank implosion by SVB in 2023 delayed the sale....this was about PNC getting scale in Colorado and Denver. Neither bank needed capital -- this was a merger to bulk-up for both.

Er.....no.

The Basel III requirements were designed to hamstring U.S. banks to make it easier for poorly-run "national trophies" in Europe to compete. Check out the stock performance of JP Morgan vs. Deutsche Bank which were fairly close back in 2007....today JPM is 12x the size of DB. It's not even close.

The EU banks are the ones with capital and loan problems.

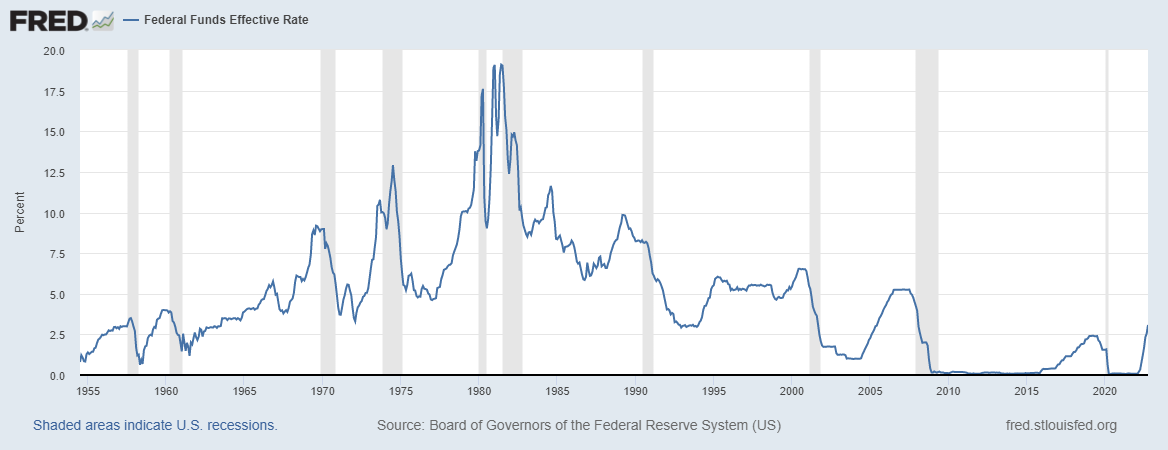

Fed Funds @ 4.0-4.25%.

4 is NOT zero.

What "sources" are you following ? You need to follow TS Lombard, or any of the Fed Watchers who watch the money market daily. This was my 1st job out of college 40 years ago. There's nothing nefarious going on....if you don't know how the thing works, you're not going to be able to comment on it properly.

No, a Repo is simply a short-term LOC/loan (1-7 days usually) using U.S. Treasury debt as collateral. These credit lines are not "used up" as they are regularly renewed.

Total speculation without any facts to back it up. And I doubt it would happen unless the folks proposing it want the 10-year headed above 5%.

Citibank got a "bailout" in 2008-09 during the GFC.

The stock is 1/5th the level back then, down over 80% (it was down over 90%). You think this is a "bailout" that the management or shareholders relish ??

They don't.

If the Fed or banking superivsors determine an orderly liquidation is best, that's what happens. The bank, management, and shareholders are NOT "bailed out." If you think they were, go talk to a Citibank shareholder from 2007 or 2008 and ask them how the bailout is going.

Liquidations or injections of capital (usually preferred stock with supervoting rights) are used to protect the taxpayer's investment. TARP made $$$ for the taxpayers and government with the only losses coming from smaller banks (politically connected) and the unions (i.e., UAW, AFL-CIO).

The 2022 IRA passed by Congress gave $36 billion with no strings attached to the Teamsters to BAILOUT their corrupt, Bernie Madoff-like CSPF Pension Fund. JPM and GS paid back their TARP loans within 9 months. The Teamsters are NEVER paying that money back.

Quick....how many "bailout" stories about Wall Street, JPM, and GS have you seen on TV ?

Now...how many about the Teamsters ???

But don't you think the US and EUR banks are so financially intertwined if DB, Barclays, UBS or BNP were in big trouble so are the US banks? The BASEL #'s were purportedly created for all the big banks to weather the storm for a worse case financial/economic collapse and the big banks could still survive since they were not over-leveraged. To prevent a 2008/09 crisis. US FED regulators were part of that commission and #.

BASEL III is like me figuring, if I lost my job for a period of time, how much debt should I currently have and money in the bank that would be needed to let me continue to pay 'necessary' bills while I get through the hard times without going bankrupt or needing a handout. It was to be applied to 'all' country banks. Don't think it was to allow EUR banks to compete. A lot of what is published on the internet is conjecture at best, you what you state is correct, but you also seem to make stuff up like this.

What "sources" are you following ?

Ya know, your "sources" are all of the ones who got us into this mess with credit, debt and inflation. You obviously don't know anything about Jim Sinclair, Bill Holter, Andy Schectman, Rafi Farber, Dunnagan Kaiser, Vince Lanci, Chris Markus, Mario Innecco, Ed Dowd, Clive Thompson, Alasdair Macleod, David Rogers Webb, Ray Dalio, Jeffrey Gundlach, Michael Pento, Peter Grandich, Gregory Mannarino, Lynnette Zang, Catherine Austin Fitts, Craig Hemke, Martin Armstrong, Rick Rule or even Peter Schiff. Added: also, David Jensen, also Eric Yeong out of Hong Kong.

I listen to all of them and then I evaluate what I've learned and make my own assessments. Every one of the above are accomplished and knowledgeable, with diverse sources in the precious metals arena, governments, banking system, finance, investments, and the one distinguishing feature is that the majority of them seem to be of a libertarian leaning, of which you are not.

If all you listen to is your "mainstream" apologists for the banking cartel, you will continue to tout a 60/40 portfolio in order to "diversify risk" or some other tripe, in spite of the fact that central banks are all accumulating gold and destroying their currencies while impoverishing their middle class and in spite of the fact that gold has now outperformed the stock market for the last quarter century. Further, I don't believe that you know all that much about the precious metals market, no offense.

You do like to pump up your "credentials" and experience, which may or may not be relevant. I could do the same, but I find it to be more constructive to stay on point.

I knew it would happen.

You can't separate the intertwined nature of all the banks. It's a system built on trust and phone calls and emails. Look up DREYFUS SECURITIES (1982) to see what can go wrong.

The capital requirements for Basel III go beyond what the advisory committees recommend. There's things there that make no sense -- gold is a Tier 1 asset (OK)...but "Green" assets are, too -- why ?

You have to strike the proper balance betwen leverage and liquidity. If you want banks to resemble Chemical Bank circa 1925 with a 25% capital ratio levered 4-to-1....then expect GDP growth like the Europeans of about 1-2% over the long term.

Better to lighten up....take the extra GDP growth...and if there is a mop-up in 5 or 10 or 20 years, deal with it then with a much bigger economy able to provide the funds.

Nominal GDP growth is our BEST insurance policy....NOT capital levels !!

I'm in a unique position because I have covered banks for investment purposes and worked for 2 European banks. I know how they work....I know how they think. Trust me, they are truly lacking.

As for "making stuff up" -- no. If I have an opinion, I'll clearly state it as such. But facts are facts and right now the U.S. banking system is in the best shape since the early-1970's. Google MIKE MAYO and read some of his commentaries. And this was a guy who was BEARISH for about 10 years, from 2005 through 2015 or longer. Being bearish for that long is usually a prescription for career suicide (unless you have hedge funds that want to short).

He stayed bearish for 2 decades and is now super-bullish on the U.S. banking system. Look at the banks that went under during the Depression.....the 1980's.....the 2008-09 GFC....and in 2023. A HUGE DOWNWARD SLIDE IN THE NUMBER OF BAD BANKS !!!

I know many of them, but some are not in the same category as the others. I spoke to Gundlach for years when I was on the sell-side. He and Dalio stand out, and I have DoubleLine's funds as my core bond holdings, among others. Very few of those guys are warning about the apocalypse, except Ray Dalio, and he can stay in cash or gold because he's worth $20 billion and it's his money so who cares.

Dalio and Gundlach have published track records. Their credentials are not questioned. But some of the others are unknowns and/or crackpots.

Your returns are hard numbers. If all but a few of those people you list have S&P 500-beating returns, please post them.

I'm not pumping up anything. You take the word of people who don't show you ANY verifiable performance which measures the strenght of their arguments in real time within the markets. Gundlach and Dalio, yes (I met Ray Dalio decades ago and he sent me Bridgewater stuff when nobody knew who they were so I've read him and BW for years).

The others might have interesting perspectives and interesting ideas, but I wouldn't bet the farm on their ideas anymore than I would on Milton Friedman, probably our greatest economist ever...but a mediocre investor and asset allocator.

Well not sure comparing post GFC failures to 2023 is a meaningful analysis. Look at 2007, WAMU was probably one of the most profitable financial institutions around, as was CITI, ML, AIG, etc. Agree 19% capital requirement is way too high, 9% seems reasonable after all the stress testing analysis done. But 3%, come on. And not sure the 10% unemployed post GFC are ok with a mop up solution. Yep the institutions and CEO's were bailed out/got the big bucks but the little guy got screwed, as usual.

But they WEREN'T "the most profitable" -- it was all leverage. ROEs and ROICs had been going down for a decade after the 1990's boom.

CITI didn't even know what they had in their books. Incompetent CEO chosen by the NYS AG.

ML was bought out. Again, too much leverage.

AIG had another incompetent CEO chosen by the NYS AG. Hank Greenberg would NEVER had taken on that CDS risk.....NEVER !!!!

9-10% capital Tier 1 is fine....implies 9-12X leverage, which is fine. Most banks in 2007-08 were at 25-35x leverage.

If you don't want the Fed or government (TARP) to "bailout" the system, then the Little Guy takes it even worse. Unemployment goes to 15-20% like during Covid.

And again....there was NO BAILOUT. The institutions got funds but they got (1) diluted to hell and/or (2) had to pay it back. JPM and GS didn't even WANT the $$$ -- they were forced to at gunpoint. They sent $$$ to the government....they bailed out the feds !!!

Ironic, no ?

Well I think most folks would label the $700B TARP, and other programs, a bailout when the FED bought toxic assets and gave cash to allow these institutions to continue since the income on these assets, esp CDO's, stopped. And JPM, well the FED sale of Bear Stearns earlier to them was a fire sale. The FED financed a good part of the deal and guaranteed any losses would be compensated. Bear Stearns turned out to be a bonanza to JPM. And yes, CITI sold part of their equity to the govt and many others issued warrants for the govt to sell back at a pre-set price. But to me, if someone is bankrupt today, I give them money to continue to stay alive and pay off liabilities, and years later they pay me back with a recovery, its still a bail out.

If the FED didn't inject money into the system, including commercial paper and money markets, everything, including most important our confidence in the banking system, would have collapsed.

Neither was 5% in 2008.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

.

"Me thinks thou doth protest too much."

This is a serious question:

Are you compensated by any financial entity for posting here ?

You are obviously tied in with the financial "industry", so naturally you want to defend it.

But no matter how much the point is argued, there is no getting around the fact that banks produce no goods, and they exist by taking a cut from those that do.

.

But a "bailout" -- properly defined -- involves a gift or windfall. The banks got no such thing. The Teamsters Pension plan got a bailout -- $36 billion, no payback period, nobody held accountabl...THAT'S a bailout !!

Banking is inherently cyclical and liquidity issues will arise. That's what we have a central bank (The Fed) for...to prevent massive dislocations, known before The Depression as panics.

The banks had to issue preferred supervoting stock to the Treasury and pay interest. Some banks were FORCED into the TARP program even though they didn't need any $$$ (JP Morgan, Goldman). The government made $$$ on TARP. So to call it a "Wall Street bailout" is highly misleading and inaccurate, IMO.

The deal stunk. Jamie Dimon tried to do the Feds a favor, and they burned him with regulatory restrictions and lawsuits that were undertaken during Bear Stearns solo years. JPM does the government a favor.....buys BS....and they stick JPM with bogus lawsuits costing $15 billion or so regarding mortgage fraud ? Are you kidding me ?

My boss was in a restaurant dining with Jamie Dimon when he got the call from the NY Fed about an emergency meeting to buy BS. Jamie left his guests and dinner to do the responsible thing. The govt then screwed Dimon and JP Morgan. Jamie is on record as saying the next time the govt calls him and needs a favor, he'll be sending the phone call to voice mail.

You won't see this story in The Atlantic or Rolling Stone or The NY Times !

They're not bankrupt, they have a temporary liquidity problem because the nature of banking is to finance long-term assets and sometimes liabilities are needed sooner. That's not how anybody defines "bankrupt."

Citibank sold more than part of their equity....they were forced to give away about 75% of the equity.

BS was no bonanza for JPM. Dimon said so and so did every analyst and PM on the Street. The mortgage claw-back lawsuits alone wrecked the deal.

That's why the Fed was created. They did their job.

The politicians who told HUD, Fannie, and Freddie to "roll the dice"..... didn't.

.

If the FED did their proper job, there wouldn't have been a 2008 "financial crisis" in the first place.

All of the bailout money went to the top. None went to the bottom. The 2008 crisis occurred because mortgage debt servicing was too high across the board, and the securities containing said mortgages faltered badly.

Had some bailout money gone to the bottom (as mortgage payment assistance, for example), that would have relieved the pressure on the mortgage securities and that would have avoided the crisis. In other words, it was totally unfair to bail out only financial institutions and not homeowners.

.

The Fed tried to do that. The politicians, Fannie, Freddie, and HUD plus state regulators prevented it. I know....I was part of a group that heard them brag that Bush and Greenspan were going to be dead-ended.

In order to prevent systemic risk, you have to take care of the banking system, not homeowners. Many homeowners walked away from their homes so don't make it seem like they got stuck with the bill...many knew what they were doing by taking out their Liar Loans.

It's easier and faster to inject liquidity into a few dozen banks than get relief to 12 million mortgage payees...some of whom are underwater...some not....some who lied...some not liars....some their primary home....some their 3rd or 4th home.....etc.

But they didn't get bailed out. And if the homeowners got the same deal, were they willing to pledge their assets and suffer losses if things broke ?

@GoldFinger1969 said:

I know many of them, but some are not in the same category as the others. I spoke to Gundlach for years when I was on the sell-side. He and Dalio stand out, and I have DoubleLine's funds as my core bond holdings, among others. Very few of those guys are warning about the apocalypse, except Ray Dalio, and he can stay in cash or gold because he's worth $20 billion and it's his money so who cares.

Dalio and Gundlach have published track records. Their credentials are not questioned. But some of the others are unknowns and/or crackpots.

The only two that you give credence to are "mainstream" billionaires from Wall Street. This conclusively tells me that you really don't follow the precious metals markets in depth and your bias is 100% in favor of the fiat debt-based banking system.

I have to laugh when you name-drop that your former boss had lunch with Jamie Dimon during the GFC and it's almost like you want to convey the impression that you've been in the room when big financial events were taking place. JPM paid a $920 million fine for spoofing the precious metals markets (as a cost of doing business, and also a criminal activity) and you flaunt your peripheral association with these people to signal your authority on all things financial.

I'll give you some credit though. At least you're willing to discuss some of the details that reveal why your bias is what it is. I give you credit for being upfront.

I knew it would happen.

BIAS and OBJECTIVITY are not the same thing. They are NOT mutually exclusive.

Yeah, I have a bias. Just like a capitalist is biased to free markets and a Marxist is not. Guess who is better qualified to discuss economics ??

There's nothing "biased" about having a published track record of investment management and being held ACCOUNTABLE each quarter and year. Gundlach and Dalio have done it for decades. The others (some or most of them) have not.

That's not bias. That's common sense.

No, but so what if I were ? The strength of my arguments wouldn't change. Does your attacking the financial industry (often without the facts ) mean you are siding with the United States government ?

) mean you are siding with the United States government ?

This is a serious question....are you compensated by any government entity, the SEC, or Labor Unions which have been completely bailed out unlike Wall Street ??

See how it can work, DC ??

See how it can work, DC ??

Seriously....my passion for defending the financial markets has to do with wanting the best to be in the United States and NYC, not London or Shanghai or Singapore or Hong Kong.

I'm not compensated by MLB for posting on baseball, right ?

I DETEST most of the individuals and politics of Hollywood -- but I think they are THE BEST creators of content and entertainment on the globe. If I hated them....shouldn't I be saying that their content SUCKS ?

Again....BIAS does not mean one isn't OBJECTIVE.

Like many other companies, businesses, and services including AMZN.

If I invest someone's money who otherwise would have earned 2% a year for the last decade...and instead earned them about 9% blended.....doesn't the fact that they have 2x the money they would have had sticking with Treasuries and CDs mean I am entitled to 50 bp. ?

Well...it does suck.

Well, the Marvel universe has played out for a while. Let's see what the buyer of Warner Brothers can do with the DCEU....I want the Snyderverse !!!

There's nothing "biased" about having a published track record of investment management and being held ACCOUNTABLE each quarter and year. Gundlach and Dalio have done it for decades. The others (some or most of them) have not.

Since you don't even know who most of them are, you have no way of knowing anything about their track records, and you seem to have erroneous prejudices against the ones you pretend to know about. Your biases don't do much for your own credibility either.

I knew it would happen.

.

That says it all right there

(that you would be OK with paid shills spewing their propaganda).

.

God bless the Fed. Markets be BOOMIN!™ THKS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

If they are RIAs and have established AIMR/GIPS-compliant performances measured, I'll stand corrected.

If any of them are professional money managers or have audited results, let me know and I'll check them out. If I am wrong, I'll say so.

Paid or not, if someone has the FACTS and TRUTH on their side, they are not a "shill" and they aren't spewing "propaganda."

I simply reversed what you said about me. That's why the entire "Wall Street bailout" nonsense shows who has the facts and who doesn't whenever I see it discussed in print or on TV. Don't tell me the banks were bailed out when they didn't WANT the $$$....but that labor unions in hock for $2 trillion and just receiving $36 billion are somehow NOT getting bailed out.

Pay no attention to that man behind the curtain.......

Well, Tech stocks at least.

If any of them are professional money managers or have audited results, let me know and I'll check them out. If I am wrong, I'll say so.

Do your own work! Ive made the list for you already. You can check any of them out on your own. (But you won't - which is ok with me.)

I knew it would happen.

.

If someone is paid to write something in favor of the payer, then that person is a PAID SHILL.

Large banks produce no goods. They exist entirely by taking from those that do produce goods and services.

The banks will do and say almost anything to keep that "party" going.

Of course a large bank is going to say that they "didn't need the money". If they really did need money, they would certainly try and cover that up.

.