@Tomthemailcarrier said:

I’ve bought 3 from PURE with no problems. However the first one that I ordered was at $4474 was cancelled by the seller. He or she claimed that their U.S. Mint order had fallen through. It is more likely that the rising price of gold and the higher selling price on PURE at that time caused him to reneg.

PURE told me today that their dealer order for the coin is still on backorder. So, I still wait for that coin at the agreed upon price. I believe that they will fulfill it but it has not been a smooth transaction.

i've been told you buy on pure and you buy from pure

sounds like a pile of junk with some of the same buy/sell issues as ebay

what good is pure now?

Unlike ebay, there is a middleman who acts as an escrow agent who will ensure that you get what you buy with no fakes and when you don't get the item, you don't lose your money.

On the plus side.

1. They do check the quality of the coin that a seller is offering.

2. They did promptly refund my money on the cancelled transaction.

3. PURE will honor the price I was quoted.

On the minus side.

1. Sellers can back out

2. Trey said that their 2025 High Relief is on backorder.

3. Lots of back and forth with the transaction

How can a dealer ABP? order be on backorder when the coin is currently available from the mint?

@ProofCollection said:

...who will ensure that you get what you buy...

apparently not

Oh, is there an instance of someone getting something other than what they bought?

...with no fakes ...

shouldn't they have it in hand to do that? yes? then why did they take a sell order when they didn't have it in hand?

That's not their business model. They bring together buyers and sellers and facilitate a transaction. They are not a retail store. Understanding how a company works is important if you're going to use them or criticize them.

Further, yes they could have a policy that disallows presales for newly released mint products but I would suggest that their customer base likes being able to pre-sale and pre-buy and understand the risks assoicated with this.

Well,if that don't beat all!! My second Sunflower was flawed as well ! It was set upsidedown inside the clam shell. Probably a past return. Sheesh This one's obverse has a small but visible to the naked eye gash to the left of the letter L and three smaller ones around the engraver initials.

They both have been shipped back packaged and usps registered mail and insured w signature required.

Thanks to the folks that shared shipping tips! So I am out some money and the bee stung me,haha.

Mint casino crapola.

Nevermore! Instead I bought a Pamp Lady Fortuna gold bar. Quality I can count on!

shouldn't they have it in hand to do that? yes? then why did they take a sell order when they didn't have it in hand?

That's not their business model. They bring together buyers and sellers and facilitate a transaction. They are not a retail store.

how does one ensure no fakes if the facilitator does not see the item?

Based on the impression I got from reading the stuff available inside the main website,I got the idea that,yes,they do inspect what they buy and end up selling. I can't give specifics and I cant preclude that there might not be loop holes.

I think the owner hangs out on this board. Maybe there is a Pure thread. Folks can ask him directly.

Good evening!

if i don't see a name then i don't want to click on buy or sell

Not sure what you're getting at. At Pure you're not dealing with the seller. You're buying from Pure who acts as a middleman.

buying from pure can't be the same as pure being a middleman, and can't go with not dealing with the seller when the seller cancels.

do the people at pure escrow the coin, too?

Yes, seller ships the coin to Pure, Pure inspects and then ships the coin to buyer. That's what make them a middleman unlike ebay which facilitates peer to peer transactions.

@MsMorrisine said:

gold bars have a lower resale value

Low mintage Sunflower coins may persevere with a premium ( collector value) but only if its proof 70 gradable or already pr 70 with a "first" label.

A flawed expensive proof coin is compromised.

In the future,I would have not felt comfortable selling it off in raw to some unsuspecting buyer.

I intended to keep both and have them graded much later.

Then after the first coun flaw discovery,

I was tempted to keep at least one,hoping on the second one, but I expected a flawless coins at that price point and being such a special run mint product.

Congratulations to those that received prime condition coins.

Mine were apparently retreads.

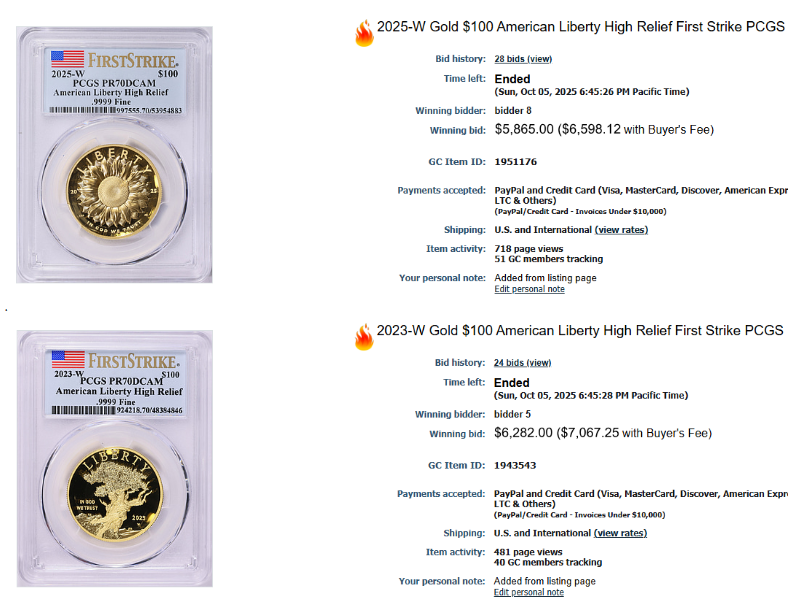

2025 coin price is lower because any buyer can still buy it directly from USMint. When it is sold out on USMint website, the market price of 2025 coin will start to increase.

.

.

I hope so....

Remember, the 2023 was $1400 cheaper on release date.

@wondercoin said:

Simple point- if on August 10, 2023, one had a pile of cash and bought 2023-W HR coins with half the funds, while buying bullion with the other half of the funds, it appears the bullion pile would be worth more than the HR pile today. Plain and simple. At least to me.

It’s the very reason I am not pushing the button to buy more 2025-W HR coins right now. I can buy collectible American proof gold eagles these days right around spot or even 1% or 2% back of spot! I personally think that pile may outperform the 2025-W HR at today’s prices. I’ve been wrong before and I might be wrong again. Hundreds of other folks are buying up the 2025 HR coins as we speak. It will be fun to see how I performed on all my different gold buys a few years from now (including the recent gold Space coin, mintage 7 to the public, auctioned by the Mint).

Just my 2 cents.

Wondercoin.

I know you are a very smart and tied in player. I think your arguments of whether a person would have been better off putting their money in bullion or into the 2023 American High Relief are extremely valid and something I have questioned myself... that being said, I would like to add a few other pieces of data.

A smart player like yourself can time the market a little bit. For me, I purchased the 2023s HRs on a dip in gold. I believe I paid $2700 per coin.

Yesterday I sold that 2023 HR pinecone NGC PF70 for $6750 to a well-known dealer. If you run those numbers, I believe I was better off buying the High Reliefs instead of bullion.

Also, once the coin is sold, the money will be redeployed into a new manner... I have been buying the 2025 High Relief Liberty, because I believe the market for the coin is currently being depressed by the coin still being for sale at the mint, I think the market for this product will prove hot once the sellout occurs, which I believe, will be very shortly

Goldman86. All great points. And not just about timing. It can also matter exactly where and when the coins are submitted and how they are submitted too (including for special labels).

Wondercoin

Please visit my website at www.wondercoins.com and my ebay auctions under my user name www.wondercoin.com.

The release of these coins has been very strange and I continue to receive exactly zero notifications when these become available. It's so odd they sell out, come back in stock in small or large numbers, and then sell out again. Since they are so expensive, perhaps these are returns from impulse purchases. It's really hard to justify the price of this coin when gold is at historic highs and analysts--even gold bugs--are expecting a correction.

@Numismetal said:

The release of these coins has been very strange and I continue to receive exactly zero notifications when these become available. It's so odd they sell out, come back in stock in small or large numbers, and then sell out again. Since they are so expensive, perhaps these are returns from impulse purchases. It's really hard to justify the price of this coin when gold is at historic highs and analysts--even gold bugs--are expecting a correction.

My previous anecdote pretty much verifies that at least one 'second round' Sunflower that I bought was a previously returned item with an overt flaw. The coin was set inside the clam shell practically 90% upside down and cock eyed.

Summary: Both my recently purchased sunflowers were flawed and returned yesterday. So, there are two more to be tossed at buyers.

Caveat Emptor

At this point, it seems to me that all those that pop up as available from here on out are likely to be those that have been returned in small quantities as "unacceptable" by original purchasers.

i just received mine back from pcgs and it was a perfect 70. my 2nd coin came from the mint yesterday, so i'll submit that for grading, but it wont have the first strike designation.

@ms71 said:

At this point, it seems to me that all those that pop up as available from here on out are likely to be those that have been returned in small quantities as "unacceptable" by original purchasers.

Exactly, that's why the secondary market price for raw coins is much lower than the PR70/PF70. Buyers assume raw coins = PR69/PF69.

@goldenboy89 said:

i just received mine back from pcgs and it was a perfect 70. my 2nd coin came from the mint yesterday, so i'll submit that for grading, but it wont have the first strike designation.

Congratualtions goldenboy89 !! Glad to hear that you got a good one.

For what it is worth, so far since morning to now, like 6 hours so far, PURE is not buying the Sunflower. Usually PURE re-prices bids with a short interim "no bids" display but not for so many hours !

Edit: 3 hours later still a "no bids" on Pure. edit: oct 8 still no bids. 'holy smokes' nun !

The PURE, "highest Bid" represents how much they pay for a product , i.e. what Pure will buy a product for. No qualifications as 'graded' or 'raw' unless noted in the product description.

For what it is worth, so far since morning to now, like 6 hours so far, PURE is not buying the Sunflower. Usually PURE re-prices bids with a short interim "no bids" display but not for so many hours !

For what it is worth, so far since morning to now, like 6 hours so far, PURE is not buying the Sunflower. Usually PURE re-prices bids with a short interim "no bids" display but not for so many hours !

Edit: 3 hours later still a "no bids" on Pure.

The PURE, "highest Bid" represents how much they pay for a product , i.e. what Pure will buy a product for. No qualifications as 'graded' or 'raw' unless noted in the product description.

No, Pure does not buy coins. Users enter bids to buy coins. None of Pure's users are interested in buying any right now. At this point I would be worried about receiving a flawed coin that someone was dumping on there.

For what it is worth, so far since morning to now, like 6 hours so far, PURE is not buying the Sunflower. Usually PURE re-prices bids with a short interim "no bids" display but not for so many hours !

any bids for graded ones?

Last I checked they didn't have a product option for graded 25DAs.

BST references: jdimmick;Gerard;wondercoin;claychaser;agentjim007;CCC2010;guitarwes;TAMU15;Zubie;mariner67;segoja;Smittys;kaz;CARDSANDCOINS;FadeToBlack; jrt103;tizofthe;bronze6827;mkman;Scootersdad;AllCoinsRule;coindeuce;dmarks;piecesofme; and many more

DATE. ATS. PRICE. TIME

8/21. 5285. $4265. 2-3 hours

9/21. 2825 (min.). $4565. 15 minutes

9/26. 2100 (min.). $4665. 3 days

10/2. 1030 (min.). $4715. 6 days

Are they done now?

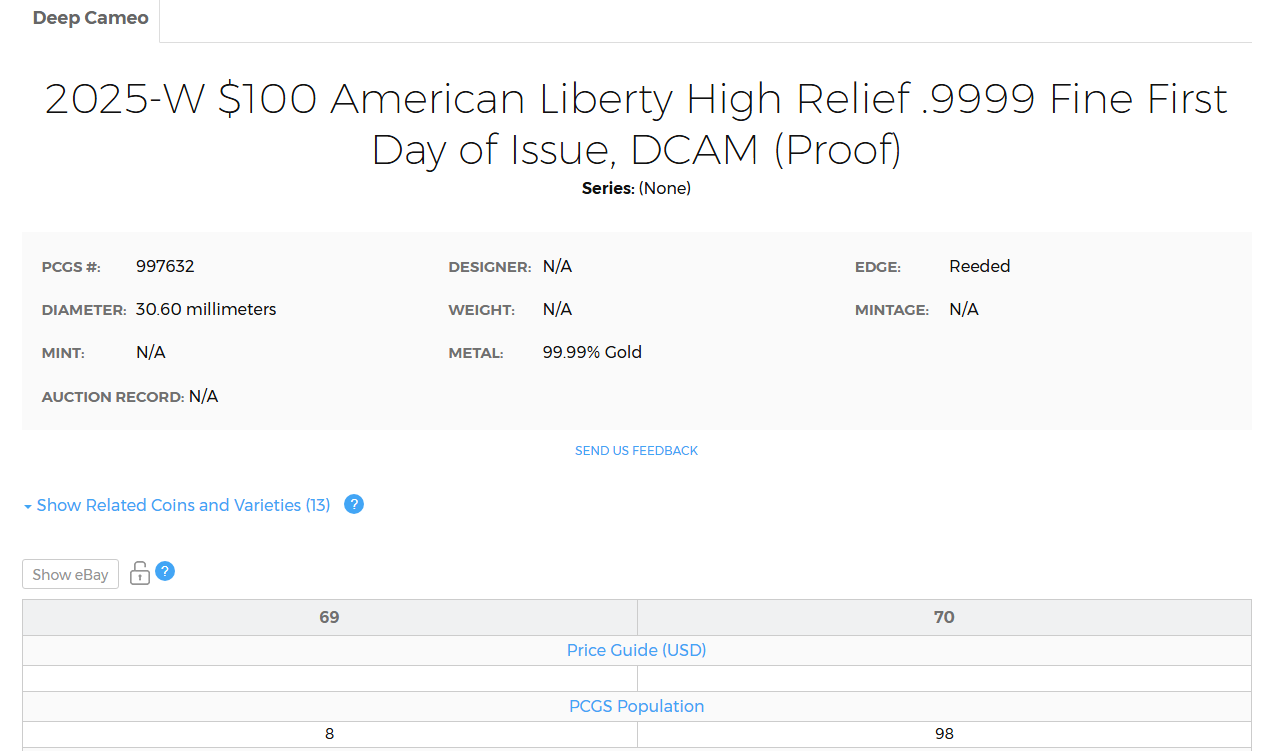

So there will be at most ~5K first strike, first day of Issue and advanced releases across NGC / PCGS. ~80% or 4K will be PR70/PF70. I am curious how this compares to 2021 and 2023.

DATE. ATS. PRICE. TIME

8/21. 5285. $4265. 2-3 hours

9/21. 2825 (min.). $4565. 15 minutes

9/26. 2100 (min.). $4665. 3 days

10/2. 1030 (min.). $4715. 6 days

Are they done now?

So there will be at most ~5K first strike, first day of Issue and advanced releases across NGC / PCGS. ~80% or 4K will be PR70/PF70. I am curious how this compares to 2021 and 2023.

Not all the first 5k coins will be graded and labeled.

@MsMorrisine said:

as gold increases, premiums decrease

I agree. When gold move up to 6 or 7K few years later. I am pretty sure I can get a MS70 for gold price +100 or 200 like the 2014-W Kennedy half dollar. Don't forget the mintage of this coin is very high 12K. It will take lots of love to move this coin higher.

So there will be at most ~5K first strike, first day of Issue and advanced releases across NGC / PCGS. ~80% or 4K will be PR70/PF70. I am curious how this compares to 2021 and 2023.

Unfortunately, I don’t think that is right.

The mint reported sales of 7350 thru 8/24 and of 7952 thru 8/31.

So that ATS number of 5285 doesn’t include the 100 the mint sold at OKC or the 2500 plus

that dealers bought ahead of time paying a 5% premium or I guess even got later.

How many of those 7952 were submitted (or returned-lol) is anybody’s guess.

And I made a least one mistake in the chart - the 9/21 date should have been 9/12. My bad- sorry

@Numismetal said:

It's really hard to justify the price of this coin when gold is at historic highs and analysts--even gold bugs--are >expecting a correction.

The premium to the gold content is what would worry me if I were buying this as a play on gold.

@Numismetal said:

It's really hard to justify the price of this coin when gold is at historic highs and analysts--even gold bugs--are >expecting a correction.

The premium to the gold content is what would worry me if I were buying this as a play on gold.

That's why I would never buy these or any other Commem as a play on gold. The premium is simply an unrecoverable acquisition cost.

All comments reflect the opinion of the author, even when irrefutably accurate.

Let's just say that the high probability is that anybody buying, from the US Mint ,leaked out Sunflowers for $4865 in the near future will get flawed coins for more money.

Comments

apparently not

shouldn't they have it in hand to do that? yes? then why did they take a sell order when they didn't have it in hand?

On the plus side.

1. They do check the quality of the coin that a seller is offering.

2. They did promptly refund my money on the cancelled transaction.

3. PURE will honor the price I was quoted.

On the minus side.

1. Sellers can back out

2. Trey said that their 2025 High Relief is on backorder.

3. Lots of back and forth with the transaction

How can a dealer ABP? order be on backorder when the coin is currently available from the mint?

Oh, is there an instance of someone getting something other than what they bought?

That's not their business model. They bring together buyers and sellers and facilitate a transaction. They are not a retail store. Understanding how a company works is important if you're going to use them or criticize them.

Further, yes they could have a policy that disallows presales for newly released mint products but I would suggest that their customer base likes being able to pre-sale and pre-buy and understand the risks assoicated with this.

http://ProofCollection.Net

how does one ensure no fakes if the facilitator does not see the item?

527

Hot! Hot! Hot!

All comments reflect the opinion of the author, even when irrefutably accurate.

buying from pure can't be the same as pure being a middleman, and can't go with not dealing with the seller when the seller cancels.

do the people at pure escrow the coin, too?

ats 521

244 sold since yesterday

Well,if that don't beat all!! My second Sunflower was flawed as well ! It was set upsidedown inside the clam shell. Probably a past return. Sheesh This one's obverse has a small but visible to the naked eye gash to the left of the letter L and three smaller ones around the engraver initials.

They both have been shipped back packaged and usps registered mail and insured w signature required.

Thanks to the folks that shared shipping tips! So I am out some money and the bee stung me,haha.

Mint casino crapola.

Nevermore! Instead I bought a Pamp Lady Fortuna gold bar. Quality I can count on!

Thanks again

Based on the impression I got from reading the stuff available inside the main website,I got the idea that,yes,they do inspect what they buy and end up selling. I can't give specifics and I cant preclude that there might not be loop holes.

I think the owner hangs out on this board. Maybe there is a Pure thread. Folks can ask him directly.

Good evening!

gold bars have a lower resale value

They also cost less

All comments reflect the opinion of the author, even when irrefutably accurate.

Yes, seller ships the coin to Pure, Pure inspects and then ships the coin to buyer. That's what make them a middleman unlike ebay which facilitates peer to peer transactions.

http://ProofCollection.Net

Low mintage Sunflower coins may persevere with a premium ( collector value) but only if its proof 70 gradable or already pr 70 with a "first" label.

A flawed expensive proof coin is compromised.

In the future,I would have not felt comfortable selling it off in raw to some unsuspecting buyer.

I intended to keep both and have them graded much later.

Then after the first coun flaw discovery,

I was tempted to keep at least one,hoping on the second one, but I expected a flawless coins at that price point and being such a special run mint product.

Congratulations to those that received prime condition coins.

Mine were apparently retreads.

as gold increases, premiums decrease

.

.

.

I hope so....

Remember, the 2023 was $1400 cheaper on release date.

I know you are a very smart and tied in player. I think your arguments of whether a person would have been better off putting their money in bullion or into the 2023 American High Relief are extremely valid and something I have questioned myself... that being said, I would like to add a few other pieces of data.

A smart player like yourself can time the market a little bit. For me, I purchased the 2023s HRs on a dip in gold. I believe I paid $2700 per coin.

Yesterday I sold that 2023 HR pinecone NGC PF70 for $6750 to a well-known dealer. If you run those numbers, I believe I was better off buying the High Reliefs instead of bullion.

Also, once the coin is sold, the money will be redeployed into a new manner... I have been buying the 2025 High Relief Liberty, because I believe the market for the coin is currently being depressed by the coin still being for sale at the mint, I think the market for this product will prove hot once the sellout occurs, which I believe, will be very shortly

But then again, that's only my opinion

Goldman86. All great points. And not just about timing. It can also matter exactly where and when the coins are submitted and how they are submitted too (including for special labels).

Wondercoin

The release of these coins has been very strange and I continue to receive exactly zero notifications when these become available. It's so odd they sell out, come back in stock in small or large numbers, and then sell out again. Since they are so expensive, perhaps these are returns from impulse purchases. It's really hard to justify the price of this coin when gold is at historic highs and analysts--even gold bugs--are expecting a correction.

My previous anecdote pretty much verifies that at least one 'second round' Sunflower that I bought was a previously returned item with an overt flaw. The coin was set inside the clam shell practically 90% upside down and cock eyed.

Summary: Both my recently purchased sunflowers were flawed and returned yesterday. So, there are two more to be tossed at buyers.

Caveat Emptor

At this point, it seems to me that all those that pop up as available from here on out are likely to be those that have been returned in small quantities as "unacceptable" by original purchasers.

Coinlearner, Ahrensdad, Nolawyer, RG, coinlieutenant, Yorkshireman, lordmarcovan, Soldi, masscrew, JimTyler, Relaxn, jclovescoins, justindan, doubleeagle07

Now listen boy, I'm tryin' to teach you sumthin' . . . . that ain't no optical illusion, it only looks like an optical illusion.

My mind reader refuses to charge me. . . . . . .

i just received mine back from pcgs and it was a perfect 70. my 2nd coin came from the mint yesterday, so i'll submit that for grading, but it wont have the first strike designation.

Exactly, that's why the secondary market price for raw coins is much lower than the PR70/PF70. Buyers assume raw coins = PR69/PF69.

ats 449

72 sold since yesterday

Congratualtions goldenboy89 !! Glad to hear that you got a good one.

For what it is worth, so far since morning to now, like 6 hours so far, PURE is not buying the Sunflower. Usually PURE re-prices bids with a short interim "no bids" display but not for so many hours !

Edit: 3 hours later still a "no bids" on Pure. edit: oct 8 still no bids. 'holy smokes' nun !

The PURE, "highest Bid" represents how much they pay for a product , i.e. what Pure will buy a product for. No qualifications as 'graded' or 'raw' unless noted in the product description.

any bids for graded ones?

No, Pure does not buy coins. Users enter bids to buy coins. None of Pure's users are interested in buying any right now. At this point I would be worried about receiving a flawed coin that someone was dumping on there.

Last I checked they didn't have a product option for graded 25DAs.

http://ProofCollection.Net

FIRST STRIKE

.

wow. low pops

probably be gone yet again by tomorrow

jdimmick;Gerard;wondercoin;claychaser;agentjim007;CCC2010;guitarwes;TAMU15;Zubie;mariner67;segoja;Smittys;kaz;CARDSANDCOINS;FadeToBlack;

jrt103;tizofthe;bronze6827;mkman;Scootersdad;AllCoinsRule;coindeuce;dmarks;piecesofme; and many more

114

FDOI

.

Appears to be a rush to buy before the latest price increase, which will be soon.

48

27

7

gone

just sold out right now after refreshing the page.

Sellout Summaries: (I think)

DATE. ATS. PRICE. TIME

8/21. 5285. $4265. 2-3 hours

9/21. 2825 (min.). $4565. 15 minutes

9/26. 2100 (min.). $4665. 3 days

10/2. 1030 (min.). $4715. 6 days

Are they done now?

ats 0

449 sold since yesterday

Is this the last dance? Or will some dealer cancel a big order again?

chance o> @RAWcoin said:

So there will be at most ~5K first strike, first day of Issue and advanced releases across NGC / PCGS. ~80% or 4K will be PR70/PF70. I am curious how this compares to 2021 and 2023.

Not all the first 5k coins will be graded and labeled.

I agree. When gold move up to 6 or 7K few years later. I am pretty sure I can get a MS70 for gold price +100 or 200 like the 2014-W Kennedy half dollar. Don't forget the mintage of this coin is very high 12K. It will take lots of love to move this coin higher.

I don’t know, but thanks for the summary and $4265, those were the good old Gold days!

$4865 now

Unfortunately, I don’t think that is right.

The mint reported sales of 7350 thru 8/24 and of 7952 thru 8/31.

So that ATS number of 5285 doesn’t include the 100 the mint sold at OKC or the 2500 plus

that dealers bought ahead of time paying a 5% premium or I guess even got later.

How many of those 7952 were submitted (or returned-lol) is anybody’s guess.

And I made a least one mistake in the chart - the 9/21 date should have been 9/12. My bad- sorry

The premium to the gold content is what would worry me if I were buying this as a play on gold.

That's why I would never buy these or any other Commem as a play on gold. The premium is simply an unrecoverable acquisition cost.

All comments reflect the opinion of the author, even when irrefutably accurate.

Taking about paying a premium !

OK the word 'premium' has various meanings.

Let's just say that the high probability is that anybody buying, from the US Mint ,leaked out Sunflowers for $4865 in the near future will get flawed coins for more money.

Sweet !