Just read the Costco article about them selling 100-200 million a month. Someone quoted their price from this week below. Seems like a small 2-3% markup from spot and the Pamp bar was shown. Loss leader for membership? What do the B&M's charge as a normal markup on bullion when selling to a retail customer?

On its website, Costco sells its 1 oz gold bar for $2,679.99. You have to be a member to buy the bullion. It's also non-refundable, and there's a limit of five total units per membership

@coastaljerseyguy said:

Just read the Costco article about them selling 100-200 million a month. Someone quoted their price from this week below. Seems like a small 2-3% markup from spot and the Pamp bar was shown. Loss leader for membership? What do the B&M's charge as a normal markup on bullion when selling to a retail customer?

On its website, Costco sells its 1 oz gold bar for $2,679.99. You have to be a member to buy the bullion. It's also non-refundable, and there's a limit of five total units per membership

2 or 3% is pretty normal. 4% is the ceiling. You're talking $50 to $100 per ounce.

All comments reflect the opinion of the author, even when irrefutably accurate.

I will have to check if the Executive Membership 2% cash back works on gold. Along with credit card cash back (and rotating 5% offer) Costco could be a place to buy in the future. I think I saw they had Buffalo's at one time.

Buffalos are coin so they trigger 1/2 of sales tax outlay in Colorado since they are "coins"

@pcgscacgold said:

I will have to check if the Executive Membership 2% cash back works on gold. Along with credit card cash back (and rotating 5% offer) Costco could be a place to buy in the future. I think I saw they had Buffalo's at one time.

more like 3500$, I expect a magical point for profiting taking tips the scales back into the 2500$ range but If I sold 100k worth of gold Im not sure where I would put the 100k. I will say my primary neckless and bracelet I've had since the early 2000s and wear everyday is over 20K in gold at todays prices (compared to about 2k when I bought them) and its giving me 2nd thoughts about wearing it so much.

For gold - The more it goes up the more of them priced out or risk averse. If it does drop potential big loss.

On the other hand maintain your overall plan gold position. For me it’s a combo investment and retail inventory class. Being that they are big ticket margins can be tight. Can get much higher margin on currency.

I did the math on a few of my FUN 2020 purchases when gold was about $1,650 an ounce. So figure gold bullion is up about 130%.

Bullion coins like Proof Gold have pretty much been flat; which is about as expected. That's for a 1-ouncer; maybe smaller gold coins have differed.

Numismatic coins like my 1923-D MS-66 was about $3,500 then; comparable today is about $5,000 or so. Figure a 40% increase. I've seen MS-65 premium coins have their premiums fall as gold rose just like my 1923-D.

I see the erosion in premiums in other gold coins I don't currently own but am considering for purchase. I wonder what common or semi-common premiums on pre-1933 sub-1 ounce coins (Eagles, Half Eagles, and Quarter Eagles) have done with gold doubling in price in a few years. Anybody see any trends there ?

@GoldFinger1969 said:

I did the math on a few of my FUN 2020 purchases when gold was about $1,650 an ounce. So figure gold bullion is up about 130%.

Bullion coins like Proof Gold have pretty much been flat; which is about as expected. That's for a 1-ouncer; maybe smaller gold coins have differed.

Numismatic coins like my 1923-D MS-66 was about $3,500 then; comparable today is about $5,000 or so. Figure a 40% increase. I've seen MS-65 premium coins have their premiums fall as gold rose just like my 1923-D.

I see the erosion in premiums in other gold coins I don't currently own but am considering for purchase. I wonder what common or semi-common premiums on pre-1933 sub-1 ounce coins (Eagles, Half Eagles, and Quarter Eagles) have done with gold doubling in price in a few years. Anybody see any trends there ?

Premiums have dropped across the board on common date gold coins. Common date slabbed AU half eagles from the 1840’s and 50’s aren’t worth much more than they were ten years ago.

It’s only making things worse for coin collectors. Large gold pieces are becoming unaffordable for many of them, and their numismatic value is gone.

Retired dealer and avid collector of U.S. type coins, 19th century presidential campaign medalets and selected medals. In recent years I have been working on a set of British coins - at least one coin from each king or queen who issued pieces that are collectible. I am also collecting at least one coin for each Roman emperor from Julius Caesar to ... ?

@BillJones said:

It’s only making things worse for coin collectors. Large gold pieces are becoming unaffordable for many of them, and their numismatic value is gone.

Funny how the markets work, this seems so counterintuitive (to me, anyway…)…. I had always assumed an increase in the value of the gold content would/could only boost the value of numismatically collectible gold coins.

@BillJones said:

It’s only making things worse for coin collectors. Large gold pieces are becoming unaffordable for many of them, and their numismatic value is gone.

Funny how the markets work, this seems so counterintuitive (to me, anyway…)…. I had always assumed an increase in the value of the gold content would/could only boost the value of numismatically collectible gold coins.

Why? $4000 is a lot of money for most people. The majority of collectors rarely spend more than $100 for a coin much less $4000.

All comments reflect the opinion of the author, even when irrefutably accurate.

I wonder if there will be any commemorative or spouse gold left graded below PR/MS 70.................An awful lot must be getting scrapped..............

I'm not even going to attempt to read this novel but will add this.

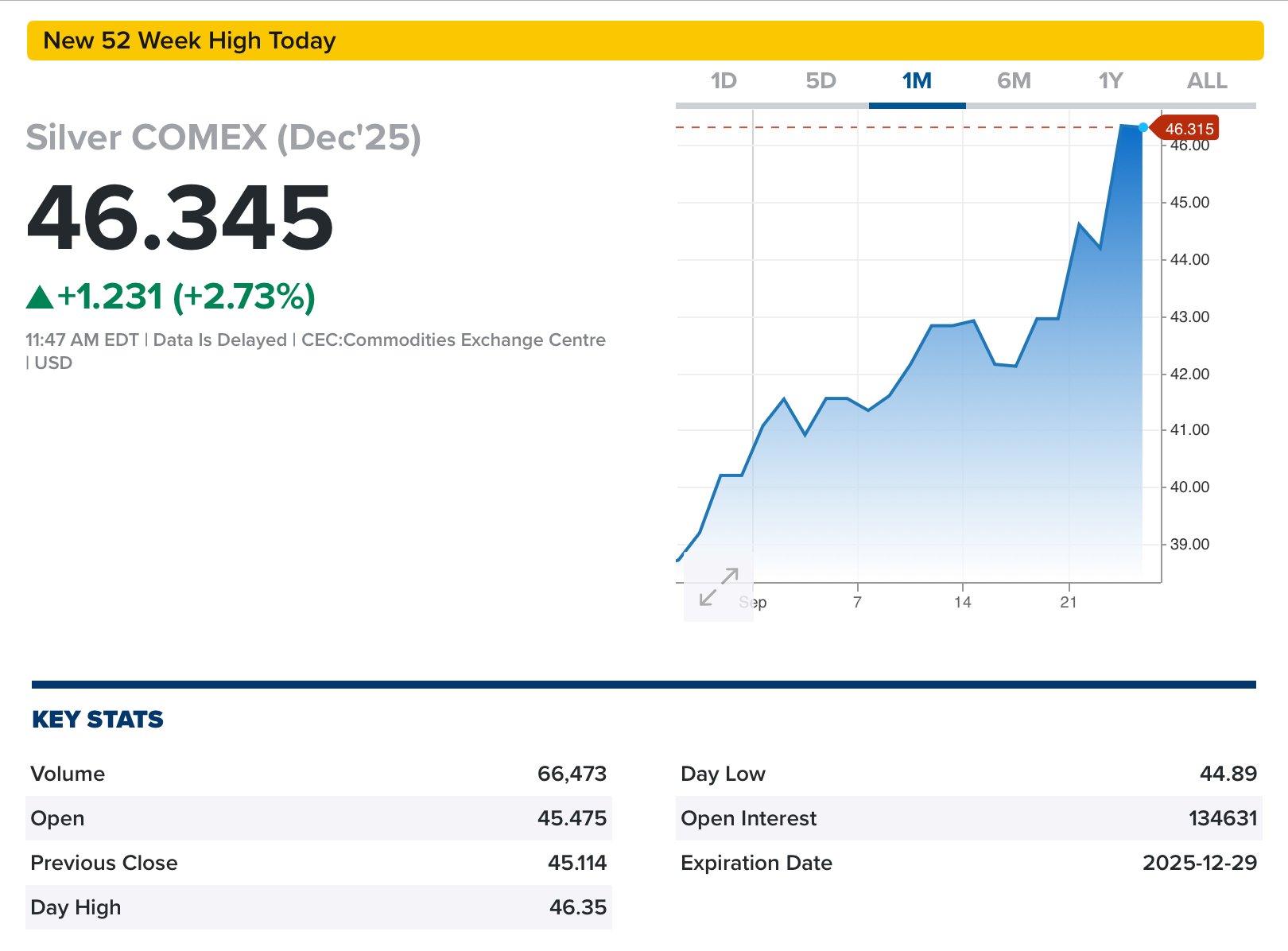

I've been too busy the last few weeks to list some silver on the BST and now I'm purposely waiting.

@BillJones said:

It’s only making things worse for coin collectors. Large gold pieces are becoming unaffordable for many of them, and their numismatic value is gone.

Funny how the markets work, this seems so counterintuitive (to me, anyway…)…. I had always assumed an increase in the value of the gold content would/could only boost the value of numismatically collectible gold coins.

Why? $4000 is a lot of money for most people. The majority of collectors rarely spend more than $100 for a coin much less $4000.

Agreed. $4K is what? Above the price of somewhere in the vicinity of 95%+ of all non-gold coinage ever struck except maybe in a holder with the highest label number(s). The higher value of the metal content means it's priced (far) above coins most collectors find (a lot) more interesting as a collectible.

@2manycoins2fewfunds said:

I wonder if there will be any commemorative or spouse gold left graded below PR/MS 70.................An awful lot must be getting scrapped..............

Maybe, but how many want it as a collectible, as opposed to buying it due to the mintage which seems to be almost entirely for speculation?

First Spouse has almost no collector appeal. It's completely uncompetitive as a collectible vs. any coinage outside of NCLT. Most modern gold commemoratives are cheaper due to the lower metal content, but still only somewhat more competitive because the designs and themes have limited appeal too. This is evident alone from the recurring NCLT threads on this forum which have virtually nothing to say about the subject coin. Completing either series is also far too expensive for the vast majority of collectors anywhere near current metal prices.

@GuzziSport said:

Funny how the markets work, this seems so counterintuitive (to me, anyway…)…. I had always assumed an increase >in the value of the gold content would/could only boost the value of numismatically collectible gold coins.

It IS boosting them....in ABSOLUTE prices (for the most part).....it's just that the value is going up LESS than the price of bullion. The premium is being eaten into...which isn't a BAD thing if you are afraid of a drop in the price of gold. In other words, if gold goes down numismatic coins should be DEFENSIVE as an investment and go down less than gold. At least there's that positive news.

These are all new developments. Gold was fixed in price until the 1970's for decades.....then we had the price float along with currencies....we had a $700 rise in price in the 1970's which was 2,000%....other rises were larger in absolute $$$ but less percentage-wise....this rise the last 5+ years is $2,000 or about 130%.

Unchartered territory.

I really do think we need to ask how some our our coins will re-price or cost us when gold is at $5,000 (which I think is very likely by 2030 if not a bit later, but before my longstanding target of 2035). I had hoped to buy an MCMVII High Relief Saint in the next few years but what happens to the price in the low-60's or high-50's where I am most likely to look if gold is $5,000 an ounce ? $10,000 an ounce ?

@skier07 said:

Premiums have dropped across the board on common date gold coins. Common date slabbed AU half eagles from >the 1840’s and 50’s aren’t worth much more than they were ten years ago.

BUT.....if the price of gold were to flatline for a while...not go up OR down....then I would expect demand for smaller bullion and pre-1933 sub-1 ounce coins to INCREASE...and you might see THOSE premiums expand. But you would need gold to go neither up nor down for a few years.

As buyers -- numismatic and bullion -- get "Sticker Shock" from the price of a single ounce gold coin (numismatic or bullion)....they'll likely try and buy sub-1 ounce coins (and maybe even Silver ASEs and other silver coins).

BTW...we're talking about the premiums on numismatic coins....has there been any material change for modern U.S. or foreign sub-1 ounce gold bullion coins (i.e., 1/2, 1/4, and 1/10th ounce American Eagles) ?

@GoldFinger1969 said:

I did the math on a few of my FUN 2020 purchases when gold was about $1,650 an ounce. So figure gold bullion is up about 130%.

Bullion coins like Proof Gold have pretty much been flat; which is about as expected. That's for a 1-ouncer; maybe smaller gold coins have differed.

Numismatic coins like my 1923-D MS-66 was about $3,500 then; comparable today is about $5,000 or so. Figure a 40% increase. I've seen MS-65 premium coins have their premiums fall as gold rose just like my 1923-D.

I see the erosion in premiums in other gold coins I don't currently own but am considering for purchase. I wonder what common or semi-common premiums on pre-1933 sub-1 ounce coins (Eagles, Half Eagles, and Quarter Eagles) have done with gold doubling in price in a few years. Anybody see any trends there ?

Premiums have dropped across the board on common date gold coins. Common date slabbed AU half eagles from the 1840’s and 50’s aren’t worth much more than they were ten years ago.

.

I see that @GoldFinger1969 agreed with the post that 1840s-1850s common-date AU half Eagles are not worth much more today that they were 10 years ago. The same debate involving @GoldFinger1969 occurred recently on another coin forum.

I showed on that forum that the contention is not true.

AU55 1847 Half Eagles sold at Heritage Auctions about 8 to 10 years ago:

MAR 2015: $470.

APR 2015: $646.

DEC 2015: $540.

MAY 2016: $517.

OCT 2016: $853.

NOV 2016: $617.

APR 2017: $540.

AU55 1852 Half Eagles sold at Heritage Auctions about 8 to 10 years ago:

JUN 2015: $646.

JUN 2015: $477.

NOV 2015: $646.

JAN 2016: $564.

OCT 2016: $587.

NOV 2016: $517.

NOV 2016: $517.

JAN 2017: $646.

APR 2017: $470.

APR 2017: $587.

JUL 2017: $493.

AUG 2017: $540.

OCT 2017: $444.

OCT 2017: $480.

AU55 1853 Half Eagles sold at Heritage Auctions about 8 to 10 years ago:

FEB 2017: $540.

APR 2017: $646.

DEC 2017: $504.

All of the above were graded by PCGS or NGC. Coins in the higher end of the price range were generally CAC certified.

Heritage Auctions does not have recent sales to compare to, but eBay has a few:

1847:

AUG 2025 (PCGS AU55): $1,900.

AUG 2025 (NGC AU53): $1,075.

1852:

AUG 2025 (NGC AU50): $1.050.

1853:

SEP 2025 (PCGS AU50): $1,250.

Recent sales on Great Collections:

1847:

AUG 2025 (NGC AU58): $1,075.

1853:

AUG 2025 (PCGS AU53): $1,030.

On average, the coins in question sold for about $550 8 to 10 years ago,

Recently, similar coins have sold for about $1,100 on average.

A doubling of the price is a lot better than "aren't worth much more".

Also note that the price appreciation might have been a bit better if not for the Fairmont Hoard which put a lot of these coins on the market last year and early this year.

My experiences from what I have sold recently is that common gold has done very well if purchased 3-4 years ago. The better date and lower pop Libs have not moved much at all (in some cases downward). Premiums have disappeared so people can pick up better dates and higher grades for little extra right now. That was not the case back at gold $2000.

I am sure others have experiences that differ from mine. There are still a large number of old time collectors sitting on multi-million dollar collections. It will interesting to see how the next few years play out as those come to market. Common DE's at $5000-6000 could become the norm. That might be enough to get some to sell. There are plenty of buyers. A recent sale of 30 Saints (online dealer that many know) took just hours to get all into new collections.

@WCC said:

Agreed. $4K is what? Above the price of somewhere in the vicinity of 95%+ of all non-gold coinage ever struck >except maybe in a holder with the highest label number(s). The higher value of the metal content means it's priced >(far) above coins most collectors find (a lot) more interesting as a collectible.

Intuitively I agree with you....but if the metal itself is worth $4,000 or $5,000 or whatever....why not still have a premium tacked on ? That's the cost of purchasing said coin.

Housing today is more expensive than it was 20 years ago and 35 years ago and 60 years ago but a HUGE factor...everything from the actual liquidation value of the materials used to build the house to the market value of the residence in a given neighborhood.

Now, most people look at a home as a necessity unlike a coin. And I expect there to be demand destruction from higher prices for a coin than with a home since real estate and land are largely fixed/ineleastic commodities.

But I'm still surprised that coins that in the past commanded 25% or 50% or 100% or more premiums....now have those premiums greatly reduced or even eliminated for the most part. I thought they WOULD change in absolute or relative dollar terms...but not disappear completely, as looks might happen if we keep going higher with gold.

@dcarr said:

I see that @GoldFinger1969 agreed with the post that 1840s-1850s common-date AU half Eagles are not worth >much more today that they were 10 years ago. The same debate involving @GoldFinger1969 occurred recently on >another coin forum.

I was "liking" the information, I am not an expert on that series or recent or past pricing.

We had the same "debate" here and others I believed agreed with it on another thread. Assuming the pricing of 2015-16 when gold was about $1,300 for the most part....it stands to reason that the premiums have eroded. How much, you guys who collect know better than me. Obviously, if someone paid above market for a particular coin or they were at the mercy of a greedy LCS or dealer than their pricing experience would be off a bit.

@dcarr said:

On average, the coins in question sold for about $550 8 to 10 years ago,

Recently, similar coins have sold for about $1,100 on average.>

A doubling of the price is a lot better than "aren't worth much more".

Also note that the price appreciation might have been a bit better if not for the Fairmont Hoard which put a lot of >these coins on the market last year and early this year.

As someone not an expert on the series, I take what both you and skier07 said as not necessarily incompatible.

Could be the specific coins he purchased moved in price the way he said they did -- I'll let him speak for himself, but I realize that both of you can be correct. It's also possible he willingly and knowingly paid above market and was happy to do so given the coins and his options at the time he made the purchases.

I had three common date pre 1860 PCGS/NGC 55 half eagles. My average purchase price was $700 in 2017. I sold them privately on FB without any selling fees four months ago. My average sales price was $960. The HA, eBay, and GC sales prices don’t reflect what the seller nets.

On a percentage basis $700 to $950 is ~40% while the price of gold doubled. I also don’t consider a $700 coin selling for $950 to be a huge windfall plus I have to pay for shipping and insurance.

@WCC said:

Agreed. $4K is what? Above the price of somewhere in the vicinity of 95%+ of all non-gold coinage ever struck >except maybe in a holder with the highest label number(s). The higher value of the metal content means it's priced >(far) above coins most collectors find (a lot) more interesting as a collectible.

Intuitively I agree with you....but if the metal itself is worth $4,000 or $5,000 or whatever....why not still have a premium tacked on ? That's the cost of purchasing said coin.

I don't track the premiums. I have a general awareness mostly for DE but that's all.

If you are referring to a similar premium to bullion which iabout 4%, a DE doesn't have a full ounce meaning I wouldn't necessarily expect it to sell for the same price or more. Higher premium maybe, but not price.

There is also some difference between really common generics like the most common Saints and the 1904 LH vs. other denominations with maybe in the range of 10,000+. It's conceivable 10,000+ buyers will buy one of these coins for their collection depending upon assumptions of the collector base. I see no possibility there are anywhere near 100K+ actual collectors (as opposed to "stackers" buying it as a substitute) for the most common Saints or the 1904. So, if there aren't enough wanting it as a collectible, it's effectively a bullion coin. That's just how reality works. There isn't enough demand from a third source who will pay more.

But I'm still surprised that coins that in the past commanded 25% or 50% or 100% or more premiums....now have those premiums greatly reduced or even eliminated for the most part. I thought they WOULD change in absolute or relative dollar terms...but not disappear completely, as looks might happen if we keep going higher with gold.

My explanation for it is 1) the coin market isn't completely efficient 2) fewer buyers buying it as a collectible because it's less competitive. 3) fewer financially motivated buyers willing to risk paying higher premiums because of 2)

This outcome shouldn't be surprising. Your view seems to be that prior premiums were "normal" or "more normal" while the more recent premiums aren't or less so. There is no "normal premium" and never was.

There is also no practical difference as a collectible between many (I'd claim practically all) of these coins but whatever difference exists, the shrinking premiums indicate it's not enough to entice buyers to pay more. At some point, the quality differences which US collecting prioritizes aren't interesting enough to enough buyers.

There are hardly any numismatic coins that have jumped up as much as the pms have, I can't think of one, that had I kept it would have realized the same increases, plus there are liquidity issues with numismatic coins and auction fees.

@WCC said:

Agreed. $4K is what? Above the price of somewhere in the vicinity of 95%+ of all non-gold coinage ever struck >except maybe in a holder with the highest label number(s). The higher value of the metal content means it's priced >(far) above coins most collectors find (a lot) more interesting as a collectible.

Intuitively I agree with you....but if the metal itself is worth $4,000 or $5,000 or whatever....why not still have a premium tacked on ? That's the cost of purchasing said coin.

Housing today is more expensive than it was 20 years ago and 35 years ago and 60 years ago but a HUGE factor...everything from the actual liquidation value of the materials used to build the house to the market value of the residence in a given neighborhood.

Now, most people look at a home as a necessity unlike a coin. And I expect there to be demand destruction from higher prices for a coin than with a home since real estate and land are largely fixed/ineleastic commodities.

But I'm still surprised that coins that in the past commanded 25% or 50% or 100% or more premiums....now have those premiums greatly reduced or even eliminated for the most part. I thought they WOULD change in absolute or relative dollar terms...but not disappear completely, as looks might happen if we keep going higher with gold.

The market is what the market ietss... didn't you say that yourself. There is no reason there needs to be any premium for gold widgets. They are extremely common.

All comments reflect the opinion of the author, even when irrefutably accurate.

I had three common date pre 1860 PCGS/NGC 55 half eagles. My average purchase price was $700 in 2017. I sold them privately on FB without any selling fees four months ago. My average sales price was $960. The HA, eBay, and GC sales prices don’t reflect what the seller nets.

On a percentage basis $700 to $950 is ~40% while the price of gold doubled. I also don’t consider a $700 coin selling for $950 to be a huge windfall plus I have to pay for shipping and insurance.

.

I compared prices realized (8 to 10 years ago) to prices realized recently.

Seller's fees, shipping, etc do cut into the profit (if any). But that can also apply to straight bullion.

If some time was spent shopping around at coin shows, at both the buying and selling points, the seller's fees can be largely eliminated.

When gold crossed $3500 I took a couple generic Eagles in PCGS holders to a "Cash for gold" place. Not to sell, just to see what those places actually do. They offered 20% back of melt for the two P62's. I asked what they do with them and was told they go straight to the refinery to be melted. Higher gold prices will cause a decrease in available coins. I am sure many places do the same thing.

@pcgscacgold said:

When gold crossed $3500 I took a couple generic Eagles in PCGS holders to a "Cash for gold" place. Not to sell, just >to see what those places actually do. They offered 20% back of melt for the two P62's. I asked what they do with >them and was told they go straight to the refinery to be melted. Higher gold prices will cause a decrease in >available coins. I am sure many places do the same thing.

Wait....so they're only giving you 80% of the spot gold price ?

@pcgscacgold said:

When gold crossed $3500 I took a couple generic Eagles in PCGS holders to a "Cash for gold" place. Not to sell, just >to see what those places actually do. They offered 20% back of melt for the two P62's. I asked what they do with >them and was told they go straight to the refinery to be melted. Higher gold prices will cause a decrease in >available coins. I am sure many places do the same thing.

Wait....so they're only giving you 80% of the spot gold price ?

That is what the Cash For Gold place was offering then. I was not selling but wanted to see what there deal was.

@pcgscacgold said:

When gold crossed $3500 I took a couple generic Eagles in PCGS holders to a "Cash for gold" place. Not to sell, just >to see what those places actually do. They offered 20% back of melt for the two P62's. I asked what they do with >them and was told they go straight to the refinery to be melted. Higher gold prices will cause a decrease in >available coins. I am sure many places do the same thing.

Wait....so they're only giving you 80% of the spot gold price ?

Not uncommon for "cash for gold" and many pawn shops. Often not good places to sell bullion.

All comments reflect the opinion of the author, even when irrefutably accurate.

That is what the Cash For Gold place was offering then. I was not selling but wanted to see what there deal was.

The higher the gold price, the more "Cash for Gold" signs I see going up on random store windows. Sad that people cash in at 80% and don't shop around.

@jmlanzaf said:

Not uncommon for "cash for gold" and many pawn shops. Often not good places to sell bullion.

I'm just surprised anybody would be that desperate to goto a place offering only 80% of spot where if you goto any LCS they are likely to be closer to 95%. Gold and PMs are pretty liquid, after all.

For other tangible items, I certainly understand the need for a sizeable haircut/discount.

@TimNH said:

The higher the gold price, the more "Cash for Gold" signs I see going up on random store windows. Sad that >people cash in at 80% and don't shop around.

There are now publicly-traded pawn shops expanding all over the country.

The thing I have to remember -- and some of you too -- is that not all of us live near major urban areas with tons of banks and LCSs. Some people are in really remote/rural areas where an LCS might be 2 hours away.

@jmlanzaf said:

Not uncommon for "cash for gold" and many pawn shops. Often not good places to sell bullion.

I'm just surprised anybody would be that desperate to goto a place offering only 80% of spot where if you goto any LCS they are likely to be closer to 95%. Gold and PMs are pretty liquid, after all.

I can't comment on desperation or not but ignorance of gold prices and the PM market is almost certainly a key driver in the vast majority of these cases.

@pcgscacgold said:

When gold crossed $3500 I took a couple generic Eagles in PCGS holders to a "Cash for gold" place. Not to sell, just >to see what those places actually do. They offered 20% back of melt for the two P62's. I asked what they do with >them and was told they go straight to the refinery to be melted. Higher gold prices will cause a decrease in >available coins. I am sure many places do the same thing.

Wait....so they're only giving you 80% of the spot gold price ?

Not uncommon for "cash for gold" and many pawn shops. Often not good places to sell bullion.

.

Also, when you ask at these places what they have to sell, they almost never have anything.

I think they buy under wholesale and immediately drive the items across town to a coin shop to sell.

@pcgscacgold said:

When gold crossed $3500 I took a couple generic Eagles in PCGS holders to a "Cash for gold" place. Not to sell, just to see what those places actually do. They offered 20% back of melt for the two P62's. I asked what they do with them and was told they go straight to the refinery to be melted. Higher gold prices will cause a decrease in available coins. I am sure many places do the same thing.

20% in back of melt is brutal! Hope you learned enough not to return for a skinning!

Comments

Just read the Costco article about them selling 100-200 million a month. Someone quoted their price from this week below. Seems like a small 2-3% markup from spot and the Pamp bar was shown. Loss leader for membership? What do the B&M's charge as a normal markup on bullion when selling to a retail customer?

On its website, Costco sells its 1 oz gold bar for $2,679.99. You have to be a member to buy the bullion. It's also non-refundable, and there's a limit of five total units per membership

2 or 3% is pretty normal. 4% is the ceiling. You're talking $50 to $100 per ounce.

All comments reflect the opinion of the author, even when irrefutably accurate.

I will have to check if the Executive Membership 2% cash back works on gold. Along with credit card cash back (and rotating 5% offer) Costco could be a place to buy in the future. I think I saw they had Buffalo's at one time.

Successful BST with drddm, BustDMs, Pnies20, lkeigwin, pursuitofliberty, Bullsitter, felinfoel, SPalladino

$5 Type Set https://www.pcgs.com/setregistry/u-s-coins/type-sets/half-eagle-type-set-circulation-strikes-1795-1929/album/344192

CBH Set https://www.pcgs.com/setregistry/everyman-collections/everyman-half-dollars/everyman-capped-bust-half-dollars-1807-1839/album/345572

Buffalos are coin so they trigger 1/2 of sales tax outlay in Colorado since they are "coins"

Bumping up (retail price) my $20 Libs and Saints.

You mean "If it goes to $3,300...."

more like 3500$, I expect a magical point for profiting taking tips the scales back into the 2500$ range but If I sold 100k worth of gold Im not sure where I would put the 100k. I will say my primary neckless and bracelet I've had since the early 2000s and wear everyday is over 20K in gold at todays prices (compared to about 2k when I bought them) and its giving me 2nd thoughts about wearing it so much.

11.5$ Southern Dollars, The little “Big Easy” set

For gold - The more it goes up the more of them priced out or risk averse. If it does drop potential big loss.

On the other hand maintain your overall plan gold position. For me it’s a combo investment and retail inventory class. Being that they are big ticket margins can be tight. Can get much higher margin on currency.

I did the math on a few of my FUN 2020 purchases when gold was about $1,650 an ounce. So figure gold bullion is up about 130%.

Bullion coins like Proof Gold have pretty much been flat; which is about as expected. That's for a 1-ouncer; maybe smaller gold coins have differed.

Numismatic coins like my 1923-D MS-66 was about $3,500 then; comparable today is about $5,000 or so. Figure a 40% increase. I've seen MS-65 premium coins have their premiums fall as gold rose just like my 1923-D.

I see the erosion in premiums in other gold coins I don't currently own but am considering for purchase. I wonder what common or semi-common premiums on pre-1933 sub-1 ounce coins (Eagles, Half Eagles, and Quarter Eagles) have done with gold doubling in price in a few years. Anybody see any trends there ?

Premiums have dropped across the board on common date gold coins. Common date slabbed AU half eagles from the 1840’s and 50’s aren’t worth much more than they were ten years ago.

It’s only making things worse for coin collectors. Large gold pieces are becoming unaffordable for many of them, and their numismatic value is gone.

The price of gold is now arriving at Gate 12...

Gate 13...

Gate 14...

Gate 20...

Gate 4,000

Funny how the markets work, this seems so counterintuitive (to me, anyway…)…. I had always assumed an increase in the value of the gold content would/could only boost the value of numismatically collectible gold coins.

Why? $4000 is a lot of money for most people. The majority of collectors rarely spend more than $100 for a coin much less $4000.

All comments reflect the opinion of the author, even when irrefutably accurate.

I wonder if there will be any commemorative or spouse gold left graded below PR/MS 70.................An awful lot must be getting scrapped..............

Futures, baby:

I'm not even going to attempt to read this novel but will add this.

I've been too busy the last few weeks to list some silver on the BST and now I'm purposely waiting.

Mo futures, (if the house is rockin…) your future wait and sell looks brighter:

Agreed. $4K is what? Above the price of somewhere in the vicinity of 95%+ of all non-gold coinage ever struck except maybe in a holder with the highest label number(s). The higher value of the metal content means it's priced (far) above coins most collectors find (a lot) more interesting as a collectible.

Maybe, but how many want it as a collectible, as opposed to buying it due to the mintage which seems to be almost entirely for speculation?

First Spouse has almost no collector appeal. It's completely uncompetitive as a collectible vs. any coinage outside of NCLT. Most modern gold commemoratives are cheaper due to the lower metal content, but still only somewhat more competitive because the designs and themes have limited appeal too. This is evident alone from the recurring NCLT threads on this forum which have virtually nothing to say about the subject coin. Completing either series is also far too expensive for the vast majority of collectors anywhere near current metal prices.

It IS boosting them....in ABSOLUTE prices (for the most part).....it's just that the value is going up LESS than the price of bullion. The premium is being eaten into...which isn't a BAD thing if you are afraid of a drop in the price of gold. In other words, if gold goes down numismatic coins should be DEFENSIVE as an investment and go down less than gold. At least there's that positive news.

These are all new developments. Gold was fixed in price until the 1970's for decades.....then we had the price float along with currencies....we had a $700 rise in price in the 1970's which was 2,000%....other rises were larger in absolute $$$ but less percentage-wise....this rise the last 5+ years is $2,000 or about 130%.

Unchartered territory.

I really do think we need to ask how some our our coins will re-price or cost us when gold is at $5,000 (which I think is very likely by 2030 if not a bit later, but before my longstanding target of 2035). I had hoped to buy an MCMVII High Relief Saint in the next few years but what happens to the price in the low-60's or high-50's where I am most likely to look if gold is $5,000 an ounce ? $10,000 an ounce ?

Unchartered territory.

BUT.....if the price of gold were to flatline for a while...not go up OR down....then I would expect demand for smaller bullion and pre-1933 sub-1 ounce coins to INCREASE...and you might see THOSE premiums expand. But you would need gold to go neither up nor down for a few years.

As buyers -- numismatic and bullion -- get "Sticker Shock" from the price of a single ounce gold coin (numismatic or bullion)....they'll likely try and buy sub-1 ounce coins (and maybe even Silver ASEs and other silver coins).

BTW...we're talking about the premiums on numismatic coins....has there been any material change for modern U.S. or foreign sub-1 ounce gold bullion coins (i.e., 1/2, 1/4, and 1/10th ounce American Eagles) ?

.

I see that @GoldFinger1969 agreed with the post that 1840s-1850s common-date AU half Eagles are not worth much more today that they were 10 years ago. The same debate involving @GoldFinger1969 occurred recently on another coin forum.

I showed on that forum that the contention is not true.

AU55 1847 Half Eagles sold at Heritage Auctions about 8 to 10 years ago:

MAR 2015: $470.

APR 2015: $646.

DEC 2015: $540.

MAY 2016: $517.

OCT 2016: $853.

NOV 2016: $617.

APR 2017: $540.

AU55 1852 Half Eagles sold at Heritage Auctions about 8 to 10 years ago:

JUN 2015: $646.

JUN 2015: $477.

NOV 2015: $646.

JAN 2016: $564.

OCT 2016: $587.

NOV 2016: $517.

NOV 2016: $517.

JAN 2017: $646.

APR 2017: $470.

APR 2017: $587.

JUL 2017: $493.

AUG 2017: $540.

OCT 2017: $444.

OCT 2017: $480.

AU55 1853 Half Eagles sold at Heritage Auctions about 8 to 10 years ago:

FEB 2017: $540.

APR 2017: $646.

DEC 2017: $504.

All of the above were graded by PCGS or NGC. Coins in the higher end of the price range were generally CAC certified.

Heritage Auctions does not have recent sales to compare to, but eBay has a few:

1847:

AUG 2025 (PCGS AU55): $1,900.

AUG 2025 (NGC AU53): $1,075.

1852:

AUG 2025 (NGC AU50): $1.050.

1853:

SEP 2025 (PCGS AU50): $1,250.

Recent sales on Great Collections:

1847:

AUG 2025 (NGC AU58): $1,075.

1853:

AUG 2025 (PCGS AU53): $1,030.

On average, the coins in question sold for about $550 8 to 10 years ago,

Recently, similar coins have sold for about $1,100 on average.

A doubling of the price is a lot better than "aren't worth much more".

Also note that the price appreciation might have been a bit better if not for the Fairmont Hoard which put a lot of these coins on the market last year and early this year.

My experiences from what I have sold recently is that common gold has done very well if purchased 3-4 years ago. The better date and lower pop Libs have not moved much at all (in some cases downward). Premiums have disappeared so people can pick up better dates and higher grades for little extra right now. That was not the case back at gold $2000.

I am sure others have experiences that differ from mine. There are still a large number of old time collectors sitting on multi-million dollar collections. It will interesting to see how the next few years play out as those come to market. Common DE's at $5000-6000 could become the norm. That might be enough to get some to sell. There are plenty of buyers. A recent sale of 30 Saints (online dealer that many know) took just hours to get all into new collections.

Successful BST with drddm, BustDMs, Pnies20, lkeigwin, pursuitofliberty, Bullsitter, felinfoel, SPalladino

$5 Type Set https://www.pcgs.com/setregistry/u-s-coins/type-sets/half-eagle-type-set-circulation-strikes-1795-1929/album/344192

CBH Set https://www.pcgs.com/setregistry/everyman-collections/everyman-half-dollars/everyman-capped-bust-half-dollars-1807-1839/album/345572

The market is what the market is.

I'd LOVE for the lack of collectors not spending more than $100 for a coin to help me purchase an MCMVII High Relief but it doesn't appear likely.

Intuitively I agree with you....but if the metal itself is worth $4,000 or $5,000 or whatever....why not still have a premium tacked on ? That's the cost of purchasing said coin.

Housing today is more expensive than it was 20 years ago and 35 years ago and 60 years ago but a HUGE factor...everything from the actual liquidation value of the materials used to build the house to the market value of the residence in a given neighborhood.

Now, most people look at a home as a necessity unlike a coin. And I expect there to be demand destruction from higher prices for a coin than with a home since real estate and land are largely fixed/ineleastic commodities.

But I'm still surprised that coins that in the past commanded 25% or 50% or 100% or more premiums....now have those premiums greatly reduced or even eliminated for the most part. I thought they WOULD change in absolute or relative dollar terms...but not disappear completely, as looks might happen if we keep going higher with gold.

I was "liking" the information, I am not an expert on that series or recent or past pricing.

We had the same "debate" here and others I believed agreed with it on another thread. Assuming the pricing of 2015-16 when gold was about $1,300 for the most part....it stands to reason that the premiums have eroded. How much, you guys who collect know better than me. Obviously, if someone paid above market for a particular coin or they were at the mercy of a greedy LCS or dealer than their pricing experience would be off a bit.

Thanks for the pricing information, DC.

As someone not an expert on the series, I take what both you and skier07 said as not necessarily incompatible.

Could be the specific coins he purchased moved in price the way he said they did -- I'll let him speak for himself, but I realize that both of you can be correct. It's also possible he willingly and knowingly paid above market and was happy to do so given the coins and his options at the time he made the purchases.

Those were numismatics not common generics, right ?

Some better dates mixed in but mostly 61-64 Saints. Some CAC, many not. Some in Rattlers so that helped make a quick sale.

Successful BST with drddm, BustDMs, Pnies20, lkeigwin, pursuitofliberty, Bullsitter, felinfoel, SPalladino

$5 Type Set https://www.pcgs.com/setregistry/u-s-coins/type-sets/half-eagle-type-set-circulation-strikes-1795-1929/album/344192

CBH Set https://www.pcgs.com/setregistry/everyman-collections/everyman-half-dollars/everyman-capped-bust-half-dollars-1807-1839/album/345572

@dcarr

I was off but here are my results.

I had three common date pre 1860 PCGS/NGC 55 half eagles. My average purchase price was $700 in 2017. I sold them privately on FB without any selling fees four months ago. My average sales price was $960. The HA, eBay, and GC sales prices don’t reflect what the seller nets.

On a percentage basis $700 to $950 is ~40% while the price of gold doubled. I also don’t consider a $700 coin selling for $950 to be a huge windfall plus I have to pay for shipping and insurance.

I don't track the premiums. I have a general awareness mostly for DE but that's all.

If you are referring to a similar premium to bullion which iabout 4%, a DE doesn't have a full ounce meaning I wouldn't necessarily expect it to sell for the same price or more. Higher premium maybe, but not price.

There is also some difference between really common generics like the most common Saints and the 1904 LH vs. other denominations with maybe in the range of 10,000+. It's conceivable 10,000+ buyers will buy one of these coins for their collection depending upon assumptions of the collector base. I see no possibility there are anywhere near 100K+ actual collectors (as opposed to "stackers" buying it as a substitute) for the most common Saints or the 1904. So, if there aren't enough wanting it as a collectible, it's effectively a bullion coin. That's just how reality works. There isn't enough demand from a third source who will pay more.

My explanation for it is 1) the coin market isn't completely efficient 2) fewer buyers buying it as a collectible because it's less competitive. 3) fewer financially motivated buyers willing to risk paying higher premiums because of 2)

This outcome shouldn't be surprising. Your view seems to be that prior premiums were "normal" or "more normal" while the more recent premiums aren't or less so. There is no "normal premium" and never was.

There is also no practical difference as a collectible between many (I'd claim practically all) of these coins but whatever difference exists, the shrinking premiums indicate it's not enough to entice buyers to pay more. At some point, the quality differences which US collecting prioritizes aren't interesting enough to enough buyers.

WCC, Skier, Dcarr....all great posts, good information and I appreciate the civil back-and-forth.

Big Picture: Gold goes higher, and premiums narrow. We're only debating the amount.

There are hardly any numismatic coins that have jumped up as much as the pms have, I can't think of one, that had I kept it would have realized the same increases, plus there are liquidity issues with numismatic coins and auction fees.

The market is what the market ietss... didn't you say that yourself. There is no reason there needs to be any premium for gold widgets. They are extremely common.

All comments reflect the opinion of the author, even when irrefutably accurate.

Silly straw man. A HR is not a widget. There are MILLIONS of common date DEs

All comments reflect the opinion of the author, even when irrefutably accurate.

.

I compared prices realized (8 to 10 years ago) to prices realized recently.

Seller's fees, shipping, etc do cut into the profit (if any). But that can also apply to straight bullion.

If some time was spent shopping around at coin shows, at both the buying and selling points, the seller's fees can be largely eliminated.

.

One thing for certain about the higher prices is that I am able to purchase far few bullion related coins than I would like to!

When gold crossed $3500 I took a couple generic Eagles in PCGS holders to a "Cash for gold" place. Not to sell, just to see what those places actually do. They offered 20% back of melt for the two P62's. I asked what they do with them and was told they go straight to the refinery to be melted. Higher gold prices will cause a decrease in available coins. I am sure many places do the same thing.

Successful BST with drddm, BustDMs, Pnies20, lkeigwin, pursuitofliberty, Bullsitter, felinfoel, SPalladino

$5 Type Set https://www.pcgs.com/setregistry/u-s-coins/type-sets/half-eagle-type-set-circulation-strikes-1795-1929/album/344192

CBH Set https://www.pcgs.com/setregistry/everyman-collections/everyman-half-dollars/everyman-capped-bust-half-dollars-1807-1839/album/345572

Do we have any dealers here who can tell us if some regular bullion buyers (modern or Pre-1933) are no longer buying 1 ounce coins but sub-1 ounce ?

Wait....so they're only giving you 80% of the spot gold price ?

That is what the Cash For Gold place was offering then. I was not selling but wanted to see what there deal was.

Successful BST with drddm, BustDMs, Pnies20, lkeigwin, pursuitofliberty, Bullsitter, felinfoel, SPalladino

$5 Type Set https://www.pcgs.com/setregistry/u-s-coins/type-sets/half-eagle-type-set-circulation-strikes-1795-1929/album/344192

CBH Set https://www.pcgs.com/setregistry/everyman-collections/everyman-half-dollars/everyman-capped-bust-half-dollars-1807-1839/album/345572

Not uncommon for "cash for gold" and many pawn shops. Often not good places to sell bullion.

All comments reflect the opinion of the author, even when irrefutably accurate.

The higher the gold price, the more "Cash for Gold" signs I see going up on random store windows. Sad that people cash in at 80% and don't shop around.

I'm just surprised anybody would be that desperate to goto a place offering only 80% of spot where if you goto any LCS they are likely to be closer to 95%. Gold and PMs are pretty liquid, after all.

For other tangible items, I certainly understand the need for a sizeable haircut/discount.

There are now publicly-traded pawn shops expanding all over the country.

The thing I have to remember -- and some of you too -- is that not all of us live near major urban areas with tons of banks and LCSs. Some people are in really remote/rural areas where an LCS might be 2 hours away.

I can't comment on desperation or not but ignorance of gold prices and the PM market is almost certainly a key driver in the vast majority of these cases.

chopmarkedtradedollars.com

.

Also, when you ask at these places what they have to sell, they almost never have anything.

I think they buy under wholesale and immediately drive the items across town to a coin shop to sell.

.

Moved this thread to the correct forum.

Abby Zechman

PCGS Education Coordinator

20% in back of melt is brutal! Hope you learned enough not to return for a skinning!