@Rc5280 said:

I just don't want to be "overly literal" in my observations, as NJ might scold me

what do you mean by that?

.

An argument might occur(and get out of hand) if someone is being overly generalistic & speculative vs someone else being overly specific, and literal when interpreting a given subject.

This is worth saving. As aphorisms go this is aphorismic!

“When you don't know what you're talking about, it's hard to know when you're finished.” - Tommy Smothers

@Onastone said:

Queen warned us about these laser beams long ago:

"She's a Killer Queen

Gunpowder, gelatine

Dynamite with a laser beam

Guaranteed to blow your mind

Anytime"

In the Brittish vernacular, are we talking the Thin Lizzie?

“When you don't know what you're talking about, it's hard to know when you're finished.” - Tommy Smothers

@Onastone said:

Queen warned us about these laser beams long ago:

"She's a Killer Queen

Gunpowder, gelatine

Dynamite with a laser beam

Guaranteed to blow your mind

Anytime"

In the Brittish vernacular, are we talking the Thin Lizzie?

@HalfDime said:

So they have struck the full amount for the first two silver eagle privy coins. Earlier it looked like this one might have come in low.

I'm wondering when the HHL of 1 was lifted.

When it went CU it was a surprise to me.

The percentage of 69's vs the 70's in AR & FS is out of whack imo.

There are still more 69's than 70's in those two categories, and the FDI ratio is not up to snuff either.

@Rc5280 said:

I'm wondering when the HHL of 1 was lifted.

They first lifted the HHL on the Army coin a couple of weeks after release in the middle of the day, and the Laser coin was about 10 days after release at 12 noon.

The gold sunflower UHR additional coins came out at a random time with no notice as well.

So all three were done randomly, although technically the UHR was lifted after the first day, but not all the coins were uploaded for sale. So it was effectively the same as a late lift on that coin.

This is why some are wondering if the mint is doing it for the benefit of the big buyers.

@Rc5280 said:

I'm wondering when the HHL of 1 was lifted.

They first lifted the HHL on the Army coin a couple of weeks after release in the middle of the day, and the Laser coin was about 10 days after release at 12 noon.

The gold sunflower UHR additional coins came out at a random time with no notice as well.

So all three were done randomly, although technically the UHR was lifted after the first day, but not all the coins were uploaded for sale. So it was effectively the same as a late lift on that coin.

This is why some are wondering if the mint is doing it for the benefit of the big buyers.

There is honestly not a lot to wonder about here. All excuses aside, they put a subset of the maximum up for sale with a HHL, sold out before the HHL was lifted, later lifted the HHL, and then put the remainder of the maximum up for sale with no notice to the public.

If they wanted to assure wide retail distribution through enforcement of a HHL, they would have placed the item on back order after the initial quantity sold out, and/or kept the HHL in place, and/or provided retail with notice that additional coins would be released. With a date and time, like they do for all initial releases since this was, in effect, a re-release, with inventory not previously made available for sale.

And, they could have made all the additional quantity available for sale to the public, rather than holding back 1200 out of 4000 for big buyers. In hindsight, we can see that they were sold, and know they were not loaded into ATS along with the other 2800.

People who want to can rationalize anything, but what they did here couldn't be more clear if they announced it in a press release.

@Rc5280 said:

I'm wondering when the HHL of 1 was lifted.

They first lifted the HHL on the Army coin a couple of weeks after release in the middle of the day, and the Laser coin was about 10 days after release at 12 noon.

The gold sunflower UHR additional coins came out at a random time with no notice as well.

So all three were done randomly, although technically the UHR was lifted after the first day, but not all the coins were uploaded for sale. So it was effectively the same as a late lift on that coin.

This is why some are wondering if the mint is doing it for the benefit of the big buyers.

There is honestly not a lot to wonder about here. All excuses aside, they put a subset of the maximum up for sale with a HHL, sold out before the HHL was lifted, later lifted the HHL, and then put the remainder of the maximum up for sale with no notice to the public.

If they wanted to assure wide retail distribution through enforcement of a HHL, they would have placed the item on back order after the initial quantity sold out, and/or kept the HHL in place, and/or provided retail with notice that additional coins would be released. With a date and time, like they do for all initial releases since this was, in effect, a re-release, with inventory not previously made available for sale.

I am of the opinion that 10 days of availability to the public at HHL=1 resulted in wide retail distribution. How many days do you think they need to give the public a chance to buy one? If someone doesn't buy one in the first 10 days, they probably don't want one, don't you think?

@Rc5280 said:

I'm wondering when the HHL of 1 was lifted.

They first lifted the HHL on the Army coin a couple of weeks after release in the middle of the day, and the Laser coin was about 10 days after release at 12 noon.

The gold sunflower UHR additional coins came out at a random time with no notice as well.

So all three were done randomly, although technically the UHR was lifted after the first day, but not all the coins were uploaded for sale. So it was effectively the same as a late lift on that coin.

This is why some are wondering if the mint is doing it for the benefit of the big buyers.

There is honestly not a lot to wonder about here. All excuses aside, they put a subset of the maximum up for sale with a HHL, sold out before the HHL was lifted, later lifted the HHL, and then put the remainder of the maximum up for sale with no notice to the public.

If they wanted to assure wide retail distribution through enforcement of a HHL, they would have placed the item on back order after the initial quantity sold out, and/or kept the HHL in place, and/or provided retail with notice that additional coins would be released. With a date and time, like they do for all initial releases since this was, in effect, a re-release, with inventory not previously made available for sale.

I am of the opinion that 10 days of availability to the public at HHL=1 resulted in wide retail distribution. How many days do you think they need to give the public a chance to buy one? If someone doesn't buy one in the first 10 days, they probably don't want one, don't you think?

Not only was 10 days enough for wide retail distribution, but the AB Bigs are also there to widely distribute retail further yet - that is their purpose.

But, the AB's are the Pigs, Thieves, and the Boogeymen that are in cahoots with the Conspiratorial Mint.

Remember, there is a narrative to uphold no matter the facts & circumstances that are right in front of us.

@Rc5280 said:

I'm wondering when the HHL of 1 was lifted.

They first lifted the HHL on the Army coin a couple of weeks after release in the middle of the day, and the Laser coin was about 10 days after release at 12 noon.

The gold sunflower UHR additional coins came out at a random time with no notice as well.

So all three were done randomly, although technically the UHR was lifted after the first day, but not all the coins were uploaded for sale. So it was effectively the same as a late lift on that coin.

This is why some are wondering if the mint is doing it for the benefit of the big buyers.

There is honestly not a lot to wonder about here. All excuses aside, they put a subset of the maximum up for sale with a HHL, sold out before the HHL was lifted, later lifted the HHL, and then put the remainder of the maximum up for sale with no notice to the public.

If they wanted to assure wide retail distribution through enforcement of a HHL, they would have placed the item on back order after the initial quantity sold out, and/or kept the HHL in place, and/or provided retail with notice that additional coins would be released. With a date and time, like they do for all initial releases since this was, in effect, a re-release, with inventory not previously made available for sale.

I am of the opinion that 10 days of availability to the public at HHL=1 resulted in wide retail distribution. How many days do you think they need to give the public a chance to buy one? If someone doesn't buy one in the first 10 days, they probably don't want one, don't you think?

Not only was 10 days enough for wide retail distribution, but the AB Bigs are also there to widely distribute retail further yet - that is their purpose.

But, the AB's are the Pigs, Thieves, and the Boogeymen that are in cahoots with the Conspiratorial Mint.

Remember, there is a narrative to uphold no matter the facts & circumstances that are right in front of us.

Who else should they sell to after they've exhausted the retail channel in 10 days? I think the system is working like it should.

@Rc5280 said:

I'm wondering when the HHL of 1 was lifted.

They first lifted the HHL on the Army coin a couple of weeks after release in the middle of the day, and the Laser coin was about 10 days after release at 12 noon.

The gold sunflower UHR additional coins came out at a random time with no notice as well.

So all three were done randomly, although technically the UHR was lifted after the first day, but not all the coins were uploaded for sale. So it was effectively the same as a late lift on that coin.

This is why some are wondering if the mint is doing it for the benefit of the big buyers.

There is honestly not a lot to wonder about here. All excuses aside, they put a subset of the maximum up for sale with a HHL, sold out before the HHL was lifted, later lifted the HHL, and then put the remainder of the maximum up for sale with no notice to the public.

If they wanted to assure wide retail distribution through enforcement of a HHL, they would have placed the item on back order after the initial quantity sold out, and/or kept the HHL in place, and/or provided retail with notice that additional coins would be released. With a date and time, like they do for all initial releases since this was, in effect, a re-release, with inventory not previously made available for sale.

I am of the opinion that 10 days of availability to the public at HHL=1 resulted in wide retail distribution. How many days do you think they need to give the public a chance to buy one? If someone doesn't buy one in the first 10 days, they probably don't want one, don't you think?

???? Where are you getting 10 days from?

These were available for around 3 hours at release. And then for a few seconds at 7:30 a few mornings. And then for a few minutes with no HHL and no notice at 7:30 on a random morning a few weeks after release.

Call it what you want. I don't call it wide, transparent, fair retail distribution.

That's the high relief gold. The Army was indeed available for an extended period with a HHL of 1. Why they lifted the HHL at 6:00 on a random night, likely with notice to some but not most, is another mystery likely involving distribution to select privileged parties, as opposed to all of us.

@Rc5280 said:

I'm wondering when the HHL of 1 was lifted.

They first lifted the HHL on the Army coin a couple of weeks after release in the middle of the day, and the Laser coin was about 10 days after release at 12 noon.

The gold sunflower UHR additional coins came out at a random time with no notice as well.

So all three were done randomly, although technically the UHR was lifted after the first day, but not all the coins were uploaded for sale. So it was effectively the same as a late lift on that coin.

This is why some are wondering if the mint is doing it for the benefit of the big buyers.

There is honestly not a lot to wonder about here. All excuses aside, they put a subset of the maximum up for sale with a HHL, sold out before the HHL was lifted, later lifted the HHL, and then put the remainder of the maximum up for sale with no notice to the public.

If they wanted to assure wide retail distribution through enforcement of a HHL, they would have placed the item on back order after the initial quantity sold out, and/or kept the HHL in place, and/or provided retail with notice that additional coins would be released. With a date and time, like they do for all initial releases since this was, in effect, a re-release, with inventory not previously made available for sale.

I am of the opinion that 10 days of availability to the public at HHL=1 resulted in wide retail distribution. How many days do you think they need to give the public a chance to buy one? If someone doesn't buy one in the first 10 days, they probably don't want one, don't you think?

???? Where are you getting 10 days from?

We were talking about the Laser Privy, as the thread title suggests. We were staying on topic.

It was someone else that decided to take things in another direction by bringing up the Sunflower Lib - 6 & 7 comments ago.

All three coin releases are related and showed that the mint is always a work in progress. They left the Army SE privy on a HHL of 1 for too long, and tried to fix that with a shorter length with the Laser coin. That one seemed to work better as far as distribution went, although they should have notified everyone how long the HHL of 1 lasts like they have done with other products.

The gold sunflower was a disaster, there is no other way to say it. Everyone who bought is probably very happy so it really doesn't matter, except that a coin that may be the coin of the year (leaving out the space Sacagawea) could have been better distributed for a better price. Now over half the coins will be full retail for buyers instead of the lower mint pricing. At full retail it will be hard to see appreciation for the coin's value, unlike what it would have done had the mintage been only 8k.

@Rc5280 said:

I'm wondering when the HHL of 1 was lifted.

They first lifted the HHL on the Army coin a couple of weeks after release in the middle of the day, and the Laser coin was about 10 days after release at 12 noon.

The gold sunflower UHR additional coins came out at a random time with no notice as well.

So all three were done randomly, although technically the UHR was lifted after the first day, but not all the coins were uploaded for sale. So it was effectively the same as a late lift on that coin.

This is why some are wondering if the mint is doing it for the benefit of the big buyers.

There is honestly not a lot to wonder about here. All excuses aside, they put a subset of the maximum up for sale with a HHL, sold out before the HHL was lifted, later lifted the HHL, and then put the remainder of the maximum up for sale with no notice to the public.

If they wanted to assure wide retail distribution through enforcement of a HHL, they would have placed the item on back order after the initial quantity sold out, and/or kept the HHL in place, and/or provided retail with notice that additional coins would be released. With a date and time, like they do for all initial releases since this was, in effect, a re-release, with inventory not previously made available for sale.

I am of the opinion that 10 days of availability to the public at HHL=1 resulted in wide retail distribution. How many days do you think they need to give the public a chance to buy one? If someone doesn't buy one in the first 10 days, they probably don't want one, don't you think?

Not only was 10 days enough for wide retail distribution, but the AB Bigs are also there to widely distribute retail further yet - that is their purpose.

But, the AB's are the Pigs, Thieves, and the Boogeymen that are in cahoots with the Conspiratorial Mint.

Remember, there is a narrative to uphold no matter the facts & circumstances that are right in front of us.

And I find that narrative tiresome and disturbing.

All comments reflect the opinion of the author, even when irrefutably accurate.

@HalfDime said:

All three coin releases are related and showed that the mint is always a work in progress. They left the Army SE privy on a HHL of 1 for too long, and tried to fix that with a shorter length with the Laser coin. That one seemed to work better as far as distribution went, although they should have notified everyone how long the HHL of 1 lasts like they have done with other products.

The gold sunflower was a disaster, there is no other way to say it. Everyone who bought is probably very happy so it really doesn't matter, except that a coin that may be the coin of the year (leaving out the space Sacagawea) could have been better distributed for a better price. Now over half the coins will be full retail for buyers instead of the lower mint pricing. At full retail it will be hard to see appreciation for the coin's value, unlike what it would have done had the mintage been only 8k.

And you may see no appreciation in value. So just appreciate the coin for what it is. People are talking themselves into a "missed opportunity" and then getting upset about it. 🙄

All comments reflect the opinion of the author, even when irrefutably accurate.

@Rc5280 said:

I'm wondering when the HHL of 1 was lifted.

They first lifted the HHL on the Army coin a couple of weeks after release in the middle of the day, and the Laser coin was about 10 days after release at 12 noon.

The gold sunflower UHR additional coins came out at a random time with no notice as well.

So all three were done randomly, although technically the UHR was lifted after the first day, but not all the coins were uploaded for sale. So it was effectively the same as a late lift on that coin.

This is why some are wondering if the mint is doing it for the benefit of the big buyers.

There is honestly not a lot to wonder about here. All excuses aside, they put a subset of the maximum up for sale with a HHL, sold out before the HHL was lifted, later lifted the HHL, and then put the remainder of the maximum up for sale with no notice to the public.

If they wanted to assure wide retail distribution through enforcement of a HHL, they would have placed the item on back order after the initial quantity sold out, and/or kept the HHL in place, and/or provided retail with notice that additional coins would be released. With a date and time, like they do for all initial releases since this was, in effect, a re-release, with inventory not previously made available for sale.

I am of the opinion that 10 days of availability to the public at HHL=1 resulted in wide retail distribution. How many days do you think they need to give the public a chance to buy one? If someone doesn't buy one in the first 10 days, they probably don't want one, don't you think?

???? Where are you getting 10 days from?

As others pointed out, that was the Army Privy ASE.

These were available for around 3 hours at release. And then for a few seconds at 7:30 a few mornings. And then for a few minutes with no HHL and no notice at 7:30 on a random morning a few weeks after release.

Call it what you want. I don't call it wide, transparent, fair retail distribution.

But we can't absolve the consumer of fault in all of this either. The mint widely advertises and promotes the availability of new products. If someone has to buy one now, all they have to do is make sure they buy one within the first few hours after release. More time to buy is always better, but everyone has a chance. We have to put a little bit of onus on the consumer that if they want one, they can't lollygag.

@Rc5280 said:

I'm wondering when the HHL of 1 was lifted.

They first lifted the HHL on the Army coin a couple of weeks after release in the middle of the day, and the Laser coin was about 10 days after release at 12 noon.

The gold sunflower UHR additional coins came out at a random time with no notice as well.

So all three were done randomly, although technically the UHR was lifted after the first day, but not all the coins were uploaded for sale. So it was effectively the same as a late lift on that coin.

This is why some are wondering if the mint is doing it for the benefit of the big buyers.

There is honestly not a lot to wonder about here. All excuses aside, they put a subset of the maximum up for sale with a HHL, sold out before the HHL was lifted, later lifted the HHL, and then put the remainder of the maximum up for sale with no notice to the public.

If they wanted to assure wide retail distribution through enforcement of a HHL, they would have placed the item on back order after the initial quantity sold out, and/or kept the HHL in place, and/or provided retail with notice that additional coins would be released. With a date and time, like they do for all initial releases since this was, in effect, a re-release, with inventory not previously made available for sale.

I am of the opinion that 10 days of availability to the public at HHL=1 resulted in wide retail distribution. How many days do you think they need to give the public a chance to buy one? If someone doesn't buy one in the first 10 days, they probably don't want one, don't you think?

???? Where are you getting 10 days from?

As others pointed out, that was the Army Privy ASE.

These were available for around 3 hours at release. And then for a few seconds at 7:30 a few mornings. And then for a few minutes with no HHL and no notice at 7:30 on a random morning a few weeks after release.

Call it what you want. I don't call it wide, transparent, fair retail distribution.

But we can't absolve the consumer of fault in all of this either. The mint widely advertises and promotes the availability of new products. If someone has to buy one now, all they have to do is make sure they buy one within the first few hours after release. More time to buy is always better, but everyone has a chance. We have to put a little bit of onus on the consumer that if they want one, they can't lollygag.

But we CAN absolve, because only a little less than half of 12K were available, with a HHL of 1, before they were gone, forever, with the other 6K made available almost exclusively to insiders with no purchase limit.

Simply no way to run a fair and transparent operation. No matter who lined up when on release day, only a little less than half of the ultimate mintage was going to be purchased by retail customers, one at a time. Not because they were actually sold out, because the balance was held back for others.

The Mint could have taken back orders. It chose not to. It could have kept the HHL in place. It chose not to. It could have reinstated the HHL if it truly had no intention to make more, but later decided to. It chose not to.

See the pattern? The Mint made a series of choices. All to the benefit of large customers, and to the detriment of the small, ultimate customer.

@Rc5280 said:

I'm wondering when the HHL of 1 was lifted.

They first lifted the HHL on the Army coin a couple of weeks after release in the middle of the day, and the Laser coin was about 10 days after release at 12 noon.

The gold sunflower UHR additional coins came out at a random time with no notice as well.

So all three were done randomly, although technically the UHR was lifted after the first day, but not all the coins were uploaded for sale. So it was effectively the same as a late lift on that coin.

This is why some are wondering if the mint is doing it for the benefit of the big buyers.

There is honestly not a lot to wonder about here. All excuses aside, they put a subset of the maximum up for sale with a HHL, sold out before the HHL was lifted, later lifted the HHL, and then put the remainder of the maximum up for sale with no notice to the public.

If they wanted to assure wide retail distribution through enforcement of a HHL, they would have placed the item on back order after the initial quantity sold out, and/or kept the HHL in place, and/or provided retail with notice that additional coins would be released. With a date and time, like they do for all initial releases since this was, in effect, a re-release, with inventory not previously made available for sale.

I am of the opinion that 10 days of availability to the public at HHL=1 resulted in wide retail distribution. How many days do you think they need to give the public a chance to buy one? If someone doesn't buy one in the first 10 days, they probably don't want one, don't you think?

???? Where are you getting 10 days from?

As others pointed out, that was the Army Privy ASE.

These were available for around 3 hours at release. And then for a few seconds at 7:30 a few mornings. And then for a few minutes with no HHL and no notice at 7:30 on a random morning a few weeks after release.

Call it what you want. I don't call it wide, transparent, fair retail distribution.

But we can't absolve the consumer of fault in all of this either. The mint widely advertises and promotes the availability of new products. If someone has to buy one now, all they have to do is make sure they buy one within the first few hours after release. More time to buy is always better, but everyone has a chance. We have to put a little bit of onus on the consumer that if they want one, they can't lollygag.

But we CAN absolve, because only a little less than half of 12K were available, with a HHL of 1, before they were gone, forever, with the other 6K made available almost exclusively to insiders with no purchase limit.

Simply no way to run a fair and transparent operation. No matter who lined up when on release day, only a little less than half of the ultimate mintage was going to be purchased by retail customers, one at a time. Not because they were actually sold out, because the balance was held back for others.

The Mint could have taken back orders. It chose not to. It could have kept the HHL in place. It chose not to. It could have reinstated the HHL if it truly had no intention to make more, but later decided to. It chose not to.

See the pattern? The Mint made a series of choices. All to the benefit of large customers, and to the detriment of the small, ultimate customer.

First of all, your assertions are just speculation. You have no facts to back anything up about what and why the mint did what it did. You have no credibility here.

Yes, the mint made choices but in the end consumers had a fair and ample opportunity to buy at least Qty 1 of their products. That's far and away better than it's ever been and it's a win for the US mint customer.

@Rc5280 said:

I'm wondering when the HHL of 1 was lifted.

They first lifted the HHL on the Army coin a couple of weeks after release in the middle of the day, and the Laser coin was about 10 days after release at 12 noon.

The gold sunflower UHR additional coins came out at a random time with no notice as well.

So all three were done randomly, although technically the UHR was lifted after the first day, but not all the coins were uploaded for sale. So it was effectively the same as a late lift on that coin.

This is why some are wondering if the mint is doing it for the benefit of the big buyers.

There is honestly not a lot to wonder about here. All excuses aside, they put a subset of the maximum up for sale with a HHL, sold out before the HHL was lifted, later lifted the HHL, and then put the remainder of the maximum up for sale with no notice to the public.

If they wanted to assure wide retail distribution through enforcement of a HHL, they would have placed the item on back order after the initial quantity sold out, and/or kept the HHL in place, and/or provided retail with notice that additional coins would be released. With a date and time, like they do for all initial releases since this was, in effect, a re-release, with inventory not previously made available for sale.

I am of the opinion that 10 days of availability to the public at HHL=1 resulted in wide retail distribution. How many days do you think they need to give the public a chance to buy one? If someone doesn't buy one in the first 10 days, they probably don't want one, don't you think?

???? Where are you getting 10 days from?

As others pointed out, that was the Army Privy ASE.

These were available for around 3 hours at release. And then for a few seconds at 7:30 a few mornings. And then for a few minutes with no HHL and no notice at 7:30 on a random morning a few weeks after release.

Call it what you want. I don't call it wide, transparent, fair retail distribution.

But we can't absolve the consumer of fault in all of this either. The mint widely advertises and promotes the availability of new products. If someone has to buy one now, all they have to do is make sure they buy one within the first few hours after release. More time to buy is always better, but everyone has a chance. We have to put a little bit of onus on the consumer that if they want one, they can't lollygag.

But we CAN absolve, because only a little less than half of 12K were available, with a HHL of 1, before they were gone, forever, with the other 6K made available almost exclusively to insiders with no purchase limit.

Simply no way to run a fair and transparent operation. No matter who lined up when on release day, only a little less than half of the ultimate mintage was going to be purchased by retail customers, one at a time. Not because they were actually sold out, because the balance was held back for others.

The Mint could have taken back orders. It chose not to. It could have kept the HHL in place. It chose not to. It could have reinstated the HHL if it truly had no intention to make more, but later decided to. It chose not to.

See the pattern? The Mint made a series of choices. All to the benefit of large customers, and to the detriment of the small, ultimate customer.

First of all, your assertions are just speculation. You have no facts to back anything up about what and why the mint did what it did. You have no credibility here.

Yes, the mint made choices but in the end consumers had a fair and ample opportunity to buy at least Qty 1 of their products. That's far and away better than it's ever been and it's a win for the US mint customer.

I actually do know EXACTLY what the Mint did. You are correct that I can only speculate as to why. Common sense is my guide there. You should feel free to grasp at straws, give them every benefit of every doubt, and consider every possibility, no matter how implausible, to have equal weight.

Retail had a little over 3 hours to grab one of 6K of the 12K minted. Totally inconsistent with "the mintage is set at 12,000 units, with orders limited to one coin per household for the first 24 hours of sales," because 12K were not made available for sale for 24 hours, with a HHL of 1 in place during that time.

Sales were cut off at 6K after around 3 hours, only to resume later, with no prior announcement, and with no HHL. Period. These are all absolute facts that I know absolutely. I'm pretty sure I know why.

You are free to remain in the dark. And, of course, to assess my credibility as you see fit. As I do with the Mint's credibility.

@HalfDime said:

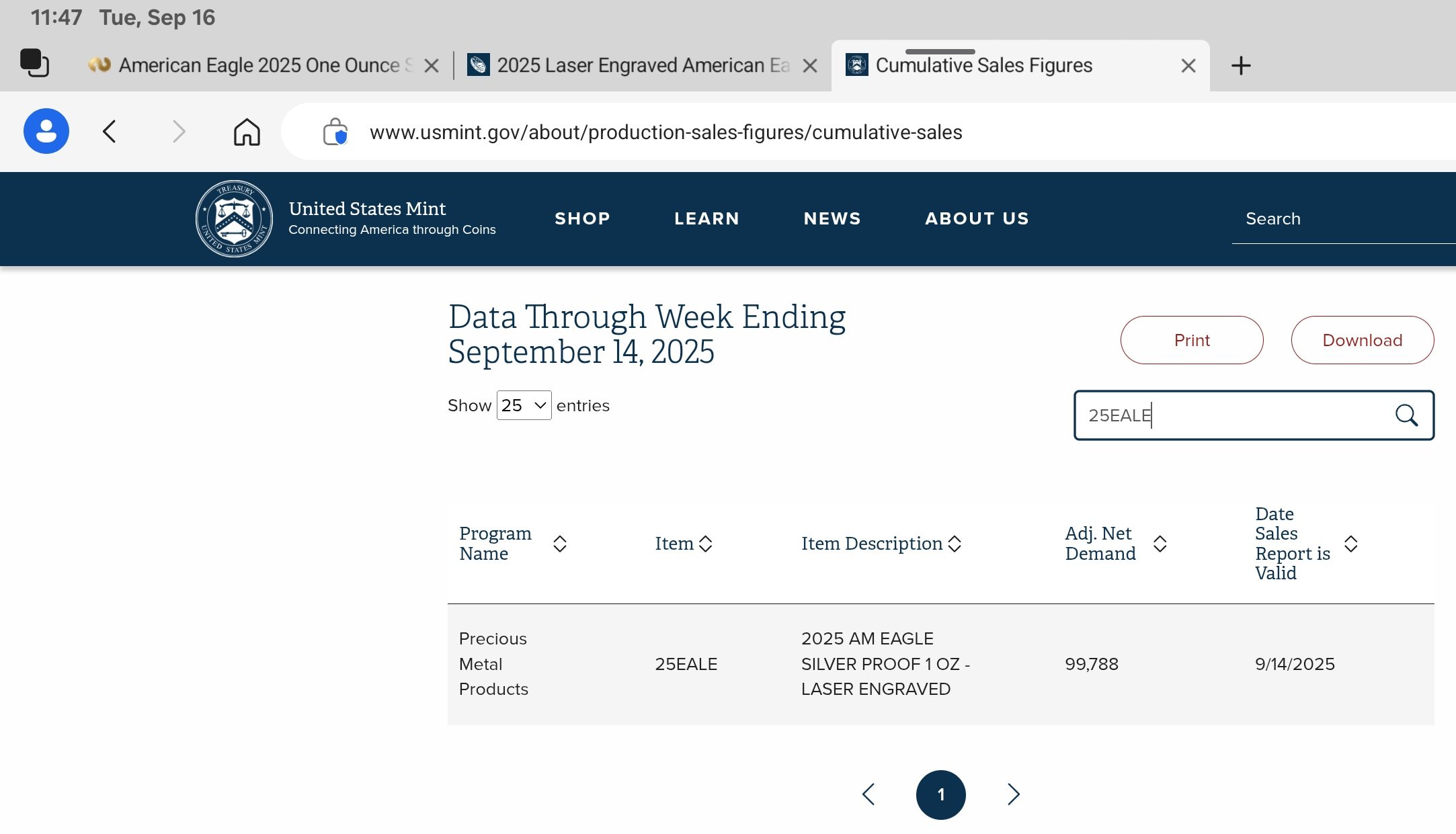

So they have struck the full amount for the first two silver eagle privy coins. Earlier it looked like this one might have come in low.

I'm wondering when the HHL of 1 was lifted.

When it went CU it was a surprise to me.

The percentage of 69's vs the 70's in AR & FS is out of whack imo.

There are still more 69's than 70's in those two categories, and the FDI ratio is not up to snuff either.

For what it's worth, Magic Mike said that laser privies graded terrible. Said he returned most of his "Advanced Release" coins. Call me crazy but I preordered one from Pinehurst when they first became available. PCGS PR70 FDOI for $389. The same coin from them is now $479. Do you think it is because of the poor grading?

For some reason with lower mintage than the Army privy the Laser seems to not have as much demand. However,, I think the 70's are going to carry quite a premium due to the quality issues. I was able to buy a handful on Pure at a great price. I think they all have a good shot at 70, they went off to PCGS this morning.

@ProofCollection said:

For some reason with lower mintage than the Army privy the Laser seems to not have as much demand. However,, I think the 70's are going to carry quite a premium due to the quality issues. I was able to buy a handful on Pure at a great price. I think they all have a good shot at 70, they went off to PCGS this morning.

Lower mintage than the Army?

I think both of them were (all the 2025 Privies) set at a 100k limit.

@ProofCollection said:

For some reason with lower mintage than the Army privy the Laser seems to not have as much demand. However,, I think the 70's are going to carry quite a premium due to the quality issues. I was able to buy a handful on Pure at a great price. I think they all have a good shot at 70, they went off to PCGS this morning.

i just got two of my laser privy coins back from pcgs and they were both 69's. Same issue with the Army privy too. so far i'm 0 for 5 on these privy coins.

@goldenboy89 said:

i just got two of my laser privy coins back from pcgs and they were both 69's. Same issue with the Army privy too. so far i'm 0 for 5 on these privy coins.

Could you share photos showing where are the imperfections on those coins?

Comments

i'll wait and find out

2024 sales to last week: 5,417

ats: 425

bulk sales: ?

mintage limit: 7,500

That can't be the laser privy

All comments reflect the opinion of the author, even when irrefutably accurate.

D'oh

can some of you talk to my doctor and say i'm slipping?

710 open auctions on ebay

sold are ~175 and slipping

briefly somewhat hot

The mint's August 31st report doesn't (yet) list sales for 25EALE.

ANA 50+ year/Life Member (now "Emeritus")

Author: 3rd Edition of the SampleSlabs book, https://sampleslabs.info/

Available..... ,,,,,,now gone.

,,,,,,now gone.

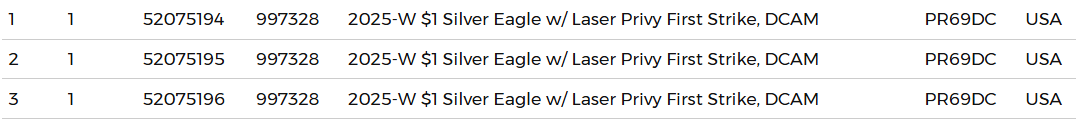

Just noticed the updated FS submissions are (69/70):

121 / 113

This might get interesting as fewer ones are graded 70- similar to the 2021-D Morgan?

This is worth saving. As aphorisms go this is aphorismic!

In the Brittish vernacular, are we talking the Thin Lizzie?

What? Are the boys back in town?

Got my laser privy grade today. I almost didn't buy one! I'm pretty happy! Here it is:

The mint has not fed this product into the mint sales report, unless I am blind as a bat this morning.

Finally dropped!

I'd really like to send mine in for grading, but I'm afraid that something might happen to it. Looks perfect the way it is, in it's capsule.

So they have struck the full amount for the first two silver eagle privy coins. Earlier it looked like this one might have come in low.

I'm wondering when the HHL of 1 was lifted.

When it went CU it was a surprise to me.

The percentage of 69's vs the 70's in AR & FS is out of whack imo.

There are still more 69's than 70's in those two categories, and the FDI ratio is not up to snuff either.

They first lifted the HHL on the Army coin a couple of weeks after release in the middle of the day, and the Laser coin was about 10 days after release at 12 noon.

The gold sunflower UHR additional coins came out at a random time with no notice as well.

So all three were done randomly, although technically the UHR was lifted after the first day, but not all the coins were uploaded for sale. So it was effectively the same as a late lift on that coin.

This is why some are wondering if the mint is doing it for the benefit of the big buyers.

There is honestly not a lot to wonder about here. All excuses aside, they put a subset of the maximum up for sale with a HHL, sold out before the HHL was lifted, later lifted the HHL, and then put the remainder of the maximum up for sale with no notice to the public.

If they wanted to assure wide retail distribution through enforcement of a HHL, they would have placed the item on back order after the initial quantity sold out, and/or kept the HHL in place, and/or provided retail with notice that additional coins would be released. With a date and time, like they do for all initial releases since this was, in effect, a re-release, with inventory not previously made available for sale.

And, they could have made all the additional quantity available for sale to the public, rather than holding back 1200 out of 4000 for big buyers. In hindsight, we can see that they were sold, and know they were not loaded into ATS along with the other 2800.

People who want to can rationalize anything, but what they did here couldn't be more clear if they announced it in a press release.

I am of the opinion that 10 days of availability to the public at HHL=1 resulted in wide retail distribution. How many days do you think they need to give the public a chance to buy one? If someone doesn't buy one in the first 10 days, they probably don't want one, don't you think?

http://ProofCollection.Net

Not only was 10 days enough for wide retail distribution, but the AB Bigs are also there to widely distribute retail further yet - that is their purpose.

But, the AB's are the Pigs, Thieves, and the Boogeymen that are in cahoots with the Conspiratorial Mint.

Remember, there is a narrative to uphold no matter the facts & circumstances that are right in front of us.

Who else should they sell to after they've exhausted the retail channel in 10 days? I think the system is working like it should.

http://ProofCollection.Net

???? Where are you getting 10 days from?

These were available for around 3 hours at release. And then for a few seconds at 7:30 a few mornings. And then for a few minutes with no HHL and no notice at 7:30 on a random morning a few weeks after release.

Call it what you want. I don't call it wide, transparent, fair retail distribution.

That's the high relief gold. The Army was indeed available for an extended period with a HHL of 1. Why they lifted the HHL at 6:00 on a random night, likely with notice to some but not most, is another mystery likely involving distribution to select privileged parties, as opposed to all of us.

We were talking about the Laser Privy, as the thread title suggests. We were staying on topic.

It was someone else that decided to take things in another direction by bringing up the Sunflower Lib - 6 & 7 comments ago.

All three coin releases are related and showed that the mint is always a work in progress. They left the Army SE privy on a HHL of 1 for too long, and tried to fix that with a shorter length with the Laser coin. That one seemed to work better as far as distribution went, although they should have notified everyone how long the HHL of 1 lasts like they have done with other products.

The gold sunflower was a disaster, there is no other way to say it. Everyone who bought is probably very happy so it really doesn't matter, except that a coin that may be the coin of the year (leaving out the space Sacagawea) could have been better distributed for a better price. Now over half the coins will be full retail for buyers instead of the lower mint pricing. At full retail it will be hard to see appreciation for the coin's value, unlike what it would have done had the mintage been only 8k.

And I find that narrative tiresome and disturbing.

All comments reflect the opinion of the author, even when irrefutably accurate.

And you may see no appreciation in value. So just appreciate the coin for what it is. People are talking themselves into a "missed opportunity" and then getting upset about it. 🙄

All comments reflect the opinion of the author, even when irrefutably accurate.

As others pointed out, that was the Army Privy ASE.

But we can't absolve the consumer of fault in all of this either. The mint widely advertises and promotes the availability of new products. If someone has to buy one now, all they have to do is make sure they buy one within the first few hours after release. More time to buy is always better, but everyone has a chance. We have to put a little bit of onus on the consumer that if they want one, they can't lollygag.

http://ProofCollection.Net

But we CAN absolve, because only a little less than half of 12K were available, with a HHL of 1, before they were gone, forever, with the other 6K made available almost exclusively to insiders with no purchase limit.

Simply no way to run a fair and transparent operation. No matter who lined up when on release day, only a little less than half of the ultimate mintage was going to be purchased by retail customers, one at a time. Not because they were actually sold out, because the balance was held back for others.

The Mint could have taken back orders. It chose not to. It could have kept the HHL in place. It chose not to. It could have reinstated the HHL if it truly had no intention to make more, but later decided to. It chose not to.

See the pattern? The Mint made a series of choices. All to the benefit of large customers, and to the detriment of the small, ultimate customer.

First of all, your assertions are just speculation. You have no facts to back anything up about what and why the mint did what it did. You have no credibility here.

Yes, the mint made choices but in the end consumers had a fair and ample opportunity to buy at least Qty 1 of their products. That's far and away better than it's ever been and it's a win for the US mint customer.

http://ProofCollection.Net

I actually do know EXACTLY what the Mint did. You are correct that I can only speculate as to why. Common sense is my guide there. You should feel free to grasp at straws, give them every benefit of every doubt, and consider every possibility, no matter how implausible, to have equal weight.

Retail had a little over 3 hours to grab one of 6K of the 12K minted. Totally inconsistent with "the mintage is set at 12,000 units, with orders limited to one coin per household for the first 24 hours of sales," because 12K were not made available for sale for 24 hours, with a HHL of 1 in place during that time.

Sales were cut off at 6K after around 3 hours, only to resume later, with no prior announcement, and with no HHL. Period. These are all absolute facts that I know absolutely. I'm pretty sure I know why.

You are free to remain in the dark. And, of course, to assess my credibility as you see fit. As I do with the Mint's credibility.

Lolol.

https://www.ebay.com/itm/257106124695

For what it's worth, Magic Mike said that laser privies graded terrible. Said he returned most of his "Advanced Release" coins. Call me crazy but I preordered one from Pinehurst when they first became available. PCGS PR70 FDOI for $389. The same coin from them is now $479. Do you think it is because of the poor grading?

i think it's 479 because they are having trouble moving them at a higher price

ebay price on ogp ones weakened from 200 to 175 to 150 now

For some reason with lower mintage than the Army privy the Laser seems to not have as much demand. However,, I think the 70's are going to carry quite a premium due to the quality issues. I was able to buy a handful on Pure at a great price. I think they all have a good shot at 70, they went off to PCGS this morning.

http://ProofCollection.Net

Lower mintage than the Army?

I think both of them were (all the 2025 Privies) set at a 100k limit.

Good luck! Let us know how you do.

down to 130 on ebay

And here I was thinking/hoping that I had finally gotten one of the good ones....

I just recently got my Laser Privy ASE back from CACG. Really like it too.

USN & USAF retired 1971-1993

Successful Transactions with more than 100 Members

i just got two of my laser privy coins back from pcgs and they were both 69's. Same issue with the Army privy too. so far i'm 0 for 5 on these privy coins.

Could you share photos showing where are the imperfections on those coins?

These are going to be rare in PR70. I have a 4th and it also was PR69.

http://ProofCollection.Net