American Eagle 2025 One Ounce Palladium Reverse Proof Coin

HalfDime

Posts: 642 ✭✭✭✭

HalfDime

Posts: 642 ✭✭✭✭

American Eagle 2025 One Ounce Palladium Reverse Proof Coin

The mintage limit for the American Eagle 2025 One Ounce Palladium Reverse Proof Coin has been posted, and it is 6000 coins for this year. That may be a new low mintage for the reverse proof coins, yet it is not a new low compared to the proof coins.

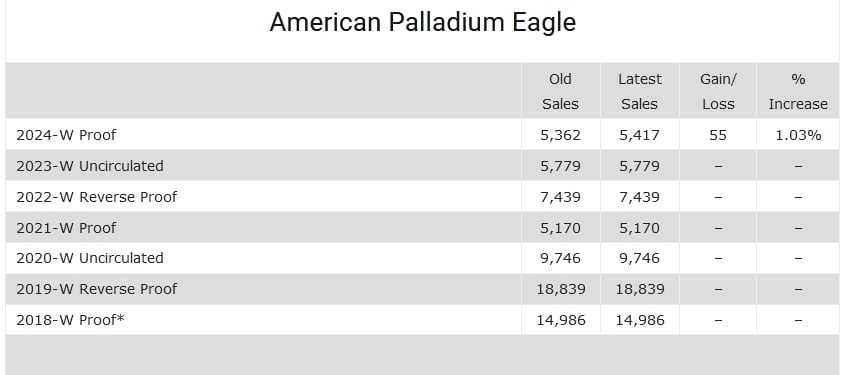

These are the mintages so far:

2018W proof 14,986

2021W proof 5,170

2024W proof 5,304 (still available)

2020W unc 9746

2023W unc 5779

2019w reverse proof 18,839

2022w reverse proof 7439

2025w reverse proof 6000 limit

Chances are the final sales will fall under 6000, so it will be comparable to the others as having a 5k+ mintage.

Checking prices on Ebay for raw key date coins, these show:

2023w unc $1795

2021w proof $2000

2022w reverse proof $1900

The current price for the still available 2024 palladium proof is $1695. This shows the past issue keys still carry barely any premium over release prices based on today's pricing. Since the 2024 coin is still available with a projected limit of about 5900 coins, the 2025 coins by comparison may not sell out this year if they strike the full numbers.

There is a chance they only strike 4000 of the 2025 coins. If that happens it would be the new low mintage winner, but only if it comes in under 5000 coins. If they strike the full amount, collectors will probably have to wait another year for a possible low mintage release winner.

Comments

The mintage difference doesn't make any of these "key". It's simply not large enough where it should make any difference, if bought as a collectible as opposed to those who are mostly or only buying it for the mintage.

I disagree with most of the assumptions I read in Jordan's two books I bought, but he's right about this one.

Add bullion strikes

2017: 15,000

2021: 8700

I am happy with my 2024w DCAM bought in June of this year from the Mint. The coin is flawless and so beautiful. My concern is if I am not careful, the coin might develop ugly dark spot/unattractive toning.

Early dealer sales show some brave souls ponied up for 179 coins.

The numbers and mintages follow after market prices in many cases, so yes the key coin will usually command the highest premium.

ats only has 2400 coins in inventory. Could they only have struck 3000 coins or less?

Nobody is interested in this coin?

It does not make sense for me to purchase one like this. The mintage doesn't even make a difference. The previous versions sell for a tiny premium over spot, even in perfect MS or PF-70 condition. I suspect this issue will be the same way.

Proud follower of Christ!

Wasn't this originally intended as a bullion coin, comparable to the Canada Palladium Maple Leaf?

If it is just a bullion coin, why does US Mint make it reserve proof?

It was.

For collectors value. Small premium over spot.

Proud follower of Christ!

yeah there was hope to have a bullion program but it appears there is little interest. look up the law that created the program to see what they are compelled to do. the numis program may be a way to satisfy the law. the law is probably under 31 usc 5112

Current premium for the 2024 proof is 47 percent.

In the aftermarket for previous pieces

Proud follower of Christ!

Not in that finish... just like proof Silver eagles are not intended as a "bullion coin"

All comments reflect the opinion of the author, even when irrefutably accurate.

I'm in. I reckon this will be low mintage as hinted at above.

When you look back at coins like this and there are years that stick out with really big prices due to low mintages, I have a feeling that's going to be 2025.

http://ProofCollection.Net

Investment?

Proud follower of Christ!

race to the bottom

collector base? can't be many. we'll find out

I don't see any palladium eagles of any date, ms or proof, selling anywhere for less than 25% over spot.

In my experience, that 25%+ premium generally applies to all palladium coins regardless of country.

The US coins almost always have a 40%+ premium wherever they are sold.

i've been wanting a palladium coin, and i would love to buy it from the mint, but It's not a must have for me, and I don't want to spend $530 over the spot for one either. maybe i'll wait a few years.

Inventory shows 659 dealer and 2850 retail so perhaps the final mintage is 3500.

2019w reverse proof 18,839

2022w reverse proof 7439

2025w reverse proof 3500?

If this holds up it will be well under all other releases. No waiting room shows tepid interest so far.

The UNC coins usually sell only 65% or so of proof (reverse proof), so next year's mintage will have to be about 2275 to compare to this one (if it is 3500). 2876 was the lowest UNC platinum in 2008. Yes, different metal, but close in sales.

Guessing 4000 mintage, as just before noon the available to sell number was 3315.

And sales to dealers thru 8/31 were 659.

Anyone know how many are left now? I expect a sellout but sure if right away.

I meant to type NOT sure.

1963

https://www.usmint.gov/on/demandware.store/Sites-USM-Site/default/Product-Variation?pid=25EK

Thanks, MsMorrisine!

this will take a 2-3 weeks to sell out. all those who wanted one got one. the demand is meh at best and there is no real collecting base.

It looks like the US Mint is playing games with the inventories, so I am done posting on US coins. I'm not going to help them sell coins with possible fake numbers.

They sell on GC for about Mint retail.

1599! who want's some genuine emissions control?

what's a red book to do?

you publish a mintage limit and a product limit

you strike a number under the mintage limit for initial sales

they sell out but

no more are struck, creating a short strike

does the red book have someone monitoring the sales stats or requesting the info directly to now a "sell out" could mean a short strike?

These will be lucky to sell out by December. There is just not collector demand for these, but this will probably be a key date in the series.

I believe Redbook publishes final audited actual mintages once the mint releases them after final accounting is complete.

http://ProofCollection.Net

How are you viewing this? When I click the link, sakes say “null”

the list titles on the left? search for "ats". that row

here are numbers from the 2024 issue

2024 sales to last week: 5,417

ats: 425

THE big number: 5,842

mintage limit: 7,500

i'm sure they minted 5,842 so ...

from the other 2025 thread:

and ats is 1557...

it looks like they set the 2025 ML to 6000 (why not 5,500 or 5,000?). however, with the suspected 4,000 initial mintage... that leaves 2,000 coins to mint and I suspect from other issues they go in 2,000s ... we may be short struck this time

that was tiring

I had purchased all of these starting in 2017, and mostly due to the palladium price dropping, I lost several thousand selling them all this year as this series is a lost cause. With the Mint charging $1,695 for these and spot at $1,123 IMO there is no upside, even if less than 3,000 are sold, which would not surprise me.

Too many collectors like me have been badly burned on these. Ignore eBay listings with hopeful premiums that do not sell. I see people talk premiums, but many do not remove 10-20% seller fees from the hype. I sold my top set on GC and lost thousands. Low mintage does not trump high mint cost, with low metal demand as more electric cars become mainstream. Buyers beware.

My US Mint Commemorative Medal Set

I forgot about that but I suspect this has doomed the series. It will be hard to recover. On the other hand, at current prices Pd is probably not going any lower than it is today and whereas there's about a ~20% premium on buying a 1oz bar, the mint issue price is not really that bad. But again, in 5 years I'm not sure there will be a lot of collectors seeking this out for reasons other than bullion.

http://ProofCollection.Net

Amazing, thank you. Last question, which row shows what they actually minted versus the advertised product limit and mintage? I know this happened with the 2025 High Reliefs and your posts have been super helpful!

I noticed ats dropped about 400 units last couple hours so I checked the household limit of one which is now none.

1158 remain

3 minutes later 1004 remain

Three more minutes gone now 957

Ten more minutes passed and now 882 left

Thought about it, but I'd rather buy an error coin or two or three or four or ... instead

Looks like the big boys are loading up after limit was dropped.

1600 were made available to them early at a 5% premium, but only 659 sold.

The remaining 941 were added to the ats to the general public yesterday.

The dealers must have figured they wouldn’t sell out, so why pay a premium.

(they sure didn’t do that with the sunflower)

Over 600 gone in a half hour

ats now 552. These will be gone before COB today...

mbogoman

https://pcgs.com/setregistry/collectors-showcase/classic-issues-colonials-through-1964/zambezi-collection-trade-dollars/7345Asesabi Lutho

311...tick, tick, tick...

mbogoman

https://pcgs.com/setregistry/collectors-showcase/classic-issues-colonials-through-1964/zambezi-collection-trade-dollars/7345Asesabi Lutho

Wow, I'm surprised the HHL was such a drawback on this. I'm glad I got one.

http://ProofCollection.Net

Didn't buy one of the 2025 RPs but I just pulled the trigger on a 2024 Proof.

The Mercury obverse in a DCAM high relief proof almost makes the premium tolerable.

How many available now??

272

Now 239 left at 208pm Colorado Time

I bought 10 since it looks like substantially lower mintage at 4000 and I remember paying well over 2000 for the other issues a few years ago.

Worth paying $2150 on eBay for a graded 70? I’m on the fence….