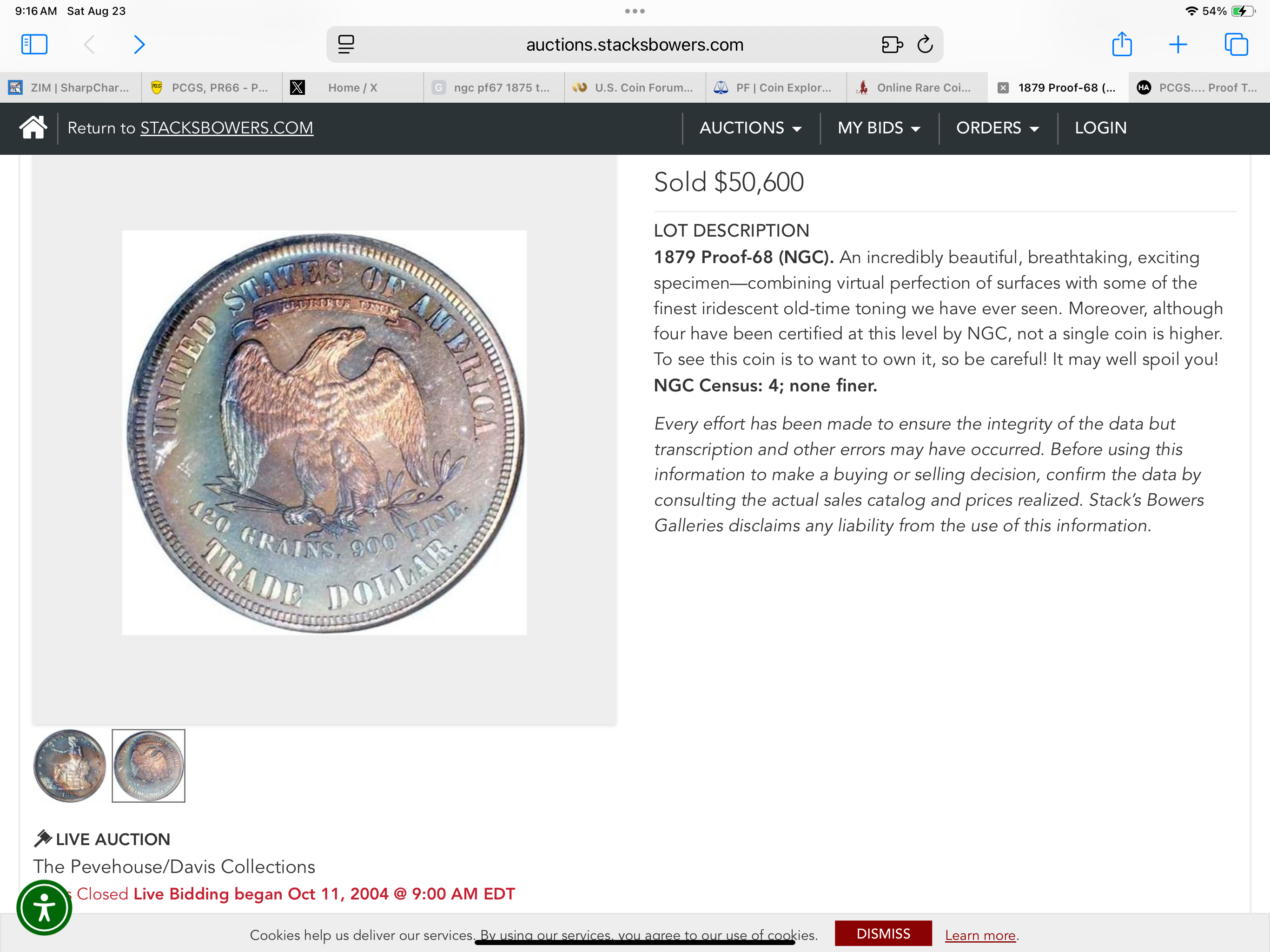

Buying the best quality you can afford …

…doesn’t always work out. This eye appealing coin brought just a 14% total return over a period of two decades

9

…doesn’t always work out. This eye appealing coin brought just a 14% total return over a period of two decades

Comments

Better than a loss. Sometimes it just depends on timing.

Successful BST with ad4400, Kccoin, lablover, pointfivezero, koynekwest, jwitten, coin22lover, HalfDimeDude, erwindoc, jyzskowsi, COINS MAKE CENTS, AlanSki, BryceM

Not surprising by any means. Some go up, some go down, and some stay the same. Census information probably made an impact. I'm sure everyone agrees that coins are a much lower returning "investment" compared to safe, long-term options such as an index fund. If you are looking for substantial return, shop your money elsewhere, not in coins.

"But seek ye first the kingdom of God and His righteousness and all these things shall be added unto you" Matthew 6:33. Young fellow suffering from Bust Half fever.

BHNC #AN-10

JRCS #1606

I could only buy something like that if I passed on buying the rarer items. Everything is a compromise unless you have infinite resources. My Trade Dollar is a PR-64.

A little worse than a savings account, but DANG! You got to own THAT coin for 20yrs, which has got to be worth a couple percent a year, right?

All those coins I bought back in 2006 that were the best quality I could afford (considered dreck by many here) are worth less today, even in absolute dollars, than I paid. I’m just trying to get my value from the ownership.

Regardless of inflation, I’d still be pretty happy that I got more than I paid.

ROI is a gamble with coins, too many uncontrollable factors in play.

My Collection of Old Holders

Never a slave to one plastic brand will I ever be.

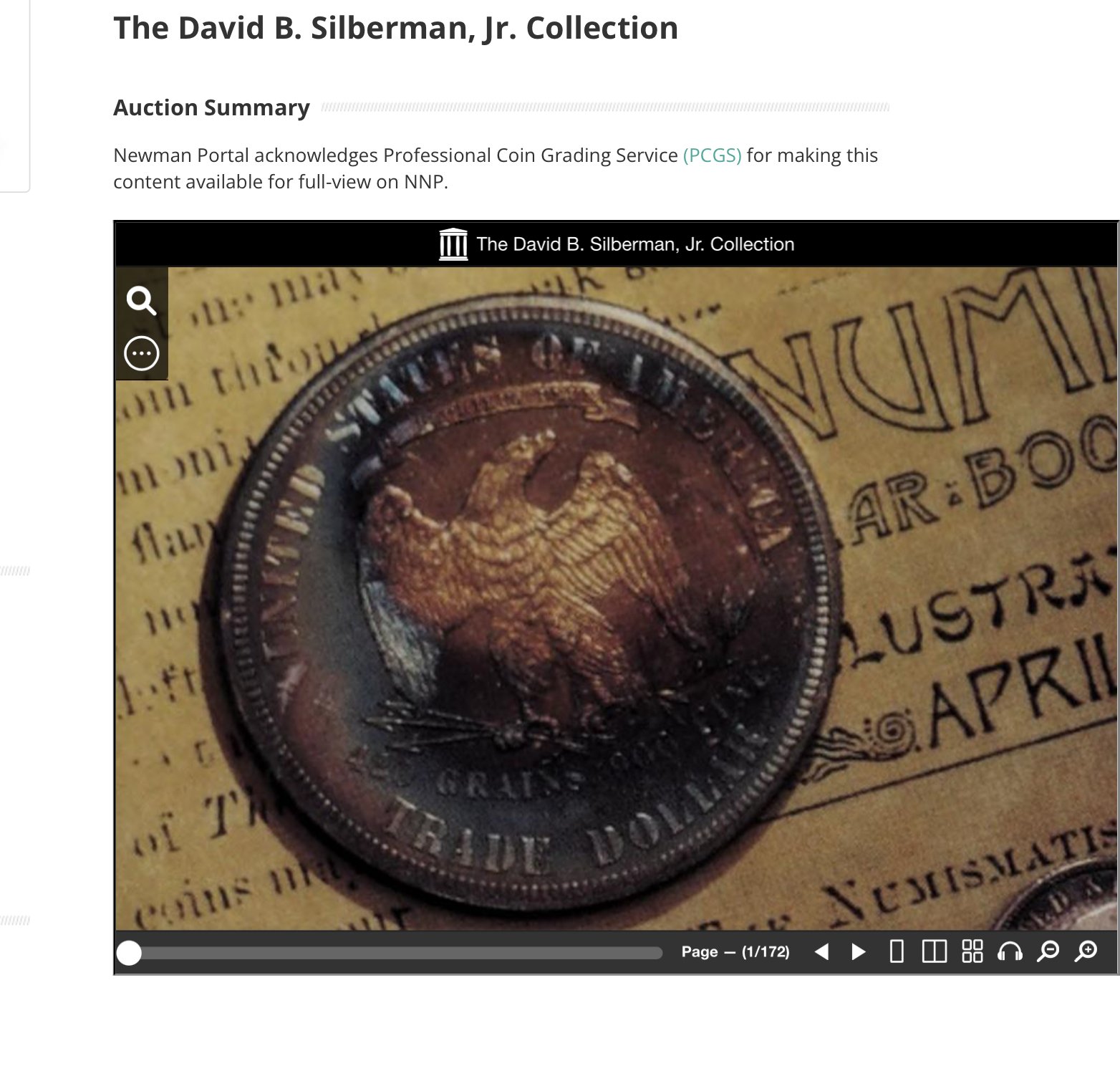

Coin sold raw in 1988 at $22,000. Was the highest realized price of the amazing Silberman trade dollar proofs. This is the reverse featured on the cover of the auction catalog

Better than no return

Coin collecting is a hobby. I golfed twenty years ago. Those rounds are completely worthless today. Should have put that money into the stock market I guess

Successful BST with drddm, BustDMs, Pnies20, lkeigwin, pursuitofliberty, Bullsitter, felinfoel, SPalladino

$5 Type Set https://www.pcgs.com/setregistry/u-s-coins/type-sets/half-eagle-type-set-circulation-strikes-1795-1929/album/344192

CBH Set https://www.pcgs.com/setregistry/everyman-collections/everyman-half-dollars/everyman-capped-bust-half-dollars-1807-1839/album/345572

Still in the NGC holder with no sticker probably had some impact, rightly or wrongly.

That cover photo and provenance is pretty darn cool!!

"But seek ye first the kingdom of God and His righteousness and all these things shall be added unto you" Matthew 6:33. Young fellow suffering from Bust Half fever.

BHNC #AN-10

JRCS #1606

I've heard, "Buy the best you can afford" for my entire life.

That certainly is an example where that simply didn't hold true.....

Great looking coin though.....

If you're in this game as an "investment," you're in the wrong game.

Sure, we can make careful choices, to minimize the likelihood of bad results. But these are nonessential goods, whose market values fluctuate wildly and, to some extent, randomly. High end coins seem, to me, to be "safer" than less expensive coins, but nothing is guaranteed (or particularly safe) in the coin collecting world (in terms of investment return).

That's a heluva coin. But if "investment return" was what you were after when you bought it, you made an unwise investment decision, IMO. Sorry.

Expensive coin needs to sell at the right time because not many can buy it

Another example like that is the 1878-S half dollar. Len Augsburger (Gobrecht Journal 2023) tested the adage on 3 coins (the key, a semi-key, and a common date) in 3 different grades from each the seated Liberty coin denominations and found that low-grade 78-Ss (AG3-Fine) performed better than the AU/MS coins from 1960 to 2023. I suspect it's SLH desperadoes competing to grab one of the more affordable examples to complete their sets. Lenny felt that the large number of MS and AU specimens (>$90K) creates more competition for the lower grade examples (<$55K) and compresses the grade/price profile. Otherwise, the adage seemed to hold up for 15 of the 21 coins examined, with UNC coins performing better than lower grades.

(Bill Bugert, 2020, A register of 1878-S Libert Seated Half Dollars, p. 7)

Lenny felt that though the adage of "buying the best quality you can afford" holds true for most examples, he felt "buying the key coins first" was an even better strategy for collectors.

You buy the best you can afford to enjoy the coins while you have them. At the end of the day you hope to recover most of what you put into them but understand the market goes up and down.

My Dad bought me one share of GM stock at $96 in 1966 when I was 13 years old to teach me about the stock market. Many years later the GM stock went to zero.

Nowhere in Bruce’s post does it read that he intended for this purchase to be a great investment, but I think it’s fair to acknowledge that the old adage of “buying the best you can afford” is not always necessarily the best financial decision. There are a number of lower end coins he could have purchased at the same time and made a 4x return.

He could have purchased a decent lettered edge slug in au58 for the same money, and it would have sold for closer to 200k.

I think a better takeaway is that the type of coin being purchased can have a much more substantial impact on future value, rather than the level of quality.

Founder- Peak Rarities

Website

Instagram

Facebook

Was this coin CAC stickered? Nothing in the opening post indicated that it was.

Worry is the interest you pay on a debt you may not owe.

"Paper money eventually returns to its intrinsic value---zero."----Voltaire

"Everything you say should be true, but not everything true should be said."----Voltaire

Correction @PeakRarities Bruce absolutely implied this was an investment when he stated that buying the best you can afford doesn’t always work out. If it wasn’t an investment then the outcome never would have mattered.

Besides if I could wipe my ass with 50k I would still have to say that that was an investment whether I liked it or not.

Anyway, after more thought I would have to agree with Bruce that this was a piss poor investment at best,

The person who sold it 88 did the best as you could buy a brand new Lincoln for around 24k while today it would cost between 80 to 100k.

Gentlemen, I don't see anything written in Bruce's posts indiccating that he was the buyer when the coin sold two decades ago.

Mark Feld* of Heritage Auctions*Unless otherwise noted, my posts here represent my personal opinions.

Great point Mark, irrelevant but great point. I guess we could leave the OPs name out and my assessment would be the same. Except slightly more convoluted than I imagined.

I was not the buyer in 2004, I was the buyer in 2025

I find it intriguing that this coin sold so strongly in 1988 and 2004 and then floundered in 2025. What happened? Did it turn in the holder? Have some line or spot that was forgiven decades ago but limits the value? TPG holder perception? Dunno. Just seemed like a relative bargain for a great eye appeal coin.

congrats

Experience the World through Numismatics...it's more than you can imagine.

In that case....nice pickup!

I guess some context might help. Perspective also seems to be taking a beating.

Did the owner buy this for investment purposes? If so i guess they didn't talk to any of the financial advisers around here. Was this part of a large collection? I can honestly say you would get some skewed results if you cherrypicked one coin out of one of my sales of a group of coins.

I am a collector. i would be a little puffed up with myself if i generated ANY profit. From my perspective this person paid the tax of getting to own this stunning coin; a tax i would be thrilled to pay if i could play in that end of the pool. James

Some further context:

I was a buyer of this PCGS coin from a dealer auction about 5 years ago [for approximately the same amount]. At the time I was bidding on it, I did research into its past - looking for the provenance. It was at that time that I became aware of the Silberman coin. A few years ago, a different PF68 was offered for sale with no pics and I got all excited- but it wasn’t the coin. So this time when it actually WAS the Silberman coin, I decided I’d be the buyer

Well your at least your in the green. Those big ticket coins are tough to move, etc.

If you can’t buy it right, get good retail sales that cover overhead costs (plus allow a decent profit), market falters - forgetta about it. Just enjoy the coins and currency you have (can easily afford), practice good security, don’t let them talk you down.

People don’t need coins to eat, many won’t even pay the money or simply can’t afford them.

The above coin subsequently upgraded. What can I say - I got a thing for nice trade dollars

Glad you were on the receiving end. My guess is right now is a good time to buy and a bad time to sell.

Bruce, all the coins pictured thus far seem on the dark side tone-wise, but you are certainly a better grader than all of us and much more knowledgeable with this series than most of us. Why did you chase after these coins?? The TrueViews show nice color but it seems clear that those images have been flooded with light to "help" the coin. In hindsight, which is always 20/20, don't you think you could have done better if you'd have been more patient and selective??

"Those who would give up essential Liberty, to purchase a little temporary Safety, deserve neither Liberty nor Safety," --- Benjamin Franklin

After having read Bruce’s posts over a period of many years, seeing some of his coins and having an idea regarding his collecting habits and strategies, I wondered if the above question was asked in jest. Or if it was taking a most undeserved pot shot at him. Because my impression is that he has been highly selective, as well as patient in his collecting and buys great, eye-appealing coins.

Mark Feld* of Heritage Auctions*Unless otherwise noted, my posts here represent my personal opinions.

Tradedollarnut could be stricken with massive amnesia and he would still be the best source for information on Seated and Trade Dollars over the last 30 or 40 years. I have been an avid follower of his going all the way back to the early days of the LSCC coin boards. Has to be a joke. james

There’s dark and dull and there’s deep but lovely. I avoid the former and seek out the latter. Some prefer pure white coins and I have a few, but they are not what I desire. Give me this 1878 over this 1883 any day of the week.

The thing about tissue toned proofs is that they can seem dark and dull straight on but when viewed at any angle they come alive. To my eye they are the most desirable examples

Were these flooded with light to get these colors? Nope. They were just tilted to reflect what light there was.

As far as being patient and selective, you might note that my set is ahead of Hansen on weighted grades - I could take first place all time finest with a yucky 1875 dcam - but I won’t do that. The right coin will come along eventually.

@tradedollarnut

Just curious... have you seen the right coin and does one with the look you seek exist?

Not trying to be difficult and I understand patience and being selective, but at what point have you... if ever... just conceded that a certain coin like the yucky 1875 dcam just might be as good as it gets?

Experience the World through Numismatics...it's more than you can imagine.

Well, there is the Simpson PCGS 67 that has the colors that I want, but is not CAC. However, I probably would not pass on it again were it offered once again. It’s probably the only one whose colors match what I’m looking for (except Hanson’s example)

@tradedollarnut, thanks for the replies. I've admired your sets for many years as I'm sure many here have and you explained yourself well.

"Those who would give up essential Liberty, to purchase a little temporary Safety, deserve neither Liberty nor Safety," --- Benjamin Franklin

Correction to your correction, I never said "an investment", I said "the greatest investment". My point being that we could have this discussion about the poor performance of this specific coin while simultaneously acknowledging that we're all predominantly aware that there are better investments to be made if returns are the primary objective. The adage itself works best as a follow up, in context, for instance - " If you're going to buy ______, buy the best quality you can afford". I agree that any 50k coin is some form of investment, whether intentional or not.

Though coin collecting hobby, and hobbies are supposed to be fun, the courts don't view 50K+ coin collections as simply a man "having fun" during divorce proceedings or an estate distribution. Long-term returns alone have never persuaded or dissuaded a purchase of mine, but I certainly don't write off a purchase like a vacation. In my experience, most buyers of 4+ figure coins do have some level of consideration of future value, whether it's #4 or #9 on their list, and presumably, we can agree on that.

Founder- Peak Rarities

Website

Instagram

Facebook

I stand corrected

Bruce, I think you're being somewhat coy with your messaging here, and I think you know exactly why it floundered. I do think there's quite possibly several reasons that held it back, and i'll talk about some of them in no particular order.

in stark contrast to -

The '25 description appears quite modest, but perhaps it would have been in vain considering the packaging, or lack thereof. The coin isn't dressed appropriately for this venue, and as a result, it's likely to be assumed to require a downcross to earn the "liquid legume" that we all know and love. Perhaps PCGS 67+ cam, which coincidentally has a price guide of... $57,500. Awfully close to the sale price at $57,600, and the NGC price guide of $60,000. If this coin were a beaned PCGS 68cam, I'd be surprised with anything under 6 figures.

Which begs the fundamental question.... "What's wrong with it?" -the internal rationale of many potential buyers for a coin of this stature. Half of which have been eliminated with the white prongs, and then another half of that half are on a strict legume diet. It appears that this is the circumstance that we have all boxed ourselves into, but I think we can safely assume it was rejected by both preferred packaging services at some point in time. It would take some brass balls to crack this puppy out, so it was sent down the river inadequately clothed, without a paddle, and with no means of communication to the homeland.

With all of that said, I think you answered your own question with this subsequent post-

You know who else didn't clean up when they sold that coin? The consignor, though unfortunately, he at least chose the right coin to start with. What he didn't do, was to maximize his return with the proper accoutrements...but you will do quite well when you sell that coin, and I'd wager it CAC'd on the first shot. Imo, that coin talks the talk no matter what plastic it's in, and frankly, I like it much better than the Silberman coin. No breaks in the toning, splotchy water spots, and frost that jumps right out and bites you through the plastic. In fact, the OGH picture makes the coin look like a DCAM, about as deep as I recall seeing on a proof trade.

In summary, "buying the best you can afford" is not necessarily the most prudent strategy, as your OP had alluded to. If it were modified, I'd say it needs to be tweaked to "best quality or eye appeal possible for the grade". The consignor of your upgrade coin may not have fallen into riches, but I can only imagine that he paid quite a bit less than the 2004 buyer of the OP coin when he first bought it, and if he had the motivation to try to max the coin out, he would have been handsomely rewarded when the auction check came in the mail. Also, proof type isn't particularly strong at this moment in time; it probably isn't a bad time to be buying up coins like this one, and I have a feeling that you'll fare better than the previous steward when the time comes, with the proper marketing and timing, of course.

Founder- Peak Rarities

Website

Instagram

Facebook

We shall have to see when I get the coin in hand. I certainly broke my cardinal rule about buying certified coins sight unseen. But, based on my experience with heritage images, I expect it to knock my socks off.

She is a great coin @tradedollarnut

My 1866 Philly Mint Set

Perhaps relevant to this discussion, is where in the coin market the "best" return is to be had over time.

I have no idea, other than my own experience (which never has, and never will, include a coin even within an order of magnitude in cost as the original coin being discussed.

But I strongly suspect that the market always will be good for the old favorites--1909-S VDB; 1955 DDO; 1918/7-D buffalo nickel; 1916 Mercury dime, etc. All of these, especially in the better grades, seem to be perennial winners (still not as good, over time as some other "investments," but fairly safe as coins go); and all of them are at least semi-affordable to a lot of serious collectors. Any coin "needed" to fill out a popular "set" will always be in strong demand.

Contrast that to coins like the original coin--relatively esoteric sets with lots of coins that cost a great deal of money (and, so, out of consideration for the vast majority even of serious collectors). I suspect that the market for $45,000 coins is relatively thin; at auction, if you don't have two well-heeled bidders, it will be a disappointment. You ALWAYS will have two or more bidders for a nice 1909-S VDB Lincoln cent.

The famous coins are famous because B Max Mehl promoted them hard and heavy. Boomers know them, but will their fame survive two generations? I’m not so sure. I mean who really has to have a 3 legged buffalo nickel that’s a simple mint maintenance act in creation?

Here is mine. It is nice in its own way. But nothing like the fabulous high-grade colorful proofs shown here previously.

Will this coin increase or decrease in value (percentage-wise) more than a high-grade coin ?

To elaborate, I'd also opine it would be best to stretch for the coins that really supercede the holder they're in...the coins that stop us in our tracks even if the label is covered up. These are the coins that are only held back by their grades, but they still tend to perform well over time. We often advise to "buy the coin that really speaks to you"...but I would tweak that adage as well, simply adding "you....and also most other collectors". Quite a few of us in this thread are fortunate to own these types of coins, and though quite a few of mine do not fall into that category, I would nominate this old piece as one of them -

There are many more that grace these boards routinely, and can come in any grade range of almost any series, but it's very difficult to over pay for coins like these. I’m even talking about many bust halves or dollars with a cpg in the 2000-3000 range that I would gladly pay double guide for.

Agreed, in fact, those are the coins I’d be selling right about now. It may be an unpopular opinion, but the younger generations don’t have the same sentimental attachment to many 20th century “keys” that boomers know and love. My passion for coins did not originate from using coins, and I think many others my age would say the same. We’re in the Information age now, and coins are accessible in a much different way than they were prior to 2000. I think those coins may be fine in the short term (1-2 decades), but in the long term, I’d gravitate towards…ahem…the coins I’ve been preaching about for the past several years while they continue to set records. Pioneer and proof gold, early federal and bust dollars and halves. Circulated seated coins, high grade not so much, except for knockout gems and gem proofs with splendid eye appeal.

I don’t know why proof type is stroll struggling to catch up, but many of them seem like a great value when you say they’re the same price they were 15 years ago, with such limited pops…

Founder- Peak Rarities

Website

Instagram

Facebook

“I don’t know why proof type is stroll struggling to catch up, but many of them seem like a great value when you say they’re the same price they were 15 years ago, with such limited pops…”

Because 15 years ago, many of today’s 67s were 66s or 65 pluses. Take a look at proof trade dollars. 67s are now growing on trees.

Good thread, haven't seen you this enthusiastic in a while.

fka renman95, Sep 2005, 7,000 posts