The Fed’s open market operations consist of buying and selling government bonds. Where do you think those bonds originate? They are issued printed by the US government to finance its deficit spending,

Fixed it for ya. Printing bonds, printing money. . . it's the same thing.

>

Then let me return the favor and fix it for you.

Printing bonds = printing interest-bearing securities, with taxpayers on the hook to pay that interest.

Printing money = printing official medium of exchange directly, no burdensome interest obligations, no continuous increase in national debt.

@GoldFinger1969 said:

Sorry, you guys don't know how monetary policy is transmitted and it's not through the BEP.

Take an economics course and stop listening to doom-and-gloomers with lousy investment track records looking for click-bait material.

Nobody here has claimed that monetary policy is transmitted through the BEP.

I simply stated that issuing "unbacked" money, either through US Notes or electronically, does not increase the national debt by a single cent. Anyone who believes otherwise, please explain why.

@GoldFinger1969 said:

Sorry, you guys don't know how monetary policy is transmitted and it's not through the BEP.

Take an economics course and stop listening to doom-and-gloomers with lousy investment track records looking for click-bait material.

.

You are apparently "unfamiliar" with the different types of currency that have been issued by the US Treasury and the Federal Reserve. Maybe it is you that needs to learn about currency alternatives to Federal Reserve Notes, and to stop listening to your banker friends' propaganda.

@Overdate said:

I simply stated that issuing "unbacked" money, either through US Notes or electronically, does not increase the >national debt by a single cent. Anyone who believes otherwise, please explain why.

Correct....and ditto for FRNs or Gold Certificates or Silver Certificates. Money in circulation has NOTHING to do with bond issuance.

@dcarr said:

You are apparently "unfamiliar" with the different types of currency that have been issued by the US Treasury and >the Federal Reserve. Maybe it is you that needs to learn about currency alternatives to Federal Reserve Notes, and >to stop listening to your banker friends' propaganda.

My 1st job out of college was watching the weekly money supply figures and the change in currency, M1, M2, etc.

What bills are issued -- FRNs, USNs, GCs, SCs, etc -- has NOTHING to do with debt issuance and whether part or all of the increase in money supply is sterilized or not via the Fed or Treasury (FX).

@Overdate said:

I simply stated that issuing "unbacked" money, either through US Notes or electronically, does not increase the >national debt by a single cent. Anyone who believes otherwise, please explain why.

Money in circulation has NOTHING to do with bond issuance.

Most newly issued bonds are bought with money in circulation. Those bonds were issued with a goal of attracting existing money.

When gold and silver move together, it signals the coming end of fiat money.

It's not rocket science and doesn't take a job right out of college to understand: Money supply, whether it be green notes, blue notes or red notes or digital notes, is dictated and controlled by the FED. Along with interest rates (fed funds rate, not your local lender's rate) it is one of their tools in attempting to control inflation. Note that I said "in attempting to control inflation."

When gold and silver move together, it signals the coming end of fiat money.

@Overdate said:

I simply stated that issuing "unbacked" money, either through US Notes or electronically, does not increase the >national debt by a single cent. Anyone who believes otherwise, please explain why.

Correct....and ditto for FRNs or Gold Certificates or Silver Certificates. Money in circulation has NOTHING to do with bond issuance.

Wrong. Money in circulation has EVERYTHING to do with bond issuance. FRNs are obligations (liabilities) of the Fed, backed for the most part by US Treasury securities that it owns or purchases. So FRNs are backed in large part by the national debt.

@Overdate said:

I simply stated that issuing "unbacked" money, either through US Notes or electronically, does not increase the >national debt by a single cent. Anyone who believes otherwise, please explain why.

Money in circulation has NOTHING to do with bond issuance.

Most newly issued bonds are bought with money in circulation. Those bonds were issued with a goal of attracting existing money.

>

>

True in the short term, not in the intermediate or long term. Bonds bought by the Fed are paid for by "new" money (obligations of the Fed).

@Overdate said:

Wrong. Money in circulation has EVERYTHING to do with bond issuance. FRNs are obligations (liabilities) of the Fed, >backed for the most part by US Treasury securities that it owns or purchases. So FRNs are backed in large part by >the national debt.

The people who vote with billions of $$$ say otherwise. The people telling you what you are posting here have no understanding of how Open Market Operations works or how the NY Fed injects liquidity into the economy via SOMA.

Has nothing to do with printed bills from the BEP.

@Overdate said:

Wrong. Money in circulation has EVERYTHING to do with bond issuance. FRNs are obligations (liabilities) of the Fed, >backed for the most part by US Treasury securities that it owns or purchases. So FRNs are backed in large part by >the national debt.

The people who vote with billions of $$$ say otherwise. The people telling you what you are posting here have no understanding of how Open Market Operations works or how the NY Fed injects liquidity into the economy via SOMA.

Has nothing to do with printed bills from the BEP.

The only person saying otherwise is you.

The mechanics of the Fed's open market operations are irrelevant to this discussion. Either FRNs are obligations (liabilities) of the Fed, or they aren't. If you think they aren't, please demonstrate why. Either FRNs are backed by the Fed's assets (predominantly US Treasury bonds or other securities), or they aren't. If you think they aren't, please demonstrate why.

@Overdate said:

The mechanics of the Fed's open market operations are irrelevant to this discussion. Either FRNs are obligations >liabilities) of the Fed, or they aren't. If you think they aren't, please demonstrate why. Either FRNs are backed by the >Fed's assets (predominantly US Treasury bonds or other securities), or they aren't. If you think they aren't, please >demonstrate why.

Because it's a relic of the years when we had a currency backed by gold and a Fed central bank. FRNs are NOT "obligations" of the Fed. Monetary policy is independent of money supply numbers.

You can't wave some FRNs and claim part of the Mariner Ecles Building as your share of the liability.

If you have $10,000 in FRNs you can buy $10,000 in U.S. Treasury bonds but the notes themselves do not give you a CLAIM on USTs anymore than they give you a claim on a new Porsche.

@Overdate said:

The mechanics of the Fed's open market operations are irrelevant to this discussion. Either FRNs are obligations >liabilities) of the Fed, or they aren't. If you think they aren't, please demonstrate why. Either FRNs are backed by the >Fed's assets (predominantly US Treasury bonds or other securities), or they aren't. If you think they aren't, please >demonstrate why.

Because it's a relic of the years when we had a currency backed by gold and a Fed central bank. FRNs are NOT "obligations" of the Fed. Monetary policy is independent of money supply numbers.

You can't wave some FRNs and claim part of the Mariner Ecles Building as your share of the liability.

If you have $10,000 in FRNs you can buy $10,000 in U.S. Treasury bonds but the notes themselves do not give you a CLAIM on USTs anymore than they give you a claim on a new Porsche.

.

That is absolutely false !

Federal Reserve Notes show up on the FED's balance sheet as a liability (obligation).

You claim to be an expert in these matters, but you don't even seem to know this ( or if you do know, you are intentionally obfuscating it - I don't know which is worse ! ).

According to the graphic I posted above, the total amount of outstanding Federal Reserve Note currency was about $1.5 Trillion (as of 2018 - quite a bit higher than that now).

That is a $1.5 Trillion dollar liability/obligation of the Federal Reserve Bank.

But it also represents a $1.5 Trillion dollar interest-free loan to the Federal Reserve (because Federal Reserve Notes do not pay any interest). The FED can use that $1.5 Trillion to buy Treasury Bonds or anything that pays interest.

Why should the US Government borrow money (via bond issuance) and pay interest on that, when the Federal Reserve can borrow $1.5 Trillion at zero interest ?

Outstanding nothingburger here. Wake up and live life. THKS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Retiring at 55, what day is today?

@dcarr said:

Also of note:

According to the graphic I posted above, the total amount of outstanding Federal Reserve Note currency was about >$1.5 Trillion (as of 2018 - quite a bit higher than that now).

It is at $2.4 trillion as per the latest FRB Release H 4.1.

That is a $1.5 Trillion dollar liability/obligation of the Federal Reserve Bank.

But it also represents a $1.5 Trillion dollar interest-free loan to the Federal Reserve (because Federal Reserve Notes >do not pay any interest). The FED can use that $1.5 Trillion to buy Treasury Bonds or anything that pays interest.

The "obligation" or "liability" is just an accounting mechanism to balance the books. In actuality, there IS no "liability" in the sense of the word because FRNs are legal tender and can be used to settle debts. Similar to "goodwill" being an asset on a corporate balance sheet but it's not really an asset.

If FRNs are "liabilities" when when does the liability come due like a 5-year Treasury note comes due in 5 years ?

Why should the US Government borrow money (via bond issuance) and pay interest on that, when the Federal >Reserve can borrow $1.5 Trillion at zero interest ?

This is the esssence of creating credit and Open Market Operations. If the Fed just printed FRNs (at 0% interest) this is high-powered money (in the vernacular) which stimulates/overheats the economy as this part of the money supply is spent.

You will note that the Currency figure is considered ESTIMATED because unlike Treasury obligations (bill, notes, bonds) the Fed cannot be sure of how much of that currency is circulated....hoarded....destroyed or damaged...overseas....etc.

When the Fed looks to inject $$$ into the economy, it does so through Open Market Operations via the banking sector, not by "printing bills" and having them distributed through ATMs.

@dcarr said:

That is a $1.5 Trillion dollar liability/obligation of the Federal Reserve Bank.

But it also represents a $1.5 Trillion dollar interest-free loan to the Federal Reserve (because Federal Reserve Notes >do not pay any interest). The FED can use that $1.5 Trillion to buy Treasury Bonds or anything that pays interest.

The "obligation" or "liability" is just an accounting mechanism to balance the books. In actuality, there IS no "liability" in the sense of the word because FRNs are legal tender and can be used to settle debts. Similar to "goodwill" being an asset on a corporate balance sheet but it's not really an asset.

If FRNs are "liabilities" when when does the liability come due like a 5-year Treasury note comes due in 5 years ?

>

>

A liability does not have to have a due date. See "perpetual bonds".

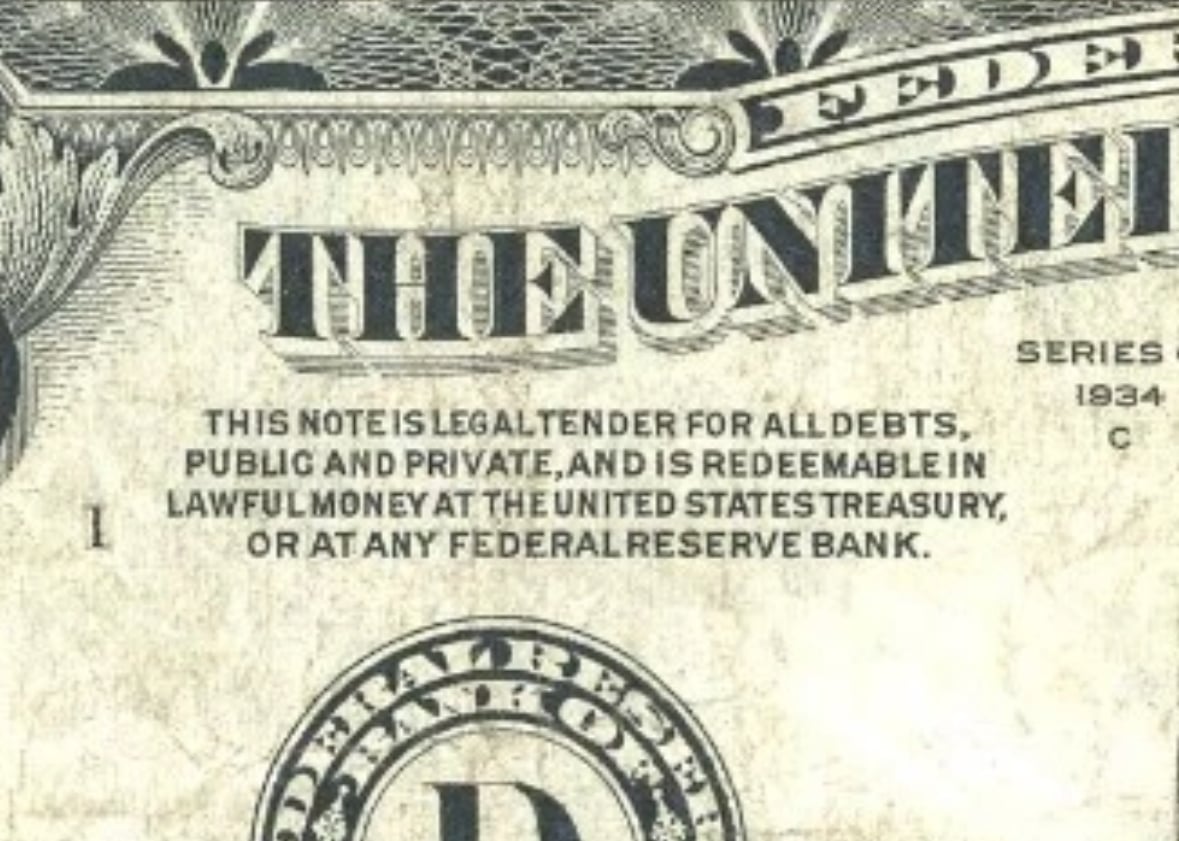

A legal tender can also be a liability. See "silver certificates" and "gold certificates". At one time FRNs explicitly stated the obligation "will pay to the bearer on demand". That obligation is still implicit.

"Goodwill" is an asset, just not a physical one. It directly affects other people's perception of a company's reputation and their willingness to deal with that company.

"You will note that the Currency figure is considered ESTIMATED because unlike Treasury obligations (bill, notes, bonds) the Fed cannot be sure of how much of that currency is circulated....hoarded....destroyed or damaged...overseas....etc."

None of this affects the status of currency as an obligation. If I loan someone an item of value and the loan documents are lost or destroyed, the obligation still continues to exist.

"When the Fed looks to inject $$$ into the economy, it does so through Open Market Operations via the banking sector, not by "printing bills" and having them distributed through ATMs."

Liabilities can be in electonic form as well as physical pieces of paper. Regardless of whether or how they are created/redeemed through Open Market Operations, they are still liabilities.

Overdate, my point is that these "liabilities" are just accounting entries, not real liabilities. If they were true liabilities, Powell would be asked about them at the Bi-Monthly meetings.

The folks who obsess about this are these Gold Bugs or anti-Fed or anti-CB guys who have no track record of investment or economic performance to speak of.

My 1st job out of college in the 1980's was as a "Fed Watcher", tracking the balance sheet, assets, liabilities, etc. of the Federal Reserve.

I watched and wrote reports on money supply figures (M1, M1A, M1B, M2, etc.)....bond yields.....supply of bonds (focus was on the 30-year Treasury back then)...and parallel and cone lines (don't ask ).

I never looked at nor was asked about worrying about bills in circulation as liabilities in the strict sense, just as high-powered money along with various Demand Deposits.

So when I say it's irrelevant, believe me, if the guy reading my reports -- the CEO/President of a Fortune 100 company -- thought it was important or market-moving, he would have let me/us know.

And believe me...I once made a typo and sweated out the whole weekend that he or one of his aides would catch it and ream/fire me on Monday. Thank God they must have missed it.

@GoldFinger1969 said: Overdate, my point is that these "liabilities" are just accounting entries, not real liabilities. If they were true liabilities, Powell would be asked about them at the Bi-Monthly meetings.

>

>

Either they are liabilities or they aren't. If they aren't, why does the Fed need a balance sheet at all?

The folks who obsess about this are these Gold Bugs or anti-Fed or anti-CB guys who have no track record of investment or economic performance to speak of.

>

Ad hominem argument avoiding the real issue by seeking to discredit the source.

@GoldFinger1969 said: Overdate, my point is that these "liabilities" are just accounting entries, not real liabilities. If they were true liabilities, Powell would be asked about them at the Bi-Monthly meetings.

The folks who obsess about this are these Gold Bugs or anti-Fed or anti-CB guys who have no track record of investment or economic performance to speak of.

Put your money where your mouth is, I say.

@GoldFinger1969 said: My 1st job out of college in the 1980's was as a "Fed Watcher", tracking the balance sheet, assets, liabilities, etc. of the Federal Reserve.

I watched and wrote reports on money supply figures (M1, M1A, M1B, M2, etc.)....bond yields.....supply of bonds (focus was on the 30-year Treasury back then)...and parallel and cone lines (don't ask ).

I never looked at nor was asked about worrying about bills in circulation as liabilities in the strict sense, just as high-powered money along with various Demand Deposits.

So when I say it's irrelevant, believe me, if the guy reading my reports -- the CEO/President of a Fortune 100 company -- thought it was important or market-moving, he would have let me/us know.

And believe me...I once made a typo and sweated out the whole weekend that he or one of his aides would catch it and ream/fire me on Monday. Thank God they must have missed it.

.

Nobody ever asks the FED any important or hard questions. Not in public, anyway.

You can try all you want to "spin" it differently, but the Federal Reserve itself states that the currency is a "liability". They also call it an "obligation".

Look at may previous post of the graphic. It is pretty clear that the FED considers the currency to be a liability/obligation.

Are you saying the FED is wrong about this ?

The crux of the matter is this:

Why should the US Government borrow money (via bond issuance) and pay interest on that (and put that burden on taxpayers), when the Federal Reserve can borrow $2.4 Trillion at zero interest ?

@GoldFinger1969 said: My 1st job out of college in the 1980's was as a "Fed Watcher", tracking the balance sheet, assets, liabilities, etc. of the Federal Reserve.

I watched and wrote reports on money supply figures (M1, M1A, M1B, M2, etc.)....bond yields.....supply of bonds (focus was on the 30-year Treasury back then)...and parallel and cone lines (don't ask ).

I never looked at nor was asked about worrying about bills in circulation as liabilities in the strict sense, just as high-powered money along with various Demand Deposits.

So when I say it's irrelevant, believe me, if the guy reading my reports -- the CEO/President of a Fortune 100 company -- thought it was important or market-moving, he would have let me/us know.

And believe me...I once made a typo and sweated out the whole weekend that he or one of his aides would catch it and ream/fire me on Monday. Thank God they must have missed it.

>

>

This is an argument from authority, implying that since you did work on aspects of this particular topic, your assertions are therefore true.

Okay, I have an MA degree in Economics and have also done financially-related work for Fortune 100 companies. But this does not in any way mean that my views are therefore correct. My arguments stand on their own, regardless of my background or experience.

@blitzdude said:

Outstanding nothingburger here. Wake up and live life. THKS!

.

You described your contribution to the discussion perfectly.

.

God Bless the FED. THKS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Retiring at 55, what day is today?

Regarding Federal Reserve notes, @overdate said "Either they are liabilities or they aren't."

That is technically a true statement, but what does it mean? Just like there are many different types of assets (e.g. cash, stocks, bonds, receivables, capitalized expenses, goodwill), there are many different kinds of liabilities (e.g. accounts payable, unearned income, various loan obligations, reserves on an insurance company books, deferred tax liabilities). In terms of the solvency and viability of an organization, different types of assets and different types of liabilities have very different implications.

@GoldFinger1969 is pointing out that some assets and liabilities are notional items that help accountants and some users of financial statements reflect better on them. I am far from an expert on the Fed balance sheet, but, showing Federal Reserve notes outstanding as a liability is one such notional item. Overdate -- you asked why it exists -- and here is my layperson's explanation. When the Fed issues reserve notes to member bank, they receive some sort of asset in return. This asset needs to show up on the asset side of the Fed balance sheet. The accountants who developed the methodology for Federal Reserve accounting did not want this transaction to increase the surplus of the Fed, So, they created a liability in an equal amount. It's a kind of balancing item. But, Goldfinger's point is that this is not a liability in the casual sense of the word, in that it doesn't represent an amount that needs to get paid back. In this sense, it is very different, for example, from the situation of borrowing with a well-defined interest rate and maturity schedule.

@Higashiyama said:

Regarding Federal Reserve notes, @overdate said "Either they are liabilities or they aren't."

That is technically a true statement, but what does it mean? Just like there are many different types of assets (e.g. cash, stocks, bonds, receivables, capitalized expenses, goodwill), there are many different kinds of liabilities (e.g. accounts payable, unearned income, various loan obligations, reserves on an insurance company books, deferred tax liabilities). In terms of the solvency and viability of an organization, different types of assets and different types of liabilities have very different implications.

@GoldFinger1969 is pointing out that some assets and liabilities are notional items that help accountants and some users of financial statements reflect better on them. I am far from an expert on the Fed balance sheet, but, showing Federal Reserve notes outstanding as a liability is one such notional item. Overdate -- you asked why it exists -- and here is my layperson's explanation. When the Fed issues reserve notes to member bank, they receive some sort of asset in return. This asset needs to show up on the asset side of the Fed balance sheet. The accountants who developed the methodology for Federal Reserve accounting did not want this transaction to increase the surplus of the Fed, So, they created a liability in an equal amount. It's a kind of balancing item. But, Goldfinger's point is that this is not a liability in the casual sense of the word, in that it doesn't represent an amount that needs to get paid back. In this sense, it is very different, for example, from the situation of borrowing with a well-defined interest rate and maturity schedule.

From ChatGPT: The classification of Federal Reserve Notes as liabilities is based on long-standing accounting and legal frameworks, not on avoiding surplus increases. This reflects their redeemability in the financial system (e.g., for bank reserves or other Fed liabilities), even if not for gold or other specific assets. While FRNs don't represent a debt like a Treasury bond, they are obligations the Fed must honor in terms of legal tender, redeemable by banks for reserve balances, and withdrawable from circulation, reducing the Fed’s liabilities. Federal Reserve Notes are a “non-interest-bearing, zero-maturity liability.” They're liabilities to the financial system, not to individuals in the way a bond is.

@Overdate - thanks, I think I agree about 85 % with Chat, but could you let me know the exact question you asked? It’s hard to judge or fully comment on the response without knowing the question.

@Higashiyama said: @Overdate - thanks, I think I agree about 85 % with Chat, but could you let me know the exact question you asked? It’s hard to judge or fully comment on the response without knowing the question.

"The following paragraph claims that federal reserve notes are not a true liability of the Fed. Please critique this paragraph: When the Fed issues reserve notes to member bank, they receive some sort of asset in return. This asset needs to show up on the asset side of the Fed balance sheet. The accountants who developed the methodology for Federal Reserve accounting did not want this transaction to increase the surplus of the Fed, So, they created a liability in an equal amount. It's a kind of balancing item. But, Goldfinger's point is that this is not a liability in the casual sense of the word, in that it doesn't represent an amount that needs to get paid back. In this sense, it is very different, for example, from the situation of borrowing with a well-defined interest rate and maturity schedule."

@Overdate -- given that it is a fairly complex question (i.e., analyzing my initial statement), I think Chat did OK.

However, I think Chat is in fact a bit confused (or contradictory) in the following key assertion they make:

"While FRNs don't represent a debt like a Treasury bond, they are obligations the Fed must honor in terms of legal tender, redeemable by banks for reserve balances, and withdrawable from circulation, reducing the Fed’s liabilities. Federal Reserve Notes are a “non-interest-bearing, zero-maturity liability.” They're liabilities to the financial system, not to individuals in the way a bond is." (QUOTED FROM CHATGPT above)

For the most part, the holder of a Federal Reserve note cannot go to the Fed and ask to exchange it for some other asset. In some sense, member banks may be able to, but the vast amount of value in Federal Reserve notes is not held by member banks.

If you ask the following very straightforward question to ChatGPT, you get a straightforward answer:

QUESTION TO CHATGPT: Is the Federal Reserve required to redeem Federal Reserve Notes for some form of asset other than currency?

ANSWER FROM CHATGPT: No, the Federal Reserve is not required to redeem Federal Reserve Notes for any form of asset other than currency. Federal Reserve Notes, which are the paper currency in circulation in the United States, are considered legal tender for all debts, public charges, taxes, and dues. They are backed by the full faith and credit of the U.S. government, but they are not redeemable in gold, silver, or any other commodity. The U.S. moved away from the gold standard in the 20th century, and Federal Reserve Notes are now fiat money, meaning their value is derived from the trust and confidence of the people who use them.

This is consistent with my statement that the accountants who established the methods called Fed notes in circulation a Fed liability because it would be undesirable to have issuance of new notes result in an increase in surplus.

I followed up my initial question as follows:

FOLLOW-UP QUESTION TO CHATGPT: then why are Federal Reserve notes listed as a liability on the balance sheet of the Federal Reserve Bank.

ANSWER FROM CHATGPT:

Federal Reserve Notes are listed as liabilities on the Federal Reserve's balance sheet because they represent obligations of the Federal Reserve. When the Federal Reserve issues currency, it essentially creates a liability for itself because it owes the holder of that currency the value represented by the note.

Here's a simplified explanation of how this works:

Issuance of Currency: When the Federal Reserve issues currency, it is essentially providing a promise that the currency can be used as legal tender for transactions.

Balance Sheet Accounting: On the balance sheet, liabilities are obligations that the entity must eventually settle. For the Federal Reserve, the currency it issues is an obligation because it must ensure that these notes retain their value as a medium of exchange.

Assets and Liabilities: The counterpart to these liabilities is the assets held by the Federal Reserve, including government securities and other financial instruments. These assets help back the value of the currency and support the Federal Reserve's ability to manage monetary policy effectively.

In summary, listing Federal Reserve Notes as liabilities reflects the obligation of the Federal Reserve to maintain their value and usability as currency, even though they are not redeemable for any specific asset.

This is consistent with GoldFinger1969's assertion that the liability shown on the Fed balance sheet for Federal Reserve Notes is a very special invention of accountants, and does not represent the type of liability that needs to explicitly be paid.

@Overdate said:

Ad hominem argument avoiding the real issue by seeking to discredit the source.

No, they generally have LOUSY track records. I followed many of these guys in the 1970's, 1980's, and up to the 1990's........interesting guys...nice guys....provocative thoughts....BUT THEY DIDN'T MAKE YOU $$$$ !!!!

@dcarr said:

You can try all you want to "spin" it differently, but the Federal Reserve itself states that the currency is a "liability". >They also call it an "obligation".

Please show me the last time any Fed Chairman discussed the implications of FRN "liabilities" for monetary policy, debt servicing, inflation, long-term interest rates, etc.

@Higashiyama said:

This is consistent with GoldFinger1969's assertion that the liability shown on the Fed balance sheet for Federal Reserve Notes is a very special invention of accountants, and does not represent the type of liability that needs to explicitly be paid.

>

According to 12 USC § 411, the classification of FRNs as liabilities are a requirement of US law rather than an “invention of accountants”. If part of the Fed’s obligation is to “maintain their value”, then clearly this obligation is not being met.

Furthermore, your ChatGPT answer confirms my original contention that FRNs are obligations backed by the Fed’s assets. These assets are real, and so are the obligations, regardless of any limitations on their redeemability.

@Overdate said:

Ad hominem argument avoiding the real issue by seeking to discredit the source.

No, they generally have LOUSY track records. I followed many of these guys in the 1970's, 1980's, and up to the 1990's........interesting guys...nice guys....provocative thoughts....BUT THEY DIDN'T MAKE YOU $$$$ !!!!

>

Another ad hominem argument. Rather than responding to my statement, you lump me in with "the folks who obsess about this" and then attack their track record, which has no relevance to the accuracy of my statement. Not a valid way to discuss or resolve the issue.

@Overdate said:

Another ad hominem argument. Rather than responding to my statement, you lump me in with "the folks who >obsess about this" and then attack their track record, which has no relevance to the accuracy of my statement. Not >a valid way to discuss or resolve the issue.

I wasn't lumping you in with them, OD. I'm just stating this whole FRN "debate" is like what the Gold Bugs have been saying for decades.

I don't think this issue HAS a resolution. Some of us don't consider them liabilities in the traditional sense, some of you do. Whatever....

All I know is the next time someone in The WH or The Treasury or The Fed discusses FRN liabilities, resuscitate this thread pronto !!

I don't expect that to happen for a long time -- if ever.

@Overdate said "According to 12 USC § 411, the classification of FRNs as liabilities are a requirement of US law rather than an “invention of accountants”

I would expect this to be required under law; that is not inconsistent with my statement. Accountants were undoubtedly involved in framing the law.

@Overdate said " If part of the Fed’s obligation is to 'maintain their value', then clearly this obligation is not being met."

Absolutely. No disagreement there whatsover.

@Overdate said "Furthermore, your ChatGPT answer confirms my original contention that FRNs are obligations backed by the Fed’s assets."

So if I bring $ 1 million in FRNs to the Fed, are the required to liquidate some of these assets? No. So, it's a little weaker than an obligation. (which goes back to the issue of understanding the heterogeneity of liabilities) The assets arose because the Fed received them (or the equivalent) in exchange for issuing FRNs. The associated liability was recorded because it would be undesirable, from an accounting perspective, to have this transaction increase Fed surplus.

But, following up on @GoldFinger1969 's last post, I will make sure to have this thread at my fingertips in case the Fed would like to use it in one of their training courses!

@Higashiyama said:

So if I bring $ 1 million in FRNs to the Fed, are the required to liquidate some of these assets? No. So, it's a little weaker than an obligation. (which goes back to the issue of understanding the heterogeneity of liabilities) The assets arose because the Fed received them (or the equivalent) in exchange for issuing FRNs. The associated liability was recorded because it would be undesirable, from an accounting perspective, to have this transaction increase Fed surplus.

>

I maintain this formulation is incorrect, especially the last sentence. To explain why, consider the following scenario:

"So if I bring $ 1 million in bonds to a Fortune 500 company, is the company required to liquidate some of its assets? No. So, it's a little weaker than an obligation. (which goes back to the issue of understanding the heterogeneity of liabilities) The assets arose because the company received them (or the equivalent) in exchange for issuing bonds. The associated liability was recorded because it would be undesirable, from an accounting perspective, to have this transaction increase the company's surplus."

Clearly this last paragraph makes no sense. The company's liability was recorded because it is a genuine liability, not an accounting gimmick. The exact same logic applies to the Fed.

A creator of the petrodollar system (3 years after Nixon killed the gold standard) explains the new Petrodollar 2.0 and what the recent trip to Saudi Arabia was really about.

When gold and silver move together, it signals the coming end of fiat money.

"I maintain this formulation is incorrect, especially the last sentence. To explain why, consider the following scenario:

"So if I bring $ 1 million in bonds to a Fortune 500 company, is the company required to liquidate some of its assets? No. So, it's a little weaker than an obligation. (which goes back to the issue of understanding the heterogeneity of liabilities) The assets arose because the company received them (or the equivalent) in exchange for issuing bonds. The associated liability was recorded because it would be undesirable, from an accounting perspective, to have this transaction increase the company's surplus."

Clearly this last paragraph makes no sense. The company's liability was recorded because it is a genuine liability, not an accounting gimmick. The exact same logic applies to the Fed."

Actually ... your "counterexample" doesn't work; you of course can't bring $ 1 million to a Fortune 500 company and ask them to liquidate assets. But, the thought exercise makes no sense for a Fortune 500 company. They don't list FRNs as liabilities on their balance sheets! The accounting treatment (i.e., showing FRNs as a liability) is unique to the Federal Reserve. So, the case of a Fortune 500 company is not parallel to that of the Fed.

This has been a somewhat interesting discussion, and I appreciate your input, but we should close sub-thread this out, since it has become a little tangential to the original topic. In any case, I'll withdraw from the discussion at this juncture.

(Even if we have not come to agreement on this topic, we agree on at least one thing: your Adolph Weinman signature is really nice. I'm currently about 2/3rds of the way through completing a Whitman album Walker set - mostly circulated coins up to the "short set" and MS from 1941 on)

@Higashiyama said:

(Even if we have not come to agreement on this topic, we agree on at least one thing: your Adolph Weinman signature is really nice. I'm currently about 2/3rds of the way through completing a Whitman album Walker set - mostly circulated coins up to the "short set" and MS from 1941 on)

>

Thank you. My father also assembled a complete circulated Whitman set and an AU-BU set in a Capital holder. I'm not collecting the series, but I have a nice birth year 1943 Walker in MS66.

The Federal Reserve has, on occasion, shrunk their balance sheet by selling assets. This policy is also sometimes known as "Quantitative Tightening" (QT).

A person could legally purchase such assets when the Federal Reserve sells them, and use Federal Reserve Notes to do it.

In fact, the Federal Reserve Bank would be legally required to accept the Federal Reserve Notes in exchange for the asset.

This is why Federal Reserve Notes must appear on the balance sheet as a liability/obligation.

@dcarr said:

The Federal Reserve has, on occasion, shrunk their balance sheet by selling assets. This policy is also sometimes >known as "Quantitative Tightening" (QT).

A person could legally purchase such assets when the Federal Reserve sells them, and use Federal Reserve Notes >to do it.

In fact, the Federal Reserve Bank would be legally required to accept the Federal Reserve Notes in exchange for >the asset.

This is why Federal Reserve Notes must appear on the balance sheet as a liability/obligation.

In theory that could happen....IN THEORY. But as Homer Simpson says, "In theory, Communism works, Marge....in theory."

The Fed injects or withdraws liquidity by buying or selling securities through the System Open Market Account (SOMA) controlled by the NY Fed. They will deal with the 25 Primary Dealers, plus other large institutions as they see fit (insurance companies, SWFs, foreign CBs, pension funds, etc.).

"what would have happened if the us had stayed on the gold standard?"

The US would have defaulted years ago, or it would have learned to following the basic accounting rules that anyone using a checkbook clearly understands.

When gold and silver move together, it signals the coming end of fiat money.

@dcarr said:

You can try all you want to "spin" it differently, but the Federal Reserve itself states that the currency is a "liability". >They also call it an "obligation".

Please show me the last time any Fed Chairman discussed the implications of FRN "liabilities" for monetary policy, debt servicing, inflation, long-term interest rates, etc.

.

The Federal Reserve Bank (FRB) doesn't want to talk about it. And Congress doesn't want out of the bankers' pockets, so they don't ask about it.

In a thread on another forum related to the history of the Gold Standard, @GoldFinger1969 indicated that the law establishing the FRB in 1913 mandated that the FRB keep a reserve of gold on-hand in an amount no less than 40% of the total Federal Reserve Notes (FRNs) issued. In other words, the FRB was required to maintain 40% gold backing for the FRNs it issued.

Some aspects of that discussion are relevant here, so I will summarize them.

According to BEP (Bureau of Printing and Engraving) records, the total number of FRNs issued from 1914-1933 amounted to $36 BILLION. At issue in the discussion is the portion of that $36 billion that was still in circulation (and not replaced or redeemed).

Why would the FRB want to issue as many FRNs as they could possibly get away with ?

Because at the time, the FRB was allowed to keep 100% of their profits. The (up to) $36 billion in FRNs issued constituted an interest-free loan to the FRB from the general public. The FRB could then use those proceeds to buy government bonds or anything that paid interest. I'd sure like to be able to borrow billions of dollars at zero interest, invest the money in interest-bearing instruments such as Treasury Bonds, keep all the profits for myself, and have the US Government bail me out if things go sour !

The BEP has no incentive to lie or "adjust" their numbers.

The FRB has a lot to hide and has significant incentives to obfuscate the real numbers (so that public perception does not sway against them).

However, for this post, I will cite data published by the FRB itself.

For the purpose of equal comparison, I will use the same date (05 April 1933, when Roosevelt signed executive order 6102 confiscating gold from the public).

05 APR 1933, total gold assets held by Federal Reserve Banks (including gold coin and Gold Certificates): $627 MILLION Dollars (see 1st chart below):

.

05 APR 1933, total Federal Reserve Notes and Federal Reserve Bank Notes "in actual circulation": $3,660 MILLION Dollars ($3.660 BILLION Dollars) (see 2nd chart below):

So, let's see, that is $3,660 Million in gold liabilities against actual gold holdings of $627 Million, for a reserve ratio of just 17.1% . Obviously, that is FAR BELOW the supposed 40% lower limit required by law.

Liars and cheats they were (and are).

The charts paint the clear picture that the actions of President Roosevelt in 1933 were largely to bail out the Federal Reserve Bank.

PS:

The BEP shows $35.8 BILLION in FRNs issued from 1914 to 1933. But the FRB claims that only $3.6 billion were "in actual circulation" (as of 05 APR 1933). Where did they all go (90% of it is apparently unaccounted for) ?

@derryb said:

to answer the OP's question we would not have been able to put our nation in such great debt. The ability to print >money at will to pay the bills removes any restraint to limit one's spending. Having the dollar backed by gold >provided that restraint. If the dollar had remained pegged to gold, gold price would now have a whole lot of zeros at >the end of it.

Or...it would have functioned like it did for decades with the price level unchanged and the gold price unchanged.

We would also have a much SMALLER GDP.

Your problem is you think ALL DEBT is bad. It is not. Only EXCESSIVE and wasteful and non-productive debt is bad.

Per your last sentence-We have over 36 T of that along with quadrillions of unfunded liabilities!

Comments

Printing bonds = printing interest-bearing securities, with taxpayers on the hook to pay that interest.

Printing money = printing official medium of exchange directly, no burdensome interest obligations, no continuous increase in national debt.

The government doesn't need a middleman or a broker to do either one. End the Fed.

Make banking responsible again.

I knew it would happen.

our central bank often prints money to buy new and existing bonds.

When gold and silver move together, it signals the coming end of fiat money.

Sorry, you guys don't know how monetary policy is transmitted and it's not through the BEP.

Take an economics course and stop listening to doom-and-gloomers with lousy investment track records looking for click-bait material.

Nobody here has claimed that monetary policy is transmitted through the BEP.

I simply stated that issuing "unbacked" money, either through US Notes or electronically, does not increase the national debt by a single cent. Anyone who believes otherwise, please explain why.

Take an economics course and stop listening to doom-and-gloomers with lousy investment track records looking for click-bait material.

Condescend much?

I knew it would happen.

.

You are apparently "unfamiliar" with the different types of currency that have been issued by the US Treasury and the Federal Reserve. Maybe it is you that needs to learn about currency alternatives to Federal Reserve Notes, and to stop listening to your banker friends' propaganda.

.

Correct....and ditto for FRNs or Gold Certificates or Silver Certificates. Money in circulation has NOTHING to do with bond issuance.

My 1st job out of college was watching the weekly money supply figures and the change in currency, M1, M2, etc.

What bills are issued -- FRNs, USNs, GCs, SCs, etc -- has NOTHING to do with debt issuance and whether part or all of the increase in money supply is sterilized or not via the Fed or Treasury (FX).

Most newly issued bonds are bought with money in circulation. Those bonds were issued with a goal of attracting existing money.

When gold and silver move together, it signals the coming end of fiat money.

It's not rocket science and doesn't take a job right out of college to understand: Money supply, whether it be green notes, blue notes or red notes or digital notes, is dictated and controlled by the FED. Along with interest rates (fed funds rate, not your local lender's rate) it is one of their tools in attempting to control inflation. Note that I said "in attempting to control inflation."

When gold and silver move together, it signals the coming end of fiat money.

Wrong. Money in circulation has EVERYTHING to do with bond issuance. FRNs are obligations (liabilities) of the Fed, backed for the most part by US Treasury securities that it owns or purchases. So FRNs are backed in large part by the national debt.

>

>

True in the short term, not in the intermediate or long term. Bonds bought by the Fed are paid for by "new" money (obligations of the Fed).

The people who vote with billions of $$$ say otherwise. The people telling you what you are posting here have no understanding of how Open Market Operations works or how the NY Fed injects liquidity into the economy via SOMA.

Has nothing to do with printed bills from the BEP.

The only person saying otherwise is you.

The mechanics of the Fed's open market operations are irrelevant to this discussion. Either FRNs are obligations (liabilities) of the Fed, or they aren't. If you think they aren't, please demonstrate why. Either FRNs are backed by the Fed's assets (predominantly US Treasury bonds or other securities), or they aren't. If you think they aren't, please demonstrate why.

Because it's a relic of the years when we had a currency backed by gold and a Fed central bank. FRNs are NOT "obligations" of the Fed. Monetary policy is independent of money supply numbers.

You can't wave some FRNs and claim part of the Mariner Ecles Building as your share of the liability.

If you have $10,000 in FRNs you can buy $10,000 in U.S. Treasury bonds but the notes themselves do not give you a CLAIM on USTs anymore than they give you a claim on a new Porsche.

.

.

That is absolutely false !

Federal Reserve Notes show up on the FED's balance sheet as a liability (obligation).

You claim to be an expert in these matters, but you don't even seem to know this ( or if you do know, you are intentionally obfuscating it - I don't know which is worse ! ).

From the FED's own web site, as of 2018:

https://chicagofed.org/publications/chicago-fed-letter/2018/395

Look, there is it, right there, you can't miss it !

.

Also of note:

According to the graphic I posted above, the total amount of outstanding Federal Reserve Note currency was about $1.5 Trillion (as of 2018 - quite a bit higher than that now).

That is a $1.5 Trillion dollar liability/obligation of the Federal Reserve Bank.

But it also represents a $1.5 Trillion dollar interest-free loan to the Federal Reserve (because Federal Reserve Notes do not pay any interest). The FED can use that $1.5 Trillion to buy Treasury Bonds or anything that pays interest.

Why should the US Government borrow money (via bond issuance) and pay interest on that, when the Federal Reserve can borrow $1.5 Trillion at zero interest ?

.

Outstanding nothingburger here. Wake up and live life. THKS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Retiring at 55, what day is today?

.

You described your contribution to the discussion perfectly.

.

It is at $2.4 trillion as per the latest FRB Release H 4.1.

https://www.federalreserve.gov/releases/h41/current/h41.htm#h41tab9

The "obligation" or "liability" is just an accounting mechanism to balance the books. In actuality, there IS no "liability" in the sense of the word because FRNs are legal tender and can be used to settle debts. Similar to "goodwill" being an asset on a corporate balance sheet but it's not really an asset.

If FRNs are "liabilities" when when does the liability come due like a 5-year Treasury note comes due in 5 years ?

This is the esssence of creating credit and Open Market Operations. If the Fed just printed FRNs (at 0% interest) this is high-powered money (in the vernacular) which stimulates/overheats the economy as this part of the money supply is spent.

You will note that the Currency figure is considered ESTIMATED because unlike Treasury obligations (bill, notes, bonds) the Fed cannot be sure of how much of that currency is circulated....hoarded....destroyed or damaged...overseas....etc.

When the Fed looks to inject $$$ into the economy, it does so through Open Market Operations via the banking sector, not by "printing bills" and having them distributed through ATMs.

>

>

A liability does not have to have a due date. See "perpetual bonds".

A legal tender can also be a liability. See "silver certificates" and "gold certificates". At one time FRNs explicitly stated the obligation "will pay to the bearer on demand". That obligation is still implicit.

"Goodwill" is an asset, just not a physical one. It directly affects other people's perception of a company's reputation and their willingness to deal with that company.

"You will note that the Currency figure is considered ESTIMATED because unlike Treasury obligations (bill, notes, bonds) the Fed cannot be sure of how much of that currency is circulated....hoarded....destroyed or damaged...overseas....etc."

None of this affects the status of currency as an obligation. If I loan someone an item of value and the loan documents are lost or destroyed, the obligation still continues to exist.

"When the Fed looks to inject $$$ into the economy, it does so through Open Market Operations via the banking sector, not by "printing bills" and having them distributed through ATMs."

Liabilities can be in electonic form as well as physical pieces of paper. Regardless of whether or how they are created/redeemed through Open Market Operations, they are still liabilities.

Overdate, my point is that these "liabilities" are just accounting entries, not real liabilities. If they were true liabilities, Powell would be asked about them at the Bi-Monthly meetings.

The folks who obsess about this are these Gold Bugs or anti-Fed or anti-CB guys who have no track record of investment or economic performance to speak of.

Put your money where your mouth is, I say.

My 1st job out of college in the 1980's was as a "Fed Watcher", tracking the balance sheet, assets, liabilities, etc. of the Federal Reserve.

I watched and wrote reports on money supply figures (M1, M1A, M1B, M2, etc.)....bond yields.....supply of bonds (focus was on the 30-year Treasury back then)...and parallel and cone lines (don't ask

etc.)....bond yields.....supply of bonds (focus was on the 30-year Treasury back then)...and parallel and cone lines (don't ask  ).

).

I never looked at nor was asked about worrying about bills in circulation as liabilities in the strict sense, just as high-powered money along with various Demand Deposits.

So when I say it's irrelevant, believe me, if the guy reading my reports -- the CEO/President of a Fortune 100 company -- thought it was important or market-moving, he would have let me/us know.

And believe me...I once made a typo and sweated out the whole weekend that he or one of his aides would catch it and ream/fire me on Monday. Thank God they must have missed it.

>

>

Either they are liabilities or they aren't. If they aren't, why does the Fed need a balance sheet at all?

>

Ad hominem argument avoiding the real issue by seeking to discredit the source.

>

>

I always do.

.

Nobody ever asks the FED any important or hard questions. Not in public, anyway.

You can try all you want to "spin" it differently, but the Federal Reserve itself states that the currency is a "liability". They also call it an "obligation".

Look at may previous post of the graphic. It is pretty clear that the FED considers the currency to be a liability/obligation.

Are you saying the FED is wrong about this ?

The crux of the matter is this:

Why should the US Government borrow money (via bond issuance) and pay interest on that (and put that burden on taxpayers), when the Federal Reserve can borrow $2.4 Trillion at zero interest ?

.

>

>

This is an argument from authority, implying that since you did work on aspects of this particular topic, your assertions are therefore true.

Okay, I have an MA degree in Economics and have also done financially-related work for Fortune 100 companies. But this does not in any way mean that my views are therefore correct. My arguments stand on their own, regardless of my background or experience.

God Bless the FED. THKS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Retiring at 55, what day is today?

Regarding Federal Reserve notes, @overdate said "Either they are liabilities or they aren't."

That is technically a true statement, but what does it mean? Just like there are many different types of assets (e.g. cash, stocks, bonds, receivables, capitalized expenses, goodwill), there are many different kinds of liabilities (e.g. accounts payable, unearned income, various loan obligations, reserves on an insurance company books, deferred tax liabilities). In terms of the solvency and viability of an organization, different types of assets and different types of liabilities have very different implications.

@GoldFinger1969 is pointing out that some assets and liabilities are notional items that help accountants and some users of financial statements reflect better on them. I am far from an expert on the Fed balance sheet, but, showing Federal Reserve notes outstanding as a liability is one such notional item. Overdate -- you asked why it exists -- and here is my layperson's explanation. When the Fed issues reserve notes to member bank, they receive some sort of asset in return. This asset needs to show up on the asset side of the Fed balance sheet. The accountants who developed the methodology for Federal Reserve accounting did not want this transaction to increase the surplus of the Fed, So, they created a liability in an equal amount. It's a kind of balancing item. But, Goldfinger's point is that this is not a liability in the casual sense of the word, in that it doesn't represent an amount that needs to get paid back. In this sense, it is very different, for example, from the situation of borrowing with a well-defined interest rate and maturity schedule.

From ChatGPT: The classification of Federal Reserve Notes as liabilities is based on long-standing accounting and legal frameworks, not on avoiding surplus increases. This reflects their redeemability in the financial system (e.g., for bank reserves or other Fed liabilities), even if not for gold or other specific assets. While FRNs don't represent a debt like a Treasury bond, they are obligations the Fed must honor in terms of legal tender, redeemable by banks for reserve balances, and withdrawable from circulation, reducing the Fed’s liabilities. Federal Reserve Notes are a “non-interest-bearing, zero-maturity liability.” They're liabilities to the financial system, not to individuals in the way a bond is.

@Overdate - thanks, I think I agree about 85 % with Chat, but could you let me know the exact question you asked? It’s hard to judge or fully comment on the response without knowing the question.

"The following paragraph claims that federal reserve notes are not a true liability of the Fed. Please critique this paragraph: When the Fed issues reserve notes to member bank, they receive some sort of asset in return. This asset needs to show up on the asset side of the Fed balance sheet. The accountants who developed the methodology for Federal Reserve accounting did not want this transaction to increase the surplus of the Fed, So, they created a liability in an equal amount. It's a kind of balancing item. But, Goldfinger's point is that this is not a liability in the casual sense of the word, in that it doesn't represent an amount that needs to get paid back. In this sense, it is very different, for example, from the situation of borrowing with a well-defined interest rate and maturity schedule."

@Overdate -- given that it is a fairly complex question (i.e., analyzing my initial statement), I think Chat did OK.

However, I think Chat is in fact a bit confused (or contradictory) in the following key assertion they make:

"While FRNs don't represent a debt like a Treasury bond, they are obligations the Fed must honor in terms of legal tender, redeemable by banks for reserve balances, and withdrawable from circulation, reducing the Fed’s liabilities. Federal Reserve Notes are a “non-interest-bearing, zero-maturity liability.” They're liabilities to the financial system, not to individuals in the way a bond is." (QUOTED FROM CHATGPT above)

For the most part, the holder of a Federal Reserve note cannot go to the Fed and ask to exchange it for some other asset. In some sense, member banks may be able to, but the vast amount of value in Federal Reserve notes is not held by member banks.

If you ask the following very straightforward question to ChatGPT, you get a straightforward answer:

QUESTION TO CHATGPT: Is the Federal Reserve required to redeem Federal Reserve Notes for some form of asset other than currency?

ANSWER FROM CHATGPT: No, the Federal Reserve is not required to redeem Federal Reserve Notes for any form of asset other than currency. Federal Reserve Notes, which are the paper currency in circulation in the United States, are considered legal tender for all debts, public charges, taxes, and dues. They are backed by the full faith and credit of the U.S. government, but they are not redeemable in gold, silver, or any other commodity. The U.S. moved away from the gold standard in the 20th century, and Federal Reserve Notes are now fiat money, meaning their value is derived from the trust and confidence of the people who use them.

This is consistent with my statement that the accountants who established the methods called Fed notes in circulation a Fed liability because it would be undesirable to have issuance of new notes result in an increase in surplus.

I followed up my initial question as follows:

FOLLOW-UP QUESTION TO CHATGPT: then why are Federal Reserve notes listed as a liability on the balance sheet of the Federal Reserve Bank.

ANSWER FROM CHATGPT:

Federal Reserve Notes are listed as liabilities on the Federal Reserve's balance sheet because they represent obligations of the Federal Reserve. When the Federal Reserve issues currency, it essentially creates a liability for itself because it owes the holder of that currency the value represented by the note.

Here's a simplified explanation of how this works:

Issuance of Currency: When the Federal Reserve issues currency, it is essentially providing a promise that the currency can be used as legal tender for transactions.

Balance Sheet Accounting: On the balance sheet, liabilities are obligations that the entity must eventually settle. For the Federal Reserve, the currency it issues is an obligation because it must ensure that these notes retain their value as a medium of exchange.

Assets and Liabilities: The counterpart to these liabilities is the assets held by the Federal Reserve, including government securities and other financial instruments. These assets help back the value of the currency and support the Federal Reserve's ability to manage monetary policy effectively.

In summary, listing Federal Reserve Notes as liabilities reflects the obligation of the Federal Reserve to maintain their value and usability as currency, even though they are not redeemable for any specific asset.

This is consistent with GoldFinger1969's assertion that the liability shown on the Fed balance sheet for Federal Reserve Notes is a very special invention of accountants, and does not represent the type of liability that needs to explicitly be paid.

No, they generally have LOUSY track records. I followed many of these guys in the 1970's, 1980's, and up to the 1990's........interesting guys...nice guys....provocative thoughts....BUT THEY DIDN'T MAKE YOU $$$$ !!!!

You might, they don't.

Please show me the last time any Fed Chairman discussed the implications of FRN "liabilities" for monetary policy, debt servicing, inflation, long-term interest rates, etc.

>

According to 12 USC § 411, the classification of FRNs as liabilities are a requirement of US law rather than an “invention of accountants”. If part of the Fed’s obligation is to “maintain their value”, then clearly this obligation is not being met.

Furthermore, your ChatGPT answer confirms my original contention that FRNs are obligations backed by the Fed’s assets. These assets are real, and so are the obligations, regardless of any limitations on their redeemability.

>

Another ad hominem argument. Rather than responding to my statement, you lump me in with "the folks who obsess about this" and then attack their track record, which has no relevance to the accuracy of my statement. Not a valid way to discuss or resolve the issue.

I wasn't lumping you in with them, OD. I'm just stating this whole FRN "debate" is like what the Gold Bugs have been saying for decades.

I don't think this issue HAS a resolution. Some of us don't consider them liabilities in the traditional sense, some of you do. Whatever....

All I know is the next time someone in The WH or The Treasury or The Fed discusses FRN liabilities, resuscitate this thread pronto !!

I don't expect that to happen for a long time -- if ever.

@Overdate said "According to 12 USC § 411, the classification of FRNs as liabilities are a requirement of US law rather than an “invention of accountants”

I would expect this to be required under law; that is not inconsistent with my statement. Accountants were undoubtedly involved in framing the law.

@Overdate said " If part of the Fed’s obligation is to 'maintain their value', then clearly this obligation is not being met."

Absolutely. No disagreement there whatsover.

@Overdate said "Furthermore, your ChatGPT answer confirms my original contention that FRNs are obligations backed by the Fed’s assets."

So if I bring $ 1 million in FRNs to the Fed, are the required to liquidate some of these assets? No. So, it's a little weaker than an obligation. (which goes back to the issue of understanding the heterogeneity of liabilities) The assets arose because the Fed received them (or the equivalent) in exchange for issuing FRNs. The associated liability was recorded because it would be undesirable, from an accounting perspective, to have this transaction increase Fed surplus.

But, following up on @GoldFinger1969 's last post, I will make sure to have this thread at my fingertips in case the Fed would like to use it in one of their training courses!

>

I maintain this formulation is incorrect, especially the last sentence. To explain why, consider the following scenario:

"So if I bring $ 1 million in bonds to a Fortune 500 company, is the company required to liquidate some of its assets? No. So, it's a little weaker than an obligation. (which goes back to the issue of understanding the heterogeneity of liabilities) The assets arose because the company received them (or the equivalent) in exchange for issuing bonds. The associated liability was recorded because it would be undesirable, from an accounting perspective, to have this transaction increase the company's surplus."

Clearly this last paragraph makes no sense. The company's liability was recorded because it is a genuine liability, not an accounting gimmick. The exact same logic applies to the Fed.

another reason why Da Boys don't need a gold standard:

Petrodollar 2.0 Is Coming

A creator of the petrodollar system (3 years after Nixon killed the gold standard) explains the new Petrodollar 2.0 and what the recent trip to Saudi Arabia was really about.

When gold and silver move together, it signals the coming end of fiat money.

@Overdate said:

"I maintain this formulation is incorrect, especially the last sentence. To explain why, consider the following scenario:

"So if I bring $ 1 million in bonds to a Fortune 500 company, is the company required to liquidate some of its assets? No. So, it's a little weaker than an obligation. (which goes back to the issue of understanding the heterogeneity of liabilities) The assets arose because the company received them (or the equivalent) in exchange for issuing bonds. The associated liability was recorded because it would be undesirable, from an accounting perspective, to have this transaction increase the company's surplus."

Clearly this last paragraph makes no sense. The company's liability was recorded because it is a genuine liability, not an accounting gimmick. The exact same logic applies to the Fed."

Actually ... your "counterexample" doesn't work; you of course can't bring $ 1 million to a Fortune 500 company and ask them to liquidate assets. But, the thought exercise makes no sense for a Fortune 500 company. They don't list FRNs as liabilities on their balance sheets! The accounting treatment (i.e., showing FRNs as a liability) is unique to the Federal Reserve. So, the case of a Fortune 500 company is not parallel to that of the Fed.

This has been a somewhat interesting discussion, and I appreciate your input, but we should close sub-thread this out, since it has become a little tangential to the original topic. In any case, I'll withdraw from the discussion at this juncture.

(Even if we have not come to agreement on this topic, we agree on at least one thing: your Adolph Weinman signature is really nice. I'm currently about 2/3rds of the way through completing a Whitman album Walker set - mostly circulated coins up to the "short set" and MS from 1941 on)

>

Thank you. My father also assembled a complete circulated Whitman set and an AU-BU set in a Capital holder. I'm not collecting the series, but I have a nice birth year 1943 Walker in MS66.

The Federal Reserve has, on occasion, shrunk their balance sheet by selling assets. This policy is also sometimes known as "Quantitative Tightening" (QT).

A person could legally purchase such assets when the Federal Reserve sells them, and use Federal Reserve Notes to do it.

In fact, the Federal Reserve Bank would be legally required to accept the Federal Reserve Notes in exchange for the asset.

This is why Federal Reserve Notes must appear on the balance sheet as a liability/obligation.

.

In theory that could happen....IN THEORY. But as Homer Simpson says, "In theory, Communism works, Marge....in theory."

The Fed injects or withdraws liquidity by buying or selling securities through the System Open Market Account (SOMA) controlled by the NY Fed. They will deal with the 25 Primary Dealers, plus other large institutions as they see fit (insurance companies, SWFs, foreign CBs, pension funds, etc.).

"what would have happened if the us had stayed on the gold standard?"

The US would have defaulted years ago, or it would have learned to following the basic accounting rules that anyone using a checkbook clearly understands.

When gold and silver move together, it signals the coming end of fiat money.

.

The Federal Reserve Bank (FRB) doesn't want to talk about it. And Congress doesn't want out of the bankers' pockets, so they don't ask about it.

In a thread on another forum related to the history of the Gold Standard, @GoldFinger1969 indicated that the law establishing the FRB in 1913 mandated that the FRB keep a reserve of gold on-hand in an amount no less than 40% of the total Federal Reserve Notes (FRNs) issued. In other words, the FRB was required to maintain 40% gold backing for the FRNs it issued.

Some aspects of that discussion are relevant here, so I will summarize them.

According to BEP (Bureau of Printing and Engraving) records, the total number of FRNs issued from 1914-1933 amounted to $36 BILLION. At issue in the discussion is the portion of that $36 billion that was still in circulation (and not replaced or redeemed).

Why would the FRB want to issue as many FRNs as they could possibly get away with ?

Because at the time, the FRB was allowed to keep 100% of their profits. The (up to) $36 billion in FRNs issued constituted an interest-free loan to the FRB from the general public. The FRB could then use those proceeds to buy government bonds or anything that paid interest. I'd sure like to be able to borrow billions of dollars at zero interest, invest the money in interest-bearing instruments such as Treasury Bonds, keep all the profits for myself, and have the US Government bail me out if things go sour !

The BEP has no incentive to lie or "adjust" their numbers.

The FRB has a lot to hide and has significant incentives to obfuscate the real numbers (so that public perception does not sway against them).

However, for this post, I will cite data published by the FRB itself.

For the purpose of equal comparison, I will use the same date (05 April 1933, when Roosevelt signed executive order 6102 confiscating gold from the public).

05 APR 1933, total gold assets held by Federal Reserve Banks (including gold coin and Gold Certificates): $627 MILLION Dollars (see 1st chart below):

.

05 APR 1933, total Federal Reserve Notes and Federal Reserve Bank Notes "in actual circulation": $3,660 MILLION Dollars ($3.660 BILLION Dollars) (see 2nd chart below):

So, let's see, that is $3,660 Million in gold liabilities against actual gold holdings of $627 Million, for a reserve ratio of just 17.1% . Obviously, that is FAR BELOW the supposed 40% lower limit required by law.

Liars and cheats they were (and are).

The charts paint the clear picture that the actions of President Roosevelt in 1933 were largely to bail out the Federal Reserve Bank.

PS:

The BEP shows $35.8 BILLION in FRNs issued from 1914 to 1933. But the FRB claims that only $3.6 billion were "in actual circulation" (as of 05 APR 1933). Where did they all go (90% of it is apparently unaccounted for) ?

to answer the question, the end result would be less income taxes because gov would be forced to spend much less.

When gold and silver move together, it signals the coming end of fiat money.

Question for the OP....would the US have stayed on while rest of the world went off?

Knowledge is the enemy of fear

Per your last sentence-We have over 36 T of that along with quadrillions of unfunded liabilities!

Try to acquire a Twenty Dollar Double Eagle for $20.

That is the gold standard , to me. And reality !

Somewhere there is “lawful money”.

``https://ebay.us/m/KxolR5