Which would be better long term investment

Gothat3rs

Posts: 204 ✭✭✭

Gothat3rs

Posts: 204 ✭✭✭

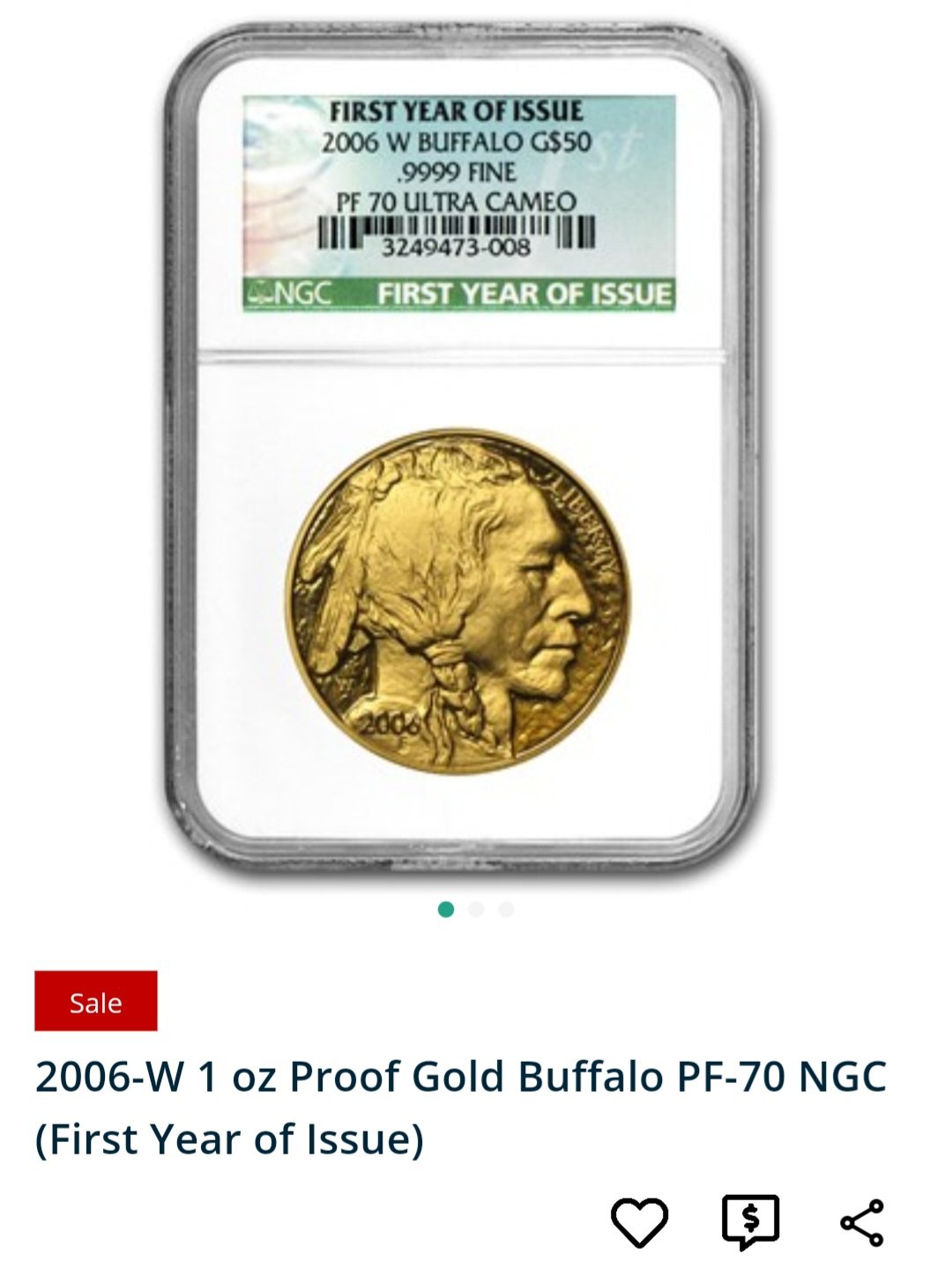

Im interested in adding a gold buffalo to my coins. I am very new to collecting buffs but I have been buying gold and silver for a couple years now. If I add a gold buffalo to my coins I figure I either just buy one as close to spot as possible or buy one that I hope might have collectors value onto of spot one day. Here are the 2 nicer coins I was looking at and wanted opinions which would be better option. One is first year of issue and other is a lower mintage

Successful Transactions dantheman984,jimtyler,perryhall,doubleeagle07,onlyroosies,bigjpst,olahinmah,jwp,Cfioretti,surfinxhi,commoncents05,jclovescoins

1

Comments

If I was buying gold for investment purposes I’d be buying either bullion or coins as close to spot as possible. I see periodically on the BST gold coins selling for less than spot.

These are basically bullion gold coins. Most all of their present and future value will be tied to bullion.

If you think gold is a great investment, even at the present levels, I’d buy as much bullion as possible and not spend money on numismatic premiums. How many collectors line up date sets of Proof one once Buffalo gold coins? My guess is that it’s a small market.

I kinda felt like this would be the case. So far all the gold I have purchased i hunted down right at spot price and it's value has gone up, which has been nice. But ya I geuss I don't see to much gold selling out there for very high unless it's like a really old legit coin

Successful Transactions dantheman984,jimtyler,perryhall,doubleeagle07,onlyroosies,bigjpst,olahinmah,jwp,Cfioretti,surfinxhi,commoncents05,jclovescoins

A side comment: you may disagree, but I have to say that modern gold coins look really good -- especially Proofs -- when you have an all-black holder like those from NGC.

Most of the time I love the PCGS holders, but on moderns, I like the all-black silhouette and background juxtaposed against the gold.

A lot of dealers won’t pay much extra for special labels and MS 70s. If you must buy certified modern gold I would stick to 69s. If it were me, I would buy classic $20 gold in common dates that are close to melt in the 64 range. To me that seems like a wiser choice.

Sometimes, it’s better to be LUCKY than good. 🍀 🍺👍

My Full Walker Registry Set (1916-1947):

https://www.ngccoin.com/registry/competitive-sets/16292/

The Reverse Proof issues seem to have a decent following. You could consider buying one of those.

Proud follower of Christ!

If you’re buying for investment (which I don’t recommend) I suggest staying away from grading labels that inflate the price. Buy something 1) because you like it and 2) because it’s at a very reasonable price.

Mark Feld* of Heritage Auctions*Unless otherwise noted, my posts here represent my personal opinions.

buy bullion not proofs

if you want graded go for 69 or less

What’s wrong with buying gold (whether physical gold or an ETF) for investment if you think it’s going up in price or to diversify your portfolio?

I was speaking primarily about coins. But even if they’re bought at melt value, they don’t pay interest or dividends and the buy-sell spread is typically a lot more than for stocks.

Mark Feld* of Heritage Auctions*Unless otherwise noted, my posts here represent my personal opinions.

What are gold Reverse Proofs?

Gold coins where the design elements have a mirrored finish and the fields have a matte or frosted finish.

Worry is the interest you pay on a debt you may not owe.

"Paper money eventually returns to its intrinsic value---zero."----Voltaire

"Everything you say should be true, but not everything true should be said."----Voltaire

It's not often I'll have this response to one of your posts mark, but for this one, I say poppycock.

Gold is up 40% on the year, the S&P is recovering at 8%, and SCHD (Dividend stock ETF) is also 8%. With all of the macroeconomic factors at play currently, I lose the least amount of sleep over my gold position. I've gotten many thank you's from clients who I convinced to open up a gold position last year, and all of us riding the market-coaster have been feeling the pain. I kick myself for not going even heavier with gold last year, but I'm still buying. What's more fun- numbers on a screen, playing with a a big bag of gold like scrooge McDuck? As long as one has a balanced and diversified portfolio, I say I have it with gold and other alternative investments.

Here's the past year's chart, and multi year performance of gold using the GLD (closely mimics gold) etf , along with SCHD (Dividend ETF) and SPY (S&P ETF) -

OP, I would suggest you stay away from those "special label" buffalo proofs if your priority is returns. When you sell them you get paid melt, like any other bullion. They don't sell for a premium in the secondary market, at least not when I sell them. There are 3 options I would consider for gold, and in my opinion bullion has the least amount of upside by far. If you want bullion, stay as close to melt as possible and avoid paying any premium for anything other than eagles or buffalos. Even then, don't pay more than $100 over which might not be possible right now. Eagle and Buff premiums recently surged upwards, they were non existent a couple months ago and now they're what, 5-6%? If you buy right and your source is fair, buy/sell spreads can be as little as 1-2%.

My line of thinking - Why buy bullion when you can buy GRADED pre 33 Gold in mint state, at historically low premiums? You can buy Saints in 61 as low as 4% over melt, and in MS64 from 6-8% depending on quality, with 62s and 63s fall somewhere in between. Hundreds of thousands, if not millions of gold bullion coins will continue to be minted every year....but they're not making any more pre-33.

Just remember that unlike stock transactions have a paper trail that Uncle Sam can access at any time. That's not always the case with gold....so that's why it's important that you keep track of your private transactions involving cash, or other tangible assets, so that you have records for tax implications. We don't want the government to miss out on any tax revenue, now do we? 😀

Disclaimer - I am not a qualified or licensed investment advisor and I do not provide personal investment advice. All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, or stock picks, expressed or implied herein, are for informational, entertainment or educational purposes only. One should always conduct their own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions.

Founder- Peak Rarities

Website

Instagram

Facebook

@PeakRarities, Dan, as I posted previously, I was speaking primarily about coins. And even gold bullion-related coins tend to have much larger buy-sell spreads than stocks and ETF’s. I also suggested staying away from labels that inflate the price of the coins. So I don’t think we’re really far enough apart in our thinking to merit the “poppycock” award to my post. Regardless, I respect your view.

Mark Feld* of Heritage Auctions*Unless otherwise noted, my posts here represent my personal opinions.

Poppycock was extreme. And, i love Dan, but his response is closer to poppycock since the OP specifically asked about "long term" and talking about one year returns is not relevant. Historically, the longer the time frame the worse PMs perform relative to stocks as Dan's chart shows even for the current 10 year run that gold had.

All comments reflect the opinion of the author, even when irrefutably accurate.

Mark, it was intended to be a playful poppycock, I don't get to use the word often and frankly I haven't seen it used enough to know it had deeper implications. I highly respect all of your views, and I'd say my disagreements with you are about an R.8 overall.

Founder- Peak Rarities

Website

Instagram

Facebook

Hmm, the OP's thought seems a bit irrational so this is a difficult area to approach. I don't trust bullion prices at the moment and, not that you asked, but in the last couple of years have shied away from bullion for bullion's sake although I do buy gold as I am able to that has at least a modicum of numismatic value....

Well, just Love coins, period.

Poppycock award for you to, (it's a funny word, I don't think it should be reserved for malintent and I don't know what makes it "extreme"). I mentioned the 1 year return briefly, but do you not see that the 10 year difference between SCHD and Gold is but a mere 2%, and 3% for spy? Sure, "worse", but hardly a bad investment.

I also fail to see how 1 year returns are "not relevant". The past year performance is reflective of modern trends, with modern economic growth, and modern economic leadership and inflationary factors. Obviously past performance =/= future performance but the past year's performance is hardly "irrelevant". Also, the fact that premiums on saints are at 25 year lows and basically nonexistent presents additional upside opportunity if demand strengthens. There's a finite supply of saints, and a growing number of investors.

What exactly do you disagree with? That gold is an investment? Do you advise against precious metals investing all together? You disagree that it's a good idea to diversify and balance your portfolio among different asset classes? Because that's my position. I do not see where the OP asked for input about whether or not gold was a good investment, he asked which gold coin was a better investment. The part of my answer pertaining to that question was to avoid high premium bullion and to consider pre-33, considering that it can be purchased essentially at melt, with premiums currently LOWER than typical bullion. You don't agree with that, or are you nitpicking just because?

Founder- Peak Rarities

Website

Instagram

Facebook

I would think that buying gold at its all-time historical high as an investment is not wise. The pm market is always volatile but it is the OP’s money to risk. It doesn’t seem like a chat-room is where I would go for investment advice.

"Those who would give up essential Liberty, to purchase a little temporary Safety, deserve neither Liberty nor Safety," --- Benjamin Franklin

Gold has been at its "all time historical high" for the past year and a half, just like stocks, just like real estate. By that logic, he should just not buy anything? He actually didn't ask for investment advice, such as the advice in your comment, he actually asked about which gold coins would be better as it pertains to investments. This is a coin forum, so I think we're fairly well qualified to answer that question. In fact, I can't think of a better place to ask that question, should he venture over to reddit or Facebook instead?

Founder- Peak Rarities

Website

Instagram

Facebook

No sweat, Dan - I took it as playful and I enjoy the product, as well as the use of the word.

Mark Feld* of Heritage Auctions*Unless otherwise noted, my posts here represent my personal opinions.

With that said, I am genuinely curious what your viewpoint is as it pertains to the topic. If one had decided to buy gold coins at the current prices, with long term appreciation as the primary consideration, what would you recommend specifically?

Edit- modified question based on info in previous comment

Founder- Peak Rarities

Website

Instagram

Facebook

I like the first one better. Looks nicer to me. I mainly price them according to CPG. If CAC / CACG - then CAC CPG.

Many players prefer MS69 /70 MWG slabbed gold over classic. I do like slabbed Classic especially Mexico, France, and Vatican.

Wrong thread.

Founder- Peak Rarities

Website

Instagram

Facebook

Without double checking up to the minute prices and premiums over melt, I'd probably recommend MS 62 and 63 $20 Libs and MS 63 and 64 Saints.

Mark Feld* of Heritage Auctions*Unless otherwise noted, my posts here represent my personal opinions.

Gold has been on its greatest bull run of all time and still lags the S&P over the last 10 years. Start looking at other 10 year, 20 year or 30 year time frames. PMs do not compound the way stocks do over time. My only disagreement was in looking at a one year chart for a "long term" return (OP's question).

I'm not sure i would advise pre-33 at these levels. [Since you asked. ] while it's true that the premiums may be on par with bars, they aren't 999. At $4000+ gold, the premium could well be negative on pre-33.

All comments reflect the opinion of the author, even when irrefutably accurate.

Right, but as I said, we weren't just looking at the one year chart. No one said that gold is the best investment, but the 1 year chart is very, very relevant to the point of diversification. When stocks and real estate (after both of which just went on their greatest bull run of all time) are sideways, we see gold surging like never before. There's nothing to disagree with, thats not even an opinion that all eggs need to be in one basket.

Now if you wouldn't recommend pre 33 at these levels, then you wouldn't recommend bullion either. The premiums can only be so negative, maybe a point or two, but you know that it's a cycle and it always has been. The premiums always do this on a gold run, because the market needs time to adjust. However, if gold took a massive drop, we'd likely see a return in the premiums which could serve as a cushion that you might not have with bullion. Given the choice between a graded saint in 64, and a raw buffalo both at 6-7%, are you telling me you're picking the buffalo? You don't even have to answer, I know you're picking the saint.

Founder- Peak Rarities

Website

Instagram

Facebook

@jmlanzaf

And I know you're DEFINITELY not going to choose the proof buffalos in the OP at +20% that nearly every collector ends up taking a loss on if gold doesn't go up substantially. It's ok to agree with me once in a while you know lol.

Founder- Peak Rarities

Website

Instagram

Facebook

If you are adding just one AGB to your gold collection, go for what you like. I don't see any financial investment risk in purchasing a 69 vs 70 Proof bullion coin. It sounds like you already have a "cost basis" collection in play with your gold coins and are in a" long position" with these holdings.

Now, if you're stacking gold and not investing in the market, then we need to talk.

I don't want to sidetrack this discussion but since the OP did mention his purchase as an "investment".....if you are going to compare gold to other investment asset classes you really should use rolling time periods to eliminate timing bias.

Needless to say, gold doesn't do too good in over 80% of them largely because of higher volatility and the lack of dividends/interest paid.

I was in your shoes a few times. If you think gold is going up, ironically the best way to play it is by eschewing paying any premium and just buy bullion (I didn't know this years ago). Paying a premium -- for a higher-graded Saint or a Proof coin or an MS-70 -- will require the premium itself to go up which doesn't usually happen over time...and ESPECIALLY if gold goes higher and higher. Premiums tend to go up only during bubble times.

If you think gold is going up, ironically the best way to play it is by eschewing paying any premium and just buy bullion (I didn't know this years ago). Paying a premium -- for a higher-graded Saint or a Proof coin or an MS-70 -- will require the premium itself to go up which doesn't usually happen over time...and ESPECIALLY if gold goes higher and higher. Premiums tend to go up only during bubble times.

In the extreme example of if gold traded at $10,000....the 5-7% premiums from 2018-24 for a Proof coin and/or an MS-70 or PF-70 would largely be wiped out by the rising gold price (as we have seen for many pre-1933 gold premiums). The premium percentage would not be tacked on to the price (nobody is paying another $500-$1,000 for the special items on the label) and if the actual premium in absolute dollars (~ $150) was tacked on it's a rounding error (I'm going by the 7-8% or $150 premium I paid for a Buffalo and a Proof Gold coin 5+ years ago at FUN 2020).

In case anyones not privy to what these retail for online, its roughly a 23% premium. I just saw that gold is way up again today, sitting right about $3400 melt.

@Gothat3rs - If you like something and it makes you happy, that conflicts with the investment approach. All I will say is that I've bought and sold these, taken them in trade, and they typically trade wholesale at melt or a touch above. I could probably find you one much closer to melt, but I don't know when that will be or what the gold price will be when it happens. If you have a Facebook account, I could also show you to some buy/sell groups where they list occasionally, or a coin show like summer FUN they will be available, and even the BST here is a good place to look. As long as you're aware that your break even would require a $600-$700 increase from where gold is now, only you can decide how much of a premium your enjoyment is worth.

Founder- Peak Rarities

Website

Instagram

Facebook

only stack ms gold in ms69 near melt

you could always buy direct from a large dealer trying to get a lower premium over melt

Best way to stack gold IMO is Buffalo bullion coins (or Eagles but I prefer .999 Buffs). Everything else carries the potential for an argument when you sell.

Definitely not. I also wouldn't pay a premium for MS70s.

To your other question, I'm not sure i would take the 64 Saint over buffaloes at 6-7% over. I don't really like either one, frankly, but if i have to pick one I think i want the Buffalo if gold is going to continue to rise and the Saint if it's going to drop. But if it's going to drop, why do i want either?

All comments reflect the opinion of the author, even when irrefutably accurate.

What potential argument would apply to graded $20’s that couldn’t also apply to the items you mentioned?

Mark Feld* of Heritage Auctions*Unless otherwise noted, my posts here represent my personal opinions.

Buying prices for Buffs and Eagles are straight forward - It's spot plus or minus a percentage, depending on the offer. Straight up, take it or leave it.

Premiums on graded $20 are more volatile. I'm sure we've all went to shows and got a response like: "Even though it's graded 65, it's really a 64", etc. Or a more standard argument from dealers with graded coins is the complaint about it being a "slow mover". There are plenty of dealers that are going to give you some reason or another for a lower offer.

I'm sure you can find straight up transactions for graded $20's, which is why I said there's a potential for argument, but that just doesn't exist with bullion coins which I prefer.

Thanks for taking the time to answer and explain.

Mark Feld* of Heritage Auctions*Unless otherwise noted, my posts here represent my personal opinions.

Yea, what we're referring to are wholesale graded $20s and it works the same as bullion like you'd see on Apmex or the like. The market makers have a buy price and a sell price, with a spread similar to Eagles or Buffs, and you might be able to get a small discount in large quantities but for the most part the price is the price. Ordinary dealers and smaller operations might just list groups of 5, 10, 20 and knock off $20 from the standard wholesale price and its all or none. Spotted coins are discounted, Ogh or flashy coins might be are marked up a bit, etc.

If I place an order of 15 saints in 64, that's all I'm promised is 15 saints in 64. I have a good relationship with my wholesaler so I'll ask him to try to pick nice ones, or send me a mix of dates, but the spreads are thin and the mark ups are marginal in quantity, just a 1-2% most of the time. In times like this, the market gets flooded with them so some dealers might be doing 40k deals to make $500, so generally "You get what you get and you dont get upset". They could be dogs, oghs all with PVC, or egregiously overgraded 1908 ams but they're just commodities for stacking. These aren't the nice coins you want to collect, the PQ coins are treated differently.

With premiums lower than they have been, it makes sense when you're buying them at basically melt, less of a premium than bullion. Graded, more importantly authenticated, 100+ years of history and some downside protection. Often treated as bullion for tax purposes and when selling on eBay, but qualify as collectibles if need be for shipping insurance or other reasons. Chinese counterfeits have gotten very advanced, so many have switched to these when premiums evaporated. My second choice is buffs though, international markets prefer the .999 fineness and they qualify for IRAs. Some collectors/stackers buy CAC Saints in quantity, but they're not quite as liquid and the premiums are substantially more so I don't really see the need.

Founder- Peak Rarities

Website

Instagram

Facebook

This has been an interesting thread to read through... to the OP- I've never really considered buying bullion coins (Buffalos/Eagles) and have mostly deferred to US gold Coins, but since you're new to coin collecting... buy what you like! That said, I've also never really considered my coin collection as an "investment". I'm not a dealer, so I've got other revenue streams for retirement: 401k, Pension Fund, etc...

There's been a lot of good advice on this thread... if you like Buffs, buying one as close to spot and avoiding a 20+% transaction fee is good. I'm more partial to US coinage, so the idea of buying MS62/3 $20 Libs or Saints... also at close to spot, is more appealing to me. Whatever you decide... please post a picture! Many of us smaller collectors live vicariously through the deeper pockets of our more well-established collectors...

Successful BST transactions with: SilverEagles92; Ahrensdad; Smitty; GregHansen; Lablade; Mercury10c; copperflopper; whatsup; KISHU1; scrapman1077, crispy, canadanz, smallchange, robkool, Mission16, ranshdow, ibzman350, Fallguy, Collectorcoins, SurfinxHI, jwitten, Walkerguy21D, dsessom.

I appreciate everyone's responses here. And to answer a couple things said I do hooe my coin collection turns into a investment one day, that includes the gold, silver and buffs. These are a hobby of mine but yes I'd like them to be profitable one day. So far the gokd and silver has been. I'm quite diversified I like to think to, I have a 401k, pension, Ira, and personal etfs I enjoy building. Also yes these 2 coins sell fir a high premium of up to around 4000 a piece. Of course if I was to get one I'm not paying that. I think I can find one for max 300 over spot, that's if I decide to go that route. But yes just reading all these threads has almost got me wanting to buy a nice old gold coin. I am very appreciative of everyone's opinions because it has giving me lots to think about so thank you

Successful Transactions dantheman984,jimtyler,perryhall,doubleeagle07,onlyroosies,bigjpst,olahinmah,jwp,Cfioretti,surfinxhi,commoncents05,jclovescoins

You have shown your passion for the buffalo design in another thread. Buy yourself a gold one if you have the resources.

I do. I'm gonna just get a nice buffalo close to spot. But I'm also definitely looking at some older stuff now to

Successful Transactions dantheman984,jimtyler,perryhall,doubleeagle07,onlyroosies,bigjpst,olahinmah,jwp,Cfioretti,surfinxhi,commoncents05,jclovescoins

I'm surprised the premium is that high. Not sure if it's for the grade, the Buffalo, or the proof status -- or a combination of all 3 (probably).

I bought a 5-year old American Eagle Proof PF-70 UC at FUN 2020. Gold was at $1,550 or so....I paid $1,730 or about 12% premium.

Not sure if Buffalo's would have sold at a richer price...but based on what we know now...had you told me that gold was going to $3,400...what would a PF-70 UC Buffalo or Eagle gonna sell for, I would have said that the premium fades just like with pre-1933 gold. I guess not !!

I saw a National Park Saint-Gaudens Gold Commemorative Double Eagle Indian in PF-70 go for $3,876/$4,360 (w/bp) this past Sunday on GC. Using $3,240 for the Friday close, those are 20% and 35% premiums for a novelty commemorative. It's a nice-looking coin...I love the homage to ASG....but I've also seen these coins at single-digit premiums at other times. It really depends on timing and if 1 or 2 bidders are chasing.

I think that now is a great time to sell gold especially the more modern gold bullion coins. Prices are sky high and a fall in prices is usually what follows.

Successful BST with ad4400, Kccoin, lablover, pointfivezero, koynekwest, jwitten, coin22lover, HalfDimeDude, erwindoc, jyzskowsi, COINS MAKE CENTS, AlanSki, BryceM

recently, it fell from about 3500 to 3225 in 8 days. the rose. it hit just under 3450 a couple of hours ago

was that enough of a pullback?

I would say buy the design that brings you joy.

Buy as close to melt as possible.

As long as you are diversified or plan to be diversified long term, I see no reason not to buy.

If the price declines to $2000, that 1oz of gold will still be gorgeous to own.

BST: KindaNewish (3/21/21), WQuarterFreddie (3/30/21), Meltdown (4/6/21), DBSTrader2 (5/5/21) AKA- unclemonkey on Blow Out

If the gold price just flatlines for a while, the premium should dissipate.....right now, with a long up-move in gold....I suspect sellers are afraid of selling "too cheap" and then having to pay more to replenish inventory. A fast-rising price in the metals market is difficult to operate in.

Some of the modern bullion coins in special condition and/or commemoratives can actually command higher premiums than pre-1933 Classic Gold. Not making more of the latter, but the former can keep getting minted.

Probably pays to include this historical chart:

big sellers hedge ans make money from the spread

big sellers replenishing inventory wouldn't be too hard