Gold exports to consider while your burgers are grilling.

RogerB

Posts: 8,852 ✭✭✭✭✭

RogerB

Posts: 8,852 ✭✭✭✭✭

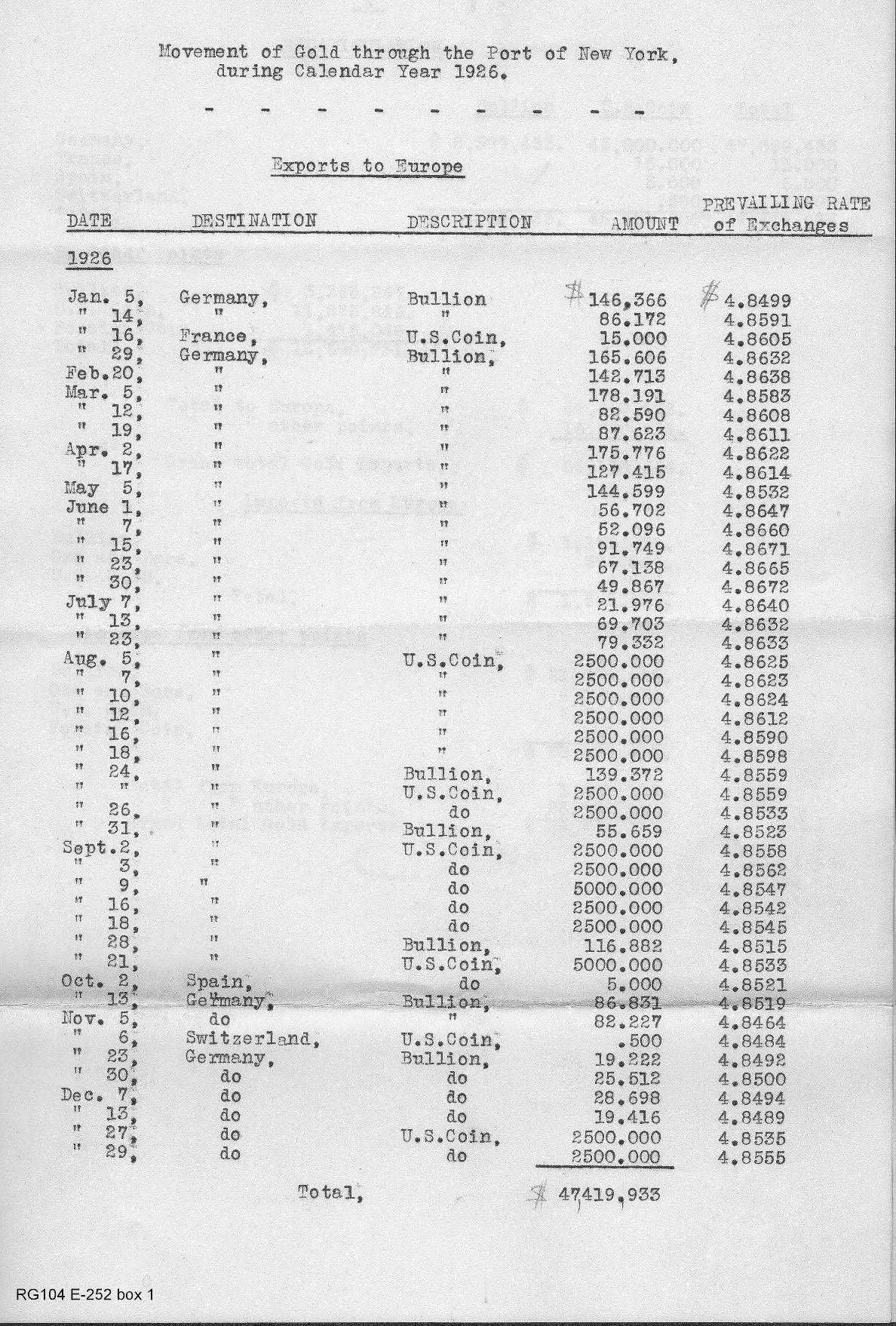

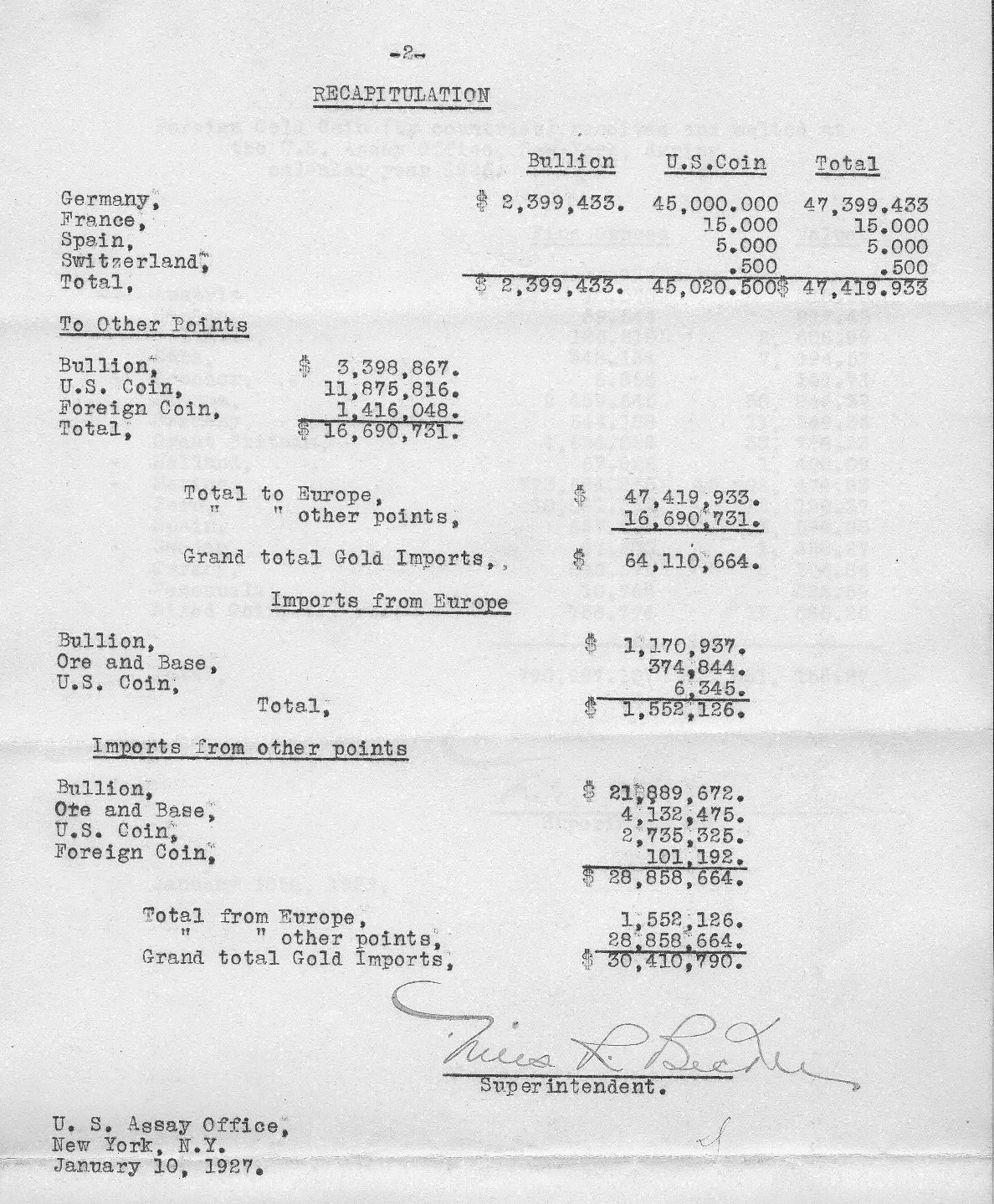

This is the annual summary of gold exported/imported via the New York Assay Office in 1926. Note the large sums to Germany as part of refinancing War Reparations through American banks. This kind of thing brought large profits to Andrew Mellon's banking empire and economic and political instability to Germany.

3

Comments

Thanks for these posts.

Interesting, thanks for posting.

it's crackers to slip a rozzer the dropsy in snide

Have you happened to notice or narrow down what year they first used a typewriter at the Mint?

Great transactions with oih82w8, JasonGaming, Moose1913.

If I am reading that correctly, during the calendar year 1926 the New York Assay Office imported about 30 million dollars in gold and exported about 64 million, for a net export of 34 million dollars worth of gold. That is roughly equivalent to the value of all US gold coins minted with "1926" dates.

This illustrates the large quantity of gold that was leaving the United States for Europe in the years leading up to 1933, and probably the major contributing factor to Roosevelt's 1933 gold "confiscation" (which was actually a bailout of the Federal Reserve bank).

Amazing the amount of gold exchanged to and from the various sources... Gold has always been money....Cheers, RickO

I don't understand. Why was the U.S. paying out gold to Germany?

Use of typed reports and correspondence was required by a Treasury order in 1897. However, typewritten Mint documents have been seen as early as 1879 - probably a Remington Model 2 which had upper and lower case characters.

I've seen earlier upper case documents but I'm not sure if they were produced at a mint or elsewhere. Treasury telegrams were early users of typed text, but those were made by the telegraph companies.

Germany did not have money to pay war reparations, so US banks loaned them money. Those are the gold transfers, most under the "Dawes Plan."

PS: The "Prevailing rate of exchange" was against the British pound.

Summaries, such as the one above, require considerable understanding of international trade of the 1920s as well as how gold was handled as both financial instrument and commercial product, to correctly understand.

One of the basic points is that physical gold bullion or coin did not have to leave the US to be exported. Many central bank-to-central bank transactions involved earmarking physical gold but not actually moving it. Others were handled by so-called "gold notes" which were similar to warehouse receipts.

The "value" of gold was not really fixed - it fluctuated with the rate of exchange between one national economy and another. The "gold point" was one way that banks made money by exporting or importing gold or gold instruments.

Dollar differences between exports and imports, as in the annual summary, cannot be treated as simplistic gains or losses. Part of the reason is that some exports and imports had additional costs. The German shipments - which were of physical gold in 1926 - are actually the residue after the banks deducted their interest, profit, and all related expenses, often amounting to more than 7 percent of the loan. Further refinancing, created additional bank profits up-front - sometimes as much as another 10 percent.

Another reason is that Ex/Im summaries ignore native production, of which the US had considerable, which skews real gold control - and thus real value - in favor of producing nations.

Thanks.

I wonder if the U.S. banks ever collected on the loans?

Yes. The banks got all their expenses and profits up front, and then most of the principle before Germany stopped payments. The US Treasury very quietly reimbursed the rest. The risk was spread among all the underwriting banks so nobody took much of a financial hit and the US Government made certain funds guarantees under the subsequent Young Plan. That, in turn, fell apart with the Great Depression of 1929 and the Smoot-Hawley Tariff Act (protective domestic tariffs) made a bad situation much worse by ruining US overseas markets. (Much like the present tariff increases cost US farmers much of their foreign markets for soy beans, hogs, and many other products.)