What was a US Mint "Warrant?"

RogerB

Posts: 8,852 ✭✭✭✭✭

RogerB

Posts: 8,852 ✭✭✭✭✭

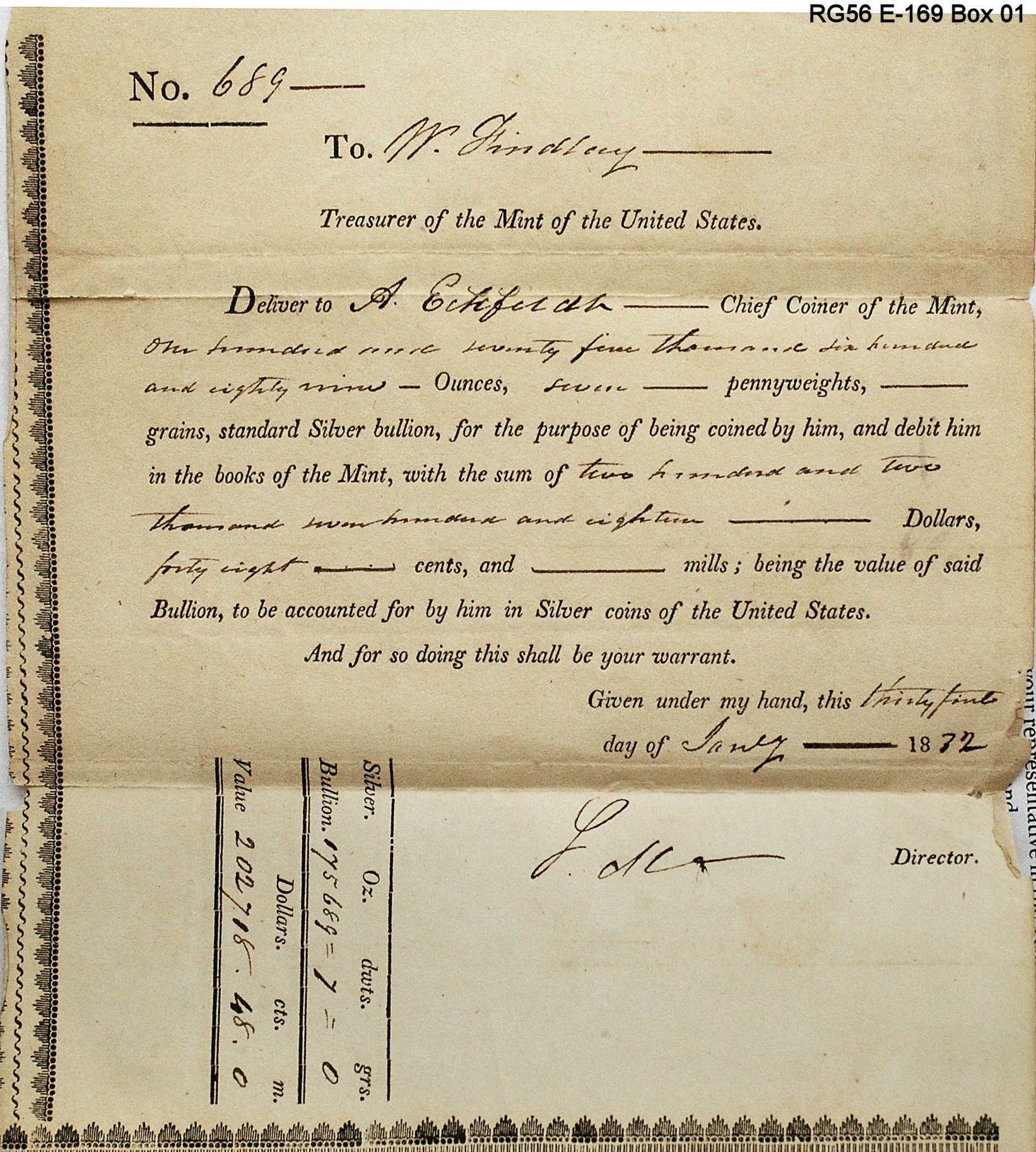

Most collectors have probably heard of the term "Mint warrant," but have not had the chance to connect the term with a real object. Here's a photo of an 1832 warrant from the Director to the Mint Treasurer for delivery of silver to Adam Eckfeldt, the Chief Coiner.

Few of these exist - they were temporary documents and the information was duplicated in the Mint's journals.

3

Comments

Frank Stewart mentioned having a very early warrant, in his book History of the First U.S. Mint. Presumably they are in the Stewart papers at Rowan University, but I never saw it when working there.

Nice piece of history Roger... The hard copy records (since there were no computers) were critical to trace movements of bullion/coins etc.. Cheers, RickO

This!

Keeper of the VAM Catalog • Professional Coin Imaging • Prime Number Set • World Coins in Early America • British Trade Dollars • Variety Attribution

A warrant is the equivalent of a check, but for payment by the government instead of by a company or private individual.

A check is actually an instruction to a bank to make a payment from your account to the named individual, company or bearer.

A warrant is the same for the government - individual departments issue warrants to have the treasurer (of the US in this case) make the payment on their behalf and against their account.

States do the same thing - your tax refunds are technically warrants. Which is why SOME state that shan't be named (but have License plates saying Land of Lincoln made by former governors) can "get away" with not paying out on warrants immediately.

Roger, do we know when the mint stopped simply paying back your bullion deposit directly? I think it was one of the reforms in the 1853 act? This would have let you receive your coins (less fees) as soon as the bullion was assayed instead of waiting for it to be coined.

ANA 50 year/Life Member (now "Emeritus")

RE: "Roger, do we know when the mint stopped simply paying back your bullion deposit directly? I think it was one of the reforms in the 1853 act? This would have let you receive your coins (less fees) as soon as the bullion was assayed instead of waiting for it to be coined."

Once Jackson killed the Second Bank of the united States, the deposit-payment situation became very fluid. Deposits made by Girard Bank and Bank of America were often held, by mutual agreement, before coining. In effect, this gave the Mint some working capital so they could pay individual depositors first. But complaints of long delay were common -- this also varied from month to month. In the spring of 1837 the Panic hit and most banks suspended specie payments. BoA failed. The situation was very confused until the fall when BoA was reorganized and relations with the Philadelphia Mint returned of their usual abnormal.

It seems that most large bullion and foreign coin depositors of gold really wanted bars for export, and that was finally approved in 1857. Silver deposits were consistently wanted in 1/2-dimes, dimes and quarters....very rarely halves and even less frequently in dollars.

Roger, than you for the information. I just read the ANA/Numismatist article on the US Mint warrants of 1785, so it was right on time. I've read articles about earlier US Mint warrants, but didn't really know what they were. I find them - the articles fascinating. It's a real eye opener to see how hard a person labored back then, and how little they were paid. I think they provide a hard link to the conditions of the time and shows the determination of people to succeed.

Sugar magnolia blossoms blooming, heads all empty and I don't care ...

I was thinking of this: http://memory.loc.gov/cgi-bin/ampage?collId=llsl&fileName=010/llsl010.db&recNum=181

Off hand, I don't see which act established the bullion fund... anybody?

FYI: http://www.heritech.com/pridger/monetaryacts.htm

ANA 50 year/Life Member (now "Emeritus")

The crafty US Mint folks had the equivalent of a "bullion fund" long before there was a law permitting it. They used bullion vs coin float with the Bank of the United States (BoUS). This allowed the Mint to have bullion to strike coins for inventory and the Bank accepted delayed payment of coins for its deposits. The Bank then charged 1 or 2 percent as overhead to its customers for the coins. NARA RG104 Entry 1 is filled with letters exchanged during this and post-BoUS period.

On July 7, 1836, President Andrew Jackson, in response to a request from

the Mint, ordered the Treasury Secretary to provide bullion to the Mint in

order to pay off deposits more quickly. No specific sum was stated, however.

The Act of January 18, 1837, (section 31) provided for a bullion fund of up

to $1 million.

Excellent info, Denga! Thanks!

The Director of the Mint at Philadelphia has presented the following Report of the operations of the Mint and its branches for the year 1855:

There is one point connected with this subject and the general management of the national coinage, which although left by law to the discretion of the Director of the Mint, and cannot be made the subject of particular legislation, yet it is of so much importance to the community generally, that this occasion seems appropriate to give it a fair and general understanding.

The 80th section of the General Mint Law-—Act of Jan. 18, 1837—provides that “in the denominations of coin delivered, the Treasurer shall comply with the wishes of the depositor, unless when impracticable or inconvenient to do so; in which case the denomination of coin shall be designated by the Director.”

In view of the fact, that the depositors are always paid before the bullion is operated upon from a stock of coin previously made ready, it is evident that in the preparation of such a supply of coin, the Director is to use his discretion in regard to the denominations before conferring with depositors; and they may or may not be exactly suited in the payment.

Undoubtedly, in the issue of coins, every proper attention should be given to the probable demand, and especially in the silver coinage, which it is to be presumed is wanted for immediate use and not for storage in vaults. Heretofore the general practice has been to pay depositors in the coin they have desired, and it is not intended by these observations to give notice that this usage will be entirely abandoned.

But the chief design of a National Mint is to subserve the interests of the people at large, preferably to a few large owners of bullion or coin. The interests of the public and of depositors are not always concurrent in the matter under discussion.

Depositors of large amounts call for their coin in a form which gives the least trouble to count; and banking institutions, in addition - to that, may prefer it in a form not likely to be drawn out. Many who present their checks at those institutions would doubtless ask for specie', but are deterred from doing so by the expectation of receiving double eagles instead of half or quarter eagles.

In a word, the plain effect of issuing gold coin of large size is to keep down the circulation of specie and increase the use of paper money.

This remark of course does not apply to such localities where paper money is prohibited, as, for example, in the State of California, because in such case the different currencies cannot come in conflict.

Before the act of Congress authorizing the issuing of gold in stamped bars, there was, it is true, a necessity for the issue of large coins, as well to meet the demand of shipment to Europe, as in some measure to relieve the pressure upon the Mint. There was no kind of propriety in going through the manipulations and bearing the expenses of making small gold coin, to be directly melted down in foreign mints or refineries.

But since the important change in our mint laws, before referred to, a distinction has been made to meet the demands of trade by which gold intended for exportation is cast into fine bars, while that which is needed for home consumption is converted into coin.

If we look at the example of the wealthiest and most civilized nations of the globe, we shall find that their largest gold coin, to speak in a general way, does not exceed our half-eagle in value. Such is the case in Great Britain, France, Russia the

Netherlands and other countries.‘

There are pieces of 10 thalers, about 8 of our money, coined in Germany, but apparently for international use. The same may be said of the American doubloons, of which the amount coined is small.

It would no longer be an embarrassment to the principal Mint, nor to the branches, excepting perhaps the branch at San Francisco—and to that institution these views are not intended particularly to apply—-to coin all the gold that is likely to be offered in pieces of $5 and less.

It is true that nearly as much labor is expended in the manufacture of a gold dollar or a quarter eagle us of an eagle or double eagle, and in thus offering to make the smaller denominations a large increase of work is assumed; but this consideration is met by another, that the division of labor and the present efficiency of the Mint establishments, especially when the repairs at the Mint are fully completed, will enable us to meet such increase without additional expenditure.

Thus, as Director Snowden emphasized, an inherent conflict occurs between the letter of the law and its direct application to practical circumstances. Large depositors benefit from large coin denominations, yet the wider general population benefit from smaller denominations. The general welfare, in Snowden's view, would benefit more from improved circulation of specie than the Banks and other large depositors would from pandering to their convenience. Where is the greater good?

Have there been changes in the past 160 years?

The July 1 10:28pm post:

I am curious, what is an "American doubloon"?

The Mysterious Egyptian Magic Coin

Coins in Movies

Coins on Television