Many people expect a stock market AND dollar crash---does that make sense?

RedneckHB

Posts: 19,735 ✭✭✭✭✭

RedneckHB

Posts: 19,735 ✭✭✭✭✭

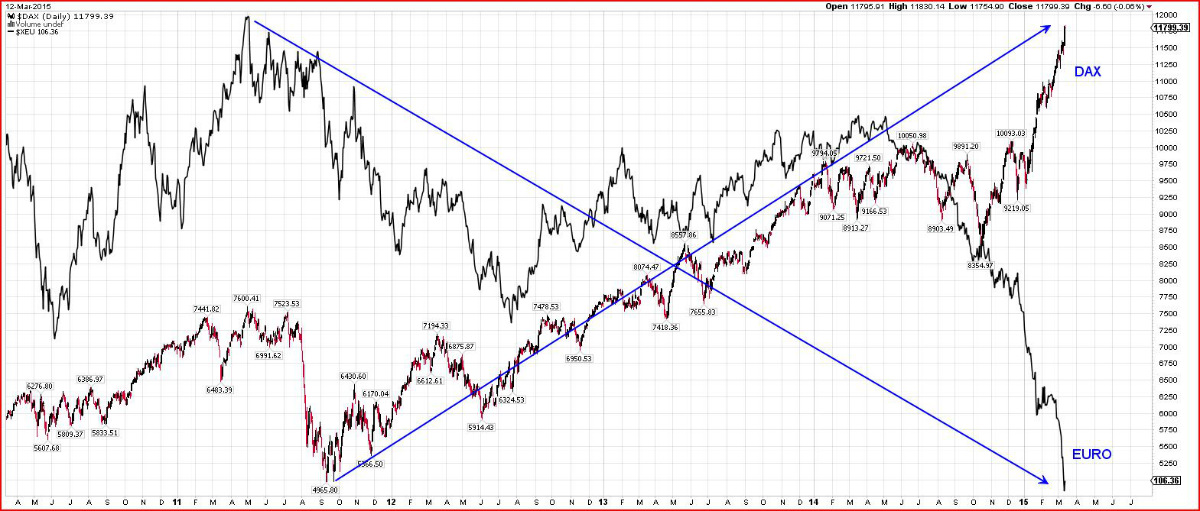

Here are charts of the Japanese stock market compared to the Yen and the German market (DAX) compared to the Euro. I have read in this forum that the US dollar will collapse and take the US stock market with it. Evidence doesnt really seem to support this notion.

Excuses are tools of the ignorant

Knowledge is the enemy of fear

0

Comments

The effects of currency muddy these things up . Germany I'd say is the best market in Europe , the worst ones though probably can't be used to show anything because they have particular issues that affect them alone or they are too small to matter. Because of that the German market can't be taken as a synonym for the Eurozone. the way the Nikkei/yen chart represents Japan

In fact if you assume that there is extra strength concentrated into the Dax its odd that the charts are so similar

The whole Euro setup was a terrible idea , if I put my tinfoil hat on it looks like more of a wealth extraction master plan than any honest attempt at a union of nations that was meant to benefit the populace.

Things are going to get worse and worse in both areas but in Japan it seems more like stubbornness or a policy failure rather than a premeditated criminal act as in Europe.

BST Transactions (as the seller): Collectall, GRANDAM, epcjimi1, wondercoin, jmski52, wheathoarder, jay1187, jdsueu, grote15, airplanenut, bigole

Knowledge is the enemy of fear

<< <i>What does your evidence suggest? >>

IBM, KO, AAPL, MSFT, GOOG, PG, ect are not going to go bankrupt if the dollar drops. And as stocks are priced in dollars it would take more dollars to buy a share of stock. Therefore, stocks would increase in dollar terms.

We cannot prevent the dollar from being "worthless", but we can accumulate more dollars. In the end it all becomes a wash.

All assets over time will have similar returns. Just play in the sun.

Knowledge is the enemy of fear

It is normal for a currency decline to result in higher equity prices when those equities are bought with that currency. Works the same way with gold and most all other investment classes. As long as a currency goes through its up and down cycles, so will the asset markets. A continued climb in the dollar index will result in a natural decline in equity prices just as it has with other assets.

The two biggest threats to equity prices are rising interest rates and a horrible currency event.

No Way Out: Stimulus and Money Printing Are the Only Path Left

Can we isolate the effects of currency weakness against the dollar somehow though?

I don't know that I want the charts in dollars .

How about a Nikkei versus the Euro and a Dax versus the Yen? Does that look exactly the same? Is it just showing us a strong dollar again?

If the dollar as a reserve currency just crushes all the smaller currencies to insignificance maybe the indexes in terms of USD are the only charts that matter.

<< <i>The two biggest threats to equity prices are rising interest rates and a horrible currency event. >>

Not in the last 20 years has the market gone down when rates were rising.

Knowledge is the enemy of fear

<< <i>All assets over time will have similar returns. Just play in the sun. >>

Appreciate your response. I do believe that these last two sentences contradict what you have said over and over on this board. I'm curious, did you really mean this?

The obvious followup question would have to be over your definition of "time".

As you have criticized many on here (that they are wrong but eventually they will be right, in time), I find it funny that you say that it really doesn't matter what you invest in, as long as it is an asset all returns will be equal in time.

BST Transactions (as the seller): Collectall, GRANDAM, epcjimi1, wondercoin, jmski52, wheathoarder, jay1187, jdsueu, grote15, airplanenut, bigole

A strong dollar or a weak alternate currency. Some say the dollar is only strong because other currencies are weak, but that simply shows ignorance of intermarket relationships. Investors are not stupid..they will go to the best risk/reward scenario. I would say a currency is strong because it has economic, demographic, political and technological advantages.

maybe the indexes in terms of USD are the only charts that matter.

If you are looking to exchange dollars for those indices, then yes. Are you looking to buy the German market using dollars? Or maybe gold using dollars? Ive heard people say "gold is doing well in Euro terms", well as an American, possessing dollars as a medium of exchange, I dont really give a rats a-- about gold VS Euro. When the dollar cycle turns negative then I want to own assets priced in dollars. The US dollar has/had been in a downtrend vs other currencies for 30 years. Could it be in an uptrend for the next 30? What were the forces that gave alternate currencies a better risk/reward profile vs the dollar all those years? Are those forces still intact?

Knowledge is the enemy of fear

<< <i>The two biggest threats to equity prices are rising interest rates and a horrible currency event. >>

<< <i>Not in the last 20 years has the market gone down when rates were rising. >>

Not in the last 20 years has the market been fueled by such massive buybacks because of low interest money.

According to Bloomberg, S&P 500 components were on track to spend a record $914 billion on buybacks last year — roughly 95% of all corporate earnings!

No Way Out: Stimulus and Money Printing Are the Only Path Left

<< <i>

<< <i>All assets over time will have similar returns. Just play in the sun. >>

Appreciate your response. I do believe that these last two sentences contradict what you have said over and over on this board. I'm curious, did you really mean this?

The obvious followup question would have to be over your definition of "time".

As you have criticized many on here (that they are wrong but eventually they will be right, in time), I find it funny that you say that it really doesn't matter what you invest in, as long as it is an asset all returns will be equal in time. >>

All assets cycle. The key is to recognize when the cycles become aged and there become gross differences in relative valuations.

Time, in this context, is ones lifetime usually about 3 generations. Time is the great "cure-all". Time heals all wounds. Call it anyway you want, there is a reason why that axiom has stood the test of time.

All those idiots on the street corner saying doomsday is coming will eventually be right. Should we give him credit when that happens?

Knowledge is the enemy of fear

<< <i>

<< <i>The two biggest threats to equity prices are rising interest rates and a horrible currency event. >>

<< <i>Not in the last 20 years has the market gone down when rates were rising. >>

Not in the last 20 years has the market been fueled by such massive buybacks because of low interest money.

According to Bloomberg, S&P 500 components were on track to spend a record $914 billion on buybacks last year — roughly 95% of all corporate earnings! >>

So what is this argument? Stocks are going up because they are being bought? Isnt that common sense?

Heres a 35yr chart. Show me when the market went down because rates went up? It may have gone sideways, but it didnt crash. And actually there are some pretty powerful rallies associated with rising rates.

In 2012 to 2013 the 10yr went from 1.4% to 3% and the SP500 went from 1300 to 1700.

In 1994 the 10yr went from 5% to 8%--stocks were flat.

In 1997 the 10yr went from 4.5% to nearly 7%---stocks exploded higher.

In 1987 the 10yr went from 7% to 10%--stocks went up 40%

Knowledge is the enemy of fear

2011

I have to do some remodeling this year. That could be the crashing sound you hear.

``https://ebay.us/m/KxolR5

It depends on how they are being bought. If HFT's are doing the buying (ie flipping them back and forth between themselves) that's not as sustainable as if real J6P's were doing most of the buying. Now last I checked J6P doesn't own an HFT computer terminal....nor does he run a hedge fund. So if HFT's are doing 70% of the trading volume how good is that? What % of the market participants owns an HFT? <1%?

A comparison can be made to how numismatic key dates were flying higher from 2002-2008. But how many of those transactions were just dealers flipping them back and forth (rising the price) until some poor J6P finally decided he better buy one before it went even higher? I would submit that most of the transactions on key dates were just dealers and large specs flipping them among themselves. That can work as long as money is sloshing around in the coin market....and with PM prices assisting in that from 2002-2011 it worked like a champ. Stocks can go up for all the right reasons, or all the wrong reasons. Traders don't care which it is.....but J6P should. And how much of the SM rise is on the backs of the >$3 TRILL in bank reserves the FED has added since 2008? That gambling stake money goes a long ways at the prop desks. In the coin business they call these thing "boiler room promotions." Sure, the coins are being bought....if that's all that matters. The best professional coin promotion I ever saw was when MS65 Columbian halves were bid up to around $3500 in 1989. Once the primary promoter dropped out of the market those things fell to $1200 in < 1 yr. Today they are buyable at about 10-15% of that promoted price.

I believe they will keep this thing propped up until they are ready to drop the hammer and bring in what the globalists call the reset(their one world system). That's basically why the debt just keeps going through the roof all over the world, because there are no real intentions of ever paying it back. They are just buying more time while they get their system fully in place. As for the markets, yes, I believe the people who want to risk their life savings in this rigged market can make money for a while longer as the band plays on. Just make sure you aren't the guy without a seat when the music stops. It's not going to be pretty.

``https://ebay.us/m/KxolR5

<< <i>So what is this argument? Stocks are going up because they are being bought? Isnt that common sense?

It depends on how they are being bought. If HFT's are doing the buying (ie flipping them back and forth between themselves) that's not as sustainable as if real J6P's were doing most of the buying. Now last I checked J6P doesn't own an HFT computer terminal....nor does he run a hedge fund. So if HFT's are doing 70% of the trading volume how good is that? What % of the market participants owns an HFT? <1%?

A comparison can be made to how numismatic key dates were flying higher from 2002-2008. But how many of those transactions were just dealers flipping them back and forth (rising the price) until some poor J6P finally decided he better buy one before it went even higher? I would submit that most of the transactions on key dates were just dealers and large specs flipping them among themselves. That can work as long as money is sloshing around in the coin market....and with PM prices assisting in that from 2002-2011 it worked like a champ. Stocks can go up for all the right reasons, or all the wrong reasons. Traders don't care which it is.....but J6P should. And how much of the SM rise is on the backs of the >$3 TRILL in bank reserves the FED has added since 2008? That gambling stake money goes a long ways at the prop desks. In the coin business they call these thing "boiler room promotions." Sure, the coins are being bought....if that's all that matters. The best professional coin promotion I ever saw was when MS65 Columbian halves were bid up to around $3500 in 1989. Once the primary promoter dropped out of the market those things fell to $1200 in < 1 yr. Today they are buyable at about 10-15% of that promoted price. >>

derryb mentioned or inferred that the market was up because companies themselves, not HFT, are buying stocks. You know my position on HTF, I hate it. IBM has bought back $30 billion in stock over the last 3 years yet the price is the same. For the record, I am very strongly against the practice of stock buybacks, but stocks are being bought by baby boomers everyday via their pension plans and iras. The notion that the stock market is only higher because the FED and corporations are buying and PMs are only down because "they" wish it is just plain ignorant.

Rare coins and stocks have very little in common. Coins are much too illiguid and should barely even be classified as an sub-asset class. MS65 columbian halves, beenie babies, old typewriters...not much difference.

Knowledge is the enemy of fear

What's not to like?

No Way Out: Stimulus and Money Printing Are the Only Path Left

Coins and stocks are both in asset markets...that makes them very comparable. You mean charts, TA, and market forces only apply to stocks and not collectibles? That's news to me. As far as coins being illiquid, my example clearly referenced key date coins, nothing else. If key date coins in collector grades are illiquid, that's also news to me. Yeah, let's compare a 1909-s VDB cent or 1916-d dime to a beanie baby.

HFT's can help to spin stock prices higher....especially before big stock buy backs occur. One could say that HFT's spinning prices higher is part of the reason why big companies want to buy back their stocks. $30 BILL is certainly a nice chunk of change for IBM.....but so is the >$3 TRILL in bank reserves being used as "stake money" to play the SM. I'm sure there are plenty of stock market "promotions" that put the coin dealers peddling MS65 Columbians to shame. GMCR is an interesting example of going from 14c to >$110+ in approx 13 years. And then retracing 84% of that in <1 yr in 2012. And back up to $158/share in Nov 2014 (up 11X). Load me up Scottie!

I do know that cohodk would not put it all into gold or silver.

Knowledge is the enemy of fear