Options

Fiscal Cliff --- I've fallen and I can't get up

Onedollarnohollar

Posts: 2,035 ✭✭✭✭

Onedollarnohollar

Posts: 2,035 ✭✭✭✭

Throw the bums out next election! Post a coin that's symbolic of this crisis!

Throw the bums out next election! Post a coin that's symbolic of this crisis! 0

Comments

- Marcus Tullius Cicero, 106-43 BC

Hoard the keys.

on earned income and dividend income ( max 35% for couples under $450k and 400k filing individually).....tax on dividend income will stay at 15% and above those levels goes to 20% ......thats alot better than the 39.6 that was suppose to kick in.

I see a huge rally in dividend paying stocks coming.

I give away money. I collect money.

I don’t love money . I do love the Lord God.

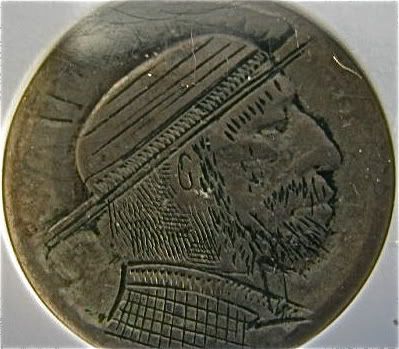

<< <i>Post a coin that's symbolic of this crisis! >>

How about a note:

No Way Out: Stimulus and Money Printing Are the Only Path Left

just afew footnotes

The rally in dividend stocks will come and go depending upon the decline in unemployment- due in part because for that strategy to work, the investment should remain parked in the stock for a reasonable period of time- 2-4 years minimum.

Unemployment is the key as to whether or not interest rates are going to advance. If unemployment drops to 6 to 6.5%, interest rates will slowly advance to more realistic levels and that may set a ceiling on how dividend stocks play out. That could change depending upon corparate earnings as well as stock buyback plans that most companies seem to have in place.

So in summary, how many folks have $$$ to tie up for 2-4 years? I suspect the answer is not that many so the next question seems to be- whom do you trust with your money? Your bank or certain fortune 500 companies that are currently in a position to pay anywhere from 2.5% to 4% dividends?

Experience the World through Numismatics...it's more than you can imagine.

<< <i>Unemployment is the key as to whether or not interest rates are going to advance. If unemployment drops to 6 to 6.5%, interest rates will slowly advance to more realistic levels and that may set a ceiling on how dividend stocks play out. That could change depending upon corparate earnings as well as stock buyback plans that most companies seem to have in place. >>

That's assuming the FED maintains control of interest rates. Bond market, depending on view of the dollar and opinion of US financial stability, could take control of rates and rain on the FED's (and government debt interest) parade. Loss of control of interest rates will be the nail in the coffin for the FED. Keep in mind that ZIRP policy makes the interest on soverign debt almost managable. The FED, in support of their Washington partners, is comitted to indefinite ZIRP.

No Way Out: Stimulus and Money Printing Are the Only Path Left