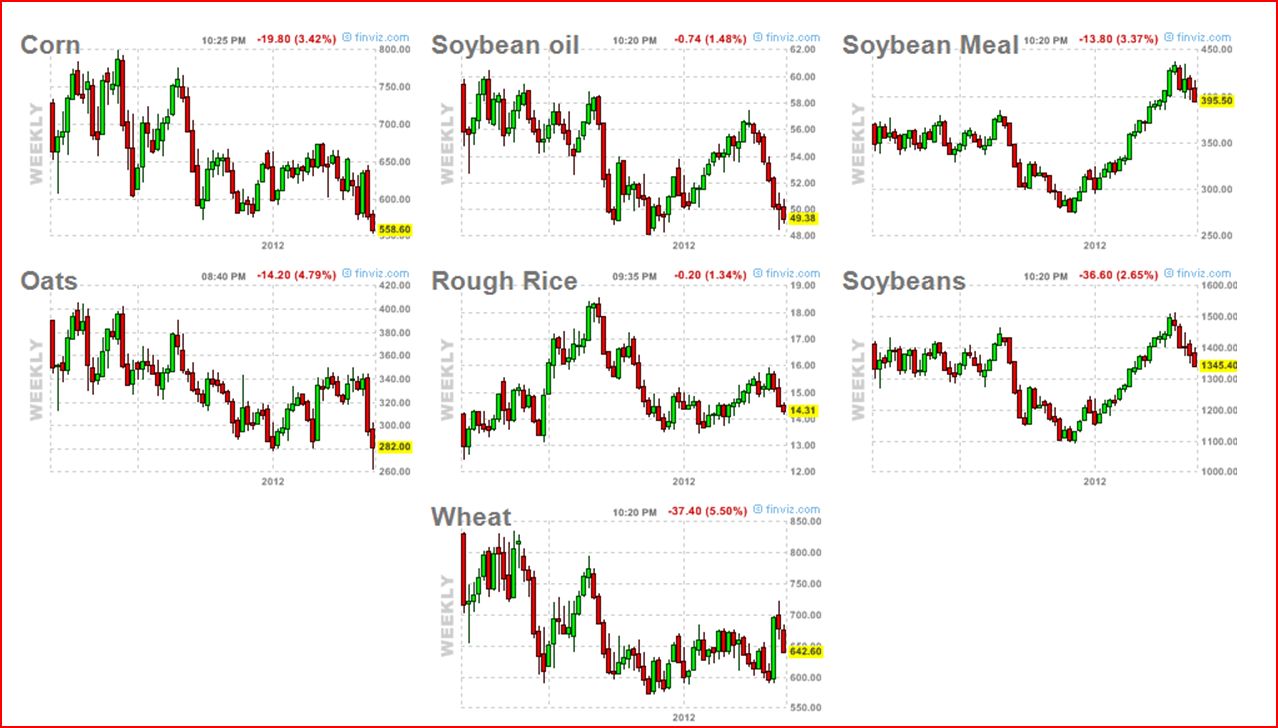

Lets take a look at charts of the major commodities over the last 18 months.

RedneckHB

Posts: 19,841 ✭✭✭✭✭

RedneckHB

Posts: 19,841 ✭✭✭✭✭

18 months seems to cover most of QE 2 and Operation Twist and the various ECB/JCB/SNB schemes . Lets see what this has done for commodities. Seems they all moved from the upper left to lower right. I think that means a downtrend.

Excuses are tools of the ignorant

Knowledge is the enemy of fear

0

Comments

How about priced in gold? fairly stable?

The dollar is the world's currency reserve...and it is so by its proven historical record of innovation, hard work , transparency and backed by its military and economic might.

Its a fantastic fiat currency ...probably better than 99% of whats out there.

Ideal almost if not for the lack of will from our elected officials to simply abuse it when push comes to shove ...and I'm afraid a strong dollar is feared more in DC than anything right now.

A strong dollar would kill the job market, put a nail in the housing market and sink the US into a very nasty depression.

Who knows maybe a strong dollar will happen regardless but it will be a fight...Gold is the perfect hedge.

Groucho Marx

<< <i>A strong dollar would kill the job market, put a nail in the housing market and sink the US into a very nasty depression.

>>

and how is that different than now?

EVERYONE I deal with in SoCal is extremely busy and the only major concern most of us have is how to make money off of that activity level. The various taxing/regulatory agencies are taking a huge bite out of all of us with no let-up in sight.

The public sector debt load and obligations are hanging over this economy like a very dark cloud. With very little awareness of that problem it seems.

This country needs some seroius shock treatment to become aware of and act on the impending disaster looming with our public sector problems. That sector is unwilling or unable to cure itself.

Fellas, leave the tight pants to the ladies. If I can count the coins in your pockets you better use them to call a tailor. Stay thirsty my friends......

``https://ebay.us/m/KxolR5

$1900 to $1550 is stable, whether it be Dollars or Euros...that's stable ?

One of two things. Either you're calculator is broken or maybe try looking at things standing up.

A strong dollar would kill the job market, put a nail in the housing market and sink the US into a very nasty depression

And that's not what's happening already. Are you saying the job market is strong the last 4 months? It's stalled and in fact going backwards now.

I can't weed out what our kitco pm chart is telling me hour by hour. Thought the hour swings meant buys and sells. But if you do a comparison to say gold and silver, the tracking is so parallel that I question if its the buying/selling say for gold/silver at almost the exact same rates... If just buy/sells alone, silver and gold would show more decoupling, eh? There's obviously more that makes the price then the level of buy/sells. I question following the charts and the numerous post evaluations.

Overall, the only thing I can see prediction wise is that PMs have been on a long term upswing, with some eratic to unreasonable spikes last year. There's enough of a check now to show a measureable leveling off in the 10 year view, not quite as serious as in end 2008 yet. I don't think there is enough data yet, to see or predict a big plunge further, or evidence of anything other than creep back. One must keep evaluating how deep they are in and if you can stand a drop for 5 years or more... I mean really, we can all survive a raise.

Gold & Silver outperforming other commodities.

Maybe gold & silver aren't ordinary commodities. Maybe they have something to do with sovereign default risk and money creation?

It's funny. All those lower commodity prices and I still pay more than I ever have for groceries. Wierd!

I knew it would happen.

I knew it would happen.

<< <i>It's funny. All those lower commodity prices and I still pay more than I ever have for groceries. Wierd! >>

Agree....especially coffee, which btw has dropped by almost 50% in the last 18 month.

even Silver +$0.82 to $28.53

I knew it would happen.

Knowledge is the enemy of fear

<< <i>What I think is impressive is the magnitude of some of the declines. Over 50% in several cases, 70% in cotton. >>

Cotton has been on the slide every since they got Zooey Deschanel as a spokes person and she sang the Cotton is the Fabric of our Lives song.

At least that is what I think.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

<< <i>the speculators are in a panic. >>

For the last 18 months? And most of these are "essential" commodities--food and clothing. What is there to panic about with a loaf of bread and a t-shirt?

Knowledge is the enemy of fear

<< <i>

<< <i>the speculators are in a panic. >>

For the last 18 months? And most of these are "essential" commodities--food and clothing. What is there to panic about with a loaf of bread and a t-shirt? >>

Speculators don't care what you do with the product or what you call it, they care about gains. Essential commodities is one of their favorite classes; can only go up, right?

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Wasn't the general theory that money printing would cause all commodity prices to shoot up?

<< <i>Wasn't the general theory that money printing would cause all commodity prices to shoot up?

My general theory is that money printing will eventually lead to consumer price inflation. Commodities and most other asset classes are at the moment suffering from the flight to investor safety (US dollar for now) as the world economies begin to crumble at a faster pace. 2008-2009 all over again. This cycle will keep repeating itself until its causes are confronted head-on or until ink is less abundant than gold.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

<< <i>Wasn't the general theory that money printing would cause all commodity prices to shoot up?

Hitler once said something to the effect that if you want people to believe a lie, then just keep telling it over and over again. Each time with more vigor and confidence.

Knowledge is the enemy of fear

if Money Supply increases faster than real output then inflation will occur.

if Money Supply increases faster than real output then inflation will occur.

If you increase the amount of money chasing a product and do not increase the quantity of the product the result will be more money being paid to acquire the product. Giving buyers more money increases what they are willing to pay and what they will pay to obtain a product whose quantity remains unchanged. The key here is getting the money into the buyers' hands. The money supply could be doubled tomorrow, but if it remains locked in a vault it will have no affect on price inflation. That is why we have not yet seen the price inflation that lies ahead. Once banks lend the new money and buyers borrow the new money all deflation bets are off. Thus far the FED has been successful in convincing the new money recipients to keep the bulk of the new money on deposit with the FED. When the markets resume control of interest rates and buyers are willing to borrow, the FED will lose control of this new money finding its way into consumer markets. An increase in inflation could easily light the fuse on borrowing demand as consumers as well as speculators see an advantage in borrowing so they can buy now at cheaper prices. This increase in borrowing demand will light the fuse for higher returns (interst rates) for banks who are presently receiving limited returns on the new money while on deposit with the FED. The increase in demand for borrowing as well as the cost of borrowing will grow in proportion to the price inflation that if feeds. The quickness with which this snowball grows could be amazing.

Increase the money supply by 10% and output by 3% and inflation will be roughly 7%. In an economy where the money supply is being increased and output is being decreased, inflation will accelerate.

The inflation flood is currently under the control of the FED who is effectively holding back all the new money. Market forces will eventually open those flood gates. Unfortunately there will be little control of the flood itself.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

<< <i>I need to show these charts to my feed store owner

Tell me about it. I've had the price of my granola oat mix double in price over the past 2 years. And various dark chocolates that I buy have only

gotten more expensive.....while cocoa prices dropped. Most grains and softs had huge runs into early 2011. Gold and silver hung on a few months longer.

But all needed to work off the froth created from 2002-2011. It takes time. I don't think that commods are down and out. We'll see all time higher prices

across the board within the next couple of years.

.. and yet you still purchase them. it seems your suppliers still have some additional pricing power to exercise.

if Money Supply increases faster than real output then inflation will occur.

Perhaps, in a closed system, and absent massive asset and debt (money) destruction. the real world is very rarely so cut and dry.

Liberty: Parent of Science & Industry

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Liberty: Parent of Science & Industry

The markets have driven rates down 100 basis points in the last month. That wasnt the Fed's doing. The markets are in completely control.

It takes a lot more than an increase in money supply to cause inflation. BWDIK?

Knowledge is the enemy of fear

<< <i>BWDIK? >>

M2

Well I for one assumed that money printing would cause the base commodity prices to increase. Those are down according to your charts but prices we pay for "finished goods" are up.

Not everything is up but the necessity items are higher

Is it energy costs ? Gas and diesel for transport are certainly up, power is probably up just about everywhere

Is it labor costs in the value added industries? Wages aren't up for anyone I know

<< <i> Is it labor costs in the value added industries? Wages aren't up for anyone I know >>

Wages increases have the most dramatic impact on costs, since LABOR is the purest form of MONEY. Many states and the Federal Govt have increased minimum wages in the last few years. This is why your BigMac costs more.

http://en.wikipedia.org/wiki/List_of_U.S._minimum_wages

Knowledge is the enemy of fear

<< <i>When the markets resume control of interest rates

The markets have driven rates down 100 basis points in the last month. That wasnt the Fed's doing. The markets are in completely control.

It takes a lot more than an increase in money supply to cause inflation. BWDIK?

>>

The markets are not controlling rates. They are being extremely manipulated using credit default swaps. This is sponsored by the worlds largest debtor, USA. Using printed money to buy 80% of the T bills as a demand vs supply factor is extreme manipulation too.

(Yes, I know one can look them up individually, but the presentation of the OP was so clear and consice, it would be awesome to revisit)

Liberty: Parent of Science & Industry

Knowledge is the enemy of fear

And don't worry about the fiscal cliff. I met a man on the street here in Hong Kong that said $417 trillion will be released into the market. The man he works for apparently gets calls from our President. He's been stuck in HK for 13 months because his services are so valuable. He said to watch for a new country in Africa to be created in February 2013 called Kamibia...the Switzerland of Africa. He got this directly from Sec. of State Clinton. He said he also had the cure to cancer in his hotel room but is scared to death to release the info. He asked if I had heard of the Illuminati? He said they are operating right here and will be pulling major strings shortly to ease the financial pain of the world. And on, and on he went....

Gold = $1,717.30/$1,556.20 = up 10.3%

Silver = $33.25/$27.60 = up 20.5%

Platinum = $1,641.00/$1,403.00 = up 17.0%

Of course, none of this means much if you buy metals to hedge against sovereign default risk.

I knew it would happen.

<< <i>Compared to the OP's charts, we have:

Gold = $1,717.30/$1,556.20 = up 10.3%

Silver = $33.25/$27.60 = up 20.5%

Platinum = $1,641.00/$1,403.00 = up 17.0%

Of course, none of this means much if you buy metals to hedge against sovereign default risk. >>

WOW, such big rallies!!! And still down from peaks.

Knowledge is the enemy of fear

Liberty: Parent of Science & Industry

Commodity Agricultural Raw Materials Index -0.84 % -4.36 % -1.39 %

Commodity Beverage Price Index -1.19 % -12.33 % -3.28 %

Commodity Price Index -3.73 % -9.07 % -2.15 %

Commodity Fuel (energy) Index -4.14 % -12.21 % -1.98 %

Commodity Food and Beverage Price Index -0.84 % 1.88 % -0.65 %

Commodity Food Price Index -0.81 % 3.40 % -0.41 %

Commodity Industrial Inputs Price Index -5.09 % -6.73 % -4.37 %

Commodity Metals Price Index -7.09 % -7.87 % -5.78 %

Commodity Non-Fuel Price Index -2.94 % -2.46 % -2.47 %

Crude Oil (petroleum), Price index -4.73 % -12.92 % -2.30 %

Coal, Australian thermal coal -2.94 % -14.25 % -0.67 %

Coal, South African export price -2.40 % -19.67 % -3.53 %

Crude Oil (petroleum) -4.69 % -12.89 % -2.31 %

Crude Oil (petroleum); Dated Brent -6.20 % -12.56 % -3.27 %

Crude Oil (petroleum); Dubai Fateh -5.16 % -13.74 % -1.92 %

Crude Oil (petroleum); West Texas Intermediate -2.29 % -12.28 % -1.62 %

Diesel -6.18 % -8.03 % -2.13 %

Gasoline -4.55 % -7.99 % 2.17 %

Heating Oil -7.13 % -8.55 % -4.11 %

Indonesian Liquified Natural Gas 0.00 % -3.42 % 0.00 %

Jet Fuel -7.74 % -8.81 % -3.95 %

Natural Gas 13.62 % 75.03 % 13.82 %

Propane 3.48 % -29.26 % 6.44 %

RBOB Gasoline -9.09 % -10.46 % 4.45 %

Russian Natural Gas 0.00 % -9.19 % -0.26 %

Cocoa beans -2.02 % -8.73 % -5.37 %

Coffee, Other Mild Arabicas 0.01 % -24.20 % -3.32 %

Coffee, Robusta 2.71 % -0.82 % 6.50 %

Tea -7.32 % -12.79 % -12.24 %

Barley 0.11 % 8.13 % 1.61 %

Maize (corn) 2.31 % 10.27 % 2.04 %

Rice -1.53 % -2.03 % -1.41 %

Soft Red Winter Wheat -4.07 % 10.04 % -7.49 %

Sorghum 2.98 % 8.29 % 1.97 %

Wheat -2.82 % 9.18 % -7.62 %

Bananas 1.42 % -18.49 % 0.51 %

Oranges 2.64 % 13.01 % 22.70 %

Beef -1.28 % -1.32 % -1.84 %

Poultry (chicken) 1.29 % 9.34 % 2.36 %

Lamb 0.00 % -16.07 % 3.93 %

Swine (pork) -8.52 % -10.26 % -8.20 %

Fish (salmon) -0.61 % 31.92 % 4.48 %

Shrimp -1.70 % -12.94 % -5.84 %

Sugar 0.66 % -22.95 % -2.76 %

Sugar, European import price -2.64 % -4.71 % -5.61 %

Sugar, U.S. import price -1.42 % -35.66 % -4.65 %

Coconut Oil -4.65 % -38.64 % -0.97 %

Fishmeal -5.24 % 35.22 % -14.58 %

Olive Oil, extra virgin -2.96 % 36.74 % 0.00 %

Palm Kernel Oil -1.42 % -39.20 % 4.78 %

Palm oil -2.59 % -30.19 % -0.60 %

Peanut Oil -2.93 % -15.24 % -8.38 %

Groundnuts (peanuts) 12.11 % 30.49 % 9.14 %

Rapeseed Oil -4.54 % -9.80 % -3.78 %

Soybean Meal -0.26 % 15.48 % 2.44 %

Soybean Oil -2.57 % -7.83 % -1.78 %

Soybeans -0.06 % 8.02 % 1.91 %

Sunflower oil -3.34 % 1.46 % -2.97 %

Coarse Wool -2.28 % -9.63 % -2.44 %

Copra -5.96 % -39.64 % -3.25 %

Cotton 5.28 % -5.08 % 10.45 %

Fine Wool -3.67 % -13.99 % -4.65 %

Hard Logs -1.85 % -12.12 % -6.09 %

Hard Sawnwood -2.48 % -7.28 % -5.58 %

Hides 0.00 % 4.56 % 0.00 %

Plywood -1.85 % -5.80 % -6.09 %

Rubber -6.55 % -24.22 % -9.88 %

Soft Logs 0.00 % 3.80 % 0.00 %

Soft Sawnwood 0.00 % 5.73 % 0.00 %

Wood Pulp 1.29 % 0.24 % 1.29 %

Aluminum -6.93 % -12.49 % -6.20 %

Copper, grade A cathode -5.07 % -9.66 % -4.98 %

Gold -2.12 % -4.82 % -4.71 %

Iron Ore -9.55 % -3.31 % -7.06 %

Lead -8.13 % 5.67 % -6.90 %

Nickel -5.42 % -10.34 % -4.36 %

Silver -5.07 % -12.57 % -7.31 %

Tin -3.76 % 1.38 % -5.27 %

Uranium -2.60 % -17.57 % -1.10 %

Zinc -9.37 % -5.24 % -5.03 %

Lots of negative returns on many of these commodities over the past month, YTD, and 12 month periods

Liberty: Parent of Science & Industry

<< <i>Commodity 1 Month Change 12 Month Change Year to Date Change

Indonesian Liquified Natural Gas 0.00 % -3.42 % 0.00 %

Natural Gas 13.62 % 75.03 % 13.82 %

Propane 3.48 % -29.26 % 6.44 %

Russian Natural Gas 0.00 % -9.19 % -0.26 %

Coffee, Other Mild Arabicas 0.01 % -24.20 % -3.32 %

Coffee, Robusta 2.71 % -0.82 % 6.50 %

Barley 0.11 % 8.13 % 1.61 %

Maize (corn) 2.31 % 10.27 % 2.04 %

Cotton 5.28 % -5.08 % 10.45 %

Sorghum 2.98 % 8.29 % 1.97 %

Bananas 1.42 % -18.49 % 0.51 %

Oranges 2.64 % 13.01 % 22.70 %

Poultry (chicken) 1.29 % 9.34 % 2.36 %

Lamb 0.00 % -16.07 % 3.93 %

Groundnuts (peanuts) 12.11 % 30.49 % 9.14 %

Hides 0.00 % 4.56 % 0.00 %

Soft Sawnwood 0.00 % 5.73 % 0.00 %

Wood Pulp 1.29 % 0.24 % 1.29 %

>>

wow whoda thunk?...

I knew it would happen.

<< <i>Commodity 1 Month Change 12 Month Change Year to Date Change

Commodity Agricultural Raw Materials Index -0.84 % -4.36 % -1.39 %

Commodity Beverage Price Index -1.19 % -12.33 % -3.28 %

Commodity Price Index -3.73 % -9.07 % -2.15 %

Commodity Fuel (energy) Index -4.14 % -12.21 % -1.98 %

Commodity Food and Beverage Price Index -0.84 % 1.88 % -0.65 %

Commodity Food Price Index -0.81 % 3.40 % -0.41 %

Commodity Industrial Inputs Price Index -5.09 % -6.73 % -4.37 %

Commodity Metals Price Index -7.09 % -7.87 % -5.78 %

Commodity Non-Fuel Price Index -2.94 % -2.46 % -2.47 %

Crude Oil (petroleum), Price index -4.73 % -12.92 % -2.30 %

Coal, Australian thermal coal -2.94 % -14.25 % -0.67 %

Coal, South African export price -2.40 % -19.67 % -3.53 %

Crude Oil (petroleum) -4.69 % -12.89 % -2.31 %

Crude Oil (petroleum); Dated Brent -6.20 % -12.56 % -3.27 %

Crude Oil (petroleum); Dubai Fateh -5.16 % -13.74 % -1.92 %

Crude Oil (petroleum); West Texas Intermediate -2.29 % -12.28 % -1.62 %

Diesel -6.18 % -8.03 % -2.13 %

Gasoline -4.55 % -7.99 % 2.17 %

Heating Oil -7.13 % -8.55 % -4.11 %

Indonesian Liquified Natural Gas 0.00 % -3.42 % 0.00 %

Jet Fuel -7.74 % -8.81 % -3.95 %

Natural Gas 13.62 % 75.03 % 13.82 %

Propane 3.48 % -29.26 % 6.44 %

RBOB Gasoline -9.09 % -10.46 % 4.45 %

Russian Natural Gas 0.00 % -9.19 % -0.26 %

Cocoa beans -2.02 % -8.73 % -5.37 %

Coffee, Other Mild Arabicas 0.01 % -24.20 % -3.32 %

Coffee, Robusta 2.71 % -0.82 % 6.50 %

Tea -7.32 % -12.79 % -12.24 %

Barley 0.11 % 8.13 % 1.61 %

Maize (corn) 2.31 % 10.27 % 2.04 %

Rice -1.53 % -2.03 % -1.41 %

Soft Red Winter Wheat -4.07 % 10.04 % -7.49 %

Sorghum 2.98 % 8.29 % 1.97 %

Wheat -2.82 % 9.18 % -7.62 %

Bananas 1.42 % -18.49 % 0.51 %

Oranges 2.64 % 13.01 % 22.70 %

Beef -1.28 % -1.32 % -1.84 %

Poultry (chicken) 1.29 % 9.34 % 2.36 %

Lamb 0.00 % -16.07 % 3.93 %

Swine (pork) -8.52 % -10.26 % -8.20 %

Fish (salmon) -0.61 % 31.92 % 4.48 %

Shrimp -1.70 % -12.94 % -5.84 %

Sugar 0.66 % -22.95 % -2.76 %

Sugar, European import price -2.64 % -4.71 % -5.61 %

Sugar, U.S. import price -1.42 % -35.66 % -4.65 %

Coconut Oil -4.65 % -38.64 % -0.97 %

Fishmeal -5.24 % 35.22 % -14.58 %

Olive Oil, extra virgin -2.96 % 36.74 % 0.00 %

Palm Kernel Oil -1.42 % -39.20 % 4.78 %

Palm oil -2.59 % -30.19 % -0.60 %

Peanut Oil -2.93 % -15.24 % -8.38 %

Groundnuts (peanuts) 12.11 % 30.49 % 9.14 %

Rapeseed Oil -4.54 % -9.80 % -3.78 %

Soybean Meal -0.26 % 15.48 % 2.44 %

Soybean Oil -2.57 % -7.83 % -1.78 %

Soybeans -0.06 % 8.02 % 1.91 %

Sunflower oil -3.34 % 1.46 % -2.97 %

Coarse Wool -2.28 % -9.63 % -2.44 %

Copra -5.96 % -39.64 % -3.25 %

Cotton 5.28 % -5.08 % 10.45 %

Fine Wool -3.67 % -13.99 % -4.65 %

Hard Logs -1.85 % -12.12 % -6.09 %

Hard Sawnwood -2.48 % -7.28 % -5.58 %

Hides 0.00 % 4.56 % 0.00 %

Plywood -1.85 % -5.80 % -6.09 %

Rubber -6.55 % -24.22 % -9.88 %

Soft Logs 0.00 % 3.80 % 0.00 %

Soft Sawnwood 0.00 % 5.73 % 0.00 %

Wood Pulp 1.29 % 0.24 % 1.29 %

Aluminum -6.93 % -12.49 % -6.20 %

Copper, grade A cathode -5.07 % -9.66 % -4.98 %

Gold -2.12 % -4.82 % -4.71 %

Iron Ore -9.55 % -3.31 % -7.06 %

Lead -8.13 % 5.67 % -6.90 %

Nickel -5.42 % -10.34 % -4.36 %

Silver -5.07 % -12.57 % -7.31 %

Tin -3.76 % 1.38 % -5.27 %

Uranium -2.60 % -17.57 % -1.10 %

Zinc -9.37 % -5.24 % -5.03 %

Lots of negative returns on many of these commodities over the past month, YTD, and 12 month periods >>

Probably a good sign. As the more posts like this that show up....it's a good sign that bottoms aren't far away, assuming they haven't already been seen.

Liberty: Parent of Science & Industry

Some foods still look to be headed lower. Sugar seems to have the most extended chart and ripe for bottoming. Metals are a mixed bag.

It makes me wonder if a countercurrent among seasonal and multi-year trends and cycles could be improved technology and efficiency of markets in, for example secularly declining energy or food production costs due, respectively, for example to opening up new wells and successive bumper crops.

edit to add: And similarly, with many prices at local minima, could they be subject to sudden shock, for example a political or technological disaster among an oil producer, or a really bad year or two for crops.

Might be a decent speculation for a small %, but to go "all in" on any one of these commodities seems like it might be swimming against larger tides that are less predictable

Liberty: Parent of Science & Industry

And also make it a great time to travel and invest abroad

(though I really don't think a slightly stronger dollar, and it will only be relatively slightly, would make things in the US as extreme as the strong words state above, with the nasty killing etc)

Liberty: Parent of Science & Industry

I'd love to know how JPM's position is spread across energy, base metals, grains, and softs. Are they short or are they long? Would the US Govt even allow them to go long on commodities to that extent? I doubt it. And it's more than probable that they took those positions with the full faith and support of the US govt behind them. Commodity prices could be due for some rebounds as the CRB sits on 10 year support. Maybe this is one way to help manage any potential bounce. At the same time I agree with Baley that many of those commodity and currency charts only seem to support further weakness in commodities. Sugar and copper "might" be bottomed out....though you can still find some sharp analysts calling for $2.00 copper. Sugar has one of the best 15yr (and 20 yr) charts out there. It's a key role player in commodities. Its long term symmetric wedge pattern has been most interesting to follow.

Sugar

The US dollar declined from 1986 to 2011. A 25 year move. It's "only" rebounded for 4 years. While it's been a sharp rise the past 16 months it could be time for an extended breather. But, one would think that it might still have to retrace a lot more of that 165 to 74 decline. Even a simple Fib retrace would suggest 108-110 at some point. The USDX rising on paper only means the Euro, Yen, Pound, Cando, etc. get crushed further. It's all floating paper.

Of course, if they're net neutral, owning about half long and half short, and making money on both sides of the trades in commissions and vigorish, then it would be a wash.

Liberty: Parent of Science & Industry

<< <i>Maybe someone ought to call JPM and Citi's hand, and force them to take delivery (if they're long) or deliver (if they're short) the underlying physical or financial assets.

Of course, if they're net neutral, owning about half long and half short, and making money on both sides of the trades in commissions and vigorish, then it would be a wash.

There certainly could be some big straddles in there such as long gold - short silver, short energy - long metals, etc. No clue really. All I know is that JPM going from a $250 BILL position to $4.1 TRILL makes no sense to orderly and transparent markets. Of course, since this Office of the US Comptroller of the Currency information was first reported by Zero Hedge, it must be fully discounted.

What I'm not seeing in those charts is any sign of the general monetary inflation, so feared by so many for so long due to accommodative fed monetary policy (low interest rates and QE)

If and when most of these charts turn back up, we'll certainly take notice, and if they were all or even most of them moving toward new highs, it would, to me, signal an inflationary trend, rather than specific commodities or sectors rotating in and out of favor over the intermediate term

Liberty: Parent of Science & Industry