What happens when a fiat currency is no longer backed by anything?

gecko109

Posts: 8,231 ✭

gecko109

Posts: 8,231 ✭

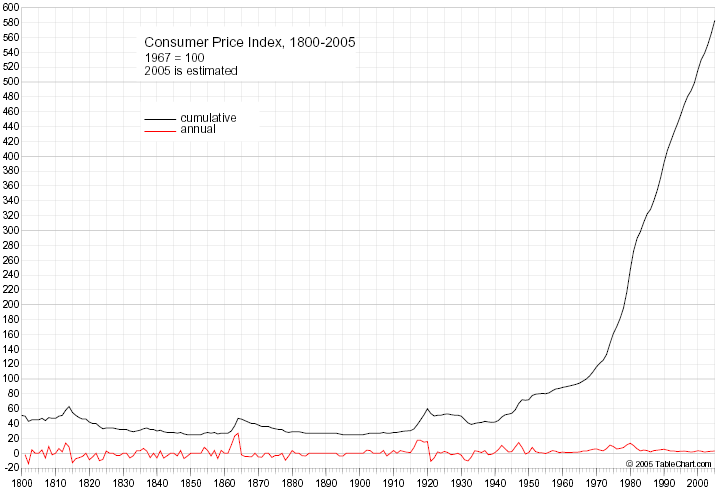

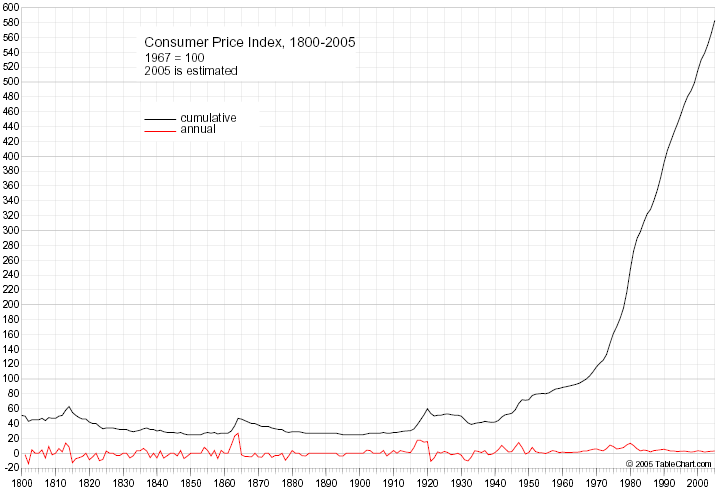

This is the result. Almost no inflation for 170 years.....and then see what happens when Nixon takes us off the gold standard in 1971!

0

Comments

I knew it would happen.

I thought it was backed by pork.

roadrunner

Such as: an average American citizen's life expectancy, access to information, ability to travel or relocate, freedom to choose a career, access to and variety of products available to purchase, supply of leisure time, and quality of life in general

Who is to say that all these improvements weren't MADE POSSIBLE by the advent of a modern banking system and loosening of hard money societal restrictions?

Would you really go back to the harsh living conditions and 40 year life expectancy of the 19th century, just so that gold and silver metal would circulate?

I'll take 2011 (as a package deal) over ANY time period in the past, thank you very much

Liberty: Parent of Science & Industry

<< <i>Gosh, the shape of that blue line could represent, if you simply changed the label and relative scale on Y axis, the change over time in any number of other things, too!

Such as: an average American citizen's life expectancy, access to information, ability to travel or relocate, freedom to choose a career, access to and variety of products available to purchase, supply of leisure time, and quality of life in general

Who is to say that all these improvements weren't MADE POSSIBLE by the advent of a modern banking system and loosening of hard money societal restrictions?

Would you really go back to the harsh living conditions and 40 year life expectancy of the 19th century, just so that gold and silver metal would circulate?

I'll take 2011 (as a package deal) over ANY time period in the past, thank you very much >>

Wow!

Have some more kool-aid...its tasty!

Liberty: Parent of Science & Industry

<< <i>I guess it was too much to hope you would think about an idea or point of veiw for more than two minutes, before reflexively attacking it in a trite and glib manner. >>

I guess it was too much for you too realize that this country made the bulk of its progress without inflation. We became a superpower without inflation. And further, that the "loosening of hard money societal restrictions" has landed us with the largest debt mankind has ever seen....with no possible way to pay it off...ever. Thats what the "loosening" has done...make no mistake about that part.

so you'd go back in time if you could? live in a different era?

do you disagree that any progress of any kind was made in the US or world since 1971, or that the rate of any positive progress has not accelerated on any front?

does that one graph, and associated dimentions of large stacks of currency, dominate your entire world view and constant day-to-day experience?

Liberty: Parent of Science & Industry

<< <i>easy, tough guy, we're just chatting. I'll try real hard not to make any mistakes, ok?

so you'd go back in time if you could? live in a different era?

do you disagree that any progress of any kind was made in the US or world since 1971, or that the rate of any positive progress has not accelerated on any front?

does that one graph, and associated dimentions of large stacks of currency, dominate your entire world view and constant day-to-day experience? >>

It does dominate my thoughts. I dont know if you have any kids, but I have a 3 year old and it pains me to see the financial track we are on.....we are simply doomed to massive change...and not the kind that BO promised either!

I dont disagree that leaps and bounds of GOOD, meningful progress has been made since '71. But at what cost? So that this once powerful nation will soon crumble under the weight of its debt? Is that a trade-off you are happy with? An I-Pod for 13 trillion of debt?

Yes, I have a wife and 2 small children. Our life is busy and wonderful, and full of hope for the future that we are making for ourselves.

And I have a couple of boxes of gold and silver, and guns and ammo, and all the other stuff. But I don't sit on top of the box of gold, cleaning and loading the gun all day.

As for the other points you make, like the graph you started the thread with, I find them oversimplifications of very complex concepts, and not foregone conclusions.

Maybe we'll discuss further as time permits later. Dinner is almost ready, and then we're going to have baths and read books.

one more thought: maybe we're all drinking kool-aid of one kind or another. I'll choose the sweet kind that the glass is half full of... the stuff in the half empty glass is very bitter

Liberty: Parent of Science & Industry

Technology, innovations etc have cause our life to be better not fiat or gold standars.

You have to compare the USA to other countries of similar wealth in the 18th century.

Also The USA is not the best example of the ravages of inflation since it has the top currency in the world and it enjoys world reserve status.

Groucho Marx

Our most recent experience is that banking has done nothing but buy politicians who then in turn shower them with favors. The recent "banking reform" of 2000 pages wasn't a banking reform at all - Glass Stegal is still dead, Fannie & Freddie still mismanaged and losing more taxpayer money, and mark to market is still a thing of the past since FASB was pushed into reneging on their long-established and functional set of valuation standards. ALL for the benefit of the banks and politicians. Who's getting hurt?

In the meantime, the debt climbs. The debt is no joke, and it affects us all, here and now - let alone future generations. It makes it more and more difficult for businesses to remain profitable in the US, which affects employment, which affects our society as a whole.

It's not like the banking system invented MS-Dos or Windows, or the Intel processor. They didn't come up with any of the advancements in modern medicine or science. What they came up with were more sophisticated ways to front-run the stock trades of their own clients and ways to sell financial paper that don't reflect the underlying value, which in many cases is very questionable.

There's no denying that the big bankers have had undue influence in formulating US policy, as almost every Treasury Secretary in recent memory stepped directly out of Goldman Sachs or the NY Fed and into the Treasury job, and almost immediately in each case rushed to push direct legislation that either hindered or destroyed competitors of their alma mater or infused massive free money into their alma mater - the height of corruption in the highest places.

Now, explain to me how that makes our lives better. I'm trying to come up with at least one example. 30-year mortgages? Maybe that was the last decent idea they've had.

I knew it would happen.

Would you really go back to the harsh living conditions and 40 year life expectancy of the 19th century, just so that gold and silver metal would circulate?

I'll take 2011 (as a package deal) over ANY time period in the past, thank you very much

I could just as easily call the "modern" banking system as a "fraudulent" banking system. Who believes that fractional reserve banking (1913-2010) and other highly leveraged financial schemes are just additional versions of Ponzi? The US having the world's reserve currency since 1944 has masked over a myriad of sins that won't be alllowed to go on much longer. Enjoy 2011 while you can as 2012-2014 is going to make 2008-2011 look like a party as the 60 and 120 yr cycles wind down. The good news is that 2015-2016 will begin the recovery.

Yes, the unusual "boom" period from the late 1940's to 2000 was directly the result of owning the world's reserve currency and exporting our inflation to emerging nations. The icing on the cake was gutting the remaining depression era financial regulations from 1999-2001.

Now, explain to me how that makes our lives better. I'm trying to come up with at least one example. 30-year mortgages? Maybe that was the last decent idea they've had.

ATM machines.

roadrunner

Box of 20

<< <i>There's absolutely nothing magical about gold. It is not immutable money, and as a metal it has very few uses. I'd argue that our perception of gold being valuable is outdated and illusory.

The ancients thought gold was valuable. In some ways this is understandable. Gold was intrinsically useful at the time when one considers the crude metalworking ability of the ancients. If you wanted an ornate and relatively durable metallic object 2000 years ago, gold was just about your only choice since it can pounded into complex shapes unlike any other metal. Today we have steel, titanium, aluminum, and engineered plastics that are all superior to gold in just about any application regardless of cost. Gold is very heavy (dense) and not very strong (soft), exactly the opposite of the public desire for strong and lightweight products. Other than gold's beauty, the properties that made gold valuable to the ancients are irrelevant to modern society.

The ancients went a step further in their appreciation of gold and started using gold as money. Using gold as money was an arbitrary choice, not bad as far as arbitrary choices go, but arbitrary none the less. Gold is durable, doesn't spoil, can be divided, and is somewhat difficult to obtain. These properties all made gold useful as money. It was difficult to debase the money supply because gold cannot usually be mined without significant labor and expense.

However, the fact that gold was used as money for centuries doesn't mean that gold is money. As a concept, money is a store of labor. A gold standard merely serves as a regulator on the quantity or supply of money. In an honest gold standard, money cannot be created in a quantity that outstrips the gold supply. Any other mechanism that regulates the money supply such that it doesn't grow faster than economic activity would provide the same advantage of a gold standard without the absurd notion that human progress is constrained by how much soft yellow metal can be dug from the ground.

Ingenuity and productive labor create real wealth, not the piling up of useless gold. When a big tree is turned into a new house, society becomes wealthier by the difference in utility between a tree and a house regardless of how much gold exists in the world. The same kind of wealth creation occurs when oil is turned into tires or useful plastic products. The quantity of gold available, even the very existence of gold, is irrelevant to this wealth creation.

When society was largely agrarian, and the stock of real wealth in the world remained relatively constant, the use of a relatively fixed stock of gold as money was not absurd. In the modern era, where wealth creation is limited less by physical resources and more by ingenuity in using those resources, the use of gold as money makes no sense.

Fiat money is really the only realistic alternative I see. There's nothing wrong with fiat money in and of itself. The potential problem with fiat money is the over creation of it. A fiat money system that grew in supply no faster than actual economic activity would remain viable as long as it were run honestly. >>

"as long as it were run honestly".

Thats a mighty big "IF" when applied to soveriegn national governments worldwide! And because there are no physical restraints on the money supply, there can never be an honest fiat system. All....and im talking in the history of mankind....ALL forms of paper fiat currency have been rendered obsolete.....with the exception of what is currently in use. It is estimated that some 3,500 distinctly different fiat currency systems are now extinct.

The USD, as well as all currently used/accepted fiat systems will eventually meet the same fate. Its simply a matter of time. However, while fiat system after fiat system has gone the way of the dodo, gold has always been highly valued. A track record of 5,000+ years man has held the metal in high regard....even today...moreso in fact today!

Your point about gold being basically useless is absolutely correct. However, because pure bartering for goods and services can never be efficient enough to facilitate business, there will ALWAYS be some form of "money" to keep track of transactions. I cannot see anything as widely accepted....worldwide....or as stable as gold is to fill that demand for a useable money. I can guarantee to you with 100% certainty that the world will shun the USD long before it turns its back on the "barbarous yellow metal". When this will happen is anyone's guess, but once China decides to stop buying our debt, its GAME OVER!

and perhaps that is where something like beads, shells, or gold come in; it is not made by keystrokes.

Also, because most of today doesn't remember the world in 1929. Why else would we be deregulating big business, actively getting rid of our unions, etc? My grandparents, who were alive during the Great Depression live on a different attitude toward money than I find most of my own peers.

Doesn't EVERY generation worry about "the end of life as we know it"? doesn't EVERY generation fear that their kids won't live as well as they did? Doesn't every generation complain that the governement is messing everything up? that the environment is getting ruined? that there will be no jobs? that the economy is crashing?

And aren't they always wrong? (in the long term?)

oh, sure, different individuals and groups will rise and fall, there will be fads and follies, booms and busts, but doesn't the world still go round?

one more thought:

Rome is still there, still a beautiful city, still full of smiling people, and they have the same human worries as always...

Liberty: Parent of Science & Industry

The question is not wether humankind will survive ..we probably will.

Gold will protect you against an erosion of your quality of life, it will protect what wealth you have already accumulated.

It wont save you against a hurricane, or make you more handsome.

Groucho Marx