Teletrade and California State Sales Tax

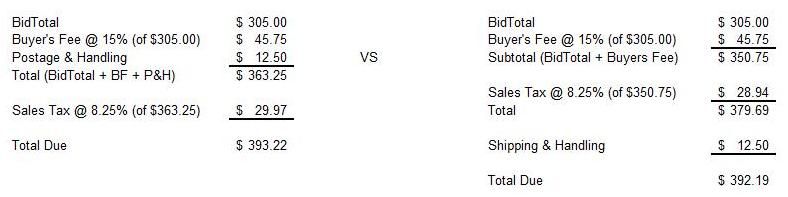

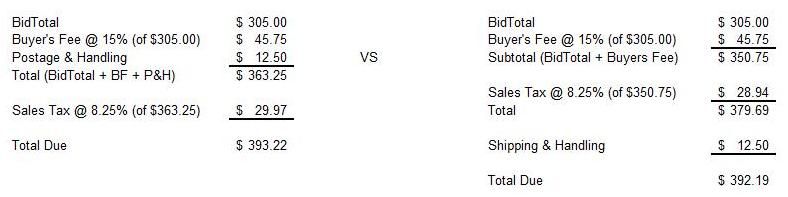

I just realized on my latest Teletrade invoice that I am being charged California State Sales Tax on the shipping charges.

Is this cool or uncool?

Is it even legal?

Is this cool or uncool?

Is it even legal?

I decided to change calling the bathroom the John and renamed it the Jim. I feel so much better saying I went to the Jim this morning.

The name is LEE!

The name is LEE!

0

Comments

Authorized dealer for PCGS, PCGS Currency, NGC, NCS, PMG, CAC. Member of the PNG, ANA. Member dealer of CoinPlex and CCE/FACTS as "CH5"

<< <i>i might want to check a little more closely on the sales tax on the shipping. it seems that theres something way wrong with that. you have nothing to lose on that in this case best wishes john >>

When TT takes a CC or PP they pay the fee on the shipping and the sales tax.

Then again the local post office DOES NOT charge sales tax for their services.

``https://ebay.us/m/KxolR5

World Collection

British Collection

German States Collection

Worry is the interest you pay on a debt you may not owe.

"Paper money eventually returns to its intrinsic value---zero."----Voltaire

"Everything you say should be true, but not everything true should be said."----Voltaire

<< <i>I never realized California's sales tax was so high---8.25%.

I think Lee's bigger issue is the extra $1.03 sales tax on the $12.50 shipping and handling charge.

It adds up and doesn't seem particularly fair.

``https://ebay.us/m/KxolR5

<< <i>I never realized California's sales tax was so high---8.25%.

Try Chicago, 10.25%!!!

I thought they couldn't charge tax unless they have a presence in the state you live in, then they have to charge you your tax rate? BTW, Heritage has never charged me tax on coins.

Subtotal 80.00 1

Buyer's Fee 12.00

Postage and handling 5.00

________

Total 97.00 ok since im new to teletrade i don't understand you win a coin by bidding 80 bucks, than they tack on 15 percent buyers fee 12.00 does the seller get 92.00? and what fees is teletrade charging. glad i don't live in calif anymore to me thats crazy they tax everything and not just the original price that you bid, even the buyers fee you get taxed that can make a good deal change to a break even deal........................

I used to be famous now I just collect coins.

Link to My Registry Set.

https://pcgs.com/setregistry/quarters/washington-quarters-specialty-sets/washington-quarters-complete-variety-set-circulation-strikes-1932-1964/publishedset/78469

Varieties Are The Spice Of LIFE and Thanks to Those who teach us what to search For.

Keeper of the VAM Catalog • Professional Coin Imaging • Prime Number Set • World Coins in Early America • British Trade Dollars • Variety Attribution

For those with insomnia, here are the rule for shipping and tax in CA. Can't wait til these guys run health care.

Lance.

Delivery-related charge is not taxable when:

All of these conditions must apply:

- You ship directly to the purchaser by common carrier, contract carrier, or US Mail;

- Your invoice clearly lists delivery, shipping, freight, or postage as a separate charge;

- The charge is not higher than your actual cost for delivery to customer.

Exception: Charge is taxable if you do not maintain records that show the actual cost of the delivery.

Delivery-related charge is taxable when:

- You do not keep records that show the actual cost of the delivery.

- You deliver merchandise with your own vehicles.

- You make a separately stated charge for fuel surcharge or “handling,” etc.

- You include a delivery charge in the unit price of the item sold.

- Your charge to your customer represents the cost of shipping the merchandise to your place of business (“freight-in”).

- You make a sale for a delivered price (sales agreement specifies that delivery is included in price, whether delivery charge is listed separately, included in per-item cost, or listed as “freight prepaid”).

<< <i>Generally, CA sales tax does not apply to delivery charges if the charges are clearly stated as a separate entry on the invoice or other bill of sale. If the delivery charges are not stated separately, they are taxable.

For those with insomnia, here are the rule for shipping and tax in CA. Can't wait til these guys run health care.

Lance.

Delivery-related charge is not taxable when:

All of these conditions must apply:

- You ship directly to the purchaser by common carrier, contract carrier, or US Mail;

- Your invoice clearly lists delivery, shipping, freight, or postage as a separate charge;

- The charge is not higher than your actual cost for delivery to customer.

Exception: Charge is taxable if you do not maintain records that show the actual cost of the delivery.

Delivery-related charge is taxable when:

- You do not keep records that show the actual cost of the delivery.

- You deliver merchandise with your own vehicles.

- You make a separately stated charge for fuel surcharge or “handling,” etc.

- You include a delivery charge in the unit price of the item sold.

- Your charge to your customer represents the cost of shipping the merchandise to your place of business (“freight-in”).

- You make a sale for a delivered price (sales agreement specifies that delivery is included in price, whether delivery charge is listed separately, included in per-item cost, or listed as “freight prepaid”). >>

Well, according to what you've quoted, it appears that it is an improper charge.

The name is LEE!

<< <i>Well, according to what you've quoted, it appears that it is an improper charge. >>

Not so sure:

<< <i>Delivery-related charge is not taxable when:

All of these conditions must apply:

...

- Your invoice clearly lists delivery, shipping, freight, or postage as a separate charge;

Delivery-related charge is taxable when:

- You make a separately stated charge for fuel surcharge or “handling,” etc. >>

Since you're charged a single S&H charge, which doesn't list the shipping separately, one of the conditions that must apply is not met. If they were to break out the handling fee, then it sounds like it would become taxable under the second set of rules that trigger taxable delivery charges. It's probably easiest for TT just to establish their S&H fee schedule and collect tax on the full amount than go through the trouble of determining exact postage before invoicing and then risking running afoul of the gummint for not collecting enough sales tax.

Keeper of the VAM Catalog • Professional Coin Imaging • Prime Number Set • World Coins in Early America • British Trade Dollars • Variety Attribution

<< <i>Subtotal 80.00 1

Buyer's Fee 12.00

Postage and handling 5.00

________

Total 97.00 ok since im new to teletrade i don't understand you win a coin by bidding 80 bucks, than they tack on 15 percent buyers fee 12.00 does the seller get 92.00? and what fees is teletrade charging. glad i don't live in calif anymore to me thats crazy they tax everything and not just the original price that you bid, even the buyers fee you get taxed that can make a good deal change to a break even deal........................

No, the seller gets the hammer price less the seller's fees (8% for under $800, with $8 minimum per lot). So in this case, seller gets $72. Seller is also out shipping for getting the coins to Teletrade.

<< <i>

<< <i>I never realized California's sales tax was so high---8.25%.

Try Chicago, 10.25%!!!

Makes sense when you consider that B.O. was from there.

Worry is the interest you pay on a debt you may not owe.

"Paper money eventually returns to its intrinsic value---zero."----Voltaire

"Everything you say should be true, but not everything true should be said."----Voltaire

<< <i>It's legal and all the auction companies calculate sales tax the same way. >>

I don't think so. I don't charge sales tax on my shipping charges and I think most dealers don't.

The e-bay sales tax algorithm doesn't charge tax on shipping.

--Jerry

<< <i>Actually I just called the State and the reply was that I should not be charging sales tax on the actual shipping cost. If I am charging a premium for shipping (envelope, label, time) then I would tax it. It was a very enlightening call. >>

Which is the purpose of my question.

Sales tax is not beong charged on "part" of the Postage and Handling but "all" of the postage and handling.

The name is LEE!

will be taxed.In addition, a new tax is pending ,based upon how much air

a person breaths. Deep breaths, higher tax.

Camelot

<< <i>I never realized California's sales tax was so high---8.25%.

It's actually higher than that depending on the county. In my county it's 9.25%.

Authorized dealer for PCGS, PCGS Currency, NGC, NCS, PMG, CAC. Member of the PNG, ANA. Member dealer of CoinPlex and CCE/FACTS as "CH5"

CA sales tax be charged on that? I know the auto mechanic charges tax on parts but not labor.

<< <i>Exception: Charge is taxable if you do not maintain records that show the actual cost of the delivery. >>

Arn't they charging flat rate shipping?

I think you are getting hosed.

<< <i>OK, what about the buyers fee. Since this is, i think, for a service (labor), should

CA sales tax be charged on that? I know the auto mechanic charges tax on parts but not labor. >>

The buyer's fee is part of the sales price. It's taxable.

<< <i>I think they are charging under the exception.

<< <i>Exception: Charge is taxable if you do not maintain records that show the actual cost of the delivery. >>

Arn't they charging flat rate shipping? >>

Not in the true sense of like Priority Mail Flat Rate but they do publish the following Postage and Handling chart:

I also emailed them about this:

"I'm a little confused on this invoice since it appears that Teletrade is charging me California Sales Tax on the shipping charges.

What's up with this?

Is it even legal?"

And received the following reply:

"Dear Mr. Lydston,

Thank you for your inquiry. Shipping charges are taxable in California as a service, yes absolutely legal. If you have further questions in this regard, please call our toll free number. We appreciate your business and thank you for choosing our services.

Regards,

Cheryl Hartigan | Assistant Controller| Teletrade

*:: 18061 Fitch | Irvine, CA | 92614

(:: 800.949.2646, x263 | 6:: 949.250.9290

8:: cherylh@Teletrade.com "

So, it appears that they truely feel they are within their rights and obligations to charge Sales Tax on "Postage and Handling" as a service.

Pressing the issue could get my account suspended since it's a free country and folks can pick and choose who they wish to do business with.

Shall I call the Franchise Tax Board?

BTW, Teletrade is located in Irvine California.

The name is LEE!

Sales tax is also higher in some California municipalities- 9, 9.5% in some case. We are also hit with a ~9.5% income tax.

Call it a sunshine tax, a fruit n' nut tax, &c..

what the ...........

i bet T.T keeps track of their shipping costs , seems like they would have to -

to know how much sale's tax to pay the state on them

<< <i>Shall I call the Franchise Tax Board? >>

I think you are picking the wrong battle.

Buying the right coin for your collection versus buying the wrong coin for your collection is a much more important decision than an argument over about a dollar worth of tax. Especially considering that you are likely to lose that argument over that dollar. Isn't your time worth more than this? Isn't there something more important to focus on?

I know most of us have a strong anti-tax sentiment and I think that's good. But pick your battles carefully to maximize your effectiveness.

<< <i>< Exception: Charge is taxable if you do not maintain records that show the actual cost of the delivery. >>

what the ...........

i bet T.T keeps track of their shipping costs , seems like they would have to -

to know how much sale's tax to pay the state on them >>

Of course they do, but I doubt if they keep a record of the charges to ship your exact specific individual purchase. They charge the same to ship 10 $40 slabbed coins as they do one slabbed $400 coin, but due to the weight difference, I doubt that it actually costs them the same.

<< <i>

<< <i>< Exception: Charge is taxable if you do not maintain records that show the actual cost of the delivery. >>

what the ...........

i bet T.T keeps track of their shipping costs , seems like they would have to -

to know how much sale's tax to pay the state on them >>

Of course they do, but I doubt if they keep a record of the charges to ship your exact specific individual purchase. They charge the same to ship 10 $40 slabbed coins as they do one slabbed $400 coin, but due to the weight difference, I doubt that it actually costs them the same. >>

And, THAT, is probably what allows the taxation.

From what was earlier posted:

Delivery-related charge is not taxable when:

All of these conditions must apply:

- You ship directly to the purchaser by common carrier, contract carrier, or US Mail;

- Your invoice clearly lists delivery, shipping, freight, or postage as a separate charge;

- The charge is not higher than your actual cost for delivery to customer.

Note, it says "ALL" and then the last bolded point is likely what makes a difference to allow the taxation where the charge may be higher than actual cost. Since they state the amount for a range, you can bet that some fall under the amount and some fall above.

I doubt this is a battle that is worth a lot. If it is, run it through with them in more than just 1 email. Why not contact the higher ups, who will punt to their accountants? Fighting the battle on a forum is silly, imho

I've been told I tolerate fools poorly...that may explain things if I have a problem with you. Current ebay items - Nothing at the moment

but I sure loved Arnie in Terminator !

<< <i>

<< <i>

<< <i>< Exception: Charge is taxable if you do not maintain records that show the actual cost of the delivery. >>

what the ...........

i bet T.T keeps track of their shipping costs , seems like they would have to -

to know how much sale's tax to pay the state on them >>

Of course they do, but I doubt if they keep a record of the charges to ship your exact specific individual purchase. They charge the same to ship 10 $40 slabbed coins as they do one slabbed $400 coin, but due to the weight difference, I doubt that it actually costs them the same. >>

And, THAT, is probably what allows the taxation.

From what was earlier posted:

Delivery-related charge is not taxable when:

All of these conditions must apply:

- You ship directly to the purchaser by common carrier, contract carrier, or US Mail;

- Your invoice clearly lists delivery, shipping, freight, or postage as a separate charge;

- The charge is not higher than your actual cost for delivery to customer.

Note, it says "ALL" and then the last bolded point is likely what makes a difference to allow the taxation where the charge may be higher than actual cost. Since they state the amount for a range, you can bet that some fall under the amount and some fall above.

I doubt this is a battle that is worth a lot. If it is, run it through with them in more than just 1 email. Why not contact the higher ups, who will punt to their accountants? Fighting the battle on a forum is silly, imho >>

I'm not trying to fight a "battle" on the forums, simply discussing and getting ideas on something which I think few were aware of and something which just doesn't appear to be right.

The name is LEE!

<< <i>I never realized California's sales tax was so high---8.25%.

Almost 10% of what you spend goes to the State, pretty sad.

I have a seller's permit so don't pay TT's sales tax. But then again I am expected to re-sell the coin and collect tax when I do.

<< <i>Califorinia needs the money, just pay it. >>

No, the California governor and legislature need to learn to spend within their means. These guys are like alcoholics. Giving them more booze is not going to solve their drinking problem.

<< <i>

<< <i>Califorinia needs the money, just pay it. >>

No, the California governor and legislature need to learn to spend within their means. These guys are like alcoholics. Giving them more booze is not going to solve their drinking problem.

Well, if Whitman makes it into office I expect all the tax rates to change anyway.

12% on the first $25.00 spent

8% on any amounts from $25.01 upto $100

6% on any amounts from $100.01 upto $1,000

4% on any amounts over $1,000.01

That'll cause quite a stir at McDonalds!

The name is LEE!

Well, those streets now need repairing and everybody whines about it but nobody wants to pay for it.

The schools need repairing and everybody whines about it but nobody wants to pay for it.

The police and fire departments are short handed because nobody wants to pay for the services yet they are the first to whine and complain about it when its late to respond.

The list goes on and on.

Everybody wants something for free.

The name is LEE!