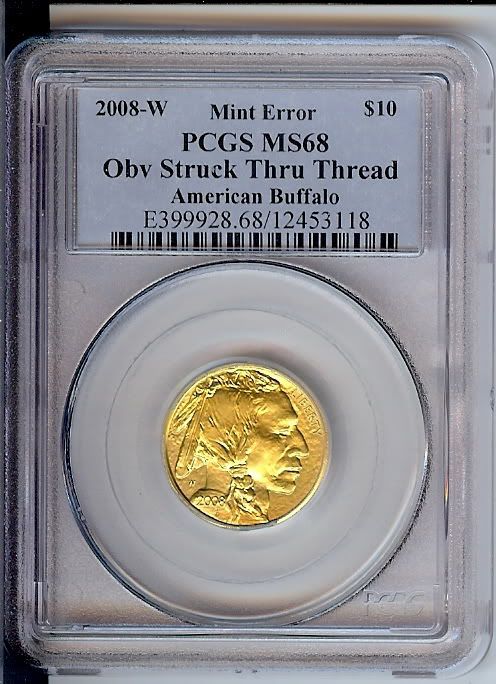

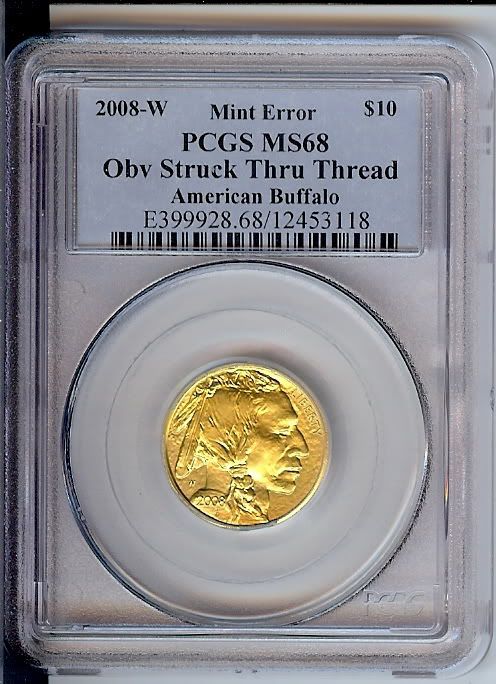

Valuation help, 08W Unc $10 Buffalo Error....

I have a 2008W Unc $10 Buffalo, certified by PCGS as an Obverse Strike-through. The error is an impressive one. I am presuming that this particular coin with it's error will be rare, a major strike-through on a (presently) one year type coin with a low mintage. My question is, how do I go about computing an insurance value on this coin when I have no idea how many other error coins of this ilk there are? HM

0

Comments

PS but that they are cool and worth keeping in my opinion.

<< <i>Modern bullion struck thrus are not worth much and sometimes worth less than a perfect example. --Jerry

PS but that they are cool and worth keeping in my opinion. >>

-Paul

Value is determined by how much a group of people would be willing to pay for something.

While your strike though is slabbable as such, I just don't think that the coin will have much value over a non-error type piece of the same date/mm.

For the record, just about anything can be slabbed as a mint error if it is in fact an error, this includes strike through's and clashed dies, but it doesn't make it collectible or even extraordinarily valuable.

For your piece, I'd just go with PCGS Price guide.

The name is LEE!

<< <i>Dang. I thought I had something myself too. My struck through is still STUCK ON!! This is a 2008 1/10 AGE and has no fewer than 3 stuck thrus on it.

Looks like Ringworm coins Jesse.. Might need some cream on those.

K S

what I call a "White Elephant" Error coin.

The coins value as a Gold piece FAR exceeds

it's value as an error, ie; a struck -thru.

For insurance purposes, I'd suggest putting

down a value for the coinas a normal coin,

without the errorvalue; odds are when you sell it,

the premium over the coin's value will be small at best.