When to cash silver in for numismatic coins?

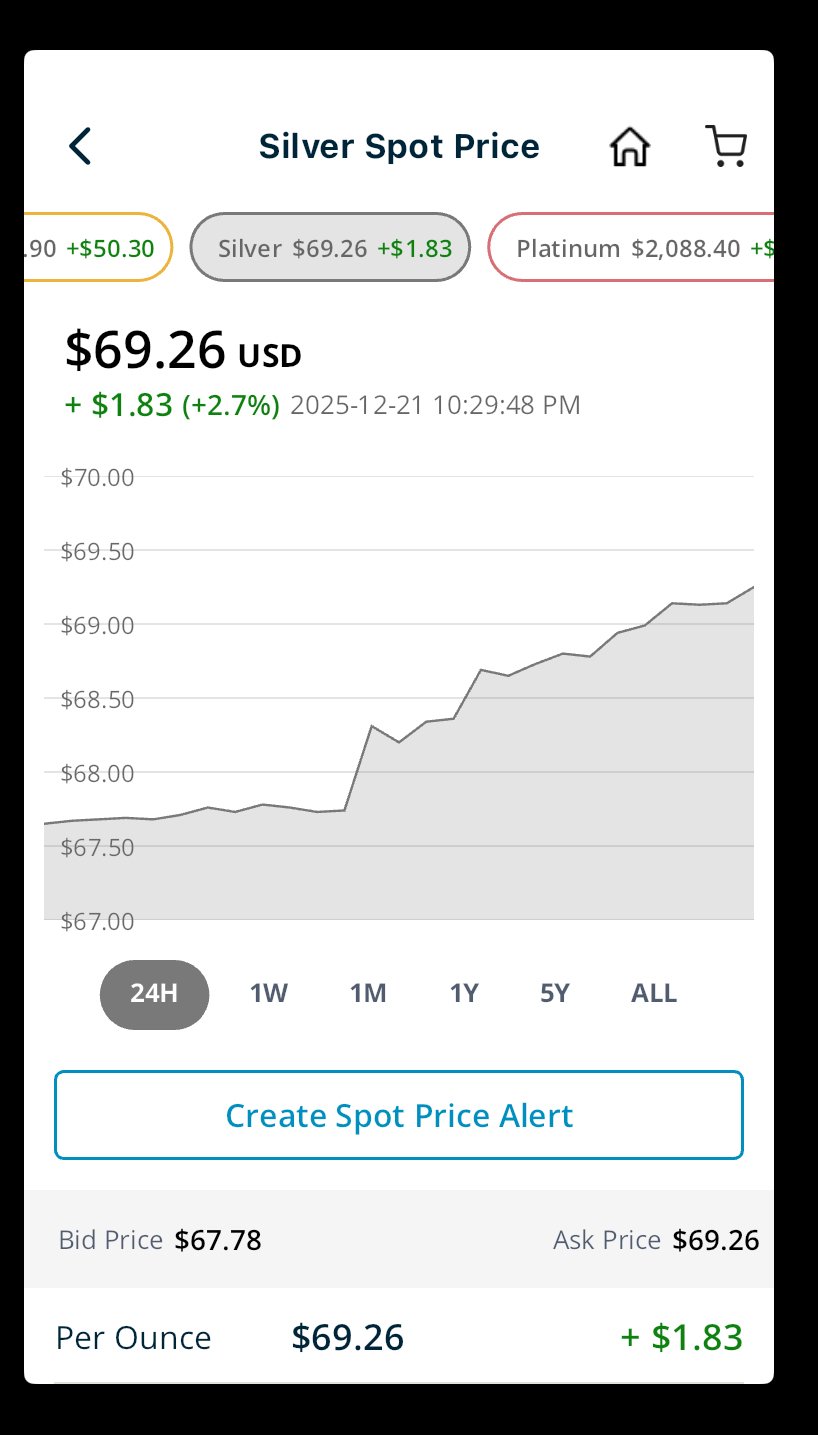

Silver keeps running up and the silver eagles I have in addition to the britannias, maple leaf, libertad and pandas are looking like they could go towards a nice coin for the collection.

When are you going to cash out? 70? 75? 80? 100????

2

Comments

I think Silver will top off at $80 sit for a while at that and then possibly move up again.

I see no reason for it to decrease in value.

Student of numismatics and collector of Morgan dollars

Successful BST transactions with: Namvet Justindan Mattniss RWW olah_in_MA

Dantheman984 Toyz4geo SurfinxHI greencopper RWW bigjpst bretsan MWallace logger7 JWP

I started gradually cashing out at $50. A promise i made to myself a few years ago. U will continue gradually selling a long as it stays above 50. At $100, VG or lower Barber coinage jobs the melt.

All comments reflect the opinion of the author, even when irrefutably accurate.

I already started, albeit just a trickle, as it seems like some irrational exuberance is occurring.

But two market adages to keep in mind; 1. markets can stay irrational for a long time, and 2. Bulls and bears can make money, but pigs eventually get slaughtered.

Here’s a clear, serious bearish (bear-case) argument for silver prices, the way a commodities analyst or skeptical investor would lay it out.

🐻 The Bear Argument for Silver

1. Silver is mostly an industrial metal, not a monetary one

Despite the “poor man’s gold” narrative, over 50–60% of silver demand is industrial:

That means silver behaves more like copper than gold during slowdowns.

➡️ If global growth weakens, industrial demand falls → silver prices fall.

Gold often rises in recessions; silver often does not.

2. Silver supply is relatively inelastic and tied to base metals

Most silver is produced as a byproduct of:

This creates a bearish dynamic:

➡️ Price drops don’t quickly reduce supply, keeping downward pressure on prices.

3. Above-ground silver inventories are larger than bulls admit

Unlike oil or food, silver:

While exact numbers are debated, the bear view is:

➡️ Silver shortages are overstated, and most “deficits” are accounting artifacts, not physical scarcity.

4. Solar demand growth may be overstated

A big bull thesis is solar-panel demand, but bears argue:

➡️ Solar growth ≠ proportional silver demand growth.

5. Silver is vulnerable to substitution

Silver’s high price encourages substitution, especially in:

Copper, aluminum, and conductive polymers are “good enough” in many applications.

➡️ High silver prices destroy their own demand.

6. Silver underperforms gold in monetary stress

Historically:

Bears argue:

➡️ Silver is a leveraged trade, not a safe haven.

7. Paper markets dominate price discovery

Silver pricing is heavily influenced by:

Bears claim:

➡️ Physical demand ≠ immediate price response.

8. Silver is volatile in both directions — and usually loses long-term

On long time scales (inflation-adjusted):

➡️ Silver is a trader’s metal, not a wealth-preserver.

🧠 The Bear’s Bottom Line

A silver bear would say:

Bear conclusion:

If you want, I can also:

Just tell me where you want to push next.

All comments reflect the opinion of the author, even when irrefutably accurate.

And for balance

Here’s the clean, intellectually honest bull case for silver, stated the way a serious silver advocate or commodities strategist would present it — not hype, but the strongest version of the argument.

🐂 The Bull Case for Silver

1. Silver is uniquely dual-purpose: monetary and industrial

Unlike gold, silver has two independent demand engines:

The bull argument is that this gives silver optionality:

➡️ Few assets have this asymmetric upside.

2. Silver is historically cheap relative to gold

The gold–silver ratio is one of the oldest valuation metrics:

Bulls argue:

➡️ Silver is dramatically undervalued vs gold, even if gold merely holds its value.

A reversion doesn’t require silver mania — just normalization.

3. Silver is being consumed, not just stored

Gold is hoarded. Silver is used up.

➡️ Unlike gold, above-ground silver shrinks over time.

This makes silver more like energy metals than monetary metals.

4. Supply is structurally constrained

Silver supply has weak price responsiveness:

Bulls argue:

➡️ Even high prices cannot quickly increase supply, setting up potential shortages.

5. Energy transition is silver-intensive

Silver is critical to:

While thrifting exists, bulls counter:

➡️ The energy transition quietly tightens silver supply.

6. Silver outperforms gold late in monetary cycles

Historically:

Examples:

Silver is volatile, but:

➡️ When confidence breaks, silver explodes upward, not gradually.

7. Physical market stress is increasing

Bulls point to:

The claim is not “manipulation” but:

➡️ Paper leverage far exceeds available physical silver, creating fragility.

8. Silver is under-owned

Compared to gold:

Bulls argue:

➡️ Even a small capital reallocation into silver would overwhelm supply.

9. Silver is cheap in real terms

Inflation-adjusted comparisons show:

➡️ Silver does not need to break records to be “expensive.”

🧠 The Bull’s Bottom Line

A silver bull would say:

Bull conclusion:

⚖️ Where Bulls and Bears Fundamentally Disagree

Final neutral framing:

Silver is not a safe, steady asset.

It is a high-volatility, regime-dependent metal.

If the world trends toward:

If you want, I can next:

Just say the word.

All comments reflect the opinion of the author, even when irrefutably accurate.

And here's the decision tree

Here’s a clean, structured decision tree that shows when the bull case for silver wins and when the bear case wins. This is how macro traders and commodities desks actually think about it.

🌳 Silver Price Decision Tree

START: What macro regime are we entering?

🟢 Branch 1: Stable Growth / Disinflation

(Soft landing, productivity gains, controlled inflation)

Key signals:

👉 Outcome:

🐻 BEARISH SILVER

Why:

Expected silver behavior:

Winner: ❌ Silver bulls lose

🟡 Branch 2: Global Recession / Demand Shock

(Deflation scare, collapsing growth)

Key signals:

👉 Outcome:

🐻 STRONGLY BEARISH (initially)

Why:

BUT → Watch closely:

If central banks respond aggressively with:

➡️ the tree splits again:

🔀 Branch 2A: Recession + Aggressive Monetary Response

Transition phase:

Then…

➡️ Silver flips violently bullish late-cycle

Outcome:

🐂 BULLISH (Delayed Explosion)

🔀 Branch 2B: Recession + Tight Policy

Outcome:

🐻 LONG BEAR MARKET

Winner: ❌ Silver bulls lose badly

🔵 Branch 3: Inflation Without Crisis

(Moderate inflation, controlled markets)

Key signals:

👉 Outcome:

⚖️ MIXED / RANGE-BOUND

Why:

Expected behavior:

Winner: No one (except volatility traders)

🔴 Branch 4: Monetary Crisis / Currency Confidence Break

(Debt crisis, fiscal dominance, loss of trust)

Key signals:

👉 Outcome:

🐂 STRONGLY BULLISH SILVER

Why:

Expected silver behavior:

Winner: ✔ Silver bulls win big (if timed)

🟣 Branch 5: Energy Transition Acceleration

(Grid buildout, EV surge, solar expansion)

Key signals:

👉 Outcome:

🐂 STRUCTURAL BULLISHNESS

Why:

BUT:

This alone does not cause mania prices — it supports higher floors, not spikes.

🟠 Branch 6: Technological Substitution Breakthrough

(Unexpected materials science advance)

Key signals:

👉 Outcome:

🐻 LONG-TERM BEARISH

Why:

🧠 MASTER SUMMARY

🎯 The Silver Truth (No Spin)

Silver only wins big in:

Silver loses quietly in:

It is not a buy-and-hold metal.

It is a conditional bet on chaos + industry.

If you want next, I can:

Just say the word.

All comments reflect the opinion of the author, even when irrefutably accurate.

@jmlanzaf that was a very educational read. I now know more than I did before. So right now the market is being artificially pushed up and not on stable ground.

I can believe it.

If people stop believing the prices will fall. I wonder how long it will last.

Student of numismatics and collector of Morgan dollars

Successful BST transactions with: Namvet Justindan Mattniss RWW olah_in_MA

Dantheman984 Toyz4geo SurfinxHI greencopper RWW bigjpst bretsan MWallace logger7 JWP

Samsung has developed new battery technology that will use roughly 1 kilogram of silver per car. Time frame is 2027. Cars will have 600 mile range and 80% charge in 9 minutes and 20 year life span. Could really ramp up silver use.

As I have mentioned before. I sold some off at $20 an oz. I sold more around $35 and received the same per roll. At some point I guess I will take some more in and see what it gets.

Successful BST with drddm, BustDMs, Pnies20, lkeigwin, pursuitofliberty, Bullsitter, felinfoel, SPalladino

$5 Type Set https://www.pcgs.com/setregistry/u-s-coins/type-sets/half-eagle-type-set-circulation-strikes-1795-1929/album/344192

CBH Set https://www.pcgs.com/setregistry/everyman-collections/everyman-half-dollars/everyman-capped-bust-half-dollars-1807-1839/album/345572

Gold and Silver are in a bull market. Numismatic (non BV) coins seem stagnant. Slabbed bullion coins and Gold Type seeing huge demand. Been busy repricing stuff up where BV up lol.

It would need more research to verify the details. But the AI did a pretty good job of covering a lot of bases.

All comments reflect the opinion of the author, even when irrefutably accurate.

The problem is finding someone locally who will pay a fair price. I've not had any luck so instead I've been selling my SLV ETF in increments.

I started at $50 as well... sold around $25 face value of 90% and a couple of other coins to fund my $3 gold Princess purchase...

Successful BST transactions with: SilverEagles92; Ahrensdad; Smitty; GregHansen; Lablade; Mercury10c; copperflopper; whatsup; KISHU1; scrapman1077, crispy, canadanz, smallchange, robkool, Mission16, ranshdow, ibzman350, Fallguy, Collectorcoins, SurfinxHI, jwitten, Walkerguy21D, dsessom.

Selling off many pounds over the last several months - $45, $55, $65, and on...

No no numismatic for me, thanks, siempre Bullion and slowly, slowly watching...

45 years ago I sold at $35 and felt bad when it went to $50. So this time I stood facing it again and now it's its $67. Goodby mercs, washingtons and Walkers. Raw only, no keys,

so far.

Jim

When a man who is honestly mistaken hears the truth, he will either quit being mistaken or cease to be honest....Abraham Lincoln

Patriotism is supporting your country all the time, and your government when it deserves it.....Mark Twain

Silver has a macro chart pattern 45 years in the making. $600 silver is coming. Foolish to sell any time soon.

Cash in bullion for numismatic coins? Are you kidding? It’s the other way around lol.

I cashed out all my junk silver and bullion back in 2011 when it hit $50. I think silver still has some room, so if I had any, now, I would hold,. I would be nervous, if I was sitting on a lot of gold, though. I think it has a propensity to drop from its current level, but that is purely speculation and opinion on my part, so who knows?? I wish I had a crystal ball.

Sometimes, it’s better to be LUCKY than good. 🍀 🍺👍

My Full Walker Registry Set (1916-1947):

https://www.ngccoin.com/registry/competitive-sets/16292/

I'm not a stacker, just slowly accumulated over the last 60 years. I didn't sell during the Hunt Brothers run up or any of the other surges thru the years. I'll let my grandkids sell after I'm gone.

$50 from 2012 is the equivalent of $70 today...

Jim

Thanks. Good point. Then I guess it was a pretty good decision. Now that I think about it, it was actually 2011, but who’s counting?

Sometimes, it’s better to be LUCKY than good. 🍀 🍺👍

My Full Walker Registry Set (1916-1947):

https://www.ngccoin.com/registry/competitive-sets/16292/

No rush:

Save your silver. It will continue to rise is my opinion.

Sell physicall and buy calls in your Roth allowing you to avoid capital gains taxes (in the roth).

There is a form for gains from selling gold and silver that the IRS has if you are so inclined.

I sold some of each to clear debt... but otherwise I use Peace dollars for tips for the garbage guys, labor crew etc but

Not going to sell anymore.. As long as everyone's health stays proper...

A lot of numismatics are in bubble area

So you are IMHO selling tops and buying tops...

Exactly. If you've been holding for 45 years waiting for the price break out, you lost a fortune. You pick your number and move on.

I've been hearing about $100 silver for 30 years. Some day, they will be right. But worse than a stopped clock, they are only right every 50 years.

That's true of everything. I recently sold one of my favorite coins: 1741 Venice coin with St. Mark lion. Love that coin. I paid $600 for it last year. I got offered $800 so I took it. Why? I'm too poor to own everything and, as I near retirement, I want my money working for me not me working to buy coins.

Does that make me a "bad" coin collector? Maybe. But everyone has a comfort level for their non-performing assets. I do not consider coins to be investments. So I play around with them, but I don't bury assets in them. YMMV

All comments reflect the opinion of the author, even when irrefutably accurate.

I haven't sold any yet but may do so if there is a coin that I really want for my set.

Collector

Over 100 Positive BST transactions buying and selling with 57 members and counting!

instagram.com/klnumismatics

I might sell the small amount of .999 I have left, if I can sell it locally. Otherwise the majority of my silver now is in BU Peace and Morgan dollars. I enjoy those a lot more than .999.

Collector, occasional seller

$50.00 in 1980 has the same buying power as nearly $200 today. Ir would seem silver has a long way to go to match its incredible run 45 years ago.

Richard

Life Member #7070

I dont know how you can say there'll be a peak at a very set figure with the dynamics for upward price growth not abating any time soon.

This, the best I have heard recently locally is $40 for $1 face. Not a bad price but not a number that makes me want to rush down. Besides I'm not a stacker, I might have 10-15 ounces of junk 90% stuff at best so not much impact anyway.

My Collection of Old Holders

Never a slave to one plastic brand will I ever be.

Locked in at $69.50 an oz. for my bullion silver bars. Selling tomorrow afternoon. My buy-in averaged out to a tad over $18. I may use some of the proceeds for a numismatic coin but I’ll wait until after the holidays to decide.

Hey now!

That is my plan

👍

"Inspiration exists, but it has to find you working" Pablo Picasso

$4500 gold and $70 silver looks great. A fun time to be in the hobby.

Successful BST with drddm, BustDMs, Pnies20, lkeigwin, pursuitofliberty, Bullsitter, felinfoel, SPalladino

$5 Type Set https://www.pcgs.com/setregistry/u-s-coins/type-sets/half-eagle-type-set-circulation-strikes-1795-1929/album/344192

CBH Set https://www.pcgs.com/setregistry/everyman-collections/everyman-half-dollars/everyman-capped-bust-half-dollars-1807-1839/album/345572

Silver is far too valuable for money. But even if it were as plentiful as gold in Ft Knox it is too unstable for use as money. Sure you could set its value far above what supply and demand could cause and use it as money but then it would become too plentiful causing economic mayhem.

Silver is going much higher so there's no urgency to convert it to numismatic prizes but this conversion should be an ongoing process because the price is erratic and you want to lock in numismatic "profits" when they are available. You can always cull and upgrade later.

People should also trade back and forth with gold as the ratio goes up and down.

Silver and gold are money, pay no dividends but preserve purchasing power.

My stash is for my family and to protect their future so I no longer trade bullion.

I'm no survivalist, but I'm hedging against a time in the near future where paper becomes worthless and the new fiat has to once again be backed by gold and commodities.

Commems and Early Type

I had posted about this in the precious metals forum, but last week I sold an old sterling flatware set that was collecting dust for what I thought was a very healthy $4100…. My fiancée and I are beginning the renovation of a historic house (1890ish ex-school house), and I can use the money for that, I’m pleased with the sale. Could I have gotten more if I waited? Perhaps

There are many big financial bubbles now. It's anyone's guess when the game of musical chairs will be over with bubbles popping. Remember prior run-ups, the collapses were as impressive as the runs.

The collapses are usually more impressive.

All comments reflect the opinion of the author, even when irrefutably accurate.

Pick your price. Make your sale. Never look back.

Congratulations.

All comments reflect the opinion of the author, even when irrefutably accurate.

@jmlanzaf said:

Jmlanzaf continues to console himself for selling at $50 😂😂

If you are bullish on the silver price, then holding pure silver bullion or coins are best. The belief that leverage will accrue to numismatic coins appears to be a 1-time result of the lifting of gold and silver price controls in the 1970's.

Back then, you'd see PM's double or triple in price....but numismatics (at least the right ones) would go up 5-10 fold.

That has not been the case since the 1989 Coin Bubble.

If you want to hold silver but are sure we are headed for a sizeable correction, numismatics should go down less. Premiums are eroded in a rising market, expand in a falling market.

I sold 50oz at $42 simply because I wanted to take some profits... Do I wish I would have waited? Yes. I'm trying not to cry about it too much as I'm still sitting on the cash but I'm not even remotely interested in buying any of it back at this level.

Click on this link to see my ebay listings.

Nope.

I knew a guy who missed the peak in 1980. Held $300,000 in gold for 30 years as it turned into $100,000 in gold. Then he sold it all and ended up declaring bankruptcy.

No one is smart enough to know when the peak is. I sold at $40-something in 2011, near the peak. Just lucky. Didn't know it was peaking. Didn't care.

I'll be selling more this week at $70. Sold most of my gold at $3500. Very happy with all the sales.

All comments reflect the opinion of the author, even when irrefutably accurate.

I did already, to some degree.

... Sold most of my gold at $3500. Very happy with all the sales.

Yep. I unloaded nearly all of my gold last August and didn't care one bit when it started to climb a couple of weeks later. Had been holding onto just under 12 oz. in modern gold commemoratives for years and was thrilled to realize more than double my original investment.

Richard

Life Member #7070

Agree. I put the money in a mutual fund which is up 15%. It's all good.

All comments reflect the opinion of the author, even when irrefutably accurate.

Just returned from dumping all of my silver bullion. Took some nice profits and made some room in the vault.

No plans to ever buy silver bullion again, but I did keep a memento to have one copy of each ASE.

The gold will remain in my collection no matter what happens. My youngest daughter has a vested interest in it, which I’m happy about.

I sold 7,000 AG-G Standing Liberty Quarters about four months ago. Yes, I'm still pissed!

Dave

That was one of Scott Travers' theories in some of his books about making money in numismatics. It is as untrue today as it was 20 years ago though I remember $20 Libs. having big premiums at certain times in the 2000s, like being worth $1800 when melts were around $1200. Those days are long gone.