Silver has hit a triple top

HalfDime

Posts: 687 ✭✭✭✭✭

HalfDime

Posts: 687 ✭✭✭✭✭

Silver has finally hit a triple top after almost 14 years of waiting. Now the question is will it continue to go higher, or fall down into more consolidation.

If silver continues this rally then it should build a new base at some point. A fall to $30 seems the support if this rally fails though,

3

Comments

What you have in that chart is a massive 45 year cup with handle formation. On a log chart the cup portion would duplicate on the breakout. That's a +900% change or $370 silver. Even on a linear chart, the doubling of the cup takes silver to $95. And neither of the last 2 peaks accounted for inflation since the 1980 peak. Meanwhile gold is 2.15X the 2011 peak and 4.75X the 1980 peak.

The only real issue I have with the above chart is the depth of the handle retracement from the 2011 peak. 82% retrace sort of violates the MMM thumbrule that handles shouldn't exceed a Fib 61% retrace to remain truly viable. So while many silver analysts are hanging their hat on the Cup with handle chart.......I have some reservations. Silver needed to remain above $20 from 2014-2022. And you can see it dropped to $12 in March 2020 CoVid washout.....and spent 6 yrs between $15-$20 before coming out of the last major bottom.

I've followed Clive Maund for the past 15-20 yrs. He's been one of the most accurate and reliable PM forecasters.

https://clivemaund.com/gmu.php?art_id=67&date=2025-10-05

Clearly we are in a bubble and the question is how high does it go and at what price to sell. Since it broke through $50 it may run to $100. The bottom of the crash will probably be down to $30 again.

At $85 to $90 I will probably be taking out silver to sell.

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Blitzdude are you going to ride the crash down once it happens?

Oct 28 is next fed meeting. Lowering rates will be like pouring gas on the fire.

Not in the SLV but perhaps in the physical unless we can find buyers before this crash. Nobody is buying physical gutter. If it hits $75 the paper will no doubt sell at $75 , the physical? Perhaps there will be a sucker of two offering $Fitydotzerozero ($50.00). Ask Jim, others have been asking if he'd sell at $300 fer $225. He seemed to become confused. CrzY WrlD!!

, the physical? Perhaps there will be a sucker of two offering $Fitydotzerozero ($50.00). Ask Jim, others have been asking if he'd sell at $300 fer $225. He seemed to become confused. CrzY WrlD!!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Almost every city has silver and gold buyers that pay cash. In the 80's they popped up like weeds at the top. People hauled in everything including silver utensils.

My LCS is offering $2 back on generic rounds, $2.50 on 5 oz or larger bars. That is about 4%. I was offered $200 back on a Krug at one place and $175 back at another. $125 back on an AGE. That is 5% or 4/24% on the Krug and 3% on the AGE. Not sure what is going on in your commonwealth, but the issue seems to be quite localized to your world...

South of spot when you more than likely acquired at or North of spot. What's going on in your world? It appears bad investment decisions. The paper SLV was bought at 0 premium and can easily be sold with that same 0 premium. It's not really NASA stuff, just a little cmmn CeNTS. THKS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

SLV carries both a premium over NAV and the bid is less than the ask. You keep flogging that lie thinking you can speak it into truth. You can’t.

Gold is also starting to melt up in price. It shows in this chart similar to 2019.

Those who get out on the way up will be better of than those who wait. My guess is gold hits 5k and silver $100.

Certainly not a bad prediction and I believe you are spot on. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Silver futures surging.

COPPER is gutter !

.

I have not (and would not) buy SLV - in spite of all the SLV spam presented here.

But I am unfamiliar with the "bid" and "ask" levels for SLV. Can you elaborate a little ?

Also, when you state "premium over NAV", is that the accumulation of the 0.5% per year evaporation of the underlying asset base (in other words, the operating fees) ?

.

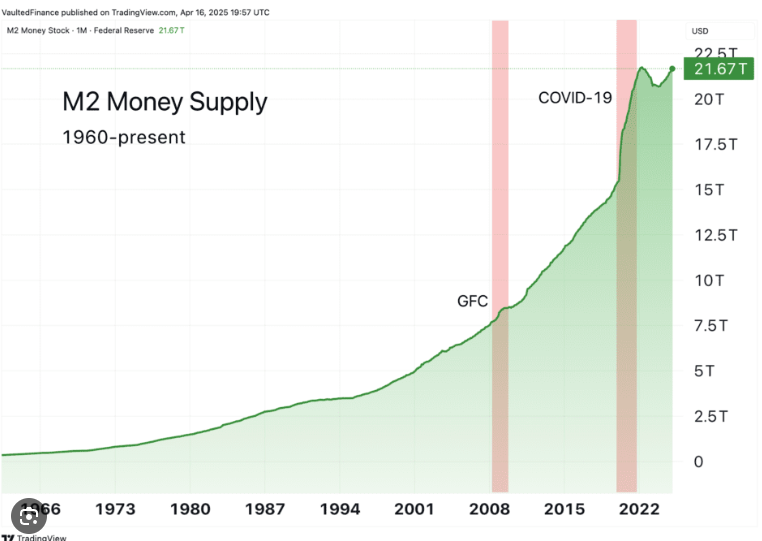

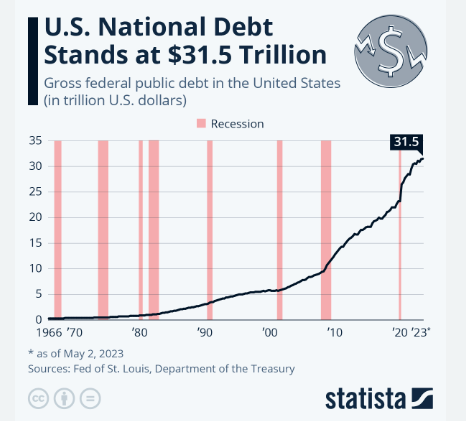

one could easily argue that we are in both a dollar and debt bubble

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Silver may or may not be overbought (I don't think it is)...but it is CLEARLY not in a bubble.

We had that in 1979-80 when it went up 8-fold in 12 months and tripled in a few weeks.

Nope. No evidence for either.

Silver just dropped by $2.50 in a matter of minutes (according to Kitco).

How the market reacts after that will tell a lot.

.

I don't know if manipulators are really doing themselves any favors by selling a years supply of silver in 3 minutes or dropping the price out of nowhere by like 10% or whatever.

People on social media just laugh at it, mock it, and post screenshots of them buying more.

Ironically enough, it erodes faith in our institutions and our dollar, which only makes precious metals stronger.

.

It did seem like a coordinated effort to drive the price down, by selling (short) a lot in a very short span of time.

A legitimate seller, that actually had silver to part with, would likely sell a little bit more slowly so that the price doesn't drop precipitously before they finish selling it all.

.

2 weeks ago a local sports card shop offered $19 on the dollar. We have at least 4 sports card shops that are buying and selling gold/silver to get in on the run up.

Opinion without understanding is why we are where we are.

Knowledge is the enemy of fear

Opinion without understanding is why we are where we are.

Says the guy who thinks that a T-bill is a bond, or that backwardation has to be confined to the futures market.

I knew it would happen.

.

You have no idea where we are.

A recent quote for SLV was $46.44 bid and $47.30 ask.

That is a buy/sell spread of $0.86, which is close to 2%.

@blitzdude has constantly touted SLV as a no-fee no-spread trading vehicle.

But it appears that is not the case ?

Each round-trip SLV trade incurs a 2% hit due to the spread ?

And there is also the 0.5% per year holding fee.

.

.

Looking at the chart again, it appears that the $2.50 drop occurred with very low volume, as if buyers were temporarily locked out of the system.

.

T-bill is a bond. Just as a car is a vehicle.

So why do you compare spot to futures when you talk of backwardations?

Knowledge is the enemy of fear

Like i said, you have no understanding. Get me a quote of SLV when the market is actually open. I think you'll find the spread is a penny or two.

Then you can rewrite your uninformed opinion.

Knowledge is the enemy of fear

A T-bill is short term debt, it may be in the bond complex, but it is not a bond. I learned this over 40 years ago. You are so good at looking up definitions. Try it sometime.

So why do you compare spot to futures when you talk of backwardations?

The spot market is the base market and futures are only a paper derivative extension of the real thing. When the cash price is higher than the derivative prices, it completely invalidates the concept of "the time value of money" which is the entire basis for the bond market. So, either you believe in "the time value of money" or you don't.

This is the consequence of market manipulation by the big bullion banks over many years. Their control of the silver market is slipping away. The volatility that is coming is merely a symptom of the banks' loss of control over silver.

I knew it would happen.

T-biil is a bond. Glad to see you understand that now.

And you confirmed backwardation is related to the futures market. Which BTW, is not in backwardation.

Go back to April 2011 and get the futures quotes and you will see what backwardation actually looks like.

The rest of what you wrote is just regurgitated and unsubstantiated gibberish.

Knowledge is the enemy of fear

Scroll up, a T-bill is not a bond.

The silver market is in backwardation, even now.

Your agenda doesn't have traction.

I knew it would happen.

.

During normal trading hours (8:00AM to 4:00PM EDT) the spread is apparently about $0.05 (0.1%).

If you want to get in or out of SLV at any other times of the day the spread is about 2.0%.

Even if the spread was 0% and no fees, I still wouldn't buy it.

.

Yes, we have proven over the last decade and especially the last 8 months that the truth has no traction.

But a t-bill is still a bond and silver is not in backwardation.

Knowledge is the enemy of fear

8am is not normal trading hour.

What are normal trading hours for physical? And how.much is the spread during those hours? What is the spread on physical at other times? Is there even a market?

Knowledge is the enemy of fear

May have been answered - wasn't willing to wade through the spam from the dynamic duo - but market makers get the difference between the bid and ask. NAV is what the underlying asset is worth - in the case of SLV their physical metal. The fact is is under the silver spot price shows the impact of the operating fees. The price of SLV being above the NAV shows buyers are wiling to pay a premium over the value of the asset.

.

I'm not a "retail speculator". I buy and/or sell at whatever price and time is advantageous. I have contacts and I don't have to be on the short end of a spread.

What is the counter-party risk with SLV ?

What if there is some sort of liquidity issue with SLV, and/or they don't have the silver to cover withdrawals ?

.

The silver market seems to have finally reverted back to contango this morning, just in the past half hour, all at once. Let's see how long it lasts.

I knew it would happen.

Wait!!! No backwardation? Lol

Knowledge is the enemy of fear

.

OK, then, that is a narrower time window for trading times - weekdays (non-holiday), 9:30AM to 4:00PM EDT.

As of right now (9:42 AM EDT), the SLV buy-sell spread is $0.06.

I’m showing a penny spread.

Wait!!! No backwardation? Lol

Your point? Of course you have none. A $3.00 swing in the spread between spot and futures is significant.

Why aren't you buying bonds and shorting silver now?

I knew it would happen.

When crypto crashed on Friday those that tried to get out had to pay a big fee because they tapped out the trading volume that the block chain was capable of processing. They are working on fixing this by making the block chain capable of 100k transactions per second. It tapped out at 3k per second.

BTW silver is an industrial metal and will always behave like an industrial metal outside of a bubble. I will be selling many silver eagles that will be worth near melt. 2008 w silver eagles right now sell for $57 raw. Some proof silver eagles are also down to near melt. However silver has to go higher from here to do it.

Looks like your broker is trying to soak you for an extra nickel a share. Might be time to switch brokers. THKS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

.

I'm not a "retail speculator", so I don't use any "broker". I'm my own broker (dealer).

.

Are you in Bizarro world?

dollar bubble evidence:

debt bubble evidence:

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Just to add a little clarity about bid-ask spreads, there's a continuum of bid & ask prices combined with quantities. Yes the big stocks have a narrow penny spread and trades are filled continually during the day at the exact same price, higher or lower then the open price. However besides market orders (trade now), there are limit & stop orders at set prices and quantities. So yes, I can buy or sell 10 shares of SLV immediately at the current market price. However if I wanted to sell 50,000 shares at market, let's say it's now $50, the order will be filled at numerous prices hitting these other market and stop orders. If my sell order quantity overwhelms current bidding, when complete, the final price filled could be $48.50 with an average price of $49 for the 50,000. So the bid-ask spread on a 50,000 share order is not .01, but depending how you look at it, it's $1 or even $1.50. And yes, after hours trading usually has higher spreads with less participants' orders to match.

Know you are being facetious, but brokers are bound by best execution rules and the firm's OMS trading system routes orders to exchanges and market makers for execution. There is no soaking, just so others don't get this false idea in their head.

"The 2011 gold and silver price surge was driven by a combination of economic uncertainty, inflation concerns, and increased industrial demand, notably in solar panel technology."

where have I heard that one before?

Silver peaked in 2011 on April 28th, when its spot price exceeded $49.50 per ounce intraday, marking the highest level in that year and close to its all-time high.

"The peak price of silver in 1980 occurred on** January 18**, when it reached an intraday record high of about $49.45 to $50.36 per troy ounce. This unprecedented surge was driven largely by the Hunt brothers' attempt to corner the silver market. The price spike was short-lived, as it led to regulatory changes and a market crash known as "Silver Thursday" on March 27, 1980, when silver prices sharply collapsed from around $21.62 to $10.80 per ounce."

The last two peaks happened early in the year, which is the normal time when money floods the markets. The way silver has moved through $50 is like it is not going to bend in the upward march ahead. I think people selling today are selling too early, but only time will tell.

Absolutely correct. None other than the United States Treasury, issuer of the paper, classifies its debt into three categories: bills, notes, and bonds. A Treasury bill is most certainly debt but it is not a bond. If it were a bond, there would be no reason for the Treasury to introduce the bills and notes terminology.

Bills, notes, and bonds are primarily distinguished on their tenor. I believe (but could be wrong) that all bills are no-coupon debt securities.

What the ?

The spread on $SLV is one penny I'm looking at it now on IB.

Correct, T-Bills have a maturity of < 1 year and are issued at a discount and if held to maturity will price at $100 face. There are no coupons and values are accredited daily.

Lets not let the facts get in the way, some see and or makeup only what they want to see. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????