Dream coin

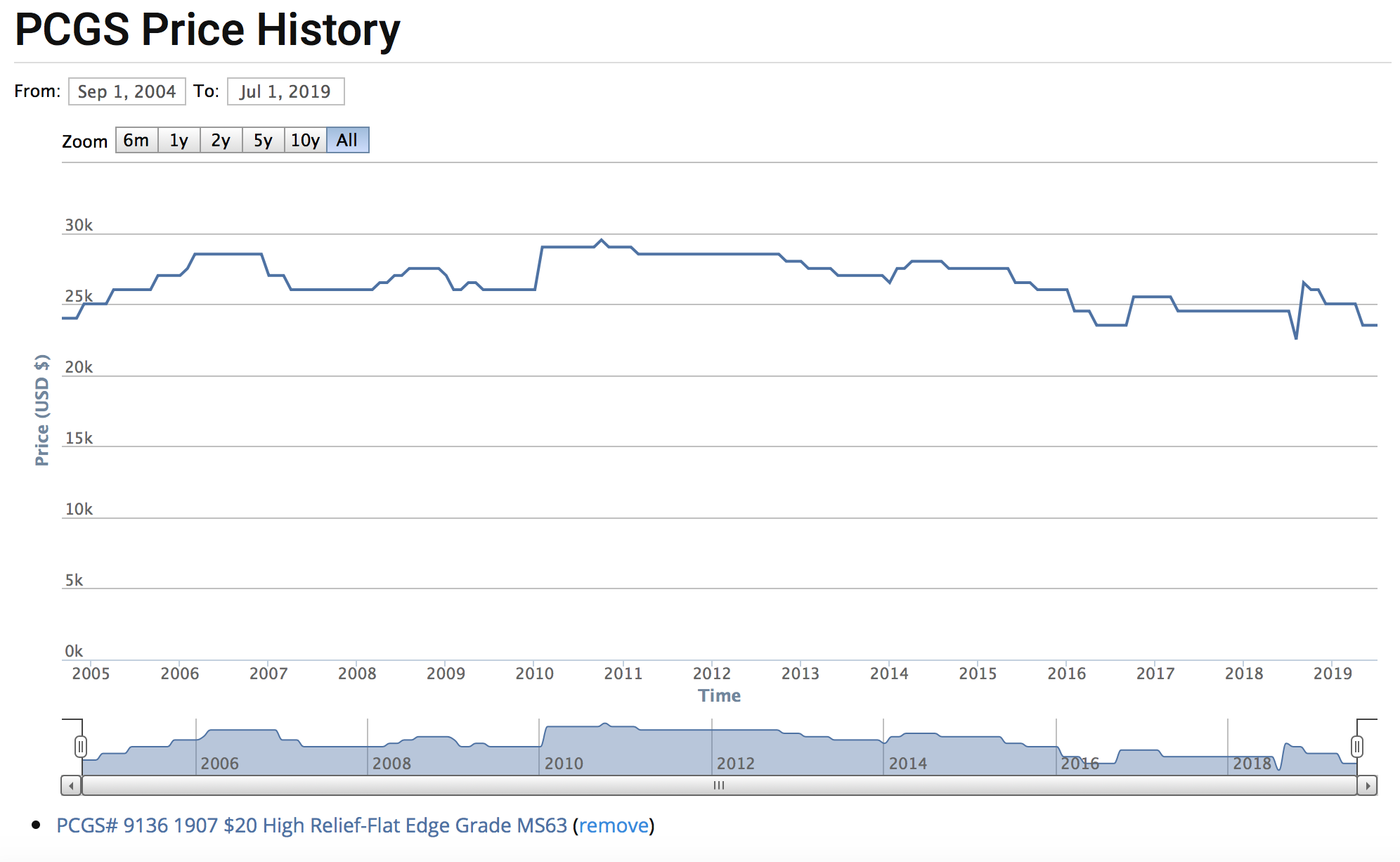

Considering adding a dream coin ($20 High Relief), but one aspect of this potential purchase is that bothers me is the coin has actually lost value with respect to inflation over the past 15 years. I know collecting is not all about return on investment, and I have enough money that if my collection was worth zero tomorrow, it wouldn't affect my standard of living at all, but when considering a $20k purchase, it is hard to ignore the possibility that this purchase will likely be worth less in 15 years than today.

As a collector, how do you reconcile this aspect of the hobby?

1

Comments

I believe everyone should ASSUME that their coins will lose value. And I mean nominal value, not inflation adjusted value. If you think of it as an "investment", you will get upset every time the price of your coins drop and you will lose the joy that comes from collecting.

Look at the PCGS3000. There are almost no coins that have kept up with inflation since the peak in 1989. Most coins have actually lost value in that period. If a drop in values bother you, collect pictures of coins in numismatic literature.

All comments reflect the opinion of the author, even when irrefutably accurate.

For me it's easy, pure and simple. It's a hobby, I am not looking at any return on these. The happiness I derive from them daily makes having my coin collection priceless to me and that's all that matters.

If it is not going to affect your lifestyle, I'd go for it.

That is my dream piece also. Donato

Donato's Complete US Type Set ---- Donato's Dansco 7070 Modified Type Set ---- Donato's Basic U.S. Coin Design Set

Successful transactions: Shrub68 (Jim), MWallace (Mike)

Collect for the enjoyment, the thrill of the chase, sense of satisfaction. Not everything has to be all about the "dollars".

Pun intended.

I don't. As you say, if the price decline is not going to affect your standard of living, what does it matter?

LIBERTY SEATED DIMES WITH MAJOR VARIETIES CIRCULATION STRIKES (1837-1891) digital album

How is the price history for PCGS CAC?

What!!??

My bullion coins aren’t an investment?!

Gotta go, on the phone with the Franklin Mint....

If I reconciled it I would have no coins.

They're not the best investment but they are still a good store of wealth and readily available funds.

As long as you're sensible in your spending, and I know that you are, then I would go for it.

Sometimes, it’s better to be LUCKY than good. 🍀 🍺👍

My Full Walker Registry Set (1916-1947):

https://www.ngccoin.com/registry/competitive-sets/16292/

Looking at your chart it seems to me that you are "Even Steven" over the last 15 years csdot, wanna see my chart?

You are being to nice Walkerfan.

My dream coin that will never happen in my time.

I share your concern, but I think that the answer is unique to each individual and the finances they are to spend on coins... i was type collecting, but realized that with my knowledge and time to look for deals (only average on both) combined with the money I could spend now normally $100-1000 per coin, that I was almost always going to lose money. So I am selling off my type coins and have been buying old gold type coins, but more as a bullion play...yes I pay more than melt for some, but the coins will always have melt value.

I also buy cwt’s now, because many can be found raw, and I can find many sub $100...plus with my average knowledge, I expect to break even or make a small profit in the future..

If I had more funds, I do believe coins special key coins in the $5000+ range will hold there value or increase ( say bust dollars or bust gold) ...why, because most people that buy these coins are not worried about discretionary funds...but for me, that would mean owning a collection of only 2-3 coins, so I passed on that route...

Last non coin thought, if you buy a car or luxury watch, you lose more than the coin as soon as you start using it, so if your sole concern is that it’s losing money...compare it to,other purchases that you make, while you don’t get use of the coin, you do get enjoyment.

My 2 cents

I sold off all of my type coins years ago SC, it was a bad decision on my part just for the fact that I wanted each and very coin minted in AU'ish condition.

Ain't going to happen.

As others have said, a neat coin, but readily available. But if you like to own one, get it, Just buy as nicest you can afford, preferably cac if possible, and don't over pay too much and you should be ok.

friend of mine bought one years ago, now this guy has unlimited funds, but bought a turd because he is cheap. He couldn't sell that thing if he had too

That "high price widget" talk regarding the HR saint makes me nervous but I'm thinking the same thing you are.

I've been really good with investmensts so I'm going to allow myself a bonehead move this one time.

My Saint Set

Widgets get a bad rap. 99% of the market are widgets. Most of course are still enjoyable collectibles.

All comments reflect the opinion of the author, even when irrefutably accurate.

I want one of these as well but it might well not appreciate given that there are dozens for sale at any given moment on the internet (67 today on collectors corner) , a few in every Heritage auction, and I have even seen a few at my local monthly coin show recently.

The opportunity cost of owning any collectable is often overlooked...even if you ignore stock market returns, it will cost you $600 a year in lost CD interest @3% to hold a 20K coin.

Commems and Early Type

I price my enjoyment time at $150/hr so I would just need to enjoy the coin for 4 hours a year to break even on the opportunity cost.

Coins are my hobby (one) and I use discretionary funds and do not consider them as an investment. I do not sell coins, so I am not concerned with monetary value. I enjoy them for the history and art. I do stack gold, but that is just a hedge against the SHTF scenario. Cheers, RickO

You can make money buying and selling coins ("Dealer," not "Investor"). But, you gotta know what you are doing--get educated, prepare a business model, and pay your dues! HOWEVER, 99.9% of coin "Investors" will not make money in the rare coin market. PERIOD!!! The PCGS charts showing coin prices sloping down from upper left to lower right are a misrepresentation. It's far worse once you account for buy/sell fees, slabbing, storage, inflation, labor, research, stress, and the minimum 2% annual ROI you're losing (CD).

Loved it!

So if you bought a cheap 20k car and had it for 15 years and decided to sell it would you be unhappy if all you lost was the labor, interest & depreciation ? If your buying Gold as part of your investment group and it is down a little after holding it for years when you sell then you have to add in the gains of other items before you calculate the total. Loss in prices it is unrelated to that specific coin.

You need to decide what your doing here. Buying your Dream coin car house boat etc or looking to invest in gold.

Best place to buy !

Bronze Associate member

A wise numismatist once told me that coins we acquire are in our possession (or in the possession of our heirs) only temporarily, and we are the custodians of these coins, making sure we care for them while they are in our possession. While with us, they provide pleasure, and the “cost” we incur is the rental fee that we pay to have them for that time period. So what’s your estimate of the ANNUAL rent you’ll be paying to have custody of this coin? Look at it that way, as an annual rental fee. For my coins, they provide me tremendous enjoyment/value for the rental fee incurred.

My collecting “Pride & Joy” is my PCGS Registry Dansco 7070 Set:

https://www.pcgs.com/setregistry/type-sets/design-type-sets/complete-dansco-7070-modified-type-set-1796-date/publishedset/213996

Why should someone buy the “nicest you can afford”? I often see that advice, but don’t necessarily think it’s sound. What’s wrong with buying a perfectly nice coin that you like, but which isn’t the “nicest you can afford”? You can use the money you save for something else - even another coin.

Mark Feld* of Heritage Auctions*Unless otherwise noted, my posts here represent my personal opinions.

Coins are generally lousy investments. You quickly learn that when you sell, whether you’ve owned a coin 1 year, or 25 years. Selling will open really your eyes. My goal is to break even!

Buy coins you love and enjoy, and keep them safe for the next generation. In a way, we’re all just renting them anyway.

Dave

Great comments all.

For better or for worse, I have not caught the CAC bug like many here, so I wouldn't know where to find a "price history for PCGS CAC?"

Indian Head $10 Gold Date Set Album

I'm sorry but that oft repeated slogan is dealer propaganda in my book. Buy the best that makes sense and/or is desirable to you.

You haven’t shared how this coin fits into your collection from a relative vale perspective. Will it be the most expensive by a large margin? Will it bring you stress owning it because of its value? If so, I’d say pass. If not, go for it and enjoy. In high priced gold, I’d recommend a CAC coin to help protect your resale value given market realities.

"Got a flaming heart, can't get my fill"

It would be the highest priced coin in my collection by far. The CAC MS63 looks to run in the @$20k-$25k range, and the highest value coin I currently have in my collection is $4.5K.

I am working on a date set of Saints (except the really high priced ones 1921, 1929-1933), so this coin certainly fits into my collection from a collector perspective.

Indian Head $10 Gold Date Set Album

Thanks for the reply. Guess it then comes down to your comfort level with a major financial commitment to your hobby.

"Got a flaming heart, can't get my fill"

I consider this all the time. Now that interest rates have risen I do a simple calculation in my head. Number of years I will own the coin X 5% annual interest income lost. Now interest rates could tank or reduce, but I consider it now on EVERY coin. This filters out all the frivilous purchases I might make.

20K X 15 years at 5% (not factoring compounding interest) = $1000 a year lost opportunity cost x 15 years. Basically, by not buying the coin, saving the picture of the coin to enjoy as a screensaver you make roughly 15K. This does not even factor potential drop in prices or auction fees when you go to sell.

I personally do not buy coins above about $1,500 for this very reason. Sure, I still lose on the $1,500 coins, but hell I have to collect something.

Take the $1,000 you make every year and buy yourself a nice $10 Eagle.

I also don’t completely agree with this advice. If the nicest I can afford is an MS63, and the nicest my friend can afford is a VF, it doesn’t make sense that these can both be the “right coin” from an investment perspective. But I think what this phrase is trying to say is: “Buy a coin you will be happy with for the long term, don’t buy a cheaper so-so piece because inevitably you will decide to upgrade it at some point and between the two coins you will have spent more than if you had just bought the better coin in the first place.”

LIBERTY SEATED DIMES WITH MAJOR VARIETIES CIRCULATION STRIKES (1837-1891) digital album

To me it just means: don't be cheap. If there is a scratchy, cleaned VF20 coin for $80 (cheap) or a similar VF20 super clean, choice original coin for $200.00. You buy the $200 coin.

The scenario is flawed...who says the grade has remained constant over those 15 years?

Agree...I'm not really a Cacker either.

Although the guy (JA) is really good at grading, I have a slightly different idea about esthetics.

I've had trouble figuring out how to grade HR coins so I'd have to rely on CAC or do a bunch of studying.

Anyway...Here's the link. (you can click on different stuff like grade/CAC/PCGS etc)

https://www.pcgs.com/auctionprices/details/1907-high-relief-wire-edge-ms/9135

My Saint Set

If return on investment is your goal then stay away from collectibles. Very few are good "investments".

Ask a few questions...

Does it matter TO YOU that it has lost value vs. inflation?

If it's a hobby is it really required to 'keep place with inflation' to be desirable?

INVESTMENTS are not NET WORTH. The accoutrements of our hobbies/life can be part of our net worth without having to perform like an investment.

The only things I expect to keep pace with (well actually, exceed) inflation are my actual investments which are a healthy mix of stocks, bonds, real estate in various instruments, and possibly a small smattering of bullion (not all asset classes are really there to 'keep pace' or 'exceed' as an individual asset class but to work together as a whole to theoretically optimize the overall portfolio return over time with regard to risk/return).

Now, some people lump collectibles as a part of their asset allocation mix, though I don't officially. In that case then one is buying the collectible (wine, art, coins, etc) without regard to personal aesthetics but only as an investment. Boring IMO. Except the wine, you can always drink the wine.

So, where do hobbies fit in? Are they investments or are they for personal satisfaction?

IMO they are for personal gain not monetary gain. It just so happens what we collect can have value and though it might be part of my NET WORTH, coins (other than straight up bullion) are NOT part of my investment portfolio. My hobby could be travel which has a lot of benefits and no monetary gain. Buying shoes. Running marathons (as if), photography (can monetize, but not really), working in a dog rescue etc. Very little are expected to do anything other than suck up discretionary funds.

My coins are collected with discretionary funds. Just like about 25% of my car's cost is 'need' (ie I have life requirements for work and daily living that a car is required for), and 75% is 'want' and came out of my discretionary budget--which is why I'm not buying as many coins lately . A car is a needed and depreciating asset, but it is also part of my 'net worth'.

. A car is a needed and depreciating asset, but it is also part of my 'net worth'.

What about housing?

Many people call their home their investment. Well, not exactly. You have a basic need for housing and a budget to cover that. If you have purchased (or are in the midst of purchasing) a home then yes, that is part of your net worth too.

But, where you live is not (again IMO) part of your investment portfolio. If you love your neighborhood, location, school system, etc do you really care and think to move just because real estate value fluctuates?

For our home 'investment return' was not considered other than having a happy spouse, a great place to raise the kids, being near my lovely (really!) in-laws who need more help nowadays etc. Technically, it would have been a 'bad' investment. One can downsize and get equity etc, but that does not change the fact you still need a place to live and those choices are not dictated by financial gain.

In contrast REITs and rental property do make up part of the investment portfolio--and I'm fully cognizant of how they are valued and what their role is in my overall mix. The duplex for example was not purchased with anything other than the return factored in which is completely different than my home.

So, where does that leave your coin you want?

Do you really have to have a hobby that paces inflation? Is part of your enjoyment of your hobby the thrill of making money--nothing wrong with that, just acknowledge if that is the case and if this particular coin fits. Or, do you just really love the coin and would buy it with discretionary funds even if it's a depreciating asset (like buying a mid level Tesla Model 3 for $50K instead of a nice used car for $15K)? What gives you joy in your hobby?

These are the things you have to factor in. And it's not always easy!

To the OP. If owning the the High Relief is an experience you desire, then go for it.

All good points made about why or why not. All psycho babble justifications to either talk you into it or out of it. In the big picture, none of it matters.

This isn’t a practice life, you only go around once.

Ditto - I don't. The High Relief Saint is one of my dream coins as well, but I'm not yet willing to prioritize that much money into a single coin.

If you’re going to derive enjoyment and pleasure from owning a HR, and as long as you can afford one, go for it. We only get to go around once. If you’re buying the coin as an investment there are literally thousands of better options.

That is a much shorter and better version than what I typed out.

The High Relief St Gaudens is a true dream coin to many collectors, myself included. Unfortunately, it remains out of my reach for the foreseeable future.

BST transactions: dbldie55, jayPem, 78saen, UltraHighRelief, nibanny, liefgold, FallGuy, lkeigwin, mbogoman, Sandman70gt, keets, joeykoins, ianrussell (@GC), EagleEye, ThePennyLady, GRANDAM, Ilikecolor, Gluggo, okiedude, Voyageur, LJenkins11, fastfreddie, ms70, pursuitofliberty, ZoidMeister,Coin Finder, GotTheBug, edwardjulio, Coinnmore, Nickpatton, Namvet69,...

If you want the coin, go for it! Think of the price drop as the coin being on sale...

My YouTube Channel

I'm not seeing a chart with enough volatility to worry about it. But if you are going to go by the technical definition, then what I see is a buy low opportunity?

The track record of a coin over the long haul is what I consider most. The pops for the high re-leaf are to high until you get to the high grade unc level to justify buying one for an investment. At this point they get very expensive. There will always be plenty of these coins in the lower end of the unc scale and lower to be had so I would avoid buying one unless you want it for what it is not what it might do in the future in terms of appreciation.

I like branch mint gold that is in au and go with the grade where the pop numbers start to get very low. An example is a $20 1850 O pcgs 55. In au 53 and below they are common but finding an accurately graded pcgs au 55 gets very tough. Point is in this case an au 55 is what I want if a 58 is too expensive and they are. The rare grades are easy to sell and appreciated the most. They are easier on the eye as well. The pop reports for the rarer coins are overstated as many collectors see a tick up on a grade and they feel the coin will bring several more thousand dollars. This is in my opinion why so many of the dealers get their coins in NGC slabs. The market is pretty good at discounting this when buying a rare coin in an NGC holder for this reason but rare coin dealers like Monaco use NGC for their grading almost exclusively.

If I had to pick one grade to own it would be an au 58. The next bump up is a 60 if any exist and they are unc but look pretty bad in terms of eye appeal.

The vast difference in this example is that an auto has immense utility. If you make 70k a year. That car will help you to earn over a million dollars. Neither gold nor a gold numismatic coin is an investment. It is where you park some money, and in the case of a numismatic coin, in this market, when you go to unpark that money, you will drive home with less than you parked, probably north of 20%. This losing strategy doesn’t even factor in opportunity costs.

Selling a 5k coin on Ebay is virtually impossible. Imagine the difficulty finding a buyer for a 20k coin unless you use an auction house or dealer who want be offering any deals on this common of a coin. That selling transaction fee will be minimum 10%, probably 20%.

Think hard before you plunk down big money on a coin. Buying is so easy, selling is not.

Tyler

I can sell anything you have in less than an hour. Selling it for a price that you'll like, that's not always easy...

I collect for the enjoyment of owning the coins - being able to examine the designs, enjoy the artwork and history involved. If I like the coin, I pay the price. The chance that it might not keep up with inflation doesn’t cross my mind at all. I really couldn’t care less about that. Coin collecting is a hobby, not an investment.