Best Of

Re: Old school B&Ms

In the Spring of 1966 my two oldest brothers needed to go to downtown Detroit to see about their impending Draft induction, and I had seen an ad in the Sunday Detroit News from dealer Earl Schill (behind Hudson's department store) offering BU $20 Libs for $50. I wanted to own a gold coin, so I scraped up some cash and some trading material and the brother who was driving dropped me off at the shop. I bought a nice BU 1900-S $20, and even sprang for $1.29 for a Capital Plastics holder for it. I was 15.

In 1968 I started going to Wayne State University a couple of miles north of downtown, so occasionally after classes I would walk down Woodward Avenue to Mr. Schill's coin shop, hitting a couple of used book stores along the way. He understood that I was a student with little or no money, but if there were no customers in the store he would show me glorious things like Bust Dollars and Large Cents and other wonders. Whenever a customer came in I would step away from the counter and go look at the books on the shelf.

He was a true gentlemen, and when I worked for Harlan Berk in his shop I tried to honor the memory of Mr. Schill by treating (most) customers as Mr. Schill had treated me.

TD

Re: Rare Errors/Variations 1990s and Older

@mrhighgrade said:

Anyone have any pics of these error cards?

I have several listed on eBay. https://www.ebay.com/sch/i.html?_dkr=1&iconV2Request=true&_blrs=recall_filtering&_ssn=jfkheat&_oac=1&_nkw=error

Lost Jokic NBA Card Sold on eBay Turns up on COMC

This is a crazy situation. Guy buys card on ebay, it disappeared then ended up on COMC's ebay

https://www.collect.guide/lost-jokic-nba-card-sold-on-ebay-turns-up-on-comc/

Re: Let’s see your new purchases!

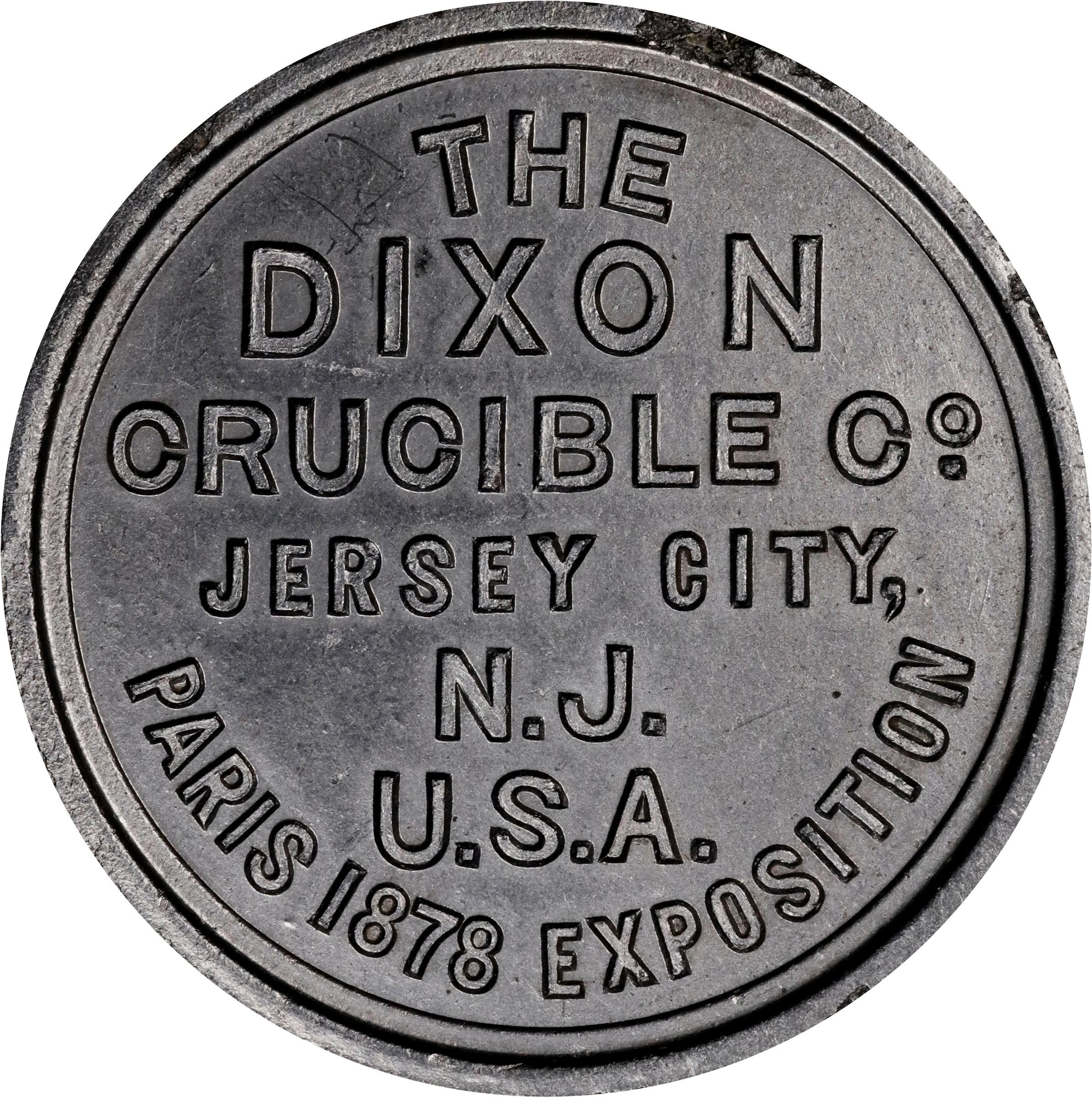

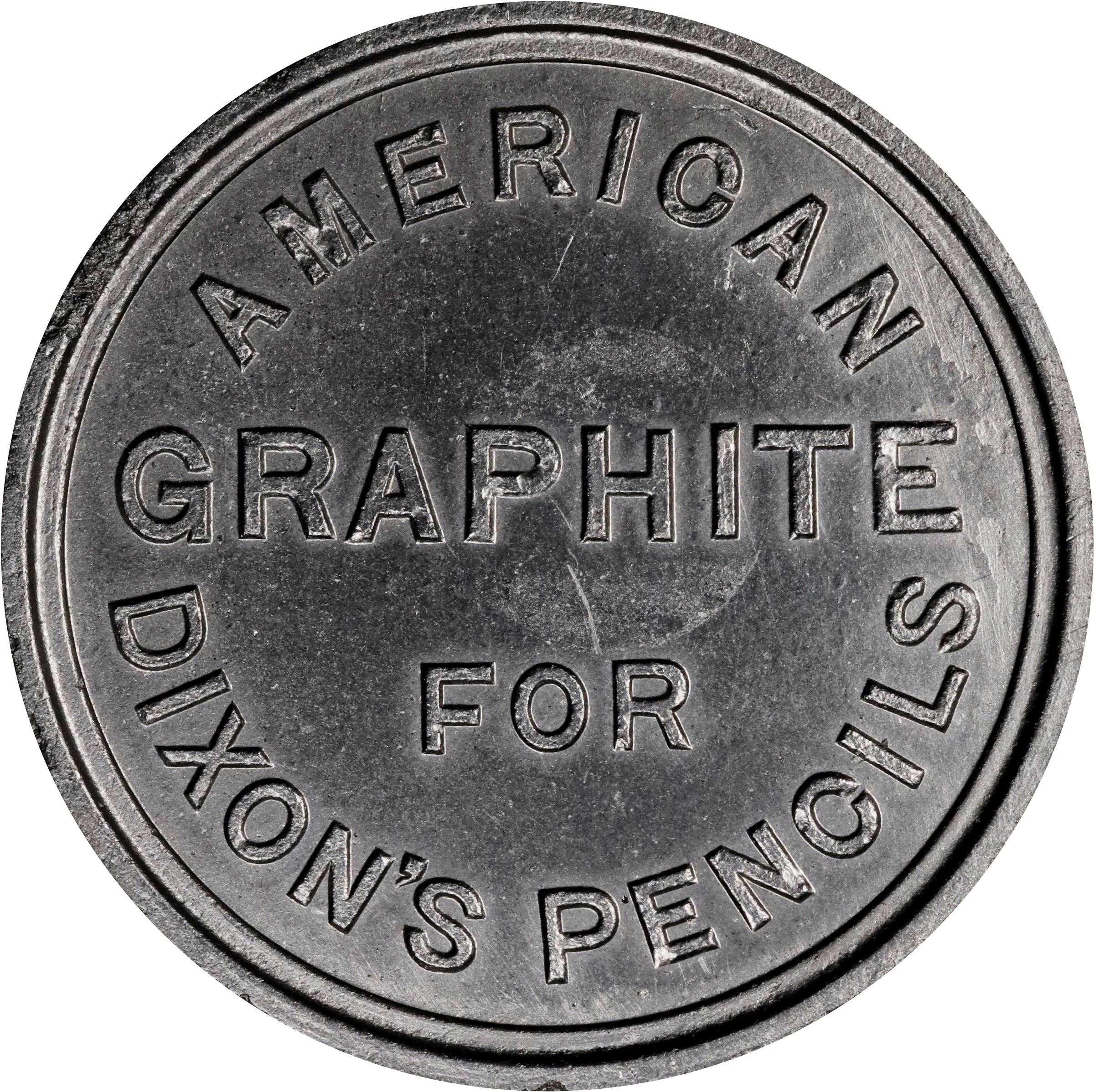

@SimonW the medals were company advertising medals, not specifically for Ticonderoga pencils. I only mentioned the pencils as being made by Dixon in my school days.

This one is from a second pair that came up recently at Stacks. Prior to these, I thought each of mine was unique. So this image isn't that of my medal, but an identical one. (All are unslabbed due to fragility.)

pruebas

pruebas

Re: "Never go shopping when you're Hungry!" On The Menu: My most Meticulous product to RIP!

@JBK said:

@joeykoins said:

@JBK said:

Am i missing something here?There are several of those cards on ebay and one just ended at $81. Some have sold for less, some for more, but none as high as $250 that I can find.

But are the ones you're seeing at only 25?

The ones I saw were numbered Iike yours, #X of 25.

I missed that sale at 81$ my mistake. That seems cheap compared to other cards numbered to 25 with auto. Joey do not sell it for 81$ you can get 125$ at least. Some of his numbered cards to 50 sold for more than 81$.

These cards seem all over the place price wise. Pujols numbered to 75 one sold for almost 300$ Canadian then another for almost 500$ Canadian. I state Canadian dollars since I am in Canada.

The Ultra-Rare, nay, UNIQUE! 1823-O Half Dollar!

So anyway, when I was at ANACS the people who opened incoming packages were trained to look at each package for anything unusual before they opened it, in case it had been tampered with or whatever, and bring it to the Office Manager's attention. One day one of the ladies brought back a Registered Mail box roughly one foot cubed that was undamaged, but had approximately $500 in cancelled stamps completely covering the outside. The Office Manager called me over and we calculated from the postage rate sheet we had that it must have had a declared value of about $500,000! I called the Director and two other Authenticators to come over and be witnesses as the Office Manager opened the box.

In it was a VF-EF-ish 1823 Bust Half with a submission form that listed it as an 1823 "O" mint mark coin, with a declared value of $500,000. There was also a check for roughly $1,000, to cover our fee for that declared value, and the same return postage already spent on getting it to us.

I looked at the coin and saw that it had a few very vaguely circular scratches above the date, where the O mint mark did eventually appear when the New Orleans Mint eventually opened in 1838. I told everybody that they could go back to work, and after the coin was duly logged in and photographed and weighed (per standard procedure) I took it to my desk and looked it up in Overton. It was a very common variety, worth at the time maybe $80?

We had a policy of being nice to people who had no idea what they were doing rather than just taking their money and screwing them, and so I wrote the lady a nice letter explaining that the New Orleans Mint did not open until 1838, so it was impossible for her 1823 coin to have an "O" mint mark. I also explained that it was a known variety for the year, from Philadelphia, and enclosed a photocopy of the page for it from Overton.

Normally we did not give values for coins submitted to us, but I told her that it was worth about $80 or so, and that if she would change her declared value IN WRITING to, say, $100 we would refund all but about $15 of her check to cover our fees and the return postage for a $100 coin. I mailed it off and put the coin in the vault for safekeeping

A few days later she called me and insisted that the coin had an O mint mark. I explained that what she was seeing were just a few random scratches, but she could not be convinced that it was not an O. After two more conversations I asked her to send me a letter stating that she had been advised that the value was far less than $500,000, and confirming that she wanted us to proceed with the authentification of the coin. She sent the letter and we issued a photo certificate certifying it as an 1823 Half Dollar with whatever the grade was, and the Overton number, and mailed it back to her via Registered Mail with a declared value of $500,000, even though the most that the Post Office would pay off on a Registered Mail package back then was $25,000 (IIRC). I did make sure that her check had cleared before we sent the package.

I few days later she called all excited. She had gotten the package and the certificate! She asked "Does this mean that it is genuine?" and I said "Yes, it is a genuine 1823 Philadelphia Mint Half Dollar." Ignoring what I just said, she said "Does this mean that it is worth $500.000???" and I said "No, as I told you several times, it is worth at most $100!" She said "WELL! I'VE BEEN CHEATED AGAIN!!!"

TD

Re: Old school B&Ms

The very first B&M shop would have been around 1972 in Jacksonville NC just off the base at Camp Lejeune. There was a place called The Hobby Shop. My brother used to go there to race slot cars too. They also had 2 roller displays and 3 ring binders full of coins in 2x2s awaiting PVC damage... ![]()

I bought my first 18th Century US coin there... a 1798 Draped Bust Large Cent AG3... for $10.

https://www.youtube.com/watch?v=GtUjEYFLehI

https://www.youtube.com/watch?v=GtUjEYFLehI