Best Of

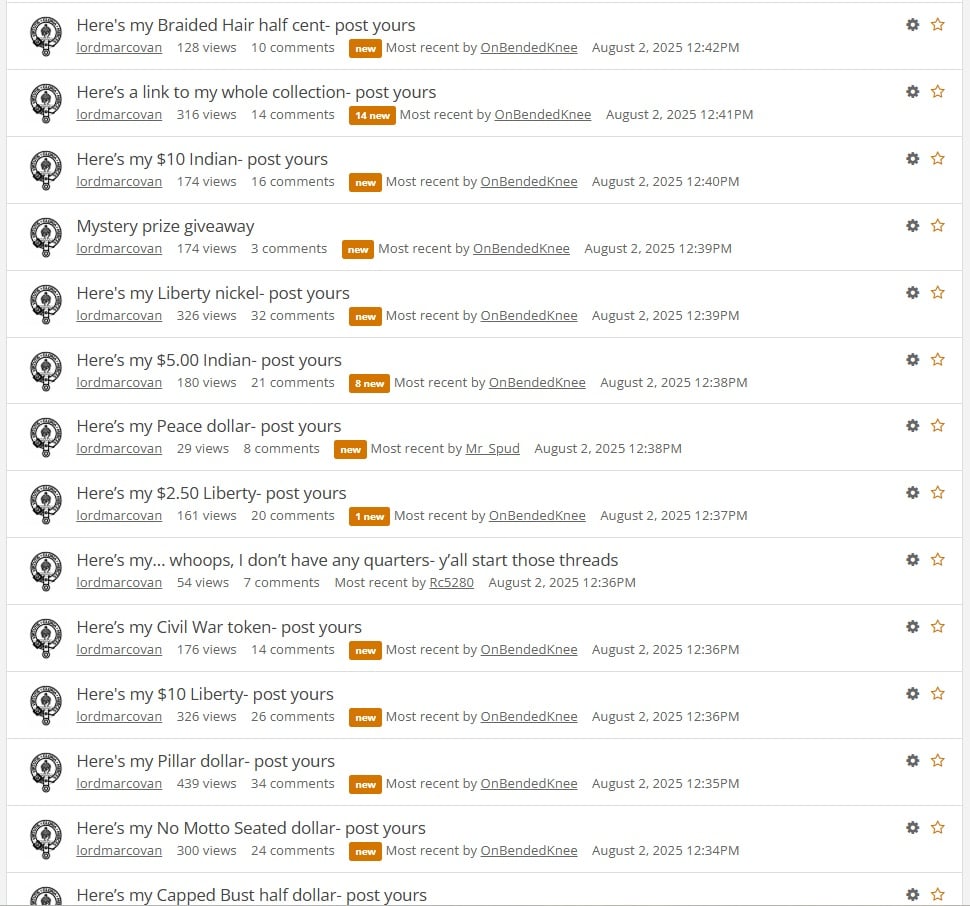

Re: Lordmarcovan, are you having an ADHD moment?

Personally, I'd rather see someone who starts a lot of threads to stimulate discussion, instead of someone who makes a lot of posts to stimulate arguments. (That's not a reference to anyone on this thread ![]() ).

).

JBK

JBK

Re: @lordmarcovan, please allow other posters’ threads some additional room on the first page here…

Hmmmm….I see what you mean. But I’d also like to point out that it’s because the posts are popular that they continue to get bumped to the top by other forum members and not by lordmarcovan.

Mr_Spud

Mr_Spud

Re: RIP Forum Member - VanHalen

He was one of the good ones! I’m so sorry! It’s a loss for us all😢

Re: 250th Anniversary United States Army American Eagle One Ounce Silver Proof Coin

@MsMorrisine said:

@SuperRecord said:

Unfortunately I'm so new to the hobbybuy it because you like it, not because you will make money

I purchased this particular coin because my Father fought in Vietnam as a Warrant Officer in his 30's. I'm going to buy the Marine Corps release to honor his service when he was a 18 year old Marine fighting in Korea. Two branches, two wars. A better Man than me.

SuperRecord

SuperRecord

Re: Lordmarcovan, are you having an ADHD moment?

@lordmarcovan said:

I’ll pause for a few days.

We appreciate your threads and posts (over 43,000) and your recent threads bring a welcome and refreshing addition to the forum.

Byers

Byers

Re: @lordmarcovan, please allow other posters’ threads some additional room on the first page here…

I like them, but then again I’m just here for the pictures of coins. I get bored too easily with the threads that turn into endless debates that don’t have coin pictures in them.

Mr_Spud

Mr_Spud

Re: Who else is going to the National ?

@Yankees70 said:

@gemint said:

@mintonlypls said:

I noticed the older man’s unopened were all raw….buyer beware. I would only buy PSA-slabbed unopened.That's Steve Sabow. Run as fast as you can. He had most of the same packs at the 2021 National. He refuses to get them authenticated.

Did he give a reason why he refuses to get them certified? You would think if he knew for sure they were legit packs he would have them certified as he would be able to sell them for a higher price.

I never bothered to ask him. I've heard the reasons he gave from advanced pack collectors but since I didn't hear it directly from him, I won't post it.

Re: BRNA Show Report

@Merc said:

Thanks for the report. I did not know Dalton GA had a coin show until I saw it listed on the PCGS main page.

@Walkerguy21D is correct the GNA (Georgia Numismatic Association) show is held there in the spring, usually in April and the BRNA ( Blue Ridge Numismatic Association) in the fall. I don't know why these shows don't get more publicity as they are both well attended great shows with something for everyone buyers and sellers alike.

tommy44

tommy44

Re: BRNA Show Report

@Merc said:

Thanks for the report. I did not know Dalton GA had a coin show until I saw it listed on the PCGS main page.

I believe the GNA show is also held there in the spring. Both shows are popular with the Florida dealers that I talk to, and worth their while to attend.