Wonderful day in the “Gutter “ neighborhood. I'm amazed at how fast we moved up. Funny how fast things can move when government and banks aren’t controlling things.

Mike

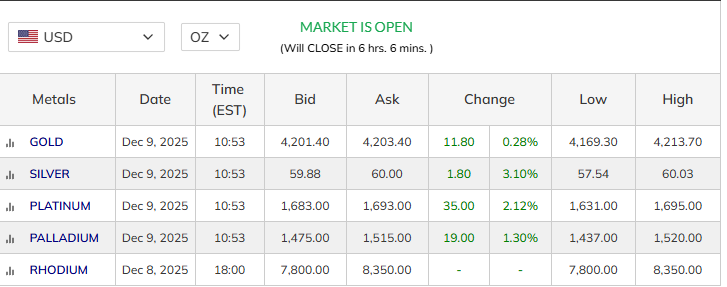

S&G climbing on expected rate cut tommorow. Be ready to very quickly dump the paper and buy the inverse ETFs if rates hold steady. Witching hour is Wed. afternoon.

que the platinum/paladium squeeze, silver vaults have now been re-upped.

Expect 20% gains in the two "Ps" next year

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

I'm buying the same as I always do. Getting more costly in paper terms for sure. Don't think I'm wholesale. But I would imagine most LCS are seeing a significant majority of sellers ATM.

Retail isnt buying as evidenced by fellow forum members observations. My LCS guy also reports no retail buying.

Last week I sold a little Ag (rounds and cull Peace dollars), Au (eagle), and Pt (eagle) to my local big bullion coin shop. I more or less got the buy prices quoted on their website, as usual. This was on a weekday and all customers (3 or 4) in the store during my visit were selling silver. Employee remarked that on the prior Saturday people were lined up out the door to sell silver. I'm glad to gradually sell off some for nice gains. I'd list some on the BST here if I thought there were buyers close to midway between what the bullion dealer buys and sells for.... but I don't think that is realistic.

Called cities largest local dealer:

$2 below spot for ASE

$5 below spot for JM pressed bars

I don't hoard %90 so didnt ask

Fun times

@jdimmick said:

90% across the board, is way back from minus 5 to minus 7 depending on company

Seems obvious that it isnt physical buying pushing prices higher.

There are at least three physical markets: retail and industrial and government. As others have pointed out retail isn't but where's your data to show the other two aren't? The US government recently declared silver a strategic/critical mineral. No one should be surprised if our government and other global governments ramp up physical purchases.

Called cities largest local dealer:

$2 below spot for ASE

$5 below spot for JM pressed bars

I don't hoard %90 so didnt ask

Fun times

@jdimmick said:

90% across the board, is way back from minus 5 to minus 7 depending on company

Seems obvious that it isnt physical buying pushing prices higher.

There are at least three physical markets: retail and industrial and government. As others have pointed out retail isn't but where's your data to show the other two aren't? The US government recently declared silver a strategic/critical mineral. No one should be surprised if our government and other global governments ramp up physical purchases.

Oh, and we just hit $62.

Govt and industrial is not retail.

But....

Where is your evidence that the US govt is buying silver? Nickel and gallium were also declared critical metals...what are prices of those doing?

Isn't it possible that it's just the paper players pushing prices higher? Nice alliteration, eh?

Isn't it possible that it's just the paper players pushing prices higher? Nice alliteration, eh?

And no one else is buying the stuff? Then call it what it is - price manipulation. LOL

So now you say the price is being manipulated higher? By whom? What is their agenda?

Is this a different group of "them", or the same?

LOL. you're the one who said no one is buying while the price is rising. Why is it rising? And if it's because of paper (SLV) then physical is being bought - SLV claims to back their paper with metal.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Isn't it possible that it's just the paper players pushing prices higher? Nice alliteration, eh?

Guess you don't understand the paper players cause the SLV Trust to buy physical silver. So in 70 days SLV had to buy 10.5MM ozs of physical silver and 50MM ozs from last year. Now isn't that included in retail or what.

Most people don't know this but larger buyers/owners (Authorized participants) of SLV shares can convert their shares to physical delivery.

And when people buy into the SLV ETF, the fund is required to acquire that much more physical silver. Thus, it is a drain on available metal in the market.

Q: Are You Printing Money? Bernanke: Not Literally

Comments

Yes, Comex hit $59.04 earlier.

http://ProofCollection.Net

that's the may 2026 contract. the front month is march 2026 which hit only 58.61

if it's pick and choose months then go december 2026 which hit 60.04

unsavory and the situation s pointing me a bit more to just using cash

You're right, I was looking at the wrong symbol. The front month contract is the most appropriate.

http://ProofCollection.Net

There we go, $59 is here.

http://ProofCollection.Net

OUCH!

Loves me some shiny!

Cut yourself? lol

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Dumped a boatload of SLV going into the close today. We shall see what next week brings.

I predict that you'll just buy it back at higher price in the very near future.

I knew it would happen.

I predict you will be wrong as usual. THKS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

.> @ProofCollection said:

Gutterdude was right wrong.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Someone we know is going to have a big case of FOMO shortly.

I knew it would happen.

Bro will spin another lie about perfect market timing with screen shots created in MSFT Paint

Loves me some shiny!

History rhymes:

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Shanghai silver inventories have collapsed to decade lows.

"It’s a shell game. And the shells are running out."

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

LOL someone got all jealous again. It's not rocket science, just takes a bit of WORK. THKS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

chart title "silver"

line legend "gold"

chart title "silver"

line legend "gold"

red line = silver that is being traded on the Shanghi Gold Exchange

grey line = silver that is being traded on the Shanghi Futures Exchange

I knew it would happen.

faulty map generator. i wonder about the source

It's not faulty. That's what's happening.

I knew it would happen.

$60 silver is happening right now.

http://ProofCollection.Net

Can't wait to see your 'screenshot' !

Loves me some shiny!

KA BOOOOOOOOOM

COPPER is gutter !

WOW.

Click on this link to see my ebay listings.

If you must:

http://ProofCollection.Net

Wonderful day in the “Gutter “ neighborhood. I'm amazed at how fast we moved up. Funny how fast things can move when government and banks aren’t controlling things.

Mike

MIKE B.

Silver be BOOMIN!

Philippians 4:4-7

I've been waiting a long time for this .

S&G climbing on expected rate cut tommorow. Be ready to very quickly dump the paper and buy the inverse ETFs if rates hold steady. Witching hour is Wed. afternoon.

que the platinum/paladium squeeze, silver vaults have now been re-upped.

Expect 20% gains in the two "Ps" next year

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

sold off AGQ around 1 pm EST at 120.56 only to watch it rise $2 in the next 4 hours!

red hot spot....hope I can jump back in if it corrects below $115

Called cities largest local dealer:

$2 below spot for ASE

$5 below spot for JM pressed bars

I don't hoard %90 so didnt ask

Fun times

Loves me some shiny!

buying or selling?

those are buy quotes

Loves me some shiny!

90% across the board, is way back from minus 5 to minus 7 depending on company

Seems obvious that it isnt physical buying pushing prices higher.

Knowledge is the enemy of fear

At least not wholesale buying. Retail sales are pushing prices higher. . . unless you have a good conspiracy theory.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

3i/atlas is powered by solar panels framed by clear aluminum. scientists are cornering the market for huge, later profits

Retail isnt buying as evidenced by fellow forum members observations. My LCS guy also reports no retail buying.

And the conspiracy stuff is your wheelhouse.

Knowledge is the enemy of fear

I'm buying the same as I always do. Getting more costly in paper terms for sure. Don't think I'm wholesale. But I would imagine most LCS are seeing a significant majority of sellers ATM.

COPPER is gutter !

Last week I sold a little Ag (rounds and cull Peace dollars), Au (eagle), and Pt (eagle) to my local big bullion coin shop. I more or less got the buy prices quoted on their website, as usual. This was on a weekday and all customers (3 or 4) in the store during my visit were selling silver. Employee remarked that on the prior Saturday people were lined up out the door to sell silver. I'm glad to gradually sell off some for nice gains. I'd list some on the BST here if I thought there were buyers close to midway between what the bullion dealer buys and sells for.... but I don't think that is realistic.

There are at least three physical markets: retail and industrial and government. As others have pointed out retail isn't but where's your data to show the other two aren't? The US government recently declared silver a strategic/critical mineral. No one should be surprised if our government and other global governments ramp up physical purchases.

Oh, and we just hit $62.

http://ProofCollection.Net

Govt and industrial is not retail.

But....

Where is your evidence that the US govt is buying silver? Nickel and gallium were also declared critical metals...what are prices of those doing?

Isn't it possible that it's just the paper players pushing prices higher? Nice alliteration, eh?

Knowledge is the enemy of fear

And no one else is buying the stuff? Then call it what it is - price manipulation. LOL

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

.

Somebody wants 1000-oz "COMEX" type bars.

Ask yourself who is buying those, why are they buying them, and does that constitute "physical" buying.

.

Who?

Knowledge is the enemy of fear

So now you say the price is being manipulated higher? By whom? What is their agenda?

Is this a different group of "them", or the same?

Knowledge is the enemy of fear

Isn't it possible that it's just the paper players pushing prices higher?

Paper players in SLV are pushing the price higher, and so are the Comex players who are taking delivery in large amounts.

And when I've been buying 90% silver lately, I'm helping in a small way.

I knew it would happen.

.

You ask questions on this forum all the time, expecting people to think about it and answer.

Now it is your turn to think and answer.

.

LOL. you're the one who said no one is buying while the price is rising. Why is it rising? And if it's because of paper (SLV) then physical is being bought - SLV claims to back their paper with metal.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Guess you don't understand the paper players cause the SLV Trust to buy physical silver. So in 70 days SLV had to buy 10.5MM ozs of physical silver and 50MM ozs from last year. Now isn't that included in retail or what.

Wait for it. . .

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Most people don't know this but larger buyers/owners (Authorized participants) of SLV shares can convert their shares to physical delivery.

http://ProofCollection.Net

Most people don't know this but larger buyers/owners (Authorized participants) of SLV shares can convert their shares to physical delivery.

And when people buy into the SLV ETF, the fund is required to acquire that much more physical silver. Thus, it is a drain on available metal in the market.

I knew it would happen.