@blitzdude said:

Paper price is $56 but dealers are only offering $45-50 in the physical world. Stuff like 90% and less the refiners don't even want it. RGDS!

Actually, spot is a physical price. As opposed to futures, which are paper.

According to my interweb, right now, as I post this on Sunday morning, closing futures on Friday were $57.03. Spot, according to Apmex, right now, is $55.33 Bid, $56.67 Ask.

Anyone offering $45-50 right now is just charging a ~10% commission to stand in the middle of a highly liquid transaction. It is not a reflection of pricing in the physical world.

The buyers at $45-50 can easily get a risk free flip at $55.33. Period. Just like we do at 7:30 a.m., chasing Mint sell outs that are going for 2x or more on eBay.

It's not quite that simple. The form of the silver matters. If they aren't comex bars, there is processing required.

Spot is not Comex bars. That's futures.

Spot is generic silver. And US Government silver is better than generic silver.

Dealers are just screwing people. Because spot is spot. And there is a VERY liquid market at spot.

Argue all you want. I'm not wrong.

Apmex publishes a bid/ask spread. The difference represents a liquid market dealer markup. Anything beyond that is called "excess profits" where I come from.

There is no "processing" involved in buying and selling ASEs. Just screwing the public. In and out, if the bid is below the widely available published bid. The ask is a different story, since ASEs trade at a premium to spot. As a result, the dealer bid should also be above the bid, because they cannot buy fresh ASEs from the Mint at spot.

Again, it's not that simple. Spot price is comex bars and the like because it is set by institutional buyers. If you walk into a BM with a 1 oz silver bat, what is that store going to do with it?

There aren't enough retail customers coming in to buy that 1 oz bar. So you have to aggregate. If you sell out to a wholesaler, it has to be shipped and it will be melted. That's not free.

My friend was buying at $52 Friday. He scrapped it at $54. That is hardly dealers ripping people off. And he only got that price because he has volume and is near a wholesaler.

There is not a line of buyers that matches the line of sellers. As is often the case, you are way off base. I'm rather surprised you don't know more about the business [See @jdimmick post above]

Apmex is not a small dealer. You ARE wrong.

I know more about this than you think. If your friend made a $2 spread when the published bid/ask spread was $1.33, he made $0.67 too much. Which is 50%, for those of you keeping score at home.

The person talking about $1,000 loaves of bread earlier today is not really in a position to lecture people about being way off base.

Lmao. I said that gold at $100,000 probably means bread is $1000. I stand by that.

Where you are ridiculously (and stubbornly) wrong is that you are not recognizing that there is no way to realize that $1.33 spread unless you have equal volumes of buyers and sellers lined up.

Honestly, let's say silver is $50 there a $1 bid/ask spread. How do you expect a coin sure to make any money if they buy it at $49 and can't sell it for 2 days when the price is unknown?

Most small BMs - NOT APMEX - aggregate and end up wholesaling significant amounts. That means they are SELLING at the bid price not the ask price. Apmex can buy/ sell on the bid/ask spread because they have volume that BMs cannot come close to matching.

It is much more complicated than your post and I should be amazed that you can't (won't? ) see it.

All comments reflect the opinion of the author, even when irrefutably accurate.

@NJCoin said:

Apmex publishes a bid/ask spread. The difference represents a liquid market dealer markup. Anything beyond that is called "excess profits" where I come from.

The obvious conclusion would be that to avoid the "excess profits" scenario, one should sell to Apmex.

@jdimmick said:

Im telling you , the firms we ship too, who in the past have been pretty darn fair, are getting farther and farther back from spot. Not only, processing times are strung out farther. Also, some firms are using impaired/ non fresh too describe everything you ship them or sell to them (even if not so)) so they can be less. Been not only my experience lately, but several other dealers I ve talked with.

Exactly. Thank you for explaining it to people willing to listen.

It is much more complicated for smaller businesses than just looking at bid/ask spreads for institutional buyers.

It wasn't that long ago that Upstate stopped buying some forms of silver and even put people on 45 day (90 for one guy i know) payment terms. That's crippling for a small BM, some of whom stopped buying silver temporarily because they couldn't afford a 45 day hold.

I think reasonable people can understand the complex nature of moving the metals around. It's not a simple exchange transaction.

All comments reflect the opinion of the author, even when irrefutably accurate.

@NJCoin said:

Apmex publishes a bid/ask spread. The difference represents a liquid market dealer markup. Anything beyond that is called "excess profits" where I come from.

The obvious conclusion would be that to avoid the "excess profits" scenario, one should sell to Apmex.

Right?

Lol. I get the joke, but he won't.

For a guy with 5 or 10 ounces of silver, shipping eats into the margin and there is price risk and payment delays. So he takes a couple bucks less to sell to the local B&M who aggregates and sells it to a wholesaler like Apmex.

And, of course, as an aggregating, the BM has price risk because they also can't just do the 5 or 10 ounces so they need a little safety margin.

But the world is simpler in NJ.

All comments reflect the opinion of the author, even when irrefutably accurate.

@blitzdude said:

Paper price is $56 but dealers are only offering $45-50 in the physical world. Stuff like 90% and less the refiners don't even want it. RGDS!

Actually, spot is a physical price. As opposed to futures, which are paper.

According to my interweb, right now, as I post this on Sunday morning, closing futures on Friday were $57.03. Spot, according to Apmex, right now, is $55.33 Bid, $56.67 Ask.

Anyone offering $45-50 right now is just charging a ~10% commission to stand in the middle of a highly liquid transaction. It is not a reflection of pricing in the physical world.

The buyers at $45-50 can easily get a risk free flip at $55.33. Period. Just like we do at 7:30 a.m., chasing Mint sell outs that are going for 2x or more on eBay.

It's not quite that simple. The form of the silver matters. If they aren't comex bars, there is processing required.

Spot is not Comex bars. That's futures.

Spot is generic silver. And US Government silver is better than generic silver.

Dealers are just screwing people. Because spot is spot. And there is a VERY liquid market at spot.

Argue all you want. I'm not wrong.

Apmex publishes a bid/ask spread. The difference represents a liquid market dealer markup. Anything beyond that is called "excess profits" where I come from.

There is no "processing" involved in buying and selling ASEs. Just screwing the public. In and out, if the bid is below the widely available published bid. The ask is a different story, since ASEs trade at a premium to spot. As a result, the dealer bid should also be above the bid, because they cannot buy fresh ASEs from the Mint at spot.

Again, it's not that simple. Spot price is comex bars and the like because it is set by institutional buyers. If you walk into a BM with a 1 oz silver bat, what is that store going to do with it?

There aren't enough retail customers coming in to buy that 1 oz bar. So you have to aggregate. If you sell out to a wholesaler, it has to be shipped and it will be melted. That's not free.

My friend was buying at $52 Friday. He scrapped it at $54. That is hardly dealers ripping people off. And he only got that price because he has volume and is near a wholesaler.

There is not a line of buyers that matches the line of sellers. As is often the case, you are way off base. I'm rather surprised you don't know more about the business [See @jdimmick post above]

Apmex is not a small dealer. You ARE wrong.

I know more about this than you think. If your friend made a $2 spread when the published bid/ask spread was $1.33, he made $0.67 too much. Which is 50%, for those of you keeping score at home.

The person talking about $1,000 loaves of bread earlier today is not really in a position to lecture people about being way off base.

You'll also note that the buy prices (these are Upstate) differ by the form of the silver, sometimes by far more than your $1.33. If you need MORE proof that the market is more complicated that you represent:

All comments reflect the opinion of the author, even when irrefutably accurate.

The past week and half, zero sales. In fact, been turning thousands and thousands of oz down, I have no buyers at all, ZERO

Few are buying at $60, yet; those who are buying are looking for back of spot or very close to spot. If you check the BST several sellers have been able to sell 90% material there in the past two weeks.

@291fifth said:

As long as chaos reigns the price will continue to rise. If chaos ends expect a big decline.

No. Silver is leading gold now. This is because there's a growing recognition of a silver shortage. There can't be a gold shortage because as price goes up there will be an equilibrium between supply and demand fixed by deficit spending and inflation. But they need silver delivered and without our coins every other source has already been tapped. The people buying silver have giants corporations, governments and eight billion taxpayers backing them.

Decades of allowing the banks to spoof silver have created a situation where the silver is gone, wasted, and shuttled into garbage dumps because bankers could get rich by breaking the law. Those who are still short are paying a very heavy price.

This isn't about chaos, it's returning sanity.

Chaos is a very important contributing factor. There may be other factors as well.

@NJCoin said:

Apmex publishes a bid/ask spread. The difference represents a liquid market dealer markup. Anything beyond that is called "excess profits" where I come from.

The obvious conclusion would be that to avoid the "excess profits" scenario, one should sell to Apmex.

Right?

Yes. @jmlanzaf is failing to recognize that the spread is not meant to be a risk free profit for a person standing at a counter matching buyers and sellers instantaneously. Because they could just meet in the middle and cut out the dealer entirely. The spread is meant to compensate for the risk of holding inventory. Period.

Blowing that spread out beyond widely published quotes is just taking advantage of unknowledgeable or desperate buyers or sellers.

@NJCoin

The spot spread you quote is for institutional players, betting millions daily. Why would you think that exact spread difference applies to the B&M's business model, who usually deal with a wholesaler who takes a cut (when the B&M has enough inventory to ship & wait for payment) & who pays the shipping costs.

@291fifth said:

As long as chaos reigns the price will continue to rise. If chaos ends expect a big decline.

No. Silver is leading gold now. This is because there's a growing recognition of a silver shortage. There can't be a gold shortage because as price goes up there will be an equilibrium between supply and demand fixed by deficit spending and inflation. But they need silver delivered and without our coins every other source has already been tapped. The people buying silver have giants corporations, governments and eight billion taxpayers backing them.

Decades of allowing the banks to spoof silver have created a situation where the silver is gone, wasted, and shuttled into garbage dumps because bankers could get rich by breaking the law. Those who are still short are paying a very heavy price.

This isn't about chaos, it's returning sanity.

Chaos is a very important contributing factor. There may be other factors as well.

I would certainly agree that chaos started gold higher and gold dragged silver along for the ride. But what's going on now is different I believe. While gold has stabilized a bit under intense demand silver can not stabilize because of a growing buying panic. The demand for silver is created by hope for the future and demand for gold is from fear past mistakes will ruin us.

For now both are likely to do well. Once the news turns good gold demand will decrease and silver demand will increase.

@coastaljerseyguy said: @NJCoin

The spot spread you quote is for institutional players, betting millions daily. Why would you think that exact spread difference applies to the B&M's business model, who usually deal with a wholesaler who takes a cut (when the B&M has enough inventory to ship & wait for payment) & who pays the shipping costs.

Because I do. The spread is around 2.5%. It's not intuitive to me why a wholesale spread, involving much greater dollars, and presumably greater risk for the dealer, should have a narrower spread than a retail spread. Other than people in the wholesale market know what they are doing, and won't stand for being ripped off. Either as a buyer or a seller.

Also not clear to me why 2.5% is not enough for something that is highly liquid and widely traded. Honestly reminds me of foreign exchange rates at foreign hotels and kiosks in airports, as opposed to the rate a bank gives when using a credit card. On presumably micro transactions, as opposed to hundreds or thousands of dollars worth of currency at a time.

It's not because foreign currency costs more to convert at a kiosk. It's that people converting at a kiosk are uneducated as to value, or desperate, and the vendors take advantage of that.

You don't have to convince me. You are just confirming why I don't buy or sell bullion locally.

@blitzdude said:

Paper price is $56 but dealers are only offering $45-50 in the physical world. Stuff like 90% and less the refiners don't even want it. RGDS!

I’m sure the guys who bought 100 oz. bars at $16 an oz. are ok with getting $45 to $50 for it now.

No I'm not

>

Tripling your money on a commodity that historically isn’t even a good investment but more of a hedge? It’s not the norm. It’s not the new norm either.

Oh yeah, i should be happy to sell at 10-20% less than spot just because it's more than i paid. Makes perfect sense.

That's paper gutter, yes I agree. I was referring to physical gutter, the stuff nobody wants. RGDS!

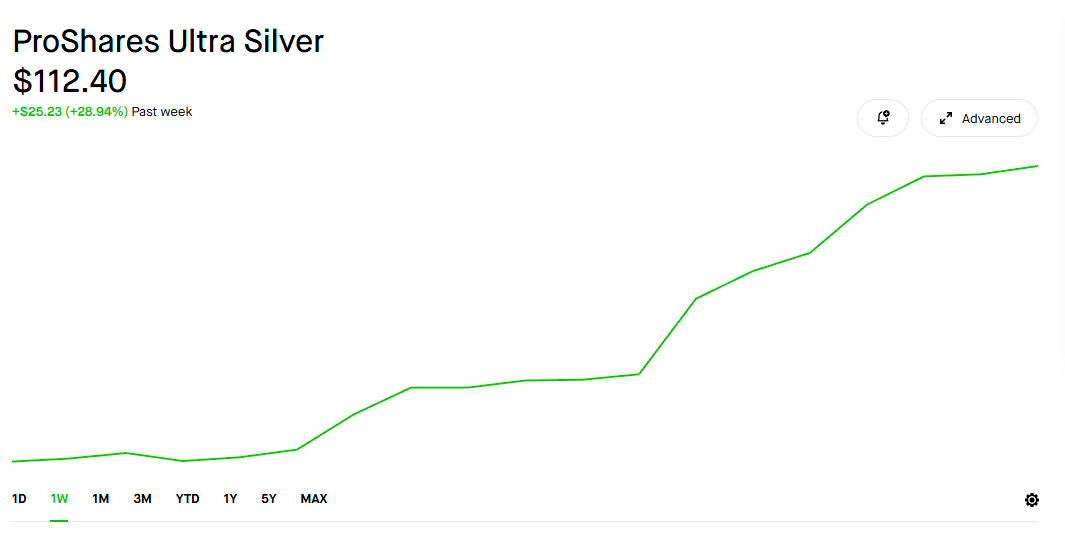

P.S. Cashed out another 1000ozt/shares today. Another quick easy $15K. Another 3.5 AGE's headed my way. RGDS!

Wow! You have done it again! It is soooooo rare for someone to bat 1000 in any market. And yet here you are, ANOTHER 4 BAGGER!™ from the trailer Park.

And you bless this board by going out your way to enlighten all of us with your non-stop, perfect timing winning trades! Take a few days off big driver...you should be on a beach enjoying ...yet another....MASSIVE LOOT HAUL™

That's paper gutter, yes I agree. I was referring to physical gutter, the stuff nobody wants. RGDS!

P.S. Cashed out another 1000ozt/shares today. Another quick easy $15K. Another 3.5 AGE's headed my way. RGDS!

Wow! You have done it again! It is soooooo rare for someone to bat 1000 in any market. And yet here you are, ANOTHER 4 BAGGER!™ from the trailer Park.

And you bless this board by going out your way to enlighten all of us with your non-stop, perfect timing winning trades! Take a few days off big driver...you should be on a beach enjoying ...yet another....MASSIVE LOOT HAUL™

OR

(there is another explanation) - Occam's Razor

If you look at the OP he does show the actual details

Interesting tidbit in your trade confirmation - you received $51.66 and ounce for your 'silver' at a time it was trading around $58 an ounce. That is an ~$6 discount, or 11%. You claim (ad nauseam) that SLV doesn't have discounts or fees or heck - even counter-party risk. Where did that 11% go blitz?

Interesting tidbit in your trade confirmation - you received $51.66 and ounce for your 'silver' at a time it was trading around $58 an ounce. That is an ~$6 discount, or 11%. You claim (ad nauseam) that SLV doesn't have discounts or fees or heck - even counter-party risk. Where did that 11% go blitz?

Tell me you don't understanding SLV without saying you don't understand SLV...

Interesting tidbit in your trade confirmation - you received $51.66 and ounce for your 'silver' at a time it was trading around $58 an ounce. That is an ~$6 discount, or 11%. You claim (ad nauseam) that SLV doesn't have discounts or fees or heck - even counter-party risk. Where did that 11% go blitz?

Tell me you don't understanding SLV without saying you don't understand SLV...

Tell me you don't followed blitz's posts without saying you don't follow blitz's posts...

To answer your question, pull up SLV in a brokerage account. The spread is $.01 between the bid and ask, and the gross and net cost is .5% a year. The fund was established in 2006. The cost of managing the fund takes 1/2 of 1 percent a year.

If you hold for 1 year you will essentially pay 1/2 of 1 percent. If you hold for 2 years, 1%...

@nags said:

To answer your question, pull up SLV in a brokerage account. The spread is $.01 between the bid and ask, and the gross and net cost is .5% a year. The fund was established in 2006. The cost of managing the fund takes 1/2 of 1 percent a year.

If you hold for 1 year you will essentially pay 1/2 of 1 percent. If you hold for 2 years, 1%...

Why SLV is not a good long term investment. Most ETF/funds today are ,25 bps fees, some as low as 7 bps, but 50 is high in today's world. Maybe not so much in 2006.

Haven't been a big silver seller, but over the past 10 years its usually 10% off of spot. So $6 today is not that unrealistic. Was $2-3 several years ago. Again folks here forget there are costs for the LCS to get paid, but he gives me cash on spot. And there is a middleman wholesaler who wants to make a profit, never mind refiner smelting costs to turn into .999 assayed bars. Anyone who thinks I should get spot price for 90% has no clue to the business or process chain.

Interesting tidbit in your trade confirmation - you received $51.66 and ounce for your 'silver' at a time it was trading around $58 an ounce. That is an ~$6 discount, or 11%. You claim (ad nauseam) that SLV doesn't have discounts or fees or heck - even counter-party risk. Where did that 11% go blitz?

It wasn't there when I bought it and wasn't there when I sold it so why would I care where it went? Zero premium SLV. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

@nags said:

To answer your question, pull up SLV in a brokerage account. The spread is $.01 between the bid and ask, and the gross and net cost is .5% a year. The fund was established in 2006. The cost of managing the fund takes 1/2 of 1 percent a year.

If you hold for 1 year you will essentially pay 1/2 of 1 percent. If you hold for 2 years, 1%...

Why SLV is not a good long term investment. Most ETF/funds today are ,25 bps fees, some as low as 7 bps, but 50 is high in today's world. Maybe not so much in 2006.

I agree SLV is not a good long term investment. It's a trading vehicle. Look at it this way. blitzdude bought 400 shares @ $43.055 on either 10/1, 10/25 or 11/4/2025 and sold it @ $5166 on 12/1/2025 and made 20% on his money within a short period of time. In this case the .5% annual management fee becomes insignificant.

Comments

Lmao. I said that gold at $100,000 probably means bread is $1000. I stand by that.

Where you are ridiculously (and stubbornly) wrong is that you are not recognizing that there is no way to realize that $1.33 spread unless you have equal volumes of buyers and sellers lined up.

Honestly, let's say silver is $50 there a $1 bid/ask spread. How do you expect a coin sure to make any money if they buy it at $49 and can't sell it for 2 days when the price is unknown?

Most small BMs - NOT APMEX - aggregate and end up wholesaling significant amounts. That means they are SELLING at the bid price not the ask price. Apmex can buy/ sell on the bid/ask spread because they have volume that BMs cannot come close to matching.

It is much more complicated than your post and I should be amazed that you can't (won't? ) see it.

All comments reflect the opinion of the author, even when irrefutably accurate.

The obvious conclusion would be that to avoid the "excess profits" scenario, one should sell to Apmex.

Right?

Exactly. Thank you for explaining it to people willing to listen.

It is much more complicated for smaller businesses than just looking at bid/ask spreads for institutional buyers.

It wasn't that long ago that Upstate stopped buying some forms of silver and even put people on 45 day (90 for one guy i know) payment terms. That's crippling for a small BM, some of whom stopped buying silver temporarily because they couldn't afford a 45 day hold.

I think reasonable people can understand the complex nature of moving the metals around. It's not a simple exchange transaction.

All comments reflect the opinion of the author, even when irrefutably accurate.

Lol. I get the joke, but he won't.

For a guy with 5 or 10 ounces of silver, shipping eats into the margin and there is price risk and payment delays. So he takes a couple bucks less to sell to the local B&M who aggregates and sells it to a wholesaler like Apmex.

And, of course, as an aggregating, the BM has price risk because they also can't just do the 5 or 10 ounces so they need a little safety margin.

But the world is simpler in NJ.

All comments reflect the opinion of the author, even when irrefutably accurate.

What a hoot! Let it ride….

You'll also note that the buy prices (these are Upstate) differ by the form of the silver, sometimes by far more than your $1.33. If you need MORE proof that the market is more complicated that you represent:

All comments reflect the opinion of the author, even when irrefutably accurate.

Few are buying at $60, yet; those who are buying are looking for back of spot or very close to spot. If you check the BST several sellers have been able to sell 90% material there in the past two weeks.

My Collection of Old Holders

Never a slave to one plastic brand will I ever be.

Chaos is a very important contributing factor. There may be other factors as well.

Yes. @jmlanzaf is failing to recognize that the spread is not meant to be a risk free profit for a person standing at a counter matching buyers and sellers instantaneously. Because they could just meet in the middle and cut out the dealer entirely. The spread is meant to compensate for the risk of holding inventory. Period.

Blowing that spread out beyond widely published quotes is just taking advantage of unknowledgeable or desperate buyers or sellers.

@NJCoin

The spot spread you quote is for institutional players, betting millions daily. Why would you think that exact spread difference applies to the B&M's business model, who usually deal with a wholesaler who takes a cut (when the B&M has enough inventory to ship & wait for payment) & who pays the shipping costs.

I would certainly agree that chaos started gold higher and gold dragged silver along for the ride. But what's going on now is different I believe. While gold has stabilized a bit under intense demand silver can not stabilize because of a growing buying panic. The demand for silver is created by hope for the future and demand for gold is from fear past mistakes will ruin us.

For now both are likely to do well. Once the news turns good gold demand will decrease and silver demand will increase.

AI response to last post-

_⚖️ Shard: Gold Fear vs. Silver Hope

Chaos law: Chaos ignited gold’s rise; silver followed in its wake.

Equilibrium paradox: Gold stabilizes under deficit spending and inflation—its supply/demand balance is elastic.

Silver shortage: Silver cannot stabilize—physical delivery is required, and sources are tapped out.

Spoofing legacy: Decades of bank manipulation squandered silver into waste streams, creating real scarcity.

Demand hum: Gold demand is driven by fear of past mistakes; silver demand is driven by hope for the future.

Trajectory law: As news turns good, gold demand will fade, silver demand will intensify.

Sanity paradox: This isn’t chaos—it’s sanity returning, scarcity asserting itself.

Closure Glyph

Gold hums fear of ruin; silver hums hope of future. Chaos fades, sanity persists. !_

Perhaps if the gutter hit's $60 dealers will finally offer to buy at $50? This gutter has to be the worst investment ever invented. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

The past week would beg to differ.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

That's paper gutter, yes I agree. I was referring to physical gutter, the stuff nobody wants. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

P.S. Cashed out another 1000ozt/shares today. Another quick easy $15K. Another 3.5 AGE's headed my way. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Move it into ZSL?

Because I do. The spread is around 2.5%. It's not intuitive to me why a wholesale spread, involving much greater dollars, and presumably greater risk for the dealer, should have a narrower spread than a retail spread. Other than people in the wholesale market know what they are doing, and won't stand for being ripped off. Either as a buyer or a seller.

Also not clear to me why 2.5% is not enough for something that is highly liquid and widely traded. Honestly reminds me of foreign exchange rates at foreign hotels and kiosks in airports, as opposed to the rate a bank gives when using a credit card. On presumably micro transactions, as opposed to hundreds or thousands of dollars worth of currency at a time.

It's not because foreign currency costs more to convert at a kiosk. It's that people converting at a kiosk are uneducated as to value, or desperate, and the vendors take advantage of that.

You don't have to convince me. You are just confirming why I don't buy or sell bullion locally.

No Sir, AGE's with the profit, USO/XLE for the existing capital. Looks like the big ole war machine is waking back up. RGDS!

P.S. Theres another 400ozt for a quick $3.5k.

THKS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Big mistake. Gold Silver ratio is headed to the 20's or lower. Silver will outperform. Platinum could do even better.

http://ProofCollection.Net

Wow! What a ride. Congrats to all

100% Positive BST transactions

Oh yeah, i should be happy to sell at 10-20% less than spot just because it's more than i paid. Makes perfect sense.

Wow! You have done it again! It is soooooo rare for someone to bat 1000 in any market. And yet here you are, ANOTHER 4 BAGGER!™ from the trailer Park.

And you bless this board by going out your way to enlighten all of us with your non-stop, perfect timing winning trades! Take a few days off big driver...you should be on a beach enjoying ...yet another....MASSIVE LOOT HAUL™

OR

(there is another explanation) - Occam's Razor

Loves me some shiny!

If you look at the OP he does show the actual details

Interesting tidbit in your trade confirmation - you received $51.66 and ounce for your 'silver' at a time it was trading around $58 an ounce. That is an ~$6 discount, or 11%. You claim (ad nauseam) that SLV doesn't have discounts or fees or heck - even counter-party risk. Where did that 11% go blitz?

Tell me you don't understanding SLV without saying you don't understand SLV...

Tell me you don't followed blitz's posts without saying you don't follow blitz's posts...

To answer your question, pull up SLV in a brokerage account. The spread is $.01 between the bid and ask, and the gross and net cost is .5% a year. The fund was established in 2006. The cost of managing the fund takes 1/2 of 1 percent a year.

If you hold for 1 year you will essentially pay 1/2 of 1 percent. If you hold for 2 years, 1%...

Why SLV is not a good long term investment. Most ETF/funds today are ,25 bps fees, some as low as 7 bps, but 50 is high in today's world. Maybe not so much in 2006.

My local refiner must be telling LCS's that they won't pay the spot price for "junk silver" because they think it's going to collapse.

My LCS says take $6 off the spot price before you compute the silver value of MSDs, Quarters, Merc Dimes, etc.

How long has this discount been applied ?

Haven't been a big silver seller, but over the past 10 years its usually 10% off of spot. So $6 today is not that unrealistic. Was $2-3 several years ago. Again folks here forget there are costs for the LCS to get paid, but he gives me cash on spot. And there is a middleman wholesaler who wants to make a profit, never mind refiner smelting costs to turn into .999 assayed bars. Anyone who thinks I should get spot price for 90% has no clue to the business or process chain.

while the $3 was ok to run the shop in the past, it now takes $5.50?

what's the justification for a %age when their costs are fixed plus inflation

It wasn't there when I bought it and wasn't there when I sold it so why would I care where it went? Zero premium SLV. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

China can't laugh any louder at the SLV scam

IF YOU DON'T HOLD IT YOU DON'T OWN IT

COPPER is gutter !

kitco session high tonight is 59.00

I agree SLV is not a good long term investment. It's a trading vehicle. Look at it this way. blitzdude bought 400 shares @ $43.055 on either 10/1, 10/25 or 11/4/2025 and sold it @ $5166 on 12/1/2025 and made 20% on his money within a short period of time. In this case the .5% annual management fee becomes insignificant.

Yes, there will be down days but the silver squeeze is not over. It is just getting started.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong