@coastaljerseyguy said:

Not for me, put 20% of my pay into 401k Vanguard ETFs. Too old to worry about risk or some 4 year cycle like some post mentioned.

Max out the 401k and IRAs also plus the additional 50+ contributions. Still have disposable income that needs to be parked somewhere. Crypto has been good for that. THKS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

@coastaljerseyguy said:

Not for me, put 20% of my pay into 401k Vanguard ETFs. Too old to worry about risk or some 4 year cycle like some post mentioned.

Max out the 401k and IRAs also plus the additional 50+ contributions. Still have disposable income that needs to be parked somewhere. Crypto has been good for that. THKS!

My wife takes care of the rest of my disposable income.

@Higashiyama said: @ProofCollection said “No, the rate of production of bitcoin cannot be accelerated. If I wasn't clear above, the bitcoin software adjusts production so that it will always”

Thanks for this correction. It’s a fascinating point, AI should impact the cost of mining and likely the number of mining operations, but will have negligible impact on the aggregate rate of mining.

It remains plausible to believe that the long term value of bitcoin will trend to zero. I find it hard to believe that bitcoin has long term value as a means of exchange, store of value, etc. Bitcoin and the bitcoin community may prove to be quite resilient, but …

Long term can be a very long time. Hard to say what the world will look like in 50 or 100 years. Will people care about PMs in 50 or 100 or 200 years? The world needs something like Bitcoin though, it's just impossible to predict if there will be something better to come along or not. I presume everyone in this discussion is American and I find that most of us tend to think about Bitcoin with a myopic US-only perspective. We've had the luxury of a currency with a fair amount of stability that is the world's reserve currency (for now). When you understand that the rest of the world doesn't have this luxury and doesn't want to rely on the US dollar and access to the SWIFT system the value of an independent digital currency accepted worldwide becomes pretty apparent.

Precious metals have been money for 5,000+ years. Will they still be valued 50 years from now ? Probably (in my opinion).

Bitcoin has been around for, what, 15 years ? Will it still be a thing 15 years from now ? I put the odds at 50-50, although I have nothing really to base that on. And that is the problem - there is no historical track record for crypto-currency in general.

My outlook for Bitcoin is for there to be significant challenges.

It is very energy-intensive. Does society really need it ? It seems that it is not really a very efficient medium of exchange.

Will Central Bank Digital Currencies (CBDC) take over ? I could see this happening as there are ways for governments to implement monetary policy and acquire revenues via CBDC.

The Achilles-Heel word has already been mentioned in this thread: "Software". Who controls and writes the software ? The Bitcoin "community". But wherever there is software, there can be hidden manipulation and hidden agendas.

As I understand it, the act of "mining" Bitcoin is the mechanism by which Bitcoin transactions are verified. The mining is where all the energy consumption originates. As time goes by, the subsidy for mining is halved at regular time intervals. At some point, there will be no more subsidy for mining and the reward from mining will come entirely from transaction fees. These fees can spike at times of peak demand for urgent transactions. I don't think anyone really knows how Bitcoin will function if everyone rushes for the exits at the same time, and the fees for these urgent transactions spike so high that it becomes impossible to trade. And if the Bitcoin value were to drop precipitously, that would greatly diminish the incentive to do the mining (because the mining reward, in real terms, could become insufficient to make it worthwhile).

So I could see Bitcoin go on for some years.

Or it could implode in spectacular fashion.

@dcarr said:

Precious metals have been money for 5,000+ years. Will they still be valued 50 years from now ? Probably (in my opinion).

Yes, hard to argue with that track record. But in the past few decades the world has gone digital. And again, technology could make it feasible to create precious metals artificially or space mining could make the metals no longer precious. Fortune telling it tough.

Bitcoin has been around for, what, 15 years ? Will it still be a thing 15 years from now ? I put the odds at 50-50, although I have nothing really to base that on. And that is the problem - there is no historical track record for crypto-currency in general.

I get it. But the US and other nations are establishing Bitcoin reserves and the future is undeniably digital. It's easy to see the direction things are headed. The future may not be Bitcoin, but things are headed that direction.

My outlook for Bitcoin is for there to be significant challenges.

It is very energy-intensive. Does society really need it ? It seems that it is not really a very efficient medium of exchange.

It probably won't be used as a medium of exchange. That's why BTC is referred to as digital gold which isn't really a medium of exchange either.

Does society need it? The success of Bitcoin would indicate that the answer is yes.

Will Central Bank Digital Currencies (CBDC) take over ? I could see this happening as there are ways for governments to implement monetary policy and acquire revenues via CBDC.

The future is digital. To expect CBs not to adopt new technology is silly. It's not if, it's when. Perhaps not all of them, but at least a few and I think some already have.

The Achilles-Heel word has already been mentioned in this thread: "Software". Who controls and writes the software ? The Bitcoin "community". But wherever there is software, there can be hidden manipulation and hidden agendas.

Nothing is hidden with Bitcoin. The code is public. The only way to change it is to get the majority of the network to run the new code. Not only is that infeasible to convince the majority of the network to adopt "bad" software improvements, but should someone manage to do that in a hostile manner, a portion of the network would run the old code and then the world could decide whether to use the New Bitcoin or the Old Bitcoin. So really the global market would decide what succeeds.

As I understand it, the act of "mining" Bitcoin is the mechanism by which Bitcoin transactions are verified. The mining is where all the energy consumption originates. As time goes by, the subsidy for mining is halved at regular time intervals. At some point, there will be no more subsidy for mining and the reward from mining will come entirely from transaction fees. These fees can spike at times of peak demand for urgent transactions. I don't think anyone really knows how Bitcoin will function if everyone rushes for the exits at the same time, and the fees for these urgent transactions spike so high that it becomes impossible to trade. And if the Bitcoin value were to drop precipitously, that would greatly diminish the incentive to do the mining (because the mining reward, in real terms, could become insufficient to make it worthwhile).

We actually do know how it functions when it becomes overloaded. That's happened before. As you note fees spike and it becomes difficult to use. Improvements have made this less likely to happen. Bitcoin is not intended for high volume transactions. Other crypto will likely fill this role.

The mining reward system is brilliant in its conception. All of the scenarios you've mentioned have happened before. When the price goes down and mining profit margins wane, mining power goes down. When mining power goes down, the algo adjusts to make mining easier to maintain the same production rate. The opposite happens when mining profit margins surge. It's not unlike gold really. With high gold prices more mines become feasible and ramp up production. As a result we will see higher gold production which absent other factors would lead to dropping gold prices and the less profitable mines shutting down again.

So I could see Bitcoin go on for some years.

Or it could implode in spectacular fashion.

Comments

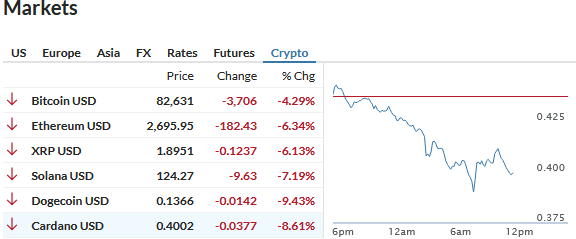

Added some BTC and ETH this morning, Thank you for the gift. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Today I've been glancing at the live Bitcoin chart, maybe around once an hour. It's frightening to watch, and I don't even own any. 😐

Don't be surprised when BTC gets a Gov bailout. If not for BTC itself, it would eventually occur for stable coins due to treasuries exposure.

Keep averaging down.

Up, down, sideways, it doesn't matter. Add it every payday just like clockwork. Again, thanks for the gift. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Not for me, put 20% of my pay into 401k Vanguard ETFs. Too old to worry about risk or some 4 year cycle like some post mentioned.

Max out the 401k and IRAs also plus the additional 50+ contributions. Still have disposable income that needs to be parked somewhere. Crypto has been good for that. THKS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

My wife takes care of the rest of my disposable income.

Long term can be a very long time. Hard to say what the world will look like in 50 or 100 years. Will people care about PMs in 50 or 100 or 200 years? The world needs something like Bitcoin though, it's just impossible to predict if there will be something better to come along or not. I presume everyone in this discussion is American and I find that most of us tend to think about Bitcoin with a myopic US-only perspective. We've had the luxury of a currency with a fair amount of stability that is the world's reserve currency (for now). When you understand that the rest of the world doesn't have this luxury and doesn't want to rely on the US dollar and access to the SWIFT system the value of an independent digital currency accepted worldwide becomes pretty apparent.

http://ProofCollection.Net

Precious metals have been money for 5,000+ years. Will they still be valued 50 years from now ? Probably (in my opinion).

Bitcoin has been around for, what, 15 years ? Will it still be a thing 15 years from now ? I put the odds at 50-50, although I have nothing really to base that on. And that is the problem - there is no historical track record for crypto-currency in general.

My outlook for Bitcoin is for there to be significant challenges.

It is very energy-intensive. Does society really need it ? It seems that it is not really a very efficient medium of exchange.

Will Central Bank Digital Currencies (CBDC) take over ? I could see this happening as there are ways for governments to implement monetary policy and acquire revenues via CBDC.

The Achilles-Heel word has already been mentioned in this thread: "Software". Who controls and writes the software ? The Bitcoin "community". But wherever there is software, there can be hidden manipulation and hidden agendas.

As I understand it, the act of "mining" Bitcoin is the mechanism by which Bitcoin transactions are verified. The mining is where all the energy consumption originates. As time goes by, the subsidy for mining is halved at regular time intervals. At some point, there will be no more subsidy for mining and the reward from mining will come entirely from transaction fees. These fees can spike at times of peak demand for urgent transactions. I don't think anyone really knows how Bitcoin will function if everyone rushes for the exits at the same time, and the fees for these urgent transactions spike so high that it becomes impossible to trade. And if the Bitcoin value were to drop precipitously, that would greatly diminish the incentive to do the mining (because the mining reward, in real terms, could become insufficient to make it worthwhile).

So I could see Bitcoin go on for some years.

Or it could implode in spectacular fashion.

.

Very plausible and good perspective on the inevitable " fees" tagged on.

Yes, hard to argue with that track record. But in the past few decades the world has gone digital. And again, technology could make it feasible to create precious metals artificially or space mining could make the metals no longer precious. Fortune telling it tough.

I get it. But the US and other nations are establishing Bitcoin reserves and the future is undeniably digital. It's easy to see the direction things are headed. The future may not be Bitcoin, but things are headed that direction.

It probably won't be used as a medium of exchange. That's why BTC is referred to as digital gold which isn't really a medium of exchange either.

Does society need it? The success of Bitcoin would indicate that the answer is yes.

The future is digital. To expect CBs not to adopt new technology is silly. It's not if, it's when. Perhaps not all of them, but at least a few and I think some already have.

Nothing is hidden with Bitcoin. The code is public. The only way to change it is to get the majority of the network to run the new code. Not only is that infeasible to convince the majority of the network to adopt "bad" software improvements, but should someone manage to do that in a hostile manner, a portion of the network would run the old code and then the world could decide whether to use the New Bitcoin or the Old Bitcoin. So really the global market would decide what succeeds.

We actually do know how it functions when it becomes overloaded. That's happened before. As you note fees spike and it becomes difficult to use. Improvements have made this less likely to happen. Bitcoin is not intended for high volume transactions. Other crypto will likely fill this role.

The mining reward system is brilliant in its conception. All of the scenarios you've mentioned have happened before. When the price goes down and mining profit margins wane, mining power goes down. When mining power goes down, the algo adjusts to make mining easier to maintain the same production rate. The opposite happens when mining profit margins surge. It's not unlike gold really. With high gold prices more mines become feasible and ramp up production. As a result we will see higher gold production which absent other factors would lead to dropping gold prices and the less profitable mines shutting down again.

Those certainly are the two possibilities.

http://ProofCollection.Net

Created by technology, destroyed by technology.

Knowledge is the enemy of fear