The banks did NOT cause the 2008 GFC...blame the GSEs and politicians for stoking the housing bubble with subprime crappola. There was too much leverage in the system but that had nothing to do with credit quality.

The Fed and Bush Administration tried to reign in the bubble as early as 2003. The politicians -- Federal and State -- wouldn't hear about it.

Huh, although the GSE's, FED, and the regulators share a lot of the blame, the banks, retail & investment, namely WAMU, ML, Lehman, Wachovia, etc caused the 2008 crash with their leverage and quest for revenue. Offering 'liar loans', i.e. no doc loans at even 100% of inflated market values what do you expect. Flippers were going crazy with the housing market. WAMU sold the loans and the investment banks packaged them up for big profits. Yes the govt entities were so concerned about getting out of the Y2K mini crash and high unemployment. They loved housing and all the consumer expenses associated with buying a home that drove the economy upwards. But they had their heads in the sand. But the Banks made the profit and ignored the credit risks with such leverage.

Thanks, I was going to chime in and say this. You can blame the regulatory agencies for not stopping this, but I think the blame should be placed on the criminals.

@coastaljerseyguy said:

Huh, although the GSE's, FED, and the regulators share a lot of the blame, the banks, retail & investment, namely >WAMU, ML, Lehman, Wachovia, etc caused the 2008 crash with their leverage and quest for revenue. Offering 'liar >loans', i.e. no doc loans at even 100% of inflated market values what do you expect. Flippers were going crazy with >the housing market. WAMU sold the loans and the investment banks packaged them up for big profits. Yes the govt >entities were so concerned about getting out of the Y2K mini crash and high unemployment. They loved housing >and all the consumer expenses associated with buying a home that drove the economy upwards. But they had >their heads in the sand. But the Banks made the profit and ignored the credit risks with such leverage.

Regulators and government entities (i.e., HUD) MANDATED these loans be made or strongly enouraged them with the threat of shooting down expansion or M&A plans. The Community Reinvestment Act (CRA) is still around nearly 50 years after it was passed (should be repealed).

Leverage was a problem....bad underwriting was a problem....but government encouragement was the biggest problem. If Fannie and Freddie said NO, then the loans don't get made no matter what Wall Street wanted.

The crappier the loan, the more politicians liked it.

@MsMorrisine said:

what is causing gold to rise so much so fast??

More buyers than sellers.

Seriously, with no big sellers -- i.e., Central Banks -- and other institutions (SWFs, ultra-rich family offices, asset managers, etc.) all buying plus retail (though price-sensitive)....you have major tailwinds behind the gold price. Many of these buyers don't really care if gold is $3,000 an ounce or $5,000 an ounce-- they manage trillions and want an allocation for the next 10-15 years. That allocation is also usually small so again, price isn't really a big thing.

When I worked in Private Banks, "cheap" gold was $300/oz. and "expensive" gold was $1,000 an ounce. It didn't matter that much for 90% of our retail clients....and NONE of our institutional clients.

The biggest problem for big institutional buyers is what to buy and how to store it.

@coastaljerseyguy said:

Huh, although the GSE's, FED, and the regulators share a lot of the blame, the banks, retail & investment, namely >WAMU, ML, Lehman, Wachovia, etc caused the 2008 crash with their leverage and quest for revenue. Offering 'liar >loans', i.e. no doc loans at even 100% of inflated market values what do you expect. Flippers were going crazy with >the housing market. WAMU sold the loans and the investment banks packaged them up for big profits. Yes the govt >entities were so concerned about getting out of the Y2K mini crash and high unemployment. They loved housing >and all the consumer expenses associated with buying a home that drove the economy upwards. But they had >their heads in the sand. But the Banks made the profit and ignored the credit risks with such leverage.

Regulators and government entities (i.e., HUD) MANDATED these loans be made or strongly enouraged them with the threat of shooting down expansion or M&A plans. The Community Reinvestment Act (CRA) is still around nearly 50 years after it was passed (should be repealed).

Leverage was a problem....bad underwriting was a problem....but government encouragement was the biggest problem. If Fannie and Freddie said NO, then the loans don't get made no matter what Wall Street wanted.

The crappier the loan, the more politicians liked it.

As I recall, and I probably won't describe it accurately, the banksters created CDS and disguised the true risk of the loan portfolios (fraud), and as a result they were able to sell high risk mortgage portfolios as low risk until the whole thing blew up. The government didn't tell them or encourage them to come up with that scheme. The whole thing was only possible because they were lying about the quality of the mortgages.

@ProofCollection said:

As I recall, and I probably won't describe it accurately, the banksters created CDS and disguised the true risk of the >loan portfolios (fraud), and as a result they were able to sell high risk mortgage portfolios as low risk until the whole >thing blew up. The government didn't tell them or encourage them to come up with that scheme. The whole thing >was only possible because they were lying about the quality of the mortgages.

Leverage was the worst.....Carlyle Capital went under investing in AAA-rated Treasury bonds because they used 30-to-1 leverage. Asset goes down 3%, you're wiped out.

CDS was basically selling insurance without properly reserving for it. Very risky.

The whole thing was predicated on rising median home prices, which had NEVER fallen in this country since 1967.....even through several (deep) recessions had taken place (1974, 1982, and less so 1990-91). If median home prices don't fall, even crappy loans and high leverage don't matter. My 1st job out of college was tracking median home prices so I know the data series very well.

Perfect storm hit: leverage + crappy loans + falling asset prices. You need all 3 to implode the system.

@coastaljerseyguy said:

Huh, although the GSE's, FED, and the regulators share a lot of the blame, the banks, retail & investment, namely >WAMU, ML, Lehman, Wachovia, etc caused the 2008 crash with their leverage and quest for revenue. Offering 'liar >loans', i.e. no doc loans at even 100% of inflated market values what do you expect. Flippers were going crazy with >the housing market. WAMU sold the loans and the investment banks packaged them up for big profits. Yes the govt >entities were so concerned about getting out of the Y2K mini crash and high unemployment. They loved housing >and all the consumer expenses associated with buying a home that drove the economy upwards. But they had >their heads in the sand. But the Banks made the profit and ignored the credit risks with such leverage.

Regulators and government entities (i.e., HUD) MANDATED these loans be made or strongly enouraged them with the threat of shooting down expansion or M&A plans. The Community Reinvestment Act (CRA) is still around nearly 50 years after it was passed (should be repealed).

Leverage was a problem....bad underwriting was a problem....but government encouragement was the biggest problem. If Fannie and Freddie said NO, then the loans don't get made no matter what Wall Street wanted.

The crappier the loan, the more politicians liked it.

.

No arm twisting was required. The banks were very happy to make such loans, so long as they could package them up and pawn them off on oblivious investors. And they did. A lot.

@dcarr said: No arm twisting was required. The banks were very happy to make such loans, so long as they could package >them up and pawn them off on oblivious investors. And they did. A lot.

Dedicated lenders like Countrywide, Novastar, and others wanted to make those loans, yes. But bigger banks had no interest in making most of those loans. JP Morgan was threatened with loss of NYC/NYS bond underwriting if they didn't increase their lending in "sensitive areas." CRA scores depended on it.

I agree they were ultimately responsible. Some banks did a better job keeping their exposure to a minimum.

@jmski52 said:

Haven't had time to think about what it means.......other than volatility which should be expected

Too many people think PMs aren't more risky and volatile than stocks or bonds. They are.

Today was a reminder that PMs are risky.

That said, nasty corrections in a bull market are to be expected. I believe we will make new highs within weeks though straightlining for a while to re-energize the trend wouldn't be a bad thing.

@jmski52 said:

Haven't had time to think about what it means.......other than volatility which should be expected

Too many people think PMs aren't more risky and volatile than stocks or bonds. They are.

Today was a reminder that PMs are risky.

That said, nasty corrections in a bull market are to be expected. I believe we will make new highs within weeks though straightlining for a while to re-energize the trend wouldn't be a bad thing.

@jmski52 said:

Haven't had time to think about what it means.......other than volatility which should be expected

Too many people think PMs aren't more risky and volatile than stocks or bonds. They are.

Today was a reminder that PMs are risky.

That said, nasty corrections in a bull market are to be expected. I believe we will make new highs within weeks though straightlining for a while to re-energize the trend wouldn't be a bad thing.

Everything has risk. Smart investing means making sure the reward is commensurate with that risk.

Too many people think PMs aren't more risky and volatile than stocks or bonds. They are.

Today was a reminder that PMs are risky.

Considering the size of the recent runups, you can't expect there not to be volatility at this point.

That said, nasty corrections in a bull market are to be expected. I believe we will make new highs within weeks though straightlining for a while to re-energize the trend wouldn't be a bad thing.

I doubt that central banks suddenly reversed course and suddenly dumped a bunch of gold.

Further, in view of all the higher price predictions and significantly larger portfolio allocation recommendations for gold recently issued by Goldman, JPM, Morgan Stanley and BoA - I tend to think that it wasn't any of them (or their clients) dumping huge amounts of gold in order to move the market.

I doubt that the BRICS - Brazil, Russia, India, China or South Africa, and including Saudi, Vietnam, or even Mexico have decided to sell off a bunch of their gold.

Who else does that leave? Hmmmmm. Maybe the Fed, the US Treasury, or even BoE. They are the ones who have a vested interest in maintaining the dollar as the reserve currency and who else is in position to create more bogus money and/or sell a bunch of naked shorts without any immediate negative consequences? Who else could it have been?

I think it's a major struggle taking place between the paper pushers (i.e., the purveyors of debt) vs. the believers in real money.

Gold was smacked down over $100 last Friday and bounced right back yesterday. Evidently someone thinks that it needed to get smacked down twice (more than $200) as hard today.

We live in interesting times. Stay tuned.

Q: Are You Printing Money? Bernanke: Not Literally

@jmski52 said: Too many people think PMs aren't more risky and volatile than stocks or bonds. They are.

Today was a reminder that PMs are risky.

Considering the size of the recent runups, you can't expect there not to be volatility at this point.

That said, nasty corrections in a bull market are to be expected. I believe we will make new highs within weeks though straightlining for a while to re-energize the trend wouldn't be a bad thing.

I doubt that central banks suddenly reversed course and suddenly dumped a bunch of gold.

Further, in view of all the higher price predictions and significantly larger portfolio allocation recommendations for gold recently issued by Goldman, JPM, Morgan Stanley and BoA - I tend to think that it wasn't any of them (or their clients) dumping huge amounts of gold in order to move the market.

I doubt that the BRICS - Brazil, Russia, India, China or South Africa, and including Saudi, Vietnam, or even Mexico have decided to sell off a bunch of their gold.

Who else does that leave? Hmmmmm. Maybe the Fed, the US Treasury, or even BoE. They are the ones who have a vested interest in maintaining the dollar as the reserve currency and who else is in position to create more bogus money and/or sell a bunch of naked shorts without any immediate negative consequences? Who else could it have been?

I think it's a major struggle taking place between the paper pushers (i.e., the purveyors of debt) vs. the believers in real money.

Gold was smacked down over $100 last Friday and bounced right back yesterday. Evidently someone thinks that it needed to get smacked down twice (more than $200) as hard today.

We live in interesting times. Stay tuned.

There's ALWAYS a pull back or retracement. So far it's about 7% from the peak. Nothing out of the ordinary.

But I do see a double top which will probably create a resistance level and I would expect gold to consolidate in the $4000-$4400 range for a while. Perhaps even dipping to $3800.

@dcarr said: No arm twisting was required. The banks were very happy to make such loans, so long as they could package >them up and pawn them off on oblivious investors. And they did. A lot.

Dedicated lenders like Countrywide, Novastar, and others wanted to make those loans, yes. But bigger banks had no interest in making most of those loans. JP Morgan was threatened with loss of NYC/NYS bond underwriting if they didn't increase their lending in "sensitive areas." CRA scores depended on it.

I agree they were ultimately responsible. Some banks did a better job keeping their exposure to a minimum.

The volume and scale of the problem wouldn't have been possible without the fraud of lying about the quality of the MBS they created.

@dcarr said:

Some of the reasons that I would never employ a financial planner are outlined above.

They don't seem to think like a contrarian. Everything they do is formulaic and main-stream, like a chef that never >has a new recipe.

Exactly. They are NOT trying to reinvent the wheel. You face lawsuits and financial liability if you veer too far off a prudent course.

While you have leeway, and ultimately the client can do what he/she wants, you are expected to guide the client. I'm the expert, not them. Just like a doctor-patient relationship.

If you retired in 1980 and all the uber-bulls like Howard Ruff controlled your thinking and you put 5% or 10% or 20% or 50% of your money into PMs because "they can't lose"....how did that work out for your retirement in the 1980's and 1990's and even into the 2000's ? Asset classes that miss out on DECADES are suspect.

.

Financial planners seem to like cherry-picking data points,

Im sure glad we dont see any of that cherry picking nonsense by PMers on internet chat rooms.

.

CFPs often reference "1980" as a basis point for metals and 1988 for stocks.

When deciding where to put money going forward from here, a basis point of 2024 would be better.

.

I have never heard a CFP use those dates. Nor, do I believe has anyone else.

Why would you say 2024 is an inflection point. What is the significance over 2020 or 2017 or 2009?

.

If you are planning one or two years out, it makes sense to use a comparison starting point that is one or two years ago, not a point that was 45 years ago.

.

SO lets plan for next year based on what happened last year? Sound. LOL

No arm twisting was required. The banks were very happy to make such loans, so long as they could package them up and pawn them off on oblivious investors. And they did. A lot.

seems no matter what, the music stops and there ain't enough chairs. Common thread in our modern economy. Jail the bankers.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

@dcarr said:

Some of the reasons that I would never employ a financial planner are outlined above.

They don't seem to think like a contrarian. Everything they do is formulaic and main-stream, like a chef that never >has a new recipe.

Exactly. They are NOT trying to reinvent the wheel. You face lawsuits and financial liability if you veer too far off a prudent course.

While you have leeway, and ultimately the client can do what he/she wants, you are expected to guide the client. I'm the expert, not them. Just like a doctor-patient relationship.

If you retired in 1980 and all the uber-bulls like Howard Ruff controlled your thinking and you put 5% or 10% or 20% or 50% of your money into PMs because "they can't lose"....how did that work out for your retirement in the 1980's and 1990's and even into the 2000's ? Asset classes that miss out on DECADES are suspect.

.

Financial planners seem to like cherry-picking data points,

Im sure glad we dont see any of that cherry picking nonsense by PMers on internet chat rooms.

.

CFPs often reference "1980" as a basis point for metals and 1988 for stocks.

When deciding where to put money going forward from here, a basis point of 2024 would be better.

.

I have never heard a CFP use those dates. Nor, do I believe has anyone else.

Why would you say 2024 is an inflection point. What is the significance over 2020 or 2017 or 2009?

.

If you are planning one or two years out, it makes sense to use a comparison starting point that is one or two years ago, not a point that was 45 years ago.

.

SO lets plan for next year based on what happened last year? Sound. LOL

.

Better than what you would do : plan for next year based on what happened 45 years ago.

@dcarr said:

Some of the reasons that I would never employ a financial planner are outlined above.

They don't seem to think like a contrarian. Everything they do is formulaic and main-stream, like a chef that never >has a new recipe.

Exactly. They are NOT trying to reinvent the wheel. You face lawsuits and financial liability if you veer too far off a prudent course.

While you have leeway, and ultimately the client can do what he/she wants, you are expected to guide the client. I'm the expert, not them. Just like a doctor-patient relationship.

If you retired in 1980 and all the uber-bulls like Howard Ruff controlled your thinking and you put 5% or 10% or 20% or 50% of your money into PMs because "they can't lose"....how did that work out for your retirement in the 1980's and 1990's and even into the 2000's ? Asset classes that miss out on DECADES are suspect.

.

Financial planners seem to like cherry-picking data points,

Im sure glad we dont see any of that cherry picking nonsense by PMers on internet chat rooms.

.

CFPs often reference "1980" as a basis point for metals and 1988 for stocks.

When deciding where to put money going forward from here, a basis point of 2024 would be better.

.

I have never heard a CFP use those dates. Nor, do I believe has anyone else.

Why would you say 2024 is an inflection point. What is the significance over 2020 or 2017 or 2009?

.

If you are planning one or two years out, it makes sense to use a comparison starting point that is one or two years ago, not a point that was 45 years ago.

.

SO lets plan for next year based on what happened last year? Sound. LOL

.

Better than what you would do : plan for next year based on what happened 45 years ago.

@jmski52 said:

Who else does that leave? Hmmmmm. Maybe the Fed, the US Treasury, or even BoE. They are the ones who have >a vested interest in maintaining the dollar as the reserve currency and who else is in position to create more bogus >money and/or sell a bunch of naked shorts without any immediate negative consequences? Who else could it have >been?

You think the SOMA of the NY Fed (System Open Market Account) isn't tracked by Wall Street Fed Watchers ? Osama Bin Laden would have a better chance of fiddling around with a bomb in Times Square in 2002 and not being noticed.

It was probably some macro hedge funds. There are dozens of hedge funds and family offices that are larger than $100 BB and hundreds over $50 billion. SWFs are also another option, they control trillions in assets.

Forget conspiracy theories, follow the money.

I think it's a major struggle taking place between the paper pushers (i.e., the purveyors of debt) vs. the believers in >real money.

Maybe between Gold Bugs but nobody managing a central bank or an economy cares for esoteric debates like that.

Gold was smacked down over $100 last Friday and bounced right back yesterday. Evidently someone thinks that it >needed to get smacked down twice (more than $200) as hard today.

When it ran up for weeks/months, that wasn't a conspiracy, so why is a drop to last Monday's level nefarious ?

When it ran up for weeks/months, that wasn't a conspiracy, so why is a drop to last Monday's level nefarious ?

Learn what fundamentals are and how they normally/should affect price. In the case of silver the fundamentals boil down to supply and demand. Fundamentals drove the price up and they did not suddenly change. Supply did not miraculusly appear and demand did not suddenly disappear.

The reason the price of any commodity has to be "smacked" is because its fundamentals beg to differ.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

@jmski52 said: )> I doubt that we will ever know who's actually selling. I tend to think that it wasn't physical gold being sold.

Physical or paper, it ultimately has to be real gold.

If I was a dealer and was looking to buy 1,000 gold coins at FUN 2026 (I'm not !! ) what is wrong with me hedging by buyingg GLD now or a futures contract ? Paper move that will ultimately be settled in real gold. I lock in today and prevent the risk of a blow-off to $5,000.

@MsMorrisine said:

they were price sensitive to take it down 9% in less than 3 days

The institutions that want to buy will buy. Whoever sold it is obviously not the same group looking to buy, unless the sales were a short and now they have to cover.

All PM prices are first determined with futures contracts. This is where it is decided if the price of gold/silver eagles will rise or fall. The futures market determines the value of what you stack. Premiums on that stack will fluctuate to a small degree based on the current supply and demand of the physical product, but the price is essentially set by bullion bankers trading contracts.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

"It is important to understand that what we are witnessing is a sovereign debt crisis, and this has not been seen for over 100 years (with the notable exception of selected third world and developing countries). Inflation is needed to “grow our way out of the debt”; the debt must be devalued against some form of money that is not subject to debasement or excessive money printing."

"Sovereign governments are more likely to attempt a devaluation or reset using gold."

Explains why central banks have stockpiling their weapon of choice. More important it opens the door to much higher gold when the CB's curtail their buying.

From one who grew up in Soviet Russia and understands monetary chaos:

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

@dcarr said:

Some of the reasons that I would never employ a financial planner are outlined above.

They don't seem to think like a contrarian. Everything they do is formulaic and main-stream, like a chef that never >has a new recipe.

Exactly. They are NOT trying to reinvent the wheel. You face lawsuits and financial liability if you veer too far off a prudent course.

While you have leeway, and ultimately the client can do what he/she wants, you are expected to guide the client. I'm the expert, not them. Just like a doctor-patient relationship.

If you retired in 1980 and all the uber-bulls like Howard Ruff controlled your thinking and you put 5% or 10% or 20% or 50% of your money into PMs because "they can't lose"....how did that work out for your retirement in the 1980's and 1990's and even into the 2000's ? Asset classes that miss out on DECADES are suspect.

.

Financial planners seem to like cherry-picking data points,

Im sure glad we dont see any of that cherry picking nonsense by PMers on internet chat rooms.

.

CFPs often reference "1980" as a basis point for metals and 1988 for stocks.

When deciding where to put money going forward from here, a basis point of 2024 would be better.

.

I have never heard a CFP use those dates. Nor, do I believe has anyone else.

Why would you say 2024 is an inflection point. What is the significance over 2020 or 2017 or 2009?

.

If you are planning one or two years out, it makes sense to use a comparison starting point that is one or two years ago, not a point that was 45 years ago.

.

SO lets plan for next year based on what happened last year? Sound. LOL

.

Better than what you would do : plan for next year based on what happened 45 years ago.

.

Actually I plan based on the future, not the past, like you. Maybe that's why you are always running into the trees?

@stevek said:

Gold below 4k today?

Not a prediction, just wondering.

We were/are way overbought, but the metrics on gold levels vs. per-capita disposable income are very high. These are NOT short-term timing instruments but they do determine long-term pricing. And that is stretched right now.

We can still go higher because of SWF, CB, and other institutional buying, plus untapped retail buying globally. But it's a much tougher slog at $4,000 than at $2,000.

@stevek said:

Gold below 4k today?

Not a prediction, just wondering.

We were/are way overbought, but the metrics on gold levels vs. per-capita disposable income are very high. These are NOT short-term timing instruments but they do determine long-term pricing. And that is stretched right now.

We can still go higher because of SWF, CB, and other institutional buying, plus untapped retail buying globally. But it's a much tougher slog at $4,000 than at $2,000.

I have read but haven't verified that a lot of the recent buying was done by stable coins which explains a lot. The XAUt stable coin looks to be a good way to acquire gold-backed crypto.

@ProofCollection said:

I have read but haven't verified that a lot of the recent buying was done by stable coins which explains a lot. The >XAUt stable coin looks to be a good way to acquire gold-backed crypto.

I haven't seen anything like that so I am not in a position to comment. Not sure why anybody would need/want "gold backed crypto" but then again we live in strange times.

Here's another piece that talks about backtesting all the gold influences, some of which don't pan out, others which do. Bernstein at the time of this report (July) was only looking for a gold price of about $3,700 for this year and maybe $4,300 at the most bullish next year.

Actually I plan based on the future, not the past, like you.

"Those who cannot remember the past are condemned to repeat it." George Santayana.

We can still go higher because of SWF, CB, and other institutional buying, plus untapped retail buying globally. But it's a much tougher slog at $4,000 than at $2,000.

Not according to Jim Rickards. You would say that he's one of those guys who doesn't have a track record.

Q: Are You Printing Money? Bernanke: Not Literally

@jmski52 said:

Not according to Jim Rickards. You would say that he's one of those guys who doesn't have a track record.

He may have some interesting thoughts, even ones I agree with. But no, he's not running money professionally, best I can tell. And I never/rarely see him on TV being interviewed.

He wrote a book predicting the collapse of the international monetary system. That was a decade ago. Reminds me of Ravi Batra, who wrote a famous book predicting the coming Depression in 1990.

@jmski52 said:

Not according to Jim Rickards. You would say that he's one of those guys who doesn't have a track record.

He may have some interesting thoughts, even ones I agree with. But no, he's not running money professionally, best I can tell. And I never/rarely see him on TV being interviewed.

He wrote a book predicting the collapse of the international monetary system.

Collapse of a monetary system is a slow motion event. If you don't see that it is underway you are in denial.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

@jmski52 said:

Not according to Jim Rickards. You would say that he's one of those guys who doesn't have a track record.

He may have some interesting thoughts, even ones I agree with. But no, he's not running money professionally, best I can tell. And I never/rarely see him on TV being interviewed.

He wrote a book predicting the collapse of the international monetary system.

Collapse of a monetary system is a slow motion event. If you don't see that it is underway you are in denial.

Certainly not in our lifetimes. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

@jmski52 said:

Not according to Jim Rickards. You would say that he's one of those guys who doesn't have a track record.

He may have some interesting thoughts, even ones I agree with. But no, he's not running money professionally, best I can tell. And I never/rarely see him on TV being interviewed.

He wrote a book predicting the collapse of the international monetary system.

Collapse of a monetary system is a slow motion event. If you don't see that it is underway you are in denial.

Certainly not in our lifetimes. RGDS!

that may be true, but you are paying the costs of it getting there.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

@derryb said:

Collapse of a monetary system is a slow motion event. If you don't see that it is underway you are in denial.

If it's so slow that it is immaterial to the financial markets, then it's a NothingBurger.

Has he given a date for this collapse ? If he isn't sure if it's 2 years or 10 years, that doesn't matter. But if he is going to take a victory lap if it happens in 75 or 130 years, that means squat.

@derryb said:

Collapse of a monetary system is a slow motion event. If you don't see that it is underway you are in denial.

If it's so slow that it is immaterial to the financial markets, then it's a NothingBurger.

Has he given a date for this collapse ? If he isn't sure if it's 2 years or 10 years, that doesn't matter. But if he is going to take a victory lap if it happens in 75 or 130 years, that means squat.

@ProofCollection said:

I have read but haven't verified that a lot of the recent buying was done by stable coins which explains a lot. The >XAUt stable coin looks to be a good way to acquire gold-backed crypto.

There are two applications. One is to use it as an ETF except there is no obfuscation about how many ounces you're buying. The other is to provide another option for when you want to sell your crypto. If it's time to sell Bitcoin, taking a long US dollar position may not be what you want to do, so take a long gold position instead.

Comments

More buyers than sellers.

Thanks, I was going to chime in and say this. You can blame the regulatory agencies for not stopping this, but I think the blame should be placed on the criminals.

http://ProofCollection.Net

Regulators and government entities (i.e., HUD) MANDATED these loans be made or strongly enouraged them with the threat of shooting down expansion or M&A plans. The Community Reinvestment Act (CRA) is still around nearly 50 years after it was passed (should be repealed).

Leverage was a problem....bad underwriting was a problem....but government encouragement was the biggest problem. If Fannie and Freddie said NO, then the loans don't get made no matter what Wall Street wanted.

The crappier the loan, the more politicians liked it.

More buyers than sellers.

Seriously, with no big sellers -- i.e., Central Banks -- and other institutions (SWFs, ultra-rich family offices, asset managers, etc.) all buying plus retail (though price-sensitive)....you have major tailwinds behind the gold price. Many of these buyers don't really care if gold is $3,000 an ounce or $5,000 an ounce-- they manage trillions and want an allocation for the next 10-15 years. That allocation is also usually small so again, price isn't really a big thing.

When I worked in Private Banks, "cheap" gold was $300/oz. and "expensive" gold was $1,000 an ounce. It didn't matter that much for 90% of our retail clients....and NONE of our institutional clients.

The biggest problem for big institutional buyers is what to buy and how to store it.

Latest thoughts from RBC Capital, PT for gold raised:

As I recall, and I probably won't describe it accurately, the banksters created CDS and disguised the true risk of the loan portfolios (fraud), and as a result they were able to sell high risk mortgage portfolios as low risk until the whole thing blew up. The government didn't tell them or encourage them to come up with that scheme. The whole thing was only possible because they were lying about the quality of the mortgages.

http://ProofCollection.Net

Leverage was the worst.....Carlyle Capital went under investing in AAA-rated Treasury bonds because they used 30-to-1 leverage. Asset goes down 3%, you're wiped out.

CDS was basically selling insurance without properly reserving for it. Very risky.

The whole thing was predicated on rising median home prices, which had NEVER fallen in this country since 1967.....even through several (deep) recessions had taken place (1974, 1982, and less so 1990-91). If median home prices don't fall, even crappy loans and high leverage don't matter. My 1st job out of college was tracking median home prices so I know the data series very well.

Perfect storm hit: leverage + crappy loans + falling asset prices. You need all 3 to implode the system.

.

No arm twisting was required. The banks were very happy to make such loans, so long as they could package them up and pawn them off on oblivious investors. And they did. A lot.

.

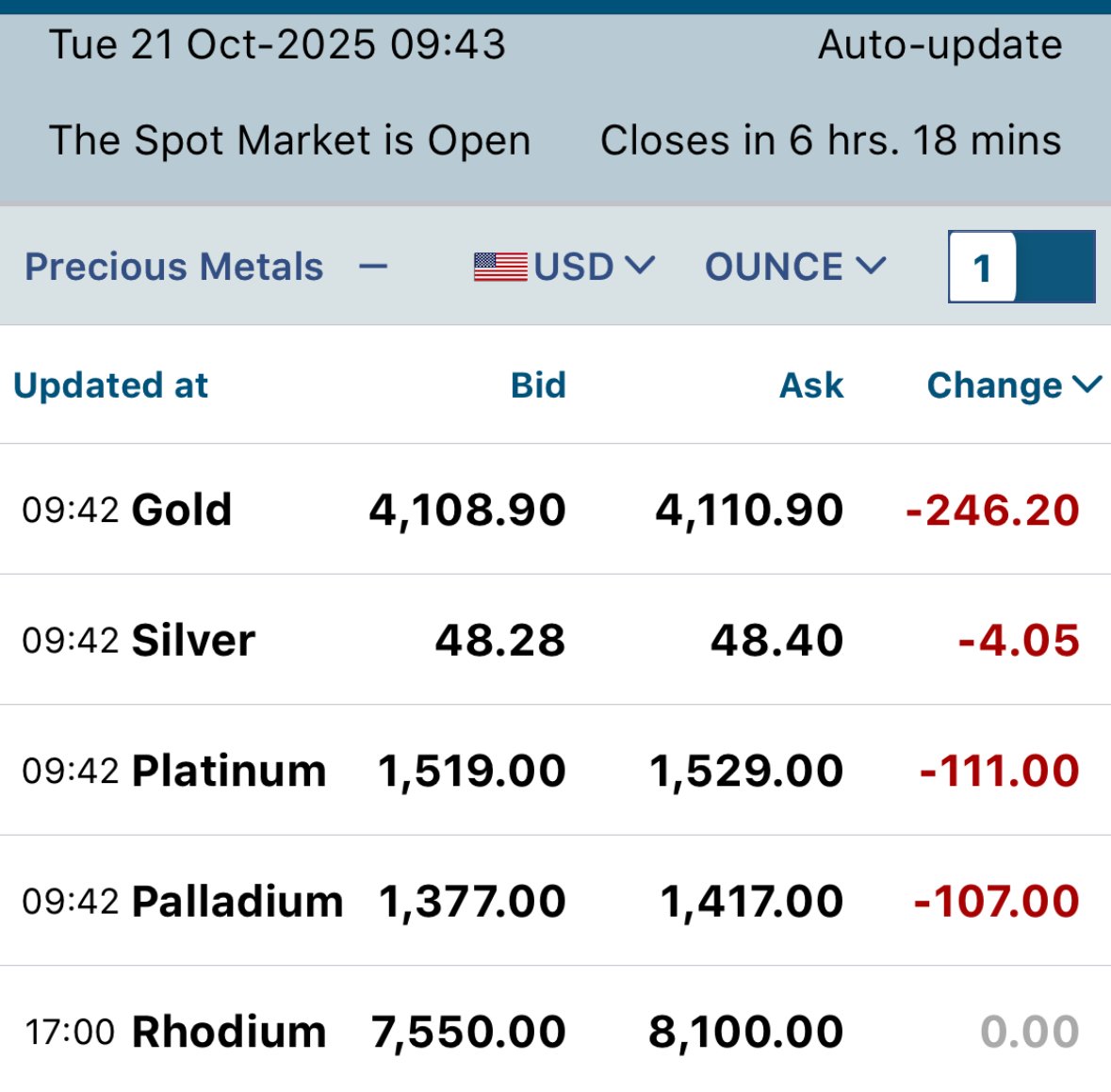

Rough day today.

Gold down 3% and still moving; silver down 5+% and still moving.

Gold only $19.00 from backwardation, spread has been fairly stable

Silver in backwardation by $.63, spread vs. Dec futures is shrinking by half

Haven't had time to think about what it means.......other than volatility which should be expected

I knew it would happen.

Buy that dip!

COPPER is gutter !

I > @jmski52 said:

Guess it means we can buy less dollars with our gold today, but how many of us really want to exchange ounces for dollars? 😇

Indian Head $10 Gold Date Set Album

Opportunity

….. relief ? Correction ? Footing ?

``https://ebay.us/m/KxolR5

Dedicated lenders like Countrywide, Novastar, and others wanted to make those loans, yes. But bigger banks had no interest in making most of those loans. JP Morgan was threatened with loss of NYC/NYS bond underwriting if they didn't increase their lending in "sensitive areas." CRA scores depended on it.

I agree they were ultimately responsible. Some banks did a better job keeping their exposure to a minimum.

Too many people think PMs aren't more risky and volatile than stocks or bonds. They are.

Today was a reminder that PMs are risky.

That said, nasty corrections in a bull market are to be expected. I believe we will make new highs within weeks though straightlining for a while to re-energize the trend wouldn't be a bad thing.

STACK IT UP!

COPPER is gutter !

Everything has risk. Smart investing means making sure the reward is commensurate with that risk.

http://ProofCollection.Net

Too many people think PMs aren't more risky and volatile than stocks or bonds. They are.

Today was a reminder that PMs are risky.

Considering the size of the recent runups, you can't expect there not to be volatility at this point.

That said, nasty corrections in a bull market are to be expected. I believe we will make new highs within weeks though straightlining for a while to re-energize the trend wouldn't be a bad thing.

I doubt that central banks suddenly reversed course and suddenly dumped a bunch of gold.

Further, in view of all the higher price predictions and significantly larger portfolio allocation recommendations for gold recently issued by Goldman, JPM, Morgan Stanley and BoA - I tend to think that it wasn't any of them (or their clients) dumping huge amounts of gold in order to move the market.

I doubt that the BRICS - Brazil, Russia, India, China or South Africa, and including Saudi, Vietnam, or even Mexico have decided to sell off a bunch of their gold.

Who else does that leave? Hmmmmm. Maybe the Fed, the US Treasury, or even BoE. They are the ones who have a vested interest in maintaining the dollar as the reserve currency and who else is in position to create more bogus money and/or sell a bunch of naked shorts without any immediate negative consequences? Who else could it have been?

I think it's a major struggle taking place between the paper pushers (i.e., the purveyors of debt) vs. the believers in real money.

Gold was smacked down over $100 last Friday and bounced right back yesterday. Evidently someone thinks that it needed to get smacked down twice (more than $200) as hard today.

We live in interesting times. Stay tuned.

I knew it would happen.

bingo

There's ALWAYS a pull back or retracement. So far it's about 7% from the peak. Nothing out of the ordinary.

But I do see a double top which will probably create a resistance level and I would expect gold to consolidate in the $4000-$4400 range for a while. Perhaps even dipping to $3800.

http://ProofCollection.Net

The volume and scale of the problem wouldn't have been possible without the fraud of lying about the quality of the MBS they created.

http://ProofCollection.Net

http://ProofCollection.Net

SO lets plan for next year based on what happened last year? Sound. LOL

Knowledge is the enemy of fear

seems no matter what, the music stops and there ain't enough chairs. Common thread in our modern economy. Jail the bankers.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Well history does rhyme.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

.

Better than what you would do : plan for next year based on what happened 45 years ago.

.

You think the SOMA of the NY Fed (System Open Market Account) isn't tracked by Wall Street Fed Watchers ? Osama Bin Laden would have a better chance of fiddling around with a bomb in Times Square in 2002 and not being noticed.

It was probably some macro hedge funds. There are dozens of hedge funds and family offices that are larger than $100 BB and hundreds over $50 billion. SWFs are also another option, they control trillions in assets.

Forget conspiracy theories, follow the money.

Maybe between Gold Bugs but nobody managing a central bank or an economy cares for esoteric debates like that.

When it ran up for weeks/months, that wasn't a conspiracy, so why is a drop to last Monday's level nefarious ?

https://www.cnbc.com/video/2025/10/22/the-demand-for-hedges-remain-high-despite-recent-market-turmoil-says-rbcs-amy-wu-silverman.html

a few seconds of gold at the end of the segment. about 6:55 through

seems to indicate a re-entry of derivative traders is beginning

When it ran up for weeks/months, that wasn't a conspiracy, so why is a drop to last Monday's level nefarious ?

Because it actually was nefarious? Now it looks like a speculative blowoff, but I do think it's likely that it was precipitated by paper manipulation.

I doubt that we will ever know who's actually selling. I tend to think that it wasn't physical gold being sold.

I knew it would happen.

Gold below 4k today?

Not a prediction, just wondering.

Learn what fundamentals are and how they normally/should affect price. In the case of silver the fundamentals boil down to supply and demand. Fundamentals drove the price up and they did not suddenly change. Supply did not miraculusly appear and demand did not suddenly disappear.

The reason the price of any commodity has to be "smacked" is because its fundamentals beg to differ.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Institutions, which are less price-sensitive, will be looking to ADD or BUY on this weakness.

Let's see how we defend $4,000.

Physical or paper, it ultimately has to be real gold.

If I was a dealer and was looking to buy 1,000 gold coins at FUN 2026 (I'm not !! ) what is wrong with me hedging by buyingg GLD now or a futures contract ? Paper move that will ultimately be settled in real gold.

) what is wrong with me hedging by buyingg GLD now or a futures contract ? Paper move that will ultimately be settled in real gold.  I lock in today and prevent the risk of a blow-off to $5,000.

I lock in today and prevent the risk of a blow-off to $5,000.

they were price sensitive to take it down 9% in less than 3 days

The institutions that want to buy will buy. Whoever sold it is obviously not the same group looking to buy, unless the sales were a short and now they have to cover.

All PM prices are first determined with futures contracts. This is where it is decided if the price of gold/silver eagles will rise or fall. The futures market determines the value of what you stack. Premiums on that stack will fluctuate to a small degree based on the current supply and demand of the physical product, but the price is essentially set by bullion bankers trading contracts.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

$10,000 gold is a very real possibility

"It is important to understand that what we are witnessing is a sovereign debt crisis, and this has not been seen for over 100 years (with the notable exception of selected third world and developing countries). Inflation is needed to “grow our way out of the debt”; the debt must be devalued against some form of money that is not subject to debasement or excessive money printing."

"Sovereign governments are more likely to attempt a devaluation or reset using gold."

Explains why central banks have stockpiling their weapon of choice. More important it opens the door to much higher gold when the CB's curtail their buying.

From one who grew up in Soviet Russia and understands monetary chaos:

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Actually I plan based on the future, not the past, like you. Maybe that's why you are always running into the trees?

Knowledge is the enemy of fear

Some gold commentary:

We were/are way overbought, but the metrics on gold levels vs. per-capita disposable income are very high. These are NOT short-term timing instruments but they do determine long-term pricing. And that is stretched right now.

We can still go higher because of SWF, CB, and other institutional buying, plus untapped retail buying globally. But it's a much tougher slog at $4,000 than at $2,000.

I have read but haven't verified that a lot of the recent buying was done by stable coins which explains a lot. The XAUt stable coin looks to be a good way to acquire gold-backed crypto.

http://ProofCollection.Net

I haven't seen anything like that so I am not in a position to comment. Not sure why anybody would need/want "gold backed crypto" but then again we live in strange times.

Here's another piece that talks about backtesting all the gold influences, some of which don't pan out, others which do. Bernstein at the time of this report (July) was only looking for a gold price of about $3,700 for this year and maybe $4,300 at the most bullish next year.

Actually I plan based on the future, not the past, like you.

"Those who cannot remember the past are condemned to repeat it." George Santayana.

We can still go higher because of SWF, CB, and other institutional buying, plus untapped retail buying globally. But it's a much tougher slog at $4,000 than at $2,000.

Not according to Jim Rickards. You would say that he's one of those guys who doesn't have a track record.

I knew it would happen.

He may have some interesting thoughts, even ones I agree with. But no, he's not running money professionally, best I can tell. And I never/rarely see him on TV being interviewed.

He wrote a book predicting the collapse of the international monetary system. That was a decade ago. Reminds me of Ravi Batra, who wrote a famous book predicting the coming Depression in 1990.

Haven't seen of him in 34 years.

.

Collapse of a monetary system is a slow motion event. If you don't see that it is underway you are in denial.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Certainly not in our lifetimes. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

that may be true, but you are paying the costs of it getting there.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

If it's so slow that it is immaterial to the financial markets, then it's a NothingBurger.

Has he given a date for this collapse ? If he isn't sure if it's 2 years or 10 years, that doesn't matter. But if he is going to take a victory lap if it happens in 75 or 130 years, that means squat.

It happens slow at first. Then it happens fast.

There are two applications. One is to use it as an ETF except there is no obfuscation about how many ounces you're buying. The other is to provide another option for when you want to sell your crypto. If it's time to sell Bitcoin, taking a long US dollar position may not be what you want to do, so take a long gold position instead.

http://ProofCollection.Net

Once belief is gone, all is lost.

Looks like 4k may be tested today.