Paying a NEGATIVE premium (as in SLV fees and the like), is the greater fool game.

I'm not understanding you.

SLV - ISHARES SILVER TRUST

Last sale $39.04+1.05 (+2.76%)

Bid x Size

$39.02 x 1,700

Ask x Size

$39.05 x 700

Spreads on 90% silver vary from dealer to dealer and are much wider.

Dcarr is likely refering to "price erosion" in ETFs, also known as Net Asset Value (NAV) erosion. It refers to the decline in an ETF's value due to distributions being paid out of the underlying capital rather than just generated income, especially when total returns underperform or there are high distribution rates. Over time this erosion can negate gains.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Most people trading SLV are in and out very quickly. Price erosion isn't even a thought. The real price erosion is all that gutter sitting in the bunker not even coming close to keeping up with inflation. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Paying a NEGATIVE premium (as in SLV fees and the like), is the greater fool game.

I'm not understanding you.

SLV - ISHARES SILVER TRUST

Last sale $39.04+1.05 (+2.76%)

Bid x Size

$39.02 x 1,700

Ask x Size

$39.05 x 700

Spreads on 90% silver vary from dealer to dealer and are much wider.

Dcarr is likely refering to "price erosion" in ETFs, also known as Net Asset Value (NAV) erosion. It refers to the decline in an ETF's value due to distributions being paid out of the underlying capital rather than just generated income, especially when total returns underperform or there are high distribution rates. Over time this erosion can negate gains.

YES, I agree. Stacking is good for long term holdings. SLV is great for trading silver in the meantime.

Price erosion can occur for physical gold/silver also. Safe deposit or other storage cost, (optional) insurance cost, transportation cost, transaction cost, time cost when buying/selling, risk of theft. ETFs can be worth the relatively small erosion, even when held for long term.

I stopped buying. Period. What is on my mind is when to let it go. I have no desire to be buried with this stuff. Oh sure I can pass it on to the kids but the point of buying it was to, lets be blunt here, to make some money.

@Overdate said:

Price erosion can occur for physical gold/silver also. Safe deposit or other storage cost, (optional) insurance cost, transportation cost, transaction cost, time cost when buying/selling, risk of theft. ETFs can be worth the relatively small erosion, even when held for long term.

.

It doesn't cost anything to bury it in the yard (if you already own the yard).

Stocks, ETFs, cryptos, etc also have a cost - you need to have a computer and/or phone, and pay for an internet connection.

Accounts can be hacked. Counter-parties (such as ETF or corporate management) can fail.

I can pass it on to the kids but the point of buying it was to, lets be blunt here, to make some money.

The larger point is to keep money under your own control and outside of the system, as Jim Sinclair said - because let's be blunt about it - Uncle Sam's inflation, Wall Street, and the banking system are pretty good at getting into your finances and stealing it.

My observation is that if you take care of your money, your money will take care of you. You never know when you're going to need it.

Q: Are You Printing Money? Bernanke: Not Literally

@Overdate said:

Price erosion can occur for physical gold/silver also. Safe deposit or other storage cost, (optional) insurance cost, transportation cost, transaction cost, time cost when buying/selling, risk of theft. ETFs can be worth the relatively small erosion, even when held for long term.

.

It doesn't cost anything to bury it in the yard (if you already own the yard).

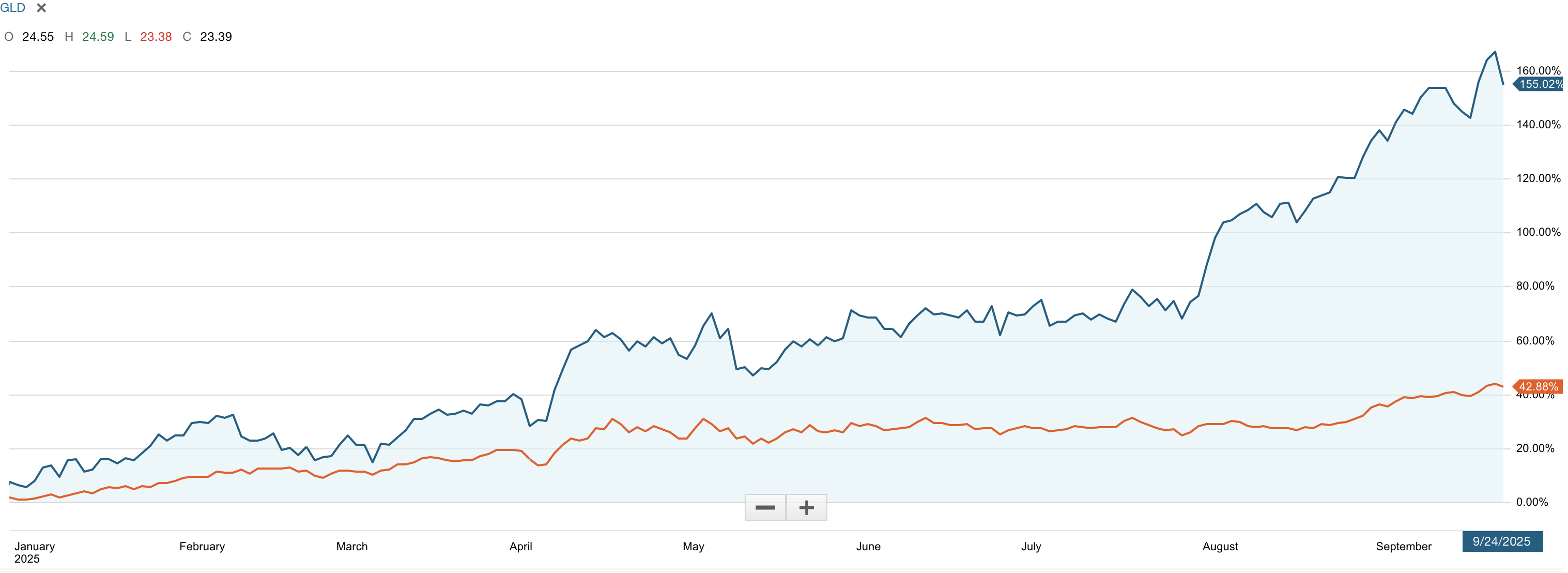

It helps to consider all options for investing in gold. A surprising example of a gold mining stock (KGC) compared to the gold ETF (GLD) since the first of the year. 155% vs. 42%

Blue is KGC. Orange is GLD

@jmski52 said: I can pass it on to the kids but the point of buying it was to, lets be blunt here, to make some money.

The larger point is to keep money under your own control and outside of the system, as Jim Sinclair said - because let's be blunt about it - Uncle Sam's inflation, Wall Street, and the banking system are pretty good at getting into your finances and stealing it.

My observation is that if you take care of your money, your money will take care of you. You never know when you're going to need it.

I consider a good reason to sell your gold and silver is when you want to buy some land. That is exactly what I am thinking. Not junk or whatever. An asset for an asset.

@jmski52 said: I can pass it on to the kids but the point of buying it was to, lets be blunt here, to make some money.

The larger point is to keep money under your own control and outside of the system, as Jim Sinclair said - because let's be blunt about it - Uncle Sam's inflation, Wall Street, and the banking system are pretty good at getting into your finances and stealing it.

My observation is that if you take care of your money, your money will take care of you. You never know when you're going to need it.

I consider a good reason to sell your gold and silver is when you want to buy some land. That is exactly what I am thinking. Not junk or whatever. An asset for an asset.

Gold paid off what was left owed on the farm. Only problem is I did so back at about $2650ish. Luckily it was not a large amount of ounces. I am currently looking at additional real estate and contemplate the sale of gold and gutter to again finance. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Gold paid off what was left owed on the farm. Only problem is I did so back at about $2650ish. Luckily it was not a large amount of ounces. I am currently looking at additional real estate and contemplate the sale of gold and gutter to again finance. RGDS!

The only issue I see is you traded an invisible asset for a non-mobile one that governments will increasingly tax...

Gold paid off what was left owed on the farm. Only problem is I did so back at about $2650ish. Luckily it was not a large amount of ounces. I am currently looking at additional real estate and contemplate the sale of gold and gutter to again finance. RGDS!

The only issue I see is you traded an invisible asset for a non-mobile one that governments will increasingly tax...

Agreed, but I got my future retirement casa out of it.....and as future snowbirds we also like to fantasize about migrating south to a winter casa. If I was able to do that from trading in the "invisible" assets that I worked hard to obtain, well mission accomplished. The bonus is, Momma certainly agrees. As for the goobers and their taxes, well that's a dangerous and subjectively political road but, personally I protest my property taxes every chance I get. SMPR!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

The price of gold has doubled since I started my "Wishlist" of gold coins. The good news is that the numsimatic coins I am looking at are up 40-50% instead of 120%.

Still, you don't pay in relative dollars, but absolute dollars. And I'm going to be paying more.

I guess a positive is that if gold wickedly reverses to the downside I shouldn't go down 1-for-1 with gold bullion.

Higher prices for gold or silver tells us they are doing their job of protecting wealth. That is a good thing for those who were smart enough to put some of their wealth into PMs. Will the trend continue? Absolutely unless inflation goes negative.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

@GoldFinger1969 said: I just saw that while the price of gold has more than doubled since I zeroed-in on my #1 Watchlist Coin....the coin itself is only up about 20%.

Of course, if I want ANY pure-bullions or near-bullions, I'm gonna pay the move in gold the last few years, about 100% more.

premiums tend to drop when spot skyrockets. Number of reasons but a good one is that sellers are happy with the value added by higher spot price and are willing to lower their premium as they are still making a good profit.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

@GoldFinger1969 said: I just saw that while the price of gold has more than doubled since I zeroed-in on my #1 Watchlist Coin....the coin itself is only up about 20%.

Of course, if I want ANY pure-bullions or near-bullions, I'm gonna pay the move in gold the last few years, about 100% more.

premiums tend to drop when spot skyrockets. Number of reasons but a good one is that sellers are happy with the value added by higher spot price and are willing to lower their premium as they are still making a good profit.

No premiums on the SLV, buy or sell. I have had physical gutter eagles and maples for sale at spot for several weeks now. Nobody's interested. THKS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

No premiums on the SLV, buy or sell. I have had physical gutter eagles and maples for sale at spot for several weeks now. Nobody's interested. THKS!

SLV is trading above its NAV, so I would disagree with the 'no premiums' part.

I wouldn't, buy slv 41.86, sell slv 41.86. I can buy it and sell it at the exact same price.

Go buy an ASE, dealer wants to charge you $2 over spot, go back to same dealer and sell him back that ASE and he'll offer you $2 under spot. That's premium. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

No premiums on the SLV, buy or sell. I have had physical gutter eagles and maples for sale at spot for several weeks now. Nobody's interested. THKS!

SLV is trading above its NAV, so I would disagree with the 'no premiums' part.

I wouldn't, buy slv 41.86, sell slv 41.86. I can buy it and sell it at the exact same price.

Go buy an ASE, dealer wants to charge you $2 over spot, go back to same dealer and sell him back that ASE and he'll offer you $2 under spot. That's premium. RGDS!

I would. Buying $40.85 worth of silver for $41.86 is paying a premium. As for a spread in the bid/ask - SLV has that as well.

No premiums on the SLV, buy or sell.

I have had physical gutter eagles and maples for sale at spot for several weeks now. Nobody's interested. THKS!

.

Maybe it isn't the coins. Maybe it's you ?

I mean, you did once write on this forum that you had "silver for sale to anyone dumb enough to buy it".

That was when silver was twenty-something per ounce.

With that kind of presentation, it is not surprising that nobody wants to buy from you.

I can see why SLV appeals to you - because you don't have to interact with any human to buy or sell.

My tip:

Venture out of that cave and into the real world. Get a table at a coin show and socialize face-to-face with some real humans.

On thing I've noticed...,. one antique store I frequent has a seller that always had silver coins, morgan dollars, etc. for sell. But nearly all is now gone... perhaps intentionally pulled off the shelves? I'm thinking the person has just withdrawn the items and is taking a wait and see approach, since prices keep going up... let's see where it goes.

@blitzdude said:

LOL get a table at a coin show? What a pathetic waste of time. No thanks, I'd rather just click a button. Time is $$$. RGDS!

.

If you don't enjoy the numismatic hobby, why do you persist in visiting this forum ?

How much time do you "waste" by posting here ?

You really should try a coin show some time. It is a place where buyers and sellers meet in person, and you can usually negotiate low premiums and low buy-sell spreads on bullion.

Yeah I know what a coin show is. I will be at the legendary PAN here in a few short weeks dumping some gutter. I certainly won't be renting a table. Who said anything about me not enjoying numismatics? There you go again putting words into my mouth. THKS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

@blitzdude said:

Yeah I know what a coin show is. I will be at the legendary PAN here in a few short weeks dumping some gutter. I certainly won't be renting a table. Who said anything about me not enjoying numismatics? There you go again putting words into my mouth. THKS!

Assuming that THKS means "thanks" and it saved you 2 keystrokes, thanking him for putting words in your mouth is a confusing sentiment to express in that context.

@blitzdude said:

Yeah I know what a coin show is. I will be at the legendary PAN here in a few short weeks dumping some gutter. I certainly won't be renting a table. Who said anything about me not enjoying numismatics? There you go again putting words into my mouth. THKS!

Assuming that THKS means "thanks" and it saved you 2 keystrokes, thanking him for putting words in your mouth is a confusing sentiment to express in that context.

Obviously, someone was absent the day they taught "sarcasm" back in grade skoollz. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

@blitzdude said:

Yeah I know what a coin show is. I will be at the legendary PAN here in a few short weeks dumping some gutter. I certainly won't be renting a table. Who said anything about me not enjoying numismatics? There you go again putting words into my mouth. THKS!

.

You stated that you thought getting a table at a coin show was a "pathetic waste of time". And yet, you complain all the time about dealer buy-sell spreads. If you don't like the dealers' buy-sell spreads, become a dealer yourself and be on the positive side of the spread. You can do that if you have a table.

@GoldFinger1969 said: I just saw that while the price of gold has more than doubled since I zeroed-in on my #1 Watchlist Coin....the coin itself is only up about 20%.

Of course, if I want ANY pure-bullions or near-bullions, I'm gonna pay the move in gold the last few years, about 100% more.

premiums tend to drop when spot skyrockets. Number of reasons but a good one is that sellers are happy with the value added by higher spot price and are willing to lower their premium as they are still making a good profit.

No premiums on the SLV, buy or sell. I have had physical gutter eagles and maples for sale at spot for several weeks now. Nobody's interested. THKS!

Imagine if gutter metal was ACTUALLY made with silver.

@blitzdude said:

Yeah I know what a coin show is. I will be at the legendary PAN here in a few short weeks dumping some gutter. I certainly won't be renting a table. Who said anything about me not enjoying numismatics? There you go again putting words into my mouth. THKS!

.

You stated that you thought getting a table at a coin show was a "pathetic waste of time". And yet, you complain all the time about dealer buy-sell spreads. If you don't like the dealers' buy-sell spreads, become a dealer yourself and be on the positive side of the spread. You can do that if you have a table.

.

I am my own dealer. Click, click. Get with it. THKS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

@tincup said:

On thing I've noticed...,. one antique store I frequent has a seller that always had silver coins, morgan dollars, etc. for sell. But nearly all is now gone... perhaps intentionally pulled off the shelves? I'm thinking the person has just withdrawn the items and is taking a wait and see approach, since prices keep going up... let's see where it goes.

I removed everything from ebay that doesn't have a big premium attached to it. I assume others have done the same.

I swung by a new coin shop inside of an antique store.

Picked up a couple pieces of high price silver 🤔 support the local business...I was the second customer.

1/8 oz and a $52 ounce Lego.

Gold has always “felt” expensive to me, all through my life, from when I was young in the 1990s until today. The choice remains the same: buy silver in bulk or be patient and wait and buy a 1/4 ounce gold coin. It takes a LOT of silver to equal 1/4 ounce of gold.

These days I monitor the gold to silver ratio. But I am stuck between buying more or pausing.

I posted this in a different thread, but it might be a good way to cope with the higher prices, to wit:

The world is moving away from dollars and debt, towards physical assets as collateral. That direction isn't going to change anytime soon. My advice would be to continue quietly accumulating and keep track of your average costs. As the numbers get larger, two things will happen:

1) Your dollars will buy fewer and fewer ounces.

2) Your savings will look better and better.

Lastly, keep a 6 month or 12 month cash cushion so that you aren't forced to liquidate unless it's for a good reason.

Q: Are You Printing Money? Bernanke: Not Literally

The one collecting thing I did right was to buy UNC modern silver commemorative dollars for my dansco albums when silver was $18-$22 an oz. I have 74 coins, but haven’t finished it yet.

"I'll split the atom! I am the fifth dimension! I am the eighth wonder of the world!" -Gef the talking mongoose.

Comments

I'm not understanding you.

SLV - ISHARES SILVER TRUST

Last sale $39.04+1.05 (+2.76%)

Bid x Size

$39.02 x 1,700

Ask x Size

$39.05 x 700

Spreads on 90% silver vary from dealer to dealer and are much wider.

Dcarr is likely refering to "price erosion" in ETFs, also known as Net Asset Value (NAV) erosion. It refers to the decline in an ETF's value due to distributions being paid out of the underlying capital rather than just generated income, especially when total returns underperform or there are high distribution rates. Over time this erosion can negate gains.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Most people trading SLV are in and out very quickly. Price erosion isn't even a thought. The real price erosion is all that gutter sitting in the bunker not even coming close to keeping up with inflation. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

YES, I agree. Stacking is good for long term holdings. SLV is great for trading silver in the meantime.

Price erosion can occur for physical gold/silver also. Safe deposit or other storage cost, (optional) insurance cost, transportation cost, transaction cost, time cost when buying/selling, risk of theft. ETFs can be worth the relatively small erosion, even when held for long term.

I stopped buying. Period. What is on my mind is when to let it go. I have no desire to be buried with this stuff. Oh sure I can pass it on to the kids but the point of buying it was to, lets be blunt here, to make some money.

.

It doesn't cost anything to bury it in the yard (if you already own the yard).

Stocks, ETFs, cryptos, etc also have a cost - you need to have a computer and/or phone, and pay for an internet connection.

Accounts can be hacked. Counter-parties (such as ETF or corporate management) can fail.

.

I can pass it on to the kids but the point of buying it was to, lets be blunt here, to make some money.

The larger point is to keep money under your own control and outside of the system, as Jim Sinclair said - because let's be blunt about it - Uncle Sam's inflation, Wall Street, and the banking system are pretty good at getting into your finances and stealing it.

My observation is that if you take care of your money, your money will take care of you. You never know when you're going to need it.

I knew it would happen.

>

As long as no one's watching.

It helps to consider all options for investing in gold. A surprising example of a gold mining stock (KGC) compared to the gold ETF (GLD) since the first of the year. 155% vs. 42%

Blue is KGC. Orange is GLD

I consider a good reason to sell your gold and silver is when you want to buy some land. That is exactly what I am thinking. Not junk or whatever. An asset for an asset.

Gold paid off what was left owed on the farm. Only problem is I did so back at about $2650ish. Luckily it was not a large amount of ounces. I am currently looking at additional real estate and contemplate the sale of gold and gutter to again finance. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

The only issue I see is you traded an invisible asset for a non-mobile one that governments will increasingly tax...

Agreed, but I got my future retirement casa out of it.....and as future snowbirds we also like to fantasize about migrating south to a winter casa. If I was able to do that from trading in the "invisible" assets that I worked hard to obtain, well mission accomplished. The bonus is, Momma certainly agrees. As for the goobers and their taxes, well that's a dangerous and subjectively political road but, personally I protest my property taxes every chance I get. SMPR!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

The price of gold has doubled since I started my "Wishlist" of gold coins. The good news is that the numsimatic coins I am looking at are up 40-50% instead of 120%.

Still, you don't pay in relative dollars, but absolute dollars. And I'm going to be paying more.

I guess a positive is that if gold wickedly reverses to the downside I shouldn't go down 1-for-1 with gold bullion.

Higher prices for gold or silver tells us they are doing their job of protecting wealth. That is a good thing for those who were smart enough to put some of their wealth into PMs. Will the trend continue? Absolutely unless inflation goes negative.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

I just saw that while the price of gold has more than doubled since I zeroed-in on my #1 Watchlist Coin....the coin itself is only up about 20%.

Of course, if I want ANY pure-bullions or near-bullions, I'm gonna pay the move in gold the last few years, about 100% more.

Above prices were from Sept 14.

Today’s sell prices:

AGE 3830

Buffs 3860

Buying bullion at -2.00

One dealer had ASEs at spot, bullion at -0.50.

premiums tend to drop when spot skyrockets. Number of reasons but a good one is that sellers are happy with the value added by higher spot price and are willing to lower their premium as they are still making a good profit.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

No premiums on the SLV, buy or sell. I have had physical gutter eagles and maples for sale at spot for several weeks now. Nobody's interested. THKS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

SLV is trading above its NAV, so I would disagree with the 'no premiums' part.

I wouldn't, buy slv 41.86, sell slv 41.86. I can buy it and sell it at the exact same price.

Go buy an ASE, dealer wants to charge you $2 over spot, go back to same dealer and sell him back that ASE and he'll offer you $2 under spot. That's premium. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

I would. Buying $40.85 worth of silver for $41.86 is paying a premium. As for a spread in the bid/ask - SLV has that as well.

The longer you hold SLV (or GLD) the more the NAV eats at your investment. Both ETFs work best when not held very long.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

.

Maybe it isn't the coins. Maybe it's you ?

I mean, you did once write on this forum that you had "silver for sale to anyone dumb enough to buy it".

That was when silver was twenty-something per ounce.

With that kind of presentation, it is not surprising that nobody wants to buy from you.

I can see why SLV appeals to you - because you don't have to interact with any human to buy or sell.

My tip:

Venture out of that cave and into the real world. Get a table at a coin show and socialize face-to-face with some real humans.

.

LOL get a table at a coin show? What a pathetic waste of time. No thanks, I'd rather just click a button. Time is $$$. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

On thing I've noticed...,. one antique store I frequent has a seller that always had silver coins, morgan dollars, etc. for sell. But nearly all is now gone... perhaps intentionally pulled off the shelves? I'm thinking the person has just withdrawn the items and is taking a wait and see approach, since prices keep going up... let's see where it goes.

Premium? Legend is offering spot for PCGS 64 CAC Saints this morning.

.

If you don't enjoy the numismatic hobby, why do you persist in visiting this forum ?

How much time do you "waste" by posting here ?

You really should try a coin show some time. It is a place where buyers and sellers meet in person, and you can usually negotiate low premiums and low buy-sell spreads on bullion.

.

Yeah I know what a coin show is. I will be at the legendary PAN here in a few short weeks dumping some gutter. I certainly won't be renting a table. Who said anything about me not enjoying numismatics? There you go again putting words into my mouth. THKS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Assuming that THKS means "thanks" and it saved you 2 keystrokes, thanking him for putting words in your mouth is a confusing sentiment to express in that context.

http://ProofCollection.Net

Obviously, someone was absent the day they taught "sarcasm" back in grade skoollz. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

.

You stated that you thought getting a table at a coin show was a "pathetic waste of time". And yet, you complain all the time about dealer buy-sell spreads. If you don't like the dealers' buy-sell spreads, become a dealer yourself and be on the positive side of the spread. You can do that if you have a table.

.

Imagine if gutter metal was ACTUALLY made with silver.

COPPER is gutter !

I am my own dealer. Click, click. Get with it. THKS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

I removed everything from ebay that doesn't have a big premium attached to it. I assume others have done the same.

I just look at what I have and wish I’d bought more.

Buy what you Like.

I swung by a new coin shop inside of an antique store.

Picked up a couple pieces of high price silver 🤔 support the local business...I was the second customer.

1/8 oz and a $52 ounce Lego.

Gold has always “felt” expensive to me, all through my life, from when I was young in the 1990s until today. The choice remains the same: buy silver in bulk or be patient and wait and buy a 1/4 ounce gold coin. It takes a LOT of silver to equal 1/4 ounce of gold.

These days I monitor the gold to silver ratio. But I am stuck between buying more or pausing.

Oct 12 prices:

Kitco silver ask $50.01

Gold ask $4018.40

Generic 1oz rounds. 48-51

ASE rolls 1020-1060

ASE singles 53

Lots of 10oz bars at 510, including one dealer that had a quantity of Engelhards at that price.

No buy prices posted anywhere.

Overheard one dealer giving questionable tax advice.

What did the pawn shops offer on the gutter bars? THKS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Never made it in, the wife’s to-do list were longer than expected and the one I went by, the line was out the door.

Well you haven't looked everywhere. Try Moneymetals.com.

http://ProofCollection.Net

Line out the door at the pawn shop? Whas everyone one in line to sell their gutter metal?

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

No buy prices posted at the LCS this morning, which is where the posted prices were obtained.

I posted this in a different thread, but it might be a good way to cope with the higher prices, to wit:

The world is moving away from dollars and debt, towards physical assets as collateral. That direction isn't going to change anytime soon. My advice would be to continue quietly accumulating and keep track of your average costs. As the numbers get larger, two things will happen:

1) Your dollars will buy fewer and fewer ounces.

2) Your savings will look better and better.

Lastly, keep a 6 month or 12 month cash cushion so that you aren't forced to liquidate unless it's for a good reason.

I knew it would happen.

The one collecting thing I did right was to buy UNC modern silver commemorative dollars for my dansco albums when silver was $18-$22 an oz. I have 74 coins, but haven’t finished it yet.

I just buy less gold.

I went to FUN 2020 and bought 3 gold coins. I hope to go to FUN 2026 and I'll be hoping to buy 1 gold coin.

"How do you guys cope with gold and silver costing so much more?"

By selling it for more.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Gold yes but why would you want to sell it? The gutter not so much, currently nobody wants the trash. THKS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????