1,715 next day delivery was too much for me. Its really pretty bullion, but I prefer gold & silver & platinum.

Having parted ways with US Mint made bullion that arrived in slabs years ago absolutely nothing I sold locally for cash achieved One Cent more in premium. Local shop XRFs everything & 70 slabs add zero value. I assume any metals I buy from Mint are 100% real.

237 left

&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&

Now Saturday morning and not sold out. ATS = 218

Happy Shopping !

@safari_dude said:

Worth paying $2150 on eBay for a graded 70? I’m on the fence….

@Goldminers said:

I had purchased all of these starting in 2017, and mostly due to the palladium price dropping, I lost several thousand selling them all this year as this series is a lost cause. With the Mint charging $1,695 for these and spot at $1,123 IMO there is no upside, even if less than 3,000 are sold, which would not surprise me.

Too many collectors like me have been badly burned on these. Ignore eBay listings with hopeful premiums that do not sell. I see people talk premiums, but many do not remove 10-20% seller fees from the hype. I sold my top set on GC and lost thousands. Low mintage does not trump high mint cost, with low metal demand as more electric cars become mainstream. Buyers beware.

I agree with you, but for a slightly different reason. The psychology of the buyer base.

Look at the content of these NCLT threads. Not just this one, all of them. The subsequent price performance after issuance isn't an accident.

@HalfDime said:

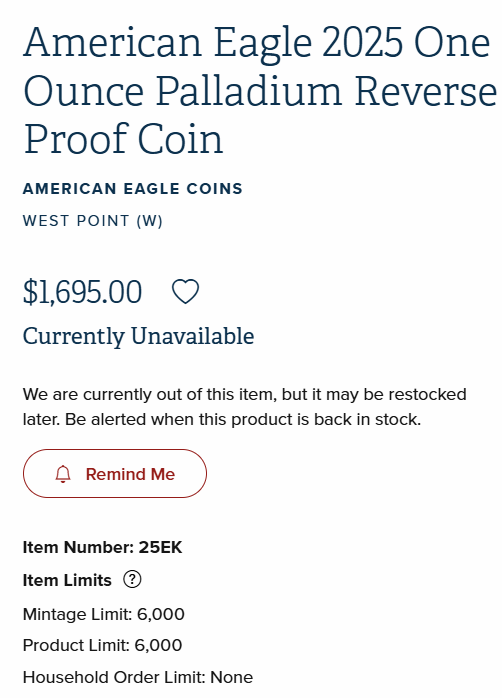

American Eagle 2025 One Ounce Palladium Reverse Proof Coin

The mintage limit for the American Eagle 2025 One Ounce Palladium Reverse Proof Coin has been posted, and it is 6000 coins for this year. That may be a new low mintage for the reverse proof coins, yet it is not a new low compared to the proof coins.

Chances are the final sales will fall under 6000, so it will be comparable to the others as having a 5k+ mintage.

Checking prices on Ebay for raw key date coins, these show:

The current price for the still available 2024 palladium proof is $1695. This shows the past issue keys still carry barely any premium over release prices based on today's pricing. Since the 2024 coin is still available with a projected limit of about 5900 coins, the 2025 coins by comparison may not sell out this year if they strike the full numbers.

There is a chance they only strike 4000 of the 2025 coins. If that happens it would be the new low mintage winner, but only if it comes in under 5000 coins. If they strike the full amount, collectors will probably have to wait another year for a possible low mintage release winner.

@HalfDime said:

American Eagle 2025 One Ounce Palladium Reverse Proof Coin

The mintage limit for the American Eagle 2025 One Ounce Palladium Reverse Proof Coin has been posted, and it is 6000 coins for this year. That may be a new low mintage for the reverse proof coins, yet it is not a new low compared to the proof coins.

Chances are the final sales will fall under 6000, so it will be comparable to the others as having a 5k+ mintage.

Checking prices on Ebay for raw key date coins, these show:

The current price for the still available 2024 palladium proof is $1695. This shows the past issue keys still carry barely any premium over release prices based on today's pricing. Since the 2024 coin is still available with a projected limit of about 5900 coins, the 2025 coins by comparison may not sell out this year if they strike the full numbers.

There is a chance they only strike 4000 of the 2025 coins. If that happens it would be the new low mintage winner, but only if it comes in under 5000 coins. If they strike the full amount, collectors will probably have to wait another year for a possible low mintage release winner.

@Goldminers said:

I had purchased all of these starting in 2017, and mostly due to the palladium price dropping, I lost several thousand selling them all this year as this series is a lost cause. With the Mint charging $1,695 for these and spot at $1,123 IMO there is no upside, even if less than 3,000 are sold, which would not surprise me.

Too many collectors like me have been badly burned on these. Ignore eBay listings with hopeful premiums that do not sell. I see people talk premiums, but many do not remove 10-20% seller fees from the hype. I sold my top set on GC and lost thousands. Low mintage does not trump high mint cost, with low metal demand as more electric cars become mainstream. Buyers beware.

I agree with you, but for a slightly different reason. The psychology of the buyer base.

Look at the content of these NCLT threads. Not just this one, all of them. The subsequent price performance after issuance isn't an accident.

And yet people are constantly arguing that "this time it's different..."

All comments reflect the opinion of the author, even when irrefutably accurate.

@WCC said:

Look at the content of these NCLT threads. Not just this one, all of them. The subsequent price performance after issuance isn't an accident.

You mean all of them like like this other thread I started prior to the release of the gold UHR. Everyone who bought has made a lot of money.

These palladium coins has followed the normal sales pattern of moderns that has already happened enough times to show a pattern. It is also struck on an industrial cyclical metal that went high enough that earlier buyers got burned by it.

It has now come down to more realistic mintages, and now is the time to buy as demand has dropped enough to where they may appreciate. A 3k mintage would have been better, but 4k is still borderline.

@WCC said:

Look at the content of these NCLT threads. Not just this one, all of them. The subsequent price performance after issuance isn't an accident.

You mean all of them like like this other thread I started prior to the release of the gold UHR. Everyone who bought has made a lot of money.

These palladium coins has followed the normal sales pattern of moderns that has already happened enough times to show a pattern. It is also struck on an industrial cyclical metal that went high enough that earlier buyers got burned by it.

It has now come down to more realistic mintages, and now is the time to buy as demand has dropped enough to where they may appreciate. A 3k mintage would have been better, but 4k is still borderline.

The math IS important, but you're leaving out a crucial variable that makes any comparison to other series a false equivalency. During the height of a robust market, palladium left a horrible taste in the mouth of many stackers and collectors dipping their toes in the water. I find it unlikely that I'm one of the only kids who took my ball and went home that day, never to return to the school yard...once bitten, twice shy.

There are millions of catalytic convertors waiting to be recycled as more people move to electric vehicles, especially with much better batteries and charging rates that are on the way. More than half of all palladium demand is for convertors. It can easily drop back below $1,000 for spot bullion in the future.

If speculating on modern coins for investments, which can be costly in many cases, I prefer to put my limited funds into lower mintage gold or silver items which also have some monetary linkage to fiat currency debt and money printing worldwide. Central banks are not buying palladium. It is a precious metal outcast with poor jewelry demand and slowing industrial use. To pay 50%+ above spot for mint bullion is removing a great deal of the limited numismatic upside for "mintage".

New designs like the gold high reliefs also matter; this palladium design and finish is getting repetitive. Better opportunities are available.

I love the liquid look of these, quite stunning imo. Maybe Pd. will make a bullish comeback as battery operated vehicles decline in popularity and replaced with vehicles using near zero emission fuels.

@morgansforever said:

I love the liquid look of these, quite stunning imo. Maybe Pd. will make a bullish comeback as battery operated vehicles decline in popularity and replaced with vehicles using near zero emission fuels.

They really are awesome looking.

Like someone else said, what's the eagle doing w the plant? Getting nesting materials I guess.

@morgansforever said:

I love the liquid look of these, quite stunning imo. Maybe Pd. will make a bullish comeback as battery operated vehicles decline in popularity and replaced with vehicles using near zero emission fuels.

They really are awesome looking.

Like someone else said, what's the eagle doing w the plant? Getting nesting materials I guess.

A beautiful coin!!!! Let’s get this sold out guys!!!

@Goldminers said:

New designs like the gold high reliefs also matter; this palladium design and finish is getting repetitive. Better opportunities are available.

I have one of each finish (the first few years, it is a beautiful piece) and that's enough. If it were a rotating design like the platinum I might feel differently, but even then the premium is too high and the investment potential is too soft.

I don't have any. They are very nice looking. I just can't pull the trigger. It's still a lot of money. I can't see them ever being worth even what I'd pay.

Man, I really liked the initial idea of adding a $25 2025 but reading about radioactivity and Russia sitting on actual tons of this interesting to read about metal made me decide to pass.

I am at peace with my choice, though I really love the designs and reverse proof presentation.

@WCC said:

Look at the content of these NCLT threads. Not just this one, all of them. The subsequent price performance after issuance isn't an accident.

You mean all of them like like this other thread I started prior to the release of the gold UHR. Everyone who bought has made a lot of money.

These palladium coins has followed the normal sales pattern of moderns that has already happened enough times to show a pattern. It is also struck on an industrial cyclical metal that went high enough that earlier buyers got burned by it.

It has now come down to more realistic mintages, and now is the time to buy as demand has dropped enough to where they may appreciate. A 3k mintage would have been better, but 4k is still borderline.

No, that's not what I meant.

It's the lack of interest in this coinage as a collectible, as opposed to buying it for financial reasons. I've never claimed this coinage can't or won't go up in price. It's that the long-term appreciation sought by those buying it requires actual hobbyist collector interest which isn't evident in hardly any of this coinage, outside of the ASE. "Strong hands" as opposed to speculators looking to dump it once it's met their ROI. Does this describe even 10% of the buyers?

In another thread, I explained to you the mindset in these threads which I infer is representative of those who buy it. Anyone who is obsessed with the price performance of what they buy (which is exactly what these threads indicate) is collecting (if it can even be called that) above their risk tolerance, doesn't like this coinage as much as they claim or infer, or both.

I don't see any indication from anyone in these threads that they actually like this coinage that much. That's why most of it is priced as a bullion or quasi-bullion substitute, regardless of the mintage. There is literally almost nothing said about this coinage as a collectible in any of these threads, so what does that tell you? Pages and pages of posts in some of these threads, yet nothing or virtually nothing about the coin.

In one of our first post exchanges, you disagreed with my assessment of Jordan's books. Both books I read demonstrated the same mindset as these threads. Both books were predominantly describing how to build an "investment portfolio" as opposed to a collection, and the best explanation for it is that there isn't much to collecting of this coinage. Except for choice of holder or holder label which isn't even a coin attribute, there is no actual variation in appearance between literally almost 100% of it and all of it can be bought in one day by anyone who has the money.

Both books contain numerous inaccurate premises, starting with the error that there is no difference in collector perception between NCLT and circulating coinage when this isn't remotely true. That's why the outsized emphasis on the mintage in these threads is misplaced. There are plenty of US proof coins dated prior to 1936 (Liberty Seated and Barber) with lower mintages which have a lot more actual collector interest still selling for less, just nowhere near as many (if any) financially motivated buyers.

@Goldminers said:

There are millions of catalytic convertors waiting to be recycled as more people move to electric vehicles, especially with much better batteries and charging rates that are on the way. More than half of all palladium demand is for convertors. It can easily drop back below $1,000 for spot bullion in the future.

If speculating on modern coins for investments, which can be costly in many cases, I prefer to put my limited funds into lower mintage gold or silver items which also have some monetary linkage to fiat currency debt and money printing worldwide. Central banks are not buying palladium. It is a precious metal outcast with poor jewelry demand and slowing industrial use. To pay 50%+ above spot for mint bullion is removing a great deal of the limited numismatic upside for "mintage".

New designs like the gold high reliefs also matter; this palladium design and finish is getting repetitive. Better opportunities are available.

I agree. I have an example of each of the three finishes for type, and that is enough for me!

115 left.

Whereas a single 1oz Palladium bar will cost about $1250-1300 or more, I think the premium for this coin is worth the potential numismatic upside.

@WCC said:

Both books contain numerous inaccurate premises, starting with the error that there is no difference in collector perception between NCLT and circulating coinage when this isn't remotely true. That's why the outsized emphasis on the mintage in these threads is misplaced. There are plenty of US proof coins dated prior to 1936 (Liberty Seated and Barber) with lower mintages which have a lot more actual collector interest still selling for less, just nowhere near as many (if any) financially motivated buyers.

Everybody who bought the sunflower gold UHR loved the coin, not sure what you are reading. Also someone posted above how beautiful this reverse proof palladium coin is.

However, as far as this coin series goes compared to the past issues, if what you say is true then nobody ever would be paying over 40k for a 230 privy gold flowing hair NCLT coin. Nobody ever would be paying over 20k for a 1945 mintage 1 ounce proof Gold eagle. And certainly nobody would be paying over 800k for one of seven available gold Sacagawea coins coming up for auction.

But they apparently are.

So is it these sophisticated buyers don't know what NCLT means? Or are people overlooking that and actually buy regardless.

It seems it must be the latter.

The majority of the classic proofs you talk about are considered a single coin by combined mintage according to the market, and that is how they are priced. That is the basis for the book you say is so inaccurate. However you do say they are underpriced compared to moderns, and that is the correct explanation given.

Comments

1,715 next day delivery was too much for me. Its really pretty bullion, but I prefer gold & silver & platinum.

Having parted ways with US Mint made bullion that arrived in slabs years ago absolutely nothing I sold locally for cash achieved One Cent more in premium. Local shop XRFs everything & 70 slabs add zero value. I assume any metals I buy from Mint are 100% real.

237 left

&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&

Now Saturday morning and not sold out. ATS = 218

Happy Shopping !

Hopefully these are sold out soon! New key!!

Pulled the trigger and got one from the mint. I like having the OGP with the coins…😉

YES!

Around 30 were added to the ats at 7:30 this morning fyi.

I agree with you, but for a slightly different reason. The psychology of the buyer base.

Look at the content of these NCLT threads. Not just this one, all of them. The subsequent price performance after issuance isn't an accident.

The 2025W remains available, so I decided to wikipedia up some info about this metal in case I wanted to impulse buy up one:

https://en.wikipedia.org/wiki/Palladium

How many still up? And how do you tell?

https://www.usmint.gov/on/demandware.store/Sites-USM-Site/default/Product-Variation?pid=25EK

search for "ats" in the left column

152 right now

And yet people are constantly arguing that "this time it's different..."

All comments reflect the opinion of the author, even when irrefutably accurate.

You mean all of them like like this other thread I started prior to the release of the gold UHR. Everyone who bought has made a lot of money.

https://forums.collectors.com/discussion/1115592/american-liberty-high-relief-1-ounce-gold-coins

Not everyone gets burned on moderns.

Everyone who has bought the 100k or lower silver eagles has made money.

https://forums.collectors.com/discussion/1114293/250th-anniversary-united-states-army-american-eagle-one-ounce-silver-proof-coin/p1

The math is important.

These palladium coins has followed the normal sales pattern of moderns that has already happened enough times to show a pattern. It is also struck on an industrial cyclical metal that went high enough that earlier buyers got burned by it.

It has now come down to more realistic mintages, and now is the time to buy as demand has dropped enough to where they may appreciate. A 3k mintage would have been better, but 4k is still borderline.

I did ok w the V75 AGE despite its being modern nclt

Thank you!!!

The math IS important, but you're leaving out a crucial variable that makes any comparison to other series a false equivalency. During the height of a robust market, palladium left a horrible taste in the mouth of many stackers and collectors dipping their toes in the water. I find it unlikely that I'm one of the only kids who took my ball and went home that day, never to return to the school yard...once bitten, twice shy.

Founder- Peak Rarities

Website

Instagram

Facebook

There are millions of catalytic convertors waiting to be recycled as more people move to electric vehicles, especially with much better batteries and charging rates that are on the way. More than half of all palladium demand is for convertors. It can easily drop back below $1,000 for spot bullion in the future.

If speculating on modern coins for investments, which can be costly in many cases, I prefer to put my limited funds into lower mintage gold or silver items which also have some monetary linkage to fiat currency debt and money printing worldwide. Central banks are not buying palladium. It is a precious metal outcast with poor jewelry demand and slowing industrial use. To pay 50%+ above spot for mint bullion is removing a great deal of the limited numismatic upside for "mintage".

New designs like the gold high reliefs also matter; this palladium design and finish is getting repetitive. Better opportunities are available.

My US Mint Commemorative Medal Set

139 now. Maybe sold out in a week lol

I love the liquid look of these, quite stunning imo. Maybe Pd. will make a bullish comeback as battery operated vehicles decline in popularity and replaced with vehicles using near zero emission fuels.

They really are awesome looking.

Like someone else said, what's the eagle doing w the plant? Getting nesting materials I guess.

A beautiful coin!!!! Let’s get this sold out guys!!!

I have one of each finish (the first few years, it is a beautiful piece) and that's enough. If it were a rotating design like the platinum I might feel differently, but even then the premium is too high and the investment potential is too soft.

I don't have any. They are very nice looking. I just can't pull the trigger. It's still a lot of money. I can't see them ever being worth even what I'd pay.

Man, I really liked the initial idea of adding a $25 2025 but reading about radioactivity and Russia sitting on actual tons of this interesting to read about metal made me decide to pass.

I am at peace with my choice, though I really love the designs and reverse proof presentation.

Anyways, available to sell, ats now sits at 118

No, that's not what I meant.

It's the lack of interest in this coinage as a collectible, as opposed to buying it for financial reasons. I've never claimed this coinage can't or won't go up in price. It's that the long-term appreciation sought by those buying it requires actual hobbyist collector interest which isn't evident in hardly any of this coinage, outside of the ASE. "Strong hands" as opposed to speculators looking to dump it once it's met their ROI. Does this describe even 10% of the buyers?

In another thread, I explained to you the mindset in these threads which I infer is representative of those who buy it. Anyone who is obsessed with the price performance of what they buy (which is exactly what these threads indicate) is collecting (if it can even be called that) above their risk tolerance, doesn't like this coinage as much as they claim or infer, or both.

I don't see any indication from anyone in these threads that they actually like this coinage that much. That's why most of it is priced as a bullion or quasi-bullion substitute, regardless of the mintage. There is literally almost nothing said about this coinage as a collectible in any of these threads, so what does that tell you? Pages and pages of posts in some of these threads, yet nothing or virtually nothing about the coin.

In one of our first post exchanges, you disagreed with my assessment of Jordan's books. Both books I read demonstrated the same mindset as these threads. Both books were predominantly describing how to build an "investment portfolio" as opposed to a collection, and the best explanation for it is that there isn't much to collecting of this coinage. Except for choice of holder or holder label which isn't even a coin attribute, there is no actual variation in appearance between literally almost 100% of it and all of it can be bought in one day by anyone who has the money.

Both books contain numerous inaccurate premises, starting with the error that there is no difference in collector perception between NCLT and circulating coinage when this isn't remotely true. That's why the outsized emphasis on the mintage in these threads is misplaced. There are plenty of US proof coins dated prior to 1936 (Liberty Seated and Barber) with lower mintages which have a lot more actual collector interest still selling for less, just nowhere near as many (if any) financially motivated buyers.

I agree. I have an example of each of the three finishes for type, and that is enough for me!

We shall see. I think this will be a winner with a 4000 mintage but maybe not. I did my part by buying 10.

115 left.

Whereas a single 1oz Palladium bar will cost about $1250-1300 or more, I think the premium for this coin is worth the potential numismatic upside.

http://ProofCollection.Net

Everybody who bought the sunflower gold UHR loved the coin, not sure what you are reading. Also someone posted above how beautiful this reverse proof palladium coin is.

However, as far as this coin series goes compared to the past issues, if what you say is true then nobody ever would be paying over 40k for a 230 privy gold flowing hair NCLT coin. Nobody ever would be paying over 20k for a 1945 mintage 1 ounce proof Gold eagle. And certainly nobody would be paying over 800k for one of seven available gold Sacagawea coins coming up for auction.

But they apparently are.

So is it these sophisticated buyers don't know what NCLT means? Or are people overlooking that and actually buy regardless.

It seems it must be the latter.

The majority of the classic proofs you talk about are considered a single coin by combined mintage according to the market, and that is how they are priced. That is the basis for the book you say is so inaccurate. However you do say they are underpriced compared to moderns, and that is the correct explanation given.

IOW's you've been wrong, wrong, wrong.

down to 111 ats

Wow! I cannot explain it ... But all the negative mojo and the ats countdown is making me juicy for this year's lowest mintage(?) RP.

considering buying 10 more if still available in am

Hold on, you have to wait for my check to clear...

Got 3 myself to continue my PD Eagle collection. Oh well, guessed I'm averaging down a bit.

Just ordered one of the RPs. Wasn't planning to but the low mintage and imminent sellout convinced me.

I'll have a 23 W Unc, 24 W Proof and 25 W RP.

ATS = 102

10!! Wow

people must be reading this thread and slowly buying because it is now ats = 100

"Max order quantity is 99", which a 29 lines of code above ATS number, so the remaining could just disappear as ats is 99 now

excellent...someone bought all of them. Sold out!

Glad I didn't have to buy another 10.

Still shows the add to bag tab for me.

I could add 50 to my bag right now. What makes you say they are sold out?

that's the 2024 regular proof.

Go for it!

Proud follower of Christ!

That obviously was not my point.

I was responding to the comment that they were sold out. I thought I was clear in that.

Oh, duh. Thanks!

I forgot that was still up there.

You’re looking at wrong one. We are discussing 2025 which is sold out

Nope.

http://ProofCollection.Net

Indeed.

My mistake.

I forgot that was still there.

currently unavailable

So, there were 99 @ 8:24 & sold out by 8:52??!! That's amazing.

These are going up in value. New key

race to the bottom