It's not the best performing asset in the past 25 years using rolling time periods, which is what professionals and serious investors focus on. Nobody rebalances for gold, except a few "hard asset" funds.

Sounds like manipulation of the data in order to C-Y-A. because you didn't include gold in the portfolio. No different than picking one time period that shows your vast superiority in managing funds. It is what it is, and it's undeniable . Go ahead and massage the numbers with "rolling time periods" if you want.

The trend in central bank behavior towards gold changed in 2010, but it sure looks like there are other large entities involved in buying gold and taking delivery now. Buffett sold, Zuckerman and Bezos have cashed out of stocks significantly. Do you think they're using rolling time periods?

Q: Are You Printing Money? Bernanke: Not Literally

@RedneckHB said:

Do you think the 150% increase in mined gold from 1980 to 2000 was the reason for the 20 year bear market in >gold price?

Nope....it was the end of inflation in 1980...stabilization of currencies after the upheaveal of the end of Bretton Woods...and Central Bank selling.

The article makes the argument that the annual supply increase relative to the stock of existing gold isn't that large. And in the 1980's onward, you had lots of supply that came on because the price of gold rose 10-fold or more in less than 10 years. Even when gold fell, you had projects that only needed $200 gold to be profitable.

Im not theorizing why it fell, but rather why the price in 2002 was the same as in 1982, and that for those 20 years prices were mostly sideways. Was this because of the massive increase of supply during those years, or because of something more nefarious?

Something more nefarious. The curtain remained closed during that period. Thanks to recent questioning of the dollar's actual world status and future by its many players, that curtain has been pulled open. Few people realize that the Wizard of Oz had many references to gold and the gold standard. Yellow brick road is one example. Research will reveal the others. Like Orwell's Animal Farm it predicted many truths.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

The term 'supply' is being used fast and loose and without needed specificity. In the gold markets there is 'new' supply which comes from mines which is what that article was about and then there is probably government supply (when central banks dump gold) and private supply (when consumers dump gold). I don't think there's an industrial supply because I assume industry doesn't hold excess gold and sells what it consumes proportionate with demand.

The total amount of "gold inflation" added each year by mining activity adding to total world supply is minimal when compared to the total existing supply and not worth much consideration.

@RedneckHB said:

Do you think the 150% increase in mined gold from 1980 to 2000 was the reason for the 20 year bear market in >gold price?

Nope....it was the end of inflation in 1980...stabilization of currencies after the upheaveal of the end of Bretton Woods...and Central Bank selling.

The article makes the argument that the annual supply increase relative to the stock of existing gold isn't that large. And in the 1980's onward, you had lots of supply that came on because the price of gold rose 10-fold or more in less than 10 years. Even when gold fell, you had projects that only needed $200 gold to be profitable.

Im not theorizing why it fell, but rather why the price in 2002 was the same as in 1982, and that for those 20 years prices were mostly sideways. Was this because of the massive increase of supply during those years, or because of something more nefarious?

Something more nefarious. The curtain remained closed during that period. Thanks to recent questioning of the dollar's actual world status and future by its many players, that curtain has been pulled open. Few people realize that the Wizard of Oz had many references to gold and the gold standard. Yellow brick road is one example. Research will reveal the others. Like Orwell's Animal Farm it predicted many truths.

@RedneckHB said:

Do you think the 150% increase in mined gold from 1980 to 2000 was the reason for the 20 year bear market in >gold price?

Nope....it was the end of inflation in 1980...stabilization of currencies after the upheaveal of the end of Bretton Woods...and Central Bank selling.

The article makes the argument that the annual supply increase relative to the stock of existing gold isn't that large. And in the 1980's onward, you had lots of supply that came on because the price of gold rose 10-fold or more in less than 10 years. Even when gold fell, you had projects that only needed $200 gold to be profitable.

Im not theorizing why it fell, but rather why the price in 2002 was the same as in 1982, and that for those 20 years prices were mostly sideways. Was this because of the massive increase of supply during those years, or because of something more nefarious?

Something more nefarious. The curtain remained closed during that period. Thanks to recent questioning of the dollar's actual world status and future by its many players, that curtain has been pulled open. Few people realize that the Wizard of Oz had many references to gold and the gold standard. Yellow brick road is one example. Research will reveal the others. Like Orwell's Animal Farm it predicted many truths.

Like Star Trek too. Beam me up Scottie!!

You've been ridiculing stackers since gold was $600. At what price will you realize you are wrong. LOL

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

@RedneckHB said:

Do you think the 150% increase in mined gold from 1980 to 2000 was the reason for the 20 year bear market in >gold price?

Nope....it was the end of inflation in 1980...stabilization of currencies after the upheaveal of the end of Bretton Woods...and Central Bank selling.

The article makes the argument that the annual supply increase relative to the stock of existing gold isn't that large. And in the 1980's onward, you had lots of supply that came on because the price of gold rose 10-fold or more in less than 10 years. Even when gold fell, you had projects that only needed $200 gold to be profitable.

Im not theorizing why it fell, but rather why the price in 2002 was the same as in 1982, and that for those 20 years prices were mostly sideways. Was this because of the massive increase of supply during those years, or because of something more nefarious?

Something more nefarious. The curtain remained closed during that period. Thanks to recent questioning of the dollar's actual world status and future by its many players, that curtain has been pulled open. Few people realize that the Wizard of Oz had many references to gold and the gold standard. Yellow brick road is one example. Research will reveal the others. Like Orwell's Animal Farm it predicted many truths.

Like Star Trek too. Beam me up Scottie!!

You've been ridiculing stackers since gold was $600. At what price will you realize you are wrong. LOL

I haven't, but you've been ridiculing equity stackers since the sp500 was 700. When are you going to realize you are wrong. ROFL.

@RedneckHB said:

Do you think the 150% increase in mined gold from 1980 to 2000 was the reason for the 20 year bear market in >gold price?

Nope....it was the end of inflation in 1980...stabilization of currencies after the upheaveal of the end of Bretton Woods...and Central Bank selling.

The article makes the argument that the annual supply increase relative to the stock of existing gold isn't that large. And in the 1980's onward, you had lots of supply that came on because the price of gold rose 10-fold or more in less than 10 years. Even when gold fell, you had projects that only needed $200 gold to be profitable.

Im not theorizing why it fell, but rather why the price in 2002 was the same as in 1982, and that for those 20 years prices were mostly sideways. Was this because of the massive increase of supply during those years, or because of something more nefarious?

Something more nefarious. The curtain remained closed during that period. Thanks to recent questioning of the dollar's actual world status and future by its many players, that curtain has been pulled open. Few people realize that the Wizard of Oz had many references to gold and the gold standard. Yellow brick road is one example. Research will reveal the others. Like Orwell's Animal Farm it predicted many truths.

Like Star Trek too. Beam me up Scottie!!

You've been ridiculing stackers since gold was $600. At what price will you realize you are wrong. LOL

I haven't, but you've been ridiculing equity stackers since the sp500 was 700. When are you going to realize you are wrong. ROFL.

No, I only ridicule you. I stack equities, metals, real estate and cash.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

@RedneckHB said:

Do you think the 150% increase in mined gold from 1980 to 2000 was the reason for the 20 year bear market in >gold price?

Nope....it was the end of inflation in 1980...stabilization of currencies after the upheaveal of the end of Bretton Woods...and Central Bank selling.

The article makes the argument that the annual supply increase relative to the stock of existing gold isn't that large. And in the 1980's onward, you had lots of supply that came on because the price of gold rose 10-fold or more in less than 10 years. Even when gold fell, you had projects that only needed $200 gold to be profitable.

Im not theorizing why it fell, but rather why the price in 2002 was the same as in 1982, and that for those 20 years prices were mostly sideways. Was this because of the massive increase of supply during those years, or because of something more nefarious?

Something more nefarious. The curtain remained closed during that period. Thanks to recent questioning of the dollar's actual world status and future by its many players, that curtain has been pulled open. Few people realize that the Wizard of Oz had many references to gold and the gold standard. Yellow brick road is one example. Research will reveal the others. Like Orwell's Animal Farm it predicted many truths.

Like Star Trek too. Beam me up Scottie!!

You've been ridiculing stackers since gold was $600. At what price will you realize you are wrong. LOL

I haven't, but you've been ridiculing equity stackers since the sp500 was 700. When are you going to realize you are wrong. ROFL.

@RedneckHB said:

I'm not theorizing why it fell, but rather why the price in 2002 was the same as in 1982, and that for those 20 years >prices were mostly sideways. Was this because of the massive increase of supply during those years, or because of >something more nefarious?

Well, you had such an explosive move from 1973-80 that it was going to take years/decades to "burn off" the excess. We pretty much went sideways for 20 years.

In the mid-to-late 1990's, after another false run-up in gold's price, the European Central Banks were BIG sellers. Eventually, they had to come to an agreement to limit/end the sales, or gold would have fallen closer to $200 (it bottomed during the Tech Boom in 1999-2000 at about $280).

In the mid-to-late 1990's, after another false run-up in gold's price, the European Central Banks were BIG sellers. Eventually, they had to come to an agreement to limit/end the sales, or gold would have fallen closer to $200 (it bottomed during the Tech Boom in 1999-2000 at about $280).

As the chart below shows, there was no false run-up of gold prices in mid to late 90's. Gold actually traded sideways 1982-2002. Recall "Brown's Bottom" when he authorized the sale of 56% of the Bank of England's gold (1999-2002) at a bottom and right before gold took off. Rumor was that he did it at the US's request to help keep a lid on an expected rise in gold. However, note the sudden rise in gold right after Euro central banks dumped it into the market - apparently the law of supply and demand is not written in stone.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

@RedneckHB said:

Do you think the 150% increase in mined gold from 1980 to 2000 was the reason for the 20 year bear market in >gold price?

Nope....it was the end of inflation in 1980...stabilization of currencies after the upheaveal of the end of Bretton Woods...and Central Bank selling.

The article makes the argument that the annual supply increase relative to the stock of existing gold isn't that large. And in the 1980's onward, you had lots of supply that came on because the price of gold rose 10-fold or more in less than 10 years. Even when gold fell, you had projects that only needed $200 gold to be profitable.

Im not theorizing why it fell, but rather why the price in 2002 was the same as in 1982, and that for those 20 years prices were mostly sideways. Was this because of the massive increase of supply during those years, or because of something more nefarious?

.

Some of the price suppression came from forward sales ("hedging") by mining companies. When that was reversed and hedge books were being closed, prices sprang upward.

Some of the price suppression came from forward sales ("hedging") by mining companies. When that was reversed and hedge books were being closed, prices sprang upward.

And how do they accomplish this hedging?

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Some of the price suppression came from forward sales ("hedging") by mining companies. When that was reversed and hedge books were being closed, prices sprang upward.

And how do they accomplish this hedging?

.

Barrick, for example, sold forward production into the market. Think of it as 20 years of gold mine production coming on the market over a 10 year span. This drove the price of gold down. The prices for gold mining stocks also declined. Why would Barrick want to drive down the price of their own shares ? So that they could buy up other gold mining companies cheap. Then at some point they switched and started closing out the hedgebook using gold from previous and newly-acquired mines. Think of this as an effect where 20 years of gold demand comes into the market over a 10-year span.

@dcarr said:

Barrick, for example, sold forward production into the market. Think of it as 20 years of gold mine production >coming on the market over a 10 year span. This drove the price of gold down. The prices for gold mining stocks also >declined. Why would Barrick want to drive down the price of their own shares ? So that they could buy up other gold >mining companies cheap.

Right, so they tanked their own stock to get bigger ? No, that's not how shareholders work, even in the 1980's and 1990's and 2000's when shareholder destruction was tolerated. Peter Munk was not that stupid...or smart.

As Bernstein showed, supplys are relatively small compared to CB sales. At some point the forward sales cease, and you have buying. The point is changing the timing of the buys and sells doesn't alter the underlying fundamentals. I doubt Barrick alone -- even the entire gold mining industry -- could materially affect prices.

I do agree that mining companies have been terrible stewarts of shareholder value. Goldminers can probably chime in here with some specific expertise.

@dcarr said:

Barrick, for example, sold forward production into the market. Think of it as 20 years of gold mine production >coming on the market over a 10 year span. This drove the price of gold down. The prices for gold mining stocks also >declined. Why would Barrick want to drive down the price of their own shares ? So that they could buy up other gold >mining companies cheap.

Right, so they tanked their own stock to get bigger ? No, that's not how shareholders work, even in the 1980's and 1990's and 2000's when shareholder destruction was tolerated. Peter Munk was not that stupid...or smart.

As Bernstein showed, supplys are relatively small compared to CB sales. At some point the forward sales cease, and you have buying. The point is changing the timing of the buys and sells doesn't alter the underlying fundamentals. I doubt Barrick alone -- even the entire gold mining industry -- could materially affect prices.

I do agree that mining companies have been terrible stewarts of shareholder value. Goldminers can probably chime in here with some specific expertise.

.

Shareholders don't work. Most have little say in the overall or day-to-day operations of a company.

This is how a company like Barrick could do what they did.

In a market where equilibrium is established between buyers and sellers, a small change at the fringe can have an outsized affect on the price.

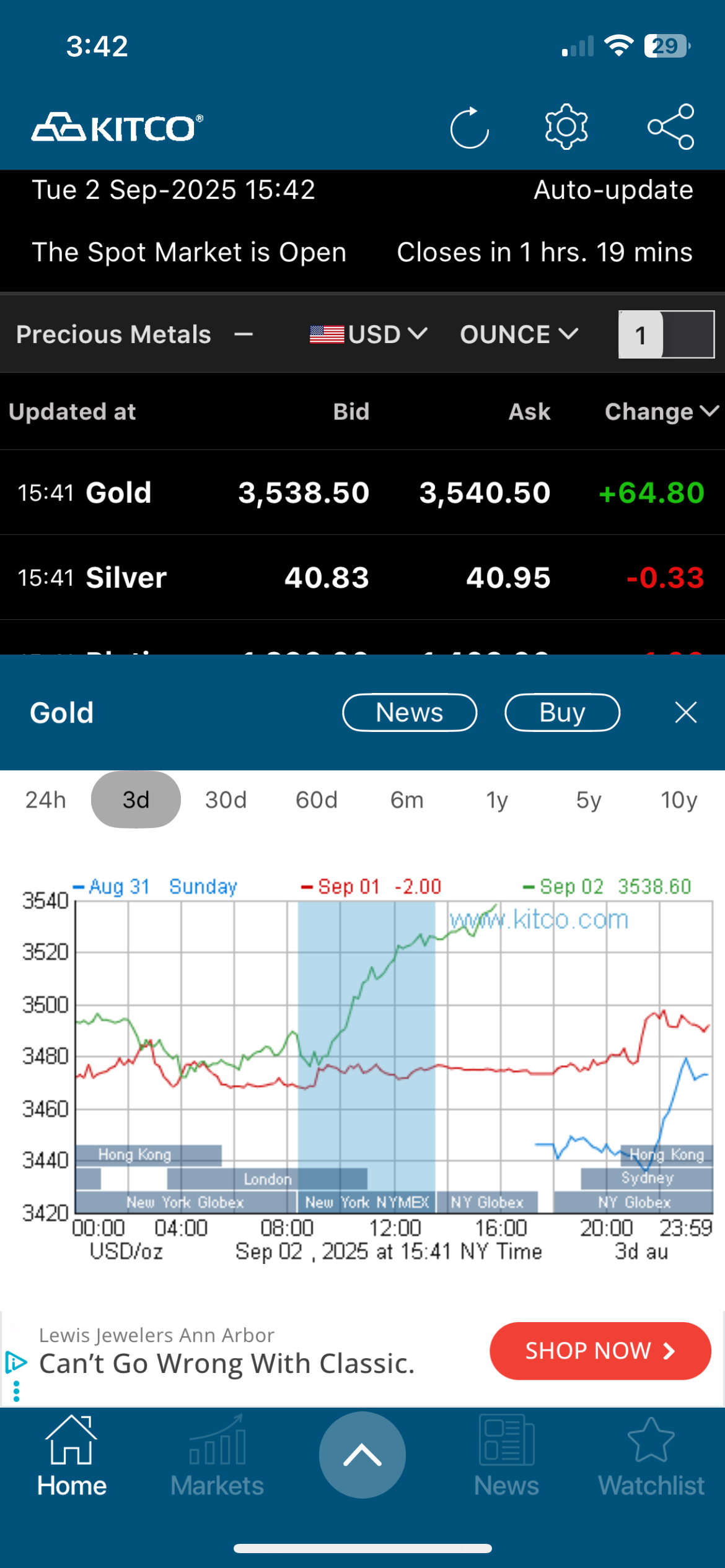

Yep, short term we should be looking at $3700-3800 gold and $41-$42 silver.

LOL 2 weeks ago you were showing us charts and telling us the sky was falling and to be ready for a big dip. THKS!

I said it wasn't looking good. A 4th monthly doji would not have been good. Long wicks up indicate that market lacks the strength to go higher and 3 of them in a row can be a topping signal. Now the month is over, the August candle has a nice breakout candle and we're ready roll. Overperformance is quite likely up to $4k and it'll drag silver up with it. REGARDS!

Comments

It's not the best performing asset in the past 25 years using rolling time periods, which is what professionals and serious investors focus on. Nobody rebalances for gold, except a few "hard asset" funds.

Sounds like manipulation of the data in order to C-Y-A. because you didn't include gold in the portfolio. No different than picking one time period that shows your vast superiority in managing funds. It is what it is, and it's undeniable . Go ahead and massage the numbers with "rolling time periods" if you want.

The trend in central bank behavior towards gold changed in 2010, but it sure looks like there are other large entities involved in buying gold and taking delivery now. Buffett sold, Zuckerman and Bezos have cashed out of stocks significantly. Do you think they're using rolling time periods?

I knew it would happen.

Something more nefarious. The curtain remained closed during that period. Thanks to recent questioning of the dollar's actual world status and future by its many players, that curtain has been pulled open. Few people realize that the Wizard of Oz had many references to gold and the gold standard. Yellow brick road is one example. Research will reveal the others. Like Orwell's Animal Farm it predicted many truths.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

The term 'supply' is being used fast and loose and without needed specificity. In the gold markets there is 'new' supply which comes from mines which is what that article was about and then there is probably government supply (when central banks dump gold) and private supply (when consumers dump gold). I don't think there's an industrial supply because I assume industry doesn't hold excess gold and sells what it consumes proportionate with demand.

The total amount of "gold inflation" added each year by mining activity adding to total world supply is minimal when compared to the total existing supply and not worth much consideration.

http://ProofCollection.Net

Like Star Trek too. Beam me up Scottie!!

Knowledge is the enemy of fear

You've been ridiculing stackers since gold was $600. At what price will you realize you are wrong. LOL

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

I haven't, but you've been ridiculing equity stackers since the sp500 was 700. When are you going to realize you are wrong. ROFL.

Knowledge is the enemy of fear

No, I only ridicule you. I stack equities, metals, real estate and cash.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

and there yu have it. quiet part said out loud

welcome to bicker world

Sad.

Knowledge is the enemy of fear

and you seem to only be here to bicker

Yeah, I never provide any rational and logical thought or factual perspective. Lol.

Break the walls of the echo chamber!!!

Knowledge is the enemy of fear

k 3370

f 3417

shrinking difference

Well, you had such an explosive move from 1973-80 that it was going to take years/decades to "burn off" the excess. We pretty much went sideways for 20 years.

In the mid-to-late 1990's, after another false run-up in gold's price, the European Central Banks were BIG sellers. Eventually, they had to come to an agreement to limit/end the sales, or gold would have fallen closer to $200 (it bottomed during the Tech Boom in 1999-2000 at about $280).

As the chart below shows, there was no false run-up of gold prices in mid to late 90's. Gold actually traded sideways 1982-2002. Recall "Brown's Bottom" when he authorized the sale of 56% of the Bank of England's gold (1999-2002) at a bottom and right before gold took off. Rumor was that he did it at the US's request to help keep a lid on an expected rise in gold. However, note the sudden rise in gold right after Euro central banks dumped it into the market - apparently the law of supply and demand is not written in stone.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

I could not understand why gold was dumped by Great Britain back then. Seemed insane... but what a buying opportunity!

There were several nice moves up during that time, your chart covers them up. Nice moves up in 1982, 1985, 1992, and a few others.

I recall the Gold Bugs all insisting we were off to new highs and it took another 15 years from the 1990's to get there.

The UK sold gold to replenish reserves lost from the Bank Of England's EMU debacles. Had nothing to do with appeasing the USA.

.

Some of the price suppression came from forward sales ("hedging") by mining companies. When that was reversed and hedge books were being closed, prices sprang upward.

.

And how do they accomplish this hedging?

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

.

Barrick, for example, sold forward production into the market. Think of it as 20 years of gold mine production coming on the market over a 10 year span. This drove the price of gold down. The prices for gold mining stocks also declined. Why would Barrick want to drive down the price of their own shares ? So that they could buy up other gold mining companies cheap. Then at some point they switched and started closing out the hedgebook using gold from previous and newly-acquired mines. Think of this as an effect where 20 years of gold demand comes into the market over a 10-year span.

.

Right, so they tanked their own stock to get bigger ? No, that's not how shareholders work, even in the 1980's and 1990's and 2000's when shareholder destruction was tolerated. Peter Munk was not that stupid...or smart.

As Bernstein showed, supplys are relatively small compared to CB sales. At some point the forward sales cease, and you have buying. The point is changing the timing of the buys and sells doesn't alter the underlying fundamentals. I doubt Barrick alone -- even the entire gold mining industry -- could materially affect prices.

I do agree that mining companies have been terrible stewarts of shareholder value. Goldminers can probably chime in here with some specific expertise.

.

Shareholders don't work. Most have little say in the overall or day-to-day operations of a company.

This is how a company like Barrick could do what they did.

In a market where equilibrium is established between buyers and sellers, a small change at the fringe can have an outsized affect on the price.

.

expect gold breakout soon.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

It continues to base...we could do it for a few more months and I'd be OK with that.....low-$4,000s sometime in Q1 2026 very likely.

much sooner

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

k 3385

f 3437

Yep, short term we should be looking at $3700-3800 gold and $41-$42 silver.

http://ProofCollection.Net

I think we hit a new gold ATH on Friday (COMEX), right ?

LOL 2 weeks ago you were showing us charts and telling us the sky was falling and to be ready for a big dip. THKS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

i said to buy the dip we have recently been seeing

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

I wasn't referring to you, it was the chart prophet. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

f 3525

k 3455

New highs tonight.

http://ProofCollection.Net

No, but tonight we did.

I said it wasn't looking good. A 4th monthly doji would not have been good. Long wicks up indicate that market lacks the strength to go higher and 3 of them in a row can be a topping signal. Now the month is over, the August candle has a nice breakout candle and we're ready roll. Overperformance is quite likely up to $4k and it'll drag silver up with it. REGARDS!

http://ProofCollection.Net

it's official

What's official? RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

it's official that i posted to the wrong thread

New ATH.....the metal will simply NOT allow buyers to get in 10-15% lower. A VERY bullish sign, IMO, if it is replicating a stock market pattern.

$4,000 for sure by January....just in time to drive-up the price of my FUN purchases !!!!

k 3525+

If you go by the low point last night it looks like we hit a $100 range in a 24 hour span.

$3600! Woo hoo!

http://ProofCollection.Net

$3535 in the real world. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

$3,600 falls on the COMEX.

Effect on premium gold coins as it approaches/exceeds $4,000 will be very interesting.

NUGT

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

k 3575

$3650+ this morning.

http://ProofCollection.Net

I saw $3600 in the real world for a few seconds anyway. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

yeah, but it takes more money to pry it from someone's hands.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong