@80sOPC said:

Pumping cards is so lame. OLB you are the new Dpeck.

its not cards i'm pumping, it's cash$$$$$$. when people have more cash, they buy. but vintage card prices are tame compared to the ss from the reds and mike trout and jrod, etc.....

@80sOPC said:

Pumping cards is so lame. OLB you are the new Dpeck.

its not cards i'm pumping, it's cash$$$$$$. when people have more cash, they buy. but vintage card prices are tame compared to the ss from the reds and mike trout and jrod, etc.....

Lol, no tax on tips, OT, SS is like a baby burger with no cheese. Markets banging around 10% year to date, last year darn near 25%.

My Spidey-sense tells me with every tingling nerve that were headed for some very tough economic times, but then I go to card shows and see cash being thrown around like confetti, and new card shops are opening up like they're 90s/00s era Starbucks, and it makes me question what reality is anymore.

Look at 2008, the party intensified right into the crash.

In Canada, RE is on this path. Went from condo developments sold out to condo developments in bankruptcy in a space of a few years.

@countdouglas said:

My Spidey-sense tells me with every tingling nerve that were headed for some very tough economic times, but then I go to card shows and see cash being thrown around like confetti, and new card shops are opening up like they're 90s/00s era Starbucks, and it makes me question what reality is anymore.

I think its a little tough to get a read on the economy. Tariffs were seen as the death blow in this calendar year, then there was backpedaling that made everything more palatable and its still not completely clear how inflation will look as everything filters through the system.

Average Joe may be hurt but who exactly is Average Joe and what does he do and buy. Think there are a huge amount of Different Jacks that fuel card buying and are going to continue to make certain card prices go up. As with anything, cant be sure which stuff goes up most and that is where speculation comes in and that seems to be part of the fun being had in this thread.

From what I see, I dont feel big dollars at card shows and eBay and big-time auctions is going anywhere anytime. But I live in my own universe when it comes to card shows. In the general DMV area, even Philly, I see a jaw-dropping amount of demand and kids with money to spend that I did not have at their age. Maybe the shows in more blue collar towns, if that is where many Average Joes are, you might see a different buying dynamic and things could be cooling off.

As far as the market, I dont think we are in a bubble or we are late in the cycle. I have heard a lot of talk that this is like 1996, not 1999 or 2000 as many feel. Or that we are now at 10:15 pm in the 4 a.m. My feelings are influenced by data centers multiplying like rabbits around me. I think that can be the main fuel of the market and I feel its just getting started. You have these hyperscalers like Google Meta Microsoft Amazon and they can talk about spending 100B this year. So they have to be buying a lot of something from somebody and its probably not going to zero next year. Think that will be a long cycle of buying and energy needed to make it work and then after that does the rollout of it all mean cost savings that make companies more profitable. As always you have to pick right if you are investing.

There is still a lot of cash in the economy. About 25% of home sales in LA are cash sales but 50% of the multi-million $ home sales are cash.

Thats why all asset classes are over valued right now. I dont see the cash supply reducing significantly. The only way we can pay off the national debt is with overvalued future dollars, which means more dollar supply.

The future is bright. My family and my buddies have not felt this confident with life in general in decades.

Regarding sports cards I attended the 4 day convention in Anaheim this week and a lot of dealers were saying they can't keep high grade vintage and unopened vintage in stock.

I sold 60 plus vintage cards to a dealer this week for double what I paid for it. I aquired the cards in the last 20 months.

heritage auctions this past weekend, should be an eye opener for the doubters. the shows moving forward will be highly attended and well invested. im hopefully going to be in chantilly in october. im anticipating a great show.

@bgr said:

Alas we have done well to normalize stupidity. That’s pretty woke if you ask me.

Can you give two specific examples of what your talking about.

I’m just saying that I can’t explain the moves in cards and I tend to think it’s dumb money. I think you usually see this type of move into alternative asset classes when there’s more certainty in the economy and from where I sit there has been less. My financial advisor has added an update on sports cards now (Bernstein) and they estimate that somewhere between $350M and $500M are changing hands every month via auctions and many private sales. I don’t know what to make of what’s going on with prices but I wouldn’t have predicted what I’m observing. I didn’t mean much by it and have no prediction on the future of sports cards.

Congratulations to those collectors that are realizing extraordinary profits in this bull market!!! There is no arguing about where the money is going or how long it will last. Enjoy….

1970 Nolan Ryan PSA-9 sold in Heritage Auction at a new record eclipsing my record for the assigned grade in the previous auction…at $14,000.

Interesting that two PSA-9s 1970 Nolan Ryan cards sold on eBay early this morning for $10,000 and $12,000+ (MBA-Gold) . I placed an offer of $12,000 for the MBA-Gold…but my offer was the under bidder.

Unopened in the Heritage Auction did well, too. A 1986 Fleer Basketball wax pack w/Michael Jordan #57 on top broke a record for the assigned grade…exceeding the previous record by $15,000+…selling for $42,700!

Not sure about a record…a 1986 Fleer Basketball wax box sold for $165,000….above recent prices.

@bgr said:

Alas we have done well to normalize stupidity. That’s pretty woke if you ask me.

Can you give two specific examples of what your talking about.

I’m just saying that I can’t explain the moves in cards and I tend to think it’s dumb money. I think you usually see this type of move into alternative asset classes when there’s more certainty in the economy and from where I sit there has been less. My financial advisor has added an update on sports cards now (Bernstein) and they estimate that somewhere between $350M and $500M are changing hands every month via auctions and many private sales. I don’t know what to make of what’s going on with prices but I wouldn’t have predicted what I’m observing. I didn’t mean much by it and have no prediction on the future of sports cards.

I think these days the dumb money is getting smarter. And you have younger people playing the game ignoring the old rules, and if enough people ignore them it begs the question, are they rules anymore. I think a lot of financial advisors are out there earning a ton of money by continually saying you need to be careful out there, its a very risky environment, I'll protect your money, here bonds and boring dividend stocks that dont go up much. There, your money is safe. I'll take my fee now. Thank you. At the same time, some sophomore in college with a 2.5 GPA is tripling that advisor's returns.

@bgr said:

Alas we have done well to normalize stupidity. That’s pretty woke if you ask me.

Can you give two specific examples of what your talking about.

I’m just saying that I can’t explain the moves in cards and I tend to think it’s dumb money. I think you usually see this type of move into alternative asset classes when there’s more certainty in the economy and from where I sit there has been less. My financial advisor has added an update on sports cards now (Bernstein) and they estimate that somewhere between $350M and $500M are changing hands every month via auctions and many private sales. I don’t know what to make of what’s going on with prices but I wouldn’t have predicted what I’m observing. I didn’t mean much by it and have no prediction on the future of sports cards.

I think these days the dumb money is getting smarter. And you have younger people playing the game ignoring the old rules, and if enough people ignore them it begs the question, are they rules anymore. I think a lot of financial advisors are out there earning a ton of money by continually saying you need to be careful out there, its a very risky environment, I'll protect your money, here bonds and boring dividend stocks that dont go up much. There, your money is safe. I'll take my fee now. Thank you. At the same time, some sophomore in college with a 2.5 GPA is tripling that advisor's returns.

It is also so easy to be part of the game now. An 18 year old kid in 1984 having to get a stock broker to buy stocks compared to an 18 yr old now who has it all in an instant on his phone. Plus now they can research hundreds of stocks in seconds on their own and really play the game.

I have come across many high school kids who call themselves day traders.

@80sOPC said:

Why would your average American have more cash?

Inflationary environment, and slowing job market.

Wages are increasing low single digits but those gains are offset by inflation.

I guess the theory for booming card prices is runaway inflation which is possible for sure, especially if the fed caves.

Inflation is part of it, but that doesn't answer it all, especially for this year.

In the summer of 2022 Inflation was ridiculous at 9%, the National Gas averaged was $5 a gallon, and the SandP sat at 3,900 for the whole summer. Now inflation is around 2.7% and Gas national average at $3.16. S and P at 6,400.

Stocks generally go up over time so each era should surpass the previous one, but these are big jumps.

So yes, definitely more money in peoples pockets right now.

Summer of 2022 the card boom was overall in a downturn from the 2021 highs.

Why did the media not promote gloom and doom with inflation in the summer of 2022 when it went to 9% like they do now when it only goes from 2.4 to 2.5?

That is partly why people can't wrap their heads around the surge in the market because they are being bombarded with negative news spins daily, so of course it doesn't add up. If the media promoted the daily rise of JPM stock every day, or daily rise of NVDA every day, or RCL, or the drop in gas prices(even though some states added extra taxes on gas to hide the decline) people would be excited not puzzled.

That being said, my mind is still programmed to wonder when does it stop climbing?? I keep thinking, going to be a big sustained downturn. Time to exit. But like someone said above, the rules are different. The old playbooks are obsolete.

All I do is look at the $4,250 sale of a Griffey RC in PSA 10 and I know the rules are different.

In another aspect what happens when all the so called third world countries/citizens get into the game? Inflation will not go away. It will only get worse naturally as that happens.

In every bull run for an asset class I always hear 'this time the rules are different'. Until things crash or come back to earth and everyone realizes the rules are just the same. Only the year is different.

@olb31 said:

1948 summed it up pretty good. i'm not allowed to say it or i will get banned.

1987 topps bonds sold for $600, incredible. never thought i would see that.

Its pretty sad that speaking one's mind as long as its not an "attack" on another poster can get you banned. If people don't like a topic/discussion they don't have to read it.

@olb31 said:

1948 summed it up pretty good. i'm not allowed to say it or i will get banned.

1987 topps bonds sold for $600, incredible. never thought i would see that.

Its pretty sad that speaking one's mind as long as its not an "attack" on another poster can get you banned. If people don't like a topic/discussion they don't have to read it.

It's more that divisive rhetoric can get a little contentious. Ya know. People have strong opinions on things and some of those opinions can be pretty crass or even off-putting to others. Just because we live in a period of time where if you say something over and over it becomes true doesn't mean that's how it should be. There should be monuments to the hills people have died on in these forums. cue Taps...

Everything needs to be put in perspective. What is the situation now and what are all the factors impacting this situation? Take "Sell in May and Go Away." If you did that this year, you are on the mat searching for your mouthpiece and Buster Douglas is the new champion.

You have to say, is this May in any way different? Well, the NASDAQ went from 20,000 to 15,200 between mid-February and early April, down about 25%. So do we hold tight to sell in May and go away when we just had the 25% dip? No, we buy in May and we are absolutely thrilled in August. Why sell in May? Because historically maybe stocks on the Dow Jones had a little more pep from December to April and run out of steam in May. But minus the pep maybe we dont put as much stock in the rule.

I think the card rules are changing a bit too. Just like a bunch of kids on the Reddit boards saying this heavily shorted stock is not that bad a company. What if we all buy buy buy until it gets to the point where institutions have to cover their shorts and we make even more? That Guidry example isnt the only case of wow that went for a lot more than it usually does. I had to bail on some stuff I was bidding on that was going 20% 35% past all-time highs. Then one I just accepted, 20% more I will still take it. Why? Cause it might be even more expensive 3 months from now. I found a Buy it Now $100 less than a recent sale and had to just grab it. I mean its not an all-time high price, yes, interested. I see a Fear of Missing Out with cards now just like people needing to get into momentum stocks regardless of whether its a buy high. Get it cause it might not be this cheap next time.

Another fundamental reason card values are increasing is that the liquidity in the hobby has never been higher. Basically you can cash out your collection over several days or weeks if needed. I would argue that getting cash for cards is easier than cashing in just about every non-digital alt asset.

The big submitters like 4SC are devaluing collections by sheer high volume of submissions.

They are just a machine of ripping wax and vending and getting high gem rate returns, then flooding the market.

I see this with some 80s cards for the guy I collect, Ron Cey, for example.

I know he's no HOFer or highly collected Superstar, but the volume of submissions seem to have been ramped up.

The number of graded PSA10 of many of his 80s cards have nearly doubled since 2021

(gemrate.com records only go back to 2021).

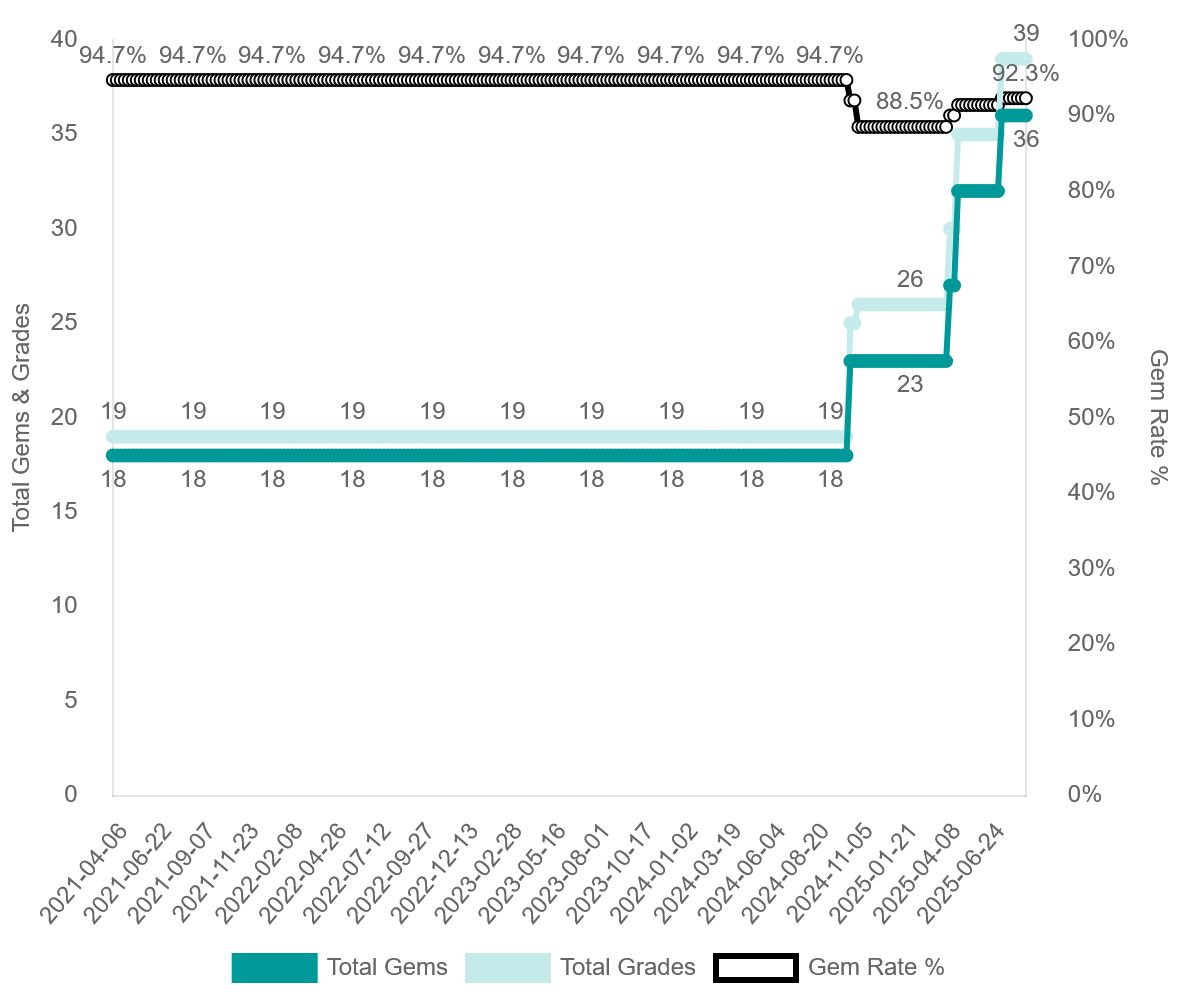

One of the more dramatic examples is the 1986 Donruss Ron Cey.

The gem rate and number of submission remained unchanged from at least 2021 to 2024.

But in the last year alone, the number of graded PSA10s has doubled from 18 to 36!!

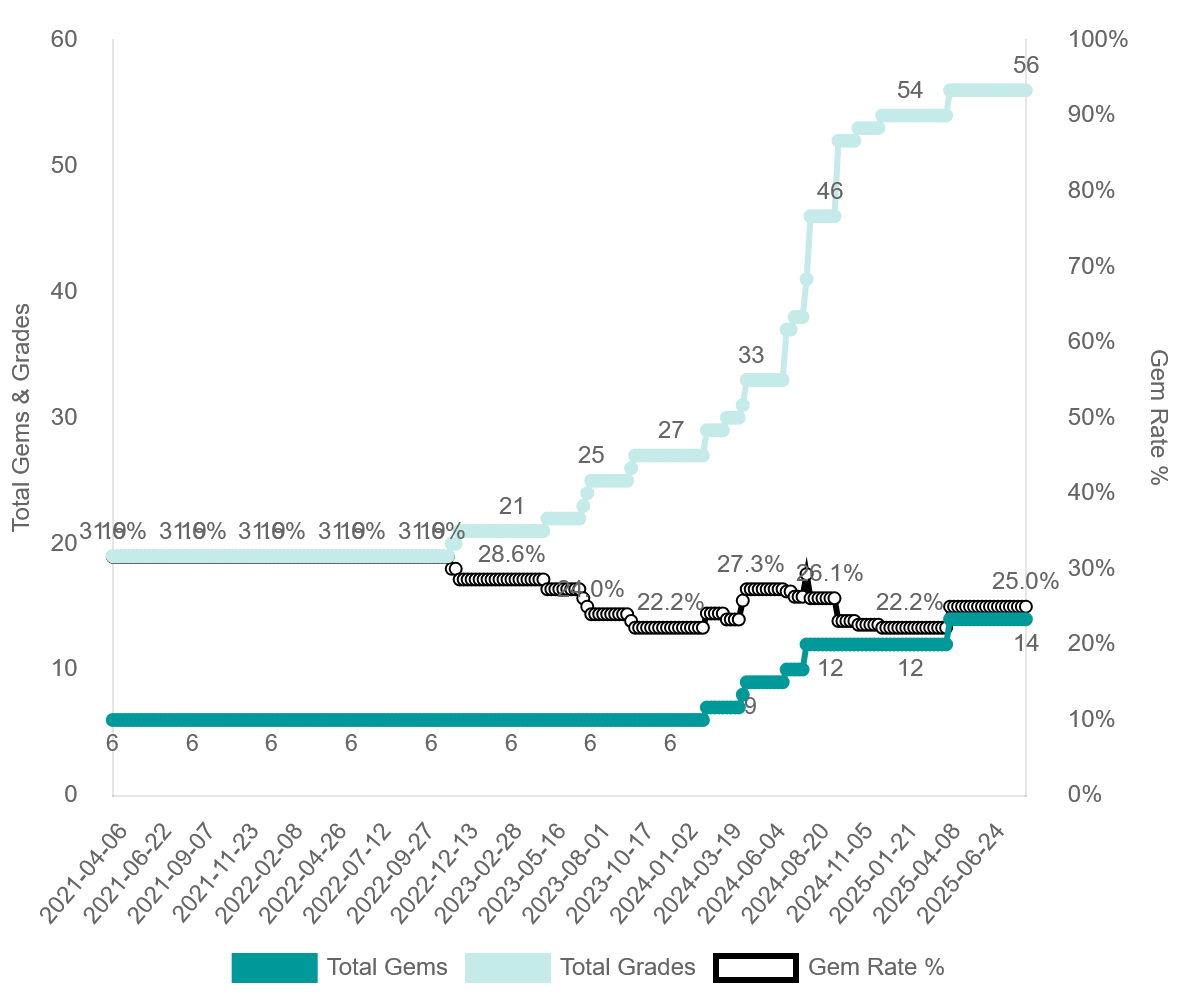

For the 1987 Topps Ron Cey, there's been a spike in the number of submissions in the last 1.5 years.

While the gem rate percentage reduced, the number of PSA10s, that didn't change from at least 2021-2024, has now more than doubled from 6 to 14.

This goes for early 1980s Ceys also.

For both 1981 Donruss and 1983 Fleer, submission have increased steadily over the last 4 years, but so has the number of graded PSA10s, doubling over just the last 4 years.

From 9 to 18 PSA10s for 1981 Donruss, and from 10 to 22 PSA10s for 1983 Fleer.

And card prices and card values have reflected that.

I don't know if this trend is happening with other lower tiered stars 1980s cards or commons.

I’m relatively new to the hobby and I don’t collect baseball (for my own personal reasons) but I’m genuinely happy that people are recognizing gains. The first thing I learned before I got back into the hobby was to do my own research. I spent over a year doing that. I came to the conclusions that sports cards are no different than commodities. Pick one and live with your choice…

payton psa 8 with mba gold sold for $2,300..highest ever sale. centered vintage is red hot. my original post..looks like..its spot on and a lot of the post comes back to some of Ullysses posts on this thread and others.

@RonSportscards said:

The big submitters like 4SC are devaluing collections by sheer high volume of submissions.

They are just a machine of ripping wax and vending and getting high gem rate returns, then flooding the market.

I see this with some 80s cards for the guy I collect, Ron Cey, for example.

I know he's no HOFer or highly collected Superstar, but the volume of submissions seem to have been ramped up.

The number of graded PSA10 of many of his 80s cards have nearly doubled since 2021

(gemrate.com records only go back to 2021).

One of the more dramatic examples is the 1986 Donruss Ron Cey.

The gem rate and number of submission remained unchanged from at least 2021 to 2024.

But in the last year alone, the number of graded PSA10s has doubled from 18 to 36!!

For the 1987 Topps Ron Cey, there's been a spike in the number of submissions in the last 1.5 years.

While the gem rate percentage reduced, the number of PSA10s, that didn't change from at least 2021-2024, has now more than doubled from 6 to 14.

This goes for early 1980s Ceys also.

For both 1981 Donruss and 1983 Fleer, submission have increased steadily over the last 4 years, but so has the number of graded PSA10s, doubling over just the last 4 years.

From 9 to 18 PSA10s for 1981 Donruss, and from 10 to 22 PSA10s for 1983 Fleer.

And card prices and card values have reflected that.

I don't know if this trend is happening with other lower tiered stars 1980s cards or commons.

they rip a lot because they know the results coming. it would a waste of time and doe for most of us. mainly 8 and 9 for us.imo.

Just saw 4SC is selling an 1983 All Star Program Hand Cut Ron Cey in a PSA10.

I had the highest graded at a PSA9 out of only (2) that were ever graded for the last 42 years, and only then, the (2) were graded only a year ago or so. Not any more.

Seems 4SC cut up (4) programs and sent (4) each of a bunch of player cards.

All (4) Ceys from 4SC got PSA10s.

Now there are (6) total graded with (4) PSA10s.

(Not that I was selling my PSA9, or that it was valuable, but you can imagine what happened to the value of it.)

So I checked surrounding Cert#s to the Cey, and it looks like they got all (4) PSA10s on many players: Matlock, Garvey, Hernandez, Carter, Rose, and more.

Although 4SC did get the "extra scrutiny" treatment on the key rookie card, Ryne Sanberg, receiving (3) PSA9s and (1) PSA8.

Unrelated to the above, but a 1976 PSA9 Dodgers Team Card just sold for only $11.

Team cards have tanked.

Excitement might be brewing for the elite vintage rookie cards and HOFers, but not so much for the others.

Payton in an 8 sold multiple times during Covid over 3k so definitely not an ATH. Very common card that sells multiple times per month and lost about 75% off that ATH. 4 year return on that card would be close to zero percent even after this big sale.

Guess it’s being run up again, the guys that bought at 3500 may break even this decade so thats positive.

Posting for those that actually care about the real numbers, not noise from guys pumping cards.

Related - sometimes I feel like the only guy on the PSA board that uses PSA’s own auction pricing tool.

There’s absurd amounts currently being paid for raw Payton rookies. Never mind the slabs. It used to be easy to grab them for a good price. Not so much now.

HARD TO COUNTER COVID PRICES. 1986 JORDAN COMES TO MIND. THEY SOLD FOR BIG NUMBER THEN PLUNGED AND NOW BACK UP. NOT SURE IF THEY ARE BREAKING RECORDS NOW THOUGH.

Comments

Thou shalt NOT question CardLord! Oh mighty and benevolent CardLord when will prices be at their maximum?

When you say vintage. You are talking about 1987-1990s right? I think Im with you and Im all in now! LETS GOOOOO!!!

Always feel like these pumper threads are a good time to point out that many key cards are still well off ATH’s.

63 Rose RC, PSA 8 had multiple sales over 20k, peaked at 30k. Will need to 2x to get back there.

its not cards i'm pumping, it's cash$$$$$$. when people have more cash, they buy. but vintage card prices are tame compared to the ss from the reds and mike trout and jrod, etc.....

i have 10,000 osacar azocar rookies...lol!!!

Lol, no tax on tips, OT, SS is like a baby burger with no cheese. Markets banging around 10% year to date, last year darn near 25%.

Why would your average American have more cash?

Inflationary environment, and slowing job market.

Wages are increasing low single digits but those gains are offset by inflation.

I guess the theory for booming card prices is runaway inflation which is possible for sure, especially if the fed caves.

My Spidey-sense tells me with every tingling nerve that were headed for some very tough economic times, but then I go to card shows and see cash being thrown around like confetti, and new card shops are opening up like they're 90s/00s era Starbucks, and it makes me question what reality is anymore.

We live in strange times. Reality isn’t what it used to be.

Last stage boom times, this is normal.

Look at 2008, the party intensified right into the crash.

In Canada, RE is on this path. Went from condo developments sold out to condo developments in bankruptcy in a space of a few years.

I think its a little tough to get a read on the economy. Tariffs were seen as the death blow in this calendar year, then there was backpedaling that made everything more palatable and its still not completely clear how inflation will look as everything filters through the system.

Average Joe may be hurt but who exactly is Average Joe and what does he do and buy. Think there are a huge amount of Different Jacks that fuel card buying and are going to continue to make certain card prices go up. As with anything, cant be sure which stuff goes up most and that is where speculation comes in and that seems to be part of the fun being had in this thread.

From what I see, I dont feel big dollars at card shows and eBay and big-time auctions is going anywhere anytime. But I live in my own universe when it comes to card shows. In the general DMV area, even Philly, I see a jaw-dropping amount of demand and kids with money to spend that I did not have at their age. Maybe the shows in more blue collar towns, if that is where many Average Joes are, you might see a different buying dynamic and things could be cooling off.

As far as the market, I dont think we are in a bubble or we are late in the cycle. I have heard a lot of talk that this is like 1996, not 1999 or 2000 as many feel. Or that we are now at 10:15 pm in the 4 a.m. My feelings are influenced by data centers multiplying like rabbits around me. I think that can be the main fuel of the market and I feel its just getting started. You have these hyperscalers like Google Meta Microsoft Amazon and they can talk about spending 100B this year. So they have to be buying a lot of something from somebody and its probably not going to zero next year. Think that will be a long cycle of buying and energy needed to make it work and then after that does the rollout of it all mean cost savings that make companies more profitable. As always you have to pick right if you are investing.

There is still a lot of cash in the economy. About 25% of home sales in LA are cash sales but 50% of the multi-million $ home sales are cash.

Thats why all asset classes are over valued right now. I dont see the cash supply reducing significantly. The only way we can pay off the national debt is with overvalued future dollars, which means more dollar supply.

That being said, the trend is your friend.

The future is bright. My family and my buddies have not felt this confident with life in general in decades.

Regarding sports cards I attended the 4 day convention in Anaheim this week and a lot of dealers were saying they can't keep high grade vintage and unopened vintage in stock.

I sold 60 plus vintage cards to a dealer this week for double what I paid for it. I aquired the cards in the last 20 months.

Alas we have done well to normalize stupidity. That’s pretty woke if you ask me.

Success is trending harder than taco night or choreographed YouTube shenanigans.

heritage auctions this past weekend, should be an eye opener for the doubters. the shows moving forward will be highly attended and well invested. im hopefully going to be in chantilly in october. im anticipating a great show.

Generally, when I see everyone absolutely convinced something is a good buy then it’s a good time to find value in something else.

Can you give two specific examples of what your talking about.

1962 Mantle PSA-9….sold for $488,000. That’s a record for the assigned grade….and exceeded estimate by $188,000!

1968 Mantle PSA-10 sold for $390,000…a record for the assigned grade….and exceeded estimate by $190,000!

Awesome prices and examples of a very strong market for high grade vintage.

1956 Jackie Robinson PSA-9….sold for $128,000….a record for the assigned grade…and exceeded estimate by $48,000!

Tonight was taco night for me. Taco place but the cheese quesadillas and guacamole are excellent so that was my choice. Yum. Hope I'm not trendy.

I’m just saying that I can’t explain the moves in cards and I tend to think it’s dumb money. I think you usually see this type of move into alternative asset classes when there’s more certainty in the economy and from where I sit there has been less. My financial advisor has added an update on sports cards now (Bernstein) and they estimate that somewhere between $350M and $500M are changing hands every month via auctions and many private sales. I don’t know what to make of what’s going on with prices but I wouldn’t have predicted what I’m observing. I didn’t mean much by it and have no prediction on the future of sports cards.

Thanks for responding. Very valid points.

Here's another card in Heritage Auction setting a record for the assigned grade...and blowing away estimate by $11,600...closing at $14,600.

Here is mine purchased 5 years ago for $3,000:

The HA example needs a blood transfusion. Yours is crispy. Nice.

Congratulations to those collectors that are realizing extraordinary profits in this bull market!!! There is no arguing about where the money is going or how long it will last. Enjoy….

1970 Nolan Ryan PSA-9 sold in Heritage Auction at a new record eclipsing my record for the assigned grade in the previous auction…at $14,000.

Interesting that two PSA-9s 1970 Nolan Ryan cards sold on eBay early this morning for $10,000 and $12,000+ (MBA-Gold) . I placed an offer of $12,000 for the MBA-Gold…but my offer was the under bidder.

Ya wanna get hot cards these days, better swipe 'em quicker than Rickey stole bags.

Unopened in the Heritage Auction did well, too. A 1986 Fleer Basketball wax pack w/Michael Jordan #57 on top broke a record for the assigned grade…exceeding the previous record by $15,000+…selling for $42,700!

Not sure about a record…a 1986 Fleer Basketball wax box sold for $165,000….above recent prices.

I think these days the dumb money is getting smarter. And you have younger people playing the game ignoring the old rules, and if enough people ignore them it begs the question, are they rules anymore. I think a lot of financial advisors are out there earning a ton of money by continually saying you need to be careful out there, its a very risky environment, I'll protect your money, here bonds and boring dividend stocks that dont go up much. There, your money is safe. I'll take my fee now. Thank you. At the same time, some sophomore in college with a 2.5 GPA is tripling that advisor's returns.

It is also so easy to be part of the game now. An 18 year old kid in 1984 having to get a stock broker to buy stocks compared to an 18 yr old now who has it all in an instant on his phone. Plus now they can research hundreds of stocks in seconds on their own and really play the game.

I have come across many high school kids who call themselves day traders.

Similar with cards.

Inflation is part of it, but that doesn't answer it all, especially for this year.

In the summer of 2022 Inflation was ridiculous at 9%, the National Gas averaged was $5 a gallon, and the SandP sat at 3,900 for the whole summer. Now inflation is around 2.7% and Gas national average at $3.16. S and P at 6,400.

Stocks generally go up over time so each era should surpass the previous one, but these are big jumps.

So yes, definitely more money in peoples pockets right now.

Summer of 2022 the card boom was overall in a downturn from the 2021 highs.

Why did the media not promote gloom and doom with inflation in the summer of 2022 when it went to 9% like they do now when it only goes from 2.4 to 2.5?

That is partly why people can't wrap their heads around the surge in the market because they are being bombarded with negative news spins daily, so of course it doesn't add up. If the media promoted the daily rise of JPM stock every day, or daily rise of NVDA every day, or RCL, or the drop in gas prices(even though some states added extra taxes on gas to hide the decline) people would be excited not puzzled.

That being said, my mind is still programmed to wonder when does it stop climbing?? I keep thinking, going to be a big sustained downturn. Time to exit. But like someone said above, the rules are different. The old playbooks are obsolete.

All I do is look at the $4,250 sale of a Griffey RC in PSA 10 and I know the rules are different.

In another aspect what happens when all the so called third world countries/citizens get into the game? Inflation will not go away. It will only get worse naturally as that happens.

Its the wild west now.

1948 summed it up pretty good. i'm not allowed to say it or i will get banned.

1987 topps bonds sold for $600, incredible. never thought i would see that.

In every bull run for an asset class I always hear 'this time the rules are different'. Until things crash or come back to earth and everyone realizes the rules are just the same. Only the year is different.

Its pretty sad that speaking one's mind as long as its not an "attack" on another poster can get you banned. If people don't like a topic/discussion they don't have to read it.

It's more that divisive rhetoric can get a little contentious. Ya know. People have strong opinions on things and some of those opinions can be pretty crass or even off-putting to others. Just because we live in a period of time where if you say something over and over it becomes true doesn't mean that's how it should be. There should be monuments to the hills people have died on in these forums. cue Taps...

Everything needs to be put in perspective. What is the situation now and what are all the factors impacting this situation? Take "Sell in May and Go Away." If you did that this year, you are on the mat searching for your mouthpiece and Buster Douglas is the new champion.

You have to say, is this May in any way different? Well, the NASDAQ went from 20,000 to 15,200 between mid-February and early April, down about 25%. So do we hold tight to sell in May and go away when we just had the 25% dip? No, we buy in May and we are absolutely thrilled in August. Why sell in May? Because historically maybe stocks on the Dow Jones had a little more pep from December to April and run out of steam in May. But minus the pep maybe we dont put as much stock in the rule.

I think the card rules are changing a bit too. Just like a bunch of kids on the Reddit boards saying this heavily shorted stock is not that bad a company. What if we all buy buy buy until it gets to the point where institutions have to cover their shorts and we make even more? That Guidry example isnt the only case of wow that went for a lot more than it usually does. I had to bail on some stuff I was bidding on that was going 20% 35% past all-time highs. Then one I just accepted, 20% more I will still take it. Why? Cause it might be even more expensive 3 months from now. I found a Buy it Now $100 less than a recent sale and had to just grab it. I mean its not an all-time high price, yes, interested. I see a Fear of Missing Out with cards now just like people needing to get into momentum stocks regardless of whether its a buy high. Get it cause it might not be this cheap next time.

Another fundamental reason card values are increasing is that the liquidity in the hobby has never been higher. Basically you can cash out your collection over several days or weeks if needed. I would argue that getting cash for cards is easier than cashing in just about every non-digital alt asset.

The big submitters like 4SC are devaluing collections by sheer high volume of submissions.

They are just a machine of ripping wax and vending and getting high gem rate returns, then flooding the market.

I see this with some 80s cards for the guy I collect, Ron Cey, for example.

I know he's no HOFer or highly collected Superstar, but the volume of submissions seem to have been ramped up.

The number of graded PSA10 of many of his 80s cards have nearly doubled since 2021

(gemrate.com records only go back to 2021).

One of the more dramatic examples is the 1986 Donruss Ron Cey.

The gem rate and number of submission remained unchanged from at least 2021 to 2024.

But in the last year alone, the number of graded PSA10s has doubled from 18 to 36!!

For the 1987 Topps Ron Cey, there's been a spike in the number of submissions in the last 1.5 years.

While the gem rate percentage reduced, the number of PSA10s, that didn't change from at least 2021-2024, has now more than doubled from 6 to 14.

This goes for early 1980s Ceys also.

For both 1981 Donruss and 1983 Fleer, submission have increased steadily over the last 4 years, but so has the number of graded PSA10s, doubling over just the last 4 years.

From 9 to 18 PSA10s for 1981 Donruss, and from 10 to 22 PSA10s for 1983 Fleer.

And card prices and card values have reflected that.

I don't know if this trend is happening with other lower tiered stars 1980s cards or commons.

Ron Fantastic work..I could send in 100 1987 Ron Cey's out of the pack and get 1 10.

I’m relatively new to the hobby and I don’t collect baseball (for my own personal reasons) but I’m genuinely happy that people are recognizing gains. The first thing I learned before I got back into the hobby was to do my own research. I spent over a year doing that. I came to the conclusions that sports cards are no different than commodities. Pick one and live with your choice…

payton psa 8 with mba gold sold for $2,300..highest ever sale. centered vintage is red hot. my original post..looks like..its spot on and a lot of the post comes back to some of Ullysses posts on this thread and others.

they rip a lot because they know the results coming. it would a waste of time and doe for most of us. mainly 8 and 9 for us.imo.

Just saw 4SC is selling an 1983 All Star Program Hand Cut Ron Cey in a PSA10.

I had the highest graded at a PSA9 out of only (2) that were ever graded for the last 42 years, and only then, the (2) were graded only a year ago or so. Not any more.

Seems 4SC cut up (4) programs and sent (4) each of a bunch of player cards.

All (4) Ceys from 4SC got PSA10s.

Now there are (6) total graded with (4) PSA10s.

(Not that I was selling my PSA9, or that it was valuable, but you can imagine what happened to the value of it.)

So I checked surrounding Cert#s to the Cey, and it looks like they got all (4) PSA10s on many players: Matlock, Garvey, Hernandez, Carter, Rose, and more.

Although 4SC did get the "extra scrutiny" treatment on the key rookie card, Ryne Sanberg, receiving (3) PSA9s and (1) PSA8.

Unrelated to the above, but a 1976 PSA9 Dodgers Team Card just sold for only $11.

Team cards have tanked.

Excitement might be brewing for the elite vintage rookie cards and HOFers, but not so much for the others.

Payton in an 8 sold multiple times during Covid over 3k so definitely not an ATH. Very common card that sells multiple times per month and lost about 75% off that ATH. 4 year return on that card would be close to zero percent even after this big sale.

Guess it’s being run up again, the guys that bought at 3500 may break even this decade so thats positive.

Posting for those that actually care about the real numbers, not noise from guys pumping cards.

Related - sometimes I feel like the only guy on the PSA board that uses PSA’s own auction pricing tool.

Here is the chart on the Payton, OLB and I must have different definitions of ATH:

There’s absurd amounts currently being paid for raw Payton rookies. Never mind the slabs. It used to be easy to grab them for a good price. Not so much now.

HARD TO COUNTER COVID PRICES. 1986 JORDAN COMES TO MIND. THEY SOLD FOR BIG NUMBER THEN PLUNGED AND NOW BACK UP. NOT SURE IF THEY ARE BREAKING RECORDS NOW THOUGH.