An auction result that caught my eye

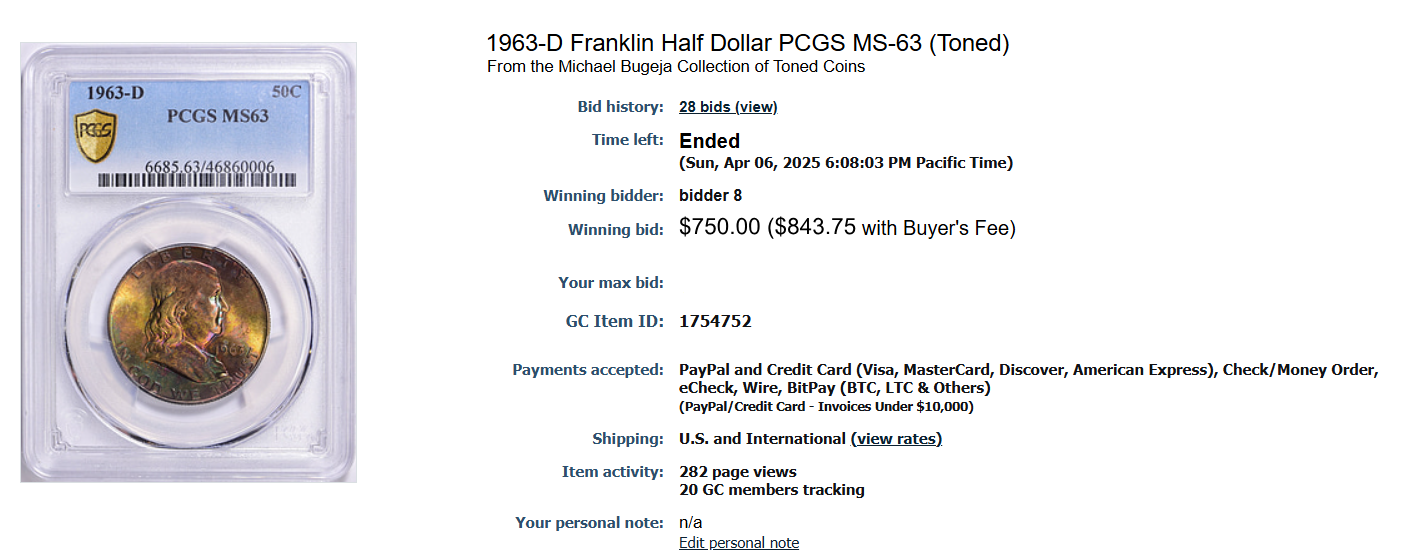

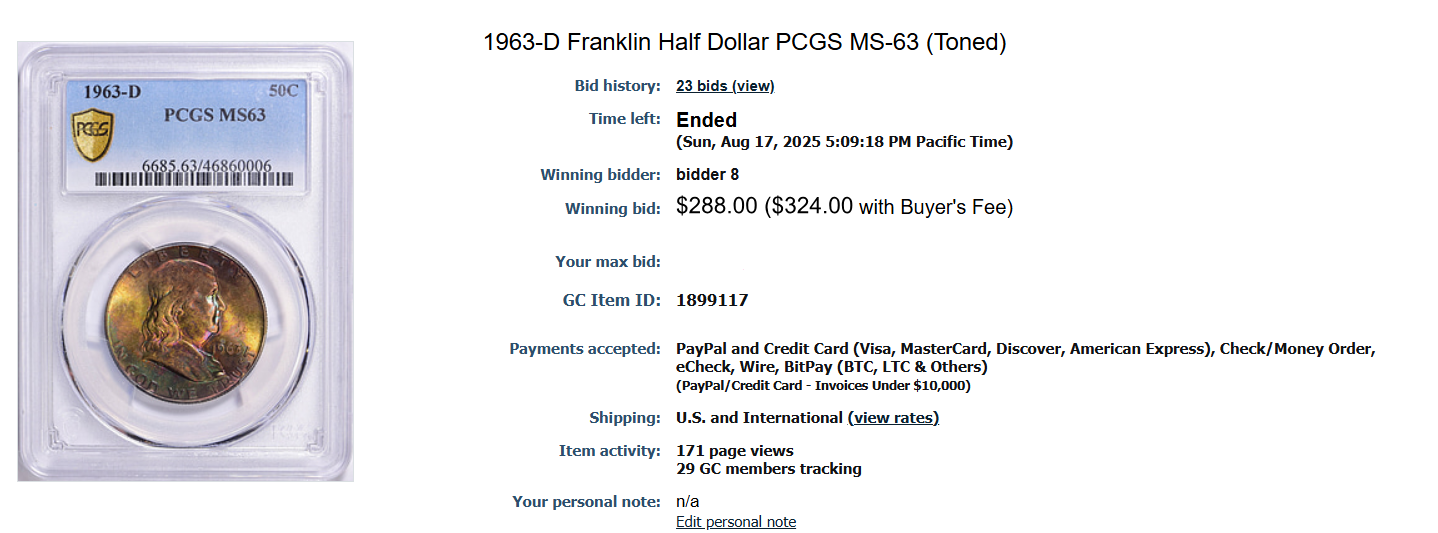

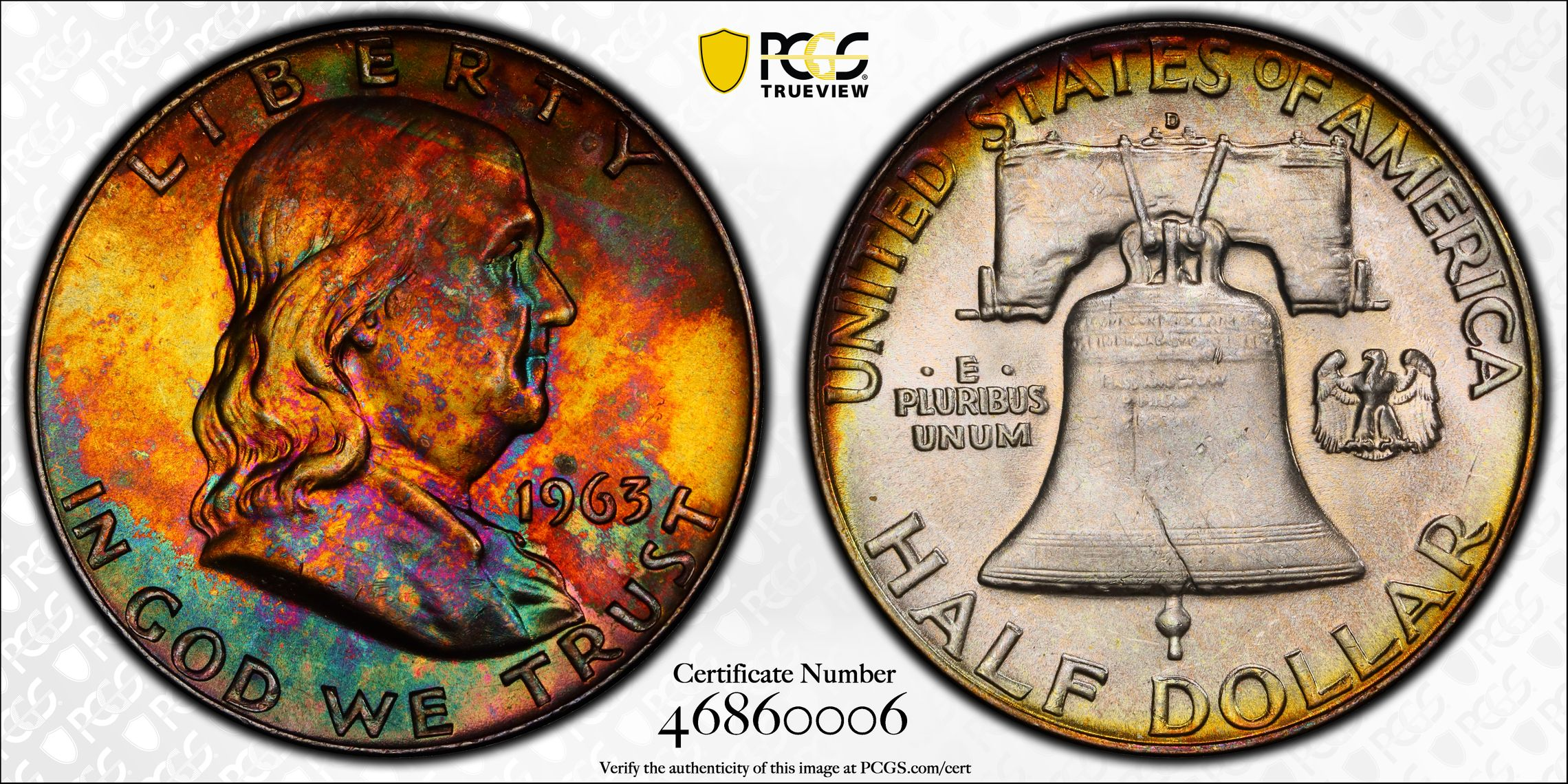

Here's a Franklin date you don't often see with strong toning that appeared twice in auction this year at GC. The first time, in April, it was part of the Michael Bugeja Collection of Toned Coins (he's a professor who also wrote coin articles, CoinWeek being where I read some of his work). There it went for a surprising (to me at least) amount of $843.75 (with the fee included). Fast forward a few months to August and it hammers for $324 (with the fee included). Over $500 less! At least four bidders put in higher bids last time around so it seems like several dropped out this time (or did not know about the auction). I debated bidding but in the end decided to focus on other coins. Anyone follow this coin or bid on it?

https://www.greatcollections.com/Coin/1899117/1963-D-Franklin-Half-Dollar-PCGS-MS-63-Toned

https://www.greatcollections.com/Coin/1754752/1963-D-Franklin-Half-Dollar-PCGS-MS-63-Toned

Comments

The Michael Bugeja Collection of Toned Coins brought in bidders looking at the collection. The next auction was a stand alone.

I suspect there are not many GreatCollection bidders that look at more than 5% of the items closing any particular week. I have not followed or bid on that coin.

This is a lesson for people selling! You have to do your own promotion and not just leave it up to luck, thoughts, prayers, etc. You need to post on BST, Instagram (post and stories), FB if you do that, etc, etc,....send messages to friends or people you think might have an interest. Even with doing all that, you can lose but not typically by that high of a percentage.

Looking for Top Pop Mercury Dime Varieties & High Grade Mercury Dime Toners.

Not practical for most collectors selling off multiple coins. I’m retired but still wouldn’t follow this advice when I do my periodic housekeeping. The major auction houses attract lots of eyeballs. Setting a minimum can eliminate serious losses like the case discussed.

Not only is it not practical, it would become counter- productive if everyone did it. Would- be bidders would be inundated with so many spam ads that they would just ignore them all.

There's an old saying that you don't make money when you sell, you make money when you buy. There was possibly just too much exuberance in the first auction. There is no real evidence that it underperformed the second time.

All comments reflect the opinion of the author, even when irrefutably accurate.

Imho, it was probably way overpriced in first offering, now perhaps it sits in a "fairer" price zone.

I sold and lost 18% on one coin and 10% on another in auction about 6 months ago. The 10% was expected because the buyer paid almost the same price I bought the coin for (with his buyer premium included).

The 18% loss was a surprise to me because I didn’t expect the loss to be that big on such a top of its grade coin (and with CAC sticker too). My lesson is in a no reserved auction, results can be unpredictable.

Pricing based on toning is usually a gamble. Common coin and grade. Nice looking coin but agree the latest price paid seems fairer and easier to sell. Almost a $600 loss (60+ %) in 4 months, that hurts.

It’s fairly simple to do for those who are on the forums and other social media. Link a few of the better items that you want to get extra eyeballs on or link the entire collection if it’s large enough where GC has its own category for it. We have had a few people here on CU do that and it helps more people see it. I saw some of the items from Las Vegas Teddy and Keyman based on their bst posts that I would have skipped over if I was just scrolling through GC listings.

I also think it was high the first time around but based on 4 people bidding more last time (not just one underbidder), I’m a bit surprised that it didn’t go for a $100-$200 more.

Agree certainly can’t hurt to go the extra mile to improve auction results. Especially when selling special coins.

The second auction feels more accurate to me. Only a 63, and a Franklin. Cool but not monster color, weird toning pattern that is probably legit endroll based on the patterning top obverse, but also kind of bizarro variegated toning mid obverse. This honestly makes me want to send a bunch of my Franklin’s in to GC to chase the 2nd result😁

Might have been a bit of an off week for toners too, I had a few up this week and there were a few deals that the buyer should be happy with.

What did you have for sale there? The Morgans that I followed seemed relatively strong to me (not crazy moon money but above what I figured they would bring).

Most of the toned coins in my consignment went pretty strong now that I’m looking at it, but these were the 2 that I think were particularly a nice deal for the buyer:

https://www.greatcollections.com/Coin/1906002/1879-S-Morgan-Silver-Dollar-NGC-MS-65-226-152--Toned

https://www.greatcollections.com/Coin/1906008/1886-Morgan-Silver-Dollar-NGC-MS-63-Toned

The 79-S is very semi-PL and just hard to image so I think it pops more in hand than the photos indicate, and for the 2nd I just have a bias toward end-roll toned coins😂. Could be seller’s bias in both cases, the market is pretty smart.

I had tracker bids on both of those but was not seriously chasing either one. I like the end roll one more and think it ended for less than it could have. On the star 65, that semi-pl did not really show well in the photos so that impacted the result somewhat. Also both lacked the super vivid colors that buyers tend to chase (still nice coins that someone will enjoy and/or resell for a small gain).

I just don't get it..................

I'd much rather buy a 20 oz silver bar.

"“Those who sacrifice liberty for security/safety deserve neither.“(Benjamin Franklin)

"I only golf on days that end in 'Y'" (DE59)

Someone’s got a good deal!

I guess it’s a thin market…

Sometimes, it’s better to be LUCKY than good. 🍀 🍺👍

My Full Walker Registry Set (1916-1947):

https://www.ngccoin.com/registry/competitive-sets/16292/

Surprised something that tarnished brought that.

As time goes on it most likely will get darker…..

IDK... there were 8 bidders the first time around, and 8 bidders the second time too... likely not the same 8 bidders!

Bottom line... be careful putting high dollar value coins up in No Reserve auctions. You might not achieve the results you're after... especially if you've hung your hat on "nice toning" on a common date, common type coin...

Successful BST transactions with: SilverEagles92; Ahrensdad; Smitty; GregHansen; Lablade; Mercury10c; copperflopper; whatsup; KISHU1; scrapman1077, crispy, canadanz, smallchange, robkool, Mission16, ranshdow, ibzman350, Fallguy, Collectorcoins, SurfinxHI, jwitten, Walkerguy21D, dsessom.

Is that the current rate 1500x Face?

Only if it looks like the one in the auction.