Numismatist. 54 year member ANA. Former ANA Senior Authenticator. Winner of four ANA Heath Literary Awards; three Wayte and Olga Raymond Literary Awards; Numismatist of the Year Award 2009, and Lifetime Achievement Award 2020. Author "The Enigmatic Lincoln Cents of 1922," due out late 2025.

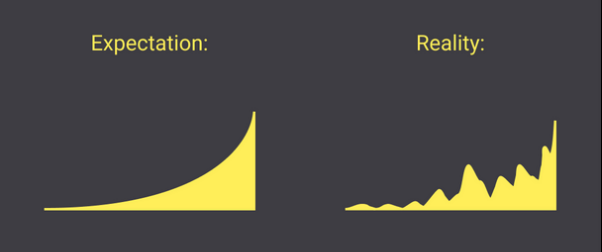

Indeed. This is the chart I posted a while ago. I was early on the breakout, but the pennant continued to form and appears to be ready to breakout and make the move to $3700+.

Jobs report huge downward revisions were the surprise. Gold likes the lower interest rate expectations and weaker dollar they often represent, so we are moving back up again.

@derryb said:

the final fight is on to save dollar's world status. focus is on beating down any competition, especially BRICS.

The era of a world reserve currency (if that's what you are referring to) is over. Crypto & digital money have made that concept obsolete.

I believe use of the dollar as an international economic weapon (sanctions and outright theft) has driven others to shun the dollar in international trade and required them to search for alternatives. This is the foundation of the BRICS alliance. The current trend for those who fear such threats is for them to hold and use other forms of financial instruments and reduce their holdings of dollars and of US debt. This is one of the primary reasons central banks have been stockpiling gold and driving its price up. Not only is the future of the reserve currency status of the dollar being threatened, but equally important is the loss of international buyers of US bonds (US debt).

US international economic policy for the past five years is the root cause of current high gold prices. Look for all out economic war on those who pose a threat to the dollar and to US bond purchases. Tariffs are simply another way to impose sanctions. Increases in international economic warfare and uncertainty drive up the price of the only currency not affected by it - gold.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

@derryb said:

the final fight is on to save dollar's world status. focus is on beating down any competition, especially BRICS.

The era of a world reserve currency (if that's what you are referring to) is over. Crypto & digital money have made that concept obsolete.

Crypto won't even exist in 20 years.

they will become a victim of Central Bank Digital Currencies. All forms of currency will disappear. Those that cannot fit into the scheme of things (gold?) will be outlawed or taxed to the point of making them worthless.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

gov.com's attempt to stuff U.S. debt into stablecoin as some sort of "backing" simply amounts to more imaginary money backing imaginary money. This will fail.

Q: Are You Printing Money? Bernanke: Not Literally

@derryb said:

the final fight is on to save dollar's world status. focus is on beating down any competition, especially BRICS.

The era of a world reserve currency (if that's what you are referring to) is over. Crypto & digital money have made that concept obsolete.

Crypto won't even exist in 20 years.

they will become a victim of Central Bank Digital Currencies. All forms of currency will disappear. Those that cannot fit into the scheme of things (gold?) will be outlawed or taxed to the point of making them worthless.

@derryb said:

the final fight is on to save dollar's world status. focus is on beating down any competition, especially BRICS.

The era of a world reserve currency (if that's what you are referring to) is over. Crypto & digital money have made that concept obsolete.

Crypto won't even exist in 20 years.

they will become a victim of Central Bank Digital Currencies. All forms of currency will disappear. Those that cannot fit into the scheme of things (gold?) will be outlawed or taxed to the point of making them worthless.

They will be victim of what they are.

an overnight fad? LOL

In it's 14 years of existence bitcoin has risen from $8 to $113,000.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

@derryb said:

the final fight is on to save dollar's world status. focus is on beating down any competition, especially BRICS.

The era of a world reserve currency (if that's what you are referring to) is over. Crypto & digital money have made that concept obsolete.

Crypto won't even exist in 20 years.

they will become a victim of Central Bank Digital Currencies. All forms of currency will disappear. Those that cannot fit into the scheme of things (gold?) will be outlawed or taxed to the point of making them worthless.

I find that pretty unlikely. Wall Street and the US government have wholly embraced and now endorse cryptocurrency. You think these two entities are going to reverse course? In the next few years trillions will pour into crypto and you think it'll just go away when the people in charge are so heavily invested?

@derryb said:

the final fight is on to save dollar's world status. focus is on beating down any competition, especially BRICS.

The era of a world reserve currency (if that's what you are referring to) is over. Crypto & digital money have made that concept obsolete.

Crypto won't even exist in 20 years.

they will become a victim of Central Bank Digital Currencies. All forms of currency will disappear. Those that cannot fit into the scheme of things (gold?) will be outlawed or taxed to the point of making them worthless.

I find that pretty unlikely. Wall Street and the US government have wholly embraced and now endorse cryptocurrency. You think these two entities are going to reverse course? In the next few years trillions will pour into crypto and you think it'll just go away when the people in charge are so heavily invested?

The interest from the US is in exploring blockchain. The heavily invested can and will disinvest in something that has no backing whatsoever. For now it's a play on growing demand. Unlike most all other assets, demand alone is what keeps crypto from being worthless. Growing demand can quickly reverse itself.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

@derryb said:

the final fight is on to save dollar's world status. focus is on beating down any competition, especially BRICS.

The era of a world reserve currency (if that's what you are referring to) is over. Crypto & digital money have made that concept obsolete.

Crypto won't even exist in 20 years.

they will become a victim of Central Bank Digital Currencies. All forms of currency will disappear. Those that cannot fit into the scheme of things (gold?) will be outlawed or taxed to the point of making them worthless.

They will be victim of what they are.

an overnight fad? LOL

In it's 14 years of existence bitcoin has risen from $8 to $113,000.

@derryb said:

the final fight is on to save dollar's world status. focus is on beating down any competition, especially BRICS.

The era of a world reserve currency (if that's what you are referring to) is over. Crypto & digital money have made that concept obsolete.

Crypto won't even exist in 20 years.

they will become a victim of Central Bank Digital Currencies. All forms of currency will disappear. Those that cannot fit into the scheme of things (gold?) will be outlawed or taxed to the point of making them worthless.

I find that pretty unlikely. Wall Street and the US government have wholly embraced and now endorse cryptocurrency. You think these two entities are going to reverse course? In the next few years trillions will pour into crypto and you think it'll just go away when the people in charge are so heavily invested?

The interest from the US is in exploring blockchain. The heavily invested can and will disinvest in something that has no backing whatsoever. For now it's a play on growing demand. Unlike most all other assets, demand alone is what keeps crypto from being worthless. Growing demand can quickly reverse itself.

I can see you haven't researched this much. With the caveat that not all cryptos are created equal and some truly are worthless, you are one of the many that has yet to see the value in networks and network size. automated and programmable money/payments, and trust less systems. Eventually you will. There's a reason why the largest companies in the world like Samsung are integrating and using (or will be using) crypto in their products and services now that the US has passed or will be passing regulations so they can proceed without legal fears.

@derryb said:

the final fight is on to save dollar's world status. focus is on beating down any competition, especially BRICS.

The era of a world reserve currency (if that's what you are referring to) is over. Crypto & digital money have made that concept obsolete.

Crypto won't even exist in 20 years.

they will become a victim of Central Bank Digital Currencies. All forms of currency will disappear. Those that cannot fit into the scheme of things (gold?) will be outlawed or taxed to the point of making them worthless.

They will be victim of what they are.

an overnight fad? LOL

In it's 14 years of existence bitcoin has risen from $8 to $113,000.

@derryb said:

the final fight is on to save dollar's world status. focus is on beating down any competition, especially BRICS.

The era of a world reserve currency (if that's what you are referring to) is over. Crypto & digital money have made that concept obsolete.

Crypto won't even exist in 20 years.

they will become a victim of Central Bank Digital Currencies. All forms of currency will disappear. Those that cannot fit into the scheme of things (gold?) will be outlawed or taxed to the point of making them worthless.

They will be victim of what they are.

an overnight fad? LOL

In it's 14 years of existence bitcoin has risen from $8 to $113,000.

I never said overnight fad and thats not my thought. Is that what you think?

Edit...i should have read further in the thread since you answered that question.

@derryb said:

the final fight is on to save dollar's world status. focus is on beating down any competition, especially BRICS.

The era of a world reserve currency (if that's what you are referring to) is over. Crypto & digital money have made that concept obsolete.

Crypto won't even exist in 20 years.

they will become a victim of Central Bank Digital Currencies. All forms of currency will disappear. Those that cannot fit into the scheme of things (gold?) will be outlawed or taxed to the point of making them worthless.

I find that pretty unlikely. Wall Street and the US government have wholly embraced and now endorse cryptocurrency. You think these two entities are going to reverse course? In the next few years trillions will pour into crypto and you think it'll just go away when the people in charge are so heavily invested?

The interest from the US is in exploring blockchain. The heavily invested can and will disinvest in something that has no backing whatsoever. For now it's a play on growing demand. Unlike most all other assets, demand alone is what keeps crypto from being worthless. Growing demand can quickly reverse itself.

I can see you haven't researched this much. With the caveat that not all cryptos are created equal and some truly are worthless, you are one of the many that has yet to see the value in networks and network size. automated and programmable money/payments, and trust less systems. Eventually you will. There's a reason why the largest companies in the world like Samsung are integrating and using (or will be using) crypto in their products and services now that the US has passed or will be passing regulations so they can proceed without legal fears.

Is it possible the "cryptos" can be worthless and yet the network remain?

Railroads have gone bust yet their tracks and terminals remain.

Is it possible the "cryptos" can be worthless and yet the network remain?

Railroads have gone bust yet their tracks and terminals remain.

there is a difference between an asset that is physical and one that is imaginary. When large corporations go bust, their physical assets still have some value to the shareholders. When a crypto goes to zero, a holder's claim goes to zero.

cryptos are much different in "tulips" in that there is serious money and serious buyers (whales) who apparently do not flinch at every down turn. Tulips peaked and fear took them quickly to the bottom. While cryptos are not a fad, they are still themselves imaginary. The money stays with them because the buyers stay with them. Serious money has been made, and lost, with them. One of the many new ways to gamble on-line.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

There's a reason why the largest companies in the world like Samsung are integrating and using (or will be using) crypto in their products and services now that the US has passed or will be passing regulations so they can proceed without legal fears.

Yes there is - because people who want to buy things from them want to use them to pay for the items they are selling. What does Samsung do with the crypto once they receive it - hold it and use it for expenses or sell it and then using local currency to pay bills? My guess is the latter and Samsung et. al view crypto the same as the Discover card - a new way to pay and enough people want to use it so might as well accept it.

Is it possible the "cryptos" can be worthless and yet the network remain?

Railroads have gone bust yet their tracks and terminals remain.

there is a difference between an asset that is physical and one that is imaginary. When large corporations go bust, their physical assets still have some value to the shareholders. When a crypto goes to zero, a holder's claim goes to zero.

cryptos are much different in "tulips" in that there is serious money and serious buyers (whales) who apparently do not flinch at every down turn. Tulips peaked and fear took them quickly to the bottom. While cryptos are not a fad, they are still themselves imaginary. The money stays with them because the buyers stay with them. Serious money has been made, and lost, with them. One of the many new ways to gamble on-line.

A decent explanation, but to take it further, stocks are also imaginary and many companies have few assets but high value. Uber stock's value is not in its assets but in its network. Same with something like Facebook. Myspace had a high valuation at one time but once its network depleted it became worthless.

@derryb said:

the final fight is on to save dollar's world status. focus is on beating down any competition, especially BRICS.

The era of a world reserve currency (if that's what you are referring to) is over. Crypto & digital money have made that concept obsolete.

Crypto won't even exist in 20 years.

they will become a victim of Central Bank Digital Currencies. All forms of currency will disappear. Those that cannot fit into the scheme of things (gold?) will be outlawed or taxed to the point of making them worthless.

I find that pretty unlikely. Wall Street and the US government have wholly embraced and now endorse cryptocurrency. You think these two entities are going to reverse course? In the next few years trillions will pour into crypto and you think it'll just go away when the people in charge are so heavily invested?

The interest from the US is in exploring blockchain. The heavily invested can and will disinvest in something that has no backing whatsoever. For now it's a play on growing demand. Unlike most all other assets, demand alone is what keeps crypto from being worthless. Growing demand can quickly reverse itself.

I can see you haven't researched this much. With the caveat that not all cryptos are created equal and some truly are worthless, you are one of the many that has yet to see the value in networks and network size. automated and programmable money/payments, and trust less systems. Eventually you will. There's a reason why the largest companies in the world like Samsung are integrating and using (or will be using) crypto in their products and services now that the US has passed or will be passing regulations so they can proceed without legal fears.

Is it possible the "cryptos" can be worthless and yet the network remain?

Railroads have gone bust yet their tracks and terminals remain.

The two are intertwined. The network builds the value and the value builds the network.

Railroad tracks are just infrastructure. Without anyone using them, they are also worthless.

Like any tool or technology, things can be used for good or evil. Do some studying and you'll find out just how useful this technology is. You'll soon be surrounded by it. My kitchen knife can be used to kill someone or make a delicious meal. A comment about knives not being good would be shortsighted.

There's a reason why the largest companies in the world like Samsung are integrating and using (or will be using) crypto in their products and services now that the US has passed or will be passing regulations so they can proceed without legal fears.

Yes there is - because people who want to buy things from them want to use them to pay for the items they are selling. What does Samsung do with the crypto once they receive it - hold it and use it for expenses or sell it and then using local currency to pay bills? My guess is the latter and Samsung et. al view crypto the same as the Discover card - a new way to pay and enough people want to use it so might as well accept it.

No, this isn't about Samsung taking payments in crypto. This is not the place to go into details. I'll just point you to this 3 year old article. I didn't bother looking for a newer one but trust me, the investment has only grown and expanded. These companies aren't investing billions just so they can accept crypto payments. That tech already exists and is not expensive or complicated as you may have noticed companies like APMEX take payments in crypto. This is so beyond that. https://cointelegraph.com/news/google-invested-a-whopping-1-5b-into-blockchain-companies-since-september

Is it possible the "cryptos" can be worthless and yet the network remain?

Railroads have gone bust yet their tracks and terminals remain.

there is a difference between an asset that is physical and one that is imaginary. When large corporations go bust, their physical assets still have some value to the shareholders. When a crypto goes to zero, a holder's claim goes to zero.

cryptos are much different in "tulips" in that there is serious money and serious buyers (whales) who apparently do not flinch at every down turn. Tulips peaked and fear took them quickly to the bottom. While cryptos are not a fad, they are still themselves imaginary. The money stays with them because the buyers stay with them. Serious money has been made, and lost, with them. One of the many new ways to gamble on-line.

A decent explanation, but to take it further, stocks are also imaginary and many companies have few assets but high value. Uber stock's value is not in its assets but in its network. Same with something like Facebook. Myspace had a high valuation at one time but once its network depleted it became worthless.

@derryb said:

the final fight is on to save dollar's world status. focus is on beating down any competition, especially BRICS.

The era of a world reserve currency (if that's what you are referring to) is over. Crypto & digital money have made that concept obsolete.

Crypto won't even exist in 20 years.

they will become a victim of Central Bank Digital Currencies. All forms of currency will disappear. Those that cannot fit into the scheme of things (gold?) will be outlawed or taxed to the point of making them worthless.

I find that pretty unlikely. Wall Street and the US government have wholly embraced and now endorse cryptocurrency. You think these two entities are going to reverse course? In the next few years trillions will pour into crypto and you think it'll just go away when the people in charge are so heavily invested?

The interest from the US is in exploring blockchain. The heavily invested can and will disinvest in something that has no backing whatsoever. For now it's a play on growing demand. Unlike most all other assets, demand alone is what keeps crypto from being worthless. Growing demand can quickly reverse itself.

I can see you haven't researched this much. With the caveat that not all cryptos are created equal and some truly are worthless, you are one of the many that has yet to see the value in networks and network size. automated and programmable money/payments, and trust less systems. Eventually you will. There's a reason why the largest companies in the world like Samsung are integrating and using (or will be using) crypto in their products and services now that the US has passed or will be passing regulations so they can proceed without legal fears.

Is it possible the "cryptos" can be worthless and yet the network remain?

Railroads have gone bust yet their tracks and terminals remain.

The two are intertwined. The network builds the value and the value builds the network.

Railroad tracks are just infrastructure. Without anyone using them, they are also worthless.

Is it possible the "cryptos" can be worthless and yet the network remain?

Railroads have gone bust yet their tracks and terminals remain.

there is a difference between an asset that is physical and one that is imaginary. When large corporations go bust, their physical assets still have some value to the shareholders. When a crypto goes to zero, a holder's claim goes to zero.

cryptos are much different in "tulips" in that there is serious money and serious buyers (whales) who apparently do not flinch at every down turn. Tulips peaked and fear took them quickly to the bottom. While cryptos are not a fad, they are still themselves imaginary. The money stays with them because the buyers stay with them. Serious money has been made, and lost, with them. One of the many new ways to gamble on-line.

A decent explanation, but to take it further, stocks are also imaginary and many companies have few assets but high value. Uber stock's value is not in its assets but in its network. Same with something like Facebook. Myspace had a high valuation at one time but once its network depleted it became worthless.

@derryb said:

the final fight is on to save dollar's world status. focus is on beating down any competition, especially BRICS.

The era of a world reserve currency (if that's what you are referring to) is over. Crypto & digital money have made that concept obsolete.

Crypto won't even exist in 20 years.

they will become a victim of Central Bank Digital Currencies. All forms of currency will disappear. Those that cannot fit into the scheme of things (gold?) will be outlawed or taxed to the point of making them worthless.

I find that pretty unlikely. Wall Street and the US government have wholly embraced and now endorse cryptocurrency. You think these two entities are going to reverse course? In the next few years trillions will pour into crypto and you think it'll just go away when the people in charge are so heavily invested?

The interest from the US is in exploring blockchain. The heavily invested can and will disinvest in something that has no backing whatsoever. For now it's a play on growing demand. Unlike most all other assets, demand alone is what keeps crypto from being worthless. Growing demand can quickly reverse itself.

I can see you haven't researched this much. With the caveat that not all cryptos are created equal and some truly are worthless, you are one of the many that has yet to see the value in networks and network size. automated and programmable money/payments, and trust less systems. Eventually you will. There's a reason why the largest companies in the world like Samsung are integrating and using (or will be using) crypto in their products and services now that the US has passed or will be passing regulations so they can proceed without legal fears.

Is it possible the "cryptos" can be worthless and yet the network remain?

Railroads have gone bust yet their tracks and terminals remain.

The two are intertwined. The network builds the value and the value builds the network.

Railroad tracks are just infrastructure. Without anyone using them, they are also worthless.

You seem to be saying cryptos could be worthless.

Some are, some aren't. And just like big companies can fail, cryptos can also fail.

Didn't gov.com confiscate a large amount of crypto a few years ago? Besides that, since gov.com can create as much fiat as they want, anytime they want - who's to say that gov.com isn't flooding the crypto market with newly-created imaginary money with the intent to control that market when needed? Crypto may have utility, but it also has untold risks that aren't even being considered. Bitcoin was a novel idea with good intentions, but it's been captured.

Q: Are You Printing Money? Bernanke: Not Literally

@jmski52 said:

Didn't gov.com confiscate a large amount of crypto a few years ago? Besides that, since gov.com can create as much fiat as they want, anytime they want - who's to say that gov.com isn't flooding the crypto market with newly-created imaginary money with the intent to control that market when needed? Crypto may have utility, but it also has untold risks that aren't even being considered. Bitcoin was a novel idea with good intentions, but it's been captured.

I wasn't familiar with gov.com so I checked it out. It just appears to be a 3rd party directory for government services but I don't think they are associated with the government. I couldn't find much about them.

But who's to say that they aren't flooding the crypto market with money? Crypto wallets are all visible on the blockchain and the largest one are monitored closely. If gov.com or any other entity were making big purchases it would probably be known. Most companies issue press releases after their purchases because it is viewed as an accomplishment.

Every asset and investment has pros and cons. Returns are usually correlated to risk. Crypto's biggest pro is its transparency, unlike stocks (see Enron and the Plunge Protection Team).

I believe the official would be gov.gov.? Disclaimer: If you are waiting on them to solve your problems, good luck!!! I don't think you will ever see that happen. I am fairly certain however they love your labour, support, and division of we the sheeple. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Comments

5 days, 15 minutes :: front month futures

Gold is Your Escape From Washington’s Fiscal Doomsday Machine

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Maro - Ruskkka perhaps? Pretty sure they vacated Washington already. THKS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

3400+ kitco and futs

It's coming.

Indeed. This is the chart I posted a while ago. I was early on the breakout, but the pennant continued to form and appears to be ready to breakout and make the move to $3700+.

http://ProofCollection.Net

k 3441.5

f 3444

Why gold will continue its run

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Down $100 in just 2 days.

My US Mint Commemorative Medal Set

I'd be real surprised if the central banks were selling gold.

I knew it would happen.

Down $150 in the past week. The market prefers buying companies with fast chips, clouds, and AI.

My US Mint Commemorative Medal Set

Don't panic. THKS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

Or the chart is consolidating as is very common and normal. Nothing goes straight up.

http://ProofCollection.Net

Weaker volume in a pennant can be a problem.

My US Mint Commemorative Medal Set

Yep. Dollar strength will be a headwind. With economic indicators improving I think the index will continue higher.

http://ProofCollection.Net

the final fight is on to save dollar's world status. focus is on beating down any competition, especially BRICS.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

final?

how do you increase exports? devalue the dollar

To which economic indicators are you referring?

Knowledge is the enemy of fear

Jobs report huge downward revisions were the surprise. Gold likes the lower interest rate expectations and weaker dollar they often represent, so we are moving back up again.

My US Mint Commemorative Medal Set

The era of a world reserve currency (if that's what you are referring to) is over. Crypto & digital money have made that concept obsolete.

http://ProofCollection.Net

I believe use of the dollar as an international economic weapon (sanctions and outright theft) has driven others to shun the dollar in international trade and required them to search for alternatives. This is the foundation of the BRICS alliance. The current trend for those who fear such threats is for them to hold and use other forms of financial instruments and reduce their holdings of dollars and of US debt. This is one of the primary reasons central banks have been stockpiling gold and driving its price up. Not only is the future of the reserve currency status of the dollar being threatened, but equally important is the loss of international buyers of US bonds (US debt).

US international economic policy for the past five years is the root cause of current high gold prices. Look for all out economic war on those who pose a threat to the dollar and to US bond purchases. Tariffs are simply another way to impose sanctions. Increases in international economic warfare and uncertainty drive up the price of the only currency not affected by it - gold.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Crypto won't even exist in 20 years.

Knowledge is the enemy of fear

they will become a victim of Central Bank Digital Currencies. All forms of currency will disappear. Those that cannot fit into the scheme of things (gold?) will be outlawed or taxed to the point of making them worthless.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

gov.com's attempt to stuff U.S. debt into stablecoin as some sort of "backing" simply amounts to more imaginary money backing imaginary money. This will fail.

I knew it would happen.

They will be victim of what they are.

Knowledge is the enemy of fear

an overnight fad? LOL

In it's 14 years of existence bitcoin has risen from $8 to $113,000.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

I find that pretty unlikely. Wall Street and the US government have wholly embraced and now endorse cryptocurrency. You think these two entities are going to reverse course? In the next few years trillions will pour into crypto and you think it'll just go away when the people in charge are so heavily invested?

http://ProofCollection.Net

The interest from the US is in exploring blockchain. The heavily invested can and will disinvest in something that has no backing whatsoever. For now it's a play on growing demand. Unlike most all other assets, demand alone is what keeps crypto from being worthless. Growing demand can quickly reverse itself.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

On a lighter note.... time for a classic!

🎶Tiptoe Through The Tulips 🎶

https://duckduckgo.com/?t=h_&q=tiny+tim+tiptoe+through+the+tulips&ia=videos&iax=videos&iai=https%3A%2F%2Fyoutube.com%2Fwatch%3Fv%3DzcSlcNfThUA

I can see you haven't researched this much. With the caveat that not all cryptos are created equal and some truly are worthless, you are one of the many that has yet to see the value in networks and network size. automated and programmable money/payments, and trust less systems. Eventually you will. There's a reason why the largest companies in the world like Samsung are integrating and using (or will be using) crypto in their products and services now that the US has passed or will be passing regulations so they can proceed without legal fears.

http://ProofCollection.Net

programmable currencies...........not good.

I knew it would happen.

I hold my BTC and ETH in high regard just as me gold. THKS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????

I never said overnight fad and thats not my thought. Is that what you think?

Edit...i should have read further in the thread since you answered that question.

Knowledge is the enemy of fear

You make it sound like a fad.

Knowledge is the enemy of fear

Is it possible the "cryptos" can be worthless and yet the network remain?

Railroads have gone bust yet their tracks and terminals remain.

Knowledge is the enemy of fear

there is a difference between an asset that is physical and one that is imaginary. When large corporations go bust, their physical assets still have some value to the shareholders. When a crypto goes to zero, a holder's claim goes to zero.

cryptos are much different in "tulips" in that there is serious money and serious buyers (whales) who apparently do not flinch at every down turn. Tulips peaked and fear took them quickly to the bottom. While cryptos are not a fad, they are still themselves imaginary. The money stays with them because the buyers stay with them. Serious money has been made, and lost, with them. One of the many new ways to gamble on-line.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Yes there is - because people who want to buy things from them want to use them to pay for the items they are selling. What does Samsung do with the crypto once they receive it - hold it and use it for expenses or sell it and then using local currency to pay bills? My guess is the latter and Samsung et. al view crypto the same as the Discover card - a new way to pay and enough people want to use it so might as well accept it.

As taxmad said, it's an additional payment method for businesses. My account with AdvanceAuto now accepts Paypal.

If you understand what is coming, then you can duck. If not, then you get sucker-punched. - Martin Armstrong

Ut oh. We agree. End of world coming.

Knowledge is the enemy of fear

A decent explanation, but to take it further, stocks are also imaginary and many companies have few assets but high value. Uber stock's value is not in its assets but in its network. Same with something like Facebook. Myspace had a high valuation at one time but once its network depleted it became worthless.

The two are intertwined. The network builds the value and the value builds the network.

Railroad tracks are just infrastructure. Without anyone using them, they are also worthless.

Like any tool or technology, things can be used for good or evil. Do some studying and you'll find out just how useful this technology is. You'll soon be surrounded by it. My kitchen knife can be used to kill someone or make a delicious meal. A comment about knives not being good would be shortsighted.

No, this isn't about Samsung taking payments in crypto. This is not the place to go into details. I'll just point you to this 3 year old article. I didn't bother looking for a newer one but trust me, the investment has only grown and expanded. These companies aren't investing billions just so they can accept crypto payments. That tech already exists and is not expensive or complicated as you may have noticed companies like APMEX take payments in crypto. This is so beyond that.

https://cointelegraph.com/news/google-invested-a-whopping-1-5b-into-blockchain-companies-since-september

http://ProofCollection.Net

You seem to be saying cryptos could be worthless.

Knowledge is the enemy of fear

Some are, some aren't. And just like big companies can fail, cryptos can also fail.

http://ProofCollection.Net

Didn't gov.com confiscate a large amount of crypto a few years ago? Besides that, since gov.com can create as much fiat as they want, anytime they want - who's to say that gov.com isn't flooding the crypto market with newly-created imaginary money with the intent to control that market when needed? Crypto may have utility, but it also has untold risks that aren't even being considered. Bitcoin was a novel idea with good intentions, but it's been captured.

I knew it would happen.

I wasn't familiar with gov.com so I checked it out. It just appears to be a 3rd party directory for government services but I don't think they are associated with the government. I couldn't find much about them.

But who's to say that they aren't flooding the crypto market with money? Crypto wallets are all visible on the blockchain and the largest one are monitored closely. If gov.com or any other entity were making big purchases it would probably be known. Most companies issue press releases after their purchases because it is viewed as an accomplishment.

Every asset and investment has pros and cons. Returns are usually correlated to risk. Crypto's biggest pro is its transparency, unlike stocks (see Enron and the Plunge Protection Team).

http://ProofCollection.Net

gov.com is my tongue in cheek reference to all of the government largesse. Sorry for the confusion, heh.

I knew it would happen.

I believe the official would be gov.gov.? Disclaimer: If you are waiting on them to solve your problems, good luck!!! I don't think you will ever see that happen. I am fairly certain however they love your labour, support, and division of we the sheeple. RGDS!

The whole worlds off its rocker, buy Gold™.

BOOMIN!™

Wooooha! Did someone just say it's officially "TACO™" Tuesday????