What credit card do you recommend?

chhull00

Posts: 53 ✭✭

chhull00

Posts: 53 ✭✭

Just curious to how I should pay for my collections,are there statiges points cash back, are there some cards better to use than others I would be interested in how to maximize my purchases if anyone has thought on this I would love to hear your thoughts on this subject.

Tagged:

1

This discussion has been closed.

Comments

You are going to pay 3% plus more for a coin by using a credit card which will exceed whatever points or cash back value realized by using it. Pay cash or, consider Paypal same as cash payback option (works with GC, but not other auction houses).

"She comes out of the sun in a silk dress,

running like a water color in the rain...."

where do you plan to use the credit card?

Maybe anywhere,i was just curious if anyone had any way of accumulate cash back points or whatever,say maybe a credit card with 3% on online stores or such.

Proud follower of Christ!

I always use my wife's Sears credit card. She has had it since 1985 and I have learned over the years we get special beebitis no one else offers. (such as 100 percent coverage on coins lost or stolen in transit). James

Sears?

All comments reflect the opinion of the author, even when irrefutably accurate.

i couldn't believe it either

here is the info:

https://citicards.citi.com/crs/CitiThankYou/info/default.htm

keep you old card! maybe you can sell it on ebay!!. just don't do what this one did!!! lol: https://www.ebay.com/itm/286551768422

that one isn't old enough anyway. here are the cards of dreams: https://www.ebay.com/itm/365718621329 << did the same thing!!!! lol

Capital One, low interest rate and cash back. I use it ALL the time

Mike

My Indians

Dansco Set

Be very careful with Paypal, if you don't pay off the balance within the 6 months the interest rate is over 30%

Mike

My Indians

Dansco Set

I use one of 5 cards depending on the rewards program-

I think you can get 200,000 bonus points and I’ll get 20,000 if anyone signs up with this referral link -

https://www.referyourchasecard.com/21u/AV4EI27TOY

Anyone who uses this referral link will get both of us a $50 gift card -

https://www.amazon.com/dp/BT00LN946S?externalReferenceId=f3bea24c-b3db-4a28-8e85-3463f731db12

$100 credit for both of us if anyone applies with this link- (sorry it’s long)

https://www.discovercard.com/application/website/apply?extole_zone_shareable_code=ddecker2695&extole_share_channel=SMS&extole_zone_name=blank&extole_zone_click_event_id=7526382364965418584&srcCde=GJVJ&cmpgnid=raf-dca-consumer-it&scmpgnid=7507014310304887932_7526382126648694233&iq_id=yraf_1500849519_sm_88_297772450486&extole_shareable_code=ddecker2695&source=RAF

$75 with your first purchase if you apply with this link (no reward on my end) -

https://apple.co/referdailycash

Every credit card purchase I make is getting at least 2% cash back no matter what. Anyone who doesn’t take advantage of credit card rewards when you don’t have to pay a fee to use them is leaving money on the table, pretty much all of my flights and hotels are covered fully by points these days. If you choose to only use cash or a debit card, you’re just subsidizing all the people like me that utilize the points for free benefits when you pay the balances off in full every month. None of them have annual fees, and I get cell phone insurance, rental coverage, free dash pass memberships, free Netflix, and all types of stuff by using them properly.

Founder- Peak Rarities

Website

Instagram

Facebook

Here’s a huge submission I just had with PCGS, I’ll end up getting over 5% back towards hotels and flights-

Founder- Peak Rarities

Website

Instagram

Facebook

Yes Sears. What is more we have always gotten all our warranties doubled. 100% coverage for anything lost or stolen (including coins). I didn't know this wasn't common until someone on here pointed it out. They have also replaced a 5 year old garbage disposal. A 4 year old Dishwasher. A 6 year old stove and a 4 year old washing machine. All at no cost. james

There is a Bank of America card that has 3% in a category of your choice on the first $2,500 spent per quarter (so you can choose online shopping and it will cover eBay/paypal purchases). Right now it also has a first year bonus that makes it 6%.

Bank of America Customized Cash Rewards Credit Card

https://www.bankofamerica.com/credit-cards/products/cash-back-credit-card/

There is also a Chase card that has 5% in rotating categories on the first $1,500 spent per quarter. One quarter usually includes paypal.

Chase Freedom Flex

https://www.chase.com/personal/credit-cards/freedom/flex

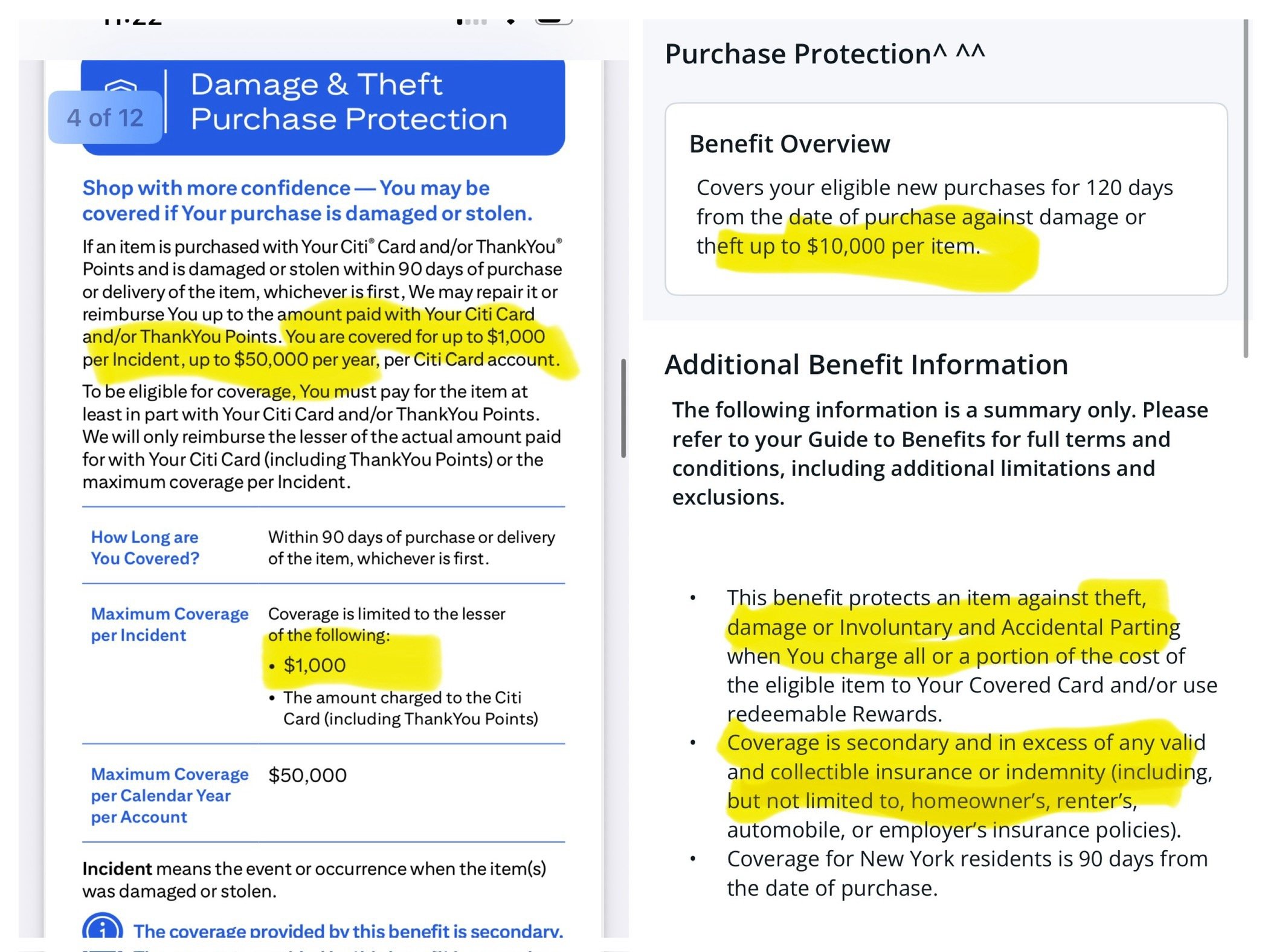

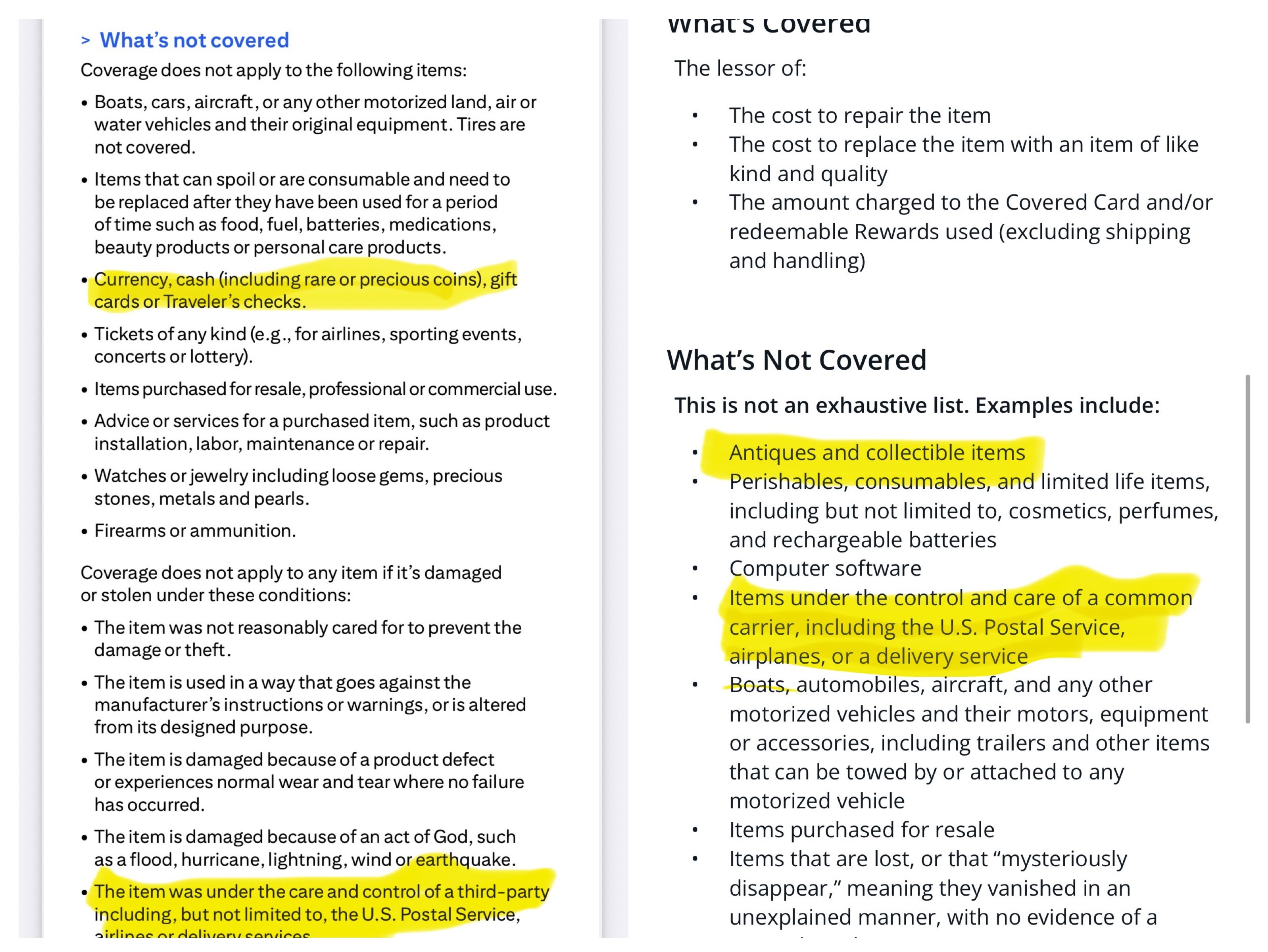

Protection against purchases made with credit cards is common, but just like anything else, there are exclusions in the fine print. Have you ever had to file a claim for a purchase of a coin? I see two things that look like that would not be the case-

Citi (sears)————————Chase

Citi (sears)————————Chase

I’ve said it once and I’ll say it again….if anyone values their sanity and sense of inner peace, DO NOT rely on USPS insurance unless you’re using registered, but even registered isn’t 100% foolproof though its much safer than priority mail. Use Hugh wood, pirate ship, or some other 3rd party that has a proven track record of handling coin claims properly and without resistance.

Founder- Peak Rarities

Website

Instagram

Facebook

Mine has Franklin on the front.

Link that Bank of America Credit card with their Merrill Edge brokerage account and you could get up to 5.25% back on internet purchases.

Mine has Franklin on the front. I hate credit cards, charge cards, cards period. It is interesting that the US Government won't take cash when entering a national park. Why? They want a record of who is there.

Do you carry a cell phone? Did you drive your car there? Do you wear a mask or cover your face everywhere you go that has security cameras? Just using cash is not enough to prevent surveillance anymore, I’m afraid that ship has sailed.

Founder- Peak Rarities

Website

Instagram

Facebook

Not to mention how much more difficult it would be to write off expenses when filing taxes….

Founder- Peak Rarities

Website

Instagram

Facebook

I have three credit cards. My most recent is Apple Card through Goldman Sachs, every time I use it through Apple Pay I get 2% back and if I use the physical card, I get one percent back so everything you use it for, you get something back.

What’s cooler still is it automatically is sent to my Apple Cash so I have a little account that’s just constantly building up money… obviously you’ll get better deals occasionally using cash especially at coin shops. There are some things that cash or card. It’s the same price so I figure hey, use the card…

I pay it off in full every month, usually every week so I’ve not paid one penny in interest.

Another thing that is cool is it only has my name on it there’s no physical number on the card, so if you send it off at a restaurant where it goes out of sight to be run, people can’t take pictures of it and have your information. it’s a very secure card.

My YouTube Channel

@PeakRarities . Yes. I have had 2 coins stolen. In both cases they just said, "I'm sorry this happened to you" and gave an immediate refund. Someone else pointed out stuff not being covered but I am guessing we have some sort of coverage that is grandfathered in from that original account. Otherwise than that I don't poke sleeping bears. James

I don't recommend ever using credit card for coin purchase. CASH is the only way to go, in my opinion. Okay, go ahead and use your bank card if you have to.

"A person who never made a mistake never tried anything new."

---Albert Einstein (b. 14Mar1879--d. 18Apr1955)

My days of paying loan interest to banks are over. Leaves me more money for coins.

I use credit cards to pay for coins. I do it through PayPal and I get paypal rewards. $6.00 this month.

Im not a big spender or high roller.

I try to pay my card off each month depending on what I have purchased. Sometime 2 or 3 months.

It's worth it to me if I like the coin.

I do bring some cash to local shows. For some reason dealers are so much more flexible with cash.

Sometimes a coin will show up that I must have and if possible I will stretch. I'll work plenty of overtime to make up for it and get it paid!

It's cool to think I'm working a 16 hour weekend for a coin. Im definetly motivated!

Student of numismatics and collector of Morgan dollars

Successful BST transactions with: Namvet Justindan Mattniss RWW olah_in_MA

Dantheman984 Toyz4geo SurfinxHI greencopper RWW bigjpst bretsan MWallace logger7

Because...

Using a credit card that you pay off monthly is better than cash as long as the vendor doesn't charge a convenience charge. You get cash back and other perks that don't exist with cash. You have buyer protections that don't exist with cash.

All comments reflect the opinion of the author, even when irrefutably accurate.

This thread is a stretch for being on-topic, IMO.

"She comes out of the sun in a silk dress,

running like a water color in the rain...."

And not unusual in that respect.

All comments reflect the opinion of the author, even when irrefutably accurate.

I use a SOFI Mastercard. No fee and 2% cash back on everything. I also get a 10% discount on everything I purchase at SOFI Stadium in LA excluding alcohol. I go to a lot of football games.

I'm surprised we have heard so little from the "debt is evil! credit cards ruined my life! i don't understand that if I pay off a credit card every month i don't pay interest and earn valuable rewards!!!!?!" contingent.

chopmarkedtradedollars.com

There's (unsurprisingly) communities who are just as into optimizing credit card rewards as we're into coins, but it's worth taking some time to at least get a decent lineup. PeakRarities' suggestions and the Bank of America cards mentioned upthread are good choices. I mostly use the (now discontinued) US Bank Altitude Reserve for coin purchases, since it has an effective 4.5% earning rate on any Apple Pay purchase, which eBay and several dealers I often buy from support. I use it for my property tax too – the county charges an extra fee for card payments, but it's less than 4.5%, so I still wind up getting about $200 back.

Say it 3x and they'll arrive...

All comments reflect the opinion of the author, even when irrefutably accurate.

Does anyone here use the AMPEX bullion card?

Debt is evil and credit cards ruined my life!

No disrespect; but, for me, those credit card rebates fund a significant part of my coin purchases. They really come in handy when there are big bills and no discounts for cash. And I payoff my no annual fees cards each month.

It's all about self control and only charging what you can pay off each month. Been doing that since 1973, never paid a penny of interest or a card fee. I have only one credit card Cap One SPARK Business 2% off everything (no limit and a bunch of free insurance things that have paid off a rental car that got totaled by an idiot running a red) automatically applied each time it hits $25 and my wife has an employee card. Yup, I write lots of things off and this makes it easy. Although I do pay cash for all yard work and jobs around the house where they will give me a 5% or better discount.

I have cut down on my credit cards, I'm down to 14 from 18

I use them all the time , as long as you use them correctly.

I take advantage of the points they reward and the balance transfers that some of them offer.

One of them just offered a zero interest rate for 21 months with a 3% transfer fee, that card I have $26,000 available credit line. If they want to let me transfer $26,000 dollars for $780 over 21 months I'll take it. You must have discipline and use them to your advantage.

Anyone not using them is foolish, IMHO

Mike

My Indians

Dansco Set

there used to be 0% transfer fees. easy money

There used to be 25 cents a gallon for gas to...............

Mike

My Indians

Dansco Set

but that wasn't easy money. and i'd mention flipping stuff other than coins, but that's not the thread topic

So most places charge 3%> @PeakRarities said:

Wow